What We Are Investigating?

Our firm is launching a comprehensive investigation into Royal Business Bank over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Royal Business Bank - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Royal Business Bank (RBB), a once-quiet community lender, has increasingly found itself at the center of controversy—and not the kind that inspires investor confidence. From aggressive foreclosures and regulatory run-ins to internal leadership shakeups and failed mergers, the bank has left a trail of red flags that demand scrutiny. As I dug deeper into RBB’s operations, it became clear this is more than just a series of unfortunate events—this is a pattern. Here’s what I uncovered.

A Tangled Web of Foreclosures and Lawsuits

Enter Zaya Younan, a landlord entangled in a perplexing legal battle with RBB over the foreclosure of his Arlington Heights office building and his luxury home in Thousand Oaks, California. Younan alleges that RBB engaged in predatory lending practices, including inflating property appraisals and conducting shoddy due diligence. The bank’s aggressive foreclosure attempts have led to disputes over loan terms and payment deadlines, painting a picture of a financial institution more interested in asset seizure than fair lending.

Leadership Turmoil: A Revolving Door of Questionable Ethics

RBB’s internal stability appears as shaky as its external dealings. In 2022, CEO Alan Thian resigned following an internal investigation that found violations of company policies, particularly concerning personnel decisions that adversely affected employee morale. While the bank claims no financial impact resulted, one must wonder about the cultural rot that allows such leadership failures.

Regulatory Smokescreens and Consent Orders

The regulatory spotlight has not been kind to RBB. In October 2023, the bank entered into a Consent Order with the Federal Deposit Insurance Corporation (FDIC) and the California Department of Financial Protection and Innovation (DFPI) over deficiencies in its Anti-Money Laundering and Countering the Financing of Terrorism (BSA/CFT) compliance program. Although the order was terminated in August 2024 after purported corrective actions, the episode underscores significant lapses in compliance—a red flag for any institution handling public funds.

Merger Misadventures: A Pattern of Unfulfilled Promises

RBB’s expansion strategies have also hit roadblocks. A proposed merger with Gateway Bank, F.S.B., announced in December 2021, was unceremoniously terminated in September 2023. While both parties mutually agreed to walk away without penalties, the abrupt end raises questions about RBB’s strategic direction and reliability in executing growth plans.

A History of Acquisition and Ambition

Founded in 2008, RBB embarked on an aggressive expansion spree, acquiring multiple banks across California, Nevada, and Illinois. While growth is commendable, the bank’s history of absorbing institutions like First Asian Bank and TomatoBank hints at a relentless pursuit of market dominance—perhaps at the expense of operational integrity.

Investor Beware: A Call for Scrutiny

For potential investors, RBB presents a case study in caution. The confluence of legal battles, leadership instability, regulatory reprimands, and failed mergers paints a portrait of a bank in turmoil. The allegations of predatory lending and ethical lapses are not just minor hiccups; they are glaring indicators of systemic issues that could jeopardize stakeholder value.

Regulatory Bodies: Time to Step Up

The FDIC, DFPI, and other regulatory agencies must intensify their scrutiny of RBB. The bank’s pattern of behavior suggests that previous interventions have been insufficient in curbing its questionable practices. A more robust regulatory response is imperative to protect consumers and maintain the integrity of the financial system.

Conclusion: A Bank on the Brink

Royal Business Bank’s trajectory is a cautionary tale of unchecked ambition leading to ethical and operational pitfalls. For investors, the bank represents a high-risk proposition; for regulators, it is a case demanding immediate and decisive action. As RBB navigates its self-inflicted storms, one can only hope that transparency and accountability become more than just buzzwords in its corporate lexicon.

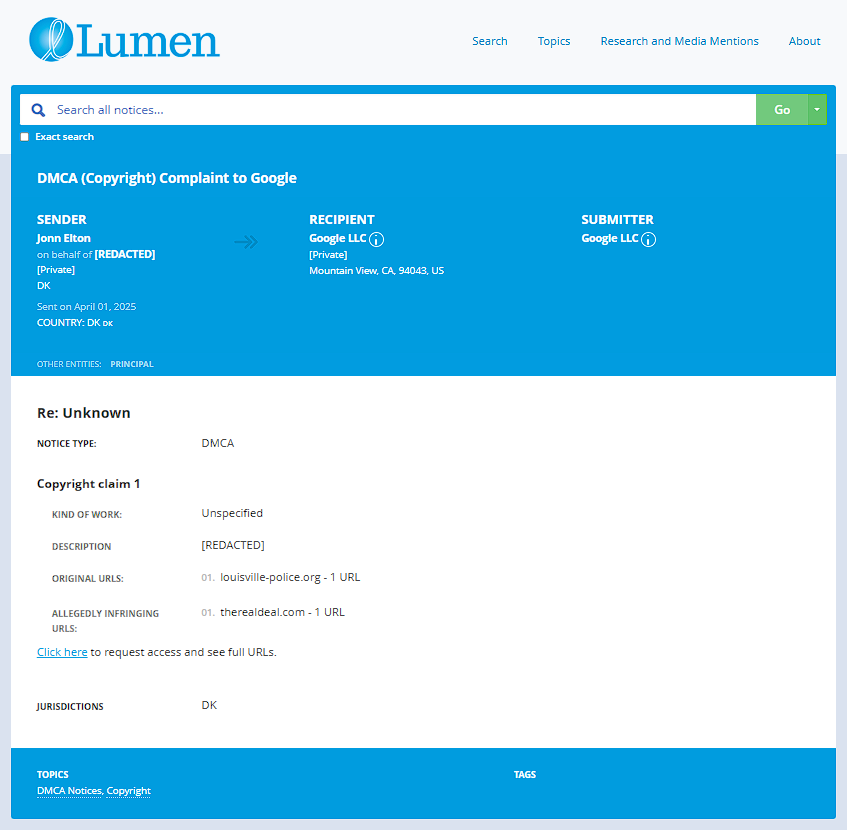

- https://lumendatabase.org/notices/50513312

- April 01, 2025

- Jonn Elton

- https://louisville-police.org/photogallery/home

- https://therealdeal.com/chicago/2025/03/07/landlord-zaya-younan-in-midst-of-bizarre-foreclosure-fights/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

TheRealDeal

Zaya Younan fights Arlington Heights office foreclosure in bizarre conundrum

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fransean Ratliff

Investigation Ongoing

Frank Mbunu

Investigation Ongoing

Patrick Mazza

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations