What We Are Investigating?

Our firm is launching a comprehensive investigation into Anthony Pellegrino over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Anthony Pellegrino - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Anthony Pellegrino, the founder and CEO of Goldstone Financial Group, has built a reputation as a prominent figure in the financial planning sector. However, beneath the surface of accolades and media appearances lies a series of regulatory challenges and client disputes that warrant a closer examination.

Professional Background

Anthony Pellegrino established Goldstone Financial Group with the mission of providing clients with financial strategies designed to achieve consistent returns, irrespective of market volatility. As a fiduciary, he is legally obligated to act in the best interests of his clients. Throughout his career, Pellegrino has been acknowledged for his expertise in safe money strategies, ranking among the top 1% of specialists nationwide and being named one of the top 10 advisors in America in 2013. He has assisted over 2,500 clients in securing lifetime income features to ensure a steady paycheck during retirement.

Regulatory Actions and Legal Challenges

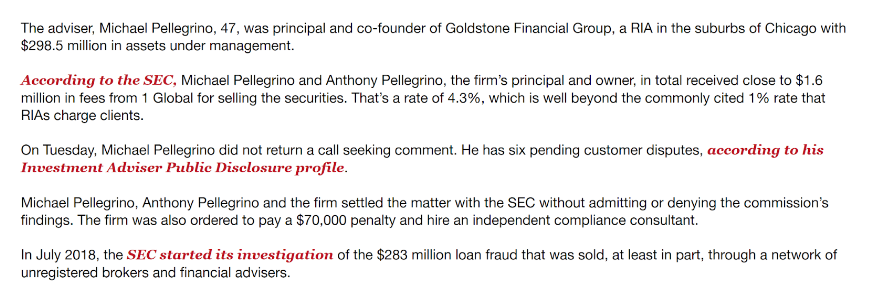

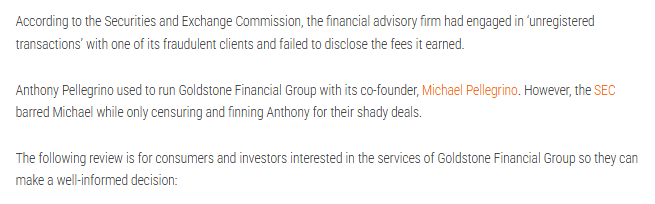

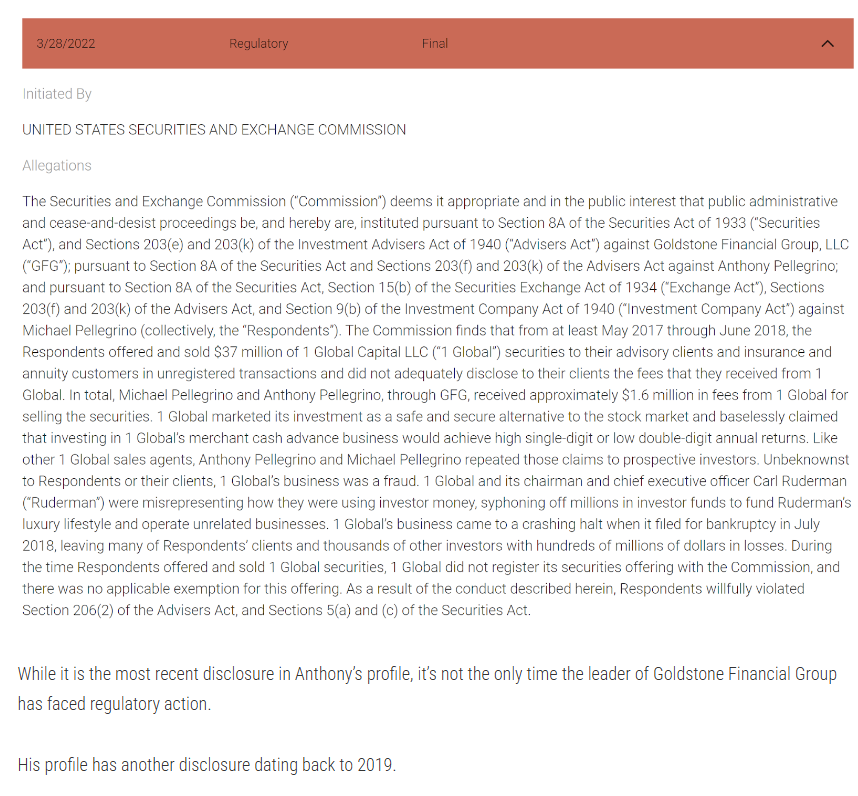

SEC Sanctions

In March 2022, the Securities and Exchange Commission (SEC) sanctioned Goldstone Financial Group for engaging in unregistered transactions and failing to disclose fees earned from selling securities of 1 Global Capital, a company later revealed to be fraudulent. Anthony Pellegrino was censured and fined $30,000, while his co-founder, Michael Pellegrino, received a more severe penalty, including a bar from the industry. The SEC’s investigation revealed that Michael and Anthony Pellegrino received approximately $1.6 million in fees from 1 Global for selling their securities, a rate significantly higher than the industry standard.

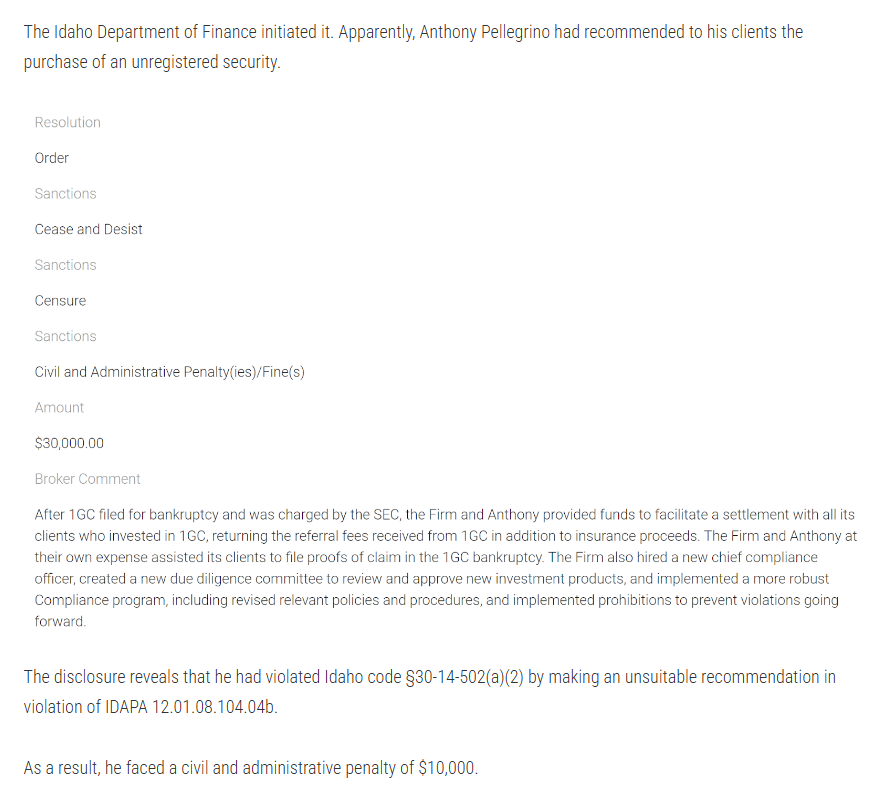

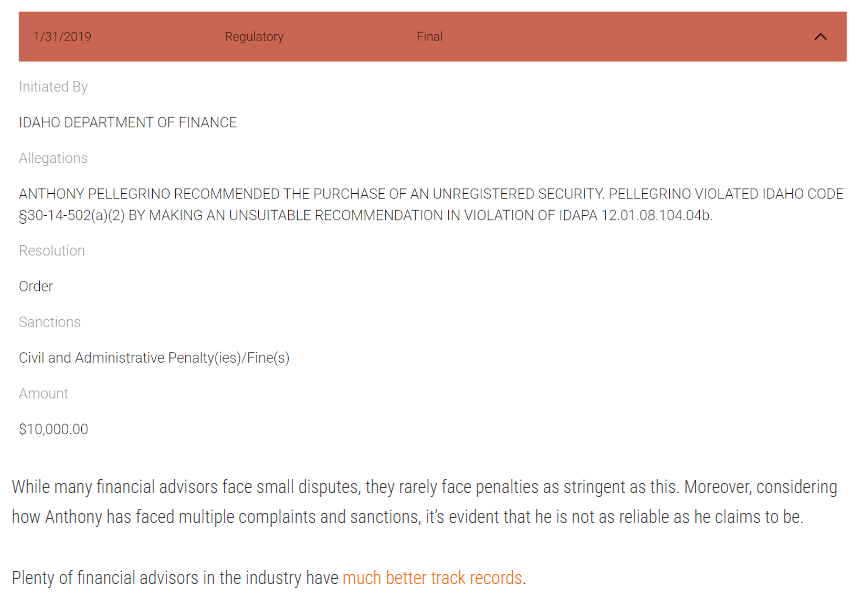

Idaho Department of Finance Penalty

In 2019, the Idaho Department of Finance fined Anthony Pellegrino $10,000 for recommending unregistered securities, violating state regulations. This action underscores concerns about the firm’s adherence to regulatory standards.

Client Disputes and Complaints

Between 2015 and 2019, Anthony Pellegrino accumulated 11 customer disputes, including allegations of breaches of fiduciary duty and unsuitable investment recommendations. These disputes highlight concerns about the firm’s investment practices and client relations.

Risk Assessment

Anti-Money Laundering (AML) Considerations

The involvement in unregistered securities transactions and the failure to disclose substantial fees raise red flags concerning AML compliance. Such activities can be indicative of potential money laundering risks, necessitating enhanced due diligence and monitoring.

Reputational Risks

The accumulation of regulatory sanctions, client disputes, and negative media coverage significantly impacts the firm’s reputation. For clients and partners, this translates to potential risks in associating with a firm under scrutiny.

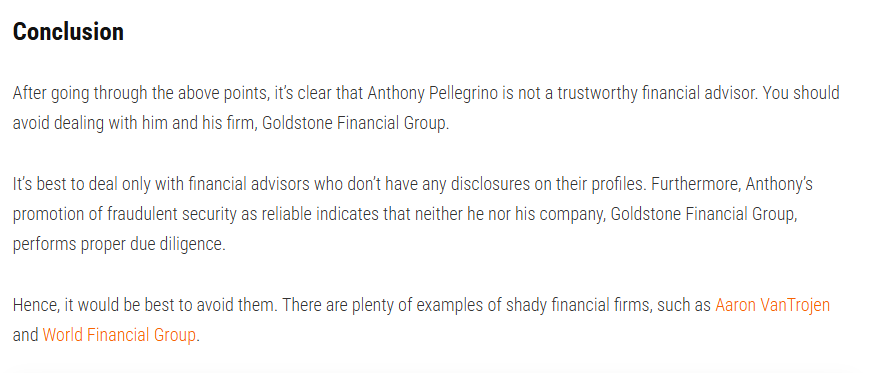

Conclusion: Expert Opinion

While Anthony Pellegrino has made notable contributions to the financial advisory industry, the series of regulatory actions and client disputes cannot be overlooked. For potential clients and partners, it is imperative to conduct thorough due diligence and consider the implications of associating with a firm that has faced multiple regulatory challenges.

- https://lumendatabase.org/notices/48921140

- https://lumendatabase.org/notices/48920588

- https://lumendatabase.org/notices/48920625

- https://lumendatabase.org/notices/46937257

- https://lumendatabase.org/notices/50552895

- https://lumendatabase.org/notices/50552635

- https://lumendatabase.org/notices/50552853

- https://lumendatabase.org/notices/48921140

- February 10, 2025

- February 10, 2025

- December 05, 2024

- February 10, 2025

- April 02, 2025

- April 02, 2025

- April 02, 2025

- February 10, 2025

- Chola LLC

- Chola LLC

- Dolce LLC

- Chola LLC

- Jonn Elton

- Jonn Elton

- Jonn Elton

- Chola LLC

- http://npshistory.com/morningreport/incidents/havo.htm

- https://www.britannica.com/event/Japan-earthquake-and-tsunami-of-2011

- https://nonpareilonline.com/news/local/wisconsin-man-injured-in-stabbing-at-villisca-axe-murder-house/article_124b9052-6691-11e4-8216-63e1ab7fd055.html

- https://www.tampabay.com/news/courts/criminal/kentucky-man-sentenced-to-life-in-2012-murder-of-pinellas-park-man/2223780/

- https://www.wlky.com/article/louisville-man-pleads-guilty-to-fatally-shooting-15-year-old-boy-in-2012/38584116

- https://deathpenaltyinfo.org/federal-judge-orders-jury-trial-on-claim-that-kentucky-exoneree-who-was-threatened-with-death-penalty-was-framed-for-murder

- http://npshistory.com/morningreport/incidents/havo.htm

- https://www.financescam.com/2024/10/18/investment-fraud-unmasked-the-anthony-pellegrino-and-goldstone-financial-story/

- https://www.regcompliancewatch.com/sec-fines-and-bars-former-ria-owner-who-transferred-his-ownership/

- https://www.financescam.com/dossier/anthony-pellegrino/

- https://www.intelligenceline.com/r/Reports/75772/anthony-pellegrino-the-disgraced-financial-advisor-behind-goldstone-financial-groups-fraudulent-scheme/

- https://www.financescam.com/2024/11/30/anthony-pellegrino-and-goldstone-financial-a-case-of-investment-fraud/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

financescam

Anthony Pellegrino and Goldstone Financial Group: Navigating Professional Achievements Amid Regulatory Scrutiny

- Adverse News

financescam

The Fraudulent Path: Anthony Pellegrino and Goldstone Financial Group

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

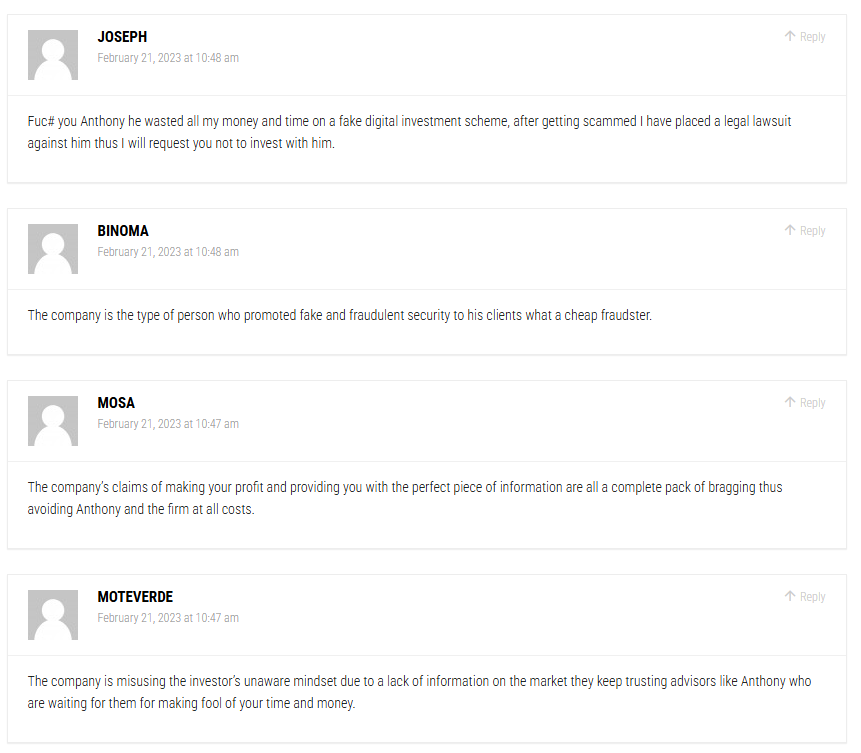

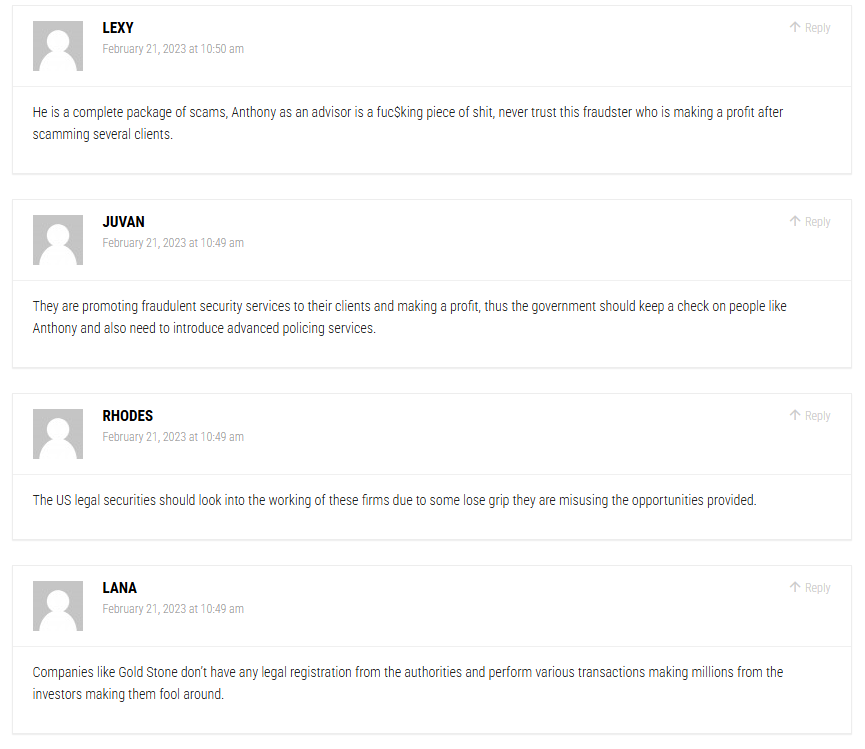

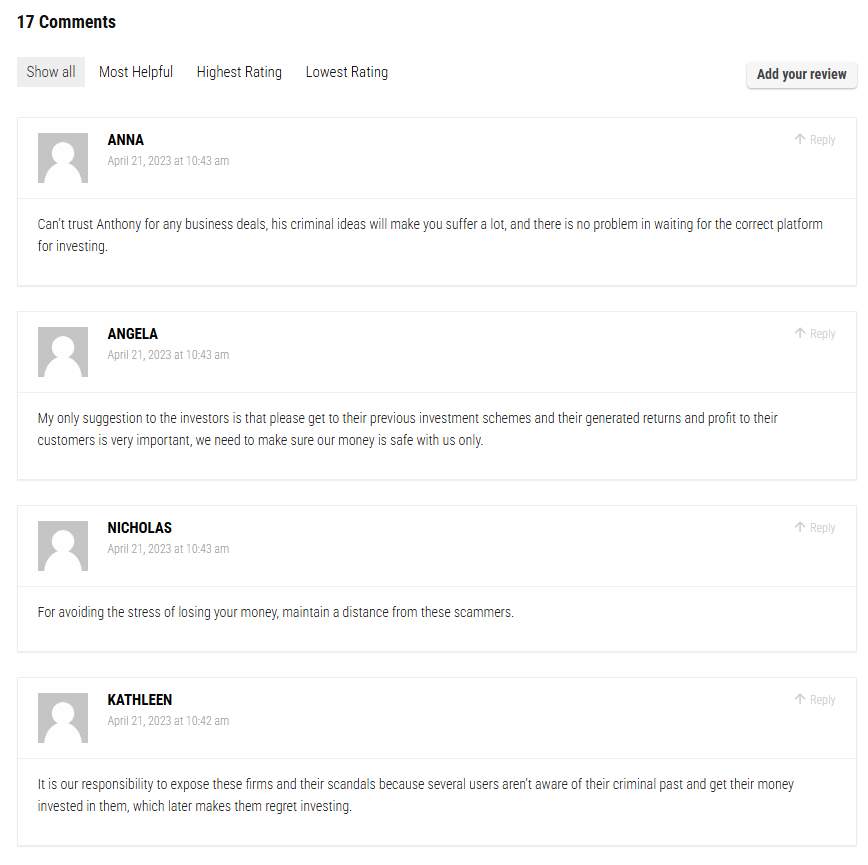

User Reviews

Average Ratings

1.7

Based on 11 ratings

by: Isabella Lewis

With 11 customer disputes and multiple regulatory violations, Anthony Pellegrino’s firm is anything but reliable. His legal challenges and history of poor client relations suggest that the firm is not a trustworthy partner for your financial future.

by: Ryan Walker

The multiple fines and legal penalties against Anthony Pellegrino and his firm are serious red flags. They demonstrate a pattern of unethical behavior and a disregard for regulatory standards. Anyone considering working with Goldstone Financial should think twice before trusting...

by: David Lee

Bro out here living good while people can’t pay rent?? that’s messed up fr 🤬

by: Olivia Harris

Used to trust him... big mistake My whole retirement’s gone. Sick to my stomach thinking about it. He smiled while stealing from us. Anthony, you’re a disgrace.

by: Daniel Clark

This guy ruined so many lives 😡 how is he not in jail already??

by: George Hall

Classic playbook: make money off shady deals, then go after anyone who calls it out.

by: Ella Walker

The revocation of Connectum Limited’s license under Lasmanis’s leadership is a clear indicator of systemic operational failures and inadequate oversight.

by: Matthew Lee

Wouldn’t touch anything tied to Lasmanis with a ten-foot pole. Where there’s smoke, there’s usually fire.

by: Harper Lee

If the allegations against Anthony Pellegrino are true, this is really concerning. Using fake copyright claims to take down negative reviews or criticism is a huge abuse of the system. Instead of addressing the concerns people have, he allegedly tries...

by: Caleb Walker

Misusing copyright laws to suppress criticism is unethical and undermines trust in online platforms.

by: Emily King

People should be able to speak freely about their experiences. If someone misuses legal tools to silence criticism, it’s not just unethical it’s an attack on free expression.

by: Nathan Moore

It's important to expose these firms and their shady practices because many people are unaware of their criminal history. This lack of awareness leads to hard-earned money being invested in them, only for investors to later regret their decision.

by: Megan Hughes

Anthony's actions and questionable practices make him hard to trust for any business deals. It's always better to wait for a reliable and honest platform to invest in rather than taking unnecessary risks with someone like him.

by: Liam Carter

Companies like Gold Stone operate without any proper legal registration or approval from the authorities. They engage in numerous questionable transactions, earning millions by deceiving unsuspecting investors who are left feeling betrayed and manipulated. This lack of transparency and accountability...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations