What We Are Investigating?

Our firm is launching a comprehensive investigation into Barry Lee Garapedian over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Barry Lee Garapedian - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Barry Lee Garapedian is a name that should ring alarm bells for anyone considering a financial advisor. Unfortunately, if he has his way, you might never hear them. With a career marred by customer complaints, allegations of unsuitable investment recommendations, and hefty regulatory fines, Garapedian is no stranger to controversy. Yet, rather than confronting the damning evidence, he appears to be spending his time and resources trying to erase it from public view. In true Orwellian fashion, Garapedian seems determined to rewrite his narrative, hoping that potential investors, regulators, and the general public will forget about his history of financial misconduct.

As an investigative journalist, I’ve seen my fair share of white-collar rogues, but Garapedian’s case stands out not just for the scale of the allegations, but for his apparent attempts to cover them up. This report will take you through the red flags littering his professional career, the customer grievances that paint a damning picture, and the regulatory sanctions that finally caught up with him. More importantly, it will shine a light on his efforts to censor the very information that could help protect future investors. Because if there’s one thing worse than a crooked financial advisor, it’s one who’s actively trying to bury the evidence.

Let’s dive into Garapedian’s track record of misconduct and the shady tactics he’s allegedly using to keep it under wraps.

A Legacy of Misconduct

Garapedian’s professional timeline is marred by a series of customer-initiated disputes and regulatory sanctions that paint a damning portrait of his approach to financial advisement. Consider the following highlights from his career:

-

December 13, 2008: A customer complaint was settled for a staggering $1,500,000. The allegations? Garapedian reportedly failed to follow instructions concerning auction rate securities transactions.

-

October 5, 2017: Another client stepped forward, alleging unsuitable recommendations involving variable annuities and exchange-traded funds (ETFs). The compensation requested remains undisclosed, but the pattern of questionable advice is evident.

-

March 20, 2018: A complaint was filed seeking $106,178 in damages, accusing Garapedian of unsuitable recommendations related to stocks and closed-end funds.

-

November 15, 2018: A settlement of $110,000 was reached over claims that Garapedian charged excessive fees, made unsuitable recommendations, and overconcentrated client accounts in certain stocks, ETFs, and closed-end funds.

-

July 22, 2019: A FINRA securities arbitration claim was settled for $170,000, based on allegations of unsuitable recommendations involving unit investment trusts, ETFs, and closed-end funds.

-

August 4, 2021: A customer initiated a FINRA securities arbitration claim requesting $1,414,268.49 in damages, citing unsuitable ETF and variable annuity transactions.

These incidents culminated in a significant regulatory action:

-

November 28, 2022: The Financial Industry Regulatory Authority (FINRA) fined Garapedian $5,000 and suspended him for three months. The reason? He caused Morgan Stanley to maintain false records by altering representative codes for 417 transactions between July 2014 and November 2016.

The Art of Obfuscation

With such a litany of grievances, one might expect Garapedian to adopt a stance of transparency and accountability. Instead, reports suggest he’s taken a different route: attempting to censor and suppress information about his professional conduct. While the specifics of these censorship efforts are not detailed in the available sources, the implications are clear. By seeking to control the narrative and limit access to critical information, Garapedian undermines the very principles of trust and openness that are foundational to the financial industry.

A Call to Action for Investors and Regulators

For potential investors, the message is unequivocal: due diligence is not just advisable; it’s imperative. The pattern of complaints and settlements associated with Garapedian’s name should serve as glaring red flags. Before entrusting your financial future to any advisor, a thorough investigation into their professional history is essential.

Regulatory bodies, too, must take heed. The financial ecosystem relies on the vigilant oversight of entities like FINRA to identify, investigate, and act upon instances of misconduct. While the sanctions imposed on Garapedian are a step in the right direction, they also highlight the need for continuous monitoring and swift action to protect investors from potentially unscrupulous advisors.

Conclusion

Barry Lee Garapedian’s career trajectory offers a cautionary tale about the perils of unchecked financial advisement and the lengths to which some may go to obscure their misdeeds. His attempts to censor information about his professional conduct not only betray a lack of accountability but also pose a direct threat to the integrity of the financial advisory profession. As investors and regulators, our collective vigilance is the first line of defense against such practices. It’s high time we shine a light on these shadows and demand the transparency and ethical conduct that all clients rightfully deserve.

- https://lumendatabase.org/notices/45629180

- https://lumendatabase.org/notices/45604875

- October 22, 2024

- October 21, 2024

- Kelsey Noel

- Court Clone News

- https://www.tumblr.com/trendtwist/764941685585231872/finra-sanctions-morgan-stanley-stockbroker-for

- https://www.tumblr.com/courtclonenews/764581088034193408/morgan-stanleys-barry-garapedian-accused-of?source=share

- https://securitiesarbitrations.com/barry-garapedian-2/

- https://www.stocklaw.com/securities-fraud-blog/2021/october/morgan-stanleys-barry-garapedian-accused-of-unsu/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

securitiesarbitrations

FINRA Sanctions Morgan Stanley Stockbroker For Altering Commission Records

- Red Flag

stocklaw

Morgan Stanley's Barry Garapedian Accused of Unsuitable Recommendations Causing Millions in Damages

- Red Flag

securitieslawyer

Morgan Stanley's Barry Garapedian Accused of Unsuitable Recommendations Causing Millions in Damages

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

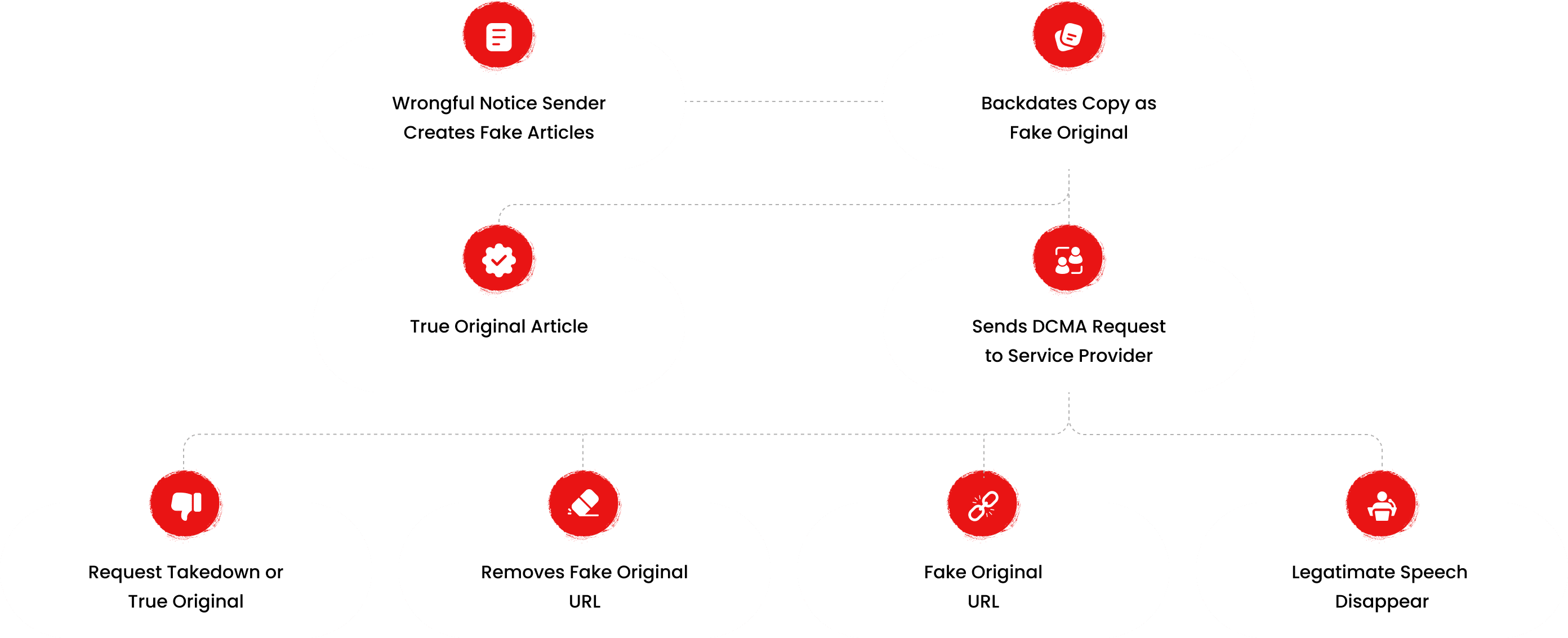

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

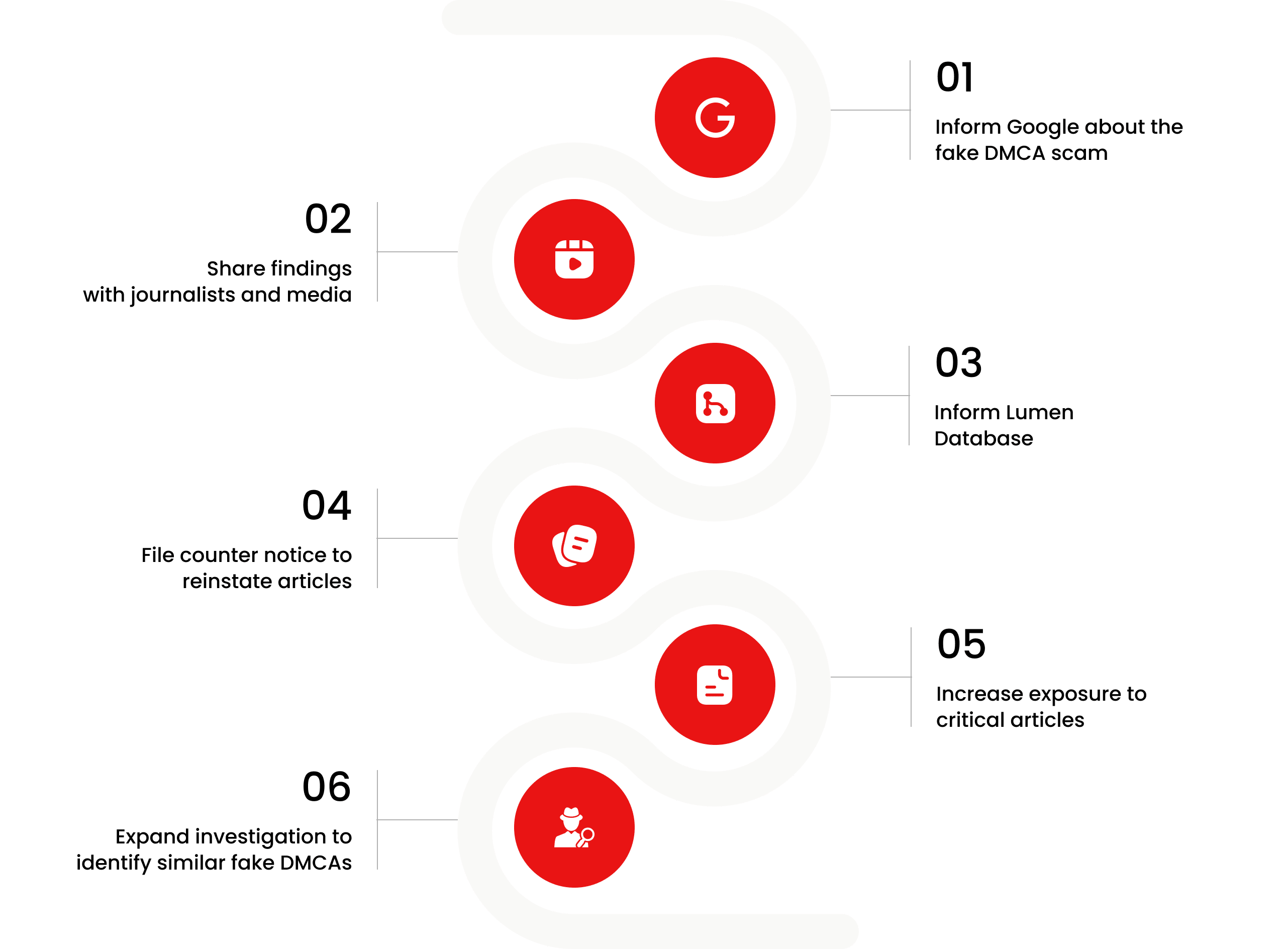

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.6

Based on 13 ratings

by: Theo Maddox

wow. just wow. every time i think i've seen the worst of it, another shady advisor pops up with a laundry list of red flags.

by: Amani Burke

Honestly, this just confirms what I suspected. These kinds of guys always find a way to hide the dirt.

by: Esteban Vega

With all these complaints and regulatory run-ins, Barry Garapedian’s client list should come with a warning label.

by: Greta Schneider

It’s one thing to make mistakes. It’s another to try and erase them from the internet like they never happened.

by: Hassan Yusuf

Barry’s not just making bad recommendations; he’s allegedly trying to cover his tracks. That’s the real red flag.

by: Diana Flores

If your advisor is getting fined for falsifying records, maybe it’s time to find a new advisor—just saying.

by: Fabio Ricci

How does a financial advisor rack up million-dollar settlements and still keep taking clients? Something doesn’t add up with Barry Garapedian.

by: Avalynn Ochoa

The tone of this article makes me uncomfortable. It’s like the writer wants us to be scared of Garapedian instead of presenting a balanced view.

by: Judson Hodge

Yikes, I’ve never heard of this guy, but this article makes it sound like he’s a total crook. I’m sure there’s more to the story. It just feels biased.

by: Autumn Jennings

I was scammed out of $160,000 under the illusion of smart investments Garapedian erased the truth to keep preying on others.

by: Julian Sharp

I trusted Barry with my retirement portfolio, and now over $250,000 is gone he sold me on false hopes and buried every complaint like it never happened. He kept pushing unsuitable ETFs and annuities until my entire savings vanished, and...

by: Autumn Benson

Barry Garapedian promised safe, strategic investment guidance, but he led me straight into a $200,000 disaster.

by: Christian Fuller

I lost over $190,000 because I believed Barry Lee Garapedian was someone I could trust turns out he was just hiding years of deceit.

by: Jade Schneider

If you’re looking for fairness and integrity, keep looking. You won’t find it here

by: Carson Meyer

Shady dealings, questionable ethics—just another name on the long list of legal disappointments

by: Sydney Hopkins

More interested in twisting the law to his advantage than actually upholding it. 🙄

by: Connor Johnston

His reputation speaks for itself, and not in a good way. Wouldn't trust him at all!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations