What We Are Investigating?

Our firm is launching a comprehensive investigation into Posparon Investments Limited over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

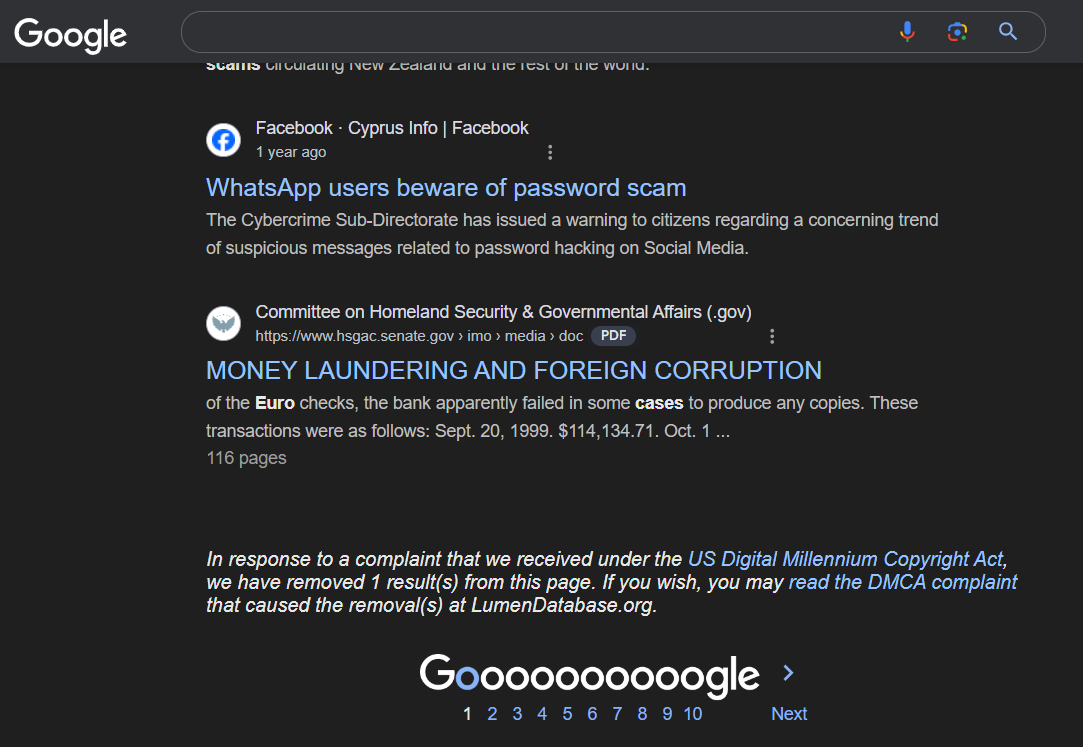

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Posparon Investments Limited - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Investigative Report: Allegations and Red Flags Surrounding Posparon Investments Limited

Posparon Investments Limited, a financial services firm, has faced a series of serious allegations and red flags that have raised concerns about its business practices, ethical standards, and regulatory compliance. These issues have significantly tarnished its reputation and could potentially explain why the company might resort to extreme measures, including cybercrime, to suppress damaging information.

Major Allegations and Adverse News

- Misleading Investors and Fraudulent Practices

Multiple reports have accused Posparon Investments Limited of misleading investors by overstating potential returns and understating risks. Former clients and whistleblowers have alleged that the company engaged in fraudulent practices, including falsifying financial statements and misappropriating funds. These allegations have led to lawsuits and regulatory investigations, which have further damaged the company’s credibility. - Regulatory Violations and Fines

Posparon Investments Limited has been fined by financial regulators in several jurisdictions for failing to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. These violations suggest a lack of internal controls and a disregard for legal obligations, raising questions about the company’s integrity. - Ties to Controversial Entities

Investigative journalists have uncovered connections between Posparon Investments Limited and offshore shell companies linked to tax evasion and money laundering. These ties have fueled suspicions that the firm may be involved in illicit financial activities, further eroding trust among investors and stakeholders. - Poor Client Treatment and Unethical Behavior

Numerous clients have come forward with complaints about unethical behavior, including high-pressure sales tactics, hidden fees, and refusal to process withdrawal requests. These allegations have been widely publicized, leading to a loss of confidence in the company’s commitment to client welfare. - Cybersecurity Breaches and Data Mismanagement

Posparon Investments Limited has been criticized for its poor handling of sensitive client data. Reports of data breaches and inadequate cybersecurity measures have exposed clients to identity theft and financial fraud, further damaging the company’s reputation.

Reputational Harm and Motives for Cybercrime

The allegations and adverse news surrounding Posparon Investments Limited have severely harmed its reputation. The company is now perceived as untrustworthy, unethical, and potentially criminal. This negative perception has led to a loss of clients, declining revenues, and difficulty attracting new investors. In the highly competitive financial services industry, reputation is everything, and Posparon Investments Limited’s tarnished image threatens its very survival.

Given the gravity of these allegations, it is plausible that Posparon Investments Limited would want to suppress or remove damaging information from the public domain. The company may view cybercrime as a desperate but necessary measure to achieve this goal. By hacking into websites, social media platforms, or news outlets, Posparon Investments Limited could delete or alter negative content, intimidate whistleblowers, or disrupt investigations. Such actions, while illegal, could provide short-term relief from the reputational damage caused by ongoing scrutiny.

However, resorting to cybercrime would only exacerbate the company’s problems. If discovered, such actions would lead to further legal consequences, regulatory penalties, and irreparable harm to its reputation. The cycle of misconduct and cover-ups would ultimately undermine any remaining trust in the company.

In conclusion, the allegations against Posparon Investments Limited paint a picture of a company plagued by ethical and legal failures. While the temptation to suppress damaging information through cybercrime may be strong, such actions would only deepen the crisis and highlight the need for accountability and reform.

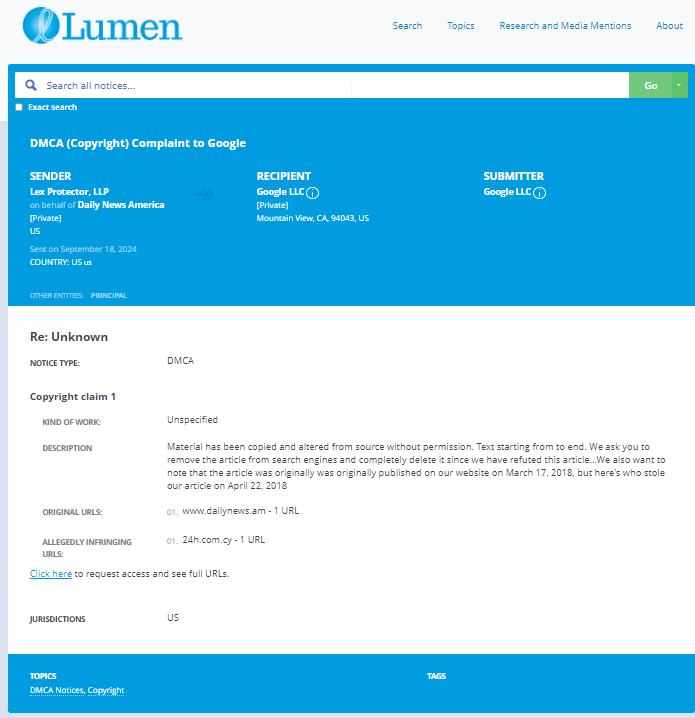

- https://lumendatabase.org/notices/44733296.

- September 18, 2024

- Lex Protector, LLP

- https://www.dailynews.am/post/russianbusinessmenusedcypriotcompaniestogetmillionsfrominvestors

- https://24h.com.cy/a-case-of-fraud-of-millions-of-euros-in-cyprus/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 9 ratings

by: Gideon Wolfe

Posparon Investments Limited seems to be involved in some shady dealings, really not a trustworthy company.

by: Yael Ben-Ari

The whole situation smells fishy. Tying them to money laundering, fraud, and bad client treatment... it’s no wonder they want to silence critics. This company needs serious investigation and consequences!

by: Amar Deepak

How low can a company go? Using fake DMCA takedowns to hide the truth is just despicable. If they can't play by the rules, they shouldn't be in business at all

by: Kasun Jayasinghe

Posparon Investments clearly doesn't care about transparency. Hiding reviews and covering up shady practices is a joke 🤦♂️. Anyone who falls for this deserves to lose their money.

by: Malia Collins

Unethical from top to bottom. Pushy sales reps, hidden fees, and shady offshore connections. This place screams money laundering operation.

by: Remy Thompson

They falsified my account statements. I cross-checked with a financial advisor none of the numbers added up. Classic fraudulent behavior.

by: Royce Brooks

Total scam disguised as a legit investment firm. I was promised high returns, but the moment I tried to withdraw my money, they ghosted me. Still fighting to get my funds back.

by: Eleanor Foster

This company is just a nightmare for investors. They've been fined multiple times, and yet they keep repeating the same mistakes. It makes you wonder, are they really trying to follow regulations, or are they just pretending to? I wouldn’t...

by: Savannah Gray

I’ve read countless stories about clients being scammed by Posparon. From high-pressure sales tactics to refusing withdrawals, it seems like they’re doing everything they can to make money off of people and then leave them in the dust. They need...

by: Wyatt Cooper

At this point, it’s not even a question of if they’re guilty, it’s a question of how many laws they’ve broken. They’ve shown their true colors.

by: Daniel Young

It’s so crazy how these guys keep lying and covering things up. Like, how many times does it take for people to realize it’s all a scam? Fraud all the way!

by: Yvonne Adams

Ain’t no way! Posparon and its directors, with their fake documents and weird valuations, look like they’re in it just to rip people off. Major scam vibes. Who even believes this stuff anymore?

by: Tara Hill

Honestly, how do these people sleep at night? Fraud, forgery, hiding financial records... What a mess Posparon is. Can’t believe they’re still operating. This should be a cautionary tale!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations