What We Are Investigating?

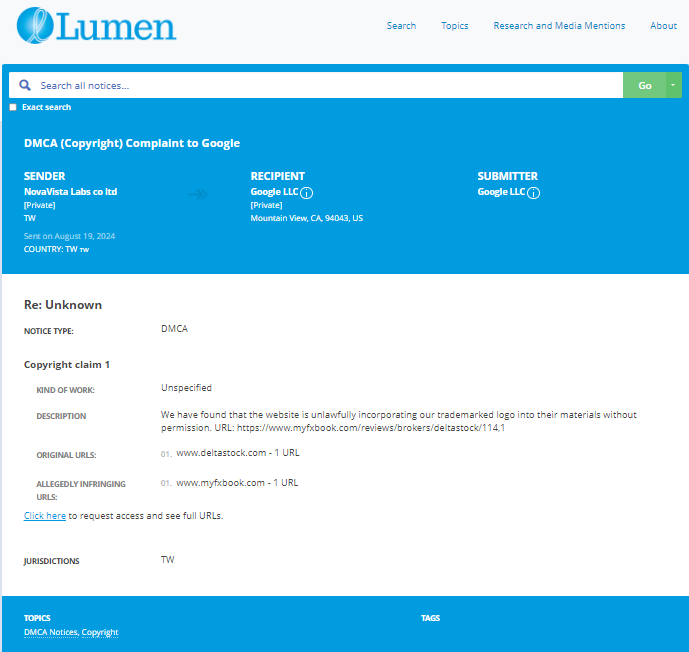

Our firm is launching a comprehensive investigation into DeltaStock over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that DeltaStock - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

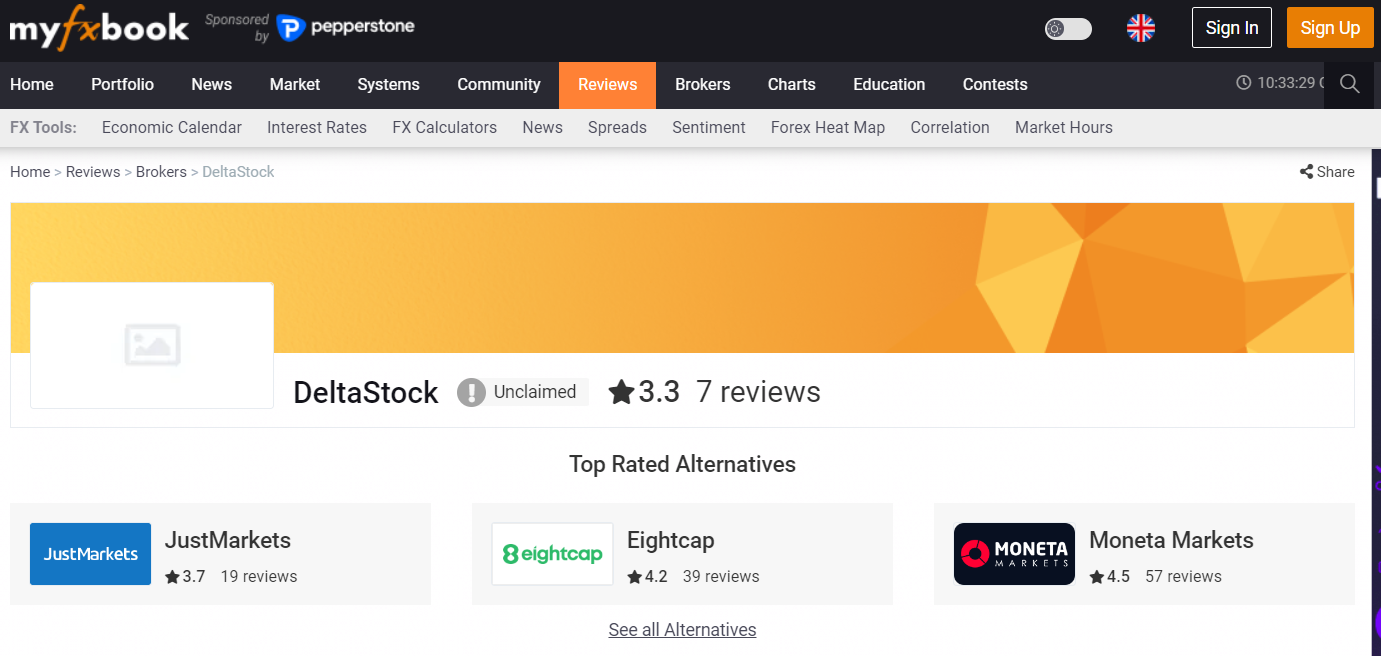

What are they trying to censor

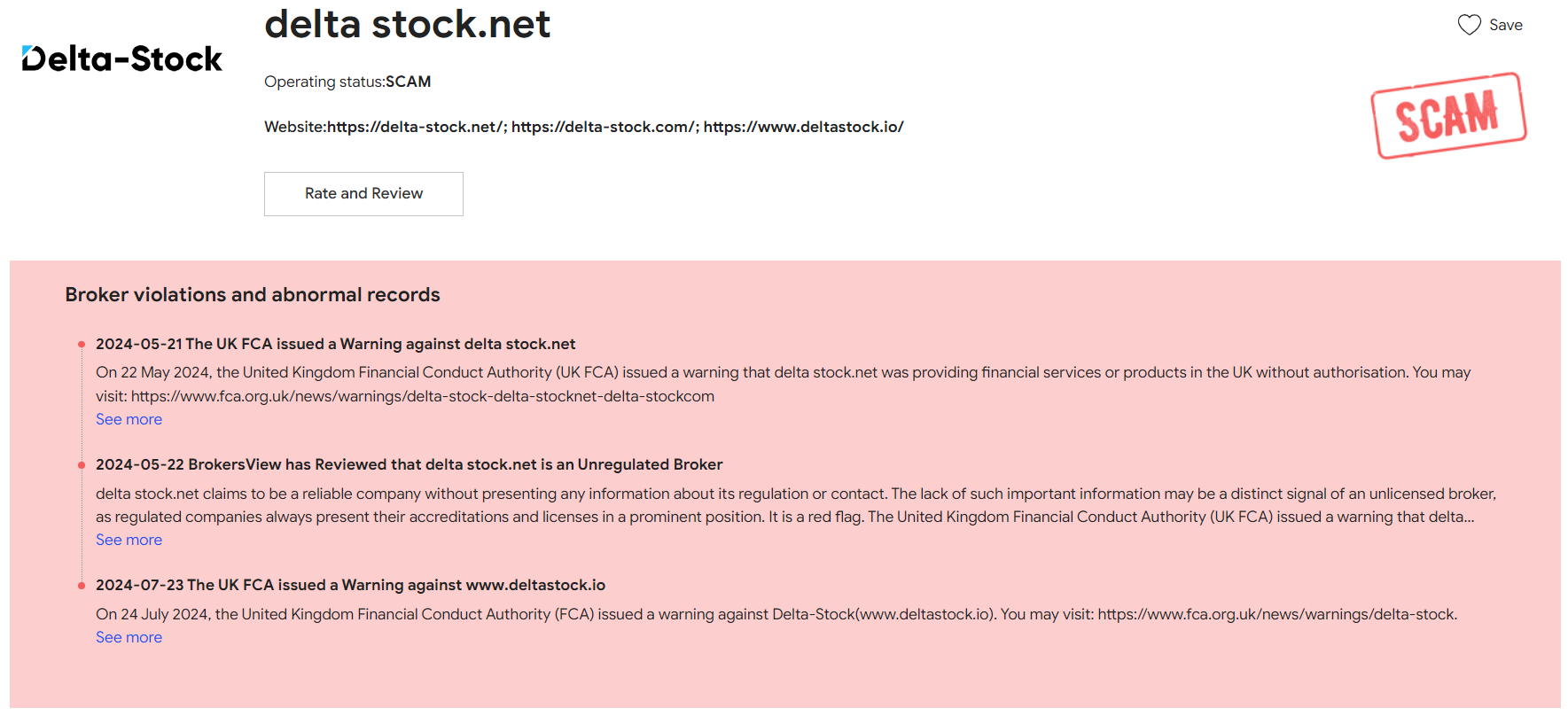

DeltaStock, a Bulgarian-based financial services company offering forex and CFD trading, has faced several allegations and red flags over the years that have raised concerns about its business practices and reputation. While the company has maintained its legitimacy, a closer examination reveals a pattern of adverse news and controversies that could harm its standing in the financial industry.

Major Allegations and Red Flags

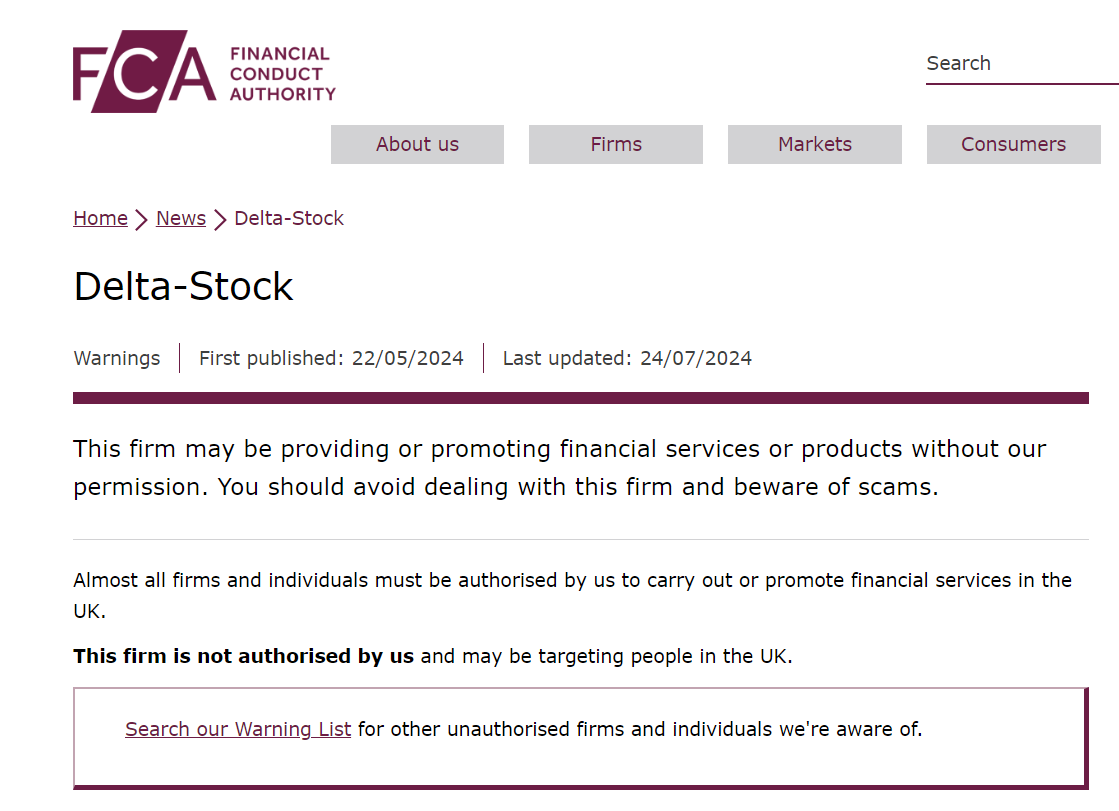

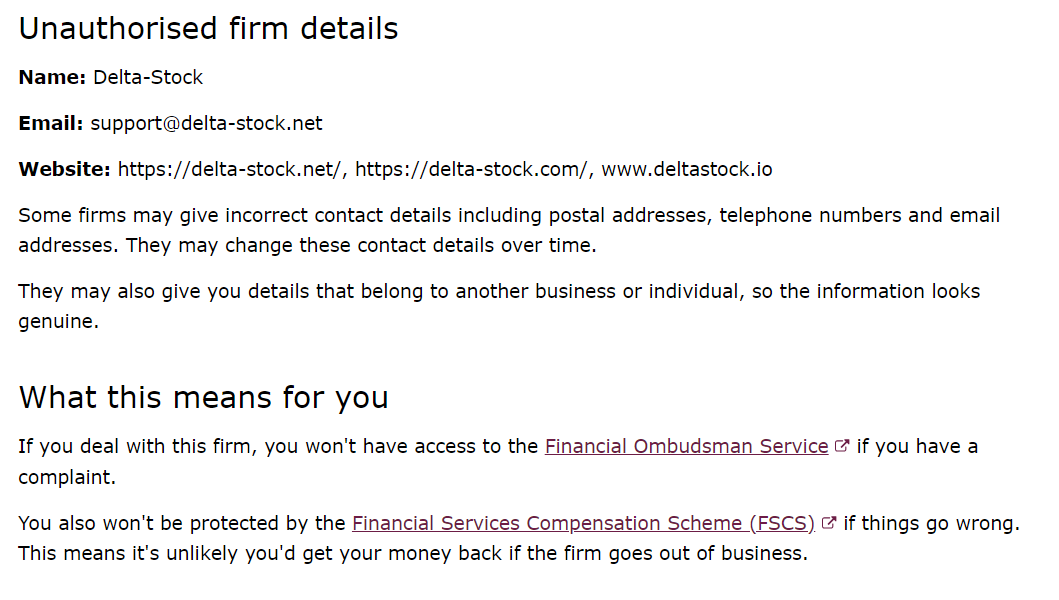

- Regulatory Scrutiny and Licensing Issues

DeltaStock has operated under the scrutiny of regulatory bodies. In 2018, the Bulgarian Financial Supervision Commission (FSC) fined the company for violating market rules, including inadequate client fund segregation and insufficient risk management practices. Such regulatory actions raise questions about the company’s compliance with financial standards and its commitment to client protection. - Misleading Advertising and Aggressive Marketing

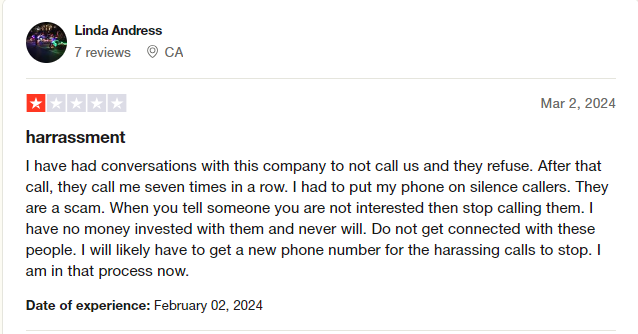

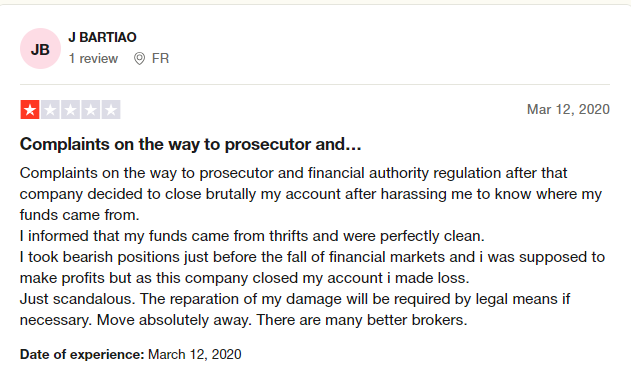

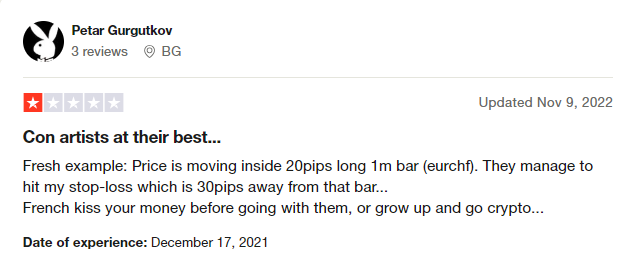

DeltaStock has been accused of using misleading advertising to attract inexperienced traders. Reports suggest that the company downplayed the risks associated with forex and CFD trading, potentially exposing clients to significant financial losses. Aggressive marketing tactics, including unsolicited calls and promises of high returns, have also been flagged as unethical. - Client Complaints and Disputes

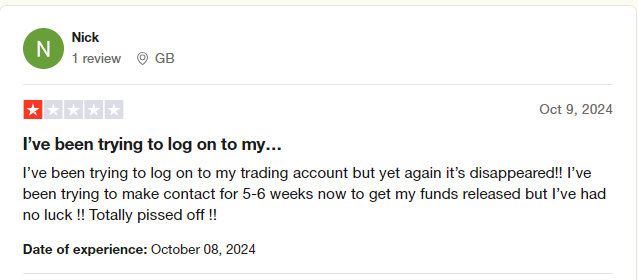

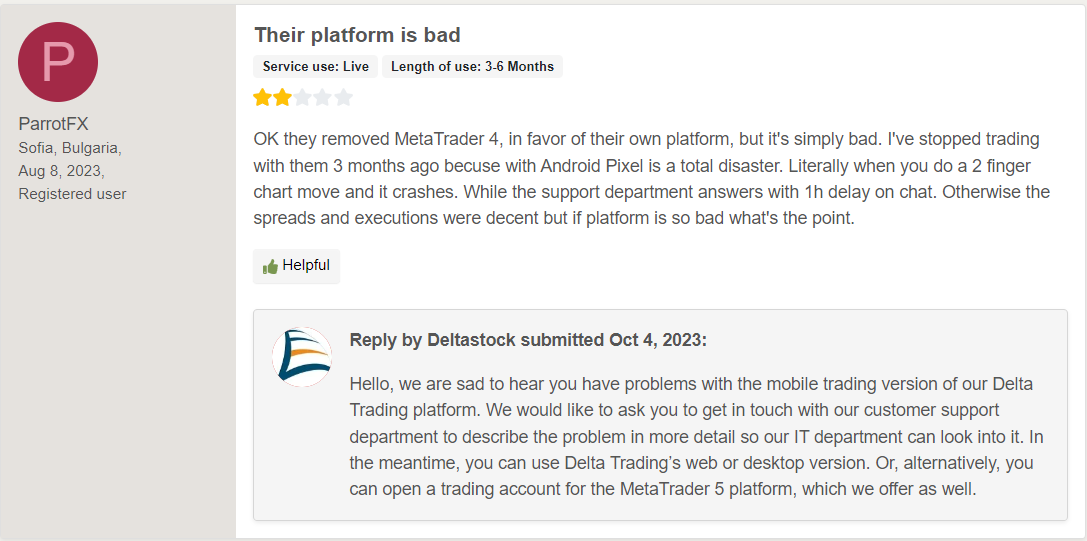

Numerous client complaints have surfaced online, alleging unfair trading practices, such as slippage, requotes, and sudden account closures. Some traders have accused DeltaStock of manipulating trading platforms to ensure client losses, a practice known as “stop hunting.” These allegations, if proven true, could severely damage the company’s credibility. - Cybersecurity Concerns

In 2020, DeltaStock was implicated in a cybersecurity incident where sensitive client data was allegedly compromised. While the company denied any breach, the incident raised concerns about its ability to safeguard client information, a critical aspect of financial services. - Association with High-Risk Jurisdictions

DeltaStock’s ties to offshore entities and high-risk jurisdictions have drawn criticism. Critics argue that such associations could facilitate money laundering or other illicit activities, though no concrete evidence has been presented to substantiate these claims.

Reputational Damage and Motives for Cyber Crime

The allegations against DeltaStock, particularly those involving regulatory violations, client mistreatment, and cybersecurity lapses, pose significant reputational risks. In the highly competitive forex and CFD industry, trust is paramount. Any perception of unethical behavior or incompetence can drive clients to competitors and deter potential investors.

Given the stakes, DeltaStock might feel compelled to suppress damaging information. For instance, negative reviews, client complaints, or investigative reports could tarnish its image and lead to financial losses. In extreme cases, the company might resort to unethical or illegal measures, such as hacking or cyberattacks, to remove or discredit harmful content. Such actions, while criminal, could be seen as a desperate attempt to protect its reputation and maintain market share.

Conclusion

DeltaStock’s history of regulatory fines, client complaints, and cybersecurity concerns paints a troubling picture. While the company has not been convicted of any major crimes, the cumulative effect of these allegations undermines its credibility. The potential for reputational harm creates a strong motive for DeltaStock to suppress adverse information, even if it means engaging in cybercrime. However, such actions would only deepen the mistrust and further damage its standing in the financial industry. Transparency and accountability, rather than suppression, are the only viable paths to restoring confidence in DeltaStock’s operations.

- https://lumendatabase.org/notices/43943039

- August 19, 2024

- NovaVista Labs co ltd

- https://www.deltastock.com/

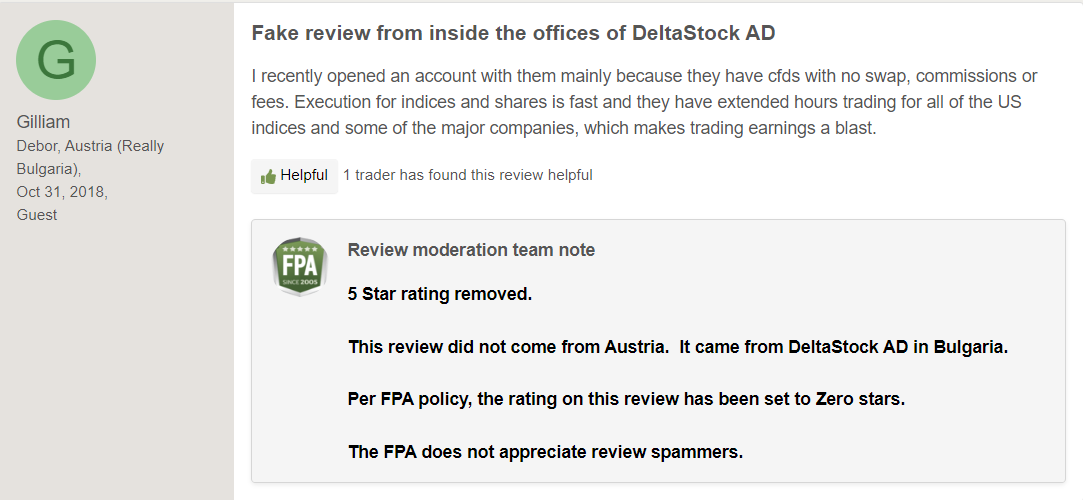

- https://www.myfxbook.com/reviews/brokers/deltastock/114,1

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

2.1

Based on 13 ratings

by: Benjamin Ward

Complaints about unfair trading practices and “stop hunting” are far too common with DeltaStock. If you’re trying to trade on their platform, you’re likely to find yourself at the losing end of the deal.

by: Olivia Jenkins

Misleading advertising and aggressive marketing are DeltaStock’s go-to tactics. Downplaying risks and promising high returns to inexperienced traders? That’s not marketing it’s manipulation.

by: Scarlett Price

Getting caught up in a data breach and then denying it ever happened doesn’t inspire much confidence. In finance, if you can’t protect your clients’ info, what else are you cutting corners on?

by: Jack Peterson

In the world of forex, reputation is everything. DeltaStock’s combination of regulatory penalties, cybersecurity scandals, and mounting user complaints makes you wonder how they’re still attracting clients unless people just aren’t reading the fine print.

by: Zoe Ramirez

DeltaStock’s aggressive sales tactics and misleading ads paint a pretty clear picture: this is a company more focused on luring in naive investors than protecting them. Promising high returns without transparently discussing the risks is just predatory.

by: Henry Hughes

There’s something deeply unsettling about a financial firm accused of stop hunting and sudden account closures. It’s one thing to lose a trade—it’s another to feel like the house is rigged against you.

by: Aria Mitchell

DeltaStock keeps insisting it's legit, but when you’re fined by your own regulator for mishandling client funds and risk controls, that ‘legitimacy’ starts looking more like a technicality than a badge of trust.

by: Coleson Serrano

I lost money tradin' with DeltaStock, now I know why – misleading ads and all. They lure you in with big promises then boom, your account’s gone.

by: Noa Salgado

This company sounds shady as hell... so many red flags and yet they're still operating?

by: Lucas Walker

They keep pushing those risky ads, telling you forex trading is easy. But it’s not, and they won’t warn you about the losses.Stay far away from DeltaStock!

by: Harper Nelson

Frustrating Experience

by: Benjamin Allen

I tried their platform, but the trades never went through right. Feels like they’re setting you up to lose.They’re always pushing their services with high-pressure ads. But once you sign up, they leave you stranded with no real support.

by: Lily Hill

DeltaStock is a total scam! They lure you in with fake promises, then take your money and leave you hanging.I lost so much with them.

by: Charlotte Moore

Account closures and problems getting funds out.

by: Noah Adams

They promise high returns and downplay the risks. But when you dig deeper, it's clear this company is just about taking advantage of inexperienced traders.

by: Gabriella Reed

Be cautious and don't trust these scammers with your hard-earned money – once it's gone, you won't get it back. It's shocking how they're still operating with such skillful deception.

by: Chloe Walker

Avoid this site at all costs—it’s unregulated, unreliable, and uses fake information to appear legitimate. My mum got scammed, but thankfully, she reported it to the bank to recover her money.

by: Xena Russell

I was scammed by this company after they convinced me to deposit $1,400 into an atomic wallet and share personal details like my passport and accounts. I feel violated and fear they might take more money. Avoid them at all...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations