What We Are Investigating?

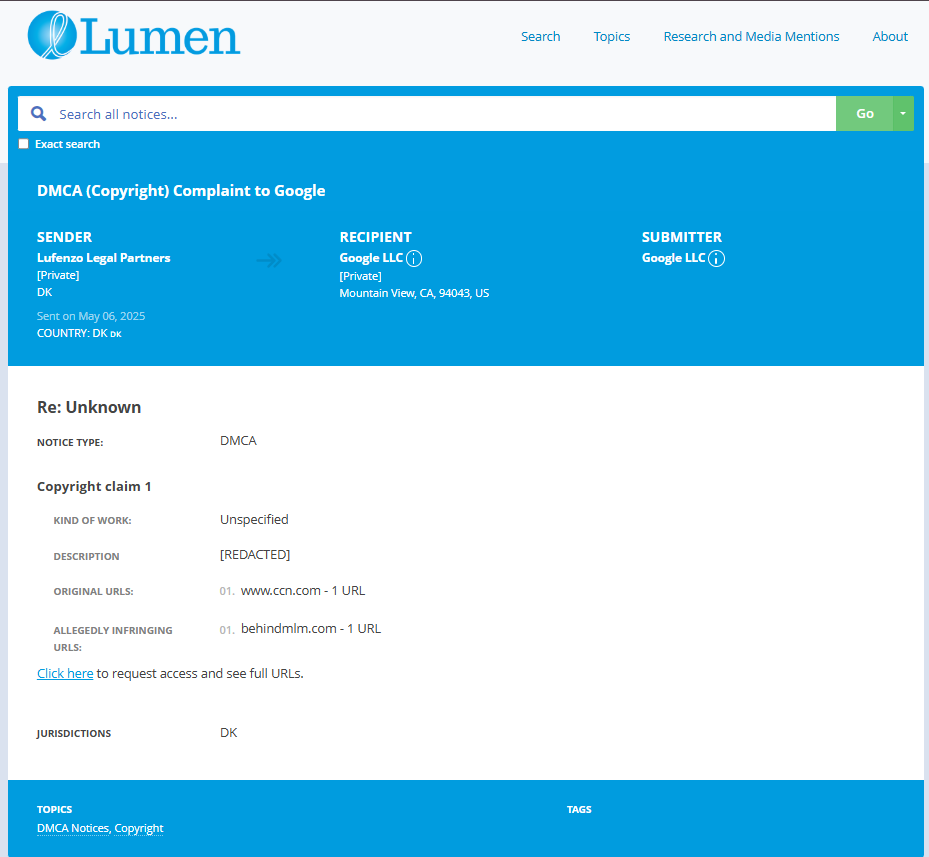

Our firm is launching a comprehensive investigation into Blue Ocean Society over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Blue Ocean Society - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

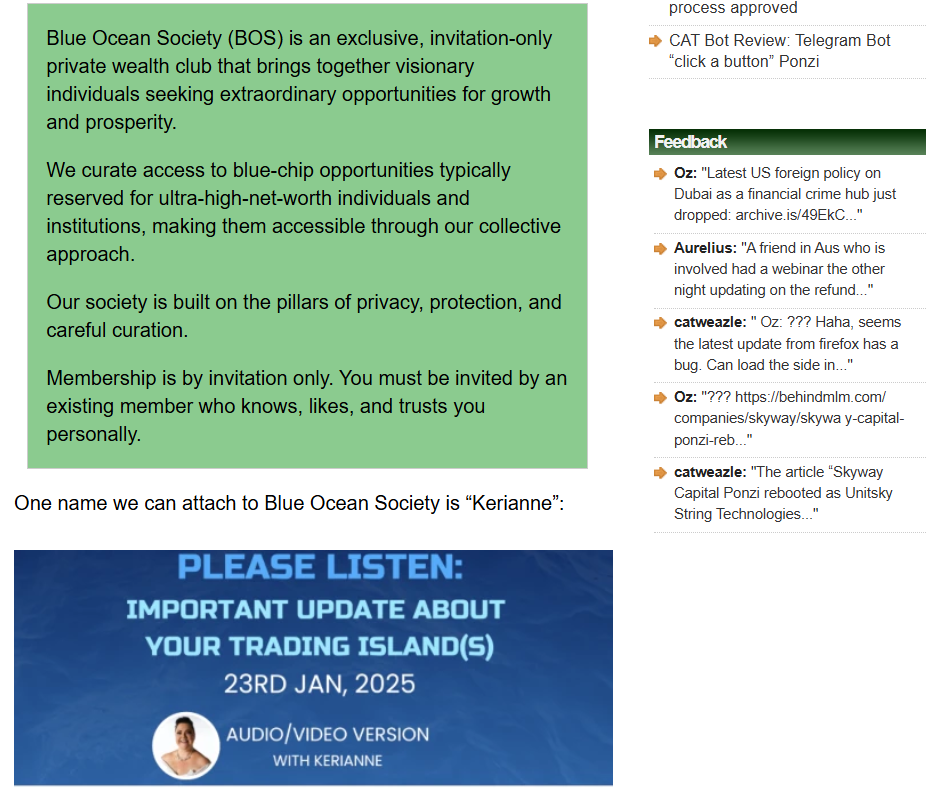

Blue Ocean Society might just be the poster child. On the surface, it bills itself as an elite, invitation-only wealth network for “visionary investors”—a sort of secret garden for financial enlightenment. But peel back the ocean-blue branding and what emerges is far less inspirational: a web of secrecy, questionable leadership, blocked investor withdrawals, and an unsettling obsession with silencing critics. If you’re an investor, a regulator, or someone who just doesn’t like being lied to, buckle up—because this rabbit hole runs deep, and it stinks of saltwater and snake oil.

The Veil of Secrecy

One of the most immediate concerns with BOS is its lack of transparency. The organization’s website fails to provide any information about its ownership or executive team. This deliberate omission is not just a minor oversight; it’s a significant red flag. Transparency is a cornerstone of any legitimate financial institution, and BOS’s intentional lack thereof suggests a deliberate attempt to obfuscate its operations .

Further investigation reveals that BOS operates under a shell company, Blue Ocean Management LLC, registered in St. Kitts & Nevis—a known tax haven with minimal regulatory oversight. This choice of jurisdiction is not coincidental and raises serious questions about the organization’s intentions and legitimacy .

The Players Behind the Curtain

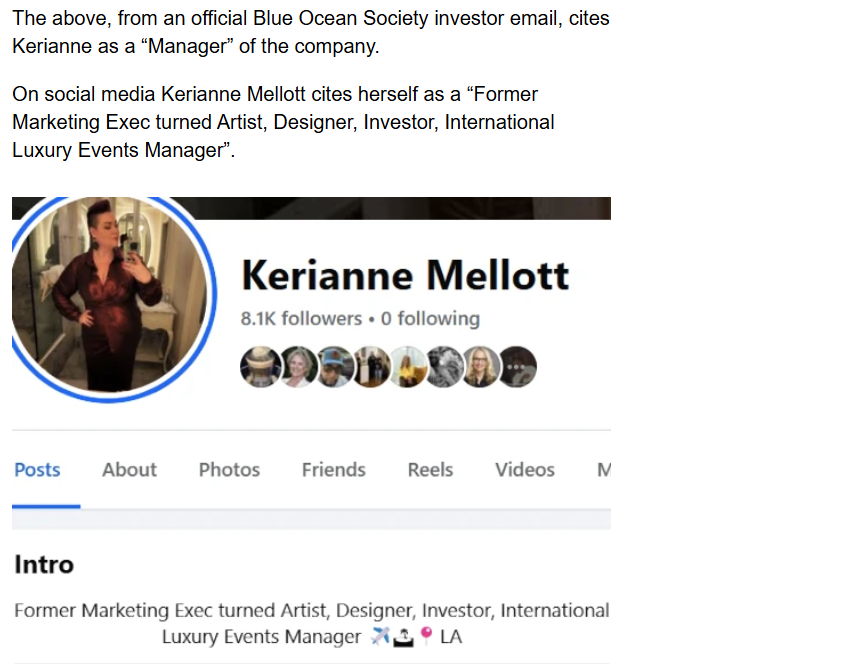

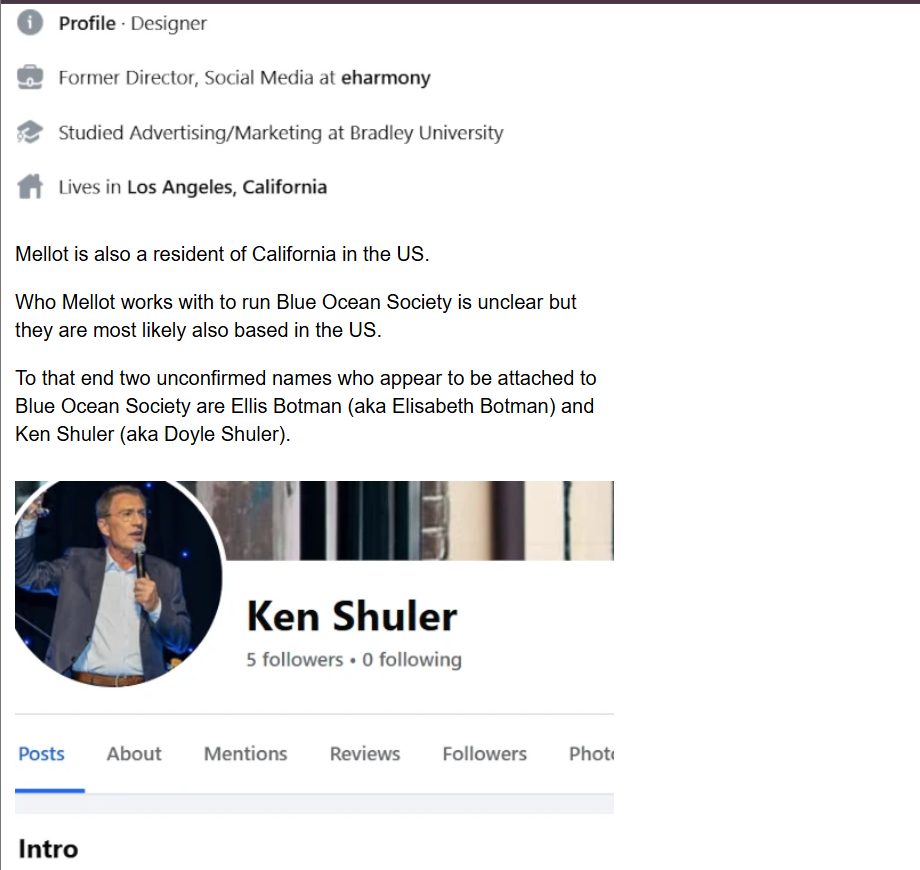

While BOS attempts to keep its leadership hidden, some names have surfaced. A “Kerianne” is mentioned in official communications as a manager. Social media links this to Kerianne Mellott, a former marketing executive turned investor and event manager based in California. More concerning are the associations with Ken Shuler (aka Doyle Shuler) and Ellis Botman (aka Elisabeth Botman), both previously linked to BotTronic, a collapsed Ponzi scheme from 2021 .

The involvement of individuals with a history of fraudulent activities cannot be ignored. Their association with BOS suggests a potential repeat of past schemes, rebranded to lure in a new wave of unsuspecting investors.

The Ponzi Playbook

BOS’s investment model bears all the hallmarks of a classic Ponzi scheme. The organization promotes unregistered investment opportunities, promising high returns without providing any verifiable financial details. Investors have reported significant issues with withdrawals, with some unable to access their funds for over a year. These delays are often accompanied by vague excuses about “randomized” withdrawal processes .

Such tactics are typical of Ponzi schemes, where returns to earlier investors are paid using the capital from new investors. When the influx of new funds slows, the scheme collapses, leaving the majority of investors with significant losses.

Legal Entanglements and Power Struggles

BOS’s questionable activities are not limited to its investment practices. The organization has been embroiled in legal disputes, notably with Global Cord Blood Corporation (GCBC). BOS, through its entity Blue Ocean Structure Investment Company Ltd., attempted to convene an extraordinary general meeting to halt GCBC’s acquisition of Cellenkos, Inc. However, the Grand Court of the Cayman Islands issued an injunction preventing BOS from proceeding with this meeting .

This legal battle highlights BOS’s aggressive tactics and willingness to engage in contentious disputes to further its interests, often at the expense of transparency and shareholder rights.

Censorship and Control

Perhaps most concerning is BOS’s apparent efforts to suppress information and silence dissent. The organization’s lack of transparency, coupled with its aggressive legal maneuvers, suggests a deliberate strategy to control the narrative and prevent scrutiny. This behavior is indicative of an organization with much to hide and little interest in accountability.

A Call to Action

The evidence against BOS is mounting. From its opaque operations and associations with known fraudsters to its questionable investment practices and aggressive legal tactics, BOS exhibits numerous red flags that should deter any prudent investor.

Regulatory authorities must take immediate action to investigate BOS’s activities and protect potential investors from falling victim to what appears to be a sophisticated financial scam. Transparency, accountability, and adherence to legal and ethical standards are non-negotiable in the financial industry. BOS’s blatant disregard for these principles cannot be allowed to continue unchecked.

Conclusion

In the world of finance, if something seems too good to be true, it often is. The Blue Ocean Society’s promises of exclusive, high-yield investment opportunities are a siren song luring investors into dangerous waters. It’s time to shine a light on BOS’s operations, hold its leaders accountable, and ensure that justice is served.

- https://lumendatabase.org/notices/51679740

- May 06, 2025

- Lufenzo Legal Partners

- https://www.ccn.com/education/crypto/victim-of-crypto-scam-spot-fake-apps-websites/

- https://behindmlm.com/mlm-reviews/blue-ocean-society-review-secretive-securities-fraud/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Mansor Abdul

Investigation Ongoing

Max Josef Meier

Investigation Ongoing

Mehmet Faysal Söylemez

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations