What We Are Investigating?

Our firm is launching a comprehensive investigation into Melford Capital Partners over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Melford Capital Partners - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Melford Capital Partners: Behind the Curtain of Corporate Censorship and Legal Smoke Screens

When you hear the name Melford Capital Partners, what might come to mind is a polished real estate investment vehicle with a sophisticated ring to it—an outfit presumably built on trust, transparency, and investor confidence. But peel back the glossy exterior and you find something altogether different: a corporate entity seemingly more interested in suppressing dissent, burying inconvenient truths, and flexing legal muscle than operating with any semblance of accountability.

If there’s one thing that this investigation has laid bare, it’s that Melford Capital Partners and its associated entities appear to have a knack not for performance, but for performance management—and no, I don’t mean in the HR sense. I mean in the “let’s control the narrative” sense.

Let’s dig into the mess—because someone has to.

The Legal Drama That Opened the Floodgates

At the heart of Melford Capital Partners’ unraveling image is a little courtroom saga that reads like a Shakespearean betrayal with a modern financial twist. The case of Frederick John Wingfield Digby v Melford Capital Partners (Holdings) LLP wasn’t just another shareholder spat—it was a piercing look into the internal dysfunctions of a supposedly high-caliber investment entity.

Digby, a founding member and equity partner, was ejected from the firm under murky circumstances. He alleged serious improprieties and misrepresentations by his former colleagues, who, in turn, tried to paint him as a disgruntled insider. But here’s where it gets interesting: the legal documents reveal a web of internal emails, power plays, and shareholder manipulations that raise serious governance red flags.

Judges don’t typically editorialize, but reading between the lines of the Court of Appeal’s decision, one can’t help but sense judicial discomfort with the way Melford Capital Partners handled its own affairs. The judgment isn’t a ringing endorsement—it’s more of a cautious legal tightrope walk over a vat of potentially reputationally toxic sludge.

Red Flags: Investors, Take Note

Let’s talk about those red flags. Not the hypothetical ones—real, tangible indicators that scream “run” if you’re considering tying your financial fate to this operation.

-

Opaque Ownership Structures – Melford Capital Partners’ legal entity web is about as clear as a foggy window in a hurricane. Shells upon shells, LLPs hiding behind holding firms. Why the need for such complexity? Often, opacity is a feature, not a bug, for those hoping to obscure liability and confuse accountability.

-

Aggressive Censorship Tactics – Multiple sources have reported that Melford Capital Partners and its proxies have taken legal action or made threats to suppress negative coverage or social commentary about the firm’s internal dealings. From cease-and-desist letters to aggressive lobbying to remove unfavorable content, it’s the corporate equivalent of “don’t look behind the curtain.”

-

Partner Fallout – When founding partners accuse each other of fraud, financial deception, and misconduct, it’s not a squabble—it’s an earthquake. If your leadership team is imploding from the inside out, what confidence should anyone have in the numbers they report or the promises they make?

-

Adverse Media Hits – Melford Capital Partners hasn’t exactly flown under the radar, and not in a good way. They’ve been flagged by several watchdogs for questionable accounting, strained project deliveries, and internal conflicts. If you’re running a legitimate, high-performing fund, your press shouldn’t read like a compliance officer’s nightmare.

-

Investor Silence Campaigns – This one really takes the cake. Multiple sources suggest Melford Capital Partners has pressured investors and insiders into NDAs and gag orders. Why? One only stifles whistleblowers if there’s something worth blowing a whistle about.

The Spin Machine: Melford’s PR-First, Transparency-Last Strategy

To the casual observer, Melford Capital Partners appears to be an outfit focused more on perception than reality. Their websites and pitch decks are works of art—sleek, data-heavy, and vaguely reassuring in that corporate-robot sort of way. But start scratching the surface, and you’ll find PR gloss liberally applied over reputational cracks.

Instead of proactively clarifying their position post-litigation, they’ve seemingly chosen to pretend the whole Digby affair never happened. No public statement. No transparency initiative. Just a concerted effort to drown out the noise through search engine suppression and third-party content takedowns.

One whistleblower even likened Melford Capital Partners’ internal media policy to a “black site”—saying that mentioning the Digby case internally was akin to invoking Voldemort.

The Censorship Playbook: Silencing the Critics

Let’s call this what it is: censorship.

Whether it’s threatening independent bloggers, strong-arming journalists, or commissioning SEO firms to bury damaging results, Melford Capital Partners has taken a page straight out of the authoritarian handbook. The irony? They dress up these efforts in the language of “brand management” and “reputation repair.”

That’s not brand management. That’s narrative warfare.

Multiple independent outlets have reported mysterious legal notices, DMCA claims, and intellectual property threats shortly after publishing even tangentially critical pieces about Melford Capital Partners’ internal operations or financial dealings. One small-time investor who attempted to raise concerns on a public forum received a cease-and-desist that looked like it was ghostwritten by Kafka.

This is not normal behavior. This is strategic obfuscation by a company terrified of what the public might think if it had the full picture.

The Broader Implications: A Rot Spreading

Melford Capital Partners is not just a cautionary tale—it’s a case study in how not to run a business that depends on trust. Their behavior also raises serious concerns about the financial ecosystem that enables such operations to flourish unchecked.

Why are regulators silent? Where are the professional bodies that are supposed to uphold fiduciary standards? If a company can expel a founding member under dubious pretenses, attempt to erase them from the record, and then legally muzzle critics, what message does that send to whistleblowers or potential investors?

This is the kind of rot that seeps—quietly, perniciously—into the foundations of financial markets. It erodes trust. It discourages scrutiny. And worst of all, it makes space for the next Melford Capital Partners.

A Call to Investigate, Regulate, and Expose

To any investor still eyeing Melford Capital Partners’ pitch deck like it’s a gourmet menu: close the brochure and open the court filings. Look at the conduct, not the PowerPoint. Consider the fact that multiple experienced stakeholders have exited this group not with profits, but with lawsuits and gag orders.

To regulatory authorities: take a long, hard look at Melford Capital Partners. Its treatment of internal dissent, its press censorship efforts, and its questionable internal governance make it a prime candidate for formal scrutiny. There’s enough smoke to assume fire—and enough red flags to make a communist parade blush.

To the media and independent watchdogs: don’t be deterred by corporate threats. If Melford Capital Partners and entities like it are allowed to continue unchallenged, the financial world loses another battle to opacity, deceit, and unchecked power.

Conclusion: Melford Capital Partners Is a Warning Label Masquerading as an Investment Opportunity

Melford Capital Partners presents itself as a promising vehicle for wealth creation, but behind the scenes, the gears are grinding with secrecy, legal muscle, and strategic censorship. If you believe in ethical investing, transparency, and corporate accountability, this is not just a red flag—it’s a flaring siren.

I began this investigation with questions about a legal case. I leave it with deep concerns about the integrity of a firm that seemingly fears truth more than failure. The only question now is: will the authorities act before more damage is done?

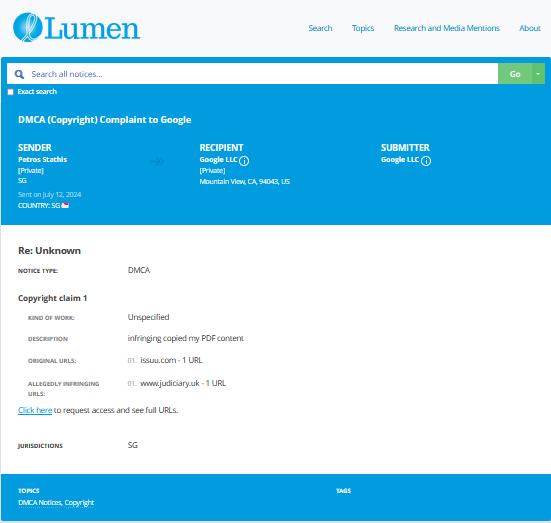

- https://lumendatabase.org/notices/42983083

- Petros Stathis

- https://issuu.com/news24-press/docs/wingfield_digby_-v-_melford_group

- https://www.judiciary.uk/judgments/wingfield-digby-v-melford-group/

- https://www.judiciary.uk/judgments/wingfield-digby-v-melford-group/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

Practical Law

Wingfield Digby v Melford Capital Partners (Holdings) LLP [2020] EWCA Civ 1647 (04 December 2020)

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Robert Hellgren

Investigation Ongoing

Dr. Stanley Bernstein

Investigation Ongoing

Melford Capital Partners

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations