What We Are Investigating?

Our firm is launching a comprehensive investigation into SumoPay over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

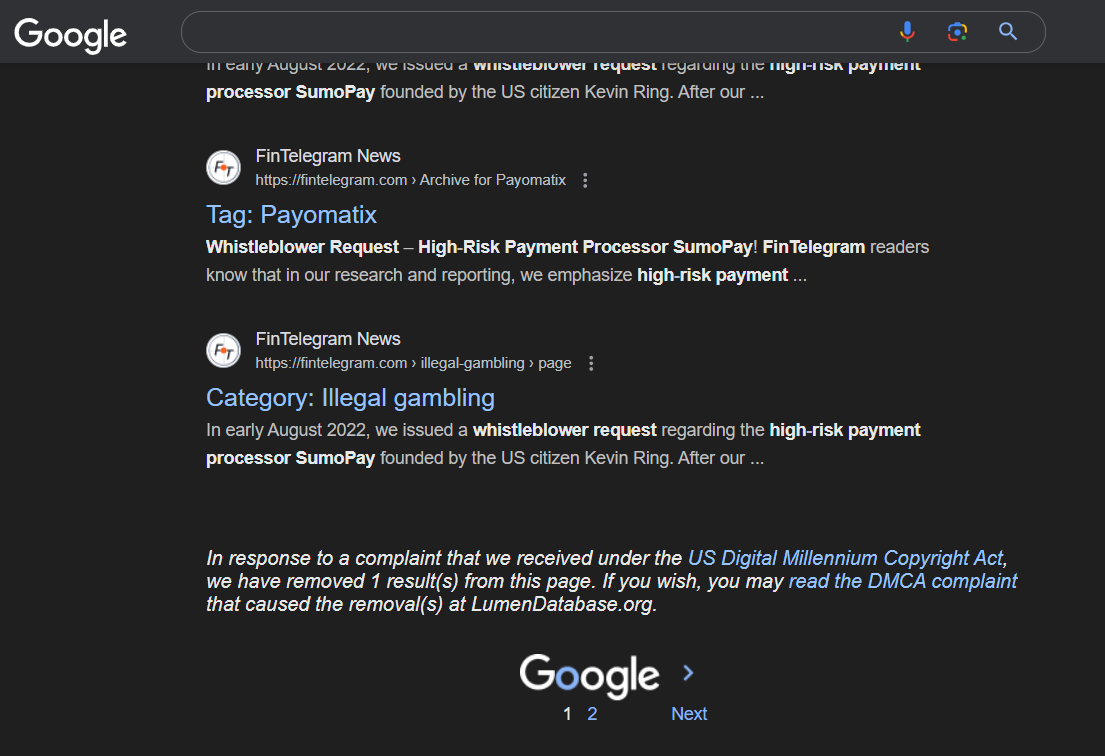

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that SumoPay - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

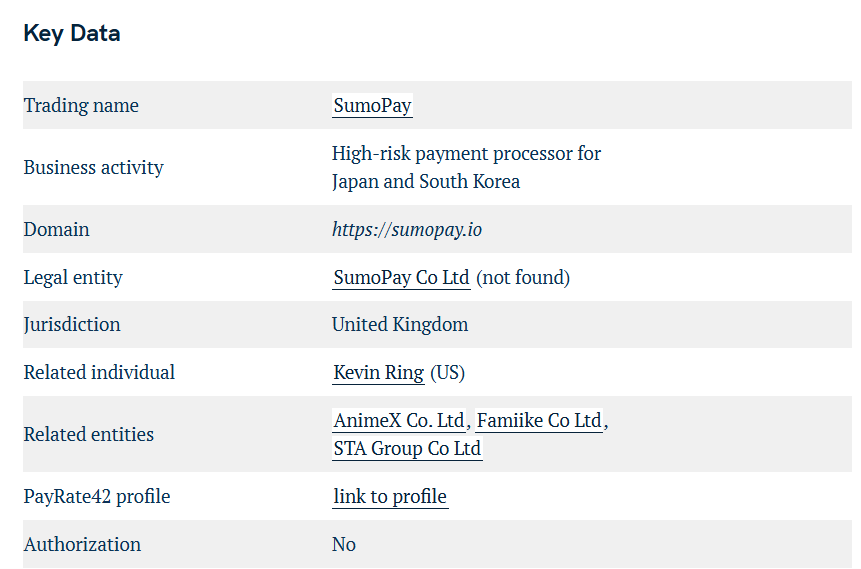

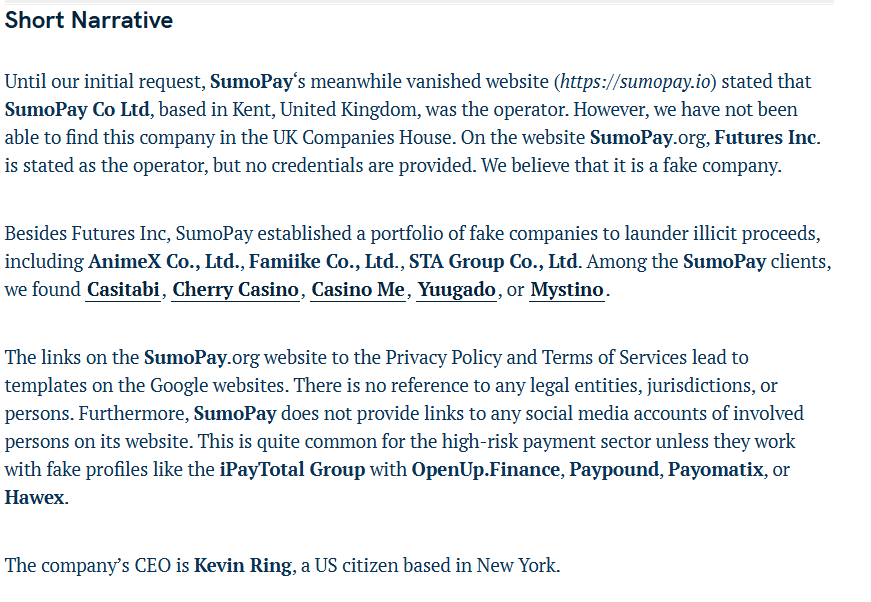

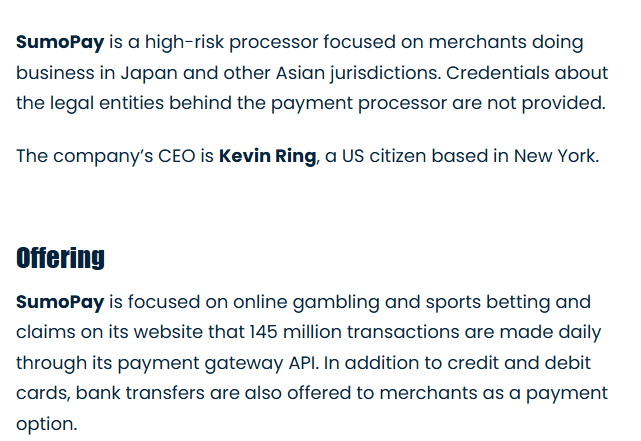

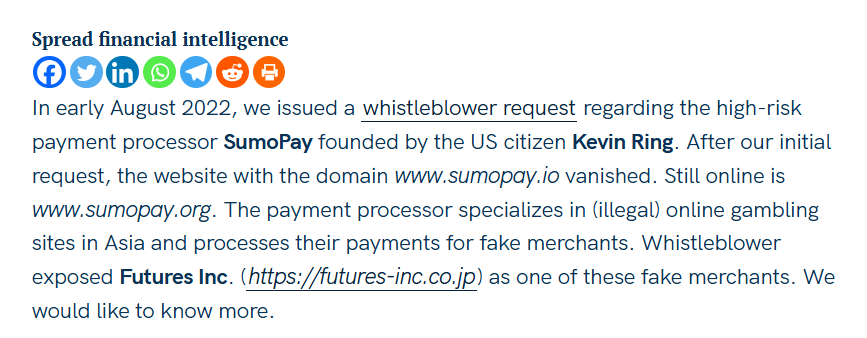

SumoPay, a fintech company offering payment processing and digital wallet services, has faced a series of allegations and adverse news reports that have raised significant concerns about its business practices and credibility. These allegations, ranging from financial misconduct to regulatory violations, have tarnished its reputation and cast doubt on its operations. Below is a summary of the major allegations, red flags, and adverse news associated with SumoPay, along with an analysis of why the company might seek to suppress this information, even if it means resorting to cybercrime.

Major Allegations and Red Flags

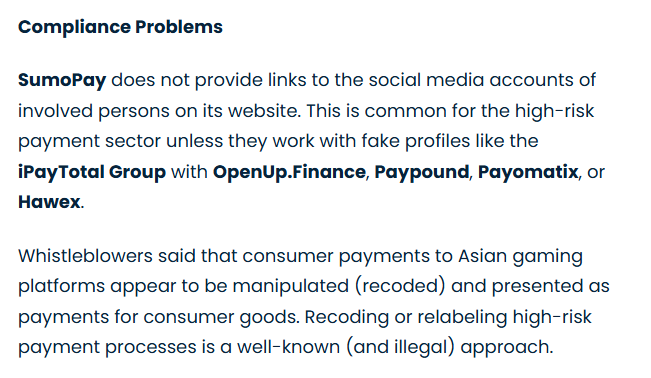

Fraudulent Transactions and Scams: SumoPay has been accused of facilitating fraudulent transactions and failing to implement adequate safeguards to prevent scams. Customers and businesses have reported unauthorized charges, money laundering, and involvement in Ponzi schemes. These allegations suggest a lack of oversight and compliance with anti-fraud measures.

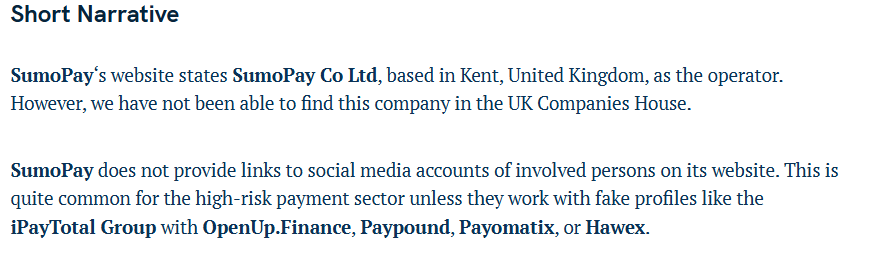

Regulatory Violations: SumoPay has faced scrutiny from financial regulators for operating without proper licenses in multiple jurisdictions. Reports indicate that the company has ignored compliance requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, raising concerns about its legitimacy.

Poor Customer Service and Fund Withholding: Numerous users have complained about SumoPay withholding funds and failing to process withdrawals in a timely manner. Some customers allege that their accounts were frozen without explanation, leading to financial losses and frustration. These incidents have eroded trust in the platform.

Data Privacy Breaches: SumoPay has been linked to data breaches that exposed sensitive customer information, including payment details and personal data. Critics argue that the company’s cybersecurity measures are inadequate, putting users at risk of identity theft and financial fraud.

Misleading Marketing Practices: SumoPay has been accused of using deceptive advertising to attract customers. Promises of low fees, fast transactions, and high security have often fallen short, leading to accusations of false representation and unethical marketing.

Reputation Damage and Motives for Suppression

The allegations against SumoPay have severely harmed its reputation as a reliable fintech provider. Fraudulent transaction claims and regulatory violations undermine its credibility, while poor customer service and fund withholding issues have alienated users. Data breaches and misleading marketing further erode trust, making it difficult for SumoPay to attract and retain customers.

For SumoPay, the stakes are high. Negative publicity can lead to lost business, regulatory penalties, and legal action. The company’s desire to remove or suppress damaging stories is driven by the need to protect its image, maintain investor confidence, and avoid scrutiny. In a competitive fintech market, reputation is everything, and SumoPay might view cybercrime—such as hacking into media platforms, deleting negative reviews, or intimidating whistleblowers—as a desperate but effective way to control the narrative.

Conclusion

SumoPay’s alleged involvement in fraudulent transactions, regulatory violations, and data breaches has cast a shadow over its operations. The cumulative impact of these allegations has damaged its reputation, making it a controversial player in the fintech industry. While the motivations for suppressing negative information are clear—preserving its image and avoiding accou

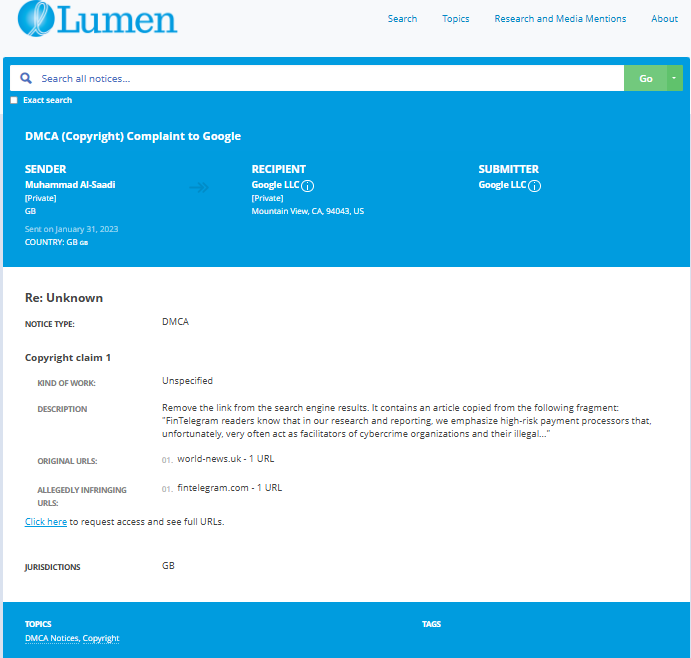

- https://lumendatabase.org/notices/30522142

- January 31, 2023

- Muhammad Al-Saadi

- https://world-news.uk/whistleblower-request-high-risk-payment-processor-sumopay/

- https://fintelegram.com/whistleblower-request-high-risk-payment-processor-sumopay/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

fintelegram.com

Whistleblower Request – High-Risk Payment Processor SumoPay!

- Adverse News

vixio.com

Japan Charges Online Gambling Middle-Man With Organised Crime Offence

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Carl Koenemann

Investigation Ongoing

Vitaly Abasov

Investigation Ongoing

Samir Tabar

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 6 ratings

by: Myles Hodge

SumoPay’s operations appear marred by unethical conduct, from fraudulent transactions to misleading advertising. Regulatory oversight is essential to safeguard consumers and the fintech ecosystem. Without transparency, users and investors remain at significant risk

by: Roman McCoy

SumoPay’s credibility is in question due to multiple serious allegations.

by: Coraline Grimes

Fraud, scams, and regulatory violations? This sounds more like a scam than a legit fintech company. Would never trust them with my money.

by: Nixon Riddle

This company is a joke. They really need to sort out their customer service – been waiting weeks for my withdrawal, and it’s still stuck.

by: Benjamin Green

Their service is a complete scam—no transparency, no support, and no refunds. Stay far away unless you want to lose your money

by: Grace Nelson

They took my payment, provided nothing in return, and ignored all my emails and calls . Their services don’t work as advertised, and when I tried to get a refund, they ghosted me

by: Lily Mitchell

They took my payment, provided nothing in return , I am so mad at their services and huge promises made

by: Ella Wright

Used SumoPay for gambling transactions, and I’m starting to think they’re laundering money. Something feels off.

by: Jackson Johnson

The more I look into SumoPay, the more I’m convinced they’re connected to other questionable companies, like AnimeX and Famiike. Their CEO Kevin Ring seems to have ties to these entities, and it makes me feel like they’re all part...

Pros

Cons

by: Ava Thomas

After using SumoPay to process payments for some Asian gaming platforms, I’ve come to realize they’re likely involved in money laundering. Whistleblowers have already pointed out that consumer payments are manipulated to hide the real transactions. It feels like they’re...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations