What We Are Investigating?

We are investigating Michael Pellegrino – Goldstone Financial Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

We are investigating Michael Pellegrino – Goldstone Financial Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

What are they trying to censor

Michael Pellegrino, co-founder of Goldstone Financial Group, has been embroiled in a series of controversies and regulatory actions that have significantly tarnished his reputation and that of his firm. These allegations range from investment fraud to regulatory violations, raising serious concerns about his professional conduct and the firm’s ethical standards.

Major Allegations and Red Flags

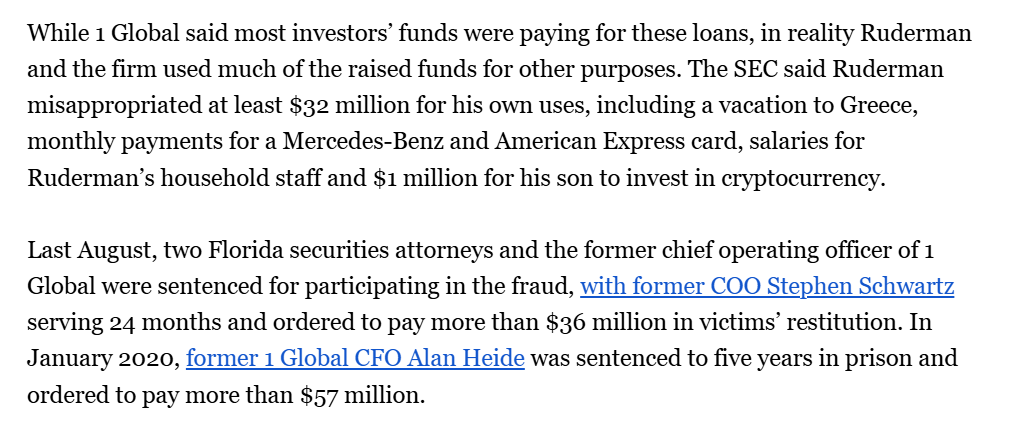

1. Involvement in the 1 Global Capital Scandal

Michael Pellegrino and Goldstone Financial Group were implicated in the 1 Global Capital Ponzi scheme, which defrauded investors of over $320 million. Pellegrino allegedly promoted unregistered securities issued by 1 Global Capital, earning $1.6 million in referral fees without disclosing this to clients. The Securities and Exchange Commission (SEC) found that these actions violated fiduciary duties and regulatory standards, leading to Pellegrino being barred from the securities industry.

2. Misrepresentation and Unsuitable Investment Recommendations

Pellegrino faced multiple customer complaints between 2015 and 2019, including allegations of breaching fiduciary duty and recommending unsuitable investments, particularly in non-traded REITs and business development companies (BDCs). These high-risk, illiquid investments were marketed with misleading claims about returns, while risks and fees were inadequately disclosed.

3. Regulatory Penalties and Legal Actions

The SEC fined Pellegrino and Goldstone Financial Group $70,000 for their role in the 1 Global Capital fraud. Additionally, Pellegrino was censured and fined $30,000 for failing to disclose referral fees and engaging in unregistered securities transactions. These penalties highlight systemic compliance failures within the firm.

4. Lawsuit Over Unregistered Securities

In 2018, five investors sued Goldstone Financial Group, alleging they were misled into investing retirement savings in unregistered securities, resulting in significant losses. Although the lawsuit was later dismissed, it exposed the firm’s questionable practices and lack of transparency.

5. Attempts to Suppress Negative Information

Pellegrino has been accused of attempting to conceal critical reviews and adverse news by improperly submitting copyright takedown notices to Google. This behavior suggests a pattern of trying to control the narrative around his professional conduct, potentially violating laws related to impersonation, fraud, and perjury.

Reputational Damage and Motives for Suppression

The allegations against Pellegrino and Goldstone Financial Group have severely damaged their reputation. The involvement in a high-profile Ponzi scheme, coupled with regulatory penalties and lawsuits, has eroded trust among clients and the broader financial community. The firm’s failure to disclose conflicts of interest and its promotion of high-risk investments have further undermined its credibility.

Pellegrino’s attempts to suppress negative information, including through alleged cyber-related activities, indicate a desperate effort to salvage his reputation. By removing adverse news, he aims to minimize public scrutiny and regain client trust. However, such actions risk further legal consequences and reinforce perceptions of unethical behavior.

Conclusion

The allegations against Michael Pellegrino and Goldstone Financial Group paint a troubling picture of a financial advisor who prioritized personal gain over client welfare. The firm’s involvement in fraudulent schemes, regulatory violations, and attempts to suppress negative information highlight systemic ethical failures. These actions not only harm Pellegrino’s reputation but also serve as a cautionary tale for investors about the importance of due diligence and transparency in financial advisory relationships.

- https://lumendatabase.org/notices/39784767

- February 28, 2024

- Liam James Corp

- https://www.deseret.com/2012/9/10/20434977/police-say-texas-teen-killed-to-keep-her-quiet/?_amp=true

- https://www.wealthmanagement.com/regulation-compliance/sec-bars-another-advisor-1-global-securities-scam

Evidence Box

We are investigating Michael Pellegrino – Goldstone Financial Group for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices.

Targeted Content and Red Flags

erezlaw.com

NorthStar Healthcare Income REIT Investment Losses with Taylor Capital Management Inc. Broker Michael Pellegrino?

- Red Flag

About the Author

The author is affiliated with Harvard University and serves as a researcher at both Lumen and FakeDMCA.com. In his personal capacity, he and his team have been actively investigating and reporting on organized crime related to fraudulent copyright takedown schemes. Additionally, his team provides advisory services to major law firms and is frequently consulted on matters pertaining to intellectual property law.

He can be reached at [email protected] directly.

Many thanks to FakeDMCA.com and Lumen for providing access to their database

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Domain Check

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Checks

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Investigation

Our Community

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Visit Forum

Threads Alert

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threads Alert

Recent Investigations

Aaron Sansoni Group

Investigation Ongoing

DX Exchange

Investigation Ongoing

Finxflo

Investigation Ongoing

Average Ratings

2

Based on 6 ratings

Ruby Carver

Share

Michael Pellegrino’s credibility is about as thin as a piece of paper at this point. Not a good look.

Elliot Monroe

Share

How does he sleep at night, knowing how many people he’s hurt? Absolutely shameful.

Evelyn Clark

Share

actions show how quickly things can spiral when you put profits over clients' trust. He got off light with a penalty, but his career and reputation are basically toast.

Ethan King

Share

Taking $1.6 million in referral fees and not telling your clients? NO shame.

Henry Price

Share

After pocketing millions from unregistered securities, Pellegrino’s exit from the industry was long overdue.

Axel Whitaker

Share

His financial 'advice' might be as shady as the Ponzi schemes he's linked to. You’d be better off betting on a coin flip.