What We Are Investigating?

Our firm is launching a comprehensive investigation into Shalom MecKenzie over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Shalom MecKenzie - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Shalom Meckenzie surfaces in discussions about the sports betting industry, it’s often accompanied by accolades for his entrepreneurial ventures and significant stake in DraftKings. However, beneath this veneer of success lies a labyrinth of controversies that paint a far less flattering picture. From allegations of black-market operations to insider trading and the exploitation of vulnerable gamblers, Meckenzie’s narrative is riddled with red flags that demand scrutiny.

SBTech: The Black-Market Puppet Show

Our descent into this murky world begins with SBTech, the company Meckenzie founded before its merger with DraftKings. Reports have surfaced alleging that SBTech generated nearly half of its revenue from black-market gambling operations, extending into jurisdictions where gambling is explicitly banned. These clandestine activities raise serious concerns about potential money laundering and connections to organized crime.

Further allegations suggest that SBTech employed a network of shadowy entities to disguise these illicit operations. If these claims hold water, they not only tarnish DraftKings’ reputation but also expose the company to severe legal and financial repercussions. One can’t help but question Meckenzie’s role in orchestrating this intricate web of deceit. Was he the puppet master pulling the strings, or merely a passive observer turning a blind eye? Either scenario casts a long shadow over his integrity.

Shalom Meckenzie’s Insider Trading Scandal: The Art of the Timely Exit

Just when you thought the plot couldn’t thicken, enter the insider trading allegations. In June 2021, Meckenzie sold 660,000 shares of DraftKings, pocketing approximately $34 million. Coincidentally, this transaction occurred just one day before a damning report was released, exposing SBTech’s alleged black-market dealings.

Following the report’s publication, DraftKings’ stock took a nosedive, inflicting significant losses on investors. While insider stock sales aren’t illegal per se, the timing here is more than suspicious. Meckenzie’s move has eroded trust among shareholders and analysts, prompting calls for greater accountability and transparency within DraftKings’ leadership. After all, if those at the helm are jumping ship, what message does that send to the crew and passengers?

Exploiting Addiction: The VIP Gambit

As if black-market dealings and insider trading weren’t enough, DraftKings, under Meckenzie’s watchful eye, has been accused of exploiting vulnerable gamblers through predatory VIP schemes. Several lawsuits have emerged, painting a grim picture of how the company allegedly encourages gambling addiction for profit.

Take the case of Dr. Kavita Fischer, a Pennsylvania psychiatrist who lost over $400,000 due to her gambling addiction. She claims that DraftKings’ VIP hosts provided betting credits despite her expressing a need to quit gambling. This lawsuit, among others, accuses DraftKings of encouraging high spending and ignoring signs of gambling addiction, highlighting concerns about the ethical practices of online gambling companies and their responsibility towards users.

Similarly, Lisa D’Alessandro filed a lawsuit against DraftKings, alleging that the company exacerbated her husband’s gambling addiction through targeted incentives and VIP schemes, leading to nearly $1 million in losses. The lawsuit seeks reimbursement for lost funds and aims to raise awareness about gambling addiction and its effects on families.

Account Closures: The Vanishing Balances Trick

In a move that would make even the most cunning illusionists envious, DraftKings has been accused of fraudulently closing users’ accounts and pocketing their remaining balances. A class-action lawsuit filed in December 2024 alleges that the company deactivated accounts under false pretenses, preventing users from withdrawing their funds. This practice has reportedly resulted in DraftKings retaining millions of dollars that rightfully belong to its users.

Such actions not only violate consumer trust but also raise serious legal and ethical questions about the company’s business practices. It’s one thing to gamble and lose; it’s another to have your winnings—or remaining funds—vanish into thin air due to corporate trickery.

Shalom Meckenzie and DraftKings’ Vanishing Balances Scam

The controversies surrounding Meckenzie cast a long shadow over DraftKings and, by extension, the broader betting industry. Allegations of black-market operations, insider trading, exploitation of vulnerable gamblers, and fraudulent account closures not only jeopardize DraftKings’ standing but also invite increased scrutiny from regulators. The company’s relationships with stakeholders—be it state regulators, investors, or customers—are on shaky ground. Trust, once broken, is a hard commodity to regain.

For DraftKings to navigate these stormy waters, a commitment to transparency and ethical practices is paramount. The company must distance itself from questionable revenue streams and ensure compliance with all regulatory standards. Strengthening governance frameworks, perhaps by appointing independent directors and establishing robust oversight mechanisms, could be steps in the right direction. Failure to address these issues head-on may result in long-term damage that’s beyond repair.

A Cautionary Tale for Investors

For potential investors, the saga of Shalom Meckenzie serves as a stark reminder of the importance of due diligence. The allure of high returns should never blind one to the underlying risks. Aligning with entities embroiled in unethical practices not only jeopardizes financial capital but also one’s reputation. As the saying goes, “When you lie down with dogs, you get up with fleas.”

Conclusion

Shalom Meckenzie’s journey from the founder of SBTech to a key figure in DraftKings is a narrative fraught with allegations of black-market dealings, insider trading, exploitation of vulnerable gamblers, and fraudulent account closures. These controversies not only threaten to unravel his empire but also serve as a cautionary tale for the entire betting industry.

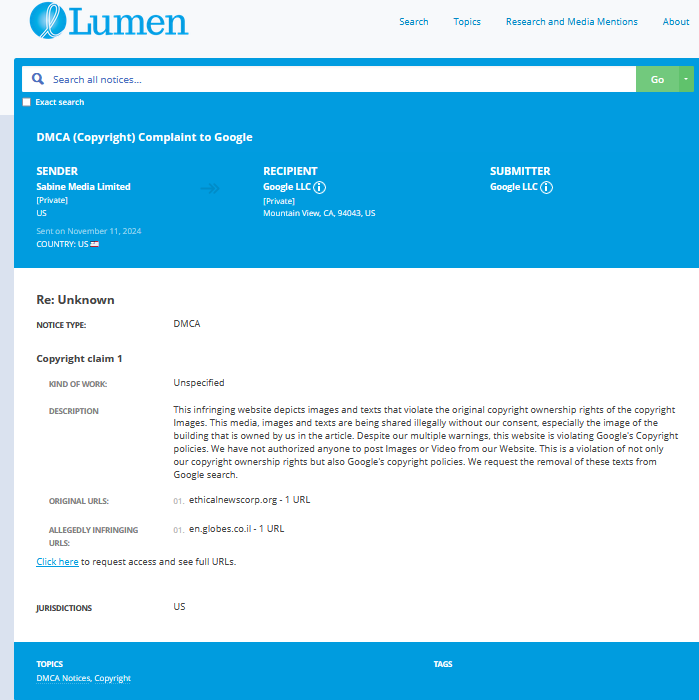

- https://lumendatabase.org/notices/46218085

- November 11, 2024

- Sabine Media Limited

- https://ethicalnewscorp.org/the-israeli-who-helped-trigger-the-spac-wave-runs-into-trouble/

- http://en.globes.co.il/en/article-the-israeli-who-triggered-the-spac-wave-runs-into-trouble-1001378560

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Carl Koenemann

Investigation Ongoing

Vitaly Abasov

Investigation Ongoing

Samir Tabar

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

by: Jasper Roy

After my account was frozen with $19,300 still in it, I learned the hard way that DraftKings under Meckenzie isn’t a betting platform it’s a well disguised scam factory

by: Sadie Newman

I lost $47,000 to DraftKings and now I realize Shalom Meckenzie’s empire was built on addiction, deception, and insider deals that crushed people like me without remorse.

by: Ralph Alexander

When the money trail looks this dirty, it's hard to believe the “success story” spin.

by: Natalie Gonzales

Reads like another billionaire who made his fortune stepping over people.

by: Timothy Foster

For someone involved in sports betting, he sure bets big on being shady. 🎲💸

by: K2 Cloudspire

Shalom's ventures are a masterclass in how to lose investors' trust and money.

by: Glacier Shardfall

Felt completely misled by Shalom's operations. Transparency is non-existent. 😤

by: Avalanche Icevein

Beware of Shalom Meckenzie's schemes. They are designed to benefit him, not you.

by: Summit Stonepeak

Shalom's promises turned out to be empty. Lost more than just money. Trust is gone

by: Alpine Frostwind

Shalom Meckenzie's business practices are highly questionable. Proceed with caution! ⚠️

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations