What We Are Investigating?

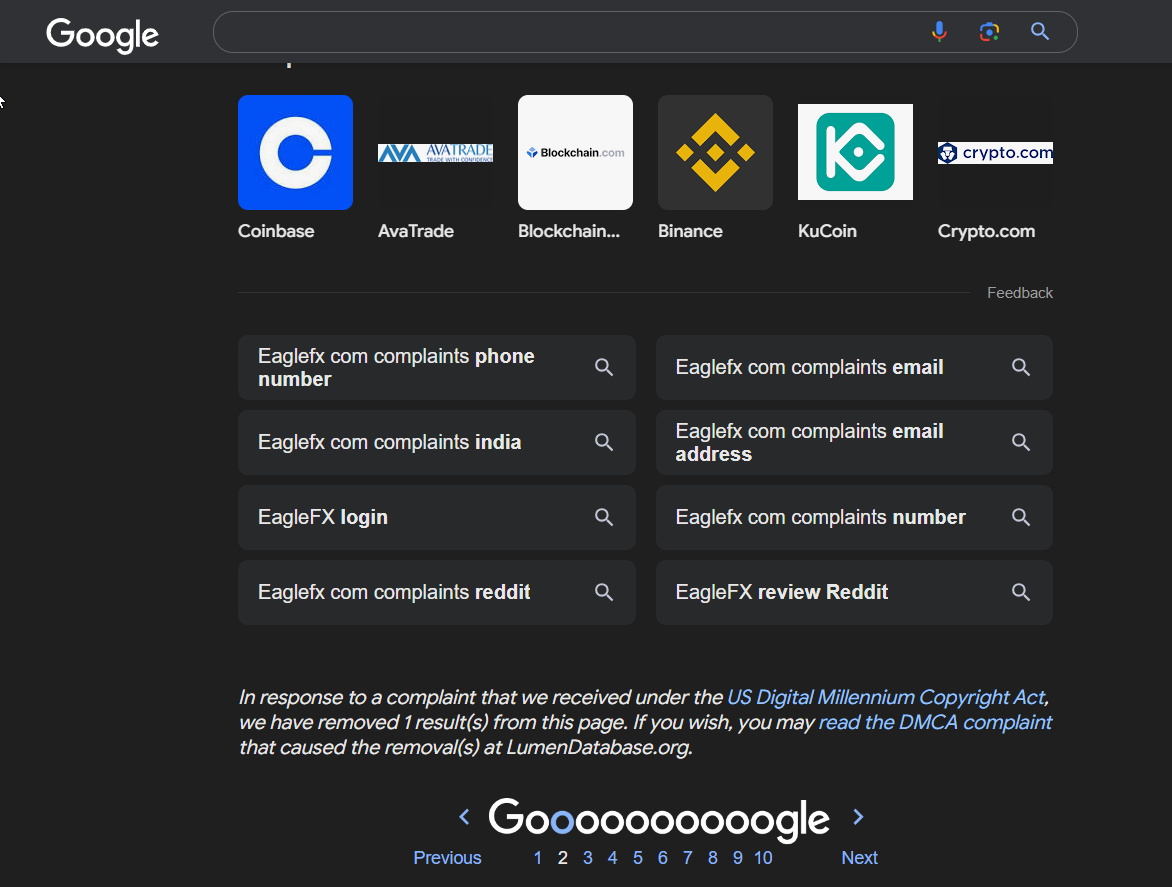

Our firm is launching a comprehensive investigation into EagleFX over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that EagleFX - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Investigative Report: Allegations and Adverse News Against EagleFX

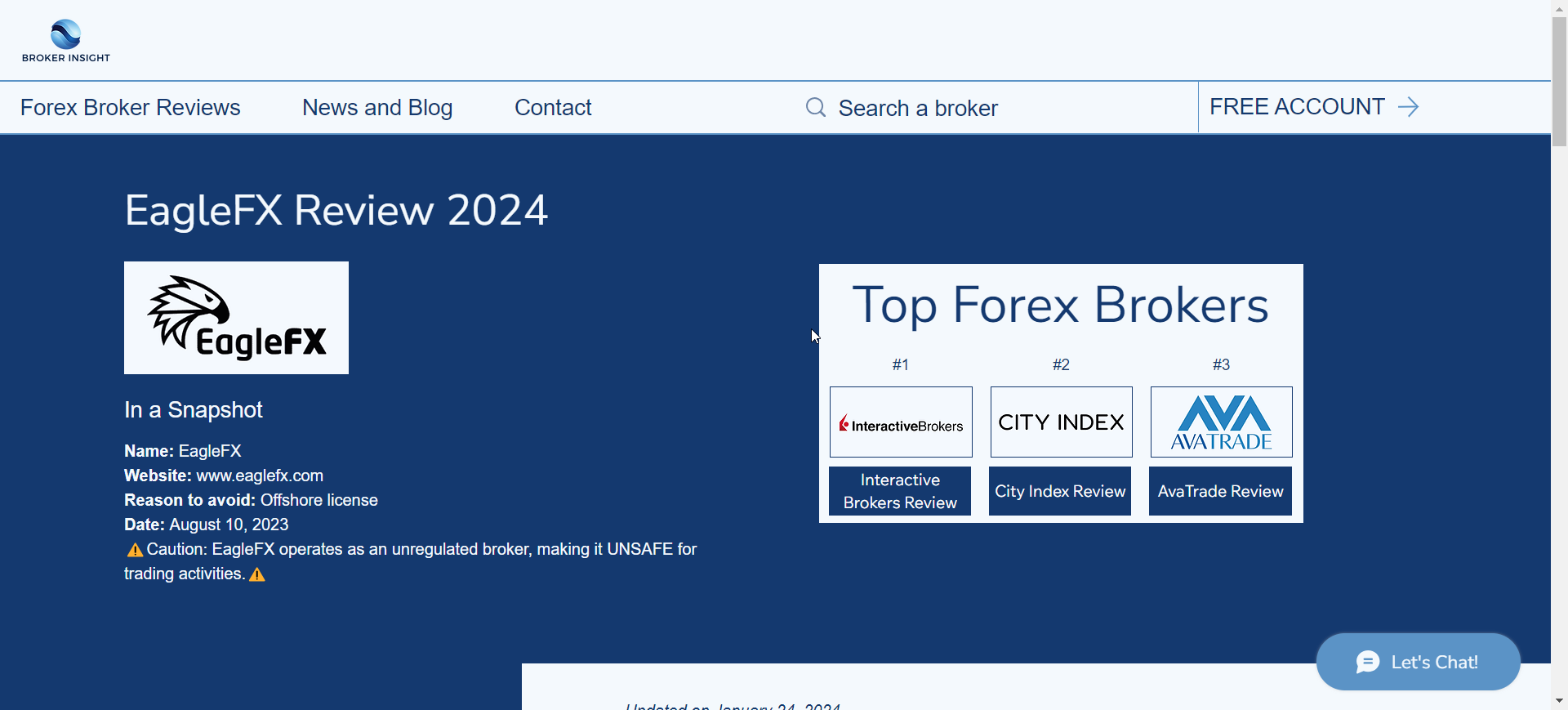

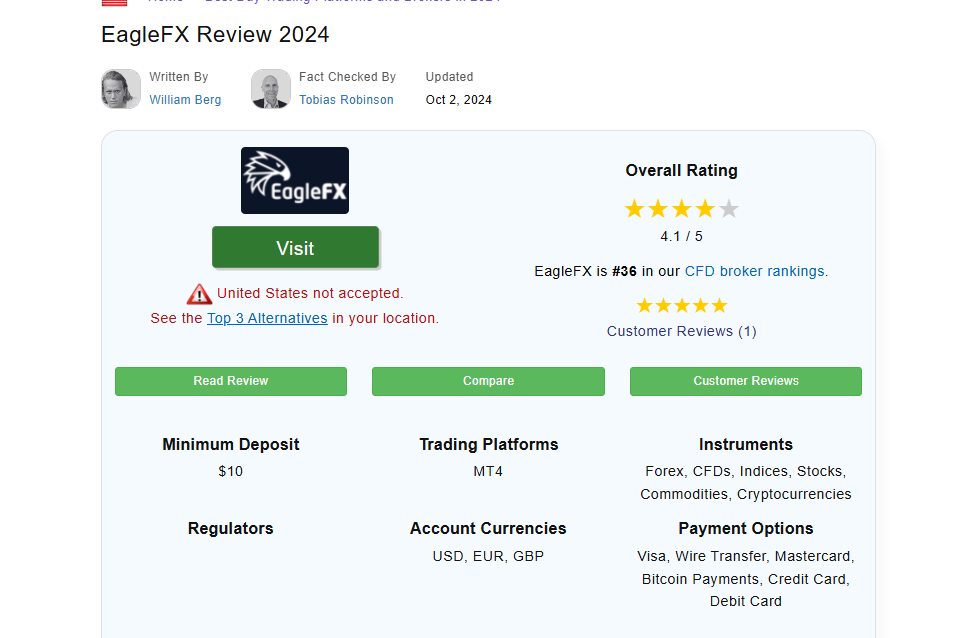

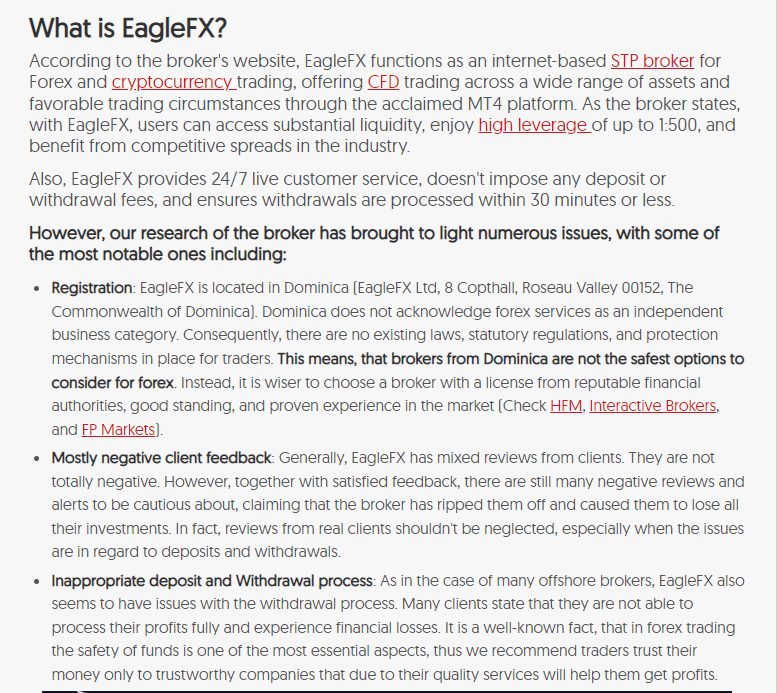

EagleFX, a forex and CFD brokerage, has faced a series of allegations and adverse news reports that have raised significant concerns about its operations, transparency, and regulatory compliance. These issues have the potential to harm its reputation and erode trust among traders and investors. Below is a summary of the major allegations and adverse news, along with an analysis of their impact on EagleFX’s reputation and the potential motivations for the company to suppress such information.

Major Allegations and Adverse News

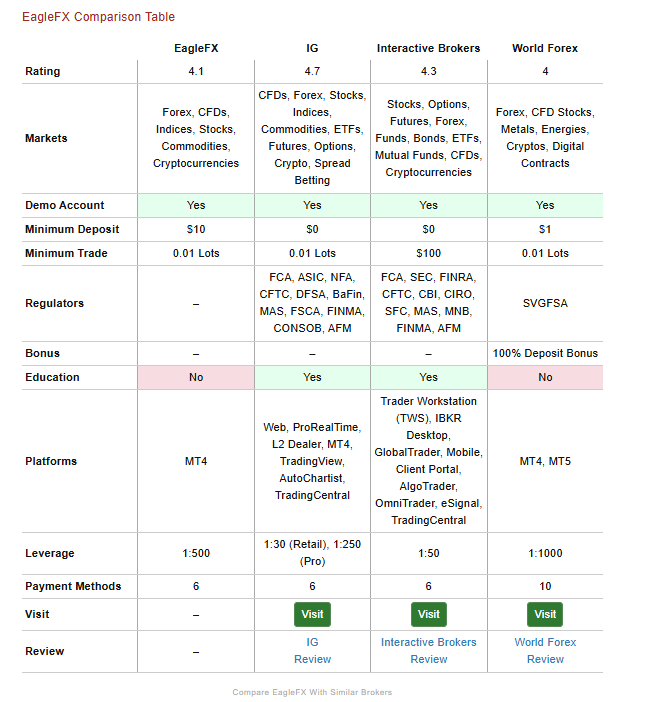

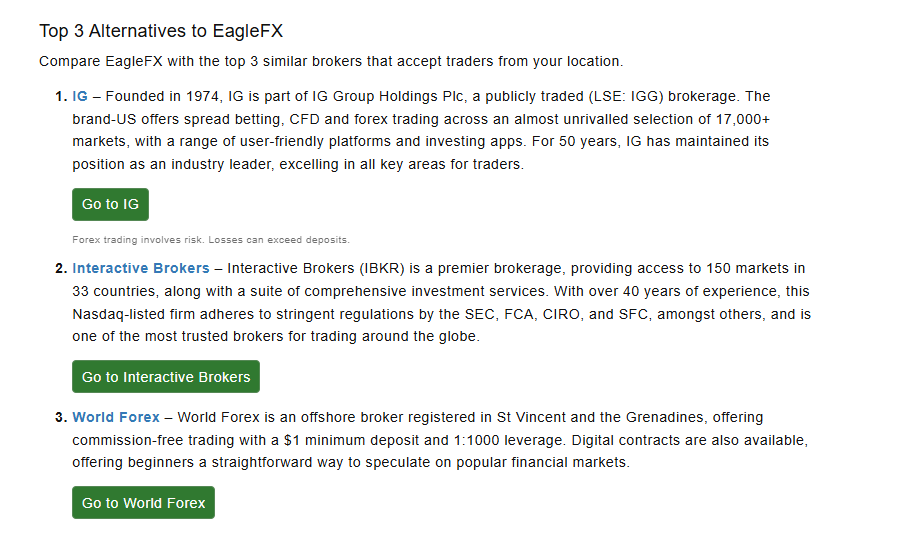

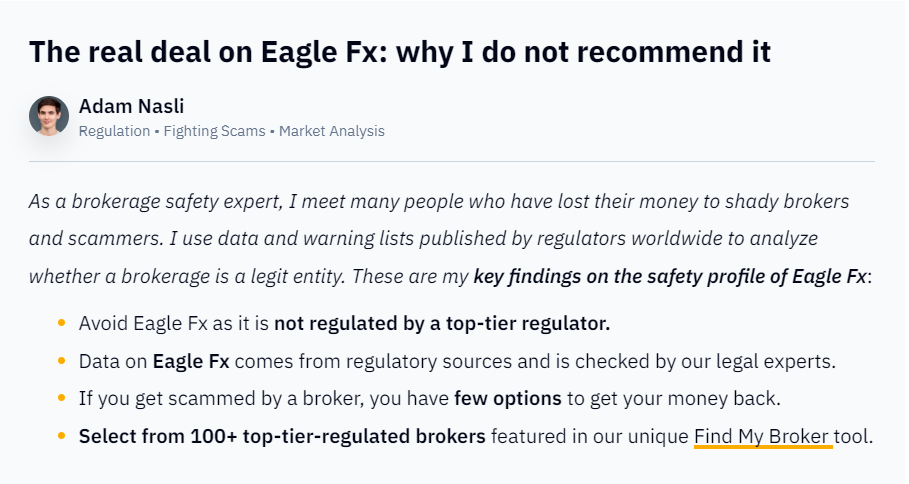

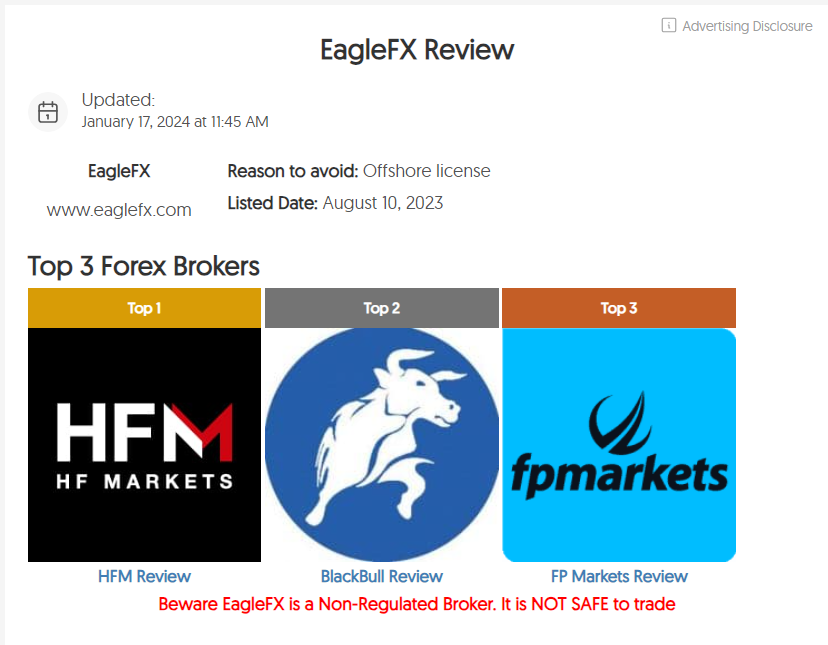

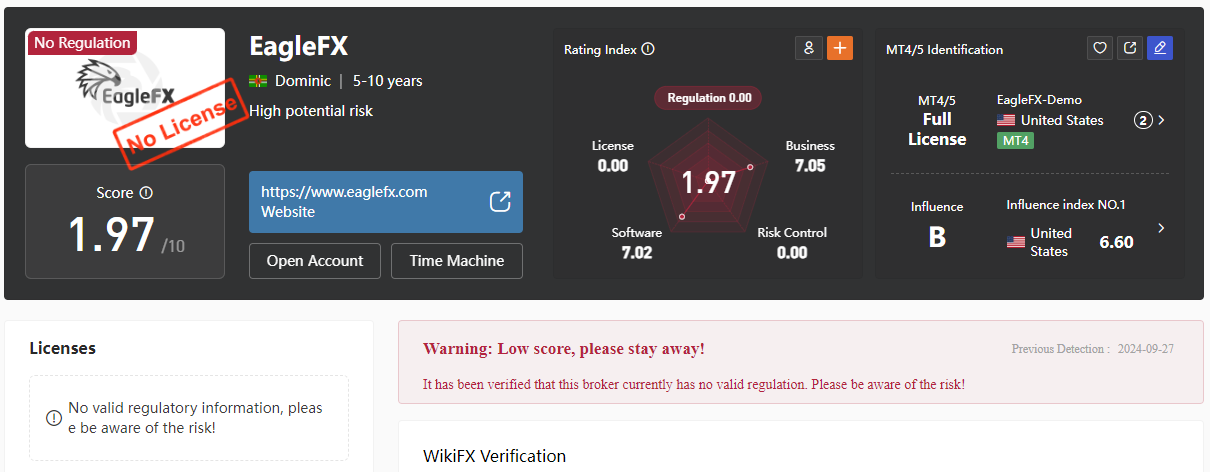

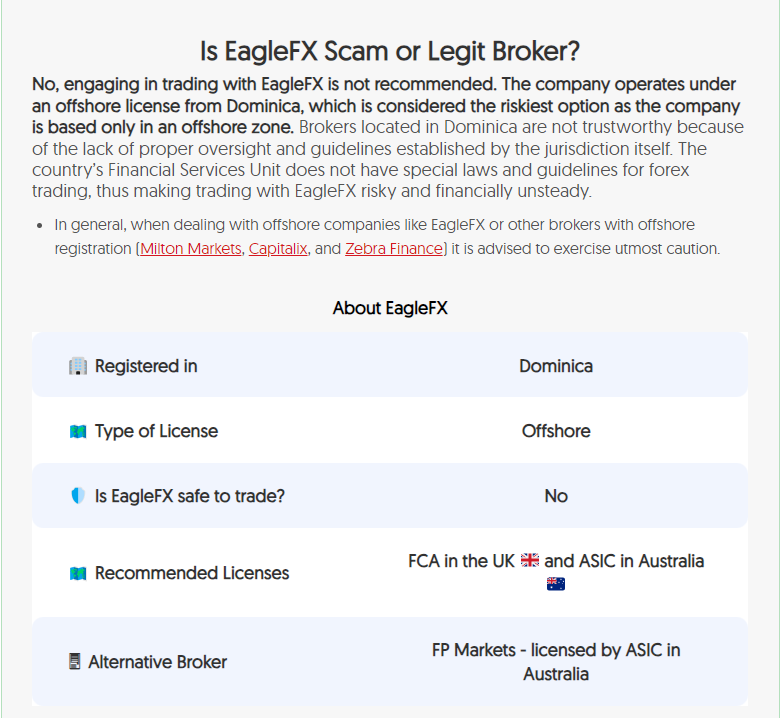

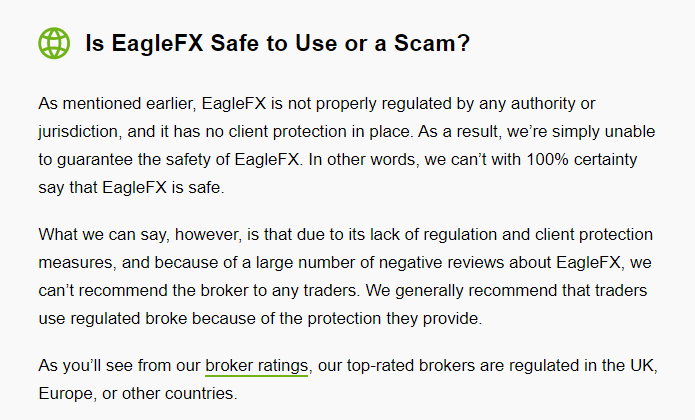

- Lack of Regulatory Oversight

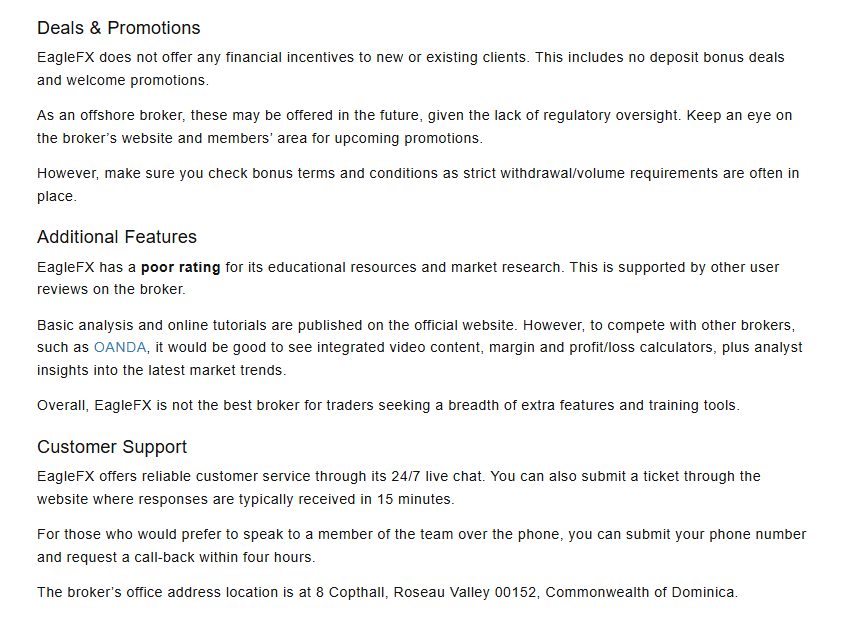

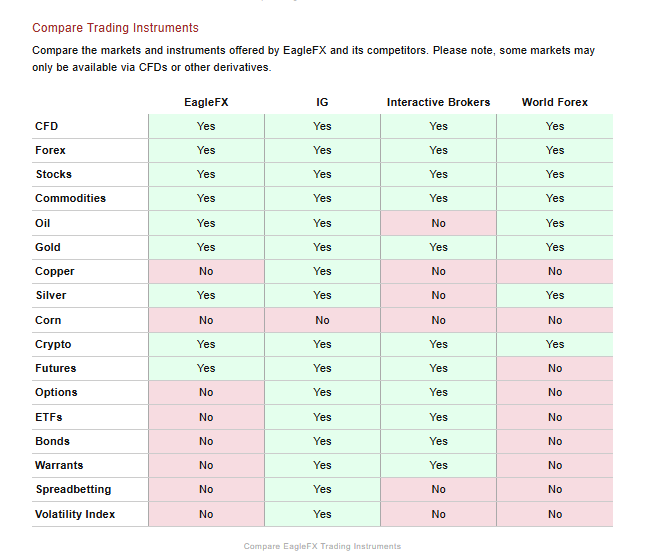

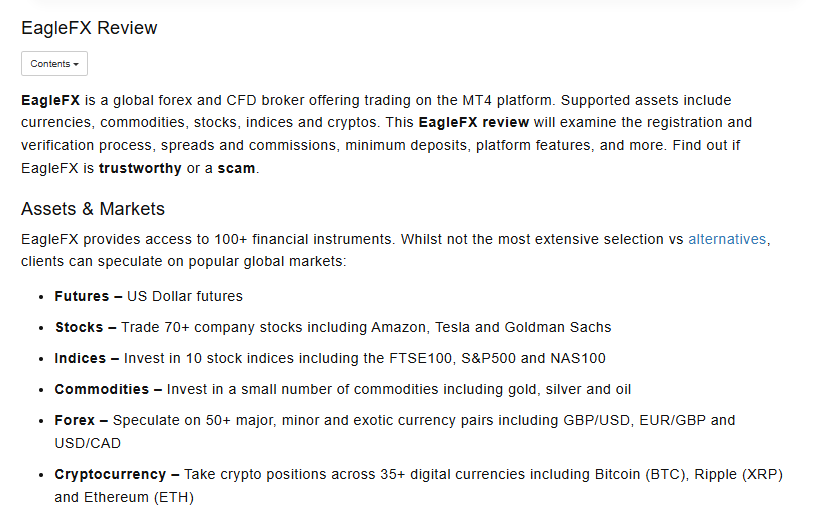

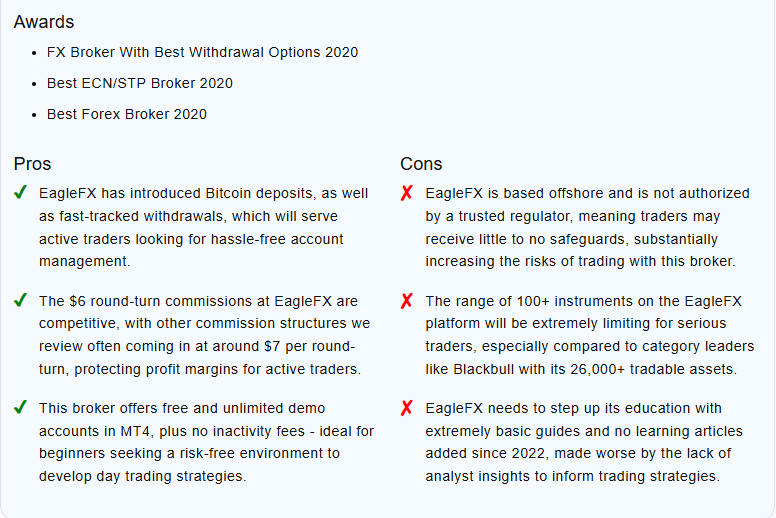

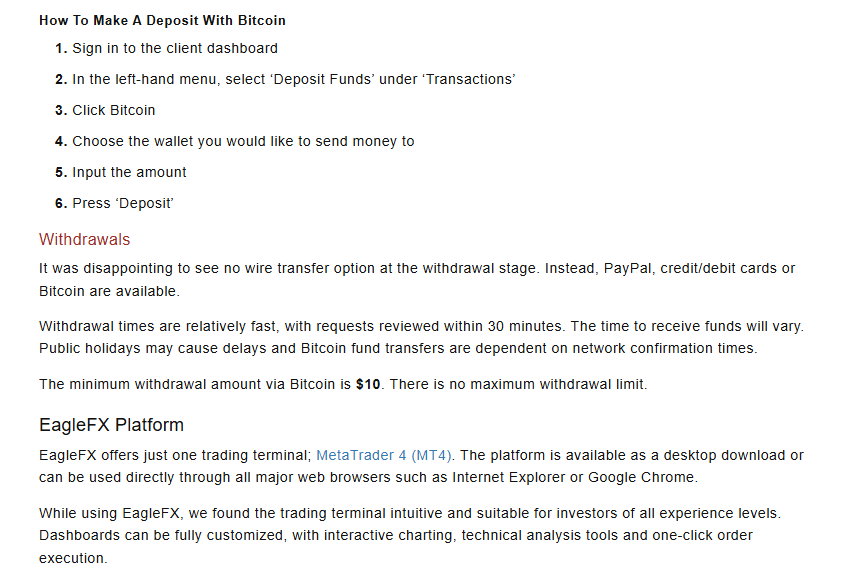

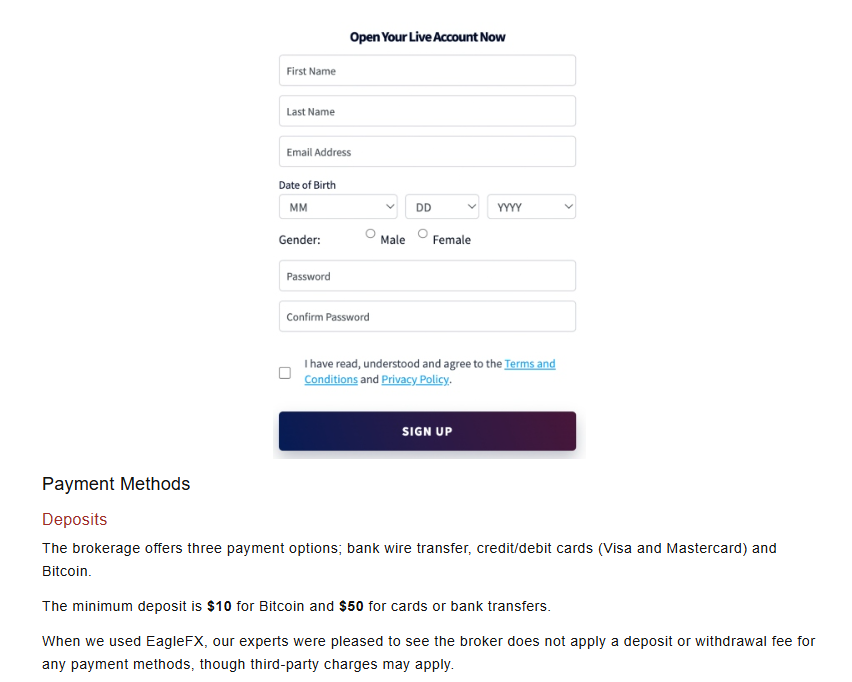

EagleFX has been repeatedly criticized for operating without proper regulatory oversight. Unlike reputable brokers regulated by authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), EagleFX is registered in the Dominican Republic, a jurisdiction with less stringent financial regulations. This lack of oversight raises concerns about the safety of client funds and the broker’s adherence to industry standards. - Withdrawal Issues

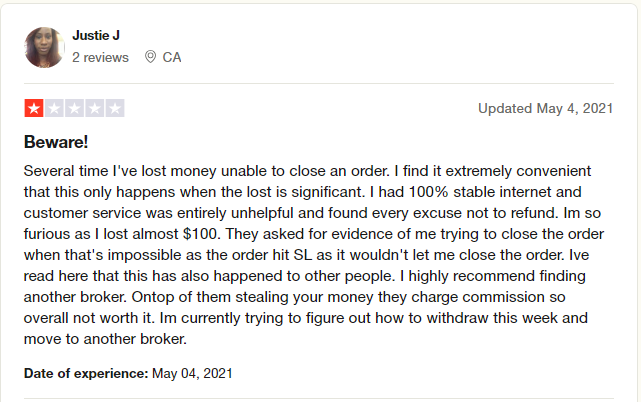

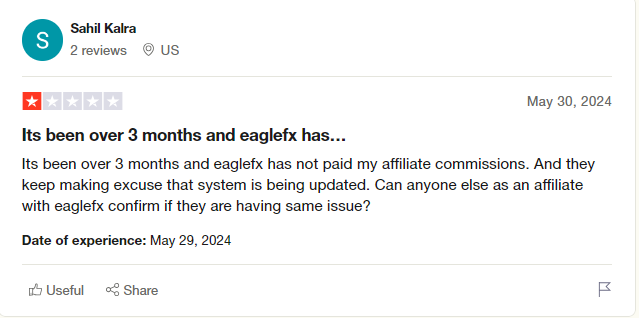

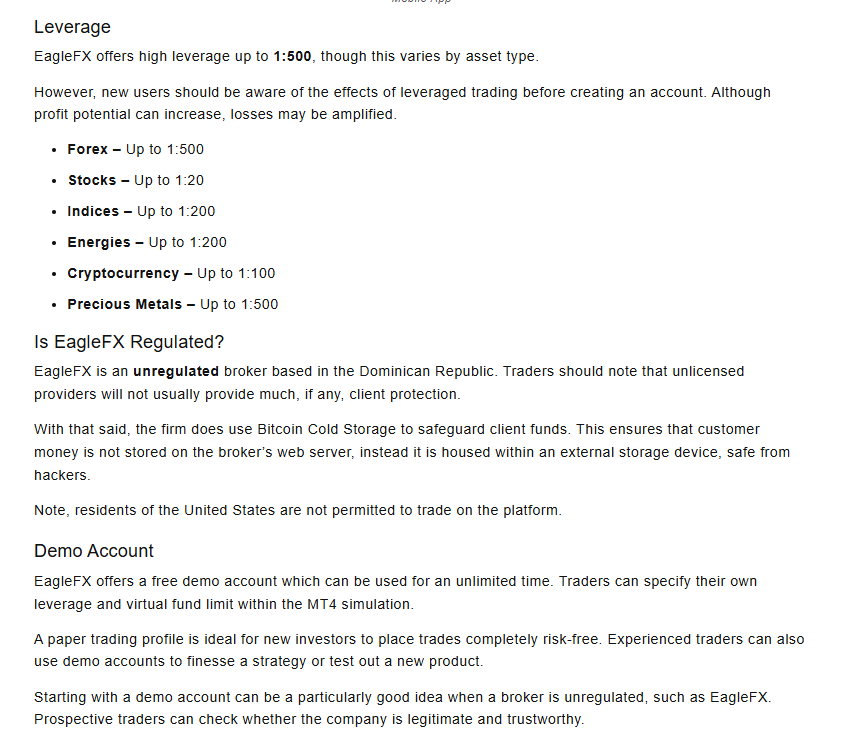

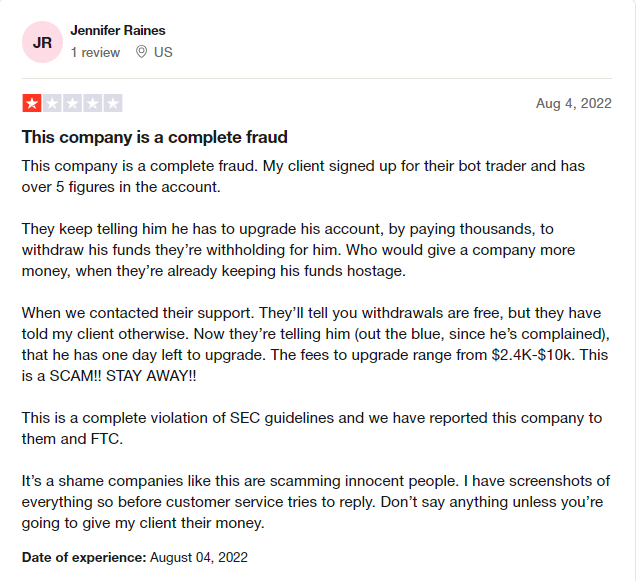

Numerous user complaints have surfaced online, alleging difficulties in withdrawing funds from EagleFX. Traders have reported delays, unexplained fees, and, in some cases, outright refusal to process withdrawals. These allegations suggest potential liquidity issues or unethical practices aimed at retaining client funds. - Misleading Advertising

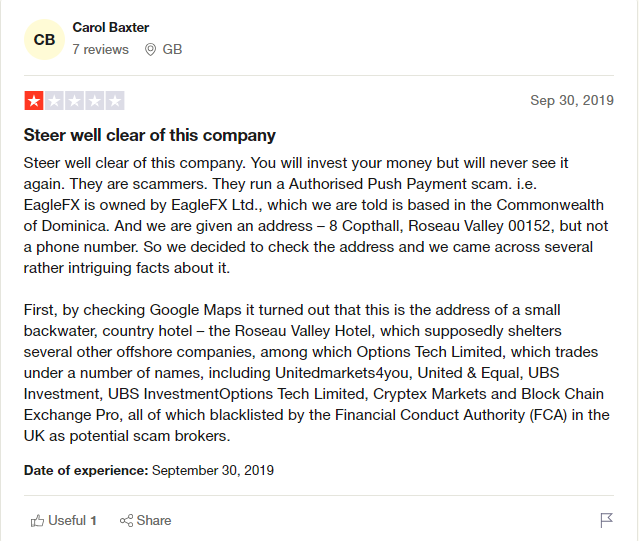

EagleFX has been accused of using misleading marketing tactics, such as promising high leverage (up to 1:500) and low spreads, without adequately disclosing the risks involved in trading with such conditions. Critics argue that this targets inexperienced traders who may not fully understand the potential for significant losses. - Anonymous Ownership and Lack of Transparency

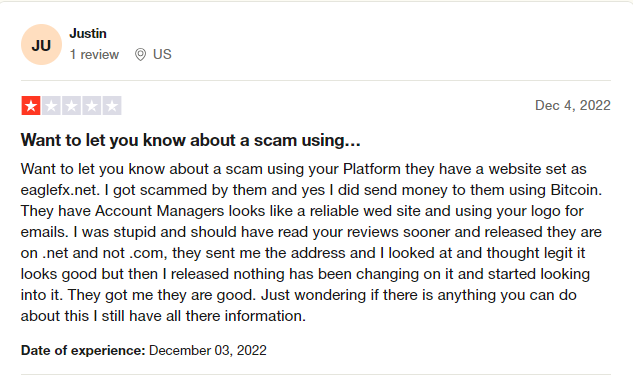

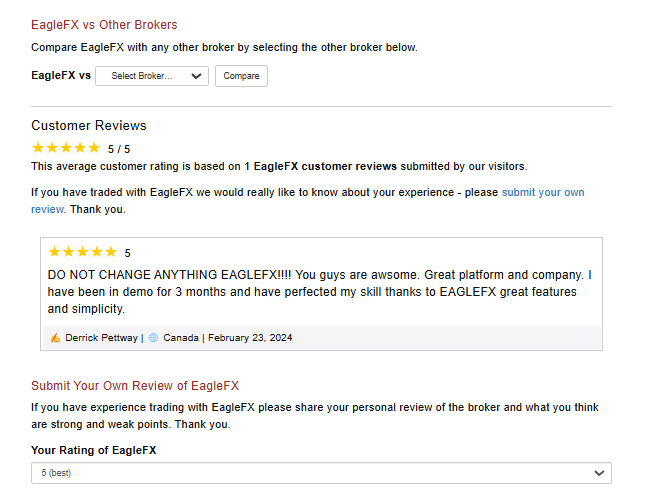

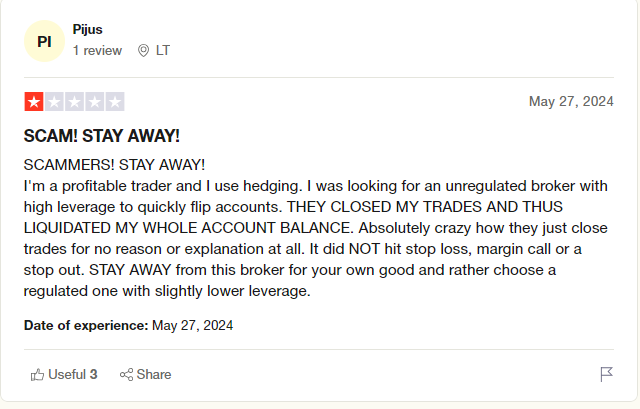

The ownership structure of EagleFX remains unclear, with no publicly available information about its founders or key executives. This lack of transparency has fueled suspicions about the broker’s legitimacy and intentions. - Negative Reviews and Scam Allegations

Online forums and review sites are rife with accusations that EagleFX is a scam. Traders have shared stories of manipulated trading conditions, sudden account closures, and unresponsive customer support. While some reviews may be exaggerated, the volume of complaints is concerning. - Association with High-Risk Practices

EagleFX has been linked to high-risk trading practices, such as offering excessive leverage and catering to unregulated crypto trading. These practices are often associated with brokers that prioritize profit over client protection.

Impact on Reputation

The allegations against EagleFX paint a picture of a broker that prioritizes profit over ethical practices and client safety. The lack of regulatory oversight and transparency undermines trust, as traders have no assurance that their funds are secure or that the broker operates fairly. Withdrawal issues and scam allegations further damage EagleFX’s credibility, as they suggest potential financial mismanagement or fraudulent behavior.

For a brokerage, reputation is everything. Negative reviews and adverse news can deter potential clients, reduce trading volumes, and ultimately impact profitability. In the highly competitive forex industry, even a single scam allegation can have long-lasting consequences.

Motivations for Suppressing Information

Given the severity of these allegations, EagleFX has a strong incentive to suppress negative information. Removing damaging content from the internet could help the broker maintain its client base, attract new traders, and protect its revenue streams. In extreme cases, a company might resort to unethical or illegal means, such as hacking or cyberattacks, to remove or discredit unfavorable reviews and reports.

For instance, if a prominent financial blog or forum were to publish a detailed exposé on EagleFX’s alleged malpractices, the broker might face a significant loss of business. In such a scenario, EagleFX could be tempted to engage in cybercrime to remove the content, intimidate whistleblowers, or manipulate search engine results to bury negative information.

Conclusion

The allegations against EagleFX highlight serious concerns about its operations and ethical standards. While the broker has not been formally charged with any crimes, the volume and consistency of complaints suggest systemic issues that cannot be ignored. The potential reputational damage from these allegations provides a clear motive for EagleFX to suppress negative information, even if it means resorting to unethical or illegal means. As always, traders are advised to exercise caution and conduct thorough due diligence before engaging with any broker, especially those operating in unregulated or high-risk jurisdictions.

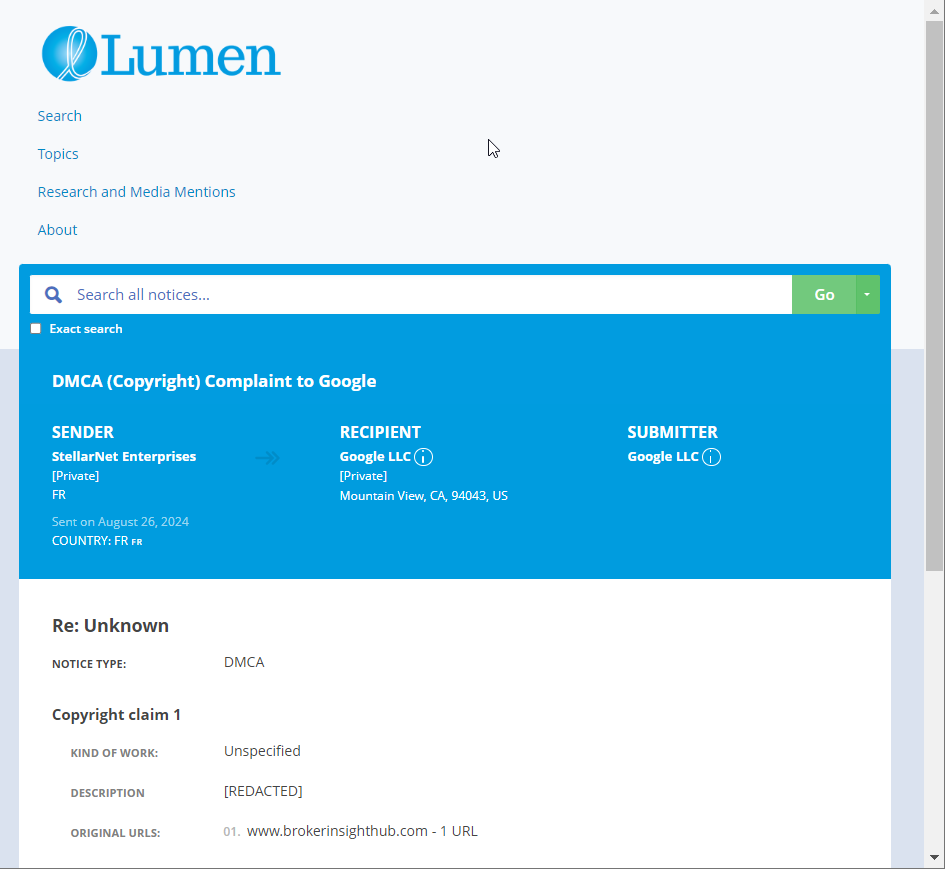

- https://lumendatabase.org/notices/44121033

- August 26, 2024

- StellarNet Enterprises

- https://www.brokerinsighthub.com/broker-to-avoid-reviews/eaglefx-review

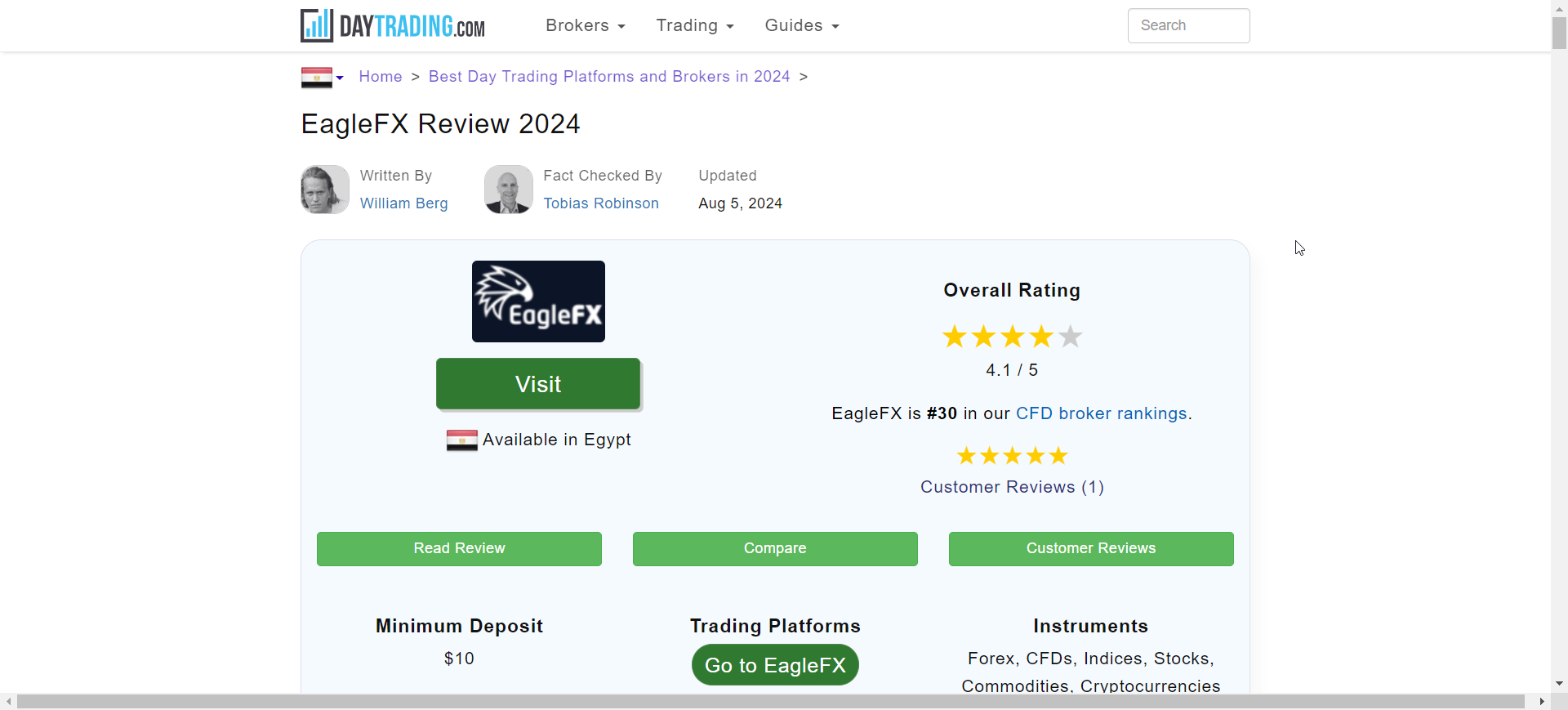

- https://www.daytrading.com/eaglefx

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Carl Koenemann

Investigation Ongoing

Vitaly Abasov

Investigation Ongoing

Samir Tabar

Investigation Ongoing

User Reviews

Average Ratings

1.7

Based on 9 ratings

by: Axel York

I tried to withdraw from EagleFX, but after weeks of waiting, my request was still unprocessed. Really frustrating!

by: Charles Knight

EagleFX promised big returns, but I lost $8,000 in just a few weeks. Now, my funds are locked, and customer support is nowhere to be found.

by: Tara Patrick

I invested $12,000 with EagleFX, but when I tried to withdraw, they blocked my account. It’s been weeks with no response. I feel completely scammed.

by: Blake Holland

I lost $10,000 trading with EagleFX, and now I can't get my money back....this company is a scam.

by: Claire Carter

They claim to be legit, but something feels off. Too many complaints online about them. Not worth the risk, honestly.

by: Eleanor Torres

I tried withdrawing my funds, and it was a nightmare. Delays, excuses, and hidden fees. Stay away from EagleFX.

by: Felix Carter

EagleFX manipulates spreads during market closures, unfairly targeting positions. For instance, bid/ask prices can be adjusted to trigger stop-outs, which feels unethical and predatory.

by: Brandon Hughes

Be cautious! The platform has issues where trades are frozen when in significant profit, and funds decline without the ability to close. Customer service promised to investigate but failed to follow up, and the chat support was unhelpful.

Pros

Cons

by: William Brooks

Avoid this broker! They closed my trades without hitting stop loss or margin call, wiping out my account. If you’re into high-leverage trading, stick to regulated brokers for peace of mind.

Pros

Cons

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations