What We Are Investigating?

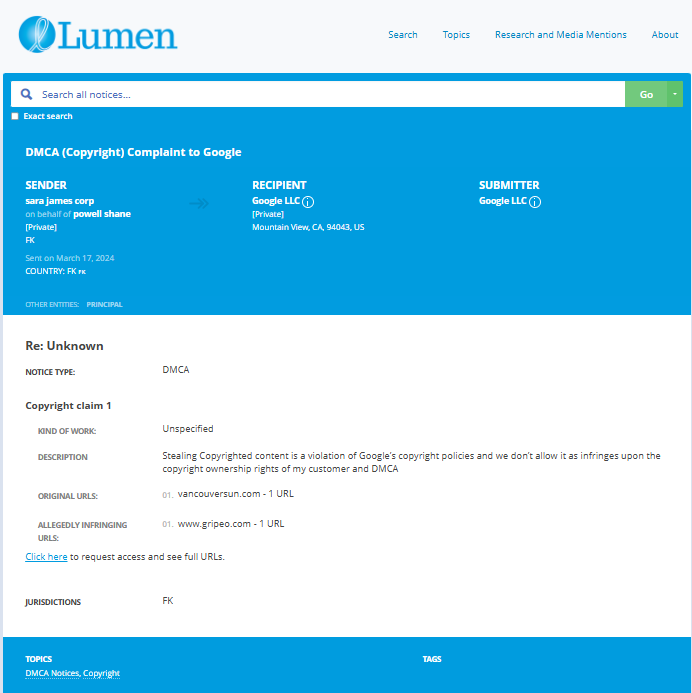

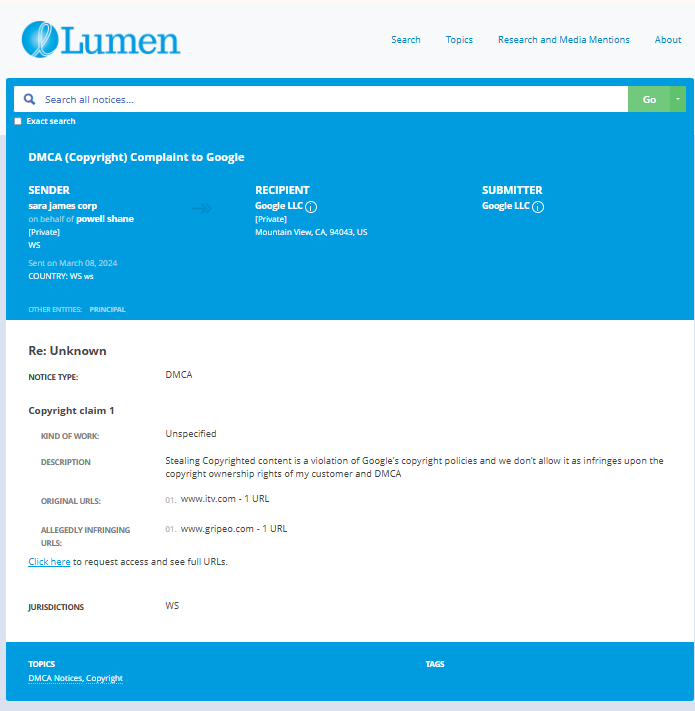

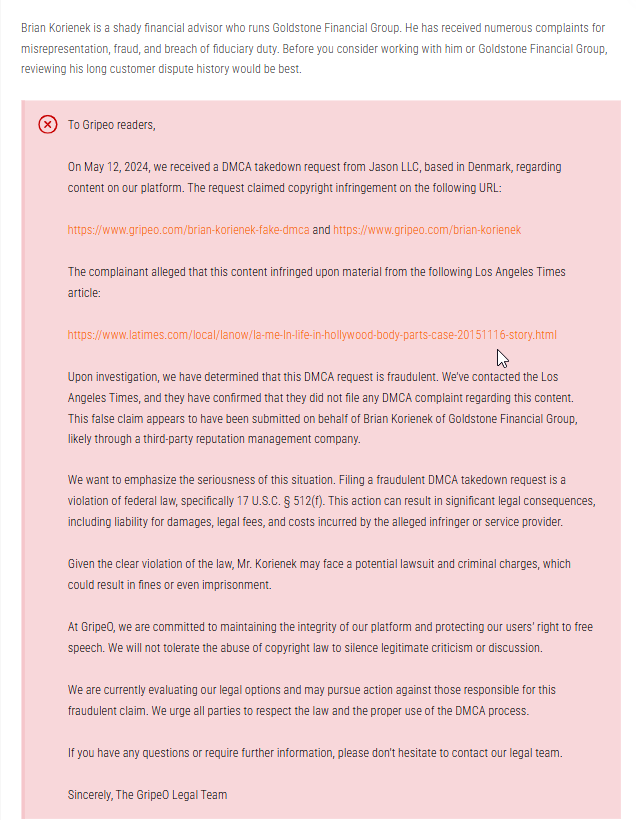

Our firm is launching a comprehensive investigation into Brian Korienek over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Brian Korienek - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

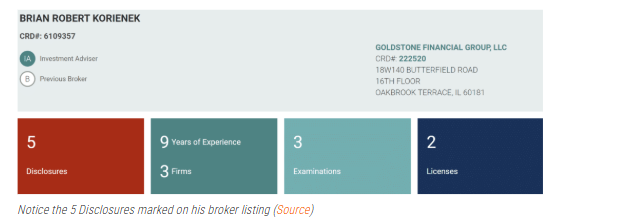

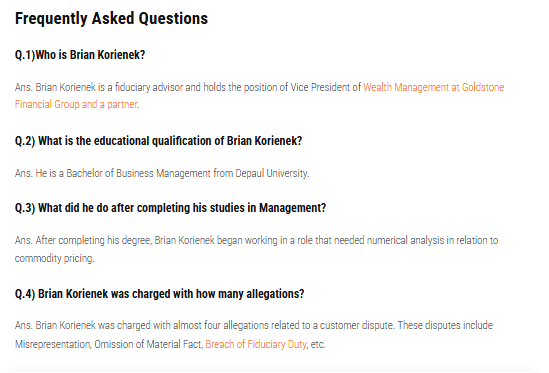

Brian Korienek, a financial advisor and founder of Goldstone Financial Group, has faced a series of allegations and adverse news reports that have cast a shadow over his professional reputation and the credibility of his firm. These allegations range from regulatory violations to client disputes, raising serious concerns about his business practices. Below is a summary of the major allegations, red flags, and adverse news associated with Korienek and Goldstone Financial Group, along with an analysis of why he and his firm might seek to suppress this information, potentially resorting to unethical or illegal means.

Major Allegations and Red Flags

Regulatory Violations: Korienek and Goldstone Financial Group have been cited by regulatory bodies, including the Financial Industry Regulatory Authority (FINRA), for violations related to misleading advertising and unsuitable investment recommendations. These violations suggest a pattern of prioritizing profits over client interests, undermining trust in the firm.

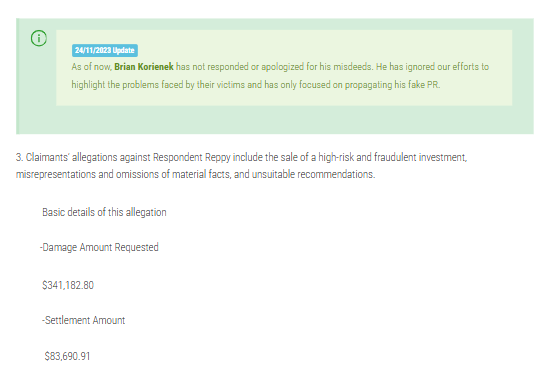

Client Complaints and Lawsuits: Multiple clients have filed complaints and lawsuits against Korienek and Goldstone Financial Group, alleging mismanagement of funds, misrepresentation of investment risks, and failure to act in their best interests. Some cases have resulted in settlements, further damaging the firm’s reputation.

High-Pressure Sales Tactics: Former clients and employees have accused Korienek of employing aggressive sales tactics to push high-commission products, often without adequately disclosing the associated risks. These allegations paint a picture of a firm more focused on revenue generation than ethical financial advising.

Questionable Investment Strategies: Goldstone Financial Group has been criticized for promoting complex and high-risk investment products, such as non-traded REITs (Real Estate Investment Trusts), which are often illiquid and unsuitable for conservative investors. These strategies have led to significant financial losses for some clients.

Lack of Transparency: Clients have reported a lack of transparency in fee structures and investment performance, with some alleging hidden fees and undisclosed conflicts of interest. This lack of openness has eroded client trust and raised questions about the firm’s integrity.

Reputation Damage and Motives for Suppression

The allegations against Brian Korienek and Goldstone Financial Group have severely harmed their reputation in the financial services industry. Regulatory violations and client lawsuits suggest a disregard for ethical standards, while high-pressure sales tactics and questionable investment strategies portray the firm as prioritizing profits over client well-being. These issues have likely led to a loss of clients, diminished credibility, and increased scrutiny from regulators.

For Korienek and Goldstone Financial Group, the stakes are high. Negative publicity can result in lost business, regulatory penalties, and reputational damage that is difficult to repair. The desire to remove or suppress damaging stories is driven by the need to protect their image, maintain client trust, and avoid further legal and financial consequences. In extreme cases, this could lead to unethical or illegal actions, such as cybercrimes, to silence critics or erase incriminating information. For example, hacking into websites, deleting negative reviews, or orchestrating disinformation campaigns could be seen as desperate measures to control the narrative.

Conclusion

Brian Korienek and Goldstone Financial Group face a litany of allegations that have significantly tarnished their reputation. From regulatory violations to client disputes, the pattern of misconduct suggests a firm struggling to balance ethical practices with profitability. While the motivations for suppressing negative information are clear—preserving reputation and avoiding accountability—the potential resort to cybercrime underscores the lengths to which individuals and organizations may go to protect their interests.

- https://lumendatabase.org/notices/40192756

- https://lumendatabase.org/notices/40001676

- March 8, 2024

- March 17, 2024

- sara james corp

- sara james corp

- https://www.itv.com/news/anglia/2012-03-28/verdict-in-florida-murder-trial

- https://vancouversun.com/news/world/indian-teen-girl-gang-raped-and-burnt-alive-with-photos

- https://www.gripeo.com/brian-korienek/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 19 ratings

by: Sahara Dune

Zero follow-through, terrible client service, and no real accountability. Steer clear.

by: Atlas Jet

His credentials don’t match the shady results he delivers. Don’t be fooled by the clean website.

by: Rio Cruz

Presents himself as a financial professional, but his advice cost me thousands. Total sham.

by: Violet Shade

The fact that Brian Korienek and Goldstone Financial Group are trying to bury negative press just proves one thing: they’ve got something to hide. If there was nothing wrong, why the need for all the damage control?

by: Felix Crest

Korienek and his firm have a serious transparency problem. Whether it’s undisclosed fees or poor investment choices, clients have every right to feel misled. This isn’t just bad business; it’s a pattern of carelessness and disregard for client trust.

by: Clara Spark

If Brian Korienek really cared about his clients, he wouldn’t be pushing high-risk, high-commission products like non-traded REITs. It’s clear that profit comes first client well-being comes second, or maybe not at all.

by: Jude Mist

Goldstone Financial Group has turned a blind eye to clients’ best interests, with lawsuits, complaints, and bad investment strategies piling up. When your reputation is built on high-pressure sales tactics and hidden fees, trust is a thing of the past.

by: Iris Flint

Brian Korienek might want to rethink his business practices if he doesn’t want the weight of those FINRA violations hanging over his head. Misleading advertising and poor investment advice are a surefire way to lose clients, and it’s only a...

by: Edwin Green

i warned my uncle bout this dude but he didnt listen, now look.

by: Donald Guzman

Used to believe in Goldstone until I lost nearly half my savings. No one warned me about the risks, just a lot of smooth talk and false promises. Shameful.

by: Elizabeth Espinoza

This guy is the reason people don't trust financial advisors anymore.

by: Christian Harper

I believed their claims of transparency and safe growth but ended up losing $22,000 and every time I contacted them they gave me silence or excuses Brian Korienek took more than my money he took my sense of security and...

by: Anna Foster

Goldstone Financial told me I was in safe hands and pushed me into complex, high risk investments I didn’t understand I lost $26,000 and they showed no accountability or remorse.

by: Stella Reid

Brian Korienek’s investment advice cost me over $22,500 and the pain of watching my retirement disappear is something I’ll never forget

by: Paisley Beck

I lost $19,000 trusting Brian Korienek and Goldstone Financial Group and now I live with the regret of believing in their false promises and hidden fees

by: Henry Stewart

They’ve been caught trying to suppress information again. It’s disgusting that a company this large is allowed to get away with this.

by: ethan perry

Goldstone Financial Group sounds more like a con artist club than a financial firm. Regulatory violations, lawsuits, and now this? Just wow.

by: Charlotte Russell

Trying to erase bad press instead of fixing your shady business practices? That says a lot about Goldstone Financial Group.

by: Emma Scott

Stay away from Goldstone! This unregulated broker.

by: Samuel Harris

SCAM ALERT! Avoid this company at all costs. Goldstone operates as an unregulated broker using a cloned license. They’ve been blacklisted for preying on older clients but now target anyone willing to trade on their platform. Their offshore, unregulated status...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations