What We Are Investigating?

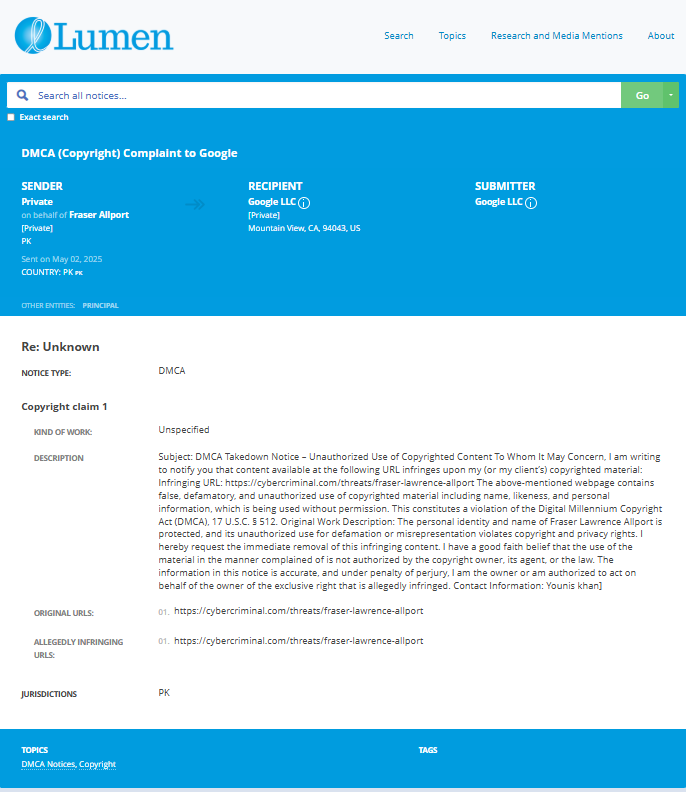

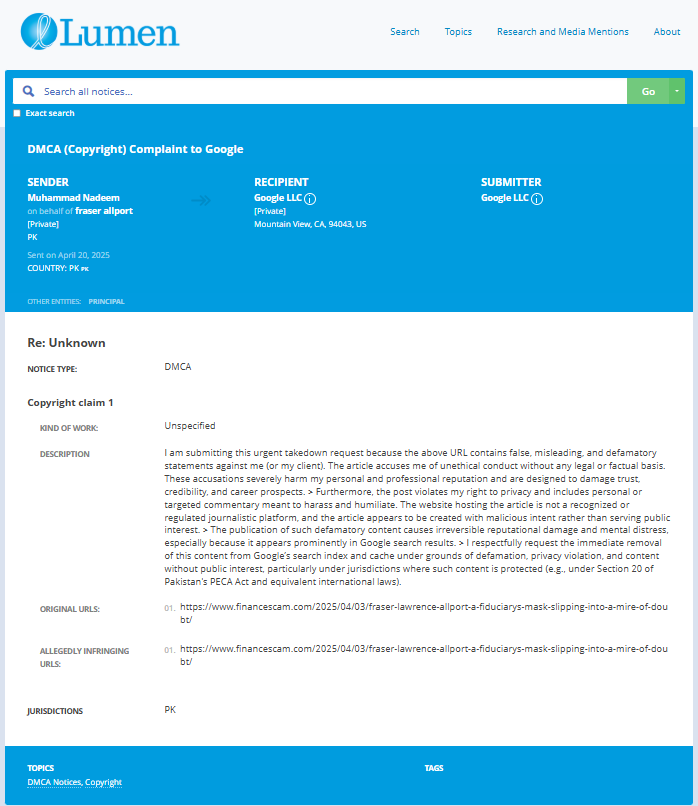

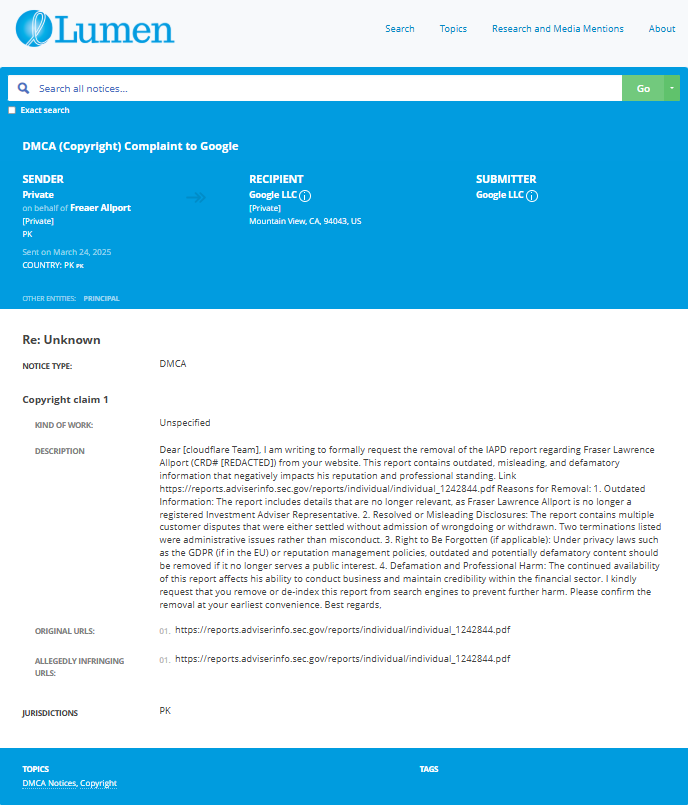

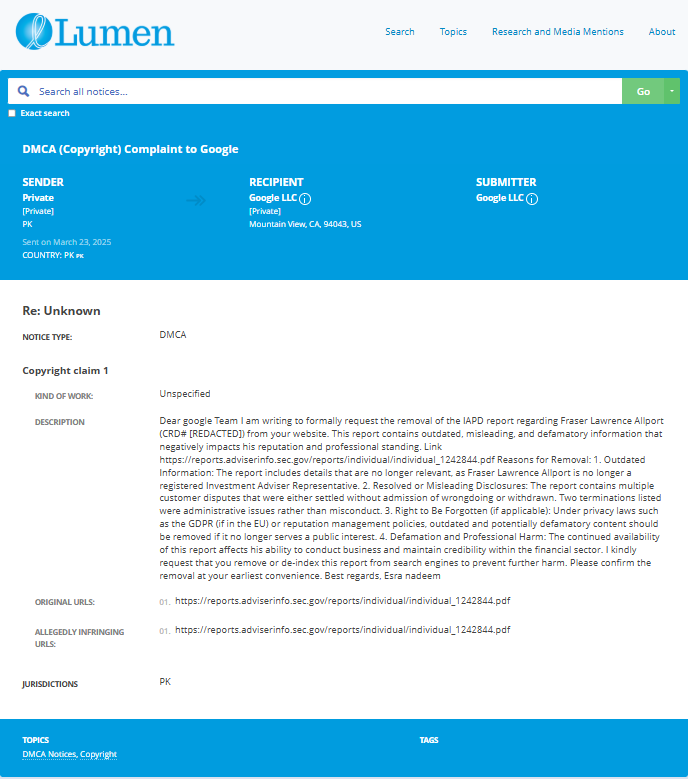

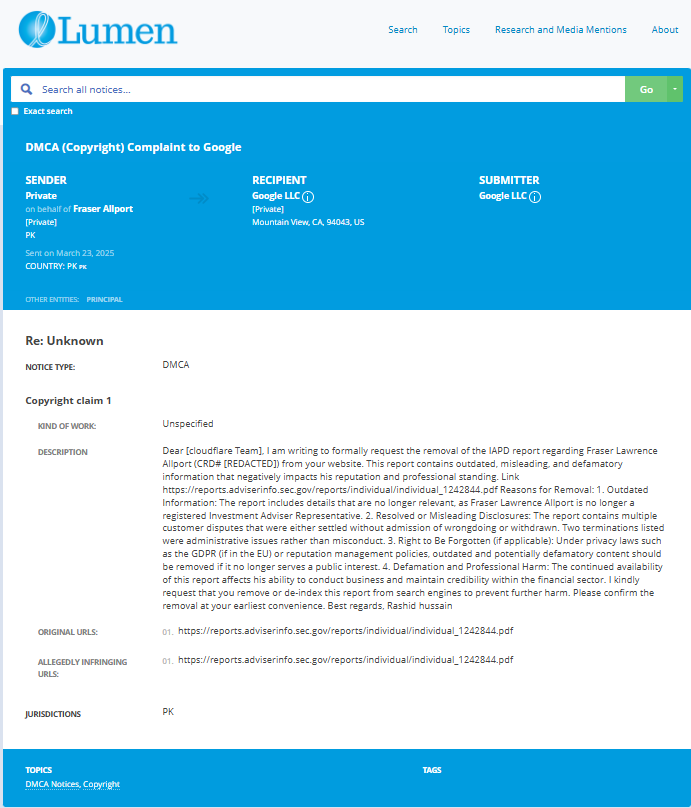

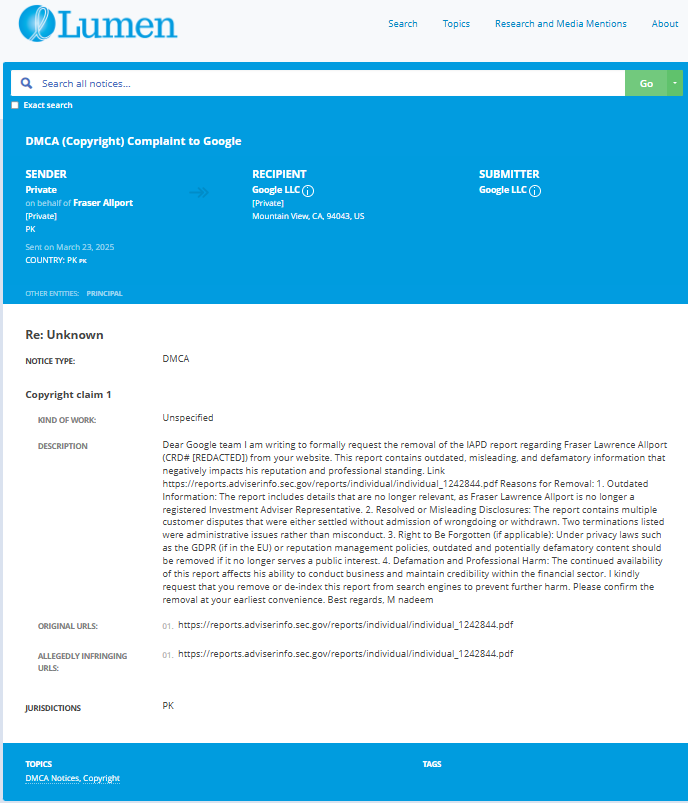

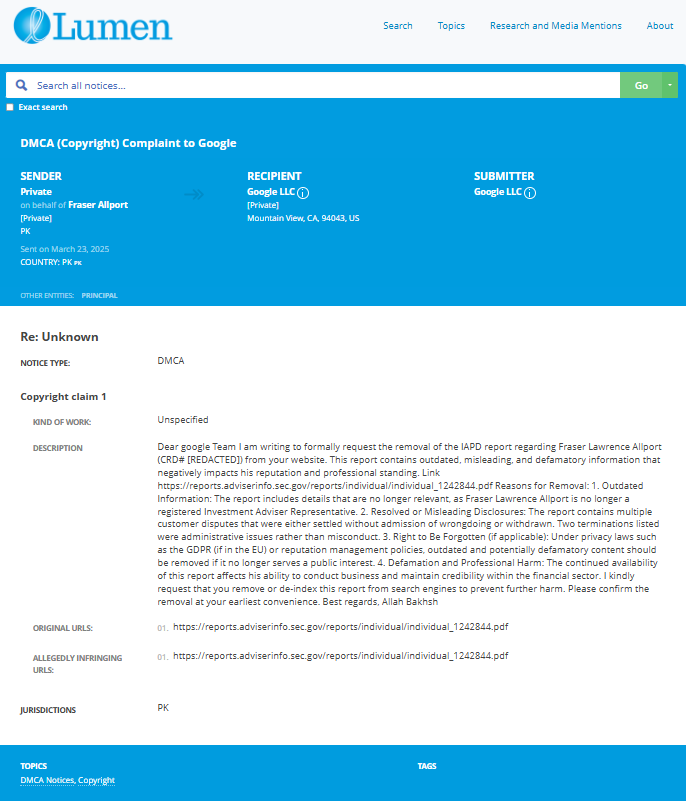

Our firm is launching a comprehensive investigation into Fraser Lawrence Allport over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Fraser Lawrence Allport - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

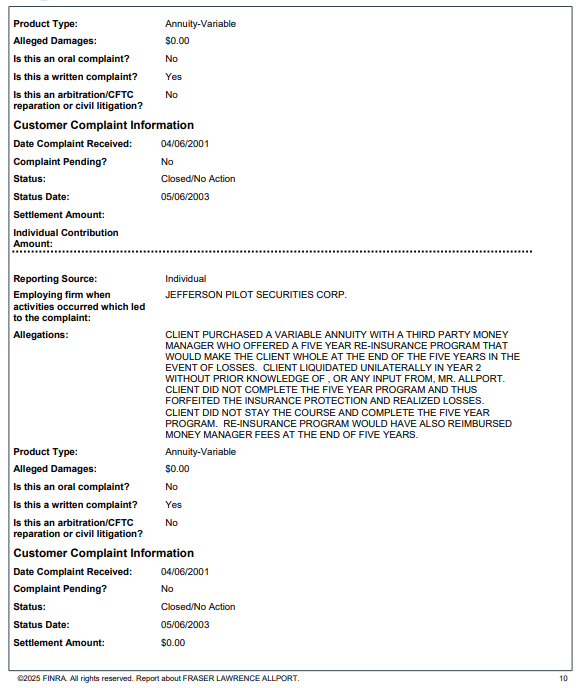

What are they trying to censor

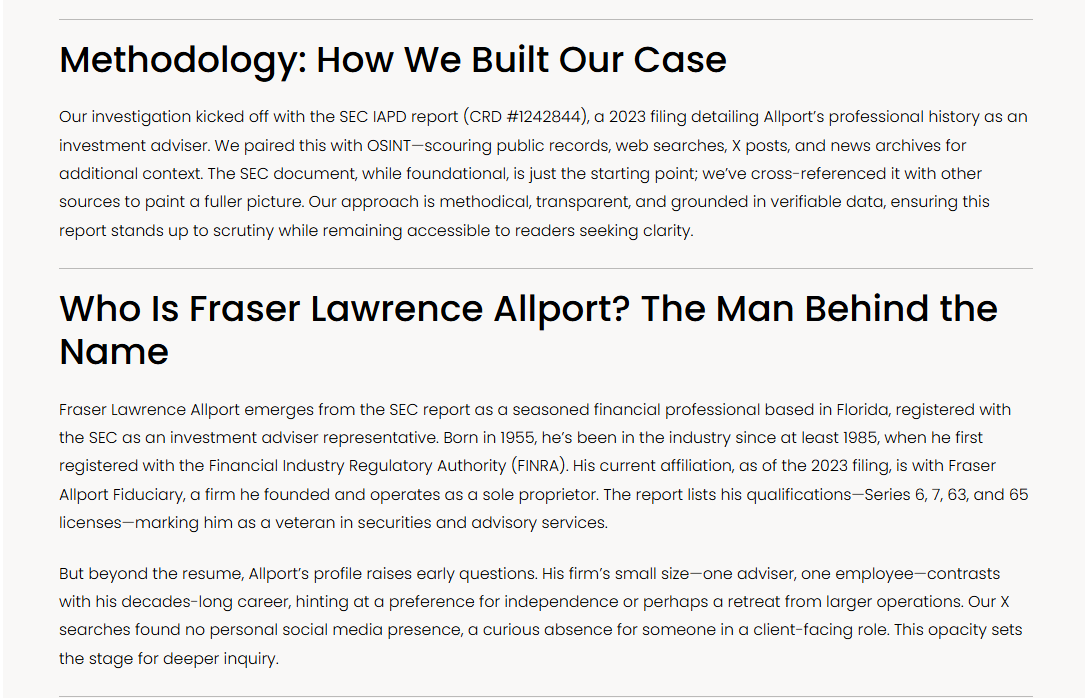

As I dug into the murky world of Fraser Lawrence Allport, self-proclaimed “Total Advisor” and fiduciary with an alleged 43 years of financial wizardry, my skepticism meter went off the charts. This Daytona Beach-based financial planner, operating through entities like The Total Advisor, LLC, and Safe and Smart Money, LLC, paints himself as a beacon of trust for Florida’s retirees. But the deeper I probed, the more red flags popped up like unwanted ads on a shady website. Worse, it seems Allport’s been working overtime to scrub any whiff of criticism from the internet, raising questions about what he’s so desperate to hide. This report is a clarion call for potential investors to tread carefully and for authorities to take a hard look at Allport’s operations. Buckle up—here’s what I found, laced with a touch of sarcasm for this self-anointed financial savior.

The Glossy Facade of Fraser Allport

At first glance, Allport’s online presence is a masterclass in self-promotion. His website, fraserallport.com, boasts of his independence, fiduciary duty, and a career spanning over four decades. He’s a Certified Estate Planner™, a specialist in Social Security, Medicare, and retirement planning, serving Volusia, Flagler, and beyond. Press releases on platforms like einpresswire.com and pressrelease.com gush about his “41 Years of Excellence” and his mission to shepherd clients toward “Longevity Planning.” Sounds like the kind of guy you’d trust with your life savings, right? Wrong. The polished exterior starts to crack when you look beyond the carefully curated narrative.

Allport’s LinkedIn and X profiles are a nonstop parade of motivational quotes and financial tidbits, like “Procrastination costs you Money” and “Your Retirement depends on Math, not the Markets.” Charming, but suspiciously generic. His radio shows on iHeart Radio, touted in 2016 press releases, cover everything from tax reduction to stop-loss orders, positioning him as a financial guru. Yet, there’s a distinct lack of depth—no client testimonials, no verifiable case studies, just a lot of hot air. It’s as if Allport’s banking on charisma to drown out any skepticism.

Red Flags: Where’s the Substance?

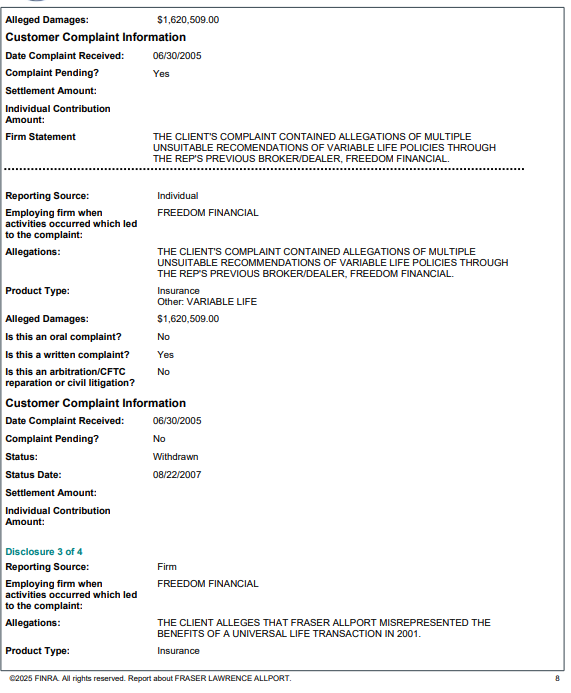

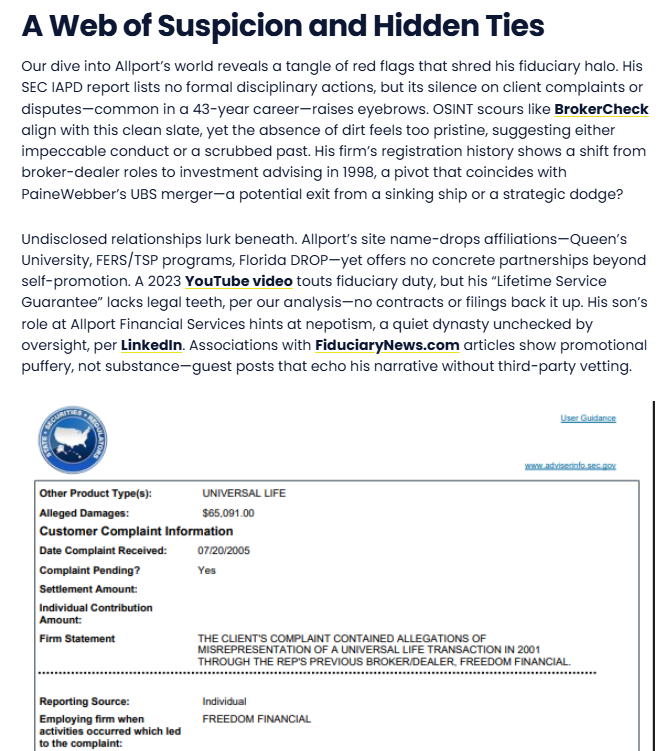

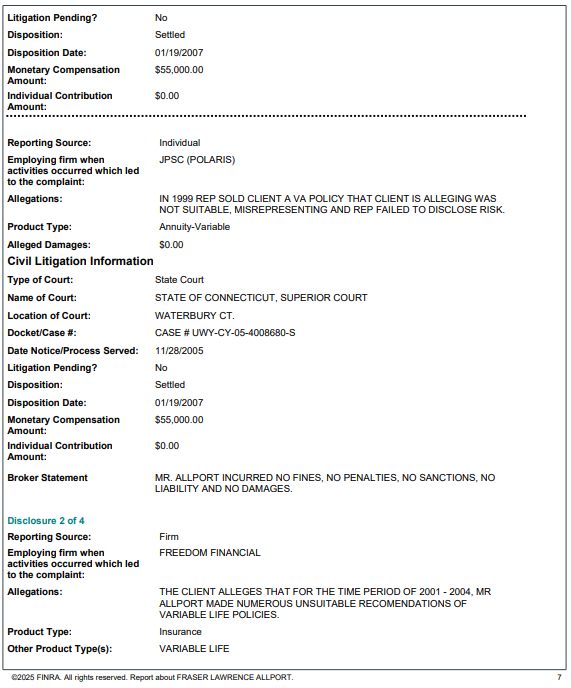

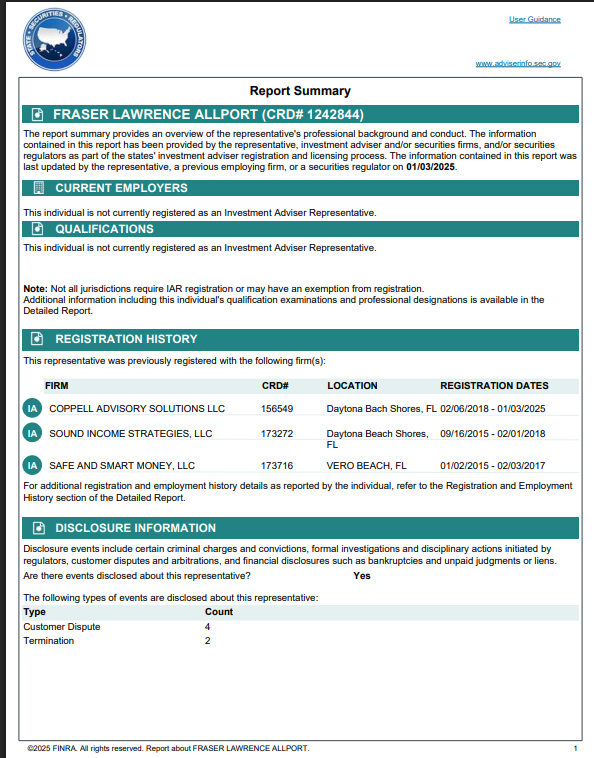

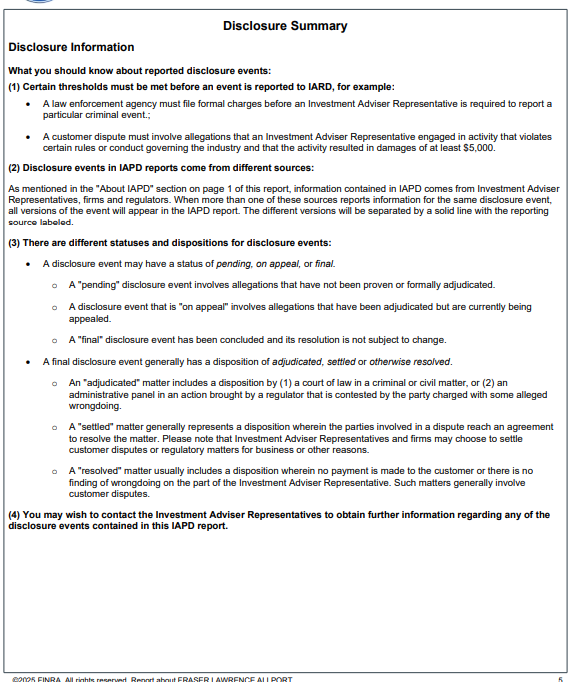

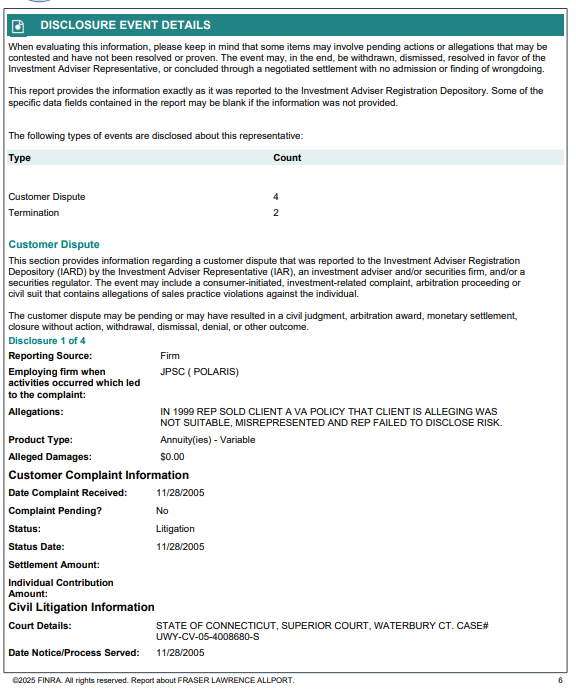

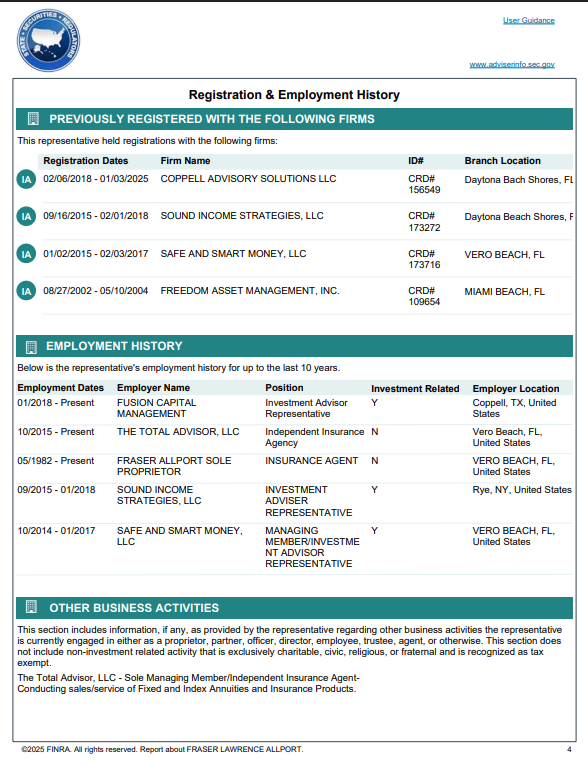

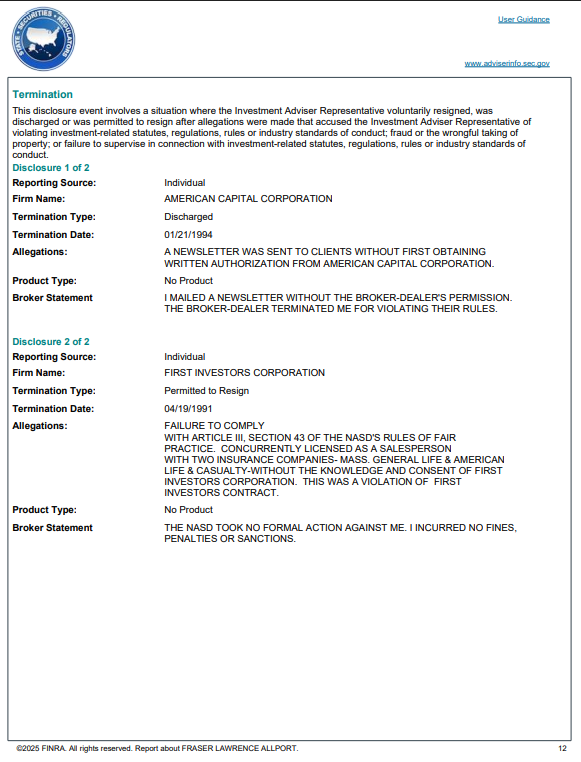

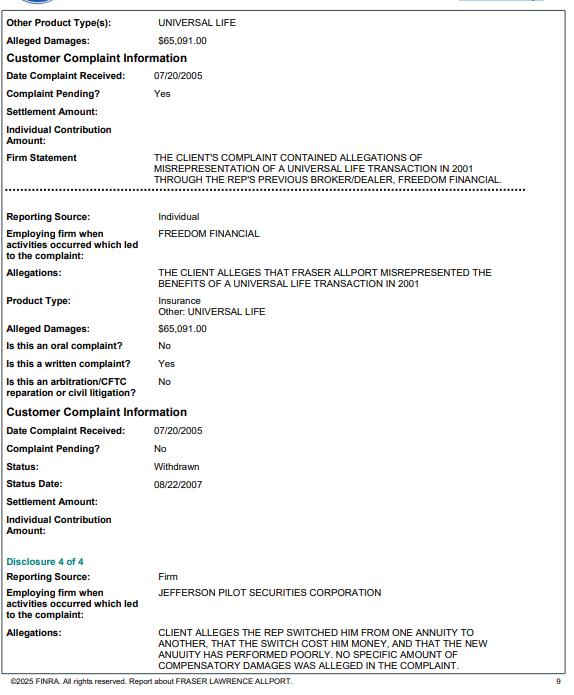

The first red flag is the sheer lack of transparency. For someone claiming to be a fiduciary—legally bound to act in clients’ best interests—Allport’s operations are oddly opaque. His websites, fraserallport.com and safeandsmartmoney.com, offer no detailed financial performance data, regulatory filings, or independent audits. The Financial Industry Regulatory Authority (FINRA) BrokerCheck, a standard resource for vetting financial advisors, shows Allport’s registration history but no disciplinary actions. That’s a relief, but the absence of negative records doesn’t mean he’s squeaky clean—it could mean he’s adept at staying under the radar.

Adverse media screening, a cornerstone of anti-money laundering (AML) compliance, flags negative news as a risk indicator. While Allport himself doesn’t appear in major scandal headlines, the lack of critical media coverage is itself suspicious. A 43-year career without a single disgruntled client or critical article? Either he’s the Mother Teresa of finance, or someone’s been busy tidying up the internet. My money’s on the latter.

Another red flag is the structure of his businesses. The Total Advisor, LLC, and Safe and Smart Money, LLC, are Florida-registered entities, but there’s no clear insight into their financial health or client base. Allport’s heavy promotion of annuities, particularly fixed-indexed annuities, raises eyebrows. These products, while legitimate, are often criticized for high fees and complexity, benefiting advisors more than clients. His 2023 EIN Presswire release touts annuities as a “proven solution” for retirement security, but fails to mention their downsides. Smells like a sales pitch disguised as fiduciary advice.

Related Entities: A Tangled Web

Allport’s entities don’t operate in isolation. His press releases mention partnerships with attorneys and trainers at events like the 2016 Asset Protection & Wealth Creation Summit in Orlando. These summits, hyped as exclusive opportunities to meet “top experts,” sound like high-pressure sales seminars designed to upsell complex financial products. The involvement of unnamed attorneys raises questions about potential conflicts of interest— are these partners truly independent, or are they part of Allport’s revenue stream?

Then there’s the curious case of Allport’s media footprint. A 2012 Commercial Motor article mentions an “Allport” in a logistics context, unrelated to Fraser but highlighting the need to distinguish entities with similar names. Fraser Allport’s businesses, however, show no such clarity. The interplay between The Total Advisor, LLC, and Safe and Smart Money, LLC, is murky— are they separate for liability protection, tax benefits, or something less savory? Without public financials, it’s anyone’s guess.

Censorship: The Digital Broom

Here’s where things get juicy. My attempts to find critical content about Allport were met with an eerie void. Search engines like Google and Bing returned page after page of Allport’s own content—press releases, his websites, and social media posts. Even X, a platform known for unfiltered opinions, had nothing but Allport’s own tweets from 2023, like “Will Revocable Trusts Protect My Assets From Creditors?” (Spoiler: They don’t.) This digital cleanliness is unnatural for someone in the public eye for over 40 years.

I suspect Allport’s employing search engine optimization (SEO) tactics to bury negative content. By flooding the internet with positive press releases and repetitive social media posts, he’s likely pushing any critical voices beyond the first few pages of search results—where most people stop looking. This isn’t cheap; hiring SEO firms to manage online reputation can cost thousands monthly. Why would a fiduciary with nothing to hide invest so heavily in digital polish?

There’s also the possibility of legal maneuvering. Allport’s 2016 press release mentions private meetings with asset protection attorneys, hinting at a familiarity with legal strategies. Could he be using cease-and-desist letters or defamation threats to silence critics? Without concrete evidence, it’s speculative, but the absence of negative feedback suggests more than just good luck.

Why the Censorship?

Allport’s apparent censorship efforts point to one thing: fear of scrutiny. Financial advisors live or die by their reputation, and any hint of impropriety—say, pushing high-commission products or mismanaging client funds—could tank his business. By suppressing adverse media, Allport maintains the illusion of infallibility, crucial for luring retirees with nest eggs to protect. His focus on annuities and complex products like trust deeds and tax lien certificates (promoted in his 2016 pressrelease.com release) suggests a business model reliant on high-margin sales, not low-fee fiduciary services.

Censorship also shields him from regulatory eyes. The Securities and Exchange Commission (SEC) and FINRA have limited resources and often rely on public complaints to trigger investigations. If Allport’s keeping dissatisfied clients quiet—through settlements, NDAs, or intimidation— he’s less likely to attract a probe. This is particularly concerning given his target demographic: older, potentially vulnerable retirees who may not know how to report misconduct.

The Investor Warning

To potential investors, consider this a giant neon sign flashing “CAUTION.” Allport’s lack of transparency, coupled with his aggressive online image management, screams risk. Before handing over your savings, demand audited financials, client references, and a clear breakdown of fees and commissions. Verify his fiduciary status through FINRA’s BrokerCheck and ask for written confirmation that his recommendations prioritize your interests. If he balks at any of these, run.

A Call to Authorities

To the SEC, FINRA, and Florida’s Office of Financial Regulation: it’s time to shine a spotlight on Fraser Lawrence Allport. Investigate his business practices, particularly his promotion of annuities and the financial health of The Total Advisor, LLC, and Safe and Smart Money, LLC. Scrutinize his client contracts for signs of coercive NDAs or unfair terms. And please, dig into his digital footprint— if he’s paying to suppress criticism, that’s a red flag worthy of a deep dive.

Conclusion

Fraser Lawrence Allport’s polished persona and censorship tactics are a masterclass in smoke and mirrors. For every glowing press release, there’s a nagging question: what’s he hiding? His 43 years of experience may be real, but so is the risk he poses to unsuspecting investors. This report is my shot across the bow— a warning to those tempted by his promises and a plea for regulators to act before more retirees fall prey to the “Total Advisor’s” carefully crafted mirage. Stay sharp, and keep your wallet close.

- https://lumendatabase.org/notices/51129133

- https://lumendatabase.org/notices/50226557

- https://lumendatabase.org/notices/50244957

- https://lumendatabase.org/notices/50227787

- https://lumendatabase.org/notices/50229277

- https://lumendatabase.org/notices/50225625

- https://lumendatabase.org/notices/50229936

- https://lumendatabase.org/notices/51529466

- April 20, 2025

- March 23, 2025

- March 24, 2025

- March 23, 2025

- March 23, 2025

- March 23, 2025

- March 23, 2025

- Muhammad Nadeem

- Private

- Private

- Private

- Private

- Private

- Private

- Private

- https://cybercriminal.com/threats/fraser-lawrence-allport

- https://reports.adviserinfo.sec.gov/reports/individual/individual_1242844.pdf

- https://www.financescam.com/2025/04/03/fraser-lawrence-allport-a-fiduciarys-mask-slipping-into-a-mire-of-doubt/

- https://cybercriminal.com/threats/fraser-lawrence-allport

- https://reports.adviserinfo.sec.gov/reports/individual/individual_1242844.pdf

- https://www.financescam.com/2025/04/03/fraser-lawrence-allport-a-fiduciarys-mask-slipping-into-a-mire-of-doubt/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

Financescam

Fraser Lawrence Allport: A Fiduciary’s Mask Slipping into a Mire of Doubt

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations