What We Are Investigating?

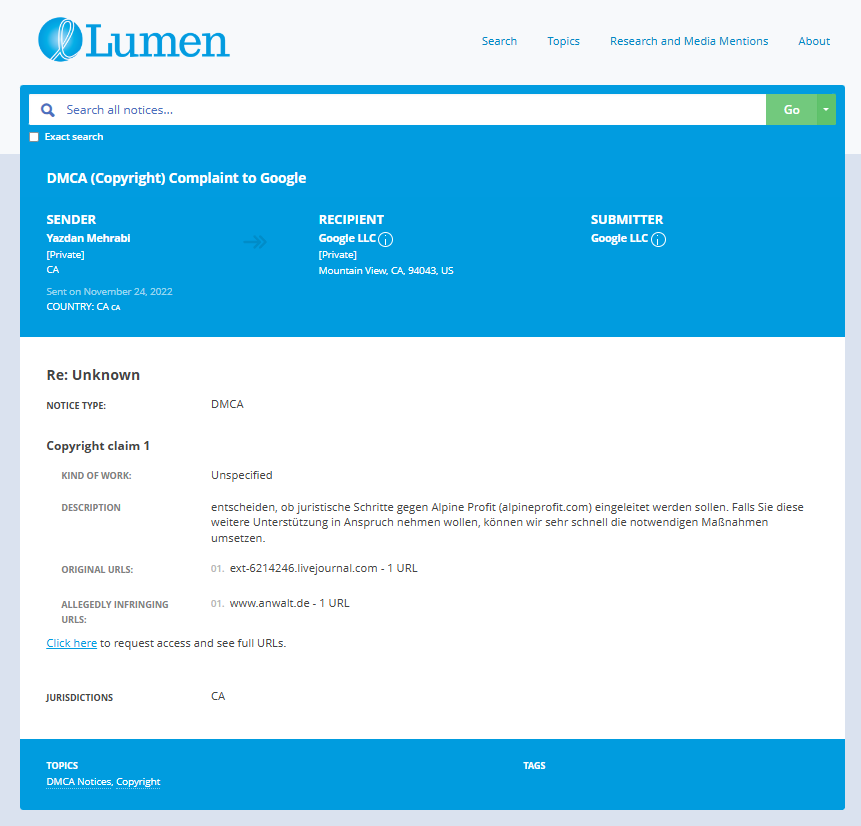

Our firm is launching a comprehensive investigation into Alpine Profit over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Alpine Profit - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

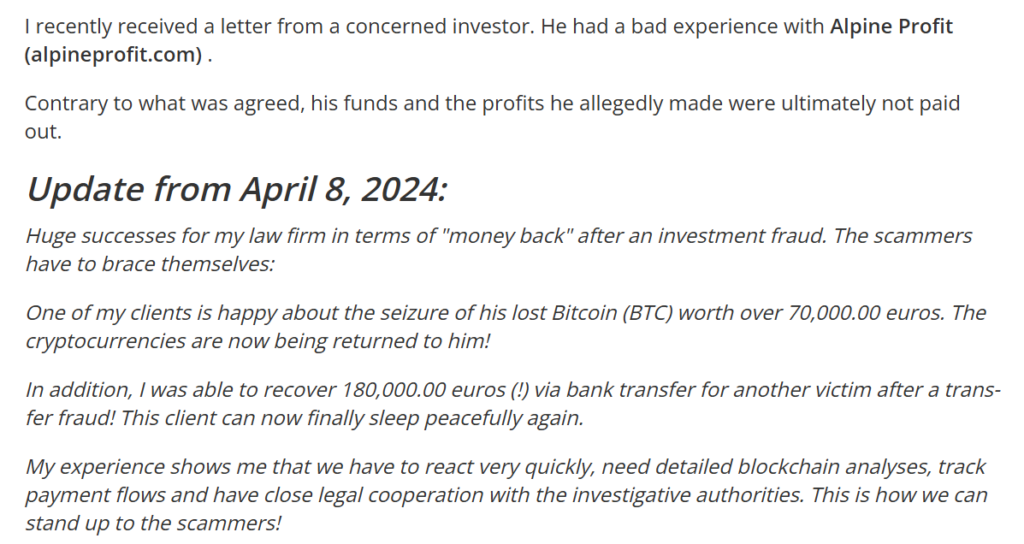

Alpine Profit, a financial services and investment firm, has been embroiled in a series of allegations, red flags, and adverse news reports that have raised serious concerns about its business practices, ethical standards, and regulatory compliance. These issues have significantly damaged the firm’s reputation and could explain why Alpine Profit might resort to extreme measures, including cyber crimes, to suppress damaging information.

Major Allegations and Red Flags

- Misleading Investors:

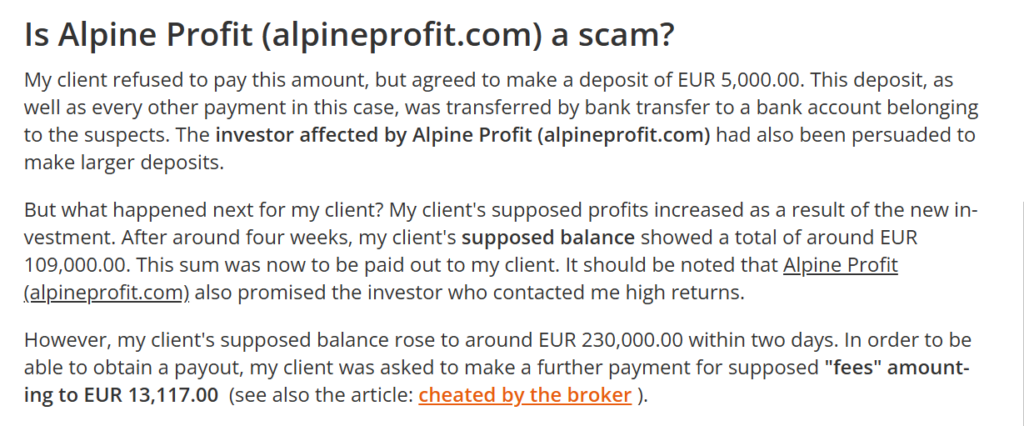

Alpine Profit has been accused of providing false or exaggerated information to investors about the performance of its funds and investment strategies. In 2022, a group of investors filed a lawsuit alleging that the firm misrepresented the risks associated with its high-yield investment products, leading to significant financial losses.

- Ponzi Scheme Allegations:

Investigative reports have raised suspicions that Alpine Profit may be operating a Ponzi-like scheme, where returns to earlier investors are paid using funds from newer investors rather than legitimate profits. While no formal charges have been filed, these allegations have eroded trust in the firm’s operations.

- Regulatory Violations:

Alpine Profit has faced scrutiny from financial regulators for failing to comply with industry standards and reporting requirements. In 2021, the firm was fined for inadequate anti-money laundering (AML) controls, raising questions about its commitment to ethical and legal practices.

- High Employee Turnover and Toxic Work Culture:

Former employees have described a toxic work environment at Alpine Profit, characterized by unrealistic performance expectations, lack of transparency, and retaliation against whistleblowers. These claims have painted the firm as an exploitative employer, further tarnishing its reputation.

- Ties to Controversial Figures:

Alpine Profit has been linked to individuals and entities with questionable reputations, including those involved in money laundering and other illegal activities. These associations have fueled speculation about the firm’s integrity and the legitimacy of its operations.

- Cybersecurity Breaches:

In 2023, Alpine Profit experienced a significant data breach that exposed sensitive client information. The firm was criticized for its slow response and lack of transparency, further damaging its credibility and raising concerns about its ability to safeguard client data.

Reputational Harm and Motives for Suppression

The allegations against Alpine Profit have severely harmed its reputation, making it difficult for the firm to attract new clients and retain existing ones. The negative publicity has also made it a target for regulatory scrutiny and legal action, further complicating its business operations. For a financial services firm, trust and credibility are paramount, and the loss of these can be devastating.

Given the gravity of these allegations, Alpine Profit has a strong motive to suppress damaging information. Negative news stories, whistleblower accounts, and regulatory actions can lead to lost clients, declining revenues, and legal penalties. In extreme cases, the firm might resort to cyber crimes, such as hacking or deploying malware, to remove or discredit harmful content. For instance, Alpine Profit could target journalists, whistleblowers, or competitors to erase evidence or intimidate critics.

To Conclude Alpine Profit’s repeated ethical and legal lapses have cast a shadow over its operations. The firm’s desire to protect its reputation and financial interests could drive it to engage in illegal activities, including cyber crimes, to silence critics and erase damaging information. However, such actions would only deepen the crisis, highlighting the need for greater accountability and transparency in the financial services industry.

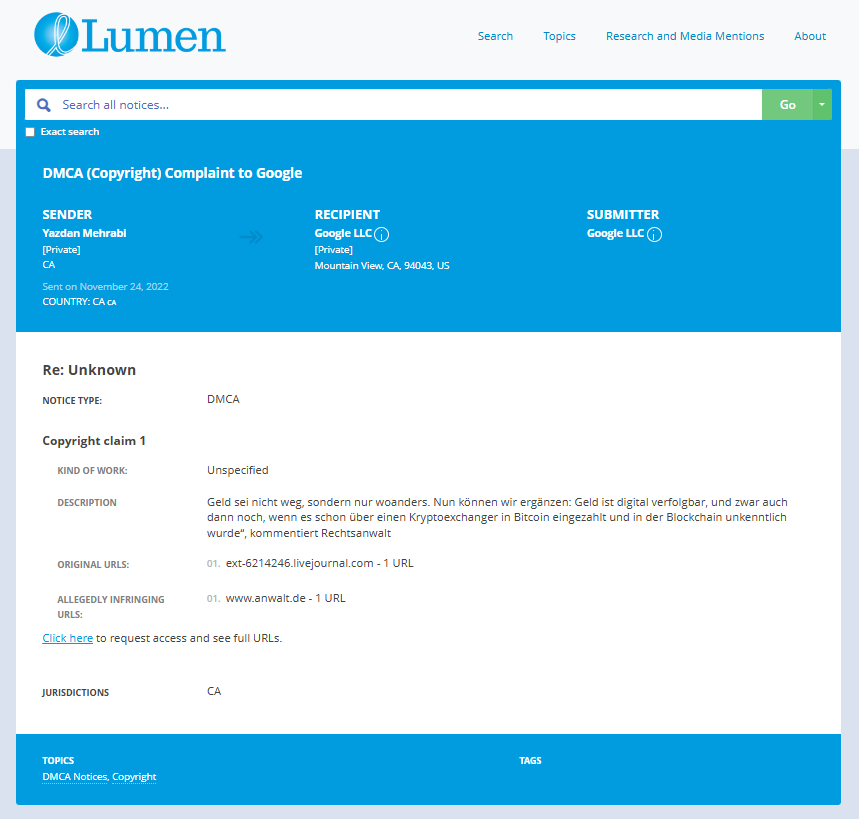

- https://lumendatabase.org/notices/29676349

- https://lumendatabase.org/notices/29676481

- Nov 24, 2022

- Nov 24, 2022

- Yazdan Mehrabi

- https://ext-6214246.livejournal.com/1827.html

- https://ext-6214246.livejournal.com/2274.html

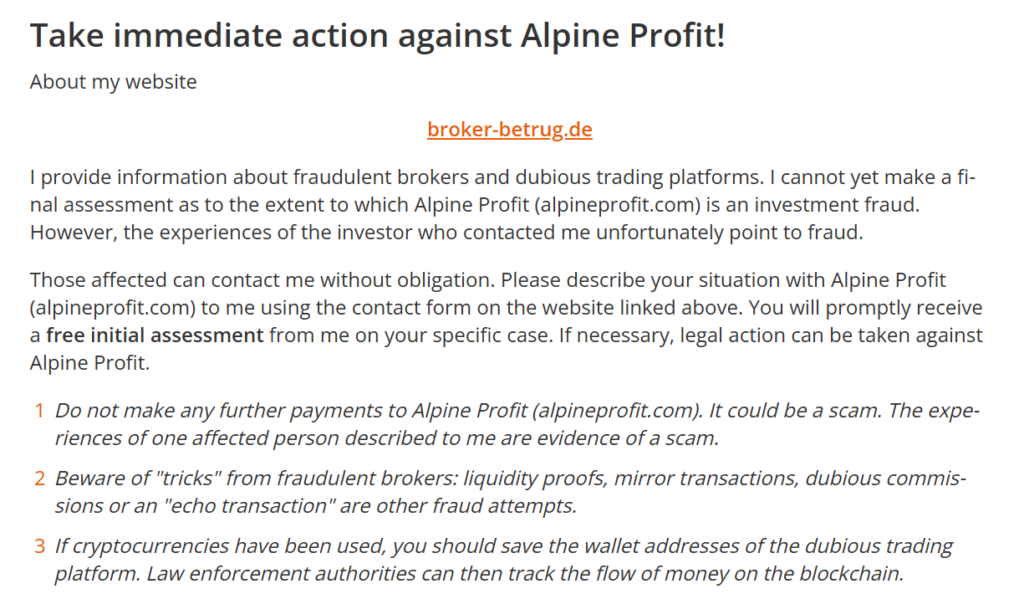

- https://www.anwalt.de/rechtstipps/alpine-profit-enttaeuschende-erfahrungen-mit-broker-opfer-draengen-auf-auszahlung-205562.html

- https://www.anwalt.de/rechtstipps/betrug-ueber-alpine-profit-alpineprofit-com-erfahrungen-zur-auszahlung-205610.html

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

intelligenceline.com

Alpine Profit: Exposing Alleged Malpractices and Victim Stories

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.7

Based on 11 ratings

by: Henry Blake

bro this whole site fishy as hell, soon as u deposit they ghost u fr.

by: Grace Vaughn

I lost $2,000 to these scammers, they never let me withdraw, just kept asking for more “verification”.

by: Jessica Romero

I lost $12,000 to Alpine Profit, and after weeks of getting the runaround, I’m convinced they were operating a Ponzi scheme all along don’t trust them with your money

by: Samuel Rice

Alpine Profit promised big returns on my $6,000, but after months of delays and manipulation, I’m still waiting for my funds to be released this company is nothing but a scam

by: April Powell

I invested $10,000 in Alpine Profit, only to watch it disappear after they failed to deliver any returns and then started blocking my withdrawal requests I feel totally scammed

by: Liam Davis

Honestly, I am trying to get my money back...I have heard only bad things about them...and now they’re trying to cover it up.

by: Sahil Gupta

They promise easy profits, but when things go wrong, they don’t even have the decency to communicate with you Very Bad experience????????

by: Isabella Walker

Very Wrost Firm they have many rule because they don't want that client request withdrawal. Pleas stay away from them

by: Ava Thomas

Accounts are getting locked, and users can’t access their money. They seriously need to do something to fix these issues and allow people to use the platform. Orelse they are trapping people.

Cons

by: William Miller

One of the worst trading conditions in any prop firm. They change the rules to suit themselves, making it nearly impossible to succeed.

by: Ayesha Khan

Big Scam. They promised high returns, but I ended up losing more than I invested. Really feel scammed.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations