What We Are Investigating?

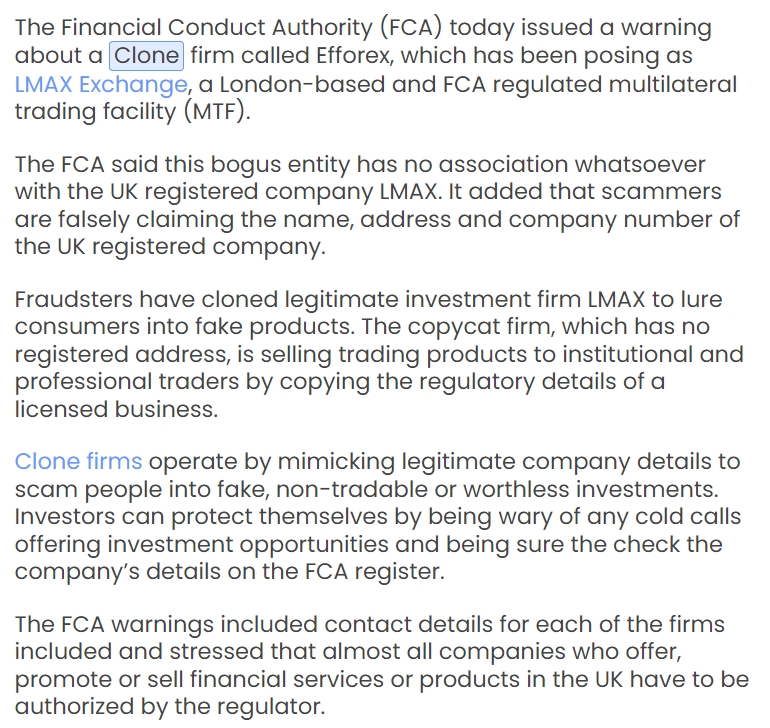

Our firm is launching a comprehensive investigation into LMAX Group over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

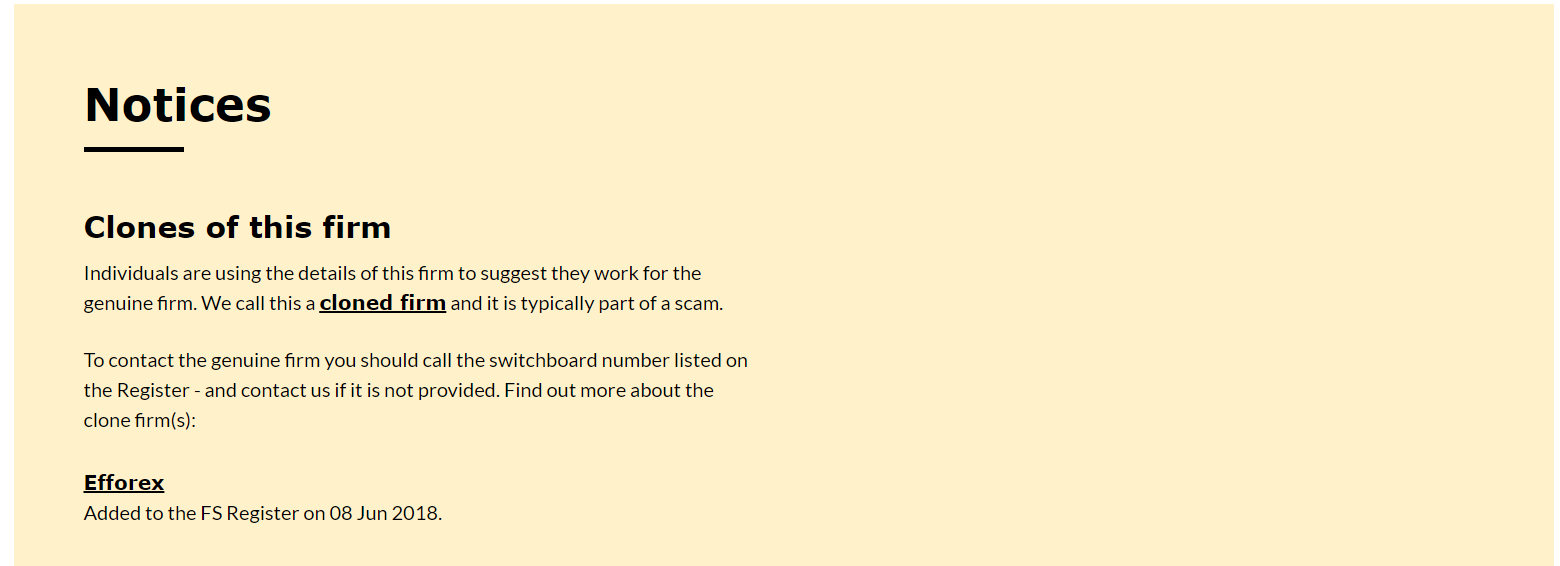

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that LMAX Group - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

LMAX Group positions itself as a beacon of innovation, offering institutional execution venues for electronic foreign exchange (FX) and cryptocurrency trading. With a portfolio that includes LMAX Exchange, LMAX Global, and LMAX Digital, the company boasts a global presence with matching engines in financial hubs like London, New York, and Tokyo.

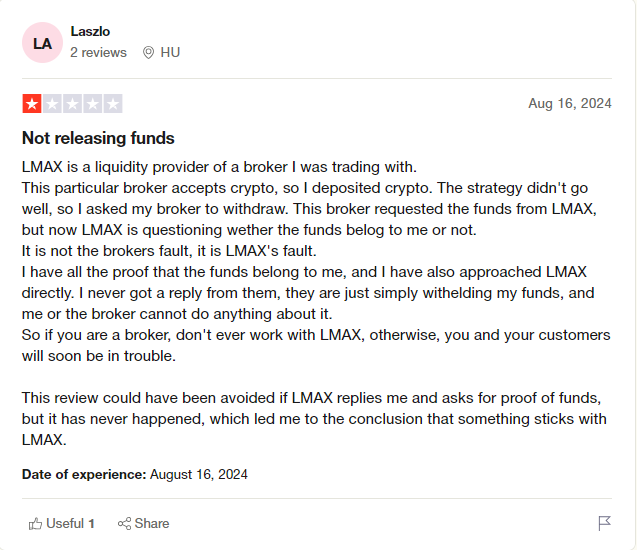

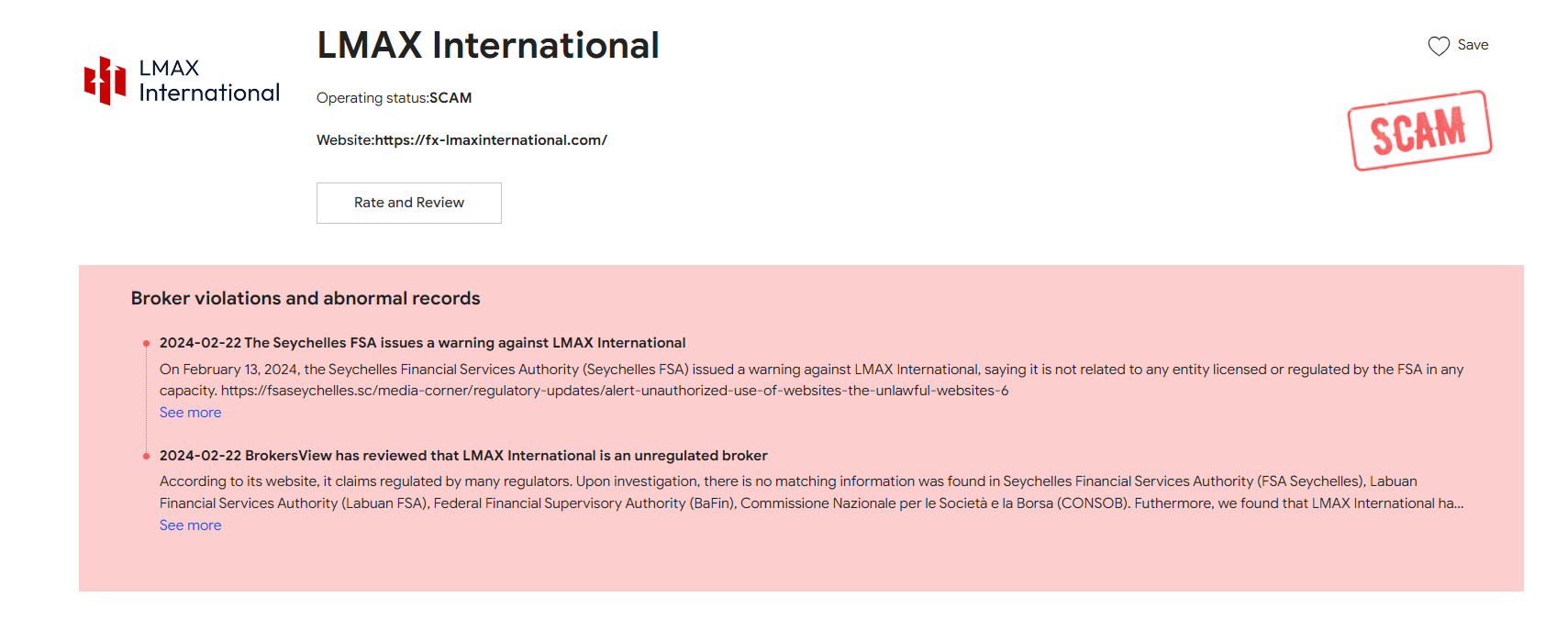

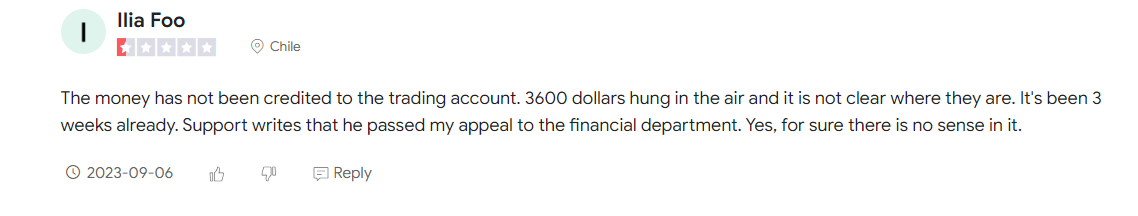

However, beneath this polished exterior lies a series of red flags that potential investors and regulatory authorities should scrutinize meticulously.

A Culture in Crisis

Employee reviews paint a troubling picture of LMAX Group’s internal environment. One former employee described the leadership as consistently demonstrating “disrespect and a dismissive attitude,” with an HR department that “fails to protect employee confidentiality, leading to trust issues.” This toxic culture contributes to high turnover and undermines employee morale.

Another review highlights the company’s “problematic and toxic” top management culture, emphasizing an urgent need for leadership training and adequate resourcing.

Compensation Concerns

Compensation practices at LMAX Group also raise eyebrows. A senior analyst noted that the company “pays way below everywhere else,” leading them to seek better opportunities elsewhere. The HR department is criticized for actively worsening the culture, focusing on ineffective events rather than addressing core issues.

Allegations of Discrimination

More alarming are allegations concerning the CEO’s behavior towards female colleagues. A review cautions potential employees to “beware of CEO behavior towards woman colleagues,” suggesting a deeper, systemic issue within the company’s leadership.

The Censorship Playbook

In an era where transparency is paramount, LMAX Group appears to be taking a different route—one that involves silencing dissent and controlling the narrative. The company’s responses to negative reviews on platforms like Glassdoor are telling. Instead of addressing the core issues, the company often provides generic replies, expressing regret that the employee’s experience did not align with the company’s values, and inviting them to discuss their concerns privately.

This strategy serves a dual purpose: it publicly showcases a facade of concern while privately isolating and potentially neutralizing critics. By shifting conversations away from public forums, LMAX Group effectively minimizes the visibility of dissenting voices, thereby controlling the public perception of the company’s culture and practices.

Implications for Investors and Regulators

The red flags surrounding LMAX Group are not merely internal matters; they have significant implications for investors and regulatory bodies. A company that fosters a toxic work environment, underpays its employees, and is led by individuals accused of discriminatory behavior is a powder keg waiting to explode.

For investors, these issues translate into potential financial and reputational risks. High employee turnover can lead to operational inefficiencies, while a tarnished reputation can deter clients and partners. Moreover, allegations of discrimination at the leadership level could result in legal battles, further draining the company’s resources and standing in the market.

Regulators, too, should take note. The patterns emerging from employee testimonials suggest systemic issues that could violate labor laws and ethical business practices. A thorough investigation into LMAX Group’s internal policies, leadership conduct, and HR practices is warranted to ensure compliance with legal and ethical standards.

A Call to Action

The time for passive observation has passed. Stakeholders must demand transparency and accountability from LMAX Group. Investors should exercise due diligence, scrutinizing not just the company’s financial statements but also its corporate culture and ethical track record. Regulators must step in to investigate the serious allegations surfacing from within the company’s ranks.

In the world of financial technology, where trust and integrity are currency, LMAX Group’s current trajectory is troubling. Without immediate and substantial reforms, the company risks not only its market position but also the livelihoods of its employees and the trust of its investors.

The ball is now in LMAX Group’s court to address these issues transparently and effectively. Failure to do so would not only confirm the concerns raised but also set the company on a path to potential ruin—a cautionary tale for others in the industry.

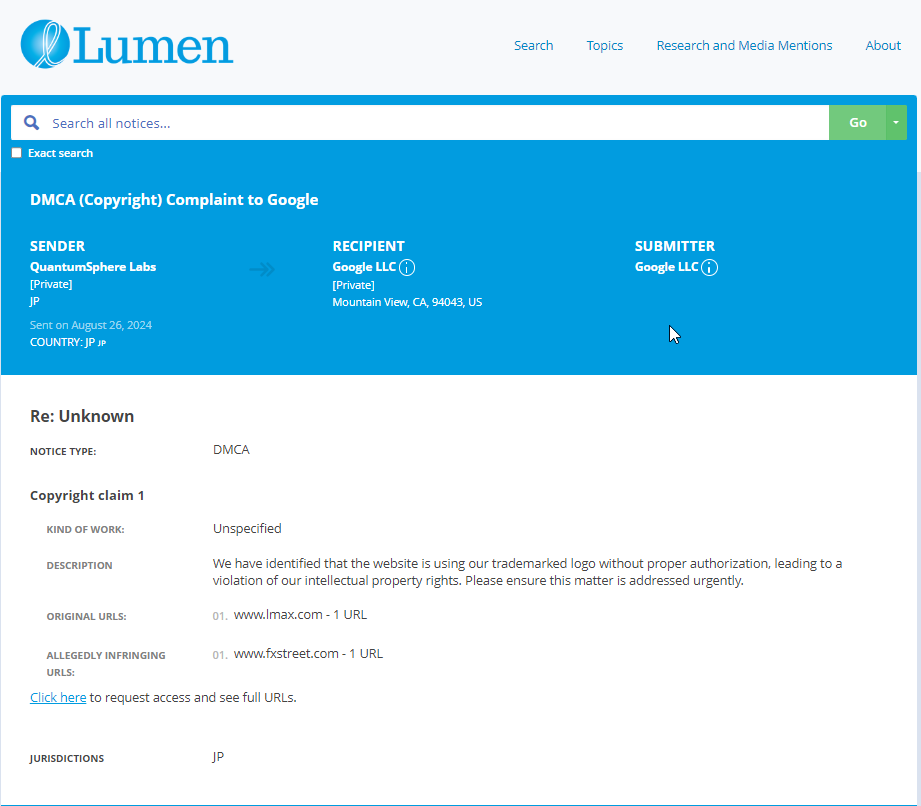

- https://lumendatabase.org/notices/44100136

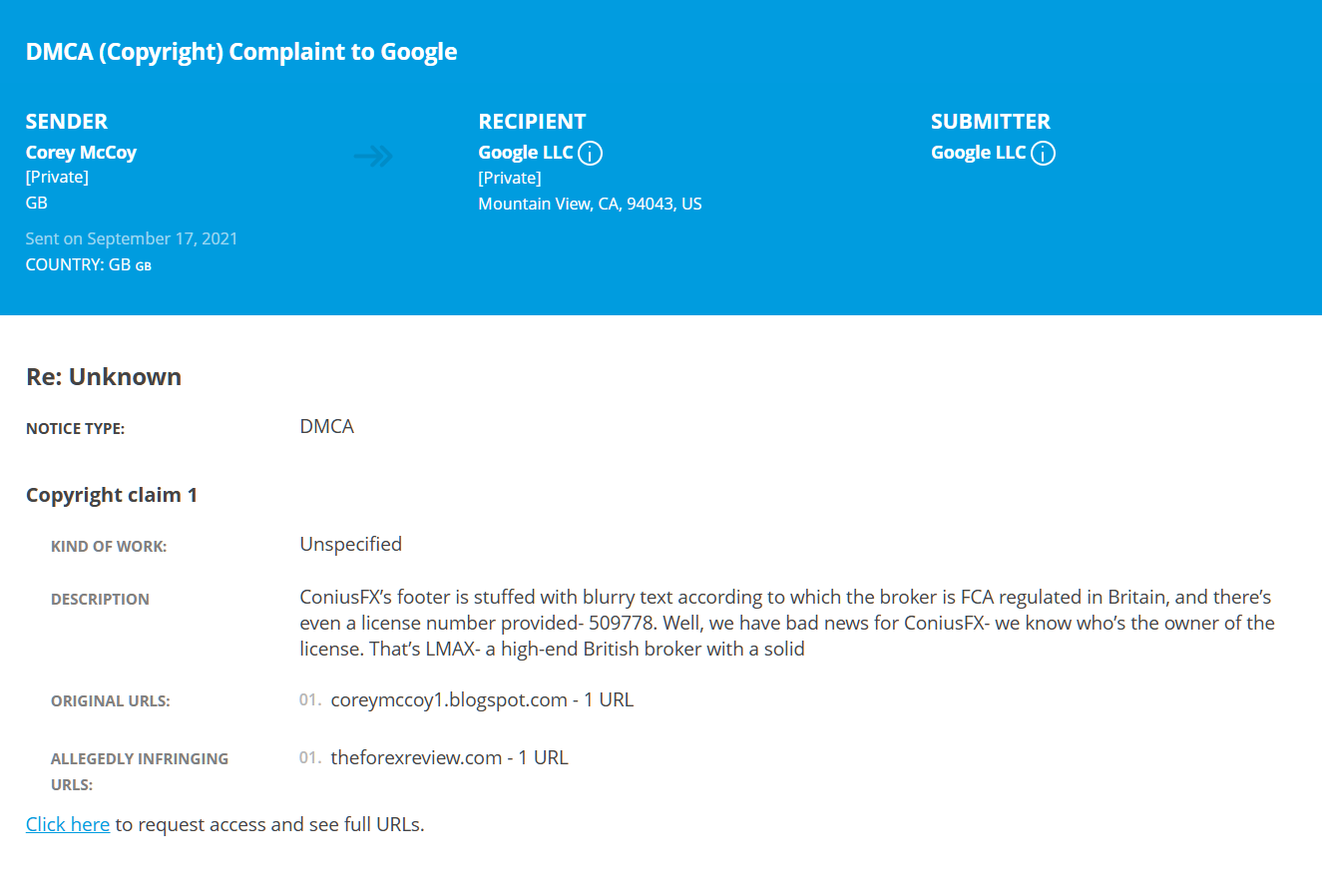

- https://lumendatabase.org/notices/25170894

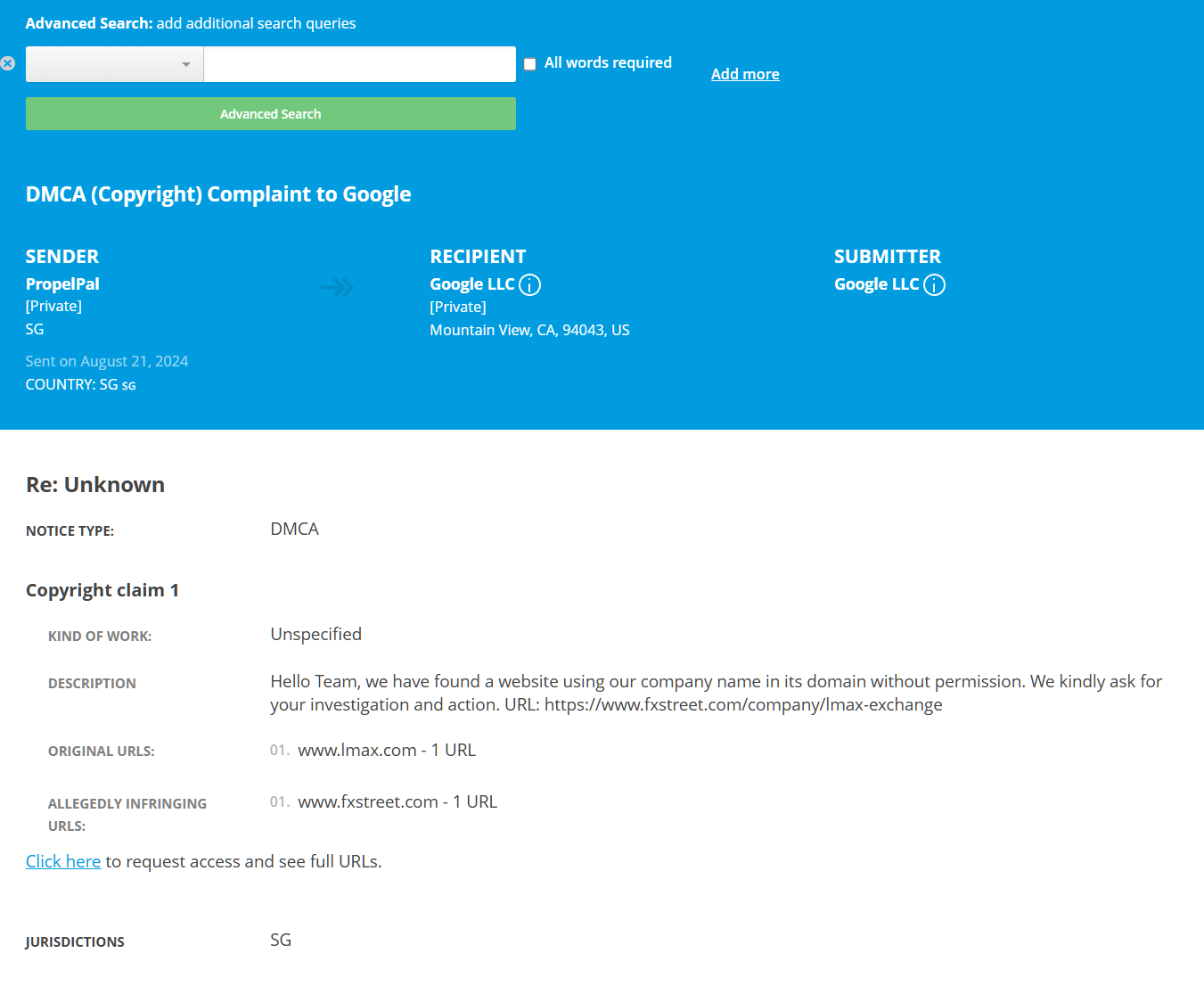

- https://lumendatabase.org/notices/43749894

- https://lumendatabase.org/notices/44002593

- Aug 26, 2024

- September 17, 2021

- August 12, 2024

- August 21, 2024

- QuantumSphere Labs

- PropelPal

- Yongyang Co. Ltd

- Corey McCoy

- https://www.lmax.com/blog/global-fx-insights/2024/07/22/expect-added-volatility-after-biden-drops-out-of-race/

- https://coreymccoy1.blogspot.com

- https://www.fxstreet.com/analysis/expect-added-volatility-after-biden-drops-out-of-race-video-202407212319

- https://www.fxstreet.com/company/lmax-exchange

- https://www.brokersview.com/brokers/lmax

Evidence Box

Evidence and relevant screenshots related to our investigation

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 7 ratings

by: Xavier Drake

Allegations of low compensation and poor HR practices suggest a lack of commitment to employee well-being at LMAX Group.

by: Willow Sage

The company's reported internal issues, including a toxic culture and discriminatory behavior, tarnish its professional reputation.

by: Mia Lewis

Spreads are ridiculous, support is nonexistent, and the platform crashes during key trades. 🤯

by: Ryan Clark

What a massive disappointment. They act legit but operate like a scammy backroom broker.

by: Avani Huber

LMAX Group doesn't have a toxic culture—it has a culture crisis on a global scale.

by: Jamison Hodge

When your CEO is a walking HR liability, it's only a matter of time before your brand collapses under the weight of lawsuits.

by: Pearl Mays

For a company that trades on speed and transparency, LMAX Group sure moves slowly when it comes to accountability.

by: Jack Phillips

Allegations of the CEO’s behavior towards women go beyond bad optics they point to a systemic problem at the top. Ignoring it doesn’t make it go away. This needs a real investigation, not corporate spin.

by: Olivia Lewis

LMAX Group’s censorship strategy is transparent delete negative reviews, issue canned responses, and hope no one notices. This isn’t damage control it’s gaslighting. A company that can’t face the truth is one that can’t be trusted.

by: Chloe Walker

The company’s low pay is pushing talent away. If you underpay staff and ignore complaints, don’t be surprised when turnover skyrockets.

by: Joshua Scott

LMAX Group’s toxic work environment is an open secret disrespectful leadership and a broken HR department are driving employees out the door. That’s not mismanagement it’s a crisis.

by: Alexander Simmons

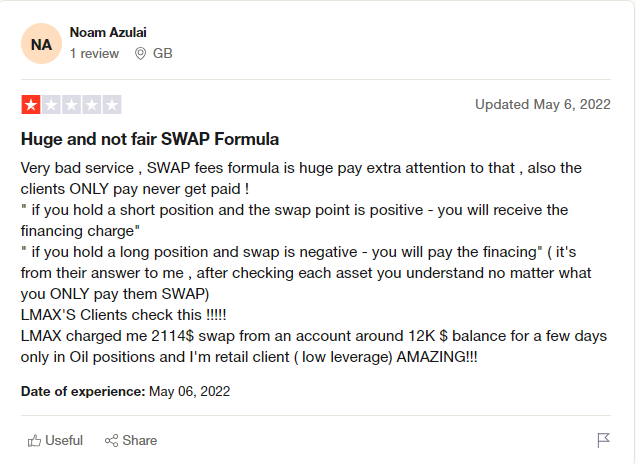

LMAX slapped me with $2114 in swap charges on a my balance for just a few days of oil positions. As a retail client, this feels excessive and unfair!

by: Oliver Rogers

The employees here are far from education ,they rarely have accurate answers when you ask them anything.

by: Emma Perez

I almost lost hope my withdrawal requests kept failing, and the whole process was frustrating.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations