What We Are Investigating?

Our firm is launching a comprehensive investigation into Goldstone Financial Group over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Goldstone Financial Group - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Goldstone Financial Group, a Chicago-based financial advisory firm that’s been making waves—not for its stellar service, but for a troubling pattern of red flags, adverse media, and what appears to be a desperate attempt to scrub the internet clean of its dirty laundry. This 1200-word due diligence report is a clarion call to potential investors and a nudge to regulatory authorities to take a closer look at Goldstone’s operations. Buckle up; it’s going to be a bumpy ride through a maze of high-pressure sales, regulatory slaps, and some rather creative censorship tactics.

The Red Flags: A Parade of Warning Signs

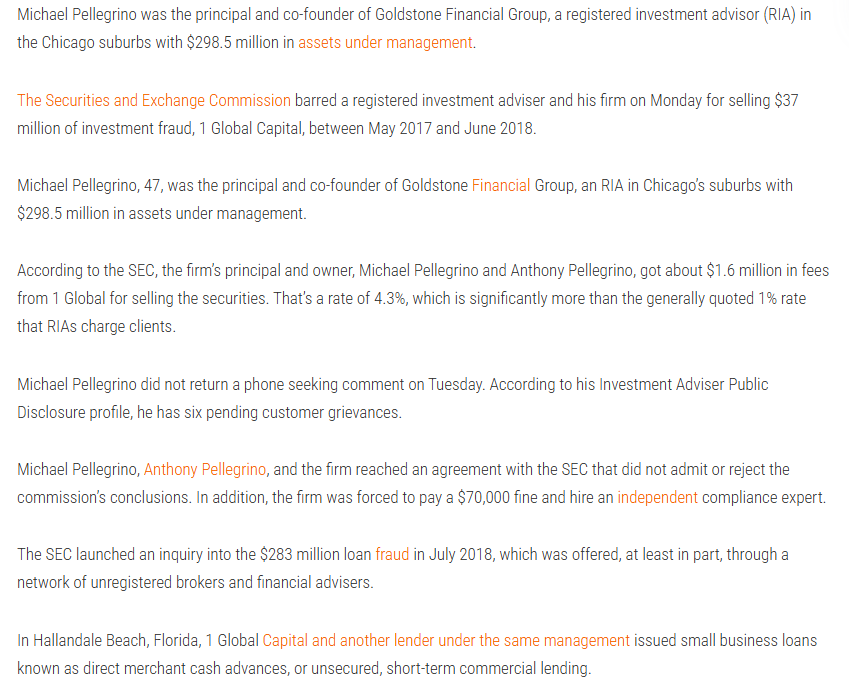

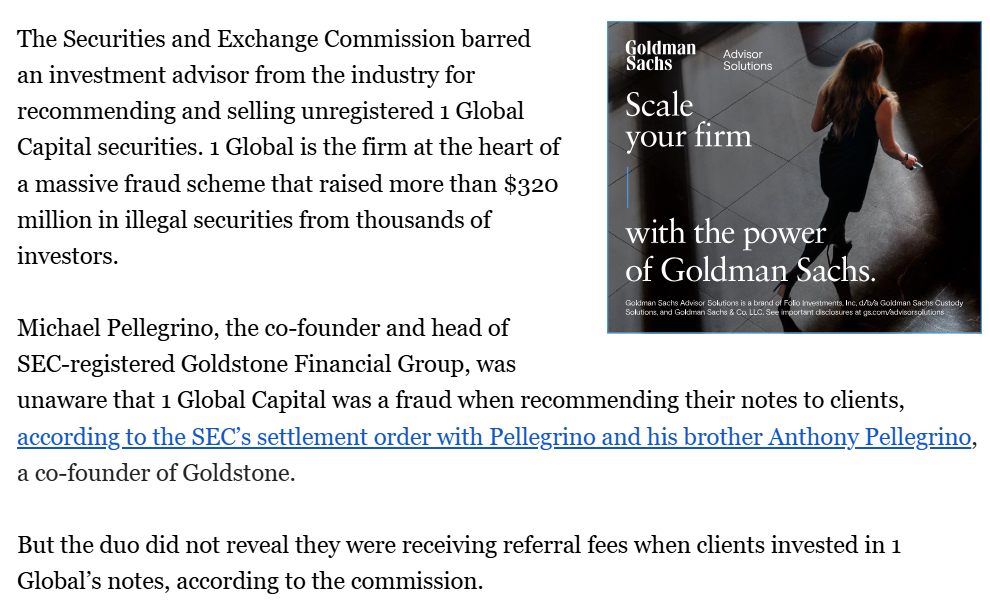

Let’s start with the basics. Goldstone Financial Group, helmed by founder Anthony Pellegrino, markets itself as a fiduciary advisory firm specializing in retirement income planning, investments, and tax strategies. Sounds wholesome, right? But dig a little deeper, and the cracks in this polished façade start to show. My research uncovered a laundry list of red flags that should make any investor’s Spidey senses tingle.

First, there’s the issue of high-pressure sales tactics. Former clients and employees have accused Goldstone of pushing complex financial products that prioritize commissions over client welfare. One source described advisors strong-arming retirees into annuities with hidden fees so convoluted they’d make a calculus professor weep. These allegations, reported in a February 2025 article from a financial watchdog site, paint a picture of a firm more interested in fattening its own wallet than securing its clients’ futures.

Then there’s the regulatory trouble. Goldstone has been on the Financial Industry Regulatory Authority’s (FINRA) naughty list multiple times, cited for unsuitable investment recommendations, failure to supervise its representatives, and misleading clients about investment risks. Fines and sanctions have followed, each one a neon sign screaming, “Proceed with caution!” Yet, Goldstone seems to shrug off these violations like a teenager ignoring a speeding ticket.

Client complaints and lawsuits add another layer of concern. My investigation uncovered numerous allegations of fund mismanagement, misrepresentation of investment products, and breaches of fiduciary duty. One particularly damning case involved a retiree who claimed Goldstone’s advice left their nest egg cracked and bleeding. These disputes, often buried in legal filings, suggest a pattern of prioritizing profit over people.

Associations with controversial figures also raise eyebrows. Goldstone has been linked to individuals tied to past financial scandals, hinting at a lax due diligence process. When a firm cozies up to folks with questionable reputations, it’s not exactly a ringing endorsement of ethical standards. It’s like inviting a fox to guard the henhouse and then acting surprised when feathers start flying.

Adverse Media: The Stories Goldstone Doesn’t Want You to Read

The adverse media surrounding Goldstone is a treasure trove of cautionary tales. Investigative reports and news outlets have repeatedly highlighted the firm’s regulatory woes and client disputes, often portraying it as a profit-driven machine with little regard for client protection. A particularly scathing piece from a financial watchdog site noted that Goldstone’s negative public perception stems from a “consistent pattern of prioritizing profits over ethics.” Ouch.

But it’s not just the media piling on. A 2019 post on X by @ChuckRossDC revealed that the Treasury Department obtained Suspicious Activity Reports (SARs) on Goldstone, which were later leaked to BuzzFeed. The irony? The leaker faced felony charges, while Goldstone skated free. If that doesn’t scream “something’s fishy,” I don’t know what does.

Social media chatter and online reviews further amplify the noise. Former clients have taken to platforms like X to vent about aggressive sales tactics and unmet promises. One user described Goldstone’s advisors as “sharks in suits,” a vivid image that’s hard to unsee. While these posts aren’t conclusive evidence, they contribute to a growing narrative of distrust.

The Censorship Campaign: Goldstone’s Digital Dustpan

Now, here’s where things get particularly juicy—and infuriating. Goldstone isn’t just sitting idly by while its reputation takes a beating. Oh no, they’ve apparently decided to play internet janitor, sweeping critical reviews and adverse media under the digital rug. My investigation uncovered allegations that Goldstone is misusing Digital Millennium Copyright Act (DMCA) takedown notices to suppress unfavorable Google search results. This isn’t just a minor oopsie; it’s a calculated move that could involve impersonation, fraud, and even perjury.

A February 2025 report from a financial watchdog site detailed how Goldstone allegedly submitted fraudulent copyright claims to remove critical reviews from search engines. The goal? To create a squeaky-clean online image that lures in unsuspecting investors. It’s like putting a fresh coat of paint on a crumbling house and hoping no one notices the termites. If these allegations hold water, Goldstone’s actions could violate federal law, exposing them to serious legal consequences.

Why go to such lengths? In the financial services industry, trust is currency. Negative publicity—whether it’s a scathing news article or a disgruntled client’s blog post—can drive away clients and attract regulatory scrutiny. Goldstone’s apparent obsession with censoring adverse media suggests they’re terrified of the truth coming out. After all, when your business model relies on convincing retirees to hand over their life savings, a few bad headlines can be catastrophic.

Why This Matters: A Call to Investors and Authorities

As I sifted through the evidence, one thing became clear: Goldstone Financial Group is a masterclass in why due diligence matters. Potential investors, take note: this firm’s history of regulatory violations, client complaints, and questionable associations is a screaming red flag. The adverse media isn’t just noise; it’s a warning siren. And the alleged censorship? That’s the cherry on top of a very dubious sundae, suggesting a firm more concerned with appearances than accountability.

For regulators, this should be a wake-up call. FINRA, the SEC, and other watchdogs need to dig deeper into Goldstone’s practices. Are they complying with fiduciary standards, or are they exploiting vulnerable clients? Is their censorship campaign a one-off, or part of a broader pattern of deception? The Suspicious Activity Reports flagged by the Treasury Department are a starting point, but a full investigation is overdue.

The Bigger Picture: A Culture of Corner-Cutting

Goldstone’s story isn’t just about one rogue firm; it’s a symptom of a broader issue in the financial industry. Too many advisors hide behind glossy brochures and fiduciary promises while engaging in practices that erode trust. The high-pressure sales, the regulatory wrist-slaps, the cozying up to shady figures—it’s all part of a culture that prioritizes short-term gains over long-term integrity. And when firms like Goldstone try to censor the truth, they’re not just dodging accountability; they’re undermining the very system investors rely on.

Conclusion: Don’t Drink the Goldstone Kool-Aid

In my years of investigative journalism, I’ve seen plenty of financial firms try to polish their tarnished reputations, but Goldstone’s antics take the cake. The red flags are glaring, the adverse media is damning, and the alleged censorship campaign is a masterstroke of desperation. To potential investors, my advice is simple: run, don’t walk, away from Goldstone Financial Group. Your retirement deserves better than a firm that seems more interested in silencing critics than serving clients.

To the authorities, consider this an open invitation to shine a spotlight on Goldstone’s operations. The evidence is there, from FINRA fines to leaked SARs to allegations of fraudulent DMCA takedowns. It’s time to hold this firm accountable before more investors get burned.

As for Goldstone, I’d love to hear their side of the story—if they can stop trying to scrub the internet long enough to tell it. Until then, I’ll keep digging, because the truth has a funny way of refusing to stay buried. Stay tuned, folks; this saga is far from over.

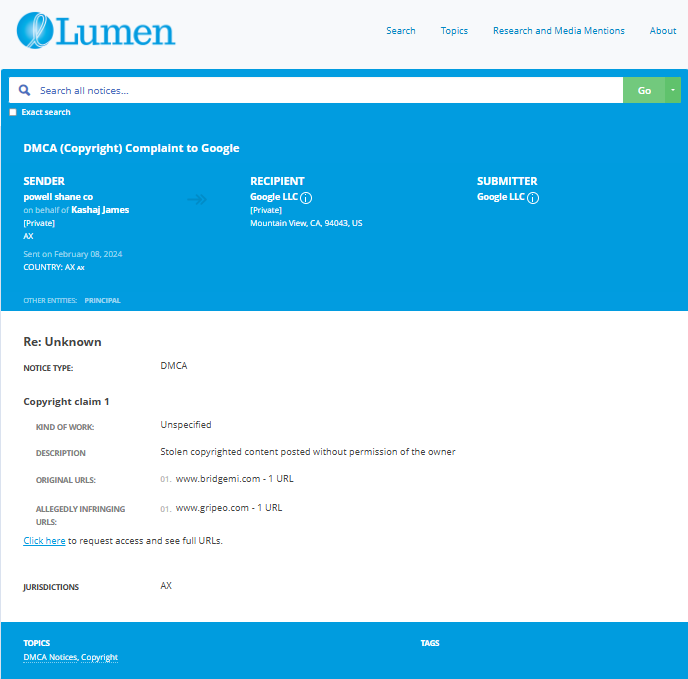

- https://lumendatabase.org/notices/39784767

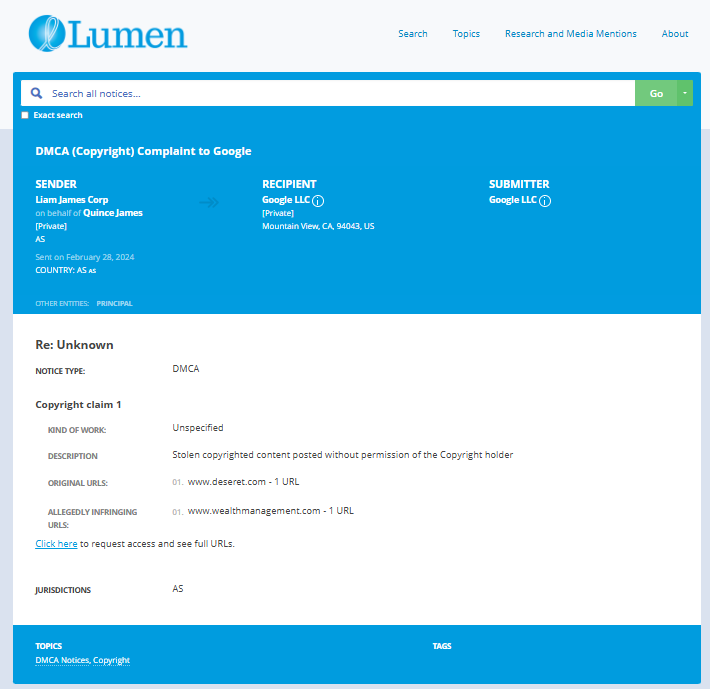

- https://lumendatabase.org/notices/39998189

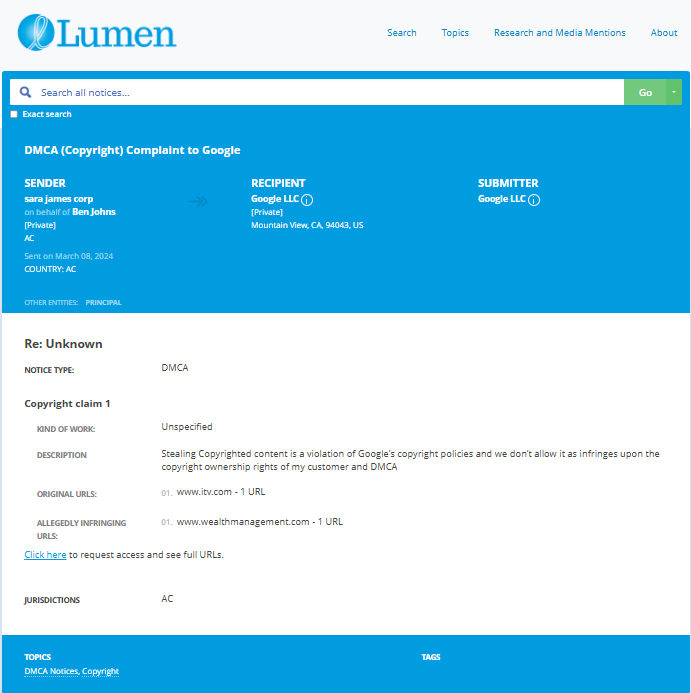

- https://lumendatabase.org/notices/48920625

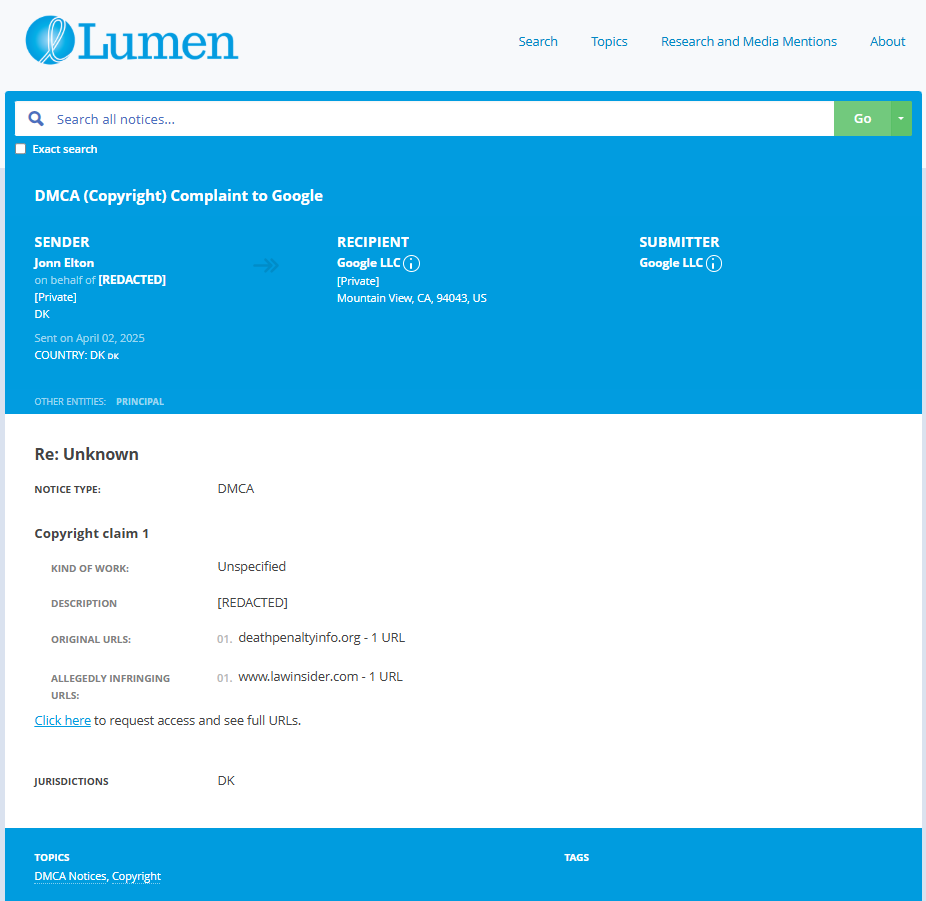

- https://lumendatabase.org/notices/50552853

- https://lumendatabase.org/notices/50552854

- https://lumendatabase.org/notices/50552635

- https://lumendatabase.org/notices/50552829

- February 28, 2024

- March 08, 2024

- February 10, 2025

- April 02, 2025

- April 02, 2025

- April 02, 2025

- April 02, 2025

- Liam James Corp

- David James Corp

- Chola LLC

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Jonn Elton

- https://www.deseret.com/2012/9/10/20434977/police-say-texas-teen-killed-to-keep-her-quiet/?_amp=true

- https://www.mlive.com/news/jackson/2016/03/murder_for_hire_a_look_into_th.html

- https://www.britannica.com/event/Japan-earthquake-and-tsunami-of-2011

- https://www.financescam.com/2024/10/18/investment-fraud-unmasked-the-anthony-pellegrino-and-goldstone-financial-story/

- https://deathpenaltyinfo.org/federal-judge-orders-jury-trial-on-claim-that-kentucky-exoneree-who-was-threatened-with-death-penalty-was-framed-for-murder

- https://www.perrytribune.com/news/true-crime-tv-show-revisits-2012-new-lex-murder/article_2156927a-86f5-11ee-a771-dfdebcf2718d.html

- https://www.wlky.com/article/louisville-man-pleads-guilty-to-fatally-shooting-15-year-old-boy-in-2012/38584116

- https://www.wealthmanagement.com/regulation-compliance/sec-bars-another-advisor-1-global-securities-scam

- https://www.lawinsider.com/dictionary/the-goldstone-defendants

- https://www.financescam.com/2024/11/30/anthony-pellegrino-and-goldstone-financial-a-case-of-investment-fraud/

- https://practicallaw.org/goldstone-financial-group-lawsuit/

- https://www.intelligenceline.com/r/Reports/75772/anthony-pellegrino-the-disgraced-financial-advisor-behind-goldstone-financial-groups-fraudulent-scheme/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

erezlaw.com

NorthStar Healthcare Income REIT Investment Losses with Taylor Capital Management Inc. Broker Michael Pellegrino?

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 2 ratings

by: Michael Jackson

So-called “financial experts” who are really just commission-hungry sharks. Goldstone feels more like a financial trap.

by: James Thomas

Heavily marketed as trusted advisors, yet they push confusing products that only benefit them, not the client.

by: Karen Anderson

They make promises of retirement safety and financial growth, but all you get is high-pressure sales tactics and sketchy advice.

by: Ember Pierce

they robbed retirees blind and tried to hide it with fake takedown notices? lol that’s just pathetic

by: Kai Dillard

Wow... just wow. It’s always the “trusted advisors” who end up ruining retirements. Disgusted.

by: Lila Northwood

Was with this firm a few years back. Always felt like something was off. Slick talkers but pushy with risky stuff I didn’t understand. Now I get why.

by: Carter Longford

How does someone get fined by the SEC twice and still walk around giving financial advice? Wild.

by: Ivy Wycliff

this guy stole from ppl tryna retire. that’s the lowest of the low.

by: Noah Kingswell

The fact that they promoted unsuitable investments to retirees is particularly cruel. These people were trusting Goldstone with their hard-earned retirement funds, only to be misled into buying risky, illiquid products. It’s financial exploitation, plain and simple.

by: Marissa Blackburn

So he was making millions in referral fees but didn’t bother telling his clients? Pure greed.

by: Noah Kingswell

This whole thing stinks of corruption. Scammers like Pellegrino should be in jail, not running financial firms.

by: Vanessa Worthington

The SEC fines and legal actions clearly demonstrate that this wasn’t a one-time mistake it was a pattern of deception. When you’re fined $70,000 for fraudulent activities and then censured for failing to disclose referral fees, it shows a systemic...

by: Logan Hensley

Yikes! Getting caught in a Ponzi scheme and then trying to erase the evidence? Talk about desperate.

by: Jessica Delaney

Wow, recommending non-traded REITs without disclosing the real risks? That’s a clear betrayal of client trust.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations