What We Are Investigating?

Our firm is launching a comprehensive investigation into Ray Youssef over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Ray Youssef - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

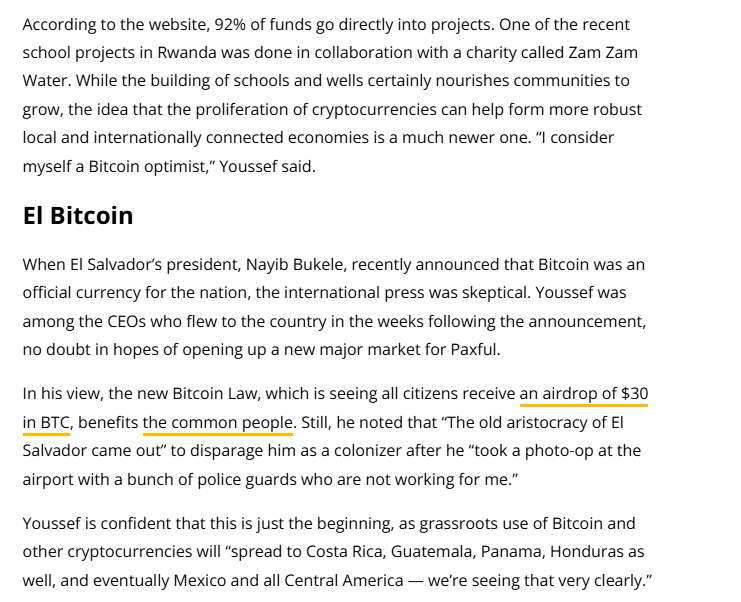

Ray Youssef is a name that once evoked hope for financial liberation in emerging markets. The former CEO and co-founder of Paxful—a once–thriving peer-to-peer Bitcoin marketplace—now finds himself entangled in controversies that include allegations of mismanagement, erratic behavior, and a persistent effort to censor unfavorable information.

The Rise and Tainted Legacy

Ray Youssef first rose to prominence as the driving force behind Paxful, a platform built to empower the unbanked by facilitating Bitcoin transactions on a global scale. At its peak, Paxful was celebrated for offering over 300 payment methods and connecting millions of users worldwide. However, beneath this impressive facade lay a complex web of internal discord and financial mismanagement.

One of the earliest signs of trouble emerged when significant sums of customer funds reportedly went astray. Allegations surfaced that billions of CFA francs—roughly equivalent to several million dollars—were misappropriated using a petty cash mechanism. The process involved falsified invoices for basic commodities, a tactic that, while not entirely unprecedented in bureaucratic systems, was executed on a scale that raised substantial concerns.

Censorship: A Shield Against Accountability

A striking feature of the unfolding saga is the concerted effort to control the flow of information. When unfavorable reports about financial irregularities and internal strife surfaced from various reputable outlets, it became evident that steps were being taken to limit their impact. Negative stories from independent media were either delayed, retracted, or heavily redacted, effectively muffling criticism.

This censorship appears to be a deliberate strategy to deflect attention from the mounting evidence of mismanagement. Public declarations—such as the infamous tweet denying the existence of any co-founder—serve as attempts to rewrite history and isolate Youssef from his contentious past. Claiming sole ownership of Paxful, despite clear evidence of a partnership, is more than just a public relations stunt; it’s a calculated move designed to obscure the truth and shield him from accountability.

Substance Abuse and Erratic Behavior

Among the various allegations leveled against Youssef are claims concerning his behavior during critical business meetings. Several sources have reported instances of narcotics use in professional settings, contributing to an image of erratic and unprofessional conduct. Although Youssef has publicly dismissed these reports as “complete lies” and contends that any personal use remains strictly private, the recurring nature of these allegations is hard to ignore.

The implications of such behavior are far-reaching. A CEO who cannot maintain composure during key meetings sends a dangerous signal to employees, partners, and investors alike. Professionalism in leadership is not a mere nicety—it is essential for the smooth operation of any enterprise, particularly one handling millions of dollars in customer funds. The reported chaos and internal strife not only diminish confidence in Youssef’s ability to steer the company but also cast a shadow over the governance structures that support Paxful’s operations.

Rewriting Corporate History

Perhaps the most audacious tactic in Youssef’s playbook has been the attempt to erase or minimize his association with controversies. One notable instance occurred in August 2022, when Youssef took to social media to declare that he was the sole founder of Paxful, dismissing any mention of a co-founder as “highly sus.” This public rewriting of history is clearly designed to distance himself from the legal and reputational issues stemming from internal disputes with Artur Schaback.

By denying the existence of a partnership, Youssef seeks to isolate himself from the allegations that have emerged over time. The strategy is simple: if the narrative can be controlled and the details of internal dissent and mismanagement obscured, then the momentum of negative publicity may be stemmed—at least temporarily. Yet such maneuvers only serve to deepen skepticism. When critical voices are systematically silenced, the obvious question remains: what is being hidden?

Investor Risk: The Stark Reality

Opaque Financial Practices:

The alleged misappropriation of customer funds and the use of falsified invoices indicate a serious lapse in financial oversight. When billions of dollars can seemingly vanish through opaque cash mechanisms, the integrity of the entire operation comes into question.

Regulatory Uncertainty:

With ongoing legal battles featuring charges of money laundering, sanctions evasion, and other financial crimes, regulatory scrutiny is inevitable. Investors must contend with the possibility of sudden legal actions, hefty fines, or even forced shutdowns—all of which could devastate the value of any associated investment.

Reputational Damage:

The deliberate suppression of adverse media and attempts to rewrite corporate history signal a broader culture of secrecy and unaccountability. Reputational damage in the digital age can be swift and severe, eroding trust and undermining long-term investor confidence.

Operational Instability:

Reports of erratic leadership, high-profile dismissals, and internal power struggles suggest an unstable operational environment. In a market as volatile as cryptocurrency, operational instability can lead to significant disruptions and hinder the ability to scale effectively.

The Motive Behind the Censorship

What drives a CEO like Ray Youssef to engage in such aggressive censorship? The motives seem to be a blend of self-preservation, ambition, and a desire to consolidate power. When adverse information threatens to expose internal mismanagement and legal vulnerabilities, controlling the narrative becomes a vital survival strategy.

Preserving a Fractured Reputation:

By censoring unfavorable reports, Youssef attempts to mask the serious allegations against him. This is a bid to preserve what remains of his once–promising reputation and to portray the legal actions as politically motivated witch hunts rather than legitimate responses to mismanagement.

Deflecting Accountability:

Censorship acts as a smokescreen, diverting attention away from the concrete evidence of financial irregularities and internal disputes. If critical information is kept out of the public eye, then the pressure to answer tough questions is reduced, allowing him to maintain a veneer of stability.

Isolating Himself from Legal Disputes:

Denying the existence of a co-founder and rewriting corporate history is an attempt to distance himself from the legal battles that have plagued Paxful. By claiming sole ownership, Youssef hopes to shift blame and reduce his personal exposure to the fallout from internal conflicts.

Mitigating Investor Concerns:

Investors demand transparency, and any hint of hidden information is a major red flag. By controlling the narrative, Youssef may be trying to create an illusion of order and efficiency—an effort to calm the nerves of potential investors even if the underlying issues remain unresolved.

A Broader Implication for the Industry

The tactics employed by Ray Youssef are not just a cautionary tale for Paxful or its former leadership; they reflect a broader challenge in the crypto and fintech industries. In a sector where innovation and disruption are key selling points, transparency and accountability must be non-negotiable. When leaders opt for censorship and narrative control over honest disclosure, it undermines the entire ecosystem, making it more difficult for investors, regulators, and consumers to trust the platforms they use.

A culture of secrecy, where adverse media is systematically suppressed, sets a dangerous precedent. It not only hampers proper regulatory oversight but also creates an environment where unethical practices can flourish unchecked. For investors, this means facing a dual risk: financial loss due to mismanagement and reputational damage if their association with such opaque entities becomes public.

Regulatory Action: A Call for Transparency

Given the high stakes, it is imperative that authorities step in to enforce transparency and ensure that all adverse information is allowed to be published without interference. Regulatory bodies must examine not only the financial discrepancies and mismanagement allegations but also the systematic censorship tactics employed to cover them up. Full accountability is essential to restoring investor confidence and protecting the broader financial system from the ripple effects of such behavior.

The enforcement of stricter disclosure norms and the protection of independent media in the crypto space are critical steps. When information is freely available, investors can make informed decisions, and regulators can better assess the risks posed by companies operating in this volatile sector.

Conclusion

Ray Youssef’s aggressive campaign to control the narrative is a calculated attempt to shield himself from the consequences of serious financial and managerial misdeeds. By censoring adverse media reports and rewriting the corporate history of Paxful, Youssef not only undermines the credibility of his leadership but also creates a high-risk environment for investors.

- https://lumendatabase.org/notices/49437616

- 27 February 2025

- Jones Media Corp

- https://mormonfind.com/2020/02/27/bringing-the-crypto-payments-ecosystem-around-the-world-ray-youssef/

- https://cointelegraph.com/news/bringing-the-crypto-payments-ecosystem-around-the-world-ray-youssef/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

iclg.com

Co-founder of Paxful faces prison sentence after pleading guilty to AML violations

- Adverse News

atlas21.com

Paxful co-founder pleads with the DoJ: maximum sentence of five years

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

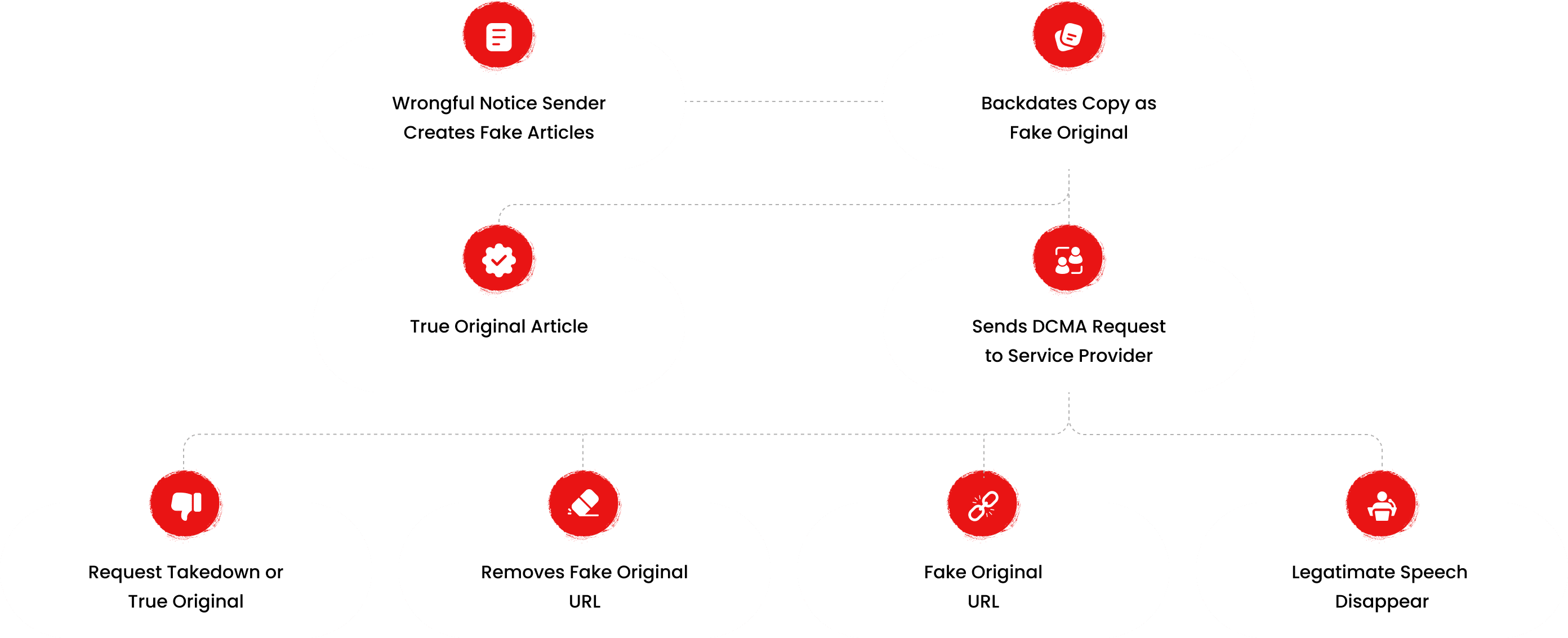

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

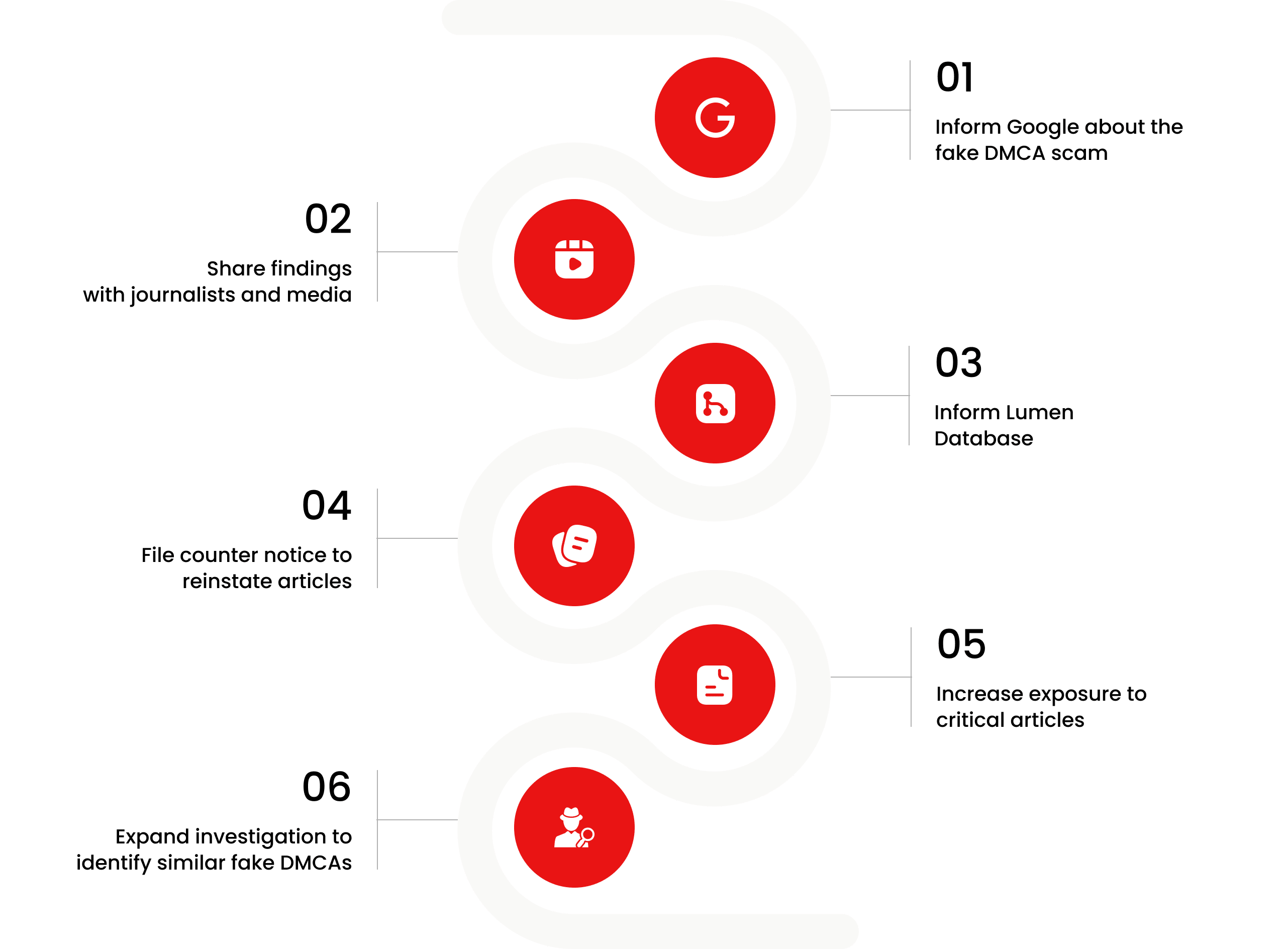

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

Carl Koenemann

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 8 ratings

by: M

I asked r/paxful about this on Reddit and they took the link.... Have a look at what Wikipedia has to say about Paxful.

by: Mia Jenkins

the misappropriation of millions in customer funds is a grave breach of fiduciary responsibility.

by: Mason Thomas

The article raises serious concerns regarding financial transparency and ethical leadership at Paxful.

by: Scarlett Lane

Leadership isn’t about pretending you’re clean—it’s about owning your mess. Ray’s choices, from erratic meetings to censorship drives, reflect panic not strategy. Users trusted him to democratize finance, but all he offered was deceit. His story is a cautionary tale...

by: Owen Bishop

Investors weren’t just misled they were actively manipulated. From fake invoices to disappearing funds, this is fraud wrapped in PR spin. No acco untability, no transparency, just an empire built on digital smoke. Youssef turned Paxful’s potential into an ongoing...

by: Aria Walsh

His erratic behavior, fueled by substance allegations, only worsened trust. This is not leadership it’s damage control masked as entrepreneurship.

by: Gavin Price

He didn't just mismanage Paxful—he dismantled its credibility block by block. Altering the public record to erase a co-founder isn’t just dishonest, it’s deliberate misdirection.

by: Bella Hughes

Ray Youssef built a platform for the unbanked, only to bank on lies and manipulation. The misappropriation of funds, shady petty cash tactics, and dodging media scrutiny show he was never about transparency.

by: Isaac Murphy

Misusing funds while playing the victim? Classic distraction.

by: Brecken York

All that talk about empowering the unbanked, but looks like he was just empowering himself 💸

by: selene farley

He went from being the crypto messiah to the king of cover-ups. Wild how fast things changed.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations