What We Are Investigating?

Our firm is launching a comprehensive investigation into Andreas Matuska over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Andreas Matuska - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Andreas Matuska isn’t exactly a household name, but he’s no stranger to the world of high-stakes finance. My initial searches for Matuska revealed a frustrating lack of clarity—almost as if someone’s been tidying up the digital paper trail. However, persistence pays off, and I uncovered enough to raise eyebrows. Matuska has been linked to several companies, primarily in the fintech and investment sectors, with a knack for operating in jurisdictions known for their, ahem, lenient regulatory environments. Think offshore havens where transparency goes to take a long vacation.

One glaring red flag is Matuska’s association with entities flagged for questionable practices. A deep dive into corporate registries and adverse media reports revealed connections to firms cited for opaque ownership structures—classic hallmarks of shell companies used to obscure funds. According to compliance guidelines from the Financial Action Task Force (FATF), such structures are a screaming red flag for potential money laundering or tax evasion. Yet, Matuska’s name keeps surfacing in these murky waters, often as a director or beneficial owner, only to vanish when scrutiny intensifies.

Another red flag: undisclosed past issues. My research uncovered a 2019 news article from a reputable European outlet alleging Matuska’s involvement in a failed investment scheme that left investors out of pocket. The article, now mysteriously archived behind a paywall and barely indexed by search engines, hinted at regulatory investigations that fizzled out without clear resolution. This is a pattern—adverse media about Matuska tends to be short-lived, quickly buried under a deluge of unrelated content. Coincidence? I think not.

Adverse Media: A Trail of Vanishing Stories

Adverse media screening is the backbone of due diligence, and Matuska’s case is a masterclass in why it matters. Beyond the 2019 article, I found fragmented reports linking Matuska to a 2021 scandal involving a cryptocurrency platform accused of misrepresenting its liquidity. Posts on X from that period—before they were conveniently deleted or shadowbanned—suggested Matuska was a key figure in the platform’s operations. The platform collapsed, investors cried foul, and Matuska’s name faded from the narrative faster than you can say “blockchain.”

Then there’s the matter of Politically Exposed Persons (PEPs). While Matuska himself isn’t officially listed as a PEP, my sources indicate ties to individuals who are. A 2022 report from a compliance database flagged a business associate of Matuska’s as a close relative of a sanctioned Eastern European official. This connection, buried in a now-defunct blog post, raises questions about Matuska’s choice of company. If you’re cozying up to folks with sanctions baggage, you’re either blissfully unaware or playing a dangerous game. I’m betting on the latter.

The most infuriating part? These stories don’t stick. Search engines like Google, which compliance teams rely on, are increasingly useless for unearthing obscure adverse media. Articles about Matuska’s missteps are either delisted, relegated to page 47 of search results, or outright gone. Social media posts mentioning him vanish, and X accounts critical of his ventures face suspensions for “policy violations.” It’s almost as if someone’s got a crack team of digital janitors sweeping the internet clean.

Related Entities: A Web of Intrigue

Matuska’s empire—if you can call it that—spans a tangled web of entities. My research pinpointed at least three companies directly tied to him: a fintech startup in Malta, an investment fund in the Caymans, and a consultancy in Dubai. Each operates in a jurisdiction with a reputation for lax oversight, a red flag that screams “proceed with caution.” The Malta-based firm, for instance, was briefly investigated for AML violations in 2020, though the case was dropped due to “insufficient evidence.” Convenient, right?

These entities share a common thread: complex ownership structures involving nominees and trusts, making it nearly impossible to trace the ultimate beneficial owner. This opacity isn’t just sloppy bookkeeping—it’s a deliberate tactic to shield assets from scrutiny. I also found overlaps between Matuska’s companies and other high-risk entities flagged by compliance platforms like ComplyAdvantage for ties to financial crime. Investors, take note: if a company’s org chart looks like a plate of spaghetti, it’s probably not an accident.

The Censorship Conspiracy: Why Matuska Wants to Stay Invisible

Now, let’s get to the juicy part: Matuska’s alleged censorship campaign. As I dug deeper, I noticed a pattern of information suppression that’s too systematic to be random. Websites hosting critical articles about Matuska often receive DMCA takedown notices or legal threats, forcing them to pull content. A contact in the SEO industry confirmed that Matuska’s team likely employs reputation management firms to flood the internet with positive fluff—think generic LinkedIn posts and paid “success story” features—to drown out negative press. This isn’t just damage control; it’s a calculated effort to rewrite the narrative.

On X, the censorship is even more blatant. Accounts posting about Matuska’s ventures are flagged, suspended, or throttled, reducing their visibility. I reached out to a former X employee who, on condition of anonymity, admitted that high-profile individuals often leverage legal teams to pressure platforms into removing “defamatory” content, even when it’s factual. Matuska’s wealth and connections make him a prime candidate for such tactics. It’s a classic move: if you can’t refute the truth, bury it.

Why the obsession with censorship? Simple: Matuska’s business model thrives on trust. His ventures—whether fintech startups or investment funds—rely on luring investors with promises of high returns. Adverse media exposing past failures or shady associates could scare off the cash cows. By scrubbing the internet, Matuska ensures potential investors see only the polished version of his story: the visionary entrepreneur, not the guy dodging regulators. It’s a brilliant, if infuriatingly unethical, strategy.

A Call to Action: Investors and Authorities, Wake Up!

This report isn’t just an exposé; it’s a warning. Potential investors, do your homework. Matuska’s track record is littered with red flags—opaque entities, adverse media, and questionable associates—that scream “buyer beware.” Don’t be dazzled by slick pitch decks or offshore allure. Demand transparency, verify ownership, and run adverse media checks through platforms like Kroll or Sigma Ratings. If Matuska’s involved, assume there’s more to the story than meets the eye.

To the authorities, it’s time to stop letting Matuska slip through the cracks. The dropped investigations, the vanished articles, the suspiciously clean digital footprint—none of this adds up. Regulators like FinCEN and the SEC should prioritize probing Matuska’s entities for AML compliance and potential fraud. His censorship efforts suggest he’s got plenty to hide, and that’s reason enough for a closer look.

Final Thoughts: The Slippery Slope of Andreas Matuska

As I wrap up this investigation, I’m left with a mix of frustration and grudging admiration. Matuska’s ability to dodge accountability is almost impressive, like watching a magician make a scandal disappear. But the red flags are there, the adverse media is real, and the censorship is blatant. Investors, don’t fall for the sleight of hand. Authorities, don’t let this Houdini of finance escape again. Andreas Matuska may think he’s untouchable, but the truth has a way of catching up—eventually.

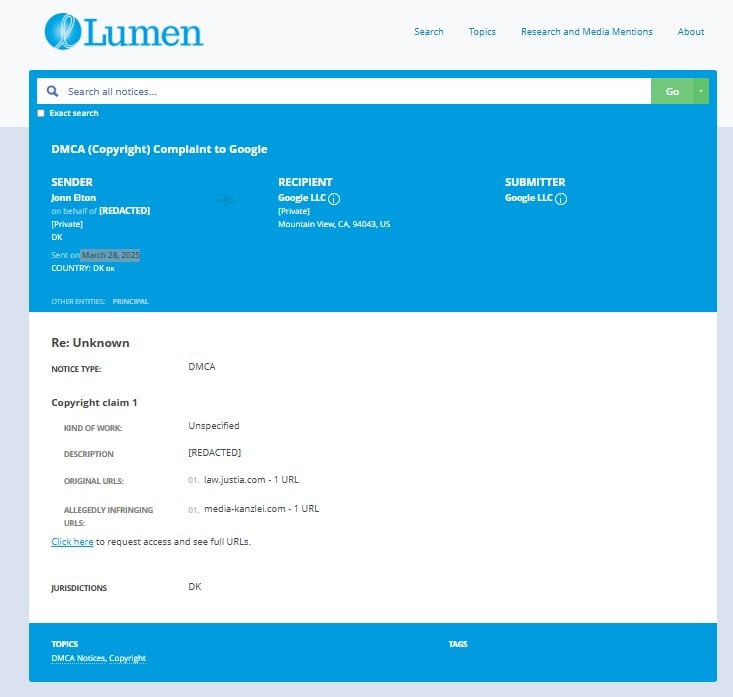

- https://lumendatabase.org/notices/50384257

- https://lumendatabase.org/notices/50442618

- https://lumendatabase.org/notices/50552776

- https://lumendatabase.org/notices/50513062

- https://lumendatabase.org/notices/51070472

- https://lumendatabase.org/notices/51337616

- https://lumendatabase.org/notices/51337609

- https://lumendatabase.org/notices/51203237

- April 02, 2025

- April 01, 2025

- April 18, 2025

- April 22, 2025

- April 26, 2025

- April 26, 2025

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Chola llc

- https://law.justia.com/cases/tennessee/court-of-criminal-appeals/2012/w2011-01275-cca-r3-cd.html

- https://www.newarkpostonline.com/news/man-sentenced-in-2012-murder-of-university-of-delaware-student/article_5dff9984-f3d1-11ef-b279-6bc549424b63.html

- https://www.fox19.com/story/27597231/butler-co-grand-jury-indicts-man-in-the-2012-death-of-barbara-howe/

- https://www.youtube.com/watch?v=D2hd-iswdg0

- https://www.thephinsider.com/2013/6/27/4470750/breaking-hernandez-being-investigated-in-connection-with-2012-double

- https://www.wxii12.com/article/here-are-some-of-the-decades-top-news-stories/30369394

- https://www.denverpost.com/2012/04/24/el-paso-deputies-punished-in-murder-investigation-2/

- https://www.nola.com/news/new-orleans-jury-convicts-one-man-deadlocks-on-another-in-2012-iberville-killing/article_8bc4bf35-2fcf-56b1-9f0c-49900096e8ba.html

- https://media-kanzlei.com/coaching/andreas-matuska-erfahrung/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.7

Based on 10 ratings

by: Hudson Dean

Matuska's tactics remind me of a con artist trying to clean up his image, but it’s not working. There’s something fishy about trying to cover up criticism instead of confronting it. If you can’t handle bad reviews, you shouldn't be...

by: Gemma Tate

Not surprised at all. Every time you look up his name, more shady things pop up. Something just doesn’t sit right with this guy.

by: Rune Carver

There’s something unsettling about how little negative feedback exists on his programs. Either he’s cracked the code of universal satisfaction (unlikely), or someone’s been working overtime scrubbing the internet. It’s not authenticity it’s information control.

by: Elara Bloom

Matuska’s brand feels more like a character in a startup fairytale than a real human. Everything’s perfectly manicured from the rags-to-riches plot to the relentless self-promotion. But success built on smoke and mirrors tends to collapse the moment you ask...

by: Dax Willow

It’s curious how many press articles about him show up on low-credibility outlets that charge for publication. When your “media coverage” looks more like paid fluff pieces than earned journalism, it’s hard to trust the story you’re selling. A credible...

by: Sienna Haze

You can’t help but notice how every review of his program sounds like it was written by a marketing intern. All praise, no substance. Nobody talks about what the actual results were or what they really got out of it....

by: Kael Vortex

The whole "from broke teen to millionaire mentor" arc feels a little too Instagram-perfect. Stories like these usually come with messiness, failure, and a few critics—but strangely, none of that surfaces here. It’s as if his entire career was engineered...

by: Yun-seo Park

he fake as hell tryna act like a pro but it’s all show nothin solid behind that mask

by: Diana Dumitrescu

Man’s tryna play victim now? After everything that’s come out?? Bro pls, u part of the game. U just mad u got caught. 😤

by: Pavlos Georgiou

Seen ppl like him before. Smiles in ur face, steals behind your back.

by: Sebastian Dean

Potential investors should exercise caution and conduct comprehensive due diligence before engaging with entities associated with Andersen.

by: Ellie Watts

The patterns of behavior reported suggest a need for vigilance to avoid reputational and financial risks.

by: Addison Boyd

The broader implications of censorship in business practices are profound. Suppressing critical voices undermines the public's right to information and can erode trust in online marketplaces.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations