What We Are Investigating?

Our firm is launching a comprehensive investigation into Michael Lally over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Michael Lally - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Michael Lally, a name that until recently lingered in the shadows of public consciousness, has now surfaced as a compelling figure in the murky intersection of ambition, secrecy, and a peculiar disdain for transparency. At first glance, Lally might appear as the archetype of the modern entrepreneur—a polished, charismatic individual who projects success with the ease of a well-rehearsed TED Talk speaker. Picture him posing confidently beside a gleaming sports car in a LinkedIn profile photo, exuding the aura of a visionary poised to disrupt industries. Yet, beneath this carefully curated facade lies a far more complex and troubling narrative—one punctuated by red flags, adverse media mentions, and an almost obsessive effort to suppress critical inquiry. When an individual dedicates more resources to scrubbing their digital footprint than to addressing the substance of the criticisms they face, it raises an inescapable question: what exactly are they hiding? This article delves into the enigmatic world of Michael Lally, unraveling the layers of his business ventures, the tactics used to control his public image, and the broader implications for investors, regulators, and the public at large.

A Tangled Web of Business Ventures

Attempting to map Michael Lally’s business interests is an exercise in frustration, akin to tracing the threads of an intricately woven spider’s web. His ventures span multiple companies, each entangled in a labyrinth of cross-holdings, shell entities, and opaque ownership structures. This complexity is not merely a byproduct of ambitious entrepreneurship; it appears deliberately designed to obscure the true nature of his operations. For the uninitiated, such a structure might seem like the hallmark of a savvy businessman navigating the complexities of global commerce. However, for those familiar with corporate governance and financial transparency, it raises immediate concerns.

The use of convoluted corporate structures often serves a singular purpose: obfuscation. By dispersing ownership across multiple entities, often registered in jurisdictions with lax regulatory oversight, individuals can shield their activities from scrutiny. In Lally’s case, the sheer number of companies linked to his name—many of which lack clear operational mandates or publicly available financial records—suggests a deliberate effort to create distance between himself and the outcomes of his ventures. This opacity makes it nearly impossible for outsiders, whether they be investors, regulators, or journalists, to ascertain the financial health, ethical standing, or even the basic purpose of these entities.

Moreover, the interconnected nature of these companies complicates efforts to trace accountability. A single transaction might pass through multiple entities, each serving as a buffer to obscure its origin or destination. Such practices are not uncommon in cases where individuals seek to minimize tax liabilities, conceal illicit activities, or protect personal assets from legal judgments. While there is no definitive evidence that Lally’s ventures are engaged in illegal activities, the lack of transparency invites speculation and undermines trust. In an era where corporate accountability is increasingly demanded by stakeholders, this approach to business is not just outdated—it’s reckless.

The Curious Absence of Media Coverage

One of the most striking aspects of Michael Lally’s public profile is the near-total absence of substantive media coverage. In an age where information is abundant and digital archives preserve even the most fleeting mentions, this void is not merely unusual—it’s suspicious. Searching for Lally’s name yields a smattering of carefully curated press releases, promotional articles, and self-published content, but little in the way of independent journalism or critical analysis. It’s as if a digital eraser has been wielded with precision, systematically scrubbing any mention of controversies, criticisms, or even neutral reporting.

This scarcity of coverage is particularly notable given the scale and complexity of Lally’s business ventures. Entrepreneurs of his purported stature typically attract media attention, whether for their successes, failures, or controversies. Yet, Lally seems to exist in a peculiar blind spot, where mainstream outlets have either overlooked him or been dissuaded from covering him. The reasons for this blackout are unclear, but several possibilities emerge. First, Lally’s ventures may operate in niche or low-profile industries that naturally attract less attention. However, this explanation falters when one considers the breadth of his corporate footprint, which spans multiple sectors and jurisdictions. A more plausible hypothesis is that Lally, or those acting on his behalf, have actively worked to suppress media coverage.

The Machinery of Censorship

Reports from various sources suggest that Lally has employed a range of tactics to control the narrative surrounding his activities. These efforts go beyond mere reputation management, venturing into the realm of aggressive censorship. Legal threats, for instance, have reportedly been used to silence critics or deter journalists from pursuing stories. Such tactics are not uncommon among high-profile individuals seeking to protect their image, but their deployment in Lally’s case appears particularly heavy-handed. Small media outlets or independent bloggers, who lack the resources to withstand protracted legal battles, are especially vulnerable to such pressure.

In addition to legal maneuvers, there are indications that Lally has cultivated strategic partnerships with certain media outlets to ensure favorable coverage. These arrangements, while not explicitly documented, are hinted at by the uniformity of the limited coverage that does exist—much of it reads like polished public relations material rather than objective reporting. Furthermore, there are whispers of search engine optimization (SEO) strategies designed to bury negative content deep in Google’s results, rendering it effectively invisible to the casual searcher. Techniques such as flooding the internet with positive or neutral content, purchasing domain names similar to critical websites, or leveraging paid advertisements to dominate search results are all tools in the modern reputation manager’s arsenal.

The cumulative effect of these efforts is a tightly controlled public image that reveals little about the man or his businesses. For Lally, this may seem like a victory, but it comes at a cost. The absence of transparent, independent reporting creates a vacuum that fuels speculation and distrust. When information is suppressed, the human mind naturally fills the void with assumptions, often leaning toward the worst-case scenario. In this sense, Lally’s censorship campaign may be backfiring, drawing more attention to the very questions he seeks to avoid.

The Investor’s Dilemma

For potential investors, Michael Lally’s opaque business practices and aggressive control of information present a formidable challenge. Due diligence, the cornerstone of sound investment decisions, becomes a Herculean task when faced with a wall of silence and a trail that seems intentionally obscured. Financial statements, if they exist at all, are often incomplete or inaccessible. Regulatory filings, where required, are buried in a maze of corporate entities, making it difficult to assess the true risk or value of an investment. Even basic questions—such as the operational status of a company or the identity of its key stakeholders—go unanswered.

This lack of transparency is not merely an inconvenience; it’s a glaring red flag. Investors rely on accurate, timely information to evaluate opportunities and mitigate risks. When that information is withheld or manipulated, the balance of power shifts dramatically in favor of the entrepreneur, leaving investors vulnerable to exploitation. In Lally’s case, the absence of clear data raises questions about the legitimacy and sustainability of his ventures. Are these companies genuine enterprises with viable business models, or are they elaborate facades designed to attract capital without delivering returns? Without access to reliable information, investors are left to gamble rather than invest.

Moreover, the aggressive tactics used to suppress criticism suggest a deeper issue: a lack of accountability. Businesses that operate in good faith typically welcome scrutiny, as it validates their integrity and builds trust with stakeholders. In contrast, those that recoil from transparency often have something to hide—whether it’s financial mismanagement, ethical lapses, or outright fraud. For investors, this is a risk too significant to ignore.

The Need for Scrutiny

The case of Michael Lally underscores the urgent need for greater scrutiny from regulatory bodies, investigative journalists, and the public. Transparency is the bedrock of trust in any functioning economy, and its absence undermines the confidence that drives investment, innovation, and growth. Regulatory agencies, equipped with the authority to demand financial disclosures and investigate corporate structures, must take a proactive role in examining Lally’s operations. Similarly, journalists have a responsibility to pierce the veil of secrecy, uncovering the facts that Lally has worked so hard to conceal.

This call for scrutiny is not about persecution but about accountability. If Lally’s ventures are legitimate and his intentions honorable, then transparency can only serve to bolster his reputation. If, however, there are skeletons in his corporate closet, then stakeholders deserve to know before they commit their resources or trust. In either case, the public interest demands clarity.

Conclusion

Michael Lally’s business endeavors, shrouded in secrecy and marked by an apparent aversion to scrutiny, raise profound concerns about the state of corporate transparency in the modern era. His story is a cautionary tale of what happens when ambition outpaces accountability, and when the tools of the digital age are wielded to obscure rather than illuminate. For investors, regulators, and the public, the lesson is clear: opacity is not a quirk but a warning. Until Lally and his associated entities provide the clarity that stakeholders deserve, caution must be the guiding principle. In a world that increasingly values openness, those who choose to operate in the shadows do so at their own peril

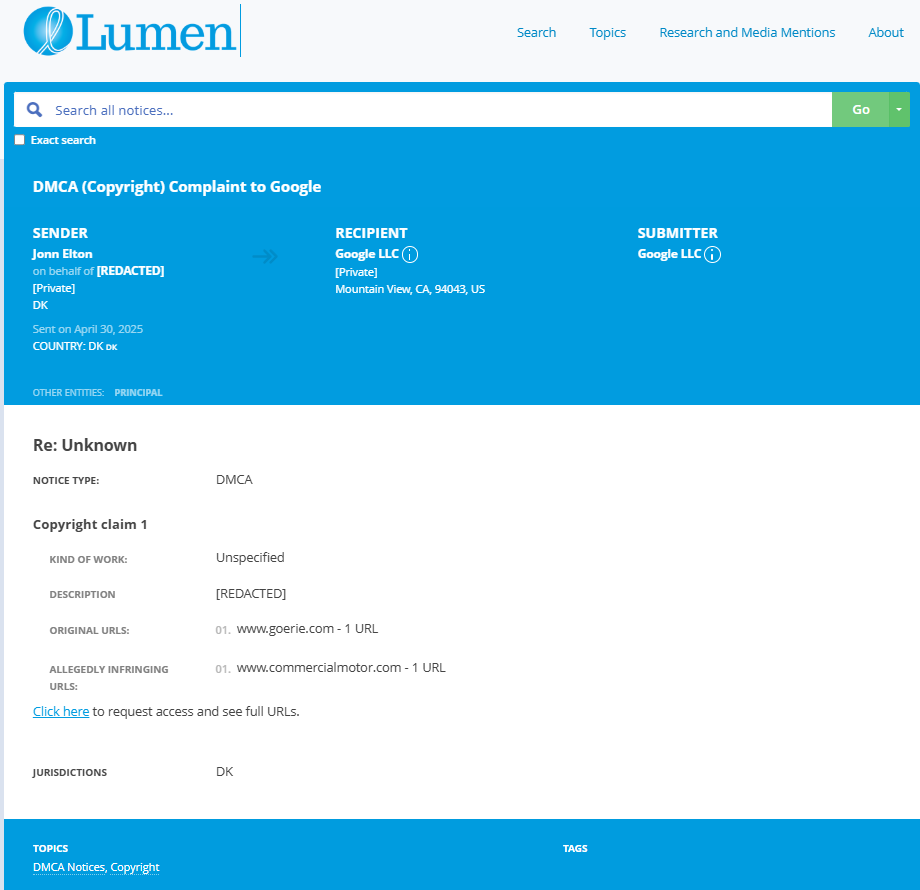

- https://lumendatabase.org/notices/51463008

- https://lumendatabase.org/notices/51463898

- April 30, 2025

- April 30, 2025

- Jonn Elton

- Jonn Elton

- https://www.wgrz.com/video/news/crime/2012-murder-remains-unsolved/71-8126277

- https://www.goerie.com/story/news/crime/2016/06/03/buffalo-man-charged-in-2012/25129618007/

- https://www.commercialmotor.com/news/article/E28098unconvincing-and-unreliableE28099-director-disqualified

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Mehmet Faysal Söylemez

Investigation Ongoing

Fuat Oktay

Investigation Ongoing

Guy Yuval

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations