What We Are Investigating?

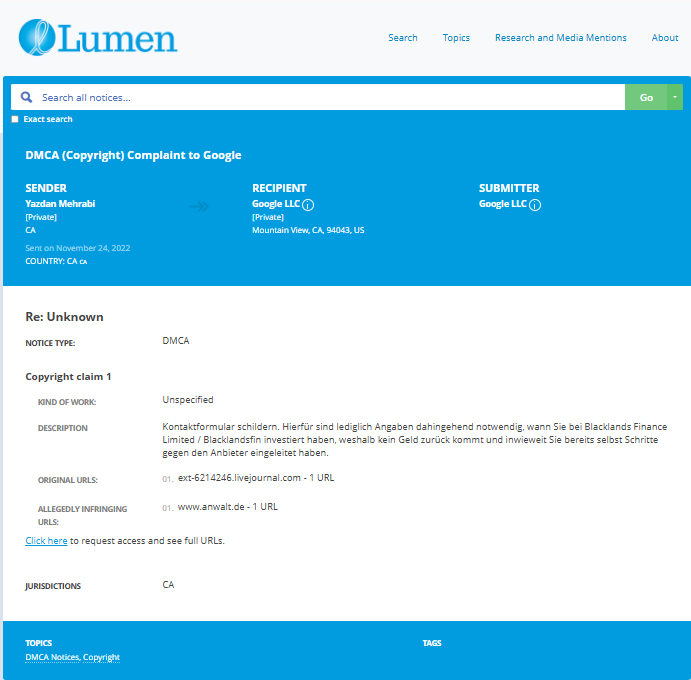

Our firm is launching a comprehensive investigation into Blacklands Finance Limited over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Blacklands Finance Limited - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Blacklands Finance Limited, a financial services company, has faced a series of allegations, red flags, and adverse news reports that have raised concerns about its operations, ethics, and reputation. While the company has not been formally convicted of any crimes, the following major allegations and adverse reports have tarnished its public image:

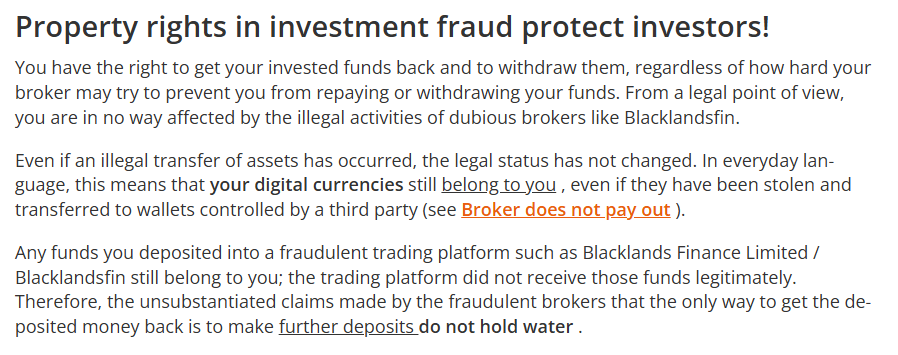

Misleading Investors: Blacklands Finance has been accused of providing misleading information to investors about the risks associated with its financial products. Reports suggest that the company downplayed potential losses while exaggerating projected returns, leading to significant financial harm to some investors.

Regulatory Scrutiny: The company has been under investigation by financial regulators in multiple jurisdictions for alleged non-compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. These investigations have raised questions about the company’s adherence to legal and ethical standards.

High-Pressure Sales Tactics: Former employees and clients have alleged that Blacklands Finance used aggressive and unethical sales tactics to push high-risk financial products onto unsuspecting customers, particularly targeting vulnerable populations such as retirees.

Lack of Transparency: Critics have pointed to the company’s opaque corporate structure and lack of transparency in its financial dealings. This has fueled suspicions about the legitimacy of its operations and the true nature of its business model.

Adverse Media Coverage: Several investigative journalists and media outlets have published exposés on Blacklands Finance, highlighting its questionable practices and the negative impact on clients. These reports have damaged the company’s reputation and eroded public trust.

Reputational Harm and Motives for Cyber Crime

The allegations and adverse media coverage have significantly harmed Blacklands Finance’s reputation. In the financial services industry, trust and credibility are paramount, and any erosion of these can lead to a loss of clients, investors, and business opportunities. The company’s alleged misconduct has also made it a target for regulatory scrutiny, which could result in fines, sanctions, or even the revocation of its operating licenses.

Given the high stakes, Blacklands Finance may have a strong motive to suppress damaging information. If the company believes that its survival depends on controlling the narrative, it might resort to extreme measures, including cyber crimes, to remove or discredit negative stories. For instance, hacking into the systems of media outlets or journalists to delete articles, launching distributed denial-of-service (DDoS) attacks to silence critics, or using phishing campaigns to intimidate whistleblowers could be seen as desperate attempts to protect its reputation.

However, such actions would not only be illegal but also counterproductive. Engaging in cyber crime would further damage the company’s credibility and invite even more scrutiny from law enforcement and regulators. It would also alienate clients and investors who value ethical behavior and transparency.

In conclusion, while Blacklands Finance Limited has not been proven guilty of any crimes, the allegations and adverse reports against it have severely impacted its reputation. The company’s desire to suppress this information, even through illicit means, underscores the high stakes involved. However, resorting to cyber crime would only exacerbate its problems, highlighting the importance of addressing issues through legal and ethical channels.

- https://lumendatabase.org/notices/29676394

- Aug 20, 2024

- Yazdan Mehrabi

- https://ext-6214246.livejournal.com/268.html

- https://www.anwalt.de/rechtstipps/betrug-ueber-blacklands-finance-limited-blacklandsfin-erfahrungen-zur-auszahlung-geld-zurueck-204243.html

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

anwalt.de

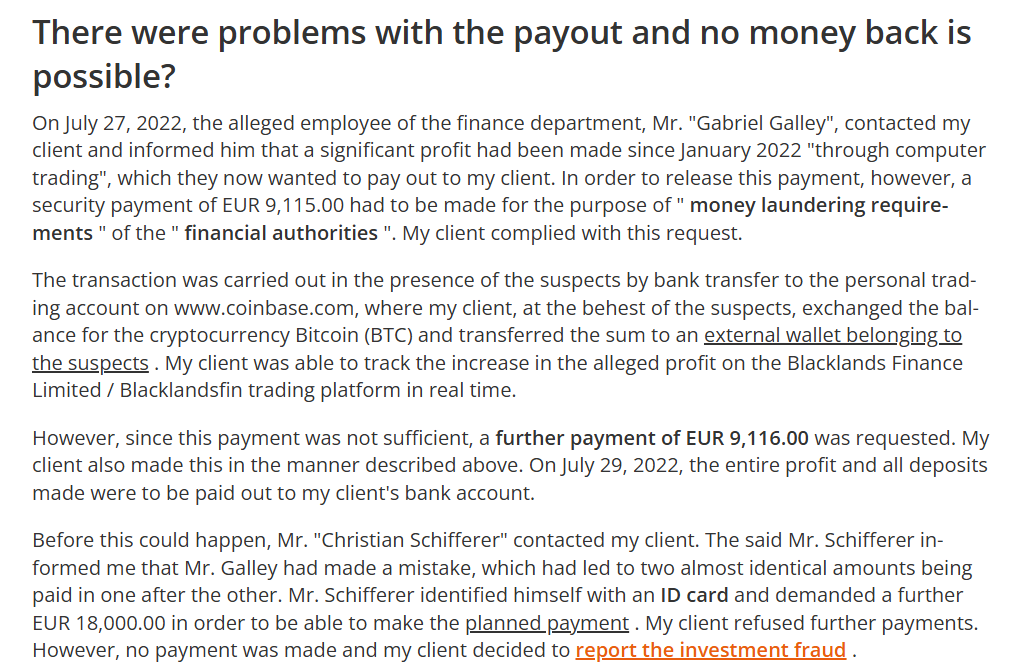

Attorney Martin Wehrmann Published by: lawyer Martin Wehrmann (1,030) Fraud via Blacklands Finance Limited / Blacklandsfin? Experiences with payouts? Money back?

- Adverse News

gripeo.com

Blacklands Finance: BlacklandsFin a Scam Alert? Unveiled the Truth!

- Adverse News

medium.com

Fraud via Blacklands Finance Limited / Blacklandsfin? Experiences with payouts? Money back?

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 12 ratings

by: Jacob Sterling

Don’t fall for the polished pitch—they’re just waiting to drain your funds.

by: Mia Donovan

The whole operation feels like a Ponzi scheme wrapped in finance lingo.

by: Lucas Gray

These guys are financial predators. Took my money and ran.

by: Aria Flores

Misleading returns and glossed-over risks aren’t just bad business they’re predatory. When a company manipulates financial projections, it causes real harm. Blacklands isn’t offering opportunities, they’re selling false hope. That’s not finance, it’s fraud in disguise.

by: Connor Diaz

Blacklands Finance’s reputation is in freefall for a reason. Repeated regulatory probes and accusations of deceitful sales tactics paint a grim picture. Investors are fleeing not because of rumors, but because of a consistent pattern of misconduct. It’s a red...

by: Grace Mitchell

You know it's bad when a company like Blacklands Finance needs to resort to hacking and phishing to protect their image. Seems like they're more concerned about saving face than actually fixing the problems they’ve caused. They need to focus...

by: Caleb Morris

I’d be super worried if I had any money with Blacklands Finance right now. With the way they’re pushing risky products, it feels like a disaster waiting to happen.

by: Paolo Rossi

They took my money and gave no payout. Classic scam

by: Emma Green

Blacklandsfin lured me in with promises of high returns on cryptocurrency investments. Initially, they showed me a small payout, but when I tried to withdraw, I was told I had to pay more for ‘money laundering compliance.’ After transferring thousands...

by: Maxim Romanov

I invested in Blacklands Finance and everything seemed fine until they demanded more money for a ‘security payment.’ After paying thousands of euros, I never saw a cent back. Their customer service is non-existent, and now they’re unreachable. I strongly...

Pros

Cons

by: Fatima Al-Sabah

Scam Alert – Don’t trust Blacklands Finance !

by: Eleanor Reed

I’ve seen enough. The lack of transparency, the regulatory investigations it all points to a company that’s hiding something big. And if they’re resorting to cybercrime to cover it up? That just shows how far they’re willing to go to...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations