What We Are Investigating?

Our firm is launching a comprehensive investigation into EA Trading over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that EA Trading - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

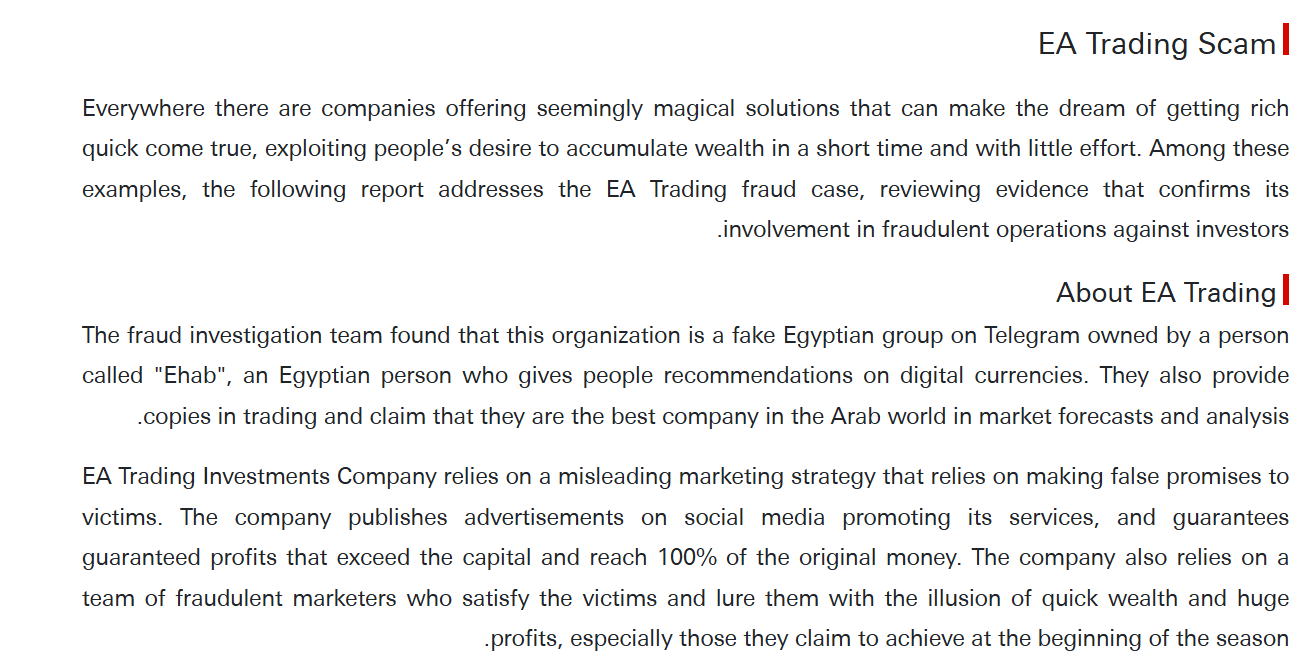

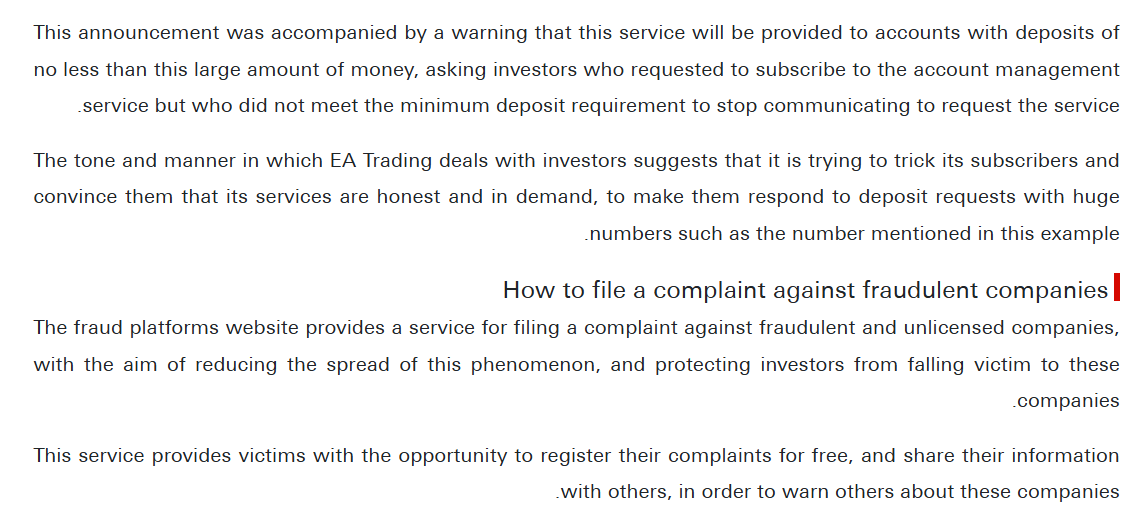

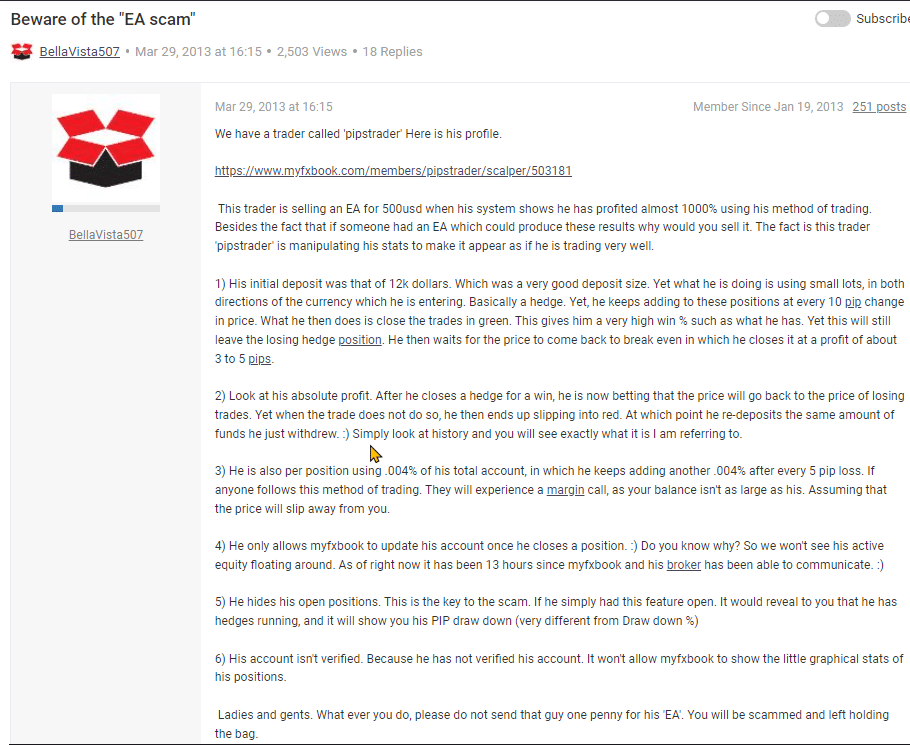

EA Trading, a financial services firm, has faced a series of serious allegations and red flags that have tarnished its reputation and raised concerns about its business practices. These allegations range from regulatory violations and customer complaints to accusations of fraudulent activities. Below is a summary of the major issues and their potential impact on EA Trading’s reputation, as well as the motivations behind the company’s possible desire to suppress this information, even through illicit means.

Major Allegations and Red Flags:

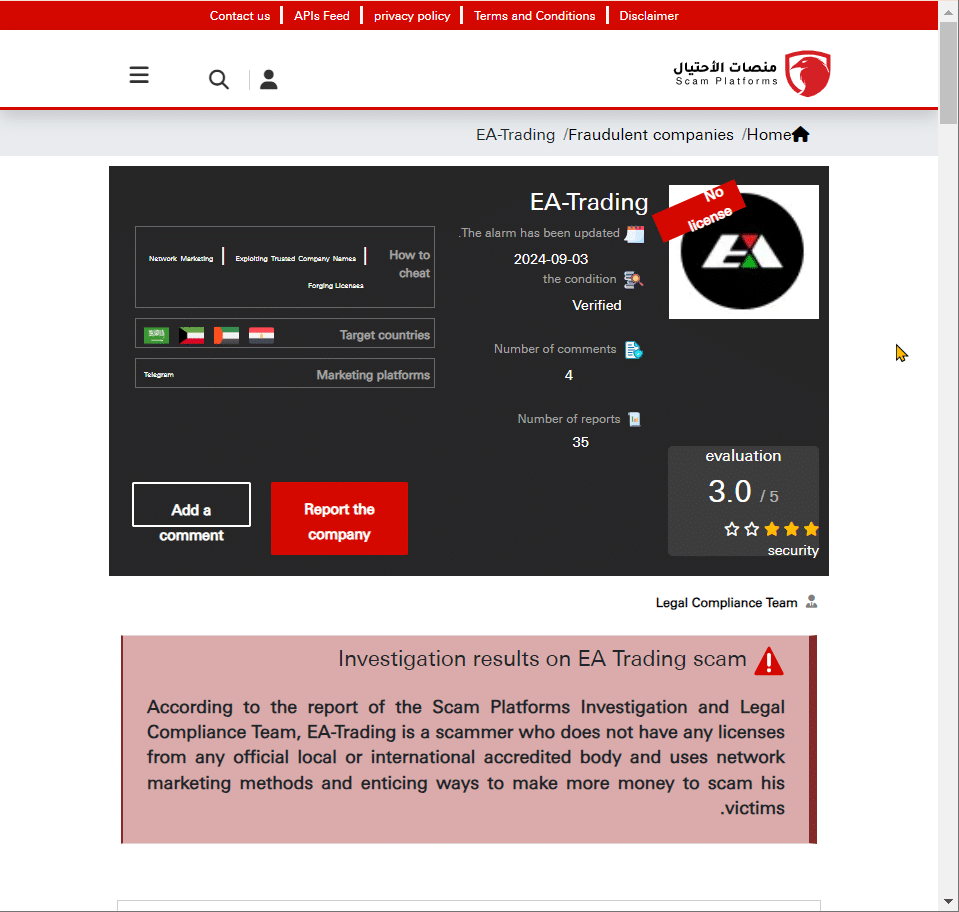

Regulatory Violations and Scrutiny: EA Trading has been accused of operating without proper licenses in multiple jurisdictions. Regulatory bodies in Europe and Asia have issued warnings against the company, citing unauthorized financial activities and failure to comply with anti-money laundering (AML) regulations. Such violations not only undermine trust but also expose clients to significant financial risks.

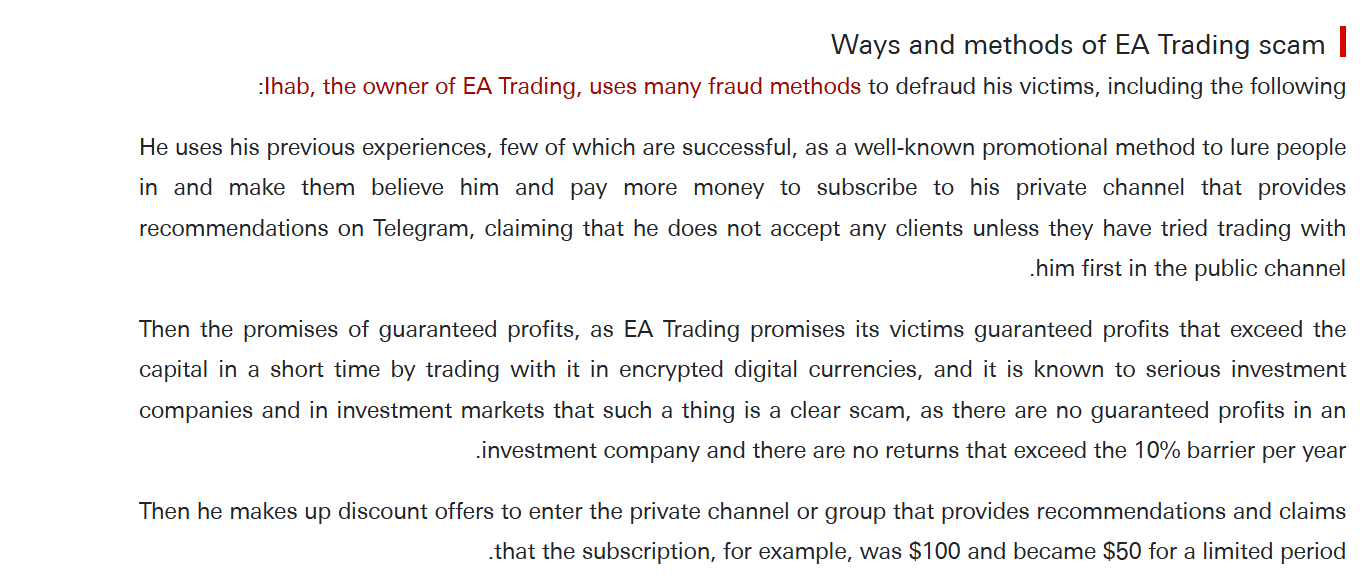

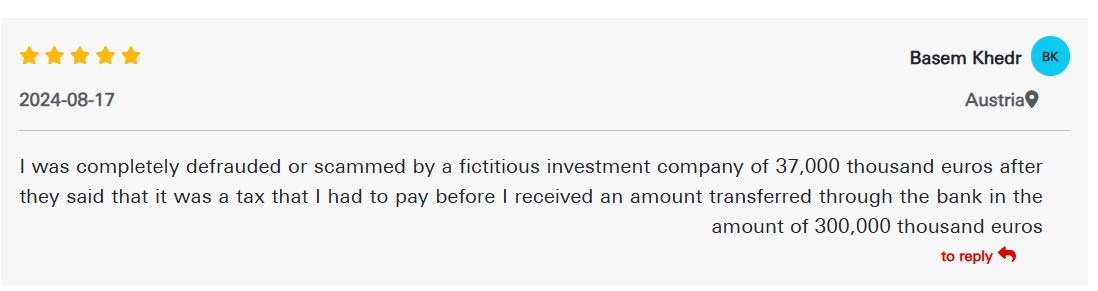

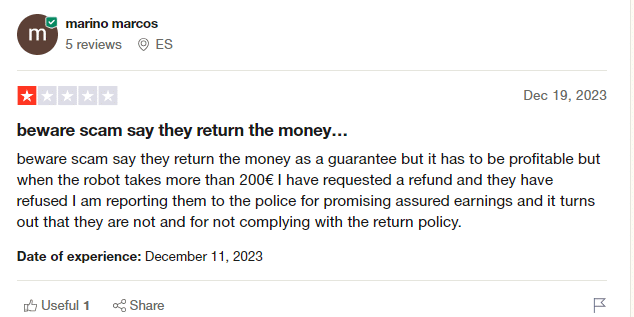

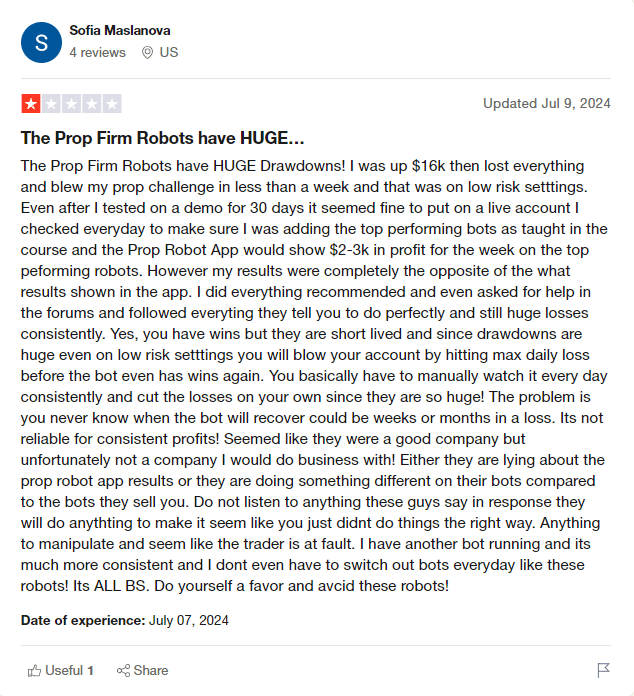

Customer Complaints of Fraud: Numerous clients have accused EA Trading of deceptive practices, including misrepresentation of investment products, hidden fees, and refusal to process withdrawals. Online forums and complaint boards are flooded with allegations of funds being frozen or lost without explanation. These stories paint a picture of a company that prioritizes profit over client welfare.

Ponzi Scheme Allegations: Some industry watchdogs have raised concerns that EA Trading operates similarly to a Ponzi scheme, using new investors’ funds to pay returns to earlier clients. While no formal charges have been proven, the lack of transparency in its operations fuels these suspicions.

Adverse Media Coverage: Investigative journalists and financial watchdogs have published exposés linking EA Trading to offshore shell companies and questionable transactions. These reports suggest potential ties to money laundering and tax evasion, further damaging the company’s credibility.

Cybersecurity Breaches and Data Mismanagement: EA Trading has been criticized for its poor handling of client data, with reports of data breaches and leaks. Clients have expressed concerns about the safety of their personal and financial information, raising questions about the company’s commitment to cybersecurity.

Reputational Damage and Motives for Suppression

The cumulative effect of these allegations has severely harmed EA Trading’s reputation. Trust is paramount in the financial services industry, and the company’s alleged misconduct has eroded confidence among potential and existing clients. Negative media coverage and regulatory scrutiny have also made it difficult for EA Trading to expand into new markets or attract reputable partners.

Given the gravity of these allegations, EA Trading has a strong incentive to suppress damaging information. Stories of fraud, regulatory violations, and ties to illicit activities could lead to legal consequences, loss of clients, and ultimately, the collapse of the business. In such a high-stakes environment, the company might resort to extreme measures, including cybercrime, to remove or discredit unfavorable content.

For instance, EA Trading could hack into websites or social media accounts to delete negative reviews, manipulate search engine results, or launch disinformation campaigns to discredit whistleblowers. Such actions, while illegal, could provide short-term relief by reducing the visibility of damaging stories and creating an illusion of legitimacy.

Conclusion

EA Trading’s alleged misconduct and the resulting reputational damage highlight the risks associated with unethical business practices in the financial sector. While the company may seek to suppress negative information through illicit means, such actions only deepen the mistrust and legal jeopardy it faces. The true path to redemption lies in transparency, accountability, and adherence to regulatory standards—not in cybercrime or cover-ups.

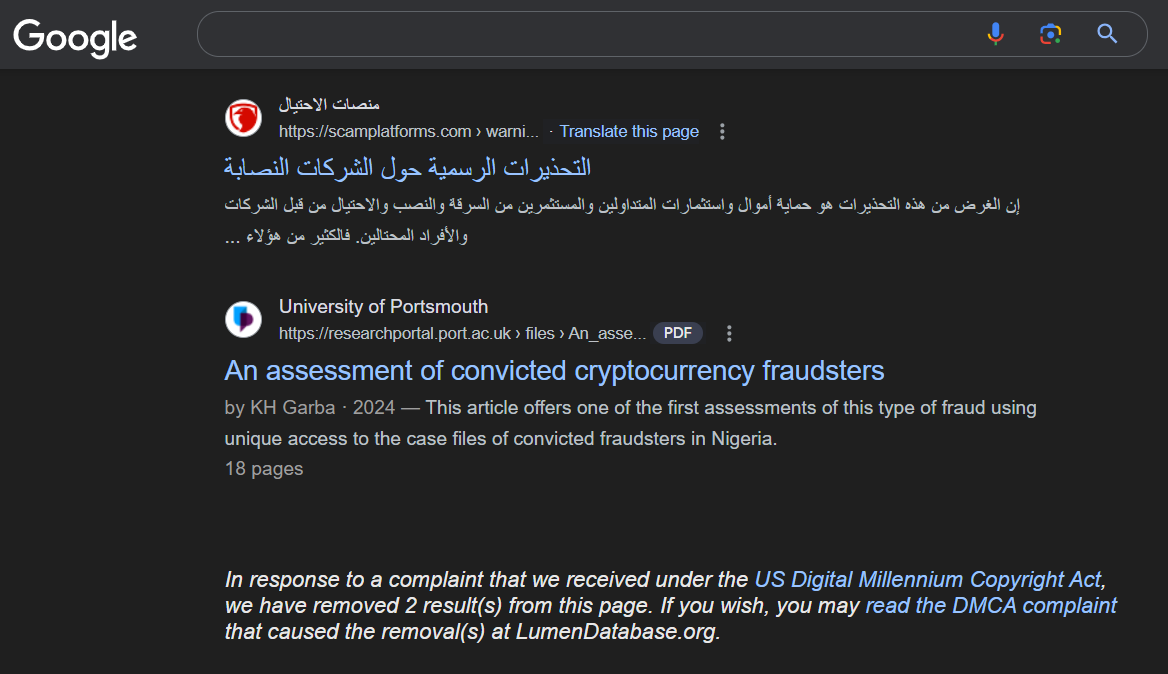

- https://lumendatabase.org/notices/44501144

- September 10, 2024

- Fraud platforms

- https://scamplatforms.com/warnings/ea-trading

- https://fraudplatforms.com/warnings/ea-trading/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Carl Koenemann

Investigation Ongoing

Vitaly Abasov

Investigation Ongoing

Samir Tabar

Investigation Ongoing

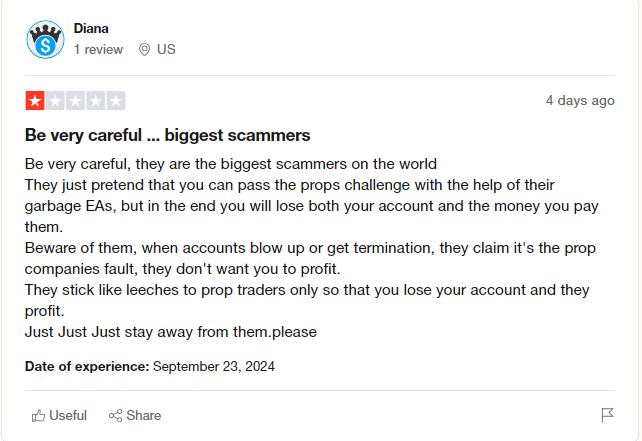

User Reviews

Average Ratings

1.5

Based on 7 ratings

by: Zara Bell

EA Trading is a complete scam, I lost a lot of money with them. They make fake promises and never process your withdrawals. Stay away from them!

by: Laura Jennings

After putting $18,000 into EA Trading, I was promised big returns, but all I got was a locked account and no response. The stress of dealing with this company is unbearable. They’ve stolen my money, and now I’m left with...

by: Jeremy Ray

I trusted EA Trading with my savings $25,000 only to see it vanish without any explanation. They promised high returns, but all I got was silence and refusal to release my funds. This is a total fraud.

by: Jack Snyder

I trusted EA Trading with my $10,000, and now my account is locked, with no way to get my money back.

by: Ghost Wisp

Hidden fees everywhere! They nickel and dime you until your account is empty. Totally unethical.

by: Fable Whisper

The platform crashes frequently during peak trading hours. Missed out on crucial trades because of this.

by: Elara Phantom

Tried to get a refund, but their support team kept giving me the runaround. Felt like I was talking to robots.

by: Dusk Mirage

Their automated trading system is a joke. It executed trades I didn't authorize, leading to massive losses.

by: Cipher Enigma

EA Trading's 'expert advisors' are anything but. Lost a significant portion of my investment following their advice.

by: Axel Sullivan

EA Trading has too many complaints online. People say they can’t withdraw their money, and customer service is terrible. Sounds like a nightmare to deal with. Avoid them

by: Dylan Bell

EA Trading seems really shady to me. They promise big profits, but I’ve heard so many people lose money with them. Feels like a scam, honestly. I wouldn’t trust them at all.please stay away and dont fall for them

by: Jacob Reed

I don’t like how EA Trading operates. They’re not clear about their fees or risks. It’s like they hide important details from customers. That’s not how a good company should work.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations