What We Are Investigating?

We are investigating Brian Korienek – Goldstone Financial Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

We are investigating Brian Korienek – Goldstone Financial Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

What are they trying to censor

Brian Korienek, a financial advisor and founder of Goldstone Financial Group, has faced a series of allegations and adverse news reports that have cast a shadow over his professional reputation and the credibility of his firm. These allegations range from regulatory violations to client disputes, raising serious concerns about his business practices. Below is a summary of the major allegations, red flags, and adverse news associated with Korienek and Goldstone Financial Group, along with an analysis of why he and his firm might seek to suppress this information, potentially resorting to unethical or illegal means.

Major Allegations and Red Flags

Regulatory Violations: Korienek and Goldstone Financial Group have been cited by regulatory bodies, including the Financial Industry Regulatory Authority (FINRA), for violations related to misleading advertising and unsuitable investment recommendations. These violations suggest a pattern of prioritizing profits over client interests, undermining trust in the firm.

Client Complaints and Lawsuits: Multiple clients have filed complaints and lawsuits against Korienek and Goldstone Financial Group, alleging mismanagement of funds, misrepresentation of investment risks, and failure to act in their best interests. Some cases have resulted in settlements, further damaging the firm’s reputation.

High-Pressure Sales Tactics: Former clients and employees have accused Korienek of employing aggressive sales tactics to push high-commission products, often without adequately disclosing the associated risks. These allegations paint a picture of a firm more focused on revenue generation than ethical financial advising.

Questionable Investment Strategies: Goldstone Financial Group has been criticized for promoting complex and high-risk investment products, such as non-traded REITs (Real Estate Investment Trusts), which are often illiquid and unsuitable for conservative investors. These strategies have led to significant financial losses for some clients.

Lack of Transparency: Clients have reported a lack of transparency in fee structures and investment performance, with some alleging hidden fees and undisclosed conflicts of interest. This lack of openness has eroded client trust and raised questions about the firm’s integrity.

Reputation Damage and Motives for Suppression

The allegations against Brian Korienek and Goldstone Financial Group have severely harmed their reputation in the financial services industry. Regulatory violations and client lawsuits suggest a disregard for ethical standards, while high-pressure sales tactics and questionable investment strategies portray the firm as prioritizing profits over client well-being. These issues have likely led to a loss of clients, diminished credibility, and increased scrutiny from regulators.

For Korienek and Goldstone Financial Group, the stakes are high. Negative publicity can result in lost business, regulatory penalties, and reputational damage that is difficult to repair. The desire to remove or suppress damaging stories is driven by the need to protect their image, maintain client trust, and avoid further legal and financial consequences. In extreme cases, this could lead to unethical or illegal actions, such as cybercrimes, to silence critics or erase incriminating information. For example, hacking into websites, deleting negative reviews, or orchestrating disinformation campaigns could be seen as desperate measures to control the narrative.

Conclusion

Brian Korienek and Goldstone Financial Group face a litany of allegations that have significantly tarnished their reputation. From regulatory violations to client disputes, the pattern of misconduct suggests a firm struggling to balance ethical practices with profitability. While the motivations for suppressing negative information are clear—preserving reputation and avoiding accountability—the potential resort to cybercrime underscores the lengths to which individuals and organizations may go to protect their interests.

- https://lumendatabase.org/notices/40192756

- https://lumendatabase.org/notices/40001676

- March 8, 2024

- March 17, 2024

- sara james corp

- sara james corp

- https://www.itv.com/news/anglia/2012-03-28/verdict-in-florida-murder-trial

- https://vancouversun.com/news/world/indian-teen-girl-gang-raped-and-burnt-alive-with-photos

- https://www.gripeo.com/brian-korienek/

Evidence Box

We are investigating Brian Korienek – Goldstone Financial Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices.

Targeted Content and Red Flags

About the Author

The author is affiliated with Harvard University and serves as a researcher at both Lumen and FakeDMCA.com. In his personal capacity, he and his team have been actively investigating and reporting on organized crime related to fraudulent copyright takedown schemes. Additionally, his team provides advisory services to major law firms and is frequently consulted on matters pertaining to intellectual property law.

He can be reached at [email protected] directly.

Many thanks to FakeDMCA.com and Lumen for providing access to their database

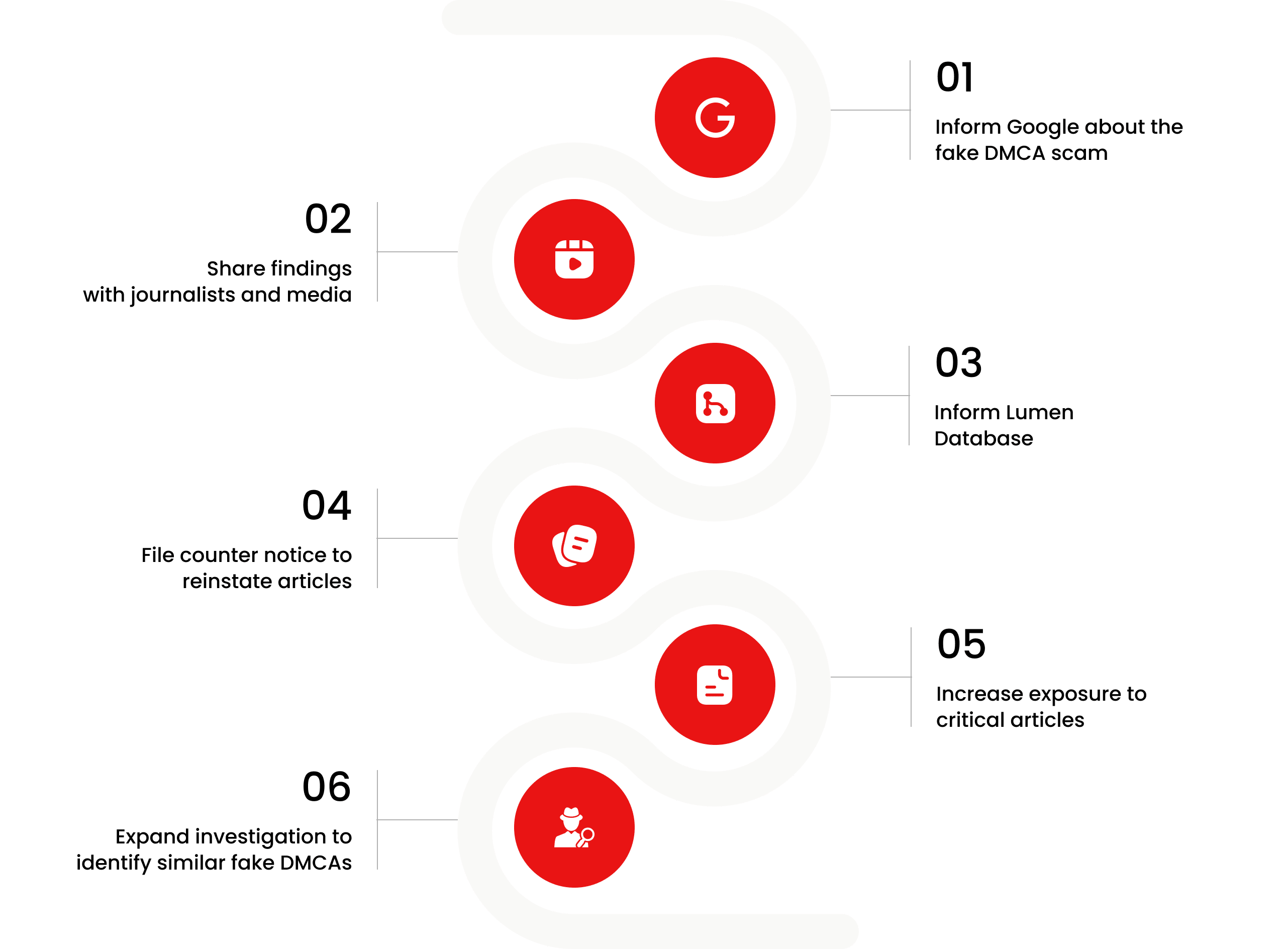

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

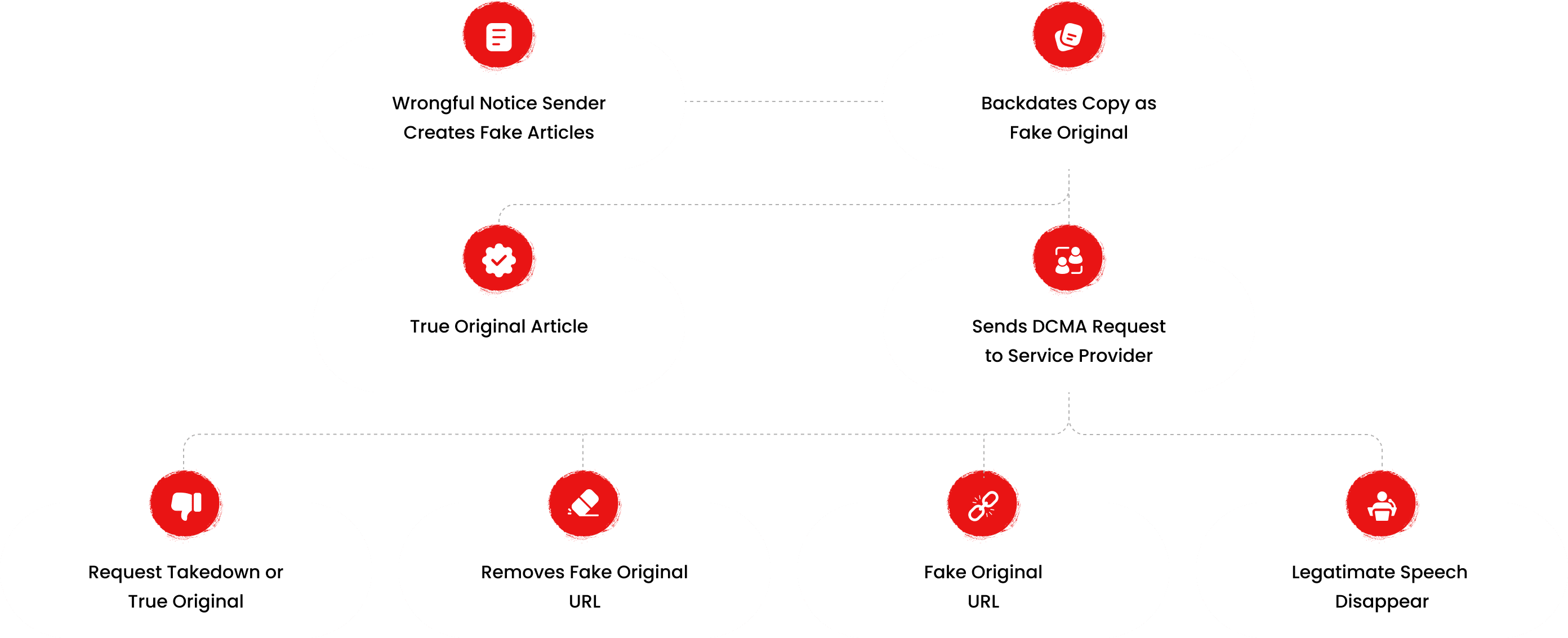

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Domain Check

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Checks

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Investigation

Our Community

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Visit Forum

Threads Alert

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threads Alert

Recent Investigations

Aaron Sansoni Group

Investigation Ongoing

DX Exchange

Investigation Ongoing

Finxflo

Investigation Ongoing

Average Ratings

2

Based on 5 ratings

Henry Stewart

Share

They’ve been caught trying to suppress information again. It’s disgusting that a company this large is allowed to get away with this.

ethan perry

Share

Goldstone Financial Group sounds more like a con artist club than a financial firm. Regulatory violations, lawsuits, and now this? Just wow.

Charlotte Russell

Share

Trying to erase bad press instead of fixing your shady business practices? That says a lot about Goldstone Financial Group.

Emma Scott

Share

Stay away from Goldstone! This unregulated broker.

Samuel Harris

Share

SCAM ALERT! Avoid this company at all costs. Goldstone operates as an unregulated broker using a cloned license. They’ve been blacklisted for preying on older clients but now target anyone willing to trade on their platform. Their offshore, unregulated status ensures you can’t recover your funds. They’ll block withdrawals, send deceptive emails, or bully you into closing your account without returning your money. My bank and legal assistance confirmed this scam.