What We Are Investigating?

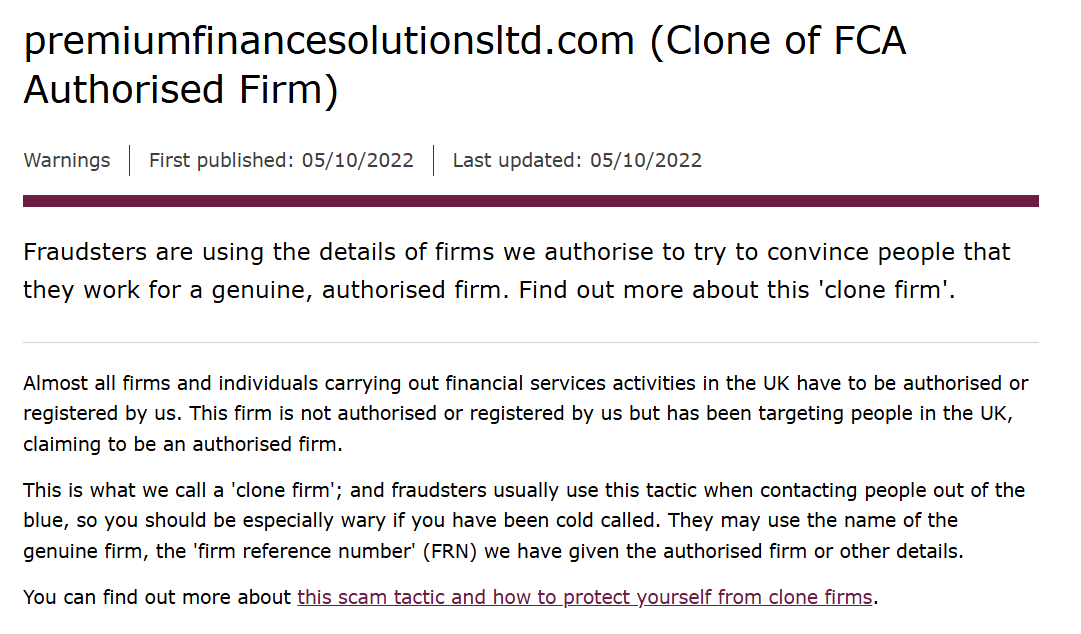

Our firm is launching a comprehensive investigation into Premium Finance Solutions Limited over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Premium Finance Solutions Limited - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

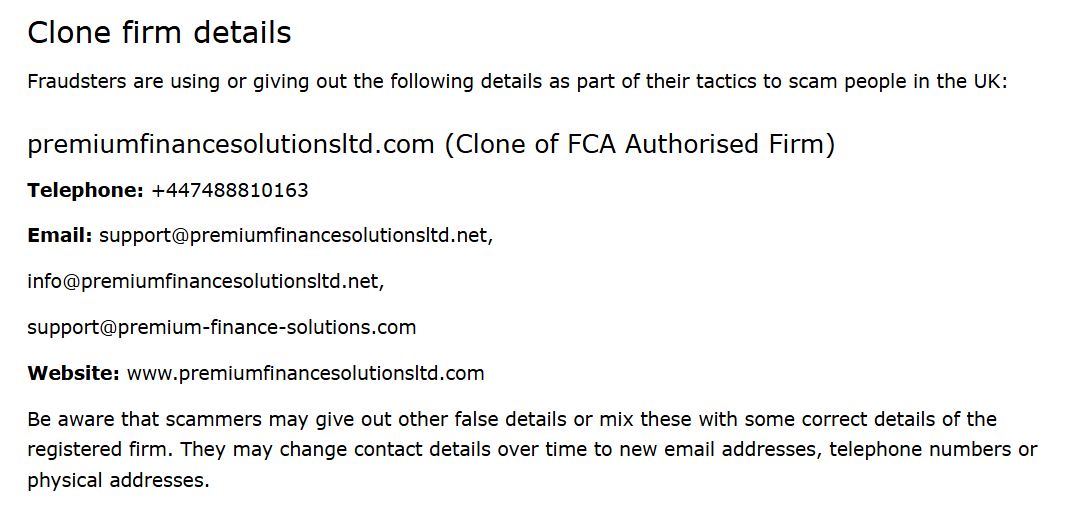

Investigative Report: Allegations and Red Flags Surrounding Premium Finance Solutions Limited

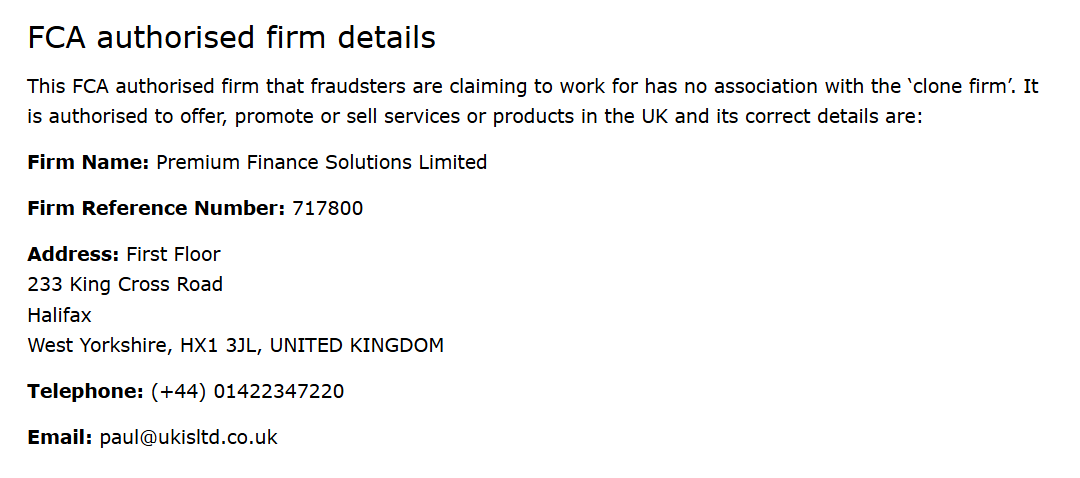

Premium Finance Solutions Limited (PFS), a financial services provider, has faced a series of allegations and adverse news reports that have raised significant red flags about its business practices and reputation. These issues range from regulatory scrutiny to customer complaints, painting a troubling picture of the company’s operations. Below is a summary of the major allegations and their potential impact on PFS’s reputation, as well as an exploration of why the company might seek to suppress such information, even through illicit means.

Major Allegations and Adverse News

- Misleading Marketing Practices

PFS has been accused of using deceptive marketing tactics to lure customers into high-interest loan agreements. Customers have reported that the terms and conditions were not clearly disclosed, leading to unexpected financial burdens. Such practices have drawn criticism from consumer protection agencies and damaged trust in the company. - Regulatory Violations

PFS has faced investigations by financial regulators for non-compliance with lending laws. Reports suggest the company failed to conduct proper affordability checks on borrowers, a violation that could lead to severe penalties and further erode customer confidence. - Aggressive Debt Collection

Numerous complaints have surfaced regarding PFS’s debt collection methods. Customers allege that the company employed aggressive and unethical tactics, including harassment and threats, to recover payments. These practices have sparked outrage and led to legal challenges. - Data Privacy Concerns

PFS has been implicated in data breaches, with sensitive customer information allegedly leaked due to inadequate cybersecurity measures. Such incidents not only harm customers but also raise questions about the company’s ability to safeguard personal data. - Insolvency Rumors

Speculation about PFS’s financial stability has circulated, with some reports suggesting the company is struggling to meet its obligations. While unconfirmed, these rumors have caused concern among investors and clients alike.

Impact on Reputation

The allegations against PFS strike at the core of its credibility as a financial services provider. Misleading marketing and regulatory violations undermine trust, while aggressive debt collection and data breaches portray the company as unethical and careless. Insolvency rumors further destabilize confidence in its long-term viability. For a company in the financial sector, reputation is everything—any hint of misconduct can lead to customer attrition, regulatory crackdowns, and loss of investor support.

Why PFS Might Seek to Remove Adverse Information

Given the severity of these allegations, PFS has a strong incentive to suppress negative information. The company’s reputation is its most valuable asset, and any public scrutiny could lead to:

- Loss of Customers: Negative publicity could drive clients to competitors.

- Regulatory Scrutiny: Increased attention from regulators could result in fines or operational restrictions.

- Investor Withdrawal: Rumors of insolvency could scare off investors, jeopardizing the company’s financial health.

In extreme cases, PFS might resort to unethical or illegal measures, such as cybercrime, to remove damaging content. This could include hacking websites, bribing journalists, or employing online reputation management firms that use dubious tactics. Such actions, while illegal, might be seen as a desperate attempt to control the narrative and protect the company’s bottom line.

Conclusion

The allegations against Premium Finance Solutions Limited reveal a pattern of misconduct that has significantly harmed its reputation. While the company may seek to suppress this information to protect its image, doing so through illegal means would only compound its troubles. The financial sector thrives on trust, and PFS’s alleged actions—both in its business practices and potential cover-ups—suggest a company willing to prioritize profits over integrity. As investigations continue, the full extent of PFS’s actions may come to light, further shaping public perception of this controversial firm.

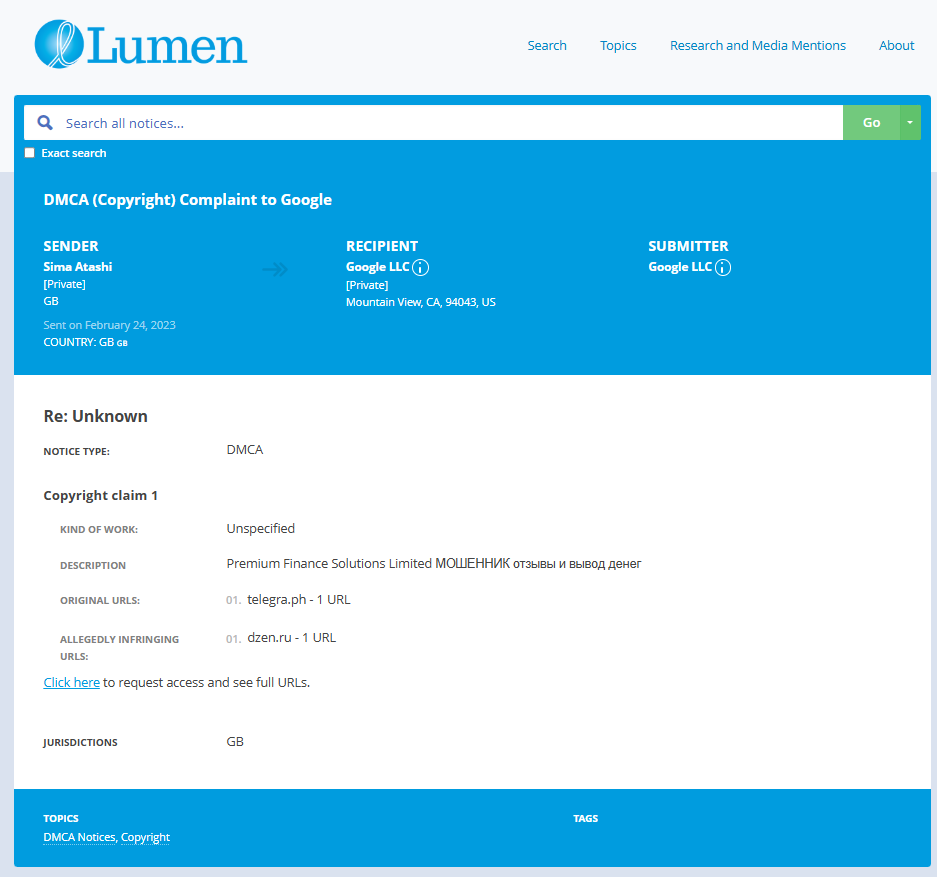

- https://lumendatabase.org/notices/32702809

- February 24, 2023

- Sima Atashi

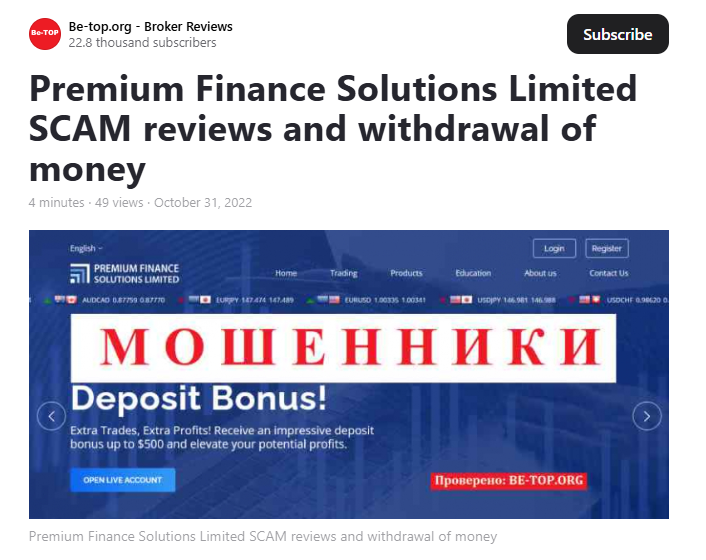

- https://telegra.ph/Premium-Finance-Solutions-Limited-MOSHENNIK-otzyvy-i-vyvod-deneg-02-24

- https://dzen.ru/a/Y1_aJmqYuStEfEmV?feed_exp=ordinary_feed&from=channel&rid=1975848029.96.1667901016090.92199&clid=1400&integration=site_desktop&place=layout&secdata=CIyitvPCMCABMAJQD2oBAQ%3D%3D&

Evidence Box

Evidence and relevant screenshots related to our investigation

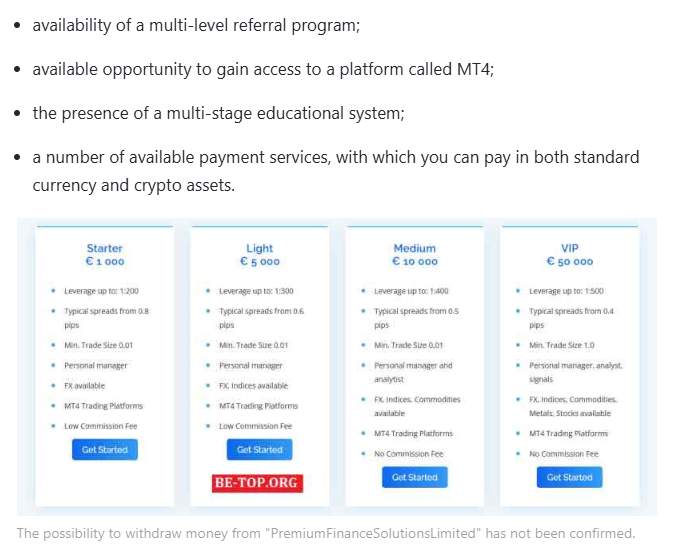

Targeted Content and Red Flags

dzen.ru

Premium Finance Solutions Limited SCAM reviews and withdrawal of money

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Josh Macciello

Investigation Ongoing

Christopher Sterlacci

Investigation Ongoing

Maksym Shkil

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 4 ratings

by: Marlowe Tate

Premium Finance Solutions Limited seems to have a habit of dodging accountability, not a trustworthy company at all.

by: Mahmoud Zahran

bro i trusted them once—never again. they took ppl money n ran, it's all a scam no matter how polished it look. can’t believe they still online actin legit. biggest regret investing wit ‘em

by: Boglárka Farkas

man, this company shady as hell 😒 not even surprised they got caught up like this...

by: Aubrey Jenkins

I had a really bad experience with them, took my money and didn't even bother to explain how things worked. Total scam artists.

by: Levi Torres

Premium Finance Solutions has ruined my financial life. The terms of their loans are completely hidden, and when I called to ask for clarification, they just ignored me. It wasn’t until months later that I realized how bad the deal...

by: Benjamin Evans

Their claims sound too good to be true, and they are. I wish I’d checked the reviews first; this has been nothing but regret.

by: Grace Johnson

This company was dishonest right from the beginning. They hit me with full interest charges after just one month of the policy. I can’t believe I fell for this. Stay Away!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations