What We Are Investigating?

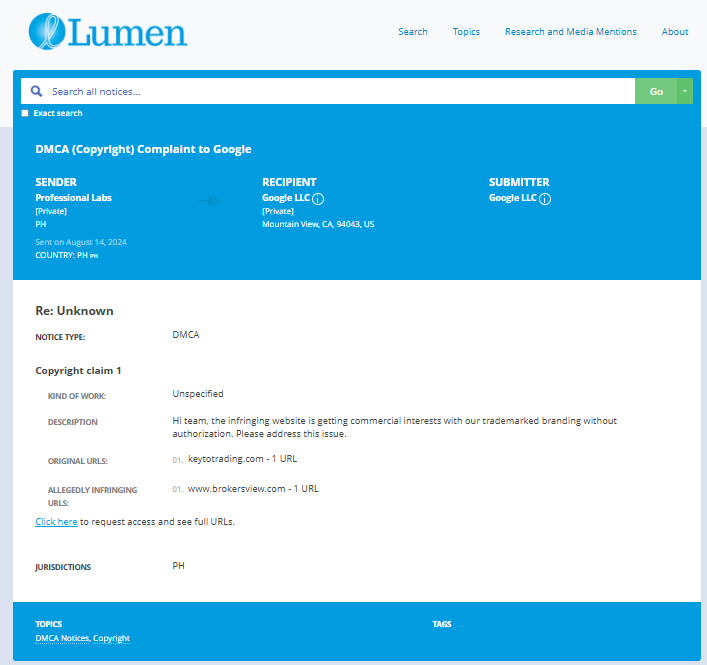

Our firm is launching a comprehensive investigation into Key To Trading over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Key To Trading - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Key To Trading, a financial education and trading platform, has faced a wave of allegations and adverse news that have raised serious concerns about its legitimacy and business practices. While the company markets itself as a gateway to financial success, numerous red flags and complaints from users and industry watchdogs suggest a darker side to its operations. Below is a summary of the major allegations, red flags, and adverse news associated with Key To Trading, along with an analysis of why the company might seek to suppress this information, even if it means resorting to cybercrime.

Major Allegations and Red Flags

Misleading Marketing Practices: Key To Trading has been accused of using deceptive marketing tactics to lure customers. Promises of guaranteed profits, financial independence, and expert-led training have been criticized as exaggerated or outright false. Many users report feeling misled after realizing the platform’s strategies are either overly simplistic or ineffective in real-world trading scenarios.

High-Pressure Sales Tactics: Former customers and employees have alleged that the company employs aggressive sales tactics to upsell expensive courses and subscription packages. Some users claim they were pressured into purchasing additional services they did not need, often at significant financial cost.

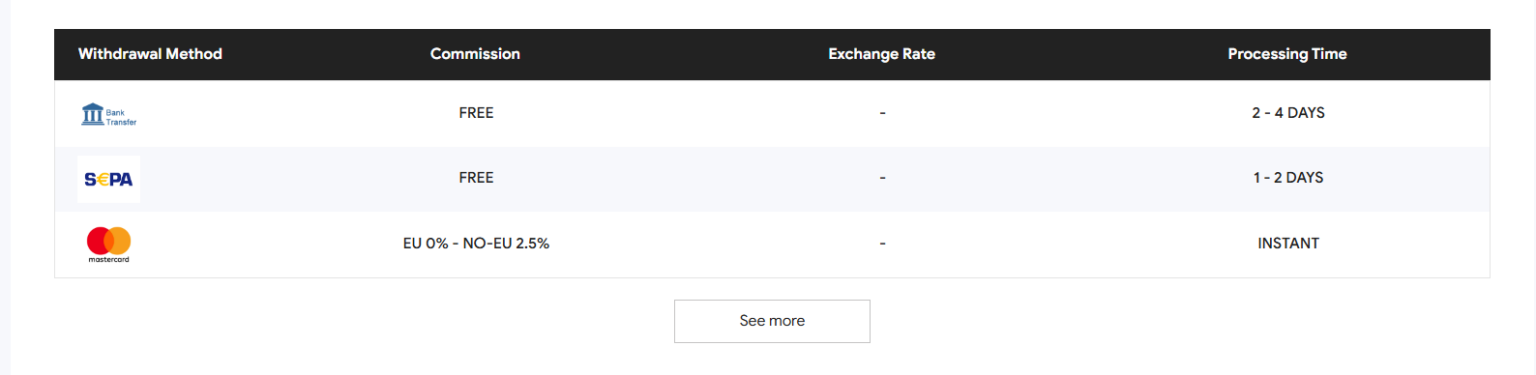

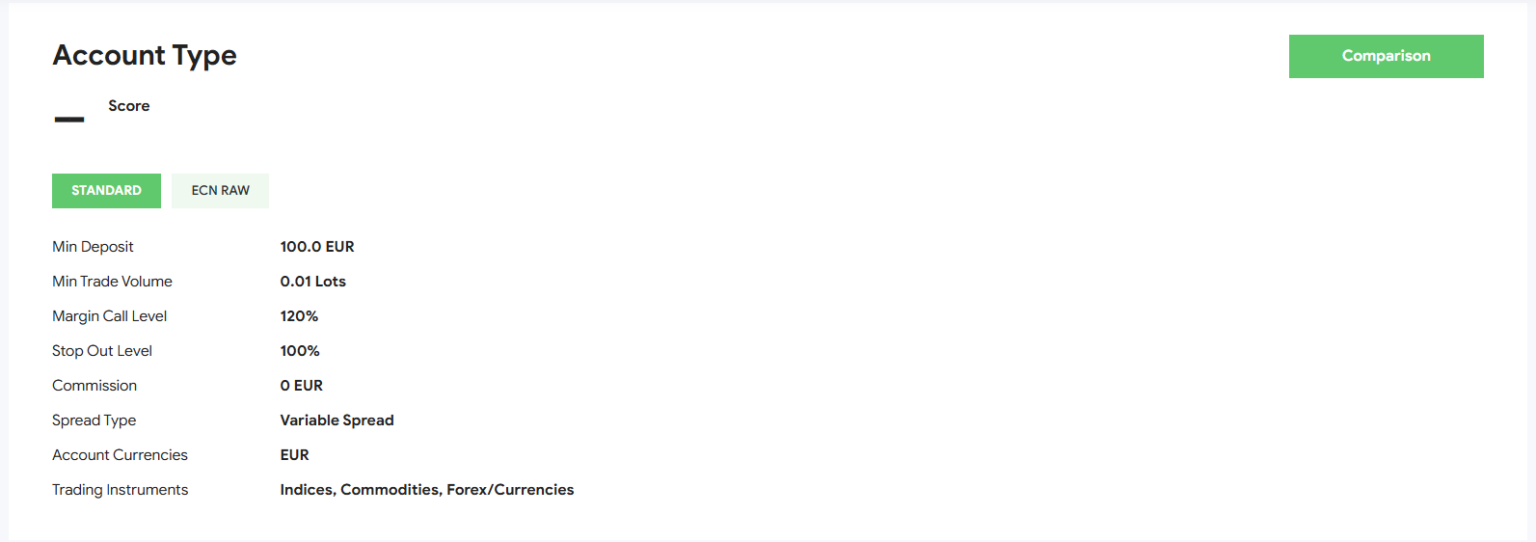

Lack of Transparency: Key To Trading has been criticized for its lack of transparency regarding fees, success rates, and the qualifications of its instructors. Many users report hidden costs and unclear terms of service, leading to frustration and financial losses.

Poor Customer Support: Numerous complaints highlight the company’s inadequate customer support. Users have reported difficulties in canceling subscriptions, obtaining refunds, or resolving disputes. This has led to accusations of the company prioritizing profits over customer satisfaction.

Legal and Regulatory Scrutiny: Key To Trading has faced scrutiny from regulatory bodies in several countries. Allegations of operating without proper licenses, violating consumer protection laws, and engaging in unethical business practices have tarnished its reputation. While no major legal action has been publicly confirmed, the scrutiny itself has raised concerns about the company’s legitimacy.

Negative User Reviews and Scam Allegations: Online forums and review platforms are rife with complaints from users who describe their experiences with Key To Trading as scams. Many allege that the platform failed to deliver on its promises, leaving them financially worse off. These reviews have significantly damaged the company’s credibility.

Reputation Damage and Motives for Suppression

The allegations against Key To Trading have severely harmed its reputation. Misleading marketing and high-pressure sales tactics erode trust, while a lack of transparency and poor customer support suggest a disregard for user welfare. Regulatory scrutiny and scam allegations further undermine the company’s credibility, making it difficult to attract new customers and retain existing ones.

For Key To Trading, the stakes are high. Negative publicity can lead to declining sales, legal repercussions, and long-term damage to its brand. The company’s desire to remove or suppress damaging stories is driven by the need to maintain its image, protect its revenue streams, and avoid accountability. In extreme cases, this could lead to unethical or illegal actions, such as hacking into review platforms to delete negative feedback, orchestrating fake positive reviews, or launching cyberattacks against critics.

Conclusion

Key To Trading’s alleged misconduct paints a troubling picture of a company prioritizing profits over ethical business practices. The cumulative impact of these allegations has irreparably damaged its reputation, making it a controversial figure in the financial education space. While the motivations for suppressing negative information are clear—preserving its image and revenue—the potential use of cybercrime to achieve these ends raises serious ethical and legal concerns.

- https://lumendatabase.org/notices/43799513

- Aug 14, 2024

- Professional Labs

- https://keytotrading.com/

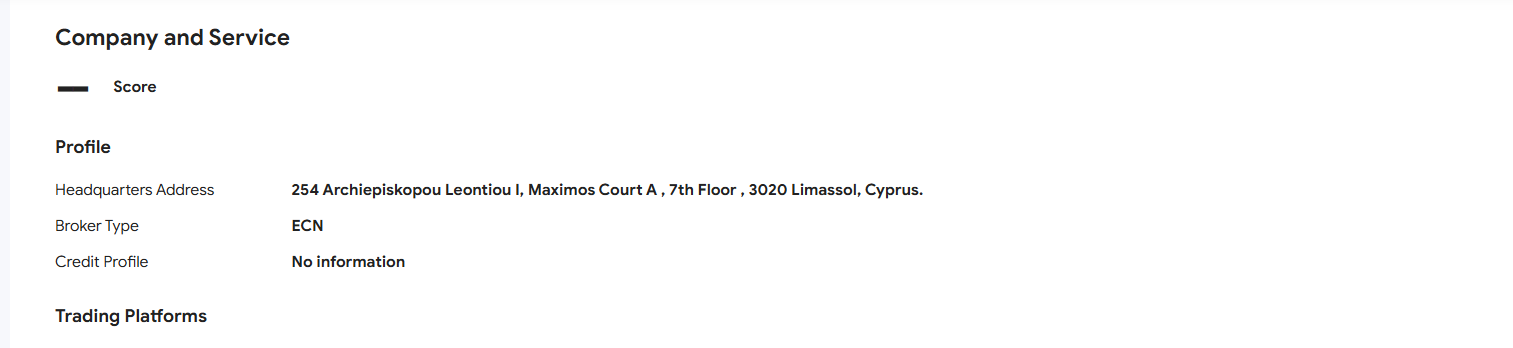

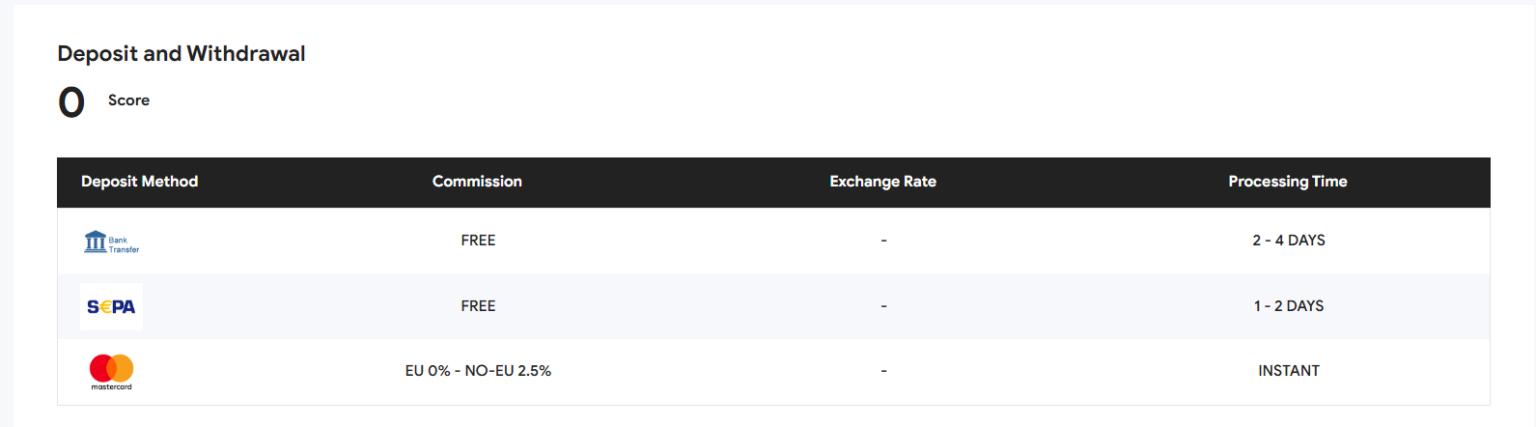

- https://www.brokersview.com/brokers/key-to-trading

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Rayan Berangi

Investigation Ongoing

Zhang Yaoyuan

Investigation Ongoing

Roobet

Investigation Ongoing

User Reviews

Average Ratings

2.1

Based on 11 ratings

by: Miguel Rivera

Total bait to suck you in, then you’re left with nothin’. I’m from the UK, and it’s embarrassin’ to see this kinda scam in the trading world. Hope the cops shut ‘em down soon.

by: Rebecca Wilson

Yo, Key to Trading’s a scam

by: Jack Mitchell

Review sites are being gamed with fake 5-star fluff while critical voices vanish. That’s not organic reputation it’s strategic misinformation. If a company needs to silence criticism to survive, that speaks volumes.

by: Olivia Martin

Key To Trading’s business model thrives on overselling dreams to beginners. Once you’re in, you’re hit with relentless upsells and no real value. They exploit financial anxiety to squeeze out every cent. It’s not education it’s exploitation.

by: Amani Frye

Can confirm the high-pressure sales tactics. They called me three times in one day trying to upsell a $2,000 ‘masterclass.

by: Kairo Whitaker

They made canceling my subscription a nightmare. I had to email them five times and still got charged the next month.

by: Selene Decker

This place is a money trap. Their ‘training’ is just recycled info from free YouTube videos. Total scam vibes

by: Eliel Vargas

Wish I had seen this before I signed up. They sold me a dream and delivered a glorified PowerPoint presentation.

by: Miles Jenkins

These scammy trading courses follow the same formula: flashy marketing, high-pressure sales, and vague success stories with no proof. Meanwhile, they make money off YOU, not actual trading. If their strategy was so good, why sell it instead of just...

by: Hazel Bryant

Man, these trading platforms always sell u a dream, but once u hand over ur money, it’s crickets . The pressure tactics alone should be a red flag

by: Lily Gray

Investing with Key To Trading feels risky!!

by: Olivia Baker

Regulation is one thing, but no reviews and little transparency? That’s a big red flag in my dictionary.

by: Elijah Moore

STay away. Limited info and few reviews make Key To Trading feel more like a gamble than an investment opportunity.

by: Isla Ross

The worst part is that they’re targeting beginners who don’t know any better. Once u realize the info is useless, it’s too late, ur money’s gone. And of course, no refunds. Total scam.

by: Miles Jenkins

These scammy trading courses follow the same formula: flashy marketing, high-pressure sales, and vague success stories with no proof. Meanwhile, they make money off YOU, not actual trading. If their strategy was so good, why sell it instead of just...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations