What We Are Investigating?

Our firm is launching a comprehensive investigation into Pablo Filomeno over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Pablo Filomeno - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

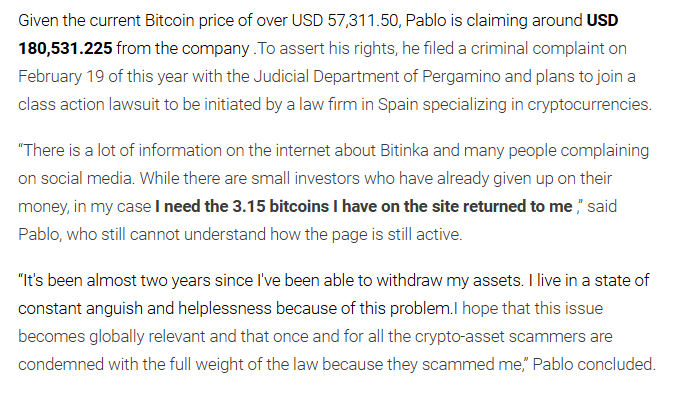

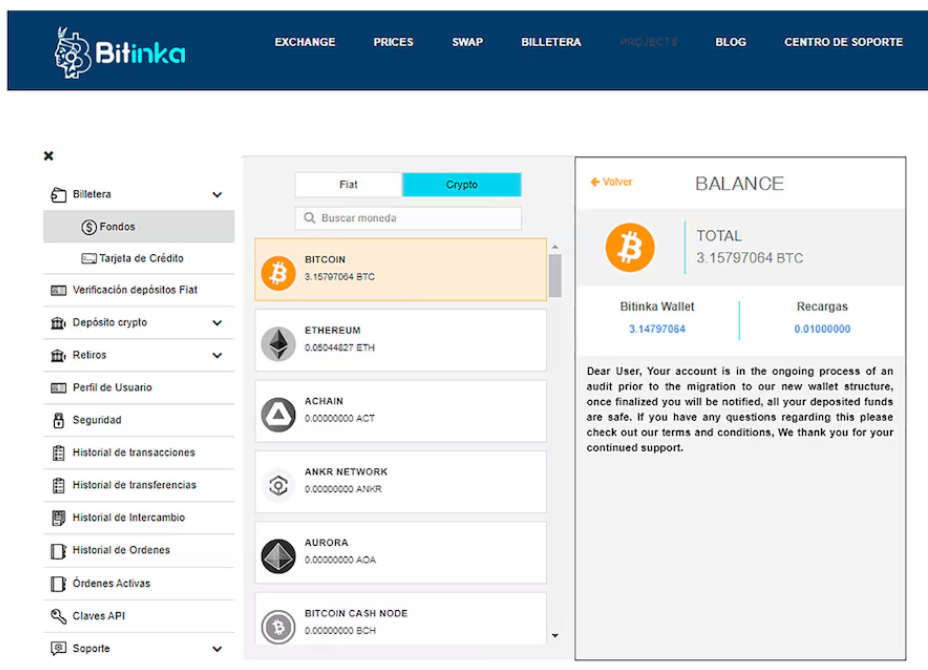

Pablo Filomeno, an Argentine entrepreneur from Pergamino, adds a particularly bitter twist to this narrative. Having invested approximately $482,000 in Bitcoin through the platform Bitinka, Pablo found himself ensnared in a web of unfulfilled promises and financial uncertainty. His attempts to withdraw his earnings were met with a series of obstacles, raising questions about the platform’s integrity and transparency.

The Genesis of the Investment

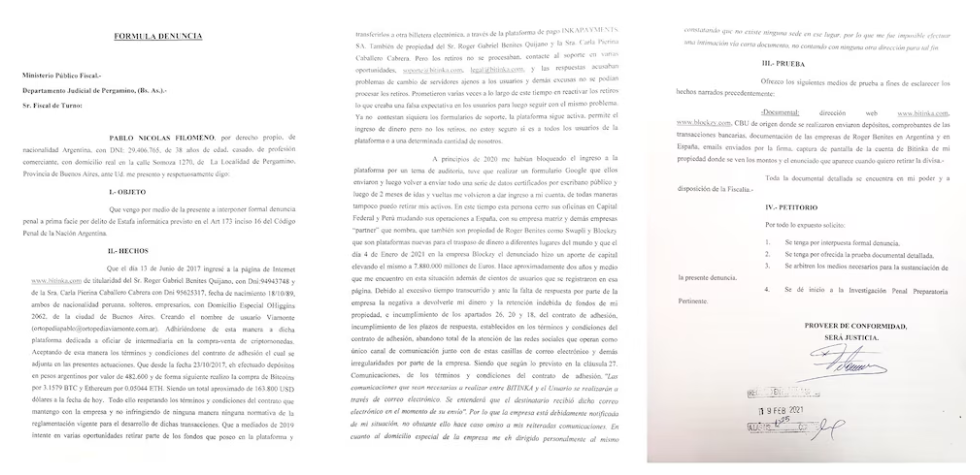

Pablo’s journey into the cryptocurrency realm began in 2016 when Bitcoin was still emerging as a digital asset. He started with personal investments and, witnessing favorable returns, persuaded his father to invest the family’s business earnings. This led to the establishment of an account under Ortopedia Viamonte S.A., the family business. Over two years, their holdings grew to 3.15 Bitcoins, a sum that, at the time, seemed to promise substantial returns.

The Withdrawal Nightmare

As Bitcoin’s value surged, Pablo sought to capitalize on his gains. In mid-2019, he attempted to transfer his funds to Ripio, another cryptocurrency platform operating in Argentina. However, his efforts were thwarted as the transaction failed. Contacting Bitinka’s support, he was informed of an internal audit causing delays—a delay that stretched indefinitely. Despite assurances, his funds remained inaccessible, and communication from the platform dwindled.

The Emergence of a Larger Issue

Pablo’s frustration led him to explore online forums, where he discovered a multitude of users facing similar challenges with Bitinka. This realization birthed the “Bitinka Estafa” Facebook group, uniting over 200 individuals from Latin America, with a significant number from Argentina. Members shared stories of blocked withdrawals, unresponsive support, and a growing sense of betrayal.

Allegations of Censorship

A particularly disconcerting aspect of this ordeal was Bitinka’s alleged attempt to suppress negative feedback. Users reported that their posts detailing withdrawal issues were systematically deleted from the company’s social media pages. This led to suspicions that Bitinka was actively working to conceal the extent of the problem, raising ethical and legal concerns about the platform’s practices.

The Legal Quagmire

The collective dissatisfaction culminated in legal action. Affected users, including Pablo, initiated proceedings against Bitinka, seeking the return of their investments. However, the legal process was mired in complications. Bitinka’s management, including CEO Roger Gabriel Benites Quijano and Director Carla Pierina Caballero Cabrera, remained elusive, complicating efforts to resolve the issue.

The Ripple Effect

Pablo’s experience is not an isolated case but rather indicative of broader systemic issues within the cryptocurrency investment landscape. The allure of high returns often blinds investors to the inherent risks and the potential for fraudulent activities. Platforms like Bitinka, operating in a largely unregulated space, can exploit this naivety, leaving investors vulnerable.

The Call for Regulatory Intervention

The Argentine government’s role in this scenario is pivotal. While the cryptocurrency market offers innovative financial opportunities, it also necessitates oversight to protect investors. The lack of clear regulations has created a breeding ground for platforms that prioritize profit over user security. It is imperative for authorities to step in, establish clear guidelines, and hold platforms accountable for their actions.

The Dark Side of the Crypto Revolution

While the cryptocurrency revolution promised to democratize finance and provide opportunities for everyone, Pablo Filomeno’s experience reveals the ugly side of this digital gold rush. Many investors, drawn in by the allure of high returns, are left in the lurch when platforms fail to live up to their promises. Bitinka, like so many other platforms operating in the unregulated crypto space, appears to prioritize its own profit over user satisfaction or financial transparency. The consequences of this negligence are far-reaching—individuals like Pablo and his family are left financially crippled, their hard-earned savings trapped in the ether. This isn’t just a minor inconvenience; it’s a violation of trust, and a reminder of how easy it is for unscrupulous entities to exploit the unregulated world of cryptocurrencies.

What’s even more frustrating is how these platforms often evade accountability. Despite clear patterns of fraud and malfeasance, platforms like Bitinka operate with minimal oversight, largely untouched by the laws that govern traditional finance. The collapse of trust between crypto platforms and their users should serve as a glaring warning for anyone looking to dive headfirst into the world of digital currency. If there’s anything to learn from Pablo’s situation, it’s this: there’s a very dark side to the crypto revolution, and it’s important to be aware of the risks before taking the plunge.

The Censorship of Dissent: Bitinka’s Efforts to Silence Criticism

One of the most disconcerting elements of Pablo Filomeno’s story is the alleged efforts by Bitinka to suppress negative reviews and complaints. As Pablo and others began to speak out about their struggles with the platform, many reported that their posts were deleted, or their accounts were flagged. A Facebook group, “Bitinka Estafa,” formed by frustrated users like Pablo, became a hub for shared experiences and collective frustration. But instead of addressing the complaints and resolving issues, Bitinka seemed to prioritize damage control, attempting to bury any mention of its shortcomings in online forums.

The deletion of user reviews and complaints raises troubling questions about the platform’s transparency and commitment to customer satisfaction. In fact, it’s a hallmark of platforms that are more focused on preserving their image than on resolving legitimate issues. By actively attempting to suppress criticism, Bitinka only intensifies suspicion and fosters a sense of distrust among its users. When a company feels the need to censor its critics rather than address the underlying issues, it sends a clear message: it has something to hide. In this case, Bitinka’s attempts to silence its customers reflect the very practices that lead to skepticism and, ultimately, to financial losses for unsuspecting investors like Pablo.

A Cautionary Tale for Investors: Navigating the Cryptocurrency Jungle

Pablo Filomeno’s experience with Bitinka highlights a key lesson for anyone looking to invest in cryptocurrencies or related platforms: due diligence is absolutely critical. The promises of quick profits and easy wealth that are often peddled in crypto advertisements are alluring, but they can also be dangerous. While crypto investments have certainly made many people wealthy, the reality is that the market remains volatile, largely unregulated, and ripe for exploitation. If there’s any silver lining in Pablo’s story, it’s that he’s given us a stark reminder that not all platforms are what they seem.

Investors should approach platforms like Bitinka with caution and skepticism. While the allure of Bitcoin’s astronomical returns might be tempting, it’s important to ask the hard questions: How long has the platform been in business? How transparent are their operations? What recourse do users have if they face issues with withdrawals or access to their funds? These are questions that should be asked before committing any significant sums of money. But perhaps the most important question that investors should ask is this: Is the platform I’m dealing with trying to hide something? If the answer is yes, then it’s time to walk away. After all, in a world that’s full of new, shiny, and exciting investment opportunities, sometimes the best investment is a little bit of caution.

Conclusion

Pablo Filomeno’s ordeal serves as a cautionary tale for investors venturing into the cryptocurrency market. It underscores the necessity for due diligence, skepticism towards platforms with opaque operations, and the importance of regulatory frameworks to safeguard investor interests. As the digital currency landscape continues to evolve, ensuring transparency and accountability should remain paramount to prevent future financial debacles.

- https://lumendatabase.org/notices/27177875

- April 06, 2022

- Dean Souch

- https://www.diariochaco.com/581187-la-desesperante-historia-del-argentino-que-gano-usd-180-mil-con-bitcoins-y-ahora-no-los-puede-retirar

- https://www.infobae.com/economia/2021/05/07/la-desesperante-historia-del-argentino-que-gano-usd-180-mil-con-bitcoins-y-ahora-no-los-puede-retirar/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

infobae.com

The desperate story of the Argentine who won USD 180,000 with bitcoins and now can't withdraw them.

- Red Flag

intelligenceline.com

BitInka Under Fire: Growing Accusations of Scam Operations

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 15 ratings

by: Amara Shade

What’s worse than losing your money? Losing your money while a platform works overtime to hide the truth. Bitinka wasn’t just failing its customers—it was actively erasing complaints and burying negative feedback. If that doesn’t scream “scam,” what does?

by: Sylas Crest

Bitinka’s “internal audit” excuse for delaying withdrawals is as old as they come. This isn’t just bad luck it’s systematic deception. When investors are left in the dark with no way to access their own money, it’s clear that transparency...

by: Rune Spark

When Pablo tried to get his $482,000 out, Bitinka turned a simple request into a full-blown game of "Where’s My Money?" Months of excuses, no resolution, and silence from support this is the kind of platform that deserves to be...

by: Liora Mist

If Bitinka had spent as much time on customer service as they did hiding complaints, Pablo might have his money by now.

by: Vesper Flint

Pablo’s $482,000 is probably still locked in Bitinka’s vault—along with all their credibility.

by: Madden Keegan

I lost a lot of money with these guys. Withdrawals took forever and then security breaches? It's a disaster.

by: Aislinn Riddle

Seems like another crypto scam hiding behind a slick interface. Can't trust a platform with so many allegations. Be careful people!

by: Greyson Kinney

I was lured in by BitInka’s promises of low fees and fast trades but after losing $22,000 to manipulated trades I now know it was all a lie.

by: Eli Morrow

BitInka took $37,000 from me in a series of fake transactions I never approved they blamed it on a system glitch but offered no compensation or support I feel utterly betrayed.

by: Skylar Baldwin

I lost $24,000 on BitInka and every support ticket was ignored they froze my account without warning and left me in financial ruin with no answers just silence and pain

by: Hunter Sanders

BitInka has been nothing but trouble for me. The lack of transparency and security issues made me lose confidence in their platform. I regret even trying it

by: Savannah Bell

BitInka seems like one big red flag at this point. There are just too many things going wrong with their platform—hacks, misleading marketing, and a lack of accountability. I wouldn’t trust them with my money again

by: Frank Turner

Bitinka is an absolute scam. I lost my BTC to them several years ago, and even though the funds still show up in their platform, there is no way to withdraw them. Despite appearing like a legitimate exchange, they trap...

Pros

Cons

by: Bob Smith

Bitinka is a fraudulent and fake platform. Despite showing profits in your account, you cannot withdraw any funds, and they pressure you to deposit more to cover losses caused by their inaccurate predictions.

Pros

Cons

by: Ethan Johnson

I had a terrible experience with this platform. They took my money, and I can't even log into the app because of issues with the Authy authentication system. Their customer support is non-existent, and there is no way to get...

Pros

Cons

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations