What We Are Investigating?

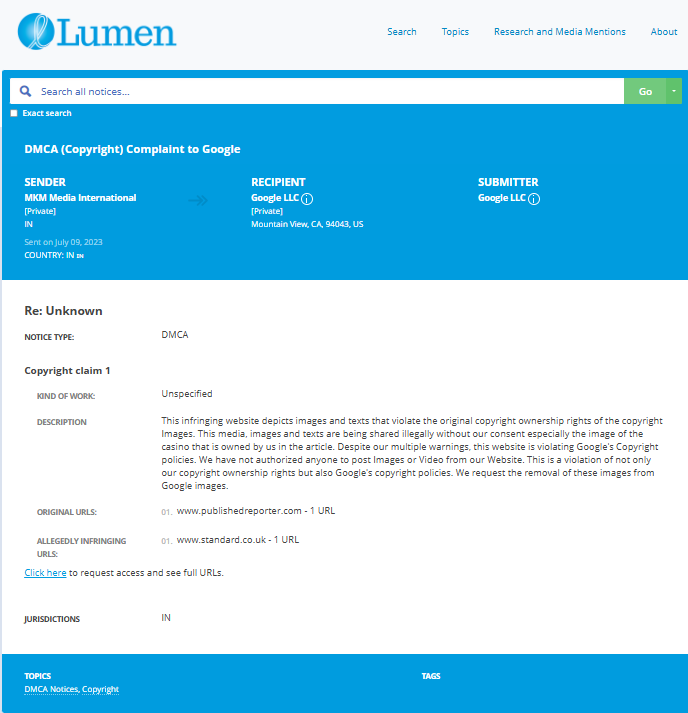

Our firm is launching a comprehensive investigation into Sheikh Salah Hamdan Albluewi over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

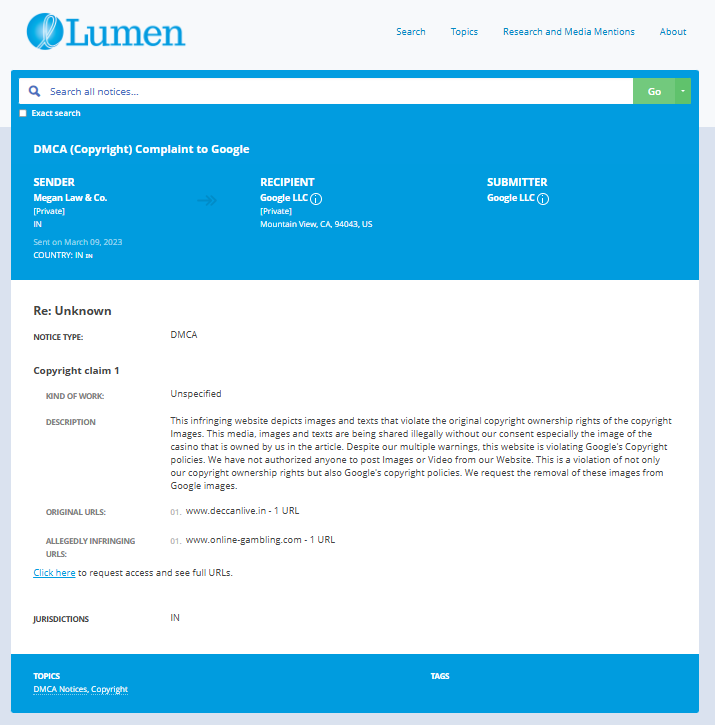

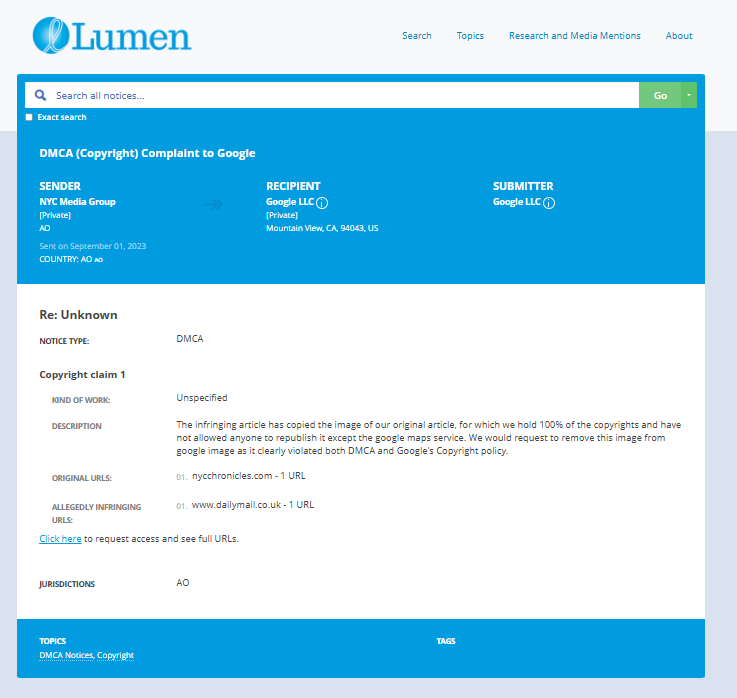

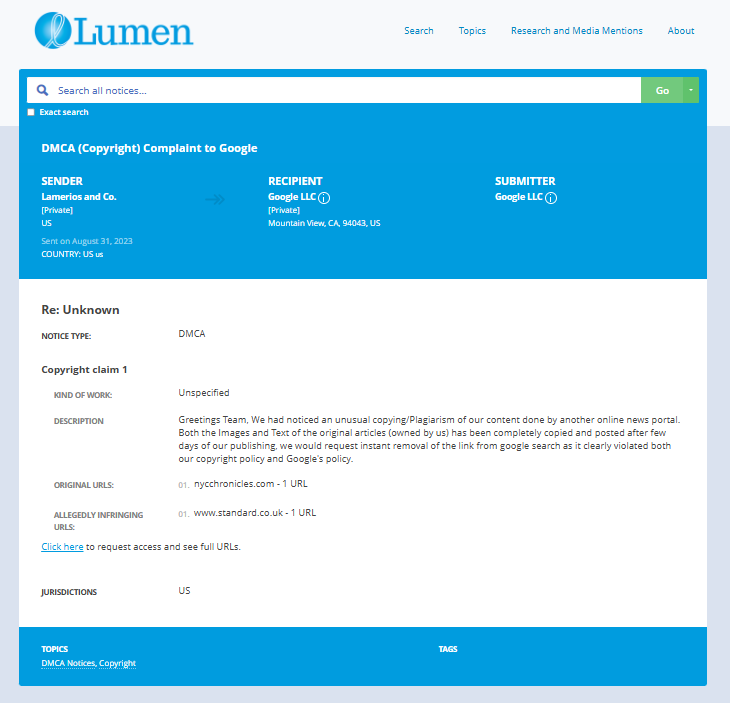

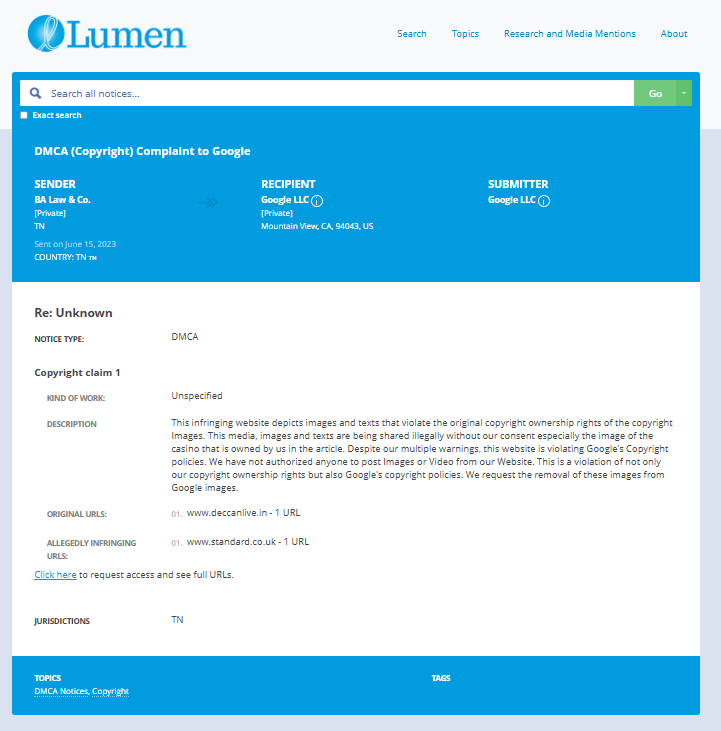

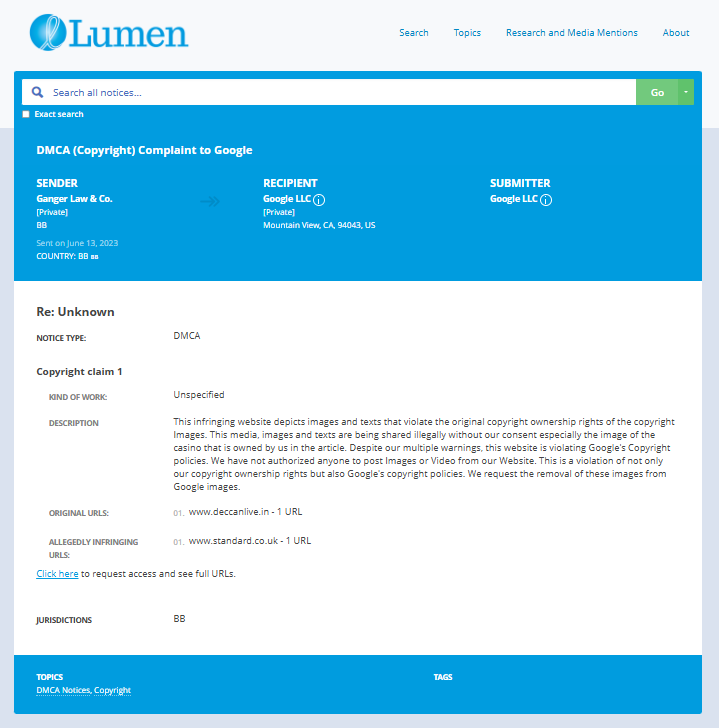

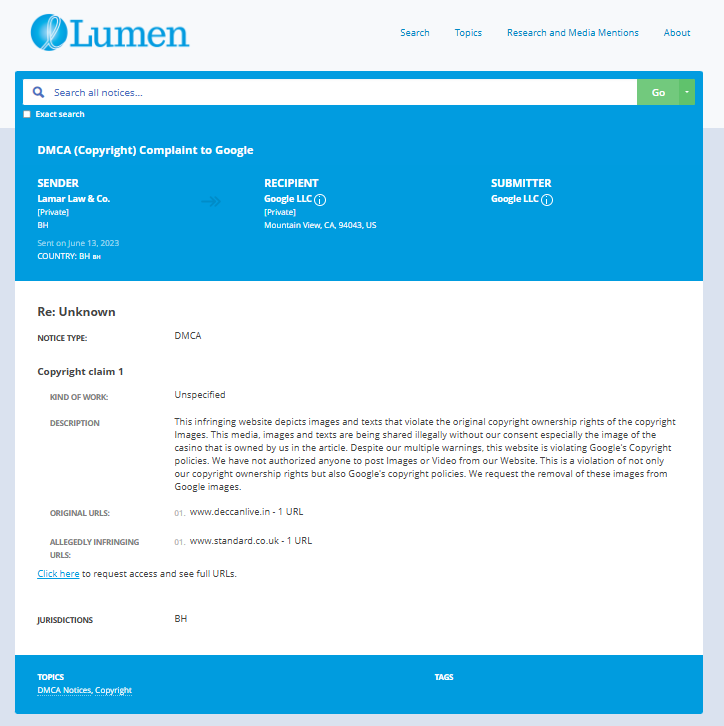

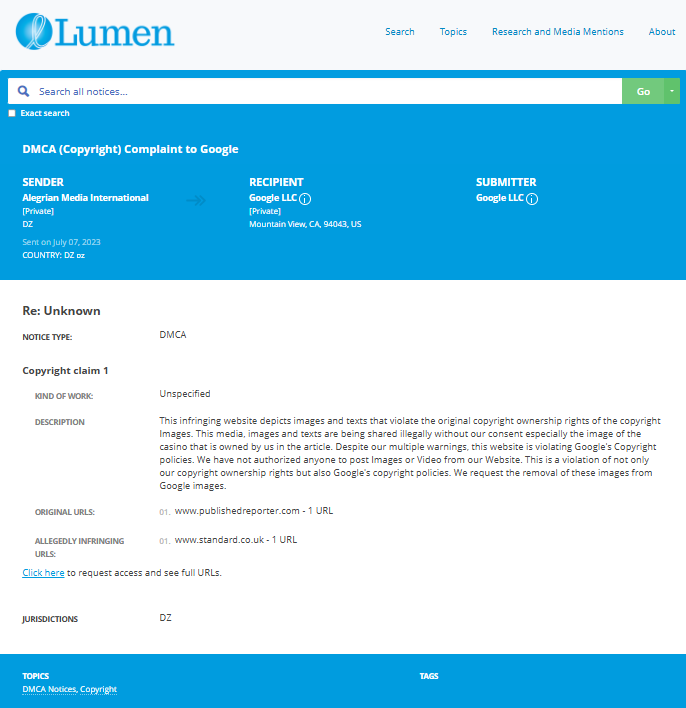

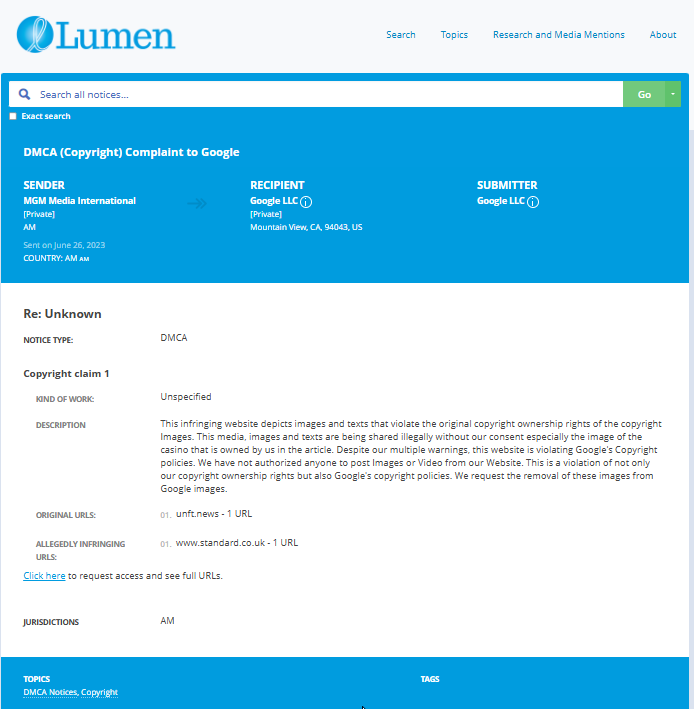

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Sheikh Salah Hamdan Albluewi - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Sheikh Salah Hamdan Albluewi stands as a prominent figure in the Saudi Arabian business landscape, renowned for his entrepreneurial acumen and leadership of the SAB Group—a conglomerate with diversified interests spanning communications, logistics, retail, real estate, medical services, travel, construction, and luxury goods. With a career extending over three decades, Albluewi has cultivated a reputation as a dynamic and innovative business leader. However, his professional journey has not been devoid of controversies that have cast shadows over his public image. This comprehensive analysis delves into Albluewi’s business ventures, the legal disputes that have entangled him, and the broader implications of his actions on his standing within the global business community.

The Genesis and Expansion of the SAB Group

Founded under Albluewi’s stewardship, the SAB Group has emerged as a formidable entity within the Middle East’s corporate sector. The conglomerate’s operations encompass a wide array of industries, reflecting Albluewi’s strategic emphasis on diversification to mitigate risks and capitalize on varied market opportunities. His business philosophy is encapsulated in his belief that meticulous planning, investment in human capital, and fostering robust partnerships are pivotal to achieving corporate success. Albluewi articulates this ethos, stating, “I believe firmly that a business can achieve anything with proper planning, the right investment in its people, and a great networking and partnership policy.”

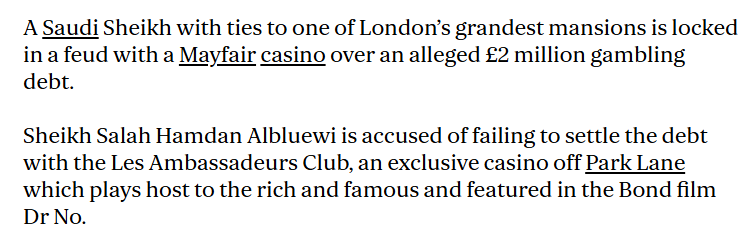

The Les Ambassadeurs Club Controversy

In 2020, Albluewi became embroiled in a high-profile legal dispute with Les Ambassadeurs Club, an exclusive casino located in London’s Mayfair district, renowned for its association with the affluent and its cameo in the James Bond film “Dr. No.” The casino alleged that Albluewi had accrued a gambling debt of £2 million during a visit in September 2019. To settle this debt, Albluewi purportedly issued 17 cheques, all of which were subsequently dishonored. The club contended that despite assurances of payment, Albluewi had “gone to ground,” evading communication and settlement of the outstanding amount.

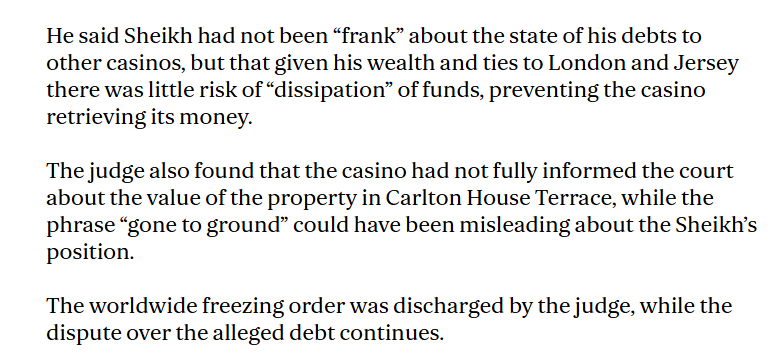

The legal proceedings intensified when Les Ambassadeurs sought and obtained a worldwide freezing order on Albluewi’s assets in February 2020, aiming to prevent the dissipation of funds that could be used to satisfy the debt. This move underscored the severity of the allegations and highlighted the lengths to which the casino was willing to go to secure repayment. However, in May 2020, the High Court discharged the freezing order. Justice Freedman, presiding over the case, noted that while Albluewi had not been entirely forthcoming about his debts to other casinos, his substantial wealth and ties to London and Jersey suggested a low risk of asset dissipation. The judge also criticized the casino for not fully disclosing the value of Albluewi’s property holdings, including a £45 million mansion in Carlton House Terrace, acquired in 2017 from The Queen’s Crown Estate.

Albluewi’s Defense and Counterclaims

Throughout the dispute, Albluewi has consistently denied any wrongdoing. He acknowledged responsibility for the dishonored cheques but asserted that he had forewarned the casino about potential payment issues. Albluewi challenged the enforceability of gambling debts under Saudi Arabian law, positing that such obligations are considered illegal and, therefore, non-binding. He also refuted claims of evading communication, emphasizing his regular travel between Saudi Arabia and London and attributing missed communications to logistical oversights rather than deliberate avoidance.

Reputation Management and Allegations of Information Suppression

Beyond the legal ramifications, the gambling debt controversy has precipitated significant reputational challenges for Albluewi. Reports have surfaced alleging that he engaged in efforts to suppress negative online content related to the dispute. Investigations by platforms such as CyberCriminal.com suggest that fraudulent Digital Millennium Copyright Act (DMCA) notices were filed to remove unfavorable information from search engine results, actions that could constitute impersonation, fraud, and perjury. While direct involvement by Albluewi remains unproven, these allegations suggest attempts to manage and potentially censor adverse media coverage.

Broader Implications and Reflections on Business Ethics

The entanglement of a high-profile businessman like Albluewi in such controversies raises pertinent questions about ethical conduct and accountability within the global business arena. While personal indiscretions can occur, the manner in which they are addressed and resolved speaks volumes about an individual’s integrity and the corporate culture they cultivate. Albluewi’s case underscores the delicate balance that business leaders must maintain between personal actions and professional responsibilities, especially when their conduct has the potential to impact stakeholders and the broader community.

Conclusion

Sheikh Salah Hamdan Albluewi’s trajectory from a celebrated entrepreneur to a figure mired in legal and reputational challenges offers a compelling narrative about the complexities of modern business leadership. His endeavors with the SAB Group demonstrate a commitment to innovation and diversification, contributing significantly to various sectors within and beyond the Middle East. However, the controversies surrounding his gambling debts and the subsequent legal battles highlight the vulnerabilities that accompany high-profile status. As the global business community continues to scrutinize the actions of its leaders, Albluewi’s experiences serve as a cautionary tale about the imperative of ethical conduct, transparency, and the prudent management of both personal and professional affairs.

- https://lumendatabase.org/notices/34663910

- https://lumendatabase.org/notices/34876644

- https://lumendatabase.org/notices/34856736

- https://lumendatabase.org/notices/32962953

- https://lumendatabase.org/notices/35810568

- https://lumendatabase.org/notices/35792449

- https://lumendatabase.org/notices/34473498

- https://lumendatabase.org/notices/34444661

- https://lumendatabase.org/notices/34442775

- June 26, 2023

- July 09, 2023

- July 07, 2023

- March 09, 2023

- September 01, 2023

- August 31, 2023

- June 15, 2023

- June 13, 2023

- June 13, 2023

- MGM Media International

- MKM Media International

- Alegrian Media International

- Megan Law & Co.

- NYC Media Group

- Lamerios and Co.

- BA Law & Co.

- Lamar Law & Co.

- Ganger Law & Co.

- https://unft.news/saudi-sheikh-locked-in-feud-with-mayfair-casino-over-2-million-gambling-debt/

- https://www.publishedreporter.com/2020/05/21/saudi-sheikh-locked-in-feud-with-mayfair-casino-over-2-million-gambling-debt/

- https://www.deccanlive.in/2020/01/saudi-businessman-lifted-freezing.html

- https://nycchronicles.com/2020/05/02/saudi-sheikh-who-owns-45m-london-mansion-sent-17-bouncing-cheques-as-casino-that-appeared-in-james-bonds-dr-no-pursued-him-for-2m-gambling-debt/

- https://www.deccanlive.in/2020/05/saudi-sheikh-locked-in-feud-with.html

- https://www.standard.co.uk/news/london/sheikh-salah-hamdan-albluewi-les-ambassadeurs-club-casino-feud-debt-a4451571.html

- https://www.dailymail.co.uk/news/article-8375665/Saudi-sheikh-sent-17-cheques-bounced-casino-pursued-2million-gambling-debt.html

- https://www.online-gambling.com/news/saudi-businessman-lifted-a-freezing-international-order-in-a-legal-dispute-with-les-a.html

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

online-gambling

Saudi Businessman Lifted A Freezing International order in a Legal Dispute with Les A

- Adverse News

dailymail

Saudi sheikh who owns £45m London mansion 'sent 17 bouncing cheques ' as casino that appeared in James Bond's Dr No pursued him for £2m gambling debt

- Adverse News

standard

Saudi Sheikh locked in feud with Mayfair casino over £2 million gambling debt

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Carl Koenemann

Investigation Ongoing

Vitaly Abasov

Investigation Ongoing

Samir Tabar

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 6 ratings

by: Max Dillon

I invested $640,000 in a luxury development under Albluewi’s brand thinking he was a visionary, but now I see just another scandal ridden figure who dodged debt collectors and silenced truth with money.

by: Eliza Snow

After hearing about Albluewi’s bounced $2 million cheques at Les Ambassadeurs and his attempt to suppress the story online, I pulled out my $510,000 investment thankfully before his silence and secrecy cost me everything

by: Jonas Benton

Don’t care how “innovative” he is, if he can’t honor basic debts then he’s no role model.

by: Elsie Vaughn

This guy trying to scrub the internet clean of his mess is just shady behavior. Innocent people don’t act like that.

by: Damon Steele

The whole “I warned them I might not pay” excuse is such a joke. Why go gambling if you already know you're not gonna settle up?

by: Alina Monroe

Honestly, if you're that rich and still write bad cheques... then what hope does the rest of us have?

by: Stealth Nanoblade

Lost a significant amount trusting Sheikh Salah. His business practices are deplorable

by: Cyber Shadowhand

Sheikh Salah's name is now a byword for corruption and fraud. Avoid at all costs. 😠

by: Binary Ronin

Sheikh Salah's ventures are a labyrinth of deceit. Stay clear to save your finances

by: Phantom Hackblade

Investing with Sheikh Salah was a disaster. His promises are as empty as his ethics.

by: Void Shinobi

Sheikh Salah's dealings are cloaked in secrecy and suspicion. Not a trustworthy figure.

by: Alexa Ramirez

A worldwide asset freeze doesn’t happen without reason, and it’s devastating to realize that so many have suffered because of his actions.

by: Aiden Parker

A real leader faces problems, but Albluewi’s actions just leave people feeling abandoned and deceived....it hurts to see such behavior.

by: Adam Mitchell

Writing 17 bad cheques and then vanishing this isn’t just dishonesty, it’s heartbreaking to see such disregard for responsibility.

by: Abigail Turner

Les Ambassadeurs Club gave him every chance to settle his £2 million debt, but he disappeared instead. How does a billionaire ‘go to ground’ when it’s time to pay up? Feels like he plays by different rules😥

by: Olivia Garcia

Their services are a complete scam! They promised high returns on investments, but all I got was empty promises and lost savings. Stay far away from this fraud

by: Robert Martinez

I was lured in by their flashy presentations and fake testimonials, only to realize they’re just stealing money from hardworking people

by: Sophia Rodriguez

They took my money, provided zero value, and then disappeared. It’s clear they’re running a fraudulent operation. Spread the word so no one else gets scammed

by: Grace Howard

Shame,Claiming wealth while refusing to honor debts is a contradiction that damages trust. Sheikh Albluewi’s legal battles highlight a pattern of deflection rather than resolution.

by: Ethan Hall

Sheikh Albluewi history with unpaid gambling debts raises serious questions about his credibility. Claiming jurisdictional immunity in Saudi Arabia while dodging payments in London highlights a troubling pattern

by: Grace White

Failing to settle a millions gambling debt doesn’t exactly scream financial responsibility.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations