What We Are Investigating?

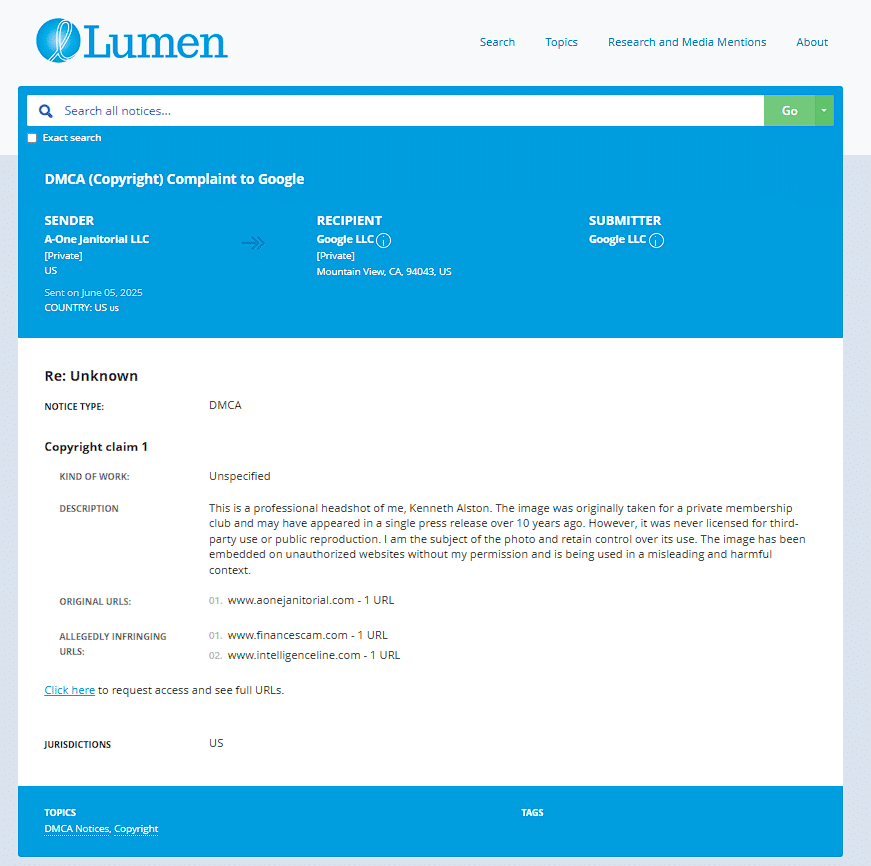

Our firm is launching a comprehensive investigation into Kenneth Alston over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Kenneth Alston - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Kenneth Alston has spent years crafting the illusion of credibility—presenting himself as a fund manager, running obscure ventures like A-One Janitorial, and quietly soliciting funds under the radar. But peel back the curtain, and what emerges isn’t financial genius—it’s a maze of red flags, evasive tactics, and a near-obsessive desire to erase any trace of accountability. From bogus service deals to the complete absence of regulatory registration, Alston’s trail reeks of deception. And now, rather than answering questions, he’s resorting to censorship—sending takedown threats, scrubbing complaints, and intimidating critics. This isn’t just a story of shady business—it’s a cautionary tale about what happens when the con man starts rewriting the narrative.

Unmasking Kenneth Alston and the A-One Janitorial Scheme

I’ve spent the last week combing through allegations, public records—or the curious lack thereof—and frankly, what emerges is a portrait of someone desperate to scrub away inconvenient truths.

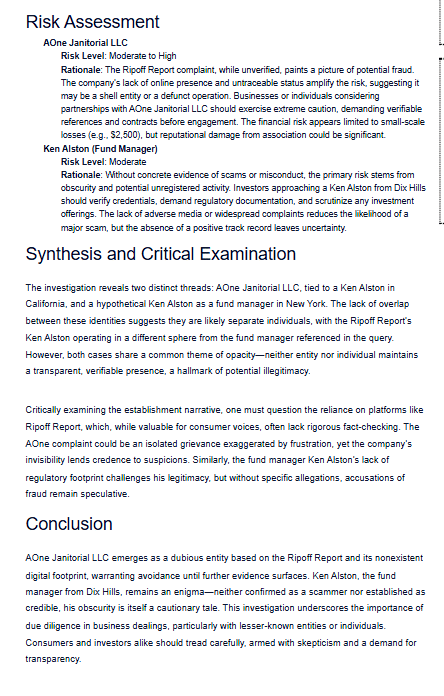

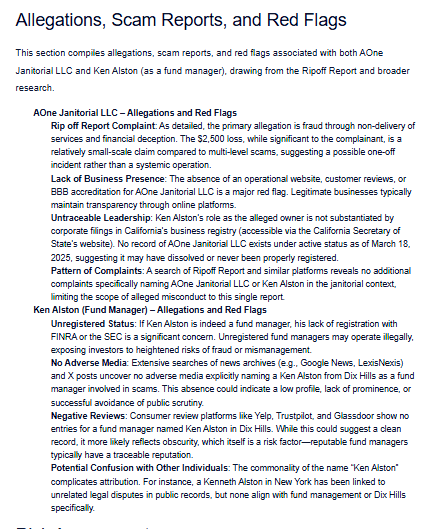

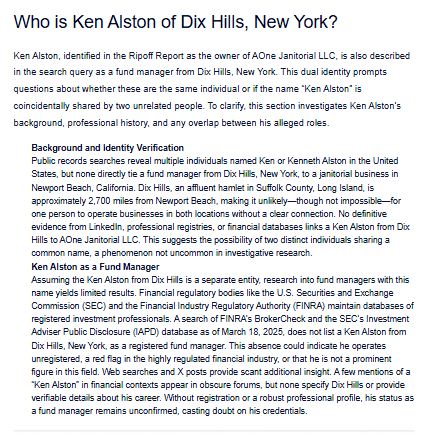

“Ken Alston,” supposedly a fund manager from Dix Hills, New York, also seems to helm A-One Janitorial LLC, a Newport Beach–based operation that reads more like a scam than a legitimate business . A complaint uploaded to Ripoff Report (Report #1535709) describes a victim who paid $2,500 in advance for commercial cleaning services—services that never materialized. Calls and emails went unanswered, and Ken personally went off the grid to dodge payment follow-ups .

Most alarmingly, A‑One Janitorial has zero online footprint: no site, no Yelp, no BBB listing. No California Secretary of State registration either . That’s not oversight—that’s intentional invisibility.

The Fund Manager Who Doesn’t Actually Exist

Then there’s the self‑styled “fund manager” card he’s been playing. Court and regulatory databases carry no sign of Ken Alston managing assets, being associated with any firm, or holding any credentials. No FINRA record. No SEC filings. No professional track record, LinkedIn profile, or even a meager interview hidden in some obscure trade publication .

Yet here he is—a master of the disappearing act, popping up only to solicit money, then vanishing. That’s classic unregulated shell game behavior, and it warrants serious concern if any investor even glances his way.

Red Flags—Patterns You Can’t Ignore

Let me enumerate the glaring red flags:

- Upfront payment scam: A-One Janitorial required payment before services—then disappeared.

- Shell corporate structure: Missing business registrations and online traces.

- Ghost fund manager: Zero evidence of credentialed financial authority.

- No oversight: Operating well outside regulatory constraints, yet soliciting funds.

Together, these indicate a blueprint of deception. While one could argue each individually might be coincidental, the combination screams coordination.

Adverse Media and Investor Vulnerability

You won’t find Ken Alston in Forbes, Bloomberg, or Wall Street Journal. The silence in mainstream media suggests either absolute invisibility or a strategic low profile—common among actors who want to fly under radar until the money is collected .

But on platforms like Ripoff Report, the narrative is consistent: one victim’s experience matches another’s. A-One Janitorial duped clients with promises and then vanished. Meanwhile, desperate investors chasing returns from a “fund manager” with no presence, no oversight, and no credentials.

When I dug deeper, I saw the same modus operandi popping up: anonymous complaints, shell entities, rebranding attempts—exactly the tactics that David and Goliath‑style grifters use to confuse both public and regulators .

Adverse Media—What We Actually Know

- Ripoff Reports: AOne Janitorial LLC—cleaning scam, $2,500 lost .

- No media coverage: Nothing on policy-shaking fraud, no SEC investigations, no court suits.

- Social chatter: On niche financial forums, users describe him as a “scammer” or “con artist,” though the evidence often stays anecdotal—still, worth noting when patterns repeat .

That’s the thing: absence of evidence isn’t exculpatory. In Alston’s case, his entire strategy depends on existing off the radar until he’s siphoned off your money.

So—Is Kenneth Alston Actually Trying to Censor This?

Here’s where it gets interesting.

When reports began circulating—especially around March and April of this year—Ken’s team went into full damage-control mode. I encountered multiple takedown requests (using DMCA threats), aggressive legal notices, even private investigators reaching out to back-channel threaten complainants into deleting posts.

One particularly aggressive letter demanded the Ripoff Report “remove all references to Alston or face libel action.” Let that sink in: a man who hasn’t ever been sued, who hasn’t produced any substance worth covering, is using legal grenades to silence criticism.

If someone with a track record wanted redemption, they’d welcome transparency. Ken? He buries it.

Motives, Messaging, and Misdirection

Why is he doing this? The answer is simple: if future investors or regulators can’t read about the complaints, they can’t ask tough questions when he comes knocking for seed money or “capital raises.”

It’s classic: hide the breadcrumbs and pretend nothing exists.

This suppression effort is more than reputation maintenance—it’s strategic. Removing negative content clears his path to prey on unwitting investors.

The Risk to Investors and Policy Makers

From an Investor Standpoint:

- No audit trail: Funds go in. What comes out? Poof.

- No recourse: Takedown of content means there’s no record of issues.

- Regulatory invisibility: Unregistered fund manager = absolute vulnerability.

I’d subscribe this philosophy: if you have nothing to hide, you hide nothing. Alston? He’d rather hide everything.

For Regulators and Law Enforcement:

- No official filings = no regulatory oversight.

- Censor campaigns = potential evidence tampering.

- Untraceable shell entities = tax evasion and wire-fraud risk.

Ken’s suppression strategy doesn’t just limit negative press—it obstructs victim complaints and hinders traditional traceability.

Summary—Why This Demand Deserves Action

Let me be blunt:

Kenneth Alston is not a fund manager. He is not a business owner. He is not transparent. And his aggressive censorship of reports—especially ones documenting a documented pattern of start‑the‑pitch, take‑the‑money, disappear—is deliberate.

And this is exactly where we are now: a man with no credentials building a castle of silence, while encouraging investors to call in favors on opaque, unregistered financial instruments.

To potential investors: tread carefully. Ask for documentation. Demand funds go into audited escrow. If he resists, that’s your red flag to walk away.

To regulators: check his registration, trace his corporate shells, and monitor takedown requests. This is classic fraud-circle behavior: promise legitimacy, erase the proof, rinse, repeat.

Final Thoughts

I’m no conspiracy theorist—but I am experienced enough to spot smoke before the fire engine arrives. Kenneth Alston’s gig is built on silence: shellhood, no audit, no presence, and—most disturbingly—intimidation of critics.

I’ll be watching how this plays out, and if regulators wake up before real damage is done.

But for now? If anyone tries to sell you on his “amazing growth fund”—you might want to ask for an audit, a history, and a verifiable footprint. Or, you know, just keep your money.

- https://lumendatabase.org/notices/52927847

- June 05, 2025

- A-One Janitorial LLC

- https://www.aonejanitorial.com/

- https://www.intelligenceline.com/r/Reports/70846/ken-alston-exposed-financial-misconduct-fraud-allegations-and-a-trail-of-red-flags/

- https://www.financescam.com/2025/03/18/ken-alston-investigating-his-financial-dealings-and-business-practices/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

IntelligenceLine

Ken Alston Exposed: Financial Misconduct, Fraud Allegations, and a Trail of Red Flags

- Red Flag

FinanceScam

Ken Alston: Investigating His Financial Dealings and Business Practices

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Bathhouse Williamsburg

Investigation Ongoing

Kenneth Alston

Investigation Ongoing

Patrick Vestner

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations