What We Are Investigating?

Our firm is launching a comprehensive investigation into Hardbody Supplements over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Hardbody Supplements - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Hardbody Supplements thinks the best way to grow a business is to sprinkle a little legal drama on your protein powder. What started as a feel-good story of a husband-and-wife duo selling green shakes and “gut-busting” nutrition plans has morphed into a saga of multimillion‑dollar misappropriation claims, default judgments, and PR stunts so transparent you could read through them like a protein‑enriched smoothie. Buckle up, dear reader: I’m here to walk you through the red flags and adverse media swirling around Hardbody Supplements and its sibling entities, and explain just how desperate they’ve become to censor the very information that could save potential investors—and regulators—a whole lot of heartache.

From Overnight Success to Investor Nightmare

Hardbody Supplements LLC burst onto the scene in 2016 as a dietary supplement company promising organic, GMO‑free pre‑workout mixes, protein powders, and weight‑loss plans manufactured at FDA‑ and GMP‑approved facilities in North America. By 2019, Inc. magazine was gushing over its “26,000% three‑year revenue growth” and an impressive No. 9 spot on the Inc. 5000 list—figures that would make even the most seasoned venture capitalist’s head spin. Investors Nathan Barns, Susannah Kilpatrick, and Darren Kilpatrick paid a cool $500,000 for a nondilutable 50% stake, banking on transparency and fair partnership. Instead, they found themselves locked out of the books and left wondering if they’d unwittingly bought a front‑row seat to a high‑stakes magic show, where the trick was making millions disappear.

The Barns v. Payne Fraud Allegations

In October 2022, Barns and the Kilpatricks filed suit in Kansas federal court, alleging that founders Lawrence and Patricia Payne “distributed more than $500,000 to themselves in 2019 and at least $1.5 million in the first quarter of 2020,” all while refusing to provide complete financial records or allow a partnership meeting to inspect the books. According to the complaint, company funds were allegedly funneled into McLaren and Lamborghini purchases, jewelry, diamonds, and even non‑fungible tokens—lavish expenditures that did little to boost Hardbody’s actual product lineup. The lawsuit charges breach of contract, fraud, breach of fiduciary duty, unjust enrichment, and conversion, and seeks disgorgement of ill‑gotten gains, damages, and judicial dissolution of the company.

A Stubborn Refusal to Share Documents

Perhaps the most eyebrow‑raising aspect of Barns v. Payne was the Payne defendants’ discovery tactics—namely, a blanket refusal to produce a privilege log and an obstinate objection to sharing communications. The court scolded them for “providing inadequate information in the privilege log to assess each element of the asserted privilege,” and ordered them to cough up an adequate log and produce all non‑privileged, responsive documents. In layman’s terms: Hardbody’s founders tried to hide behind legalese and vague objections to keep investors—and the court—guessing about where the money went.

Default Judgment in 8fig, Inc. v. Hardbody Supplements

If you thought one lawsuit was enough, try being Hardbody Supplements when your web‑design vendor sues you. In early 2024, 8fig, Inc.—a company providing financing and revenue‑based growth services—filed suit in the Western District of Texas, alleging breach of contract and failure to pay for services rendered. When Hardbody and its founders failed to respond, the court entered a default judgment against Hardbody Supplements LLC, Lawrence Payne, and Patricia Payne on March 4, 2025 Ouch.

More Lawsuits, More Drama

And the hits kept coming:

-

Swift Funding Source Inc. v. Hardbody Supplements, LLC saw a complaint filed on August 27, 2024, accusing Hardbody and related entities (including Hardbody Coaching and Hardbody Energy LLC) of failing to honor financing agreements.

-

MR. Advance LLC v. Hardbody Energy LLC et al., filed February 26, 2024 in New York State Supreme Court, lists a raft of defendants—Hardbody Energy LLC, Payne Capital LLC, Hardbody Supplements LLC, Acceleration Labs, and Hardbody Coaching LLC—alleging breach of contract and seeking damages

-

Velocity Capital Group LLC v. Hardbody Coaching LLC, filed November 8, 2024, accuses the coaching arm of another round of contract defaults and missed payments.

If you’re keeping score, that’s at least five separate civil actions in less than two years—all painting a picture of a company and its founders unable or unwilling to pay their bills.

Adverse Media and PR Cover‑Ups

When lawsuits weren’t enough, Hardbody’s founders apparently tried to manage the narrative. FinanceScam.com’s March 25, 2025 exposé reports that Lawrence Payne was “charged with concealing financial accounts and embezzling money for personal use, along with his business, Hardbody Supplements”. The same article lambasts Payne’s “fake PR” tactics—flooding AccessWire, Crunchbase, and other lesser‑known outlets with glowing profiles to drown out negative coverage—an approach so desperate it reads like a confession.

Fake Reviews and Online Sabotage

Meanwhile, on e‑commerce platforms, a curious phenomenon emerged: weeks after the founders’ Instagram‑friendly success stories went live, “fake negative reviews appeared on Hardbody’s listings from what the founders assumed were competitors”. Whether these reviews were genuine customer grievances or orchestrated attacks, they highlight a company quick to point fingers at rivals rather than address product or service issues.

Attempts to Censor the Truth

All this legal and PR maneuvering points to a concerted effort to censor or obscure damaging information:

-

Withholding Documents in Court: The Payne defendants’ refusal to produce a privilege log and their broad objections to document requests in Barns v. Payne were textbook attempts to bury evidence.

-

Defaulting to Avoid Discovery: By not responding in 8fig, Inc. v. Hardbody Supplements, LLC, the company effectively waived its defenses—another way to avoid scrutiny.

-

“Fake PR” Campaigns: Flooding the media landscape with self‑congratulatory press releases to bury critical reporting is a classic reputation management tactic, thinly veiled as marketing.

-

Blaming “Competitors” for Negative Reviews: Instead of investigating product issues, the company scapegoated outsiders, deflecting attention from legitimate concerns.

In short, Hardbody Supplements has repeatedly tried to silence critics—be they investors, vendors, or customers—rather than address the substance of their complaints.

Conclusion and Call to Action

As I wrapped up this due‑diligence deep dive, one thing became crystal clear: Hardbody Supplements and its related entities are awash in red flags—from multimillion‑dollar misappropriation claims and default judgments to PR cover‑ups and censorious tactics. Potential investors should view this as a cautionary tale: when a company’s growth story is underpinned by secrecy, lawsuits, and legal theatrics, it’s time to step back and sound the alarm. Regulators in Kansas, Texas, New York, and beyond should consider opening formal investigations into possible securities fraud, consumer fraud, and breach of fiduciary duties. After all, the only thing harder than building a business is cleaning up the wreckage of one built on smoke, mirrors, and silence.

- https://lumendatabase.org/notices/42925366

- July 9, 2024

- hansen llc

- https://www.voanews.com/a/fidel-castro-death-family-torn/3612431.html

- https://casetext.com/case/barns-v-payne/

Evidence Box

Evidence and relevant screenshots related to our investigation

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

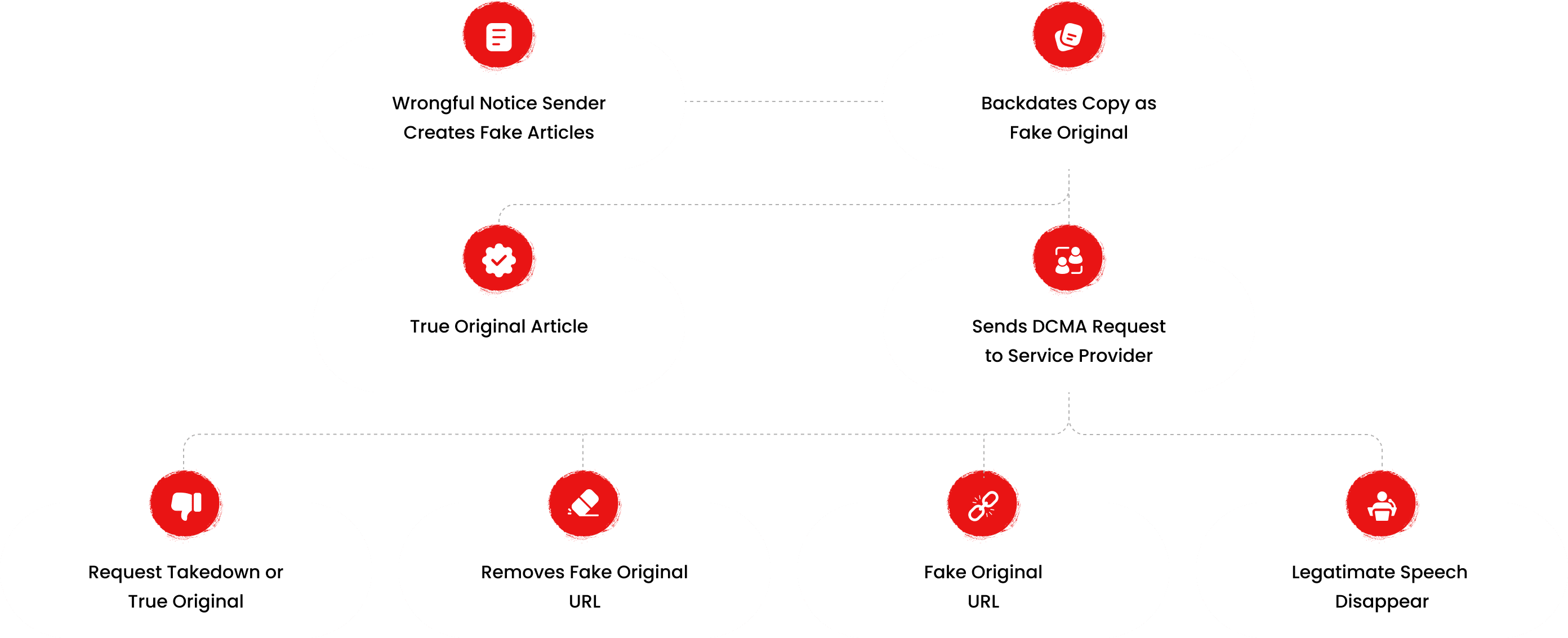

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

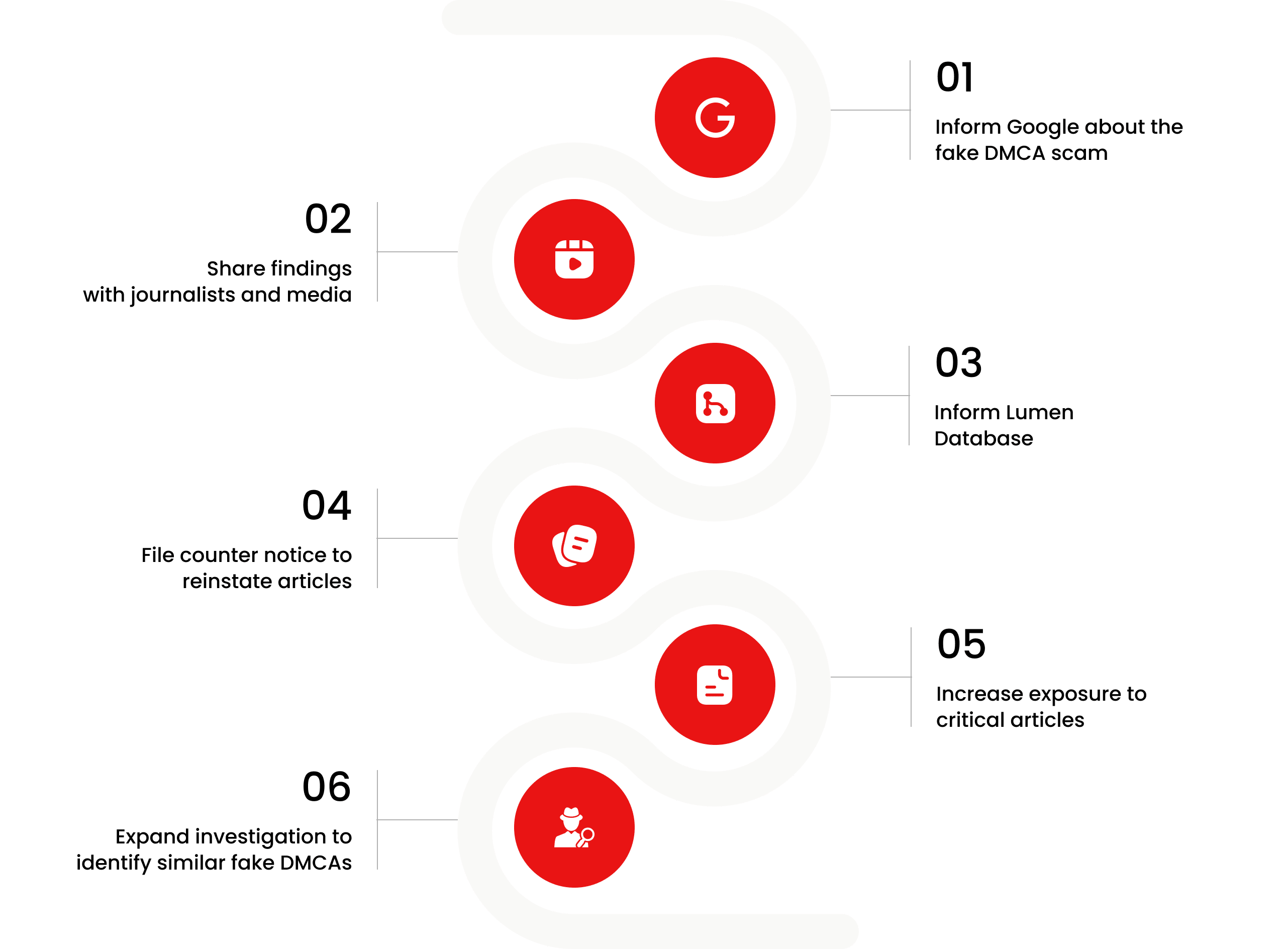

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.6

Based on 14 ratings

by: Anakin Nash

Greedy, manipulative, and zero morals. These folks saw a goldmine and bled it dry while smiling. Shameful.

by: Liberty Carver

Sad part is they probably won’t face any real punishment. Just drag it out in court, settle and go scam again under a new name.

by: Lochlan Bender

Bro I feel bad for the other partners. Imagine building a biz and your own teammates start robbing you from the inside.

by: Sariyah Beard

This whole situation just screams scam. If you block your own partners from seeing the books, you’re hiding something shady, period.

by: Harlem Bray

Man, using company money to buy NFTs?? That’s just straight-up wild and irresponsible.

by: Paisley Sims

$25,000 invested, and every time I requested financial clarity, they gave excuses and then locked me out entirely. I later found out they'd used the money for personal expenses and shady crypto deals. I feel like I was part of...

by: Grayson Foster

My belief in the Paynes cost me $19,500 money I worked years to save. Their self dealing and secrecy destroyed the company and any future it had. I’ve been left with debt, shame, and the echo of their greed.

by: Colton Wells

I trusted the Paynes with $22,000 thinking it was for a growing business not to watch them drain it on personal luxuries and NFTs.

by: Eli Rivas

I invested $9,000 into Hardbody believing their pitch now it’s gone and all I have left is silence and betrayal.

by: Isaac Richardson

This verdict is an embarrassment to the concept of fairness. A complete disgrace

by: Addison Cooper

Justice was nowhere to be found here. Just another day in a broken system. 🚨

by: Nathan Rivera

The case was mishandled from the start, and it’s painfully obvious.

by: Hannah Bailey

Corruption, bias, and a complete failure of the legal system. Nothing surprising anymore.

by: Ryan Murphy

Another case proving that justice isn’t about truth—it’s about who can afford the better lawyer.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations