What We Are Investigating?

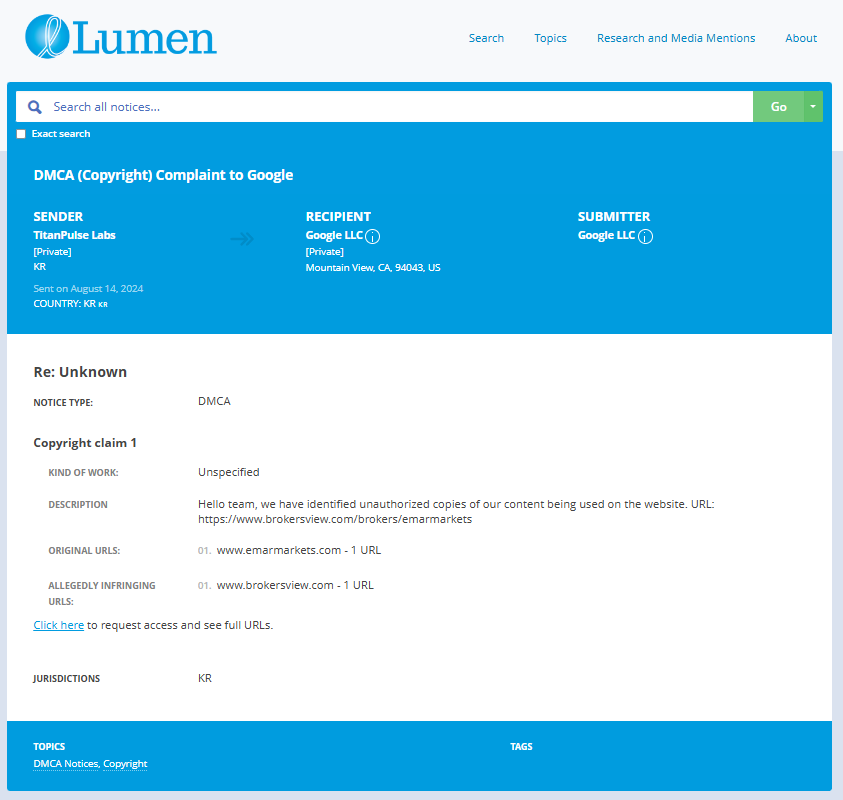

Our firm is launching a comprehensive investigation into Emar Markets over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Emar Markets - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

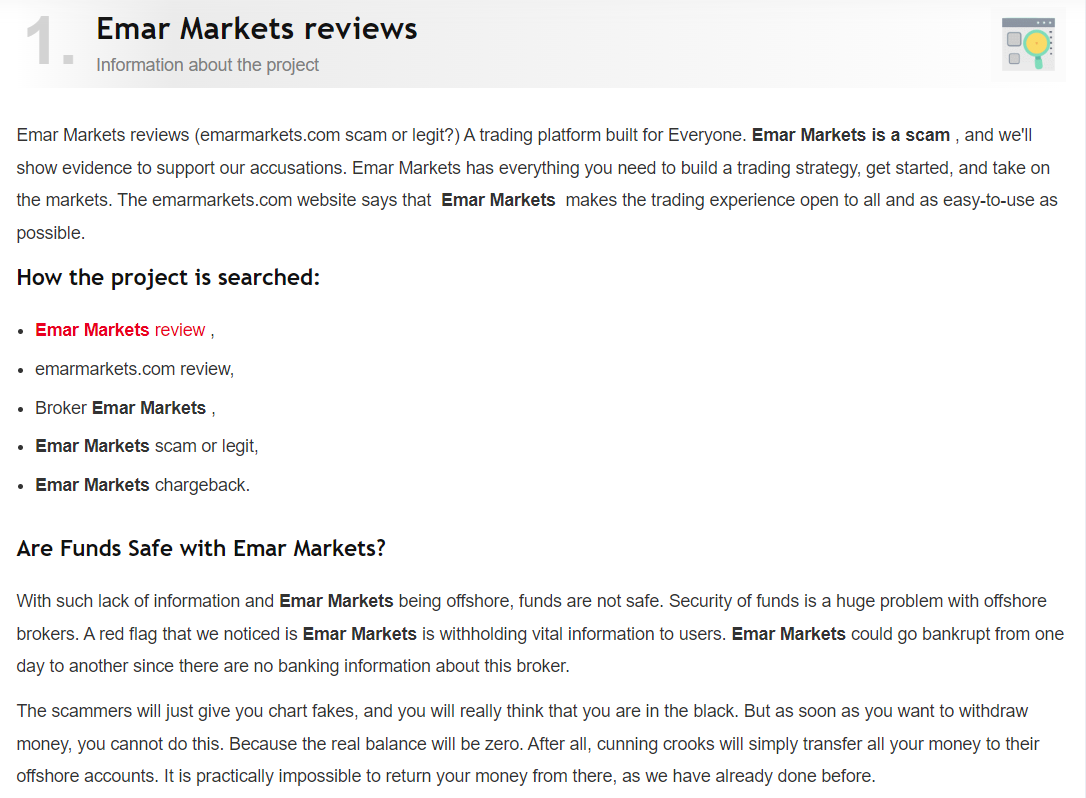

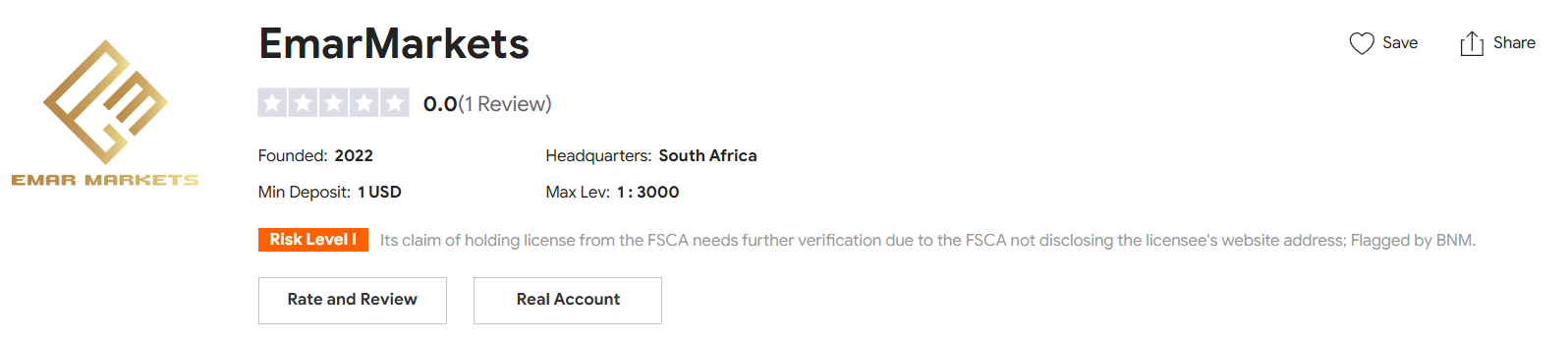

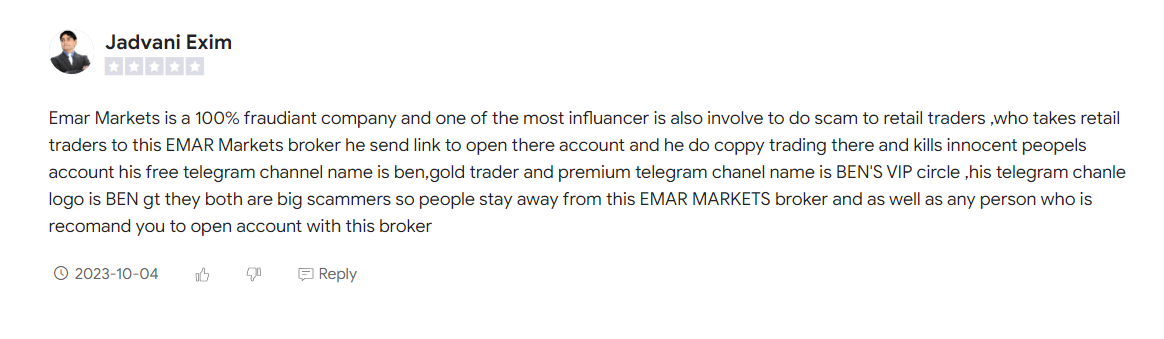

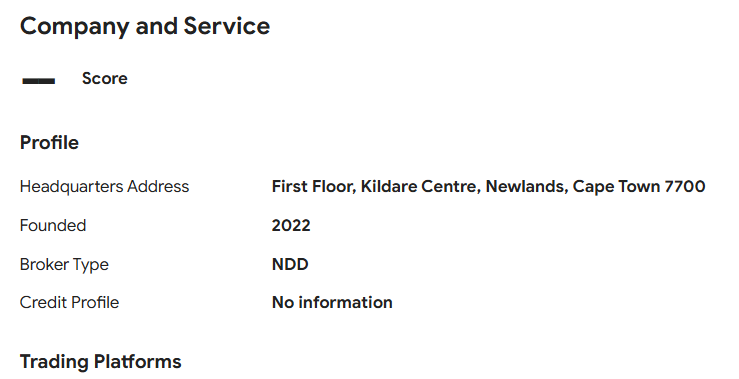

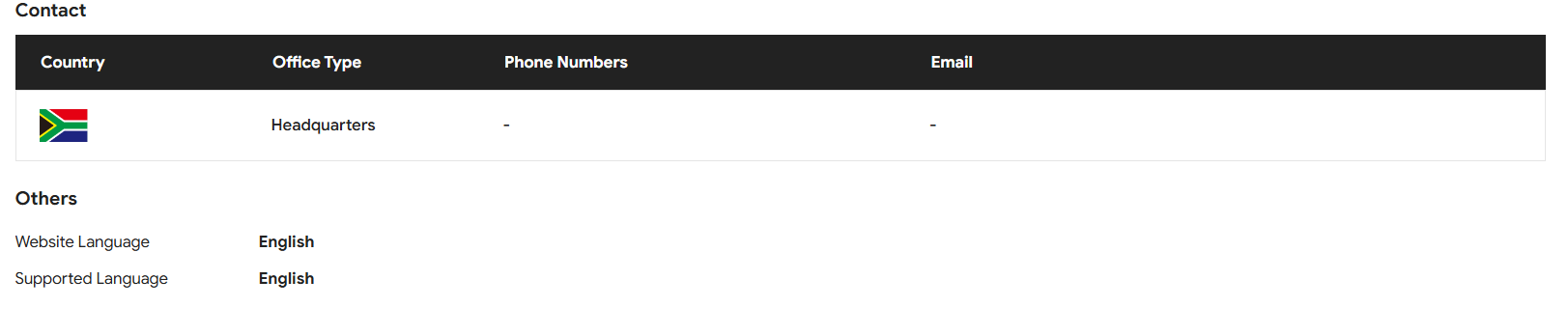

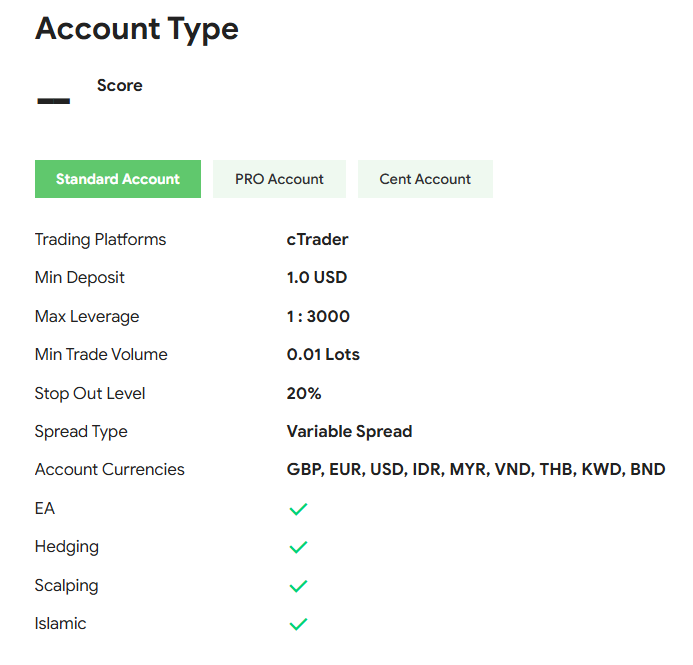

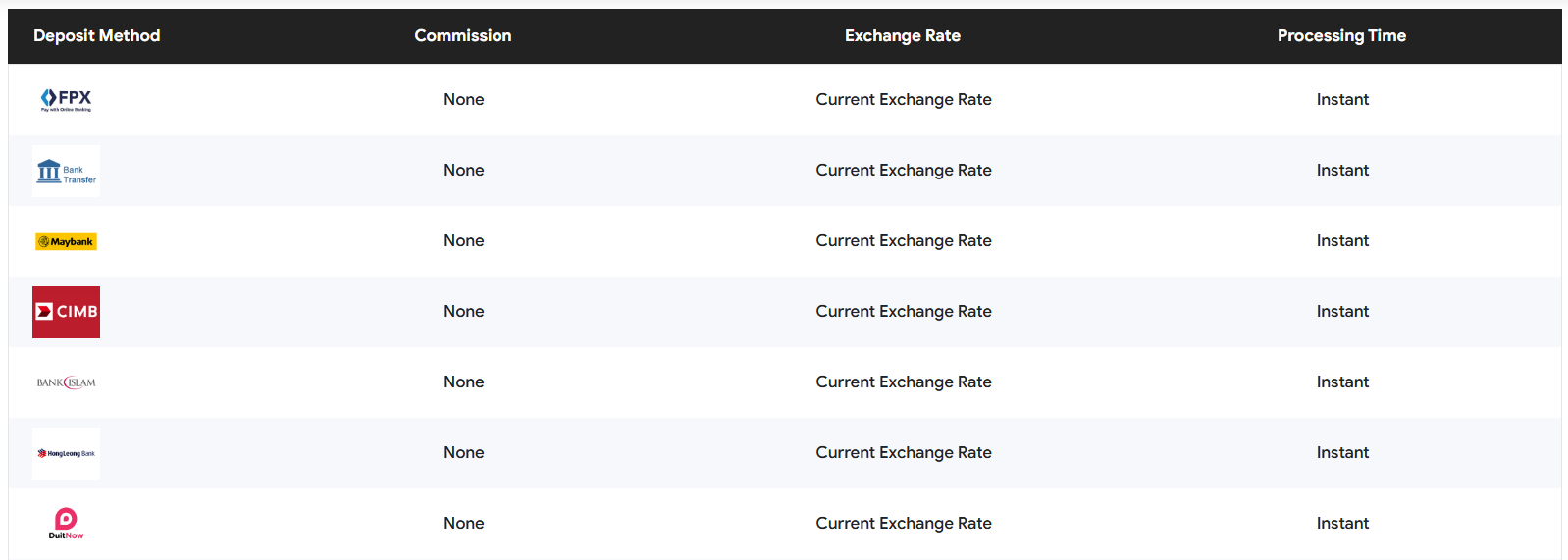

Emar Markets, a forex and CFD broker, has faced several allegations, red flags, and adverse news over the years, which have raised concerns about its credibility and business practices. Below is a summary of the major issues and their potential impact on Emar Markets’ reputation:

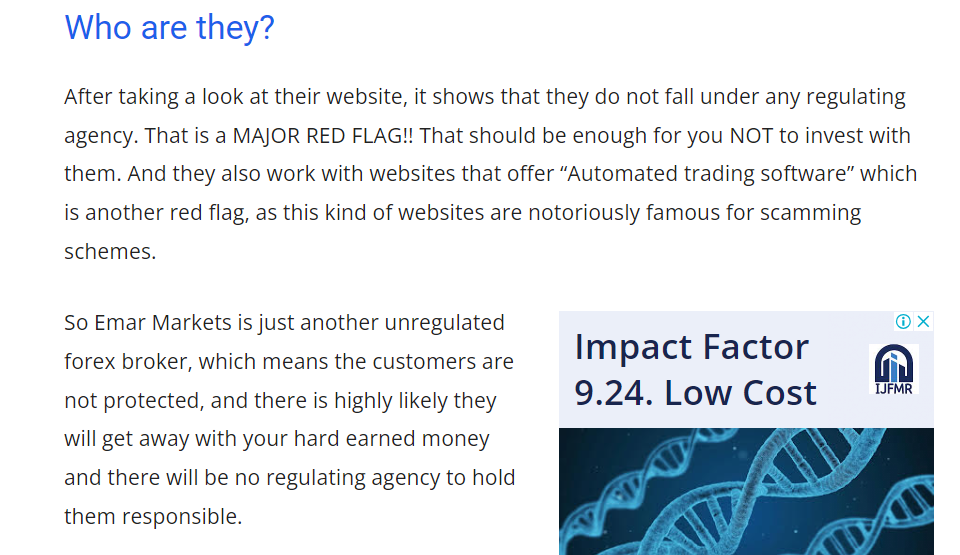

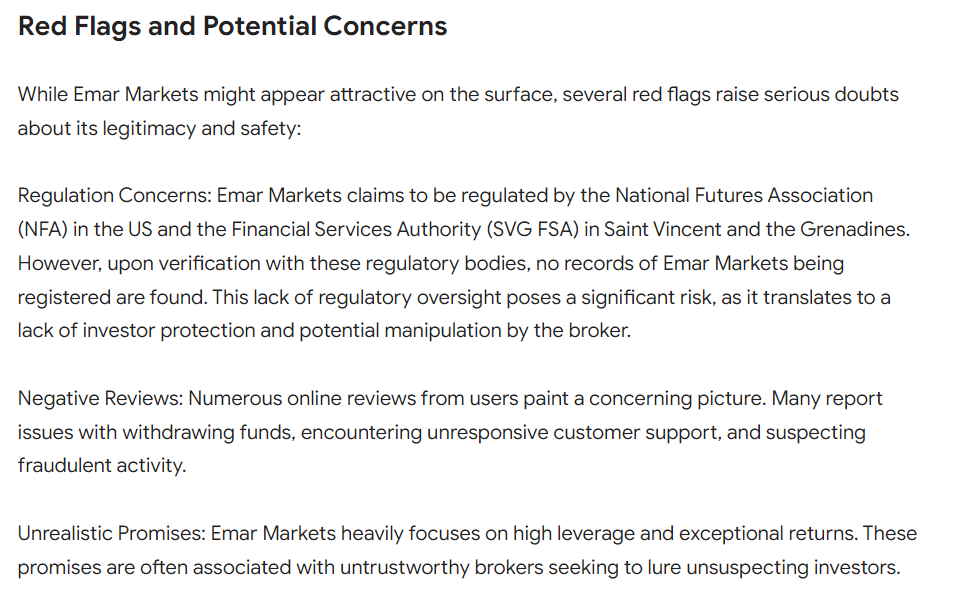

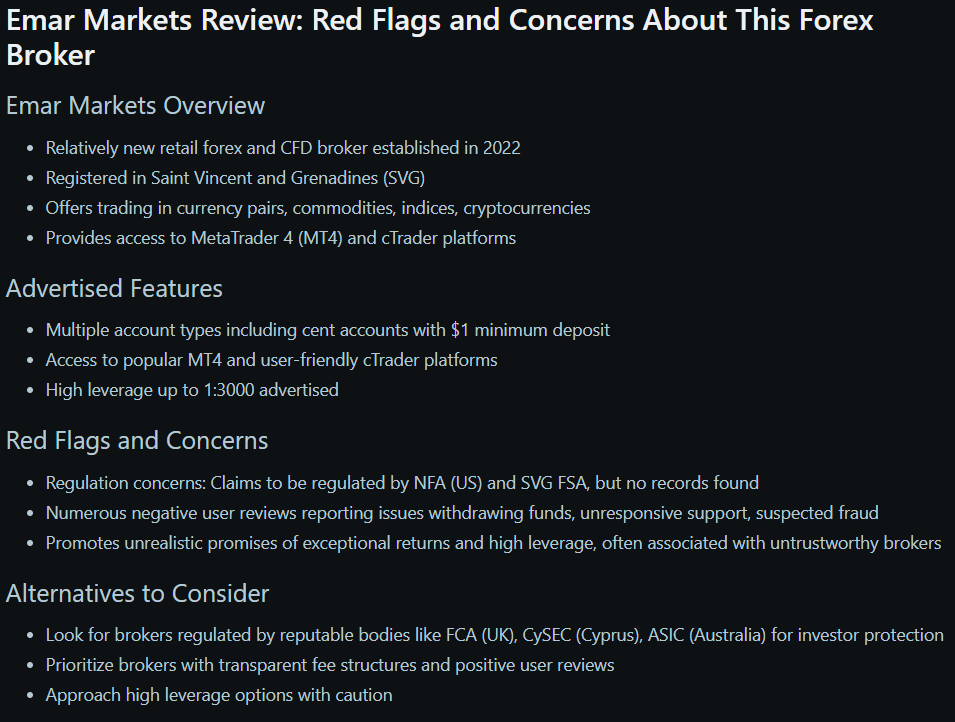

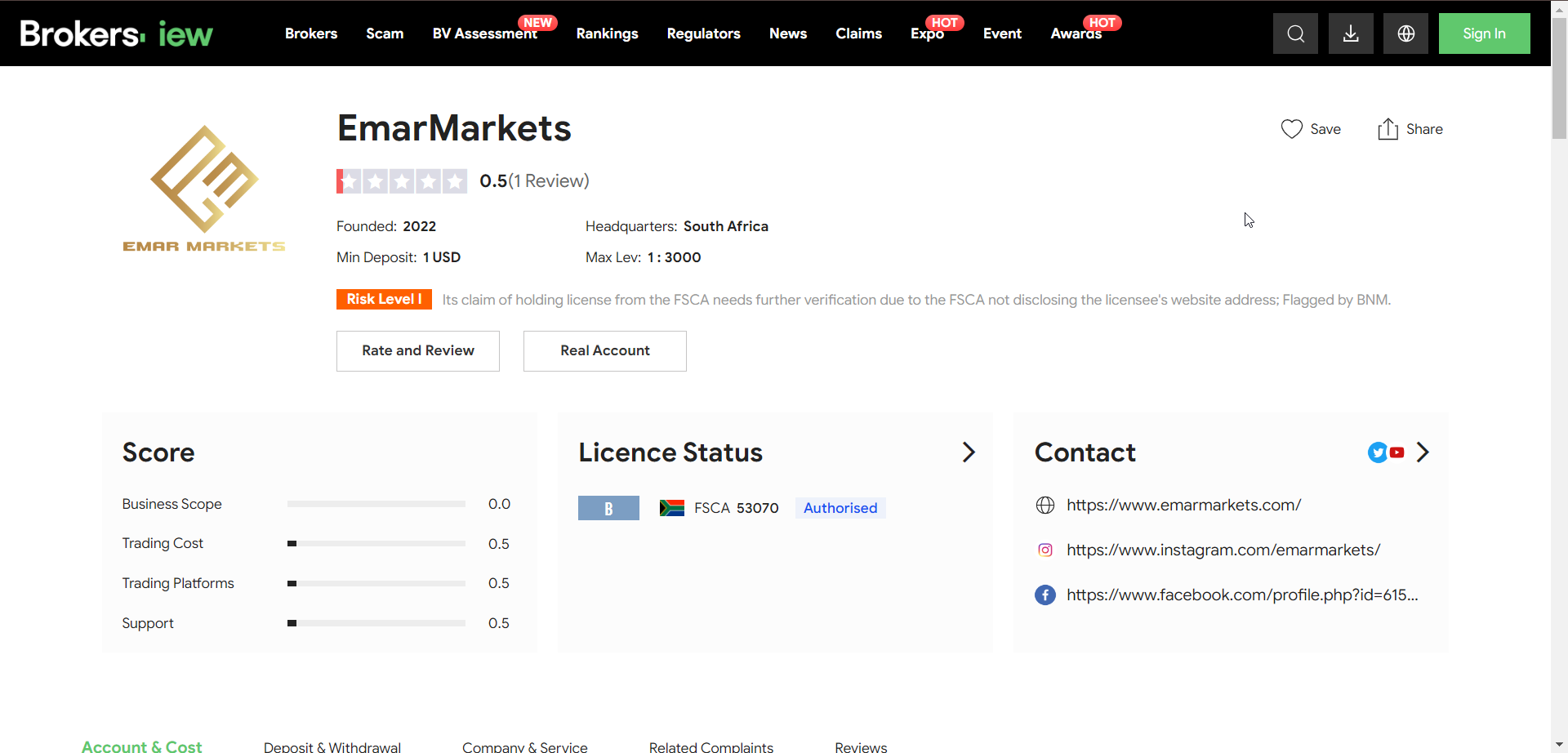

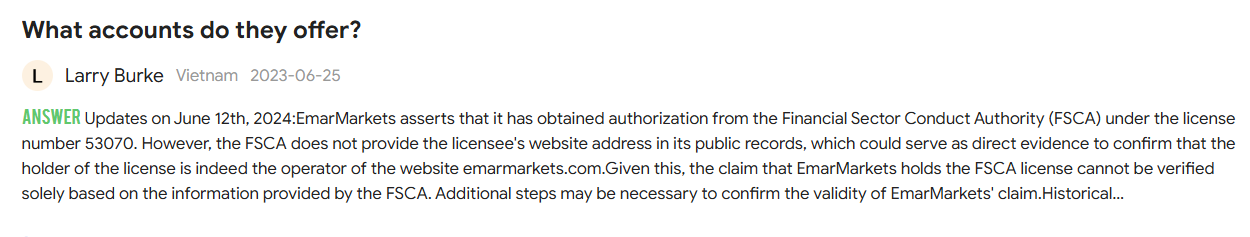

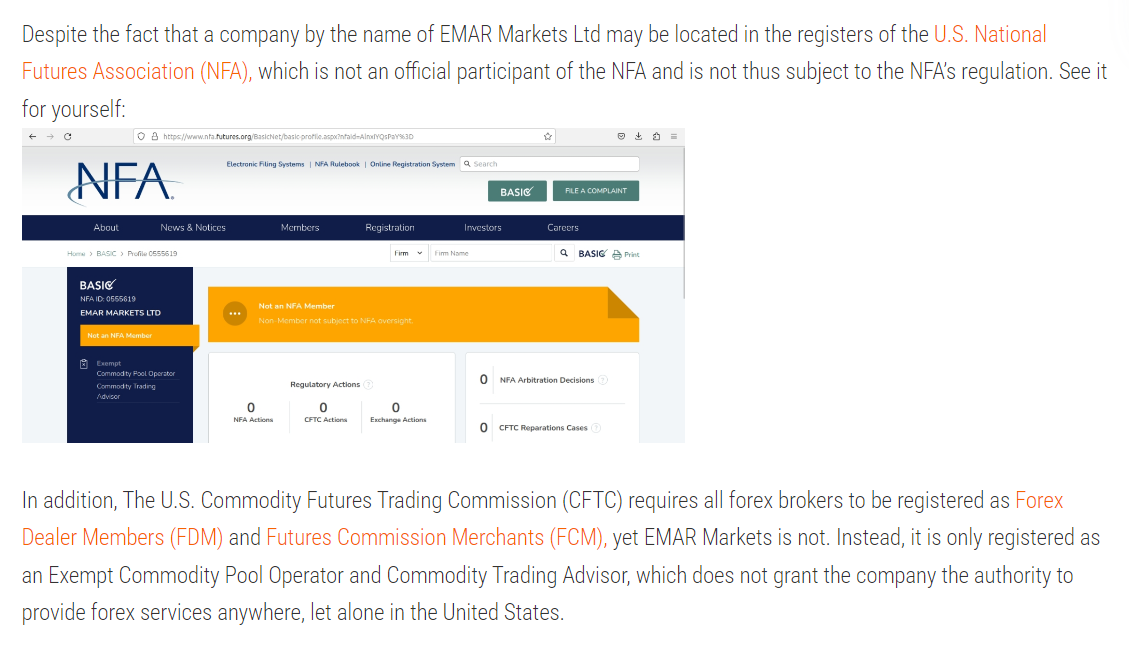

Regulatory Concerns: Emar Markets has been accused of operating without proper regulatory oversight in certain jurisdictions. Regulatory compliance is critical in the financial services industry, and the absence of a reputable license can deter potential clients and harm the broker’s credibility.

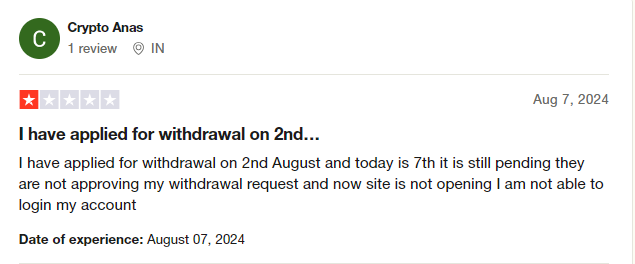

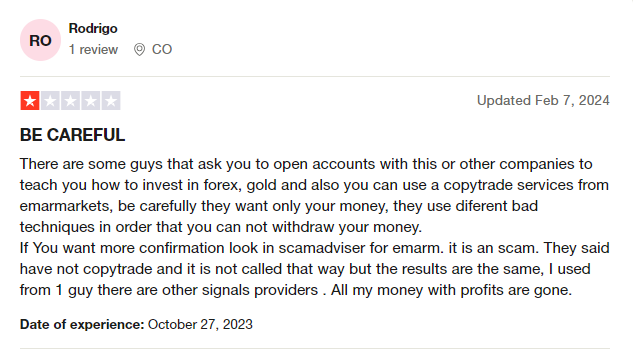

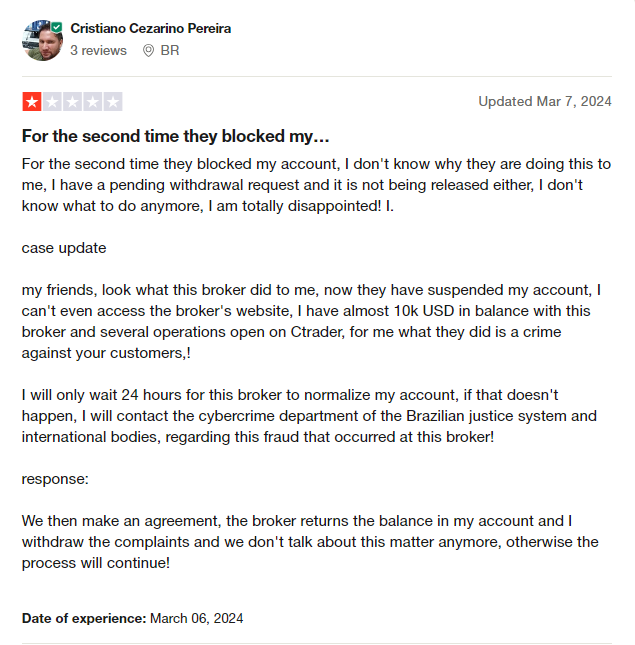

Withdrawal Issues: Numerous clients have reported difficulties in withdrawing funds from their accounts. Delayed or denied withdrawals are a significant red flag, as they suggest potential liquidity problems or unethical practices, which can erode trust in the broker.

Misleading Advertising: Emar Markets has been criticized for making exaggerated claims about potential profits and downplaying the risks associated with trading. Such practices can mislead inexperienced traders and damage the broker’s reputation for transparency and fairness.

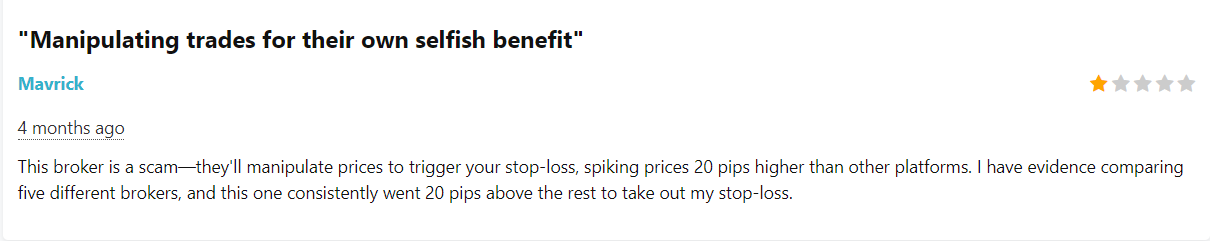

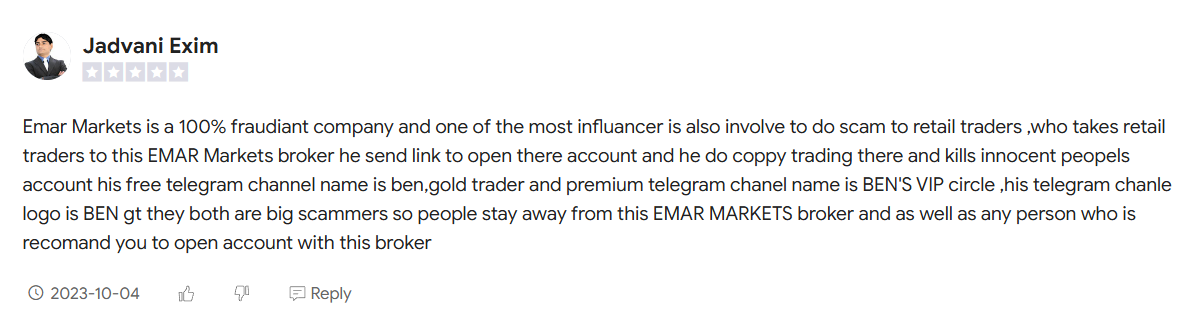

Negative Client Reviews: Online forums and review sites are filled with complaints from clients alleging poor customer service, platform malfunctions, and unfair trading conditions. These reviews can deter new clients and harm the broker’s public image.

Lack of Transparency: Emar Markets has been accused of not providing clear information about its ownership, management, and operational structure. This lack of transparency can raise suspicions about the broker’s legitimacy and intentions.

Aggressive Marketing Tactics: Some clients have reported being pressured into making deposits or trading beyond their comfort level. Aggressive sales tactics can alienate clients and create a negative perception of the broker’s ethical standards.

Why These Issues Harm Emar Markets’ Reputation:

Trust Erosion: Financial services rely heavily on trust. Allegations of withdrawal issues, misleading advertising, and lack of transparency can make clients and potential investors wary of engaging with the broker.

Legal and Regulatory Risks: Operating without proper licenses or facing regulatory scrutiny can lead to legal consequences, fines, or even shutdowns, further damaging the broker’s reputation.

Client Retention Challenges: Negative reviews and poor customer service can lead to client attrition, making it difficult for Emar Markets to retain its user base and grow its business.

Competitive Disadvantage: In a highly competitive industry, brokers with a tarnished reputation may struggle to attract clients compared to more reputable competitors.

Why Emar Markets Might Want These Stories Removed:

Emar Markets would likely want these stories removed to protect its brand image, attract new clients, and retain existing ones. Negative publicity can have a lasting impact on a company’s reputation, and removing such content could help the broker present itself as a trustworthy and reliable entity. However, attempting to remove or suppress negative information without addressing the underlying issues could backfire, as it may be perceived as an attempt to hide wrongdoing rather than resolve it.

In conclusion, Emar Markets faces significant reputational challenges due to regulatory concerns, client complaints, and unethical practices. Addressing these issues transparently and proactively is crucial for rebuilding trust and ensuring long-term success.

- https://lumendatabase.org/notices/43802851

- Aug 14 2024

- TitanPulse Labs

- https://www.emarmarkets.com/

- https://www.brokersview.com/brokers/emarmarkets

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.4

Based on 9 ratings

by: Noah Robinson

Complaints about platform issues and bad customer service aren’t isolated incidents. They’re a pattern that reflects a business model more concerned with profits than with providing quality service.

by: Isabella Harris

Withdrawal issues are rampant. Clients are stuck with “pending” withdrawals, leading to frustration and suspicion that Emar Markets is running into liquidity problems. It’s not a glitch it’s a serious red flag.

by: David Sanchez

I invested $6,900 with Emar Markets, and now I’m left with nothing but frustration after constant withdrawal issues and misleading promises.

by: Francisco Mason

I invested $7,800 in Emar Markets, thinking I was making a smart move, but now I can’t withdraw a single penny.

by: Onyx Drift

I was lured in by sleek marketing only to realize I was dealing with a black hole. Once your deposit is in, don’t expect to see it again. 😤

by: Mirai Hologram

Everything about Emar Markets screams “run.” Poor support, fake licenses, and a user experience that feels like a trap laid by amateurs with bad intentions.

by: Lexa Cypher

They’re not just avoiding regulators—they’re actively hiding from them. What legit business needs to erase criticism from Google with fake copyright claims?

by: Kairo Neon

Classic shady broker move—promises profits, then traps your money. Can’t even get your withdrawals out without jumping through flaming hoops. Scam alert. 🚨

by: Liam Johnson

Emar Markets is a fraud. They lure you in with big promises, but once you invest, they disappear. I tried contacting them multiple times, but no one ever replied.

by: Sophia Turner

I invested with Emar Markets, and it was the worst decision ever. They don’t explain anything clearly, and their platform is confusing.

by: isaac Anderson

Emar Markets is a complete scam. They promised high returns, but I lost all my money. Their customer service is terrible, and they never respond to complaints. Stay away from them if you don’t want to get ripped off. They...

by: Jacob Evans

I applied for a withdrawal on August 2nd, and today is the 7th, but it’s still pending. They haven’t approved my request, and now the website isn’t opening. I can’t even log in to my account. This is extremely frustrating...

by: John Smith

Be cautious when trading with EMAR Markets, especially for those new to the platform. I noticed potential market manipulation while trading XAUUSD on November 23, 2024. The market closed at USD 2705 at 04:45 UTC+8 on EMAR Markets, whereas my...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations