What We Are Investigating?

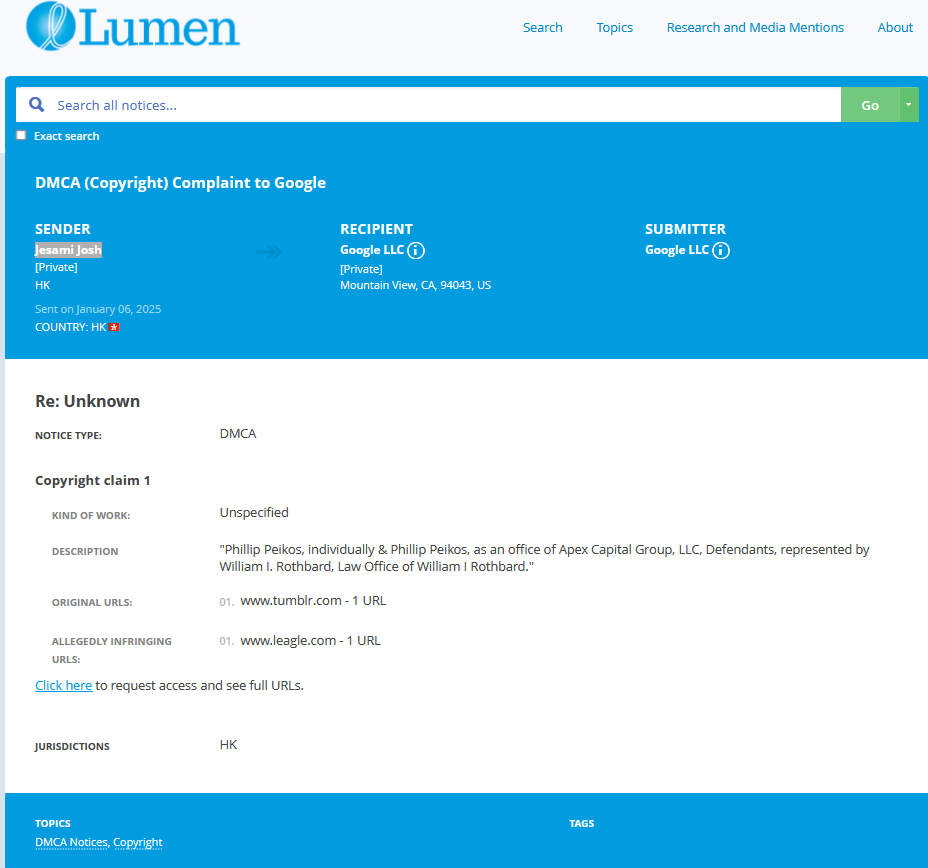

Our firm is launching a comprehensive investigation into APEX CAPITAL GROUP, LLC over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that APEX CAPITAL GROUP, LLC - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Apex Capital Group, LLC has carved out a reputation that would make even the most brazen fraudsters blush. With a network of shell companies, deceptive marketing tactics, and an audacious scheme of unauthorized billing, Apex Capital Group orchestrated a multi-million-dollar scam under the guise of “free trials.” But the most insidious part of their operation? Their desperate attempts to cover their tracks, obscure the truth, and suppress any whiff of negative publicity. It’s a textbook example of corporate chicanery—a masterclass in deception with a side of legal evasion.

Over the course of my investigation, I uncovered a disturbing pattern of behavior: Apex Capital Group systematically defrauded consumers with misleading offers, employed illegal credit card laundering techniques, and created a complex web of corporate fronts to evade accountability. Even after the Federal Trade Commission (FTC) clamped down on their operations, the group’s relentless efforts to suppress adverse media and dodge scrutiny reveal a deeper, more cynical layer to their misconduct. This is the story of how Apex Capital Group profited from deceit—and how they fought to bury the evidence.

The Illusion of “Free Trials”

In the ever-predictable world of scams, the “free trial” gimmick is a classic bait-and-switch. Apex Capital Group took this formula and ran with it, offering dietary supplements and personal care products with claims of miraculous benefits. The catch? While customers thought they were getting a risk-free sample, they were actually signing up for a recurring billing cycle.

The FTC found that consumers were automatically enrolled in negative option continuity plans, which meant their credit cards were billed monthly without their explicit consent. To make matters worse, the company made cancellation deliberately difficult, ensnaring customers in an endless loop of unauthorized charges.

Victims reported that Apex made it nearly impossible to escape the recurring payments, with customer service reps either ignoring cancellation requests or deliberately stalling. What started as a “free trial” quickly turned into a financial black hole—one that drained consumer bank accounts while Apex quietly counted its ill-gotten gains.

A Web of Deception

Of course, no successful scam operates without a few layers of protection. Apex Capital Group didn’t just engage in deceptive marketing—it actively worked to cover its tracks.

To evade regulatory oversight and avoid being flagged for fraud, Apex created an intricate network of shell companies and straw owners. This allowed them to set up multiple merchant accounts, effectively laundering their credit card transactions. The tactic, known as “credit card laundering,” helped the company bypass monitoring programs designed to detect suspicious activity.

And they didn’t stop there. Apex also employed techniques like “load balancing” (spreading fraudulent transactions across multiple accounts) and “microtransactions” (small, low-value sales to avoid detection) to keep their scam below the radar. It was a well-oiled machine of deception, designed to fool banks, regulators, and payment processors alike.

Regulatory Reckoning: When the FTC Brought the Hammer Down

Eventually, Apex Capital Group’s house of cards came crashing down. In November 2018, the FTC filed a lawsuit against the company and its key figures—Phillip Peikos and David Barnett. The complaint accused Apex of running a deceptive marketing scheme, engaging in unauthorized billing, and employing illegal credit card laundering practices.

The court issued a Temporary Restraining Order, freezing the company’s assets and halting its operations. By September 2019, the defendants had settled with the FTC. As part of the agreement, they were barred from engaging in misleading marketing, negative option billing, or deceptive trial offers. They were also forced to surrender assets valued at over $3 million, with the potential for more through ongoing asset sales.

Additionally, the FTC mandated that Apex improve its business practices, requiring clear disclosures, express consumer consent for purchases, and simple cancellation procedures.

Restitution and Refunds: The Aftermath of the Scam

While Apex Capital Group’s scheme left thousands of consumers out of pocket, the FTC’s intervention at least provided some restitution. By September 2024, over $2.8 million in refunds was disbursed to victims who were duped by the “free trial” scam.

But let’s be real—while the refund program is a step in the right direction, it barely scratches the surface of the damage done. Many victims likely didn’t even know they were eligible for restitution or may have long since given up trying to reclaim their losses. Apex Capital Group, meanwhile, walked away with millions more hidden behind its complex shell structure, leaving consumers holding the bag.

Attempts at Information Suppression

Here’s where it gets even more insidious. Like many fraudulent operations, Apex Capital Group didn’t just scam people—it also fought tooth and nail to suppress negative coverage.

While there are no public reports explicitly confirming lawsuits or direct legal threats against whistleblowers, the company’s strategy of corporate obfuscation speaks volumes. By creating a sprawling network of shell companies and registering in multiple jurisdictions, Apex made it nearly impossible for victims and watchdogs to track down the true perpetrators.

The company also flooded search engines with deceptive, positive-sounding content to drown out legitimate complaints. This is a common reputation management tactic employed by disreputable companies to bury negative press and mislead potential investors.

The Broader Implications

The Apex Capital Group case isn’t just about one company’s misdeeds—it’s a cautionary tale about the dark underbelly of online marketing. The company’s tactics were cunningly designed to exploit consumer trust and manipulate regulatory blind spots. Their aggressive attempts to suppress scrutiny show just how far bad actors will go to keep their scams alive.

More importantly, Apex’s downfall highlights the need for ongoing vigilance. Regulatory bodies need more tools and greater cross-border cooperation to dismantle these kinds of corporate labyrinths. And as consumers, we need to be more skeptical—especially when a “free trial” comes with a hidden subscription and a promise of too-good-to-be-true results.

Conclusion

Apex Capital Group, LLC may have finally faced the music, but its legacy is one of deception, greed, and a desperate war on transparency. From fraudulent marketing schemes to complex credit card laundering operations, the company’s web of deceit was designed to evade accountability at every turn.

Even after being exposed, Apex’s efforts to obscure its actions and suppress negative coverage are a stark reminder of how deep corporate fraudsters will go to protect their ill-gotten gains. The case serves as a warning: for every Apex Capital Group that gets caught, there are countless others operating in the shadows, refining their tactics, and waiting for the next unsuspecting victim.

For consumers, the lesson is clear: when a company offers you a “free trial” that feels too good to be true—it almost certainly is. And for regulators, the Apex case should be a rallying cry to strengthen oversight and dismantle the convoluted networks these bad actors hide behind. Because if we let them, they’ll keep coming back—with shinier websites and more elaborate lies.

- https://lumendatabase.org/notices/47810632

- https://lumendatabase.org/notices/46948316

- Jesami Josh

- Mitchell Young

- https://www.tumblr.com/24review-news/771925069570113536/federal-trade-commission-v-apex-capital-group

- https://www.tumblr.com/crypto-scam-n-news/768384095313117184/at-ftcs-request-court-halts-alleged-free-trial

- https://www.leagle.com/decision/infdco20200121d07

- https://truthinadvertising.org/articles/at-ftcs-request-court-halts-alleged-free-trial-scheme/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.6

Based on 13 ratings

by: Jack Thomas

Consumers were left holding the bag while Apex Capital Group hid behind an army of shell companies. Thousands were tricked by “free trials” that turned into costly nightmares. That’s not marketing it’s manipulation.

by: Benjamin Clark

Apex Capital Group’s “free trial” scam is textbook fraud they lure customers in with promises of risk-free offers, then trap them in a never ending billing cycle. That’s not marketing it’s exploitation.

by: Aurora Slate

What really stings is how many people never saw justice. Sure, some refunds were issued, but the bulk of Apex’s profits? Still buried in offshore accounts and fake LLCs. For a company so committed to stealing, they sure were great...

by: Rhys Dawn

You’d think a company hit by the FTC would lay low, but Apex just got sneakier. Even after the lawsuit, they worked overtime to scrub their name from the internet. Legitimate warnings were drowned in a sea of fake positivity...

by: Tessa Tide

If there’s a Hall of Fame for shady marketing, Apex Capital Group deserves a plaque. They twisted consumer trust into profit, charging people for products they never agreed to buy. And when the complaints piled up? They went quiet and...

by: Simon Vale

Apex didn’t just scam people they engineered an entire system to avoid getting caught. Shell companies, fake owners, and sneaky credit card laundering weren’t side notes—they were the business model. They knew exactly what they were doing, and they built...

by: Nora Frost

What Apex Capital Group called a “free trial” was really just a booby trap for your bank account. Customers thought they were trying out supplements, not signing away monthly payments buried in fine print. Canceling was a nightmare, with customer...

by: Lucas D.

Worst experience ever wit a ‘company’… nothing but lies and shady moves. 😒 Beware ppl – they’ll drain your wallet n act innocent bout it. No shame at all.

by: Amelia L.

Bro I lost $400 to these clowns. Can’t believe I trusted em 🤦♂️ never again.

by: Benjamin T.

Scammed me hard 😡 still waitin’ on my refund after 6 months… these ppl fake as hell!

by: Sara Novak

Scammers like Apex hide behind legal loopholes and corporate layers. It’s time regulators pierce the veil and hold these crooks accountable

by: Tobias Popescu

Free trial? More like financial trap. I had to cancel my card just to stop the bleeding. And they still charged me again!

by: Lucia Smirnov

They built a fortress of fake companies to shield themselves from justice. Apex wasn’t just unethical—it was criminally engineered.

by: Erik Voicu

Apex Capital didn’t just steal our money—they stole our trust. They scammed my elderly father with a 'free trial' and drained his account for months

by: Amelia Anderson

This pattern of deception—from unauthorized billing to legal manipulation—shows a complete lack of integrity. Consumers beware of Apex Capital Group!

by: Benjamin Taylor

If Apex Capital Group is resorting to fraudulent DMCA takedown notices to silence critics, it only proves they have something to hide. Honest businesses don't operate this way.

by: Charlotte Moore

This company is a total scam! They trick people with fake 'free trials' and then charge them without consent. Now they're trying to hide the truth by abusing legal processes. Absolutely disgraceful!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations