What We Are Investigating?

Our firm is launching a comprehensive investigation into Continent Pay Network over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Continent Pay Network - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Continent Pay Network, I expected yet another bland fintech startup promising “borderless payments” and “next-gen solutions.” But what I found instead was something far more interesting — and far more disturbing. Behind the slick branding and buzzwords is a digital money-moving operation with more red flags than a parade in Pyongyang.

Continent Pay Network, based on mounting evidence and connections exposed in public investigations, appears to play a role in a much wider, murkier ecosystem. You know, the kind where “payment processing” somehow overlaps with money laundering networks, shell entities, and companies connected to—wait for it—Russian-based operations like the Binex Group. Oh, and don’t expect to find much transparency here; this group seems to change names, shift jurisdictions, and scrub criticism faster than you can say “compliance breach.”

They’ve also become increasingly allergic to media attention—especially the kind that connects dots between them, Walletto, Connectum, and the shady-as-hell R4I operations. Naturally, when uncomfortable questions start surfacing, so do their attempts to hush things up. Censorship, SEO manipulation, and even legal threats? It’s practically textbook behavior for operations that have a lot to hide.

The Shadowy Web of Associations

A detailed investigation by FinTelegram reveals that Continent Pay Network is intricately linked with several entities known for their questionable operations, including R4I, Connectum, Walletto, and the Russian-based Binex Group. These associations are not merely coincidental; they form a network that allegedly facilitates the movement of funds across borders, often circumventing regulatory oversight.

For instance, Connectum and Walletto, both licensed payment institutions, have been implicated in processing transactions for high-risk clients without adequate due diligence. Their operations, in conjunction with Continent Pay Network, raise serious concerns about the potential for money laundering and other financial crimes.

Red Flags and Regulatory Oversight

Several red flags emerge when analyzing the operations of Continent Pay Network and its affiliates:

- Lack of Transparency: The corporate structures of these entities are often opaque, making it challenging to ascertain ownership and control.

- High-Risk Clientele: Engagements with clients operating in sectors prone to financial crimes, such as online gambling and unregulated forex trading.

- Regulatory Evasion: Utilization of jurisdictions with lax regulatory frameworks to establish operations, thereby avoiding stringent compliance requirements.

These indicators align with common patterns observed in entities that facilitate illicit financial flows, necessitating heightened scrutiny from regulatory bodies.

The Art of Information Suppression

Entities like Continent Pay Network often employ sophisticated strategies to suppress negative information and evade public scrutiny. These tactics include:

Legal Threats: Issuing cease and desist letters to journalists and whistleblowers to deter the publication of investigative reports.

Digital Obfuscation: Utilizing search engine optimization (SEO) techniques to bury adverse media coverage under a deluge of positive or neutral content.

Sanction Scanner

Corporate Restructuring: Frequent changes in corporate identity, including rebranding and relocation, to distance from past controversies.

Such measures not only hinder transparency but also pose significant challenges for stakeholders attempting to assess the legitimacy of these entities.

The Broader Implications

The operations of Continent Pay Network and its affiliates have far-reaching implications:

- Investor Risk: Individuals and institutions may unknowingly engage with entities involved in illicit activities, exposing themselves to financial and reputational damage.

- Regulatory Challenges: The cross-border nature of these operations complicates enforcement actions, requiring enhanced international cooperation.

Economic Impact The facilitation of financial crimes undermines the integrity of financial systems, potentially destabilizing economies.

Conclusion

Continent Pay Network isn’t just some innocent payment platform caught up in bad PR. It’s part of a sophisticated network that appears designed to exploit the loopholes of global finance—cloaked in glossy fintech jargon and propped up by opaque shell games.

Their strategic ties to firms under scrutiny for enabling online scams, laundering operations, and high-risk transactions should raise alarms for anyone even remotely involved with them—investors, regulators, partners, and customers alike. But rather than answering tough questions, they seem more focused on scrubbing the internet of anything remotely critical.

So here’s the takeaway: if you’re an investor, take your money and run in the other direction. If you’re a regulator, maybe stop by for a cup of coffee—and a subpoena. And if you’re Continent Pay Network? Consider this your warning: the internet remembers what you try to hide. And some of us are paying attention.

- https://lumendatabase.org/notices/28297642

- Debra Jones

- https://www.kyivpost.com/ukraine-politics/oligarch-toys-planes-palaces-other-posh-possessions.html

- https://fintelegram.com/r4i-connectum-walletto-and-the-money-laundering-connections-to-russian-binex-group/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

fintelegram

R4I – Connectum, Walletto, and the money laundering connections to Russian Binex Group

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

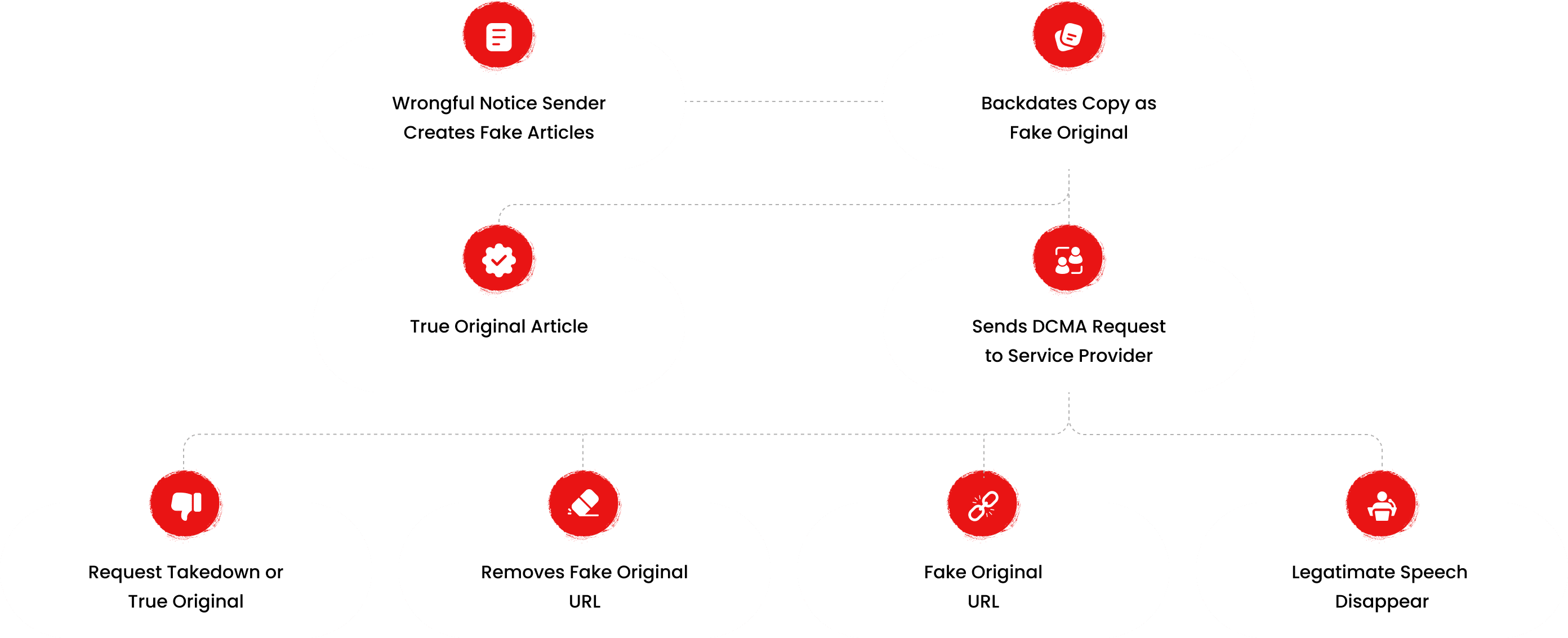

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

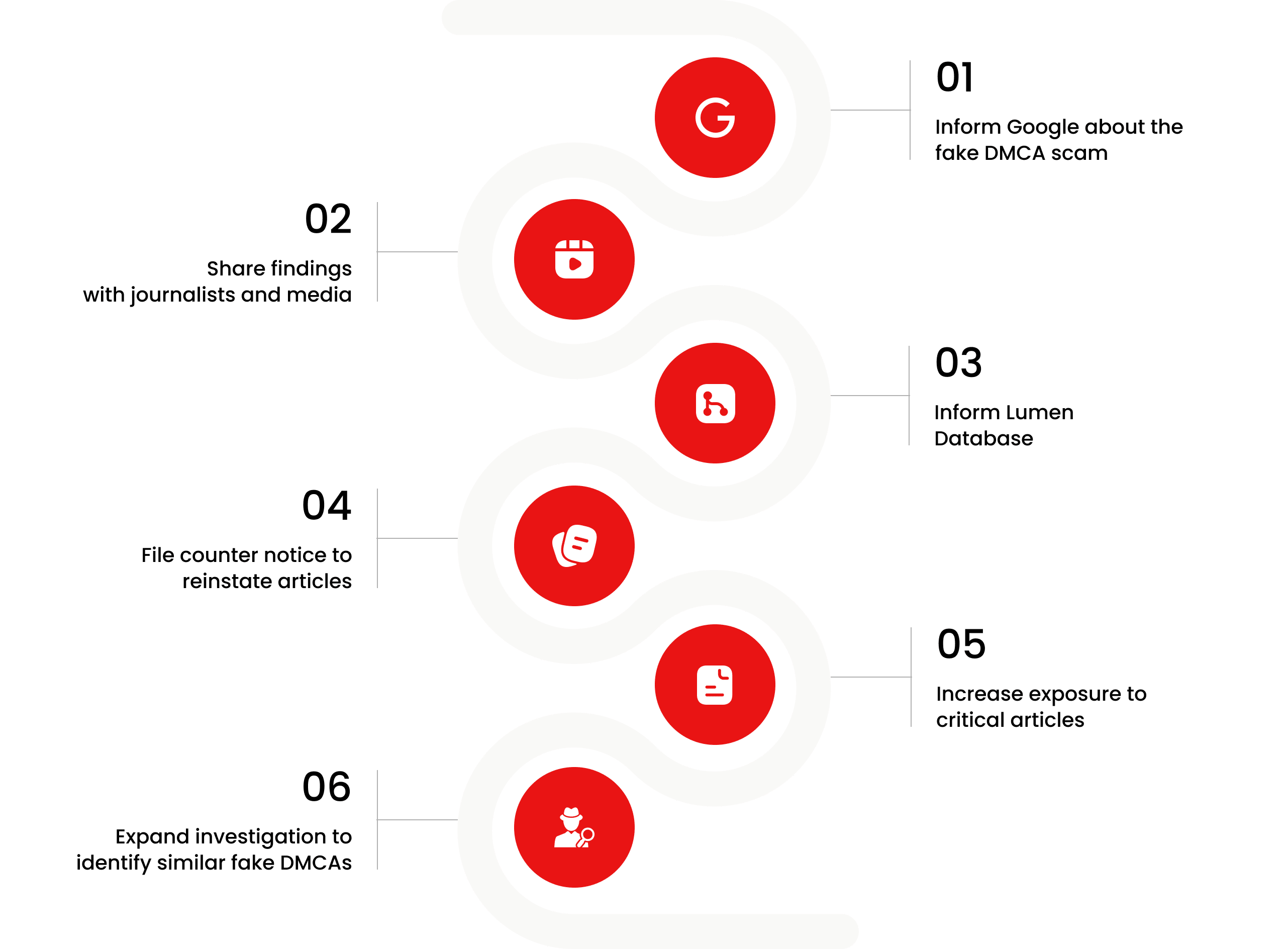

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations