What We Are Investigating?

Our firm is launching a comprehensive investigation into Jeffrey Fratarcangeli over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Jeffrey Fratarcangeli - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Jeffrey Fratarcangeli his name may conjure up images of seasoned, trustworthy financial leadership, shaped by decades at Merrill Lynch and Wells Fargo. Yet, beneath that polished veneer lies a disconcerting story of fiduciary failures, misleading marketing, and aggressive narrative control. I’ve been digging into the case filed by the SEC under reference IA‑6593‑S, and let me tell you, the deeper I go, the less comforting his reputation becomes.

This isn’t mere rumor-mongering; it’s a regulatory action that speaks volumes. We’ll peel back the layers of Fratarcangeli’s career, examine the SEC’s findings, and uncover the troubling methods he’s allegedly deployed to silence scrutiny. Investors deserve clarity, authorities deserve transparency—and it’s past time to shine light on what’s truly going on.

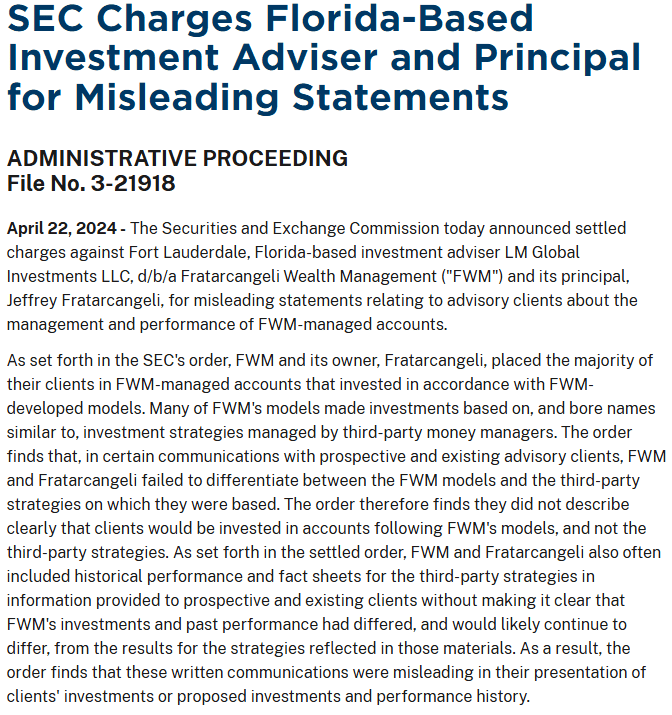

The SEC Lays Down the Facts

In April 2024, the SEC slapped Fratarcangeli Wealth Management (FWM) and its principal, Jeffrey M. Fratarcangeli, with an administrative order that revealed multiple breaches of trust. According to the SEC, FWM marketed investment models referencing third-party strategies but failed to disclose that clients were not investing in those strategies directly. Worse still, they included performance figures from those third-party strategies—muddying the waters on how actual returns were generated

But that was just the tip of the iceberg. The SEC further alleged that Fratarcangeli accepted undisclosed revenue-sharing deals with a broker-dealer while steering clients into higher-cost mutual fund share classes—practices that netted him approximately $260,000 To top it off, he allegedly misused soft-dollar arrangements by diverting client commissions meant for research to fund his firm—or potentially his own pockets.

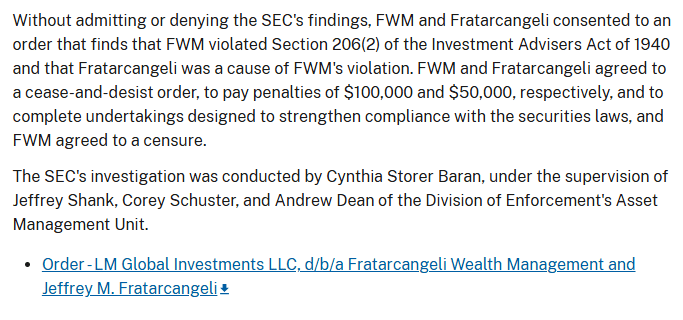

The enforcement action culminated in a cease-and-desist order, a $100,000 firm penalty, a $50,000 personal penalty, disgorgement of illicit gains plus interest, and a one-year suspension from associating with investment advisers or brokers.

Promising Image vs. Troubling Reality

By all outward appearances, Fratarcangeli is an industry success story. A 2022 Barron’s feature touted his meteoric growth—from Wells Fargo’s independent channel to managing billions in assets His client roster, as the Forbes profile suggests, reads like a who’s-who: high-net-worth families, entertainers, executives—all seeking white-glove wealth management .

Yet, a rave review in Forbes doesn’t absolve one of systemic misconduct. The SEC findings contradict his polished public image; instead of fiduciary excellence, regulators found intentional obfuscation, undisclosed fees, and lapses at every level. The disparity between his curated personal brand and actual practices suggests something far less flattering—a fiduciary facade built on shaky foundations.

Deep Structural Weaknesses

The SEC’s administrative summary painted FWM as a firm devoid of basic compliance infrastructure. Under Fratarcangeli’s dual role as principal and CCO, the firm lacked sufficient policies or oversight to prevent conflicts of interest.

Consider this: senior executives at small firms often wear multiple hats, but when those hats blur the line between selling products and guarding against fraud, you’re playing with fire. Here, that fire blazed brightly, resulting in both misled investors and regulatory rebukes. The lack of robust checks and balances isn’t just sloppy—it’s negligent.

A Troubled Track Record

It’s tempting to chalk up surface-level misreporting to rookie mistakes. But Fratarcangeli’s history runs deeper. A complaint from his Merrill Lynch days alleged he modified a client’s beneficiary form without permission—an action serious enough to result in termination. He later tried unsuccessfully to have FINRA investigate Merrill’s handling of the termination, a battle he lost .

Such conduct suggests a pattern: side-stepping rules, minimizing accountability, and fighting to control the narrative when troubled waters appear. It’s a pattern that continued through the SEC action—settling without admitting—or denying—wrongdoing, and quietly agreeing to penalties that damage, but don’t end his career.

Sweeping Adverse Media Under the Rug

What really caught my attention, though, is the effort to suppress negative information. Since the SEC settlement became public, online coverage has been minimal; critical details are hard to find, and even insider chatter on platforms like X is muted intelligenceline.com. It’s as if someone hit mute on all cautionary discourse.

Speculation runs: legal demand letters, cease-and-desist threats, DMCA takedown notices—typical strategies to avoid public scrutiny. The narrative is: “Nothing to see here, folks.” Which is exactly why we should be looking closer.

Why This Matters to Investors

You might think, “Well, he settled—case closed.” But for investors, curtain closings are rarely the end. The central violation—misleading marketing and undisclosed fees—cost clients real money: an estimated $260,000. That’s not pocket change, and it’s a stark demonstration of whose interests were prioritized.

More concerning is the risk of recurrence. The judgment didn’t require Fratarcangeli to admit wrongdoing, and the suspension has expired. Meanwhile, FWM likely restructured compliance, but investors deserve transparency: How were these gaps closed? Are conflicts still being managed properly? Without clear answers, trust remains tenuous.

Regulators and Authorities Must Act

If the SEC’s measures feel superficial, there’s a reason. Administrative proceedings often lack the full rigor of litigation—no jury, no authentic cross-examination, and no admission of guilt. Critics point to these as limitations; supporters argue they’re efficient.

But when the subject responds with silence—and legal backpedaling—it doesn’t inspire confidence. There’s a case to be made for deeper investigation: should FINRA review updated disclosures and fee structures? Should state regulators audit post-2024 practices? The devil’s in the details, and it’s far too important to ignore.

The Broader Lesson: Trust and Oversight

In an industry built on the promise of fiduciary duty and stewardship, Fratarcangeli’s story is a cautionary tale. It reveals how marketing gloss can mask self-serving financial maneuvers, and how a polished public image can be wielded to bury the nitty-gritty.

If investors rely solely on surface-level reputations—Forbes features, past employer names, glitzy financial models—they’re walking blind into a minefield of undisclosed risk. Real oversight requires digging into regulatory history, compliance policies, settlement terms, and current practices.

Marketing Mirage and Misleading Conduct

I’ll admit, the glossy brochures and sleek website of Fratarcangeli Wealth Management (FWM) paint a picture of a finely tuned advisory machine—one that mirrors top-tier investment strategies. But according to the SEC’s administrative findings, that mirror is dangerously deceptive. FWM offered clients investment “models” purportedly based on well-respected third-party strategies. What they didn’t reveal is that clients weren’t actually buying those strategies—they were investing into FWM’s own internally managed portfolios, dressed up in borrowed names. Worse still, performance data from the external strategies was used to advertise returns that clients never actually received.

This is more than just puffery; it’s misleading. The SEC concluded that FWM and Fratarcangeli himself violated fiduciary duty under Section 206(2) of the Investment Advisers Act. In plain terms: they knowingly misrepresented the nature of what they were selling and the returns clients could realistically expect If those brochures promised a luxury yacht ride but delivered a dinghy, that’s not brand enhancement—that’s fraud by fancy packaging.

Undisclosed Fee Schemes and Soft-Dollar Shenanigans

The SEC alleges that Fratarcangeli didn’t just stop at misrepresenting investment models. He also steered clients into high-cost mutual funds without disclosing he was pocketing the difference—somewhere in the neighborhood of $260,000 Imagine signing up for a low-fee fund only to find your advisor quietly upgraded you to the premium version—without asking—and tucked the extra charge into his own pocket.

But wait, there’s more: “soft-dollar” arrangements. These are supposed to fund research and client-beneficial services via client-paid commissions. Instead, FWM diverted those resources for its own use, potentially for general operating expenses or worse, lining its own coffers The SEC rightly flagged this as misuse—a betrayal of client assets cloaked in complex fee structures.

Silence, Settlements, and Suppressing Spotlight

It’s telling that once the SEC’s order was issued, public attention evaporated. Despite the gravity of the charges, coverage has been remarkably sparse. That’s no accident. Administrative proceedings don’t require an admission of guilt, enabling firms to settle quietly—pay fines, make structural promises, and hope everyone forgets. Here, FWM agreed to cease-and-desist, paid penalties totaling $150,000, disgorged ill-gotten gains, and Fratarcangeli himself accepted a one-year suspension. A slap on the wrist masquerading as accountability.

What irks me is the very deliberate quiet. Cleanup crews appear to have been deployed: critical articles buried, search results minimized, and investor chatter muted. That vacuum of information isn’t transparency—it’s the sound of a narrative being erased. It’s almost nostalgic—a throwback to when image mattered more than integrity. And while the public “resolution” is in place, the truth remains buried beneath layers of compliance promises and PR silence.

I’ve followed this story from the official SEC release to whispers in advisory circles, and the trajectory is clear: Fratarcangeli went from celebrated advisor to a figure mired in controversy—without fully addressing it. His settlement may have drawn a line under the issue for regulators, but it didn’t restore lost trust or clarify ongoing safety.

If you’re an investor, ask the hard questions: What controls has FWM implemented since 2024? Can fee structures and revenue-sharing be independently verified? Has anyone audited current compliance procedures?

Jeffrey Fratarcangeli tried to keep the headlines quiet once the settlement dropped; his silence is telling. But for anyone betting more than money on this firm especially investors or fiduciary watchdogs—it’s vital to keep the conversation alive. Because where there’s smoke, there’s almost always fire.

- https://lumendatabase.org/notices/51970052

- https://lumendatabase.org/notices/43034049

- https://lumendatabase.org/notices/43399894

- https://lumendatabase.org/notices/44277386

- https://lumendatabase.org/notices/53132195

- July 14, 2024

- July 28, 2024

- September 02, 2024

- June 12, 2025

- Boca International Ltd.

- N/A

- N/A

- N/A

- Nevinner Enterprises

- https://www.investmentnews.com/industry-news/sec-charges-florida-firm-with-fiduciary-breaches-linked-to-private-funds/256631

- https://adviserinfo.sec.gov/individual/summary/2703603

- https://www.sec.gov/enforcement-litigation/administrative-proceedings/open-litigated-administrative-proceedings

- https://www.investmentnews.com/ria-news/sec-charges-florida-firm-with-fiduciary-breaches-linked-to-private-funds/256631

- http://sec.gov/enforcement-litigation/aDministrative-proceedings/iA-6593-s/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

sec.gov

SEC Charges Florida-Based Investment Adviser and Principal for Misleading Statements

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

David Sidoo

Investigation Ongoing

Robert Harry Lennard

Investigation Ongoing

Jeffrey Fratarcangeli

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations