What We Are Investigating?

We are investigating Quantek Asset Management LLC for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

We are investigating Quantek Asset Management LLC for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices. This includes potential violations such as impersonation, fraud, and perjury

What are they trying to censor

Quantek Asset Management LLC, a Miami-based investment firm, has faced several allegations, red flags, and adverse news over the years, which have significantly impacted its reputation. Below is a summary of the major issues:

SEC Charges and Fraud Allegations: In 2012, the U.S. Securities and Exchange Commission (SEC) charged Quantek Asset Management LLC and its executives, Javier Guerra and Ralph Patino, with fraud. The SEC alleged that the firm misled investors about the use of their funds, overstated the value of assets, and failed to disclose conflicts of interest. Specifically, Quantek was accused of funneling investor money to related parties without proper disclosure, which harmed investor trust and raised questions about the firm’s integrity.

Misrepresentation of Fund Performance: Quantek was accused of providing inaccurate and misleading information about the performance of its funds. The SEC found that the firm inflated the value of its holdings and misrepresented the financial health of its investments. This misrepresentation not only misled investors but also damaged the firm’s credibility in the financial industry.

Lack of Transparency and Conflicts of Interest: Quantek failed to disclose significant conflicts of interest, particularly regarding its dealings with related parties. The firm was accused of favoring certain entities in which its executives had personal financial stakes, which raised ethical concerns and undermined investor confidence.

Legal Settlements and Penalties: As a result of the SEC’s investigation, Quantek and its executives agreed to settle the charges by paying significant penalties. Javier Guerra and Ralph Patino were barred from the securities industry, and the firm was required to disgorge ill-gotten gains. These legal actions further tarnished Quantek’s reputation and highlighted its regulatory non-compliance.

Investor Losses and Lawsuits: Quantek’s actions led to substantial financial losses for its investors, many of whom filed lawsuits against the firm. These lawsuits alleged negligence, breach of fiduciary duty, and fraud, further damaging Quantek’s standing in the investment community.

Reputational Harm and Motivation for Removal:

The allegations of fraud, misrepresentation, and lack of transparency have severely harmed Quantek Asset Management LLC’s reputation. Investors and regulators view the firm as untrustworthy, which has likely led to a loss of clients and business opportunities. The negative publicity surrounding the SEC charges and legal settlements has made it difficult for Quantek to operate effectively in the financial industry.

Quantek would want these stories removed because they undermine its credibility and deter potential investors. The firm’s ability to attract new clients and retain existing ones depends on its reputation for integrity and transparency. By removing or suppressing negative information, Quantek could attempt to rebuild its image and regain trust in the market. However, such actions could also raise further ethical and legal concerns, as they may involve attempts to obscure past misconduct.

In summary, Quantek Asset Management LLC’s reputation has been significantly damaged by allegations of fraud, misrepresentation, and conflicts of interest. The firm’s desire to remove or suppress this information stems from its need to restore investor confidence and remain competitive in the financial industry. However, doing so without addressing the underlying issues could perpetuate a cycle of distrust and regulatory scrutiny.

- https://lumendatabase.org/notices/23235381

- March 12, 2021

- James Wilson

- https://globalbreakingnewsupdates.blogspot.com/2012/05/miami-hedge-fund-misled-clients-about.html

- https://www.bloomberg.com/news/articles/2012-05-29/miami-hedge-fund-misled-clients-about-managers-stake-sec-says

Evidence Box

We are investigating Quantek Asset Management LLC for allegedly attempting to conceal critical reviews and adverse news from Google by improperly submitting copyright takedown notices.

Targeted Content and Red Flags

hflawreport.com

SEC Sanctions Quantek Asset Management and its Portfolio Manager for Misleading Investors About “Skin in the Game” and Related-Party Transactions

- Red Flag

sec.gov

In the Matter of Quantek Asset Management, LLC, et al. Admin. Proc. File No. 3-14893

- Red Flag

About the Author

The author is affiliated with Harvard University and serves as a researcher at both Lumen and FakeDMCA.com. In his personal capacity, he and his team have been actively investigating and reporting on organized crime related to fraudulent copyright takedown schemes. Additionally, his team provides advisory services to major law firms and is frequently consulted on matters pertaining to intellectual property law.

He can be reached at [email protected] directly.

Many thanks to FakeDMCA.com and Lumen for providing access to their database

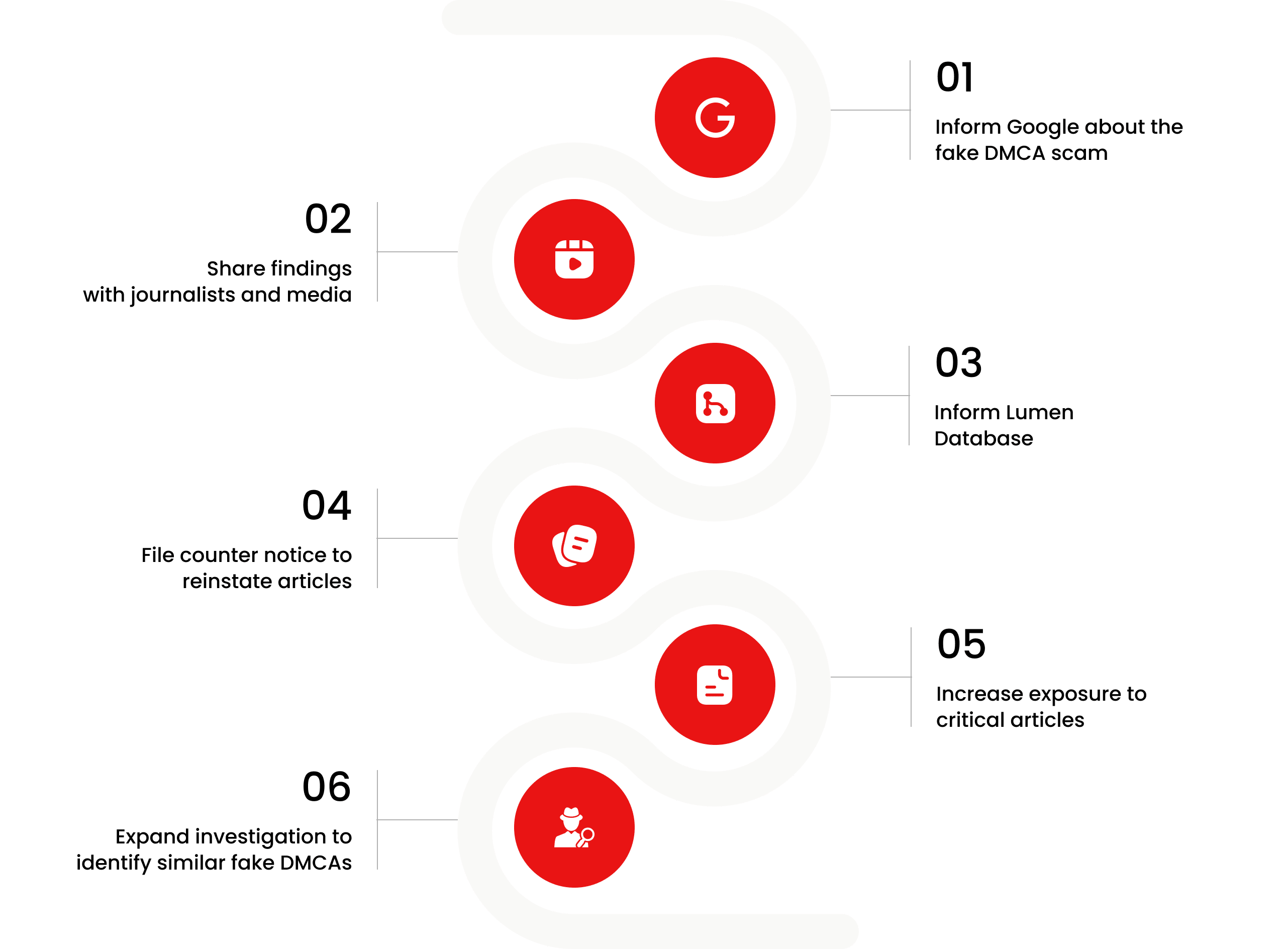

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

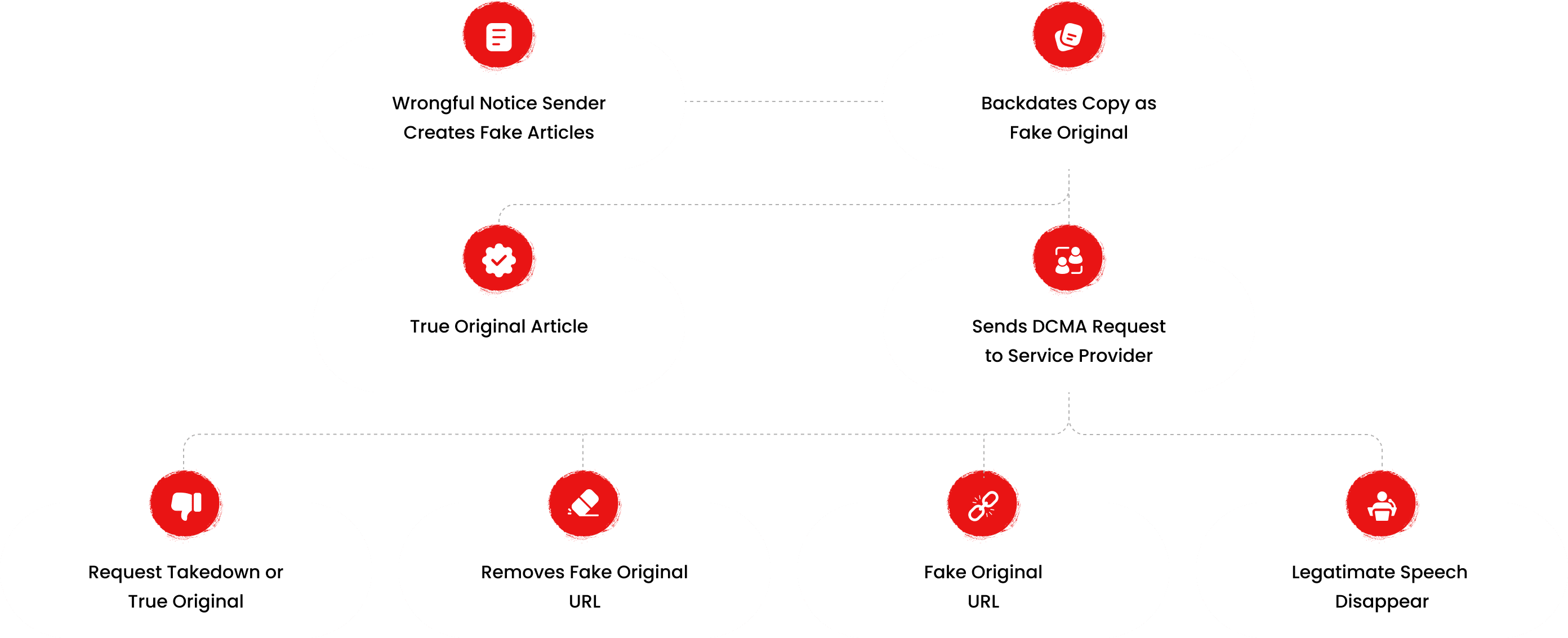

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

The fake DMCA notices we found always use the ?back-dated article? technique. With this technique, the wrongful notice sender (or copier) creates a copy of a ?true original? article and back-dates it, creating a ?fake original? article (a copy of the true original) that, at first glance, appears to have been published before the true original.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Domain Check

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent Checks

Cyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent Investigation

Our Community

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Visit Forum

Threads Alert

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threads Alert

Recent Investigations

Aaron Sansoni Group

Investigation Ongoing

DX Exchange

Investigation Ongoing

Finxflo

Investigation Ongoing

Average Ratings

1.9

Based on 11 ratings

Josiah Chapman

Share

The way it calls him a "shadowy figure" feels straight out of a thriller novel rather than an objective analysis. Sensational much?

Hazel Knight

Share

I get that people are skeptical of big investors in tech, but this whole article feels like a smear campaign. Where’s the investigative rigor? Where are the interviews, the data, the legal findings? Without those, it just seems like an attempt to stir controversy rather than provide real insight

Nova Stone

Share

I get that people are skeptical of big investors in tech, but this whole article feels like a smear campaign. Where’s the investigative rigor? Where are the interviews, the data, the legal findings? Without those, it just seems like an attempt to stir controversy rather than provide real insight.

Harrison King

Share

Quantek’s fraudulent activities have left a lasting stain on its reputation. The SEC charges and legal penalties highlight a deep-rooted culture of deception and mismanagement that eroded investor trust and ultimately led to the firm’s downfall.

Lydia Webb

Share

Quantek wants to erase its past, but the damage is done. – Suppressing negative news won’t change the fact that they betrayed investors.

Sophie Griffin

Share

Years of dishonesty and greed finally led to Quantek’s downfall, and rightfully so

Diana Nguyen

Share

It’s disappointing that Quantek Asset Management thought they could get away with such blatant fraud and manipulation. The SEC penalties are just the tip of the iceberg. Their use of fake DMCA takedowns to hide their misdeeds is an appalling attempt to avoid accountability and suppress free speech.

Chloe Thompson

Share

The misuse of DMCA notices to silence critical reviews demonstrates Quantek’s desperate attempts to conceal its fraudulent actions.

Oliver Meyer

Share

Quantek Asset Management LLC’s fraudulent actions, including the false representation of executive investments in its flagship fund, led to a complete erosion of trust from investors. Their claim of having 'skin in the game' was nothing more than a deceptive marketing ploy, designed to create a false sense of security for those investing substantial sums. The truth was, the firm's executives had no real financial stake in the fund, misleading investors and resulting in significant financial losses.

Isabelle Gonzales

Share

Financial markets rely on trust, and Quantek has completely shattered that. The firm’s fraudulent behavior has not only hurt its own reputation but also contributed to a wider sense of distrust in the asset management sector, harming the industry as a whole.

Blake Alexander

Share

The accusations of cyber espionage sound dramatic, but where’s the hard evidence? It’s all speculation and fear-mongering!