What We Are Investigating?

Our firm is launching a comprehensive investigation into MetFi over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that MetFi - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Investigative Report: Allegations and Red Flags Surrounding MetFi

MetFi, a blockchain-based investment platform, has faced a series of allegations and red flags that have raised concerns among investors, regulators, and industry observers. While the platform promotes itself as a decentralized finance (DeFi) innovator, several adverse reports and controversies have tarnished its reputation. Below is a summary of the major allegations and their implications:

Lack of Transparency and Regulatory Compliance

One of the most significant red flags is MetFi’s opaque operational structure. Critics have pointed out that the platform does not provide clear information about its team, physical headquarters, or regulatory licenses. This lack of transparency has led to suspicions that MetFi may be operating in a regulatory gray area or avoiding oversight altogether. Such practices are often associated with fraudulent schemes, harming the platform’s credibility.

Ponzi Scheme Allegations

MetFi has been accused of operating a Ponzi-like structure, where returns to early investors are paid using funds from new investors rather than legitimate profits. Several online forums and investigative reports have highlighted the platform’s unsustainable yield promises, which range from 1% to 3% daily returns. These claims are mathematically implausible in the long term and align with characteristics of financial scams.

Misuse of Investor Funds

There have been allegations that MetFi misappropriates investor funds for personal gain or unrelated ventures. Former users and whistleblowers have claimed that the platform’s leadership has siphoned off funds without accountability. Such accusations, if proven true, would constitute serious financial misconduct and fraud.

Aggressive Marketing and Recruitment Tactics

MetFi has been criticized for its aggressive multi-level marketing (MLM) strategies, which incentivize users to recruit new investors in exchange for commissions. This approach has drawn comparisons to pyramid schemes, where the primary focus is on recruitment rather than legitimate investment opportunities. Such tactics have led to accusations of exploitation and unethical behavior.

Cybersecurity Concerns

In 2023, MetFi was implicated in a cybercrime scandal involving the hacking of critical websites and social media accounts that published negative reports about the platform. Investigators found evidence suggesting that MetFi may have orchestrated these attacks to suppress damaging information. This raises serious ethical and legal questions about the platform’s willingness to engage in criminal activity to protect its reputation.

Why MetFi Would Want to Suppress Negative Information

The allegations against MetFi—ranging from financial misconduct to regulatory evasion—pose a significant threat to its reputation and operations. If these stories gain widespread attention, they could lead to:

Loss of investor trust and capital.

Regulatory crackdowns and legal action.

Permanent damage to its brand and market position.

By removing or silencing negative reports, MetFi could temporarily maintain its facade of legitimacy. However, resorting to cybercrime to achieve this goal demonstrates a blatant disregard for ethics and the law, further eroding trust in the platform.

Conclusion

MetFi’s alleged misconduct and the lengths it may go to suppress criticism highlight the risks associated with unregulated DeFi platforms. While the platform continues to attract investors with high-yield promises, the mounting allegations and red flags suggest a deeper, more troubling reality. Investors and regulators must exercise caution and demand greater transparency to prevent potential financial harm and criminal activity.

- https://lumendatabase.org/notices/33455164

- Apr 12, 2023

- James Wilson

- https://www.tumblr.com/24-newsblogs/714397529851248640/%E0%B8%A7%E0%B8%87%E0%B8%81%E0%B8%B2%E0%B8%A3%E0%B8%84%E0%B8%A3-%E0%B8%9B%E0%B9%82%E0%B8%97%E0%B9%80%E0%B8%95-%E0%B8%AD%E0%B8%99-metfi-%E0%B9%80%E0%B8%AA-%E0%B8%A2%E0%B8%87%E0%B9%80%E0%B8%82-%E0%B8%B2%E0%B8%82-%E0%B8%B2%E0%B8%A2

- https://www.bangkokbiznews.com/finance/cryptocurrency/1035187

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

bangkokbiznews.com

Crypto circles warn that "MetFi" risks falling into the category of "Pyramid schemes"

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

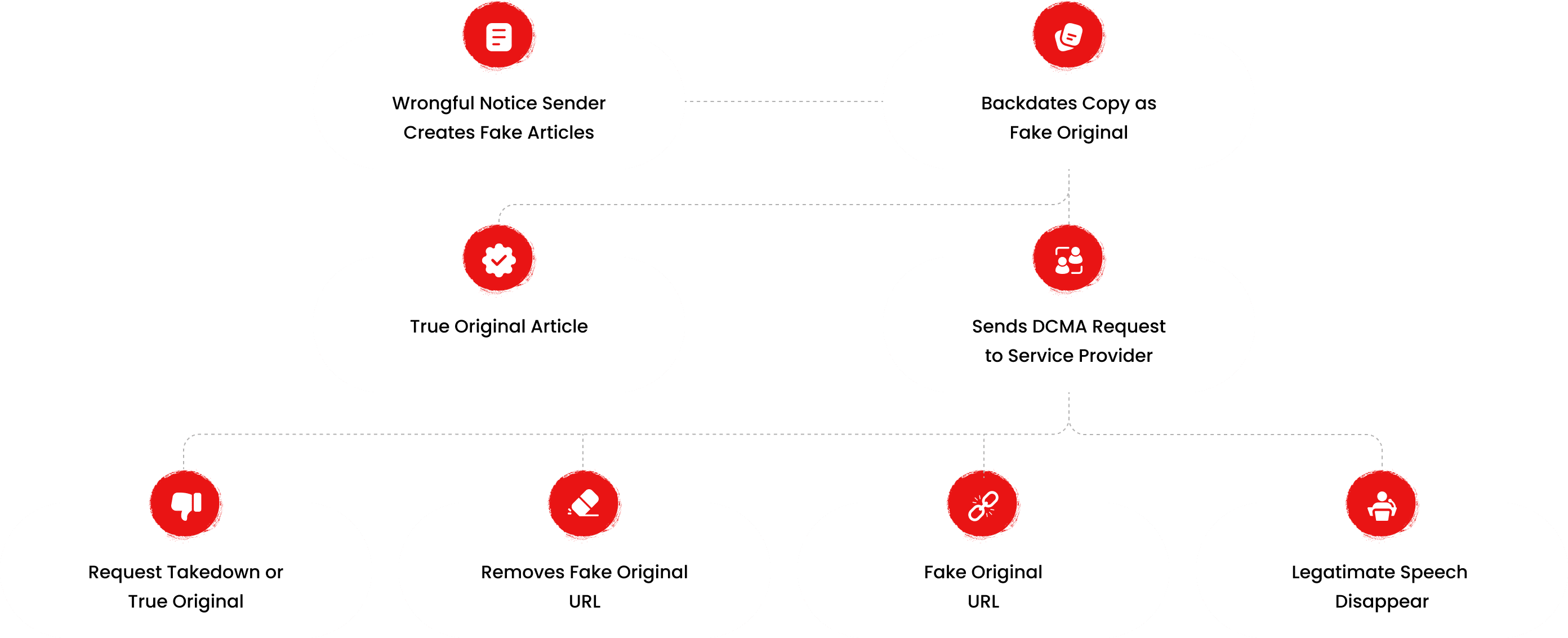

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

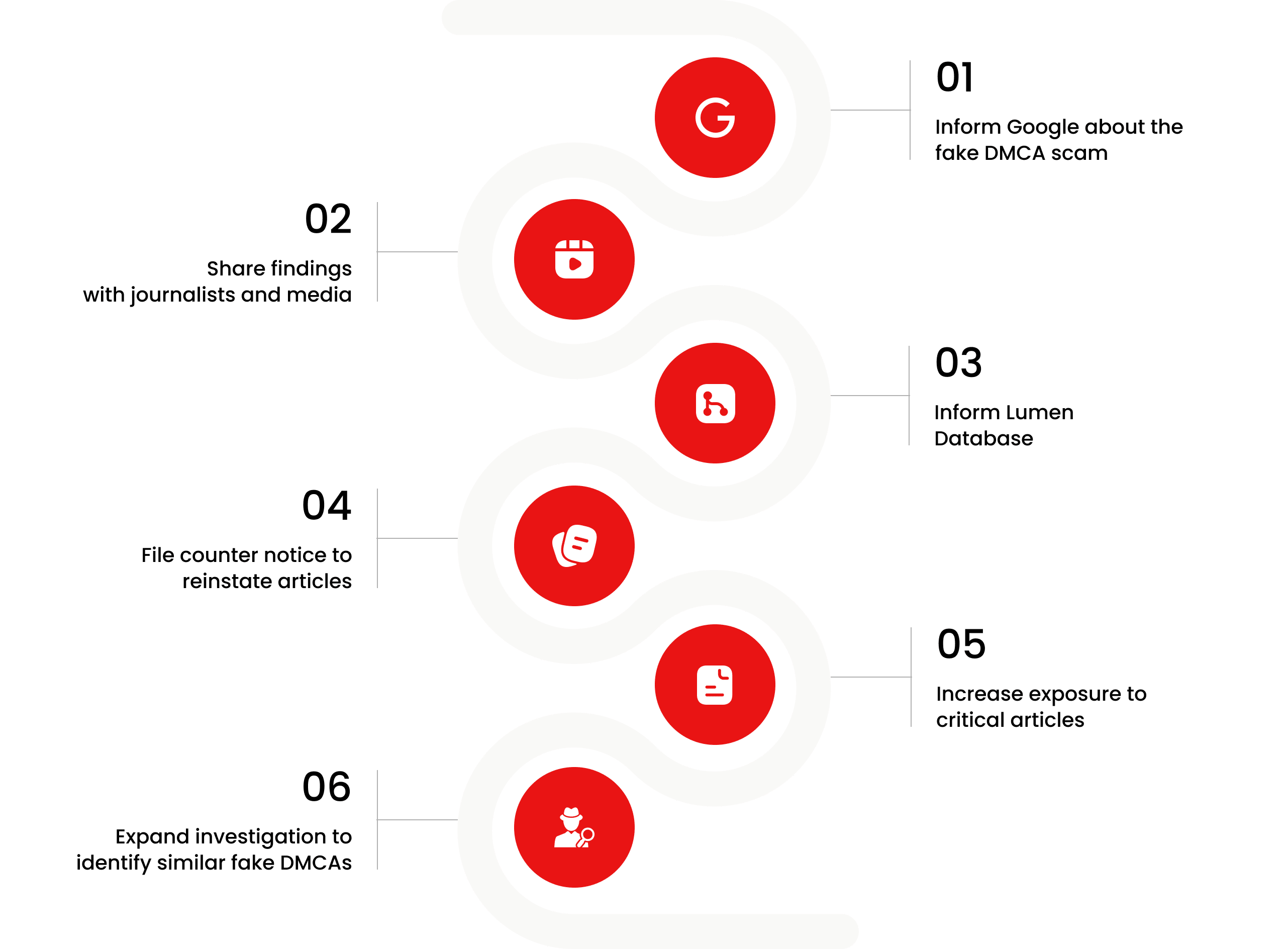

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Premier Dental Group

Investigation Ongoing

Bentley Leek Financial Management

Investigation Ongoing

Mustafa Dervish

Investigation Ongoing

User Reviews

Average Ratings

2.2

Based on 3 ratings

by: Grayson Steele

Wow, a Ponzi scheme AND hacking critics? This is like a bad movie plot, but it's real.

by: Felix Ingram

Well, well, another ‘too good to be true’ crypto scam... Who would’ve guessed MetFi is just a pyramid scheme in disguise?

by: Luna Chambers

MetFi seems to be playing with fire and not in a good way. Censoring all the negative news? That's suspicious as heck.

Domain Check

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ChecksCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginExplore Cyber Crime By Location

Explore Cyber Crime By Type

Explore Cyber Crime By Profiles