What We Are Investigating?

We are investigating Ikenna Ikokwu for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

We are investigating Ikenna Ikokwu for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

What are they trying to censor

Ikenna Ikokwu, a financial advisor based in Cumming, Georgia, has faced significant legal challenges that have adversely affected his professional reputation. These challenges primarily stem from allegations of fraud and misconduct in his investment advisory practices.

Fraudulent Investment Scheme

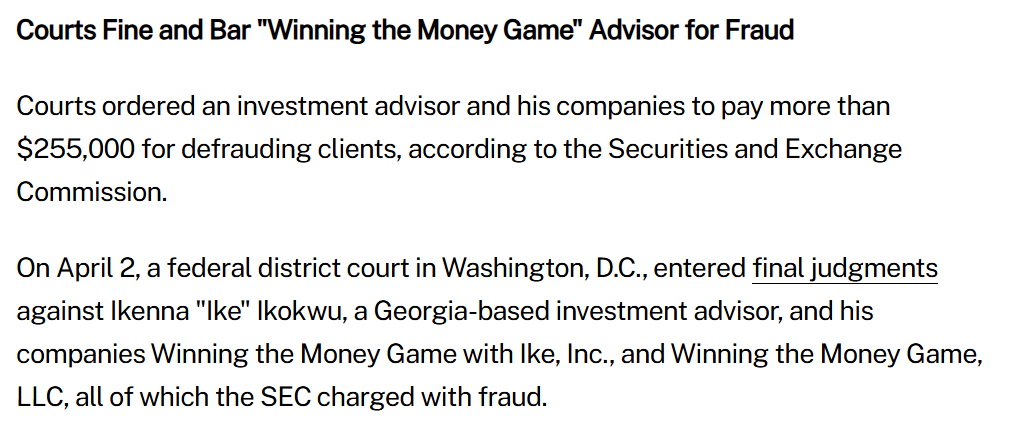

In 2016, the U.S. Securities and Exchange Commission (SEC) charged Ikokwu and his companies, Winning the Money Game with Ike, Inc., and Winning the Money Game, LLC, with defrauding clients. The SEC alleged that Ikokwu persuaded over 20 clients to collectively invest $5 million in securities issued by FutureGen Company, a firm previously charged with defrauding investors. In exchange for these investments, Ikokwu reportedly received undisclosed kickbacks exceeding $100,000 from FutureGen.

Legal Consequences

In April 2018, a federal district court in Washington, D.C., entered final judgments against Ikokwu and his companies. The court ordered them to pay disgorgement of $169,311.64 plus prejudgment interest of $6,869.93. Additionally, Ikokwu was fined $80,000. The court also enjoined Ikokwu and his companies from future violations of securities laws.

Reputation Impact

These legal proceedings have significantly tarnished Ikokwu’s professional image. The allegations of fraud and the subsequent legal actions have raised concerns among clients and peers about his trustworthiness and ethical standards. The public nature of these proceedings ensures that information about his legal challenges remains accessible, potentially deterring potential clients and partners.

Potential Motivations for Information Removal

Given the substantial impact on his reputation, Ikokwu might be motivated to remove or suppress information related to these legal issues. The persistent online presence of news articles, court documents, and other records detailing his legal challenges could hinder his ability to attract new clients and maintain professional relationships. To mitigate the damage and restore his public image, he might consider legal avenues to have defamatory content removed or suppressed.

Conclusion

Ikenna Ikokwu’s involvement in fraudulent investment activities and the subsequent legal actions have significantly damaged his professional reputation. The desire to remove or suppress information related to these incidents is understandable, as it could aid in mitigating the damage to his public image and facilitate a potential career resurgence.

- https://lumendatabase.org/notices/37781882

- November 29, 2023

- https://www.sec.gov/

- https://www.sec.gov/litigation/litreleases/lr-24103

- https://www.forsythnews.com/local/crime-courts/local-advisor-fined-allegedly-defrauding-investors/

Evidence Box

We are investigating Ikenna Ikokwu for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices.

Targeted Content and Red Flags

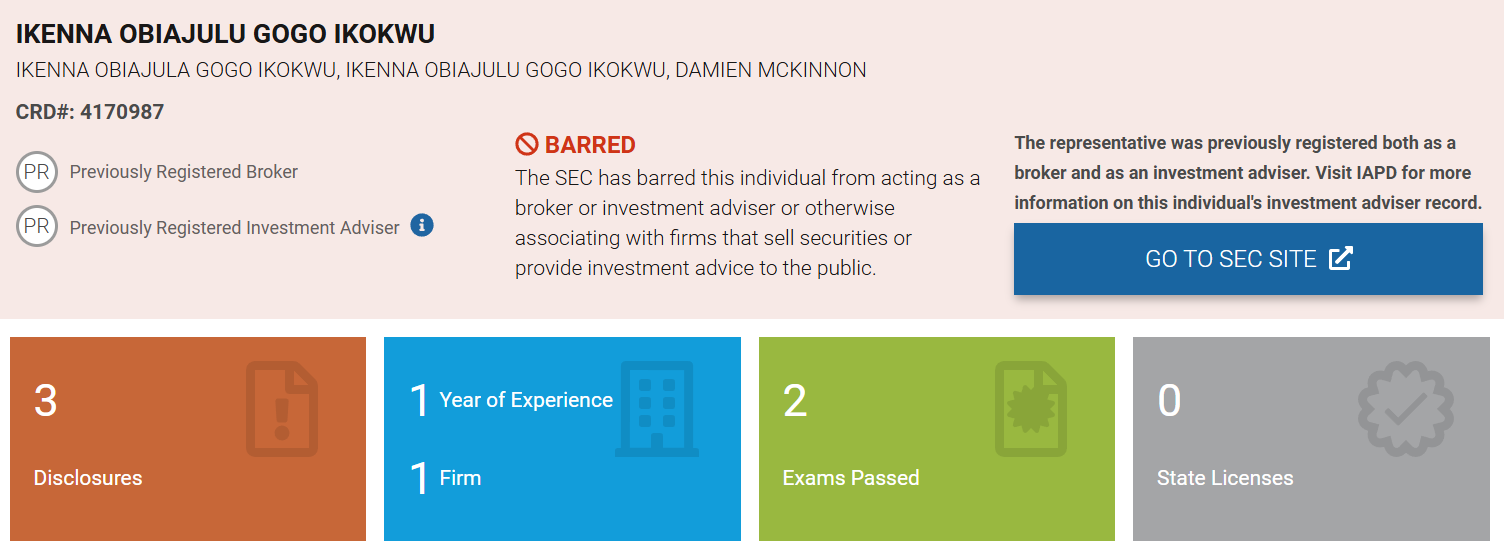

broker check

The SEC has barred this individual from acting as a broker or investment adviser or otherwise associating with firms that sell securities or provide investment advice to the public.

- Red Flag

About the Author

The author is affiliated with Harvard University and serves as a researcher at both Lumen and FakeDMCA.com. In his personal capacity, he and his team have been actively investigating and reporting on organized crime related to fraudulent copyright takedown schemes. Additionally, his team provides advisory services to major law firms and is frequently consulted on matters pertaining to intellectual property law.

He can be reached at [email protected] directly.

Many thanks to FakeDMCA.com and Lumen for providing access to their database

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Domain Check

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Checks

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Investigation

Our Community

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Visit Forum

Threads Alert

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threads Alert

Recent Investigations

Aaron Sansoni Group

Investigation Ongoing

DX Exchange

Investigation Ongoing

Finxflo

Investigation Ongoing

Average Ratings

1.5

Based on 6 ratings

Jasmine Howard

Share

This guy should be held accountable for every penny he stole and every trust he broke!

Melanie Ross

Share

It’s not just the fraud charges that hurt his reputation—it’s the fact that he knowingly steered clients toward a scam and profited from it.

Rhett James

Share

Ikenna Ikokwu clearly doesn’t care about people—he's just after his own gain, leaving a trail of ruined lives behind.

Chloe Walker

Share

Honestly, it’s like he knew about the red flags and was just like “nah, let’s just keep going” – crazy! Definitely a huge breach of trust.

Xena Russell

Share

Bruh, this is straight up unprofessional. How do you not tell people about the risks with FutureGen? It’s not even like they’re tiny risks, they’re huge! Trust totally broken.

Thomas Ward

Share

Ikokwu's claims of offering independent, objective advice were outright lies. He hid his financial connections and kickbacks from FutureGen, leading to his clients being defrauded.