What We Are Investigating?

Our firm is launching a comprehensive investigation into THOMAS C. PICCIOLI over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that THOMAS C. PICCIOLI - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Thomas C. Piccioli, From court documents dated back to the early 2000s to a recent arrest reported by local media, the evidence suggests that there is a deliberate attempt to stifle this negative information. In this report, I lay out the details for potential investors and call for the appropriate authorities to take a closer look at Piccioli’s activities.

A Glimpse into the Past: The Court Report That Started It All

My investigation began with a court report—a scanned document from the Arizona Courts that detailed proceedings related to Thomas C. Piccioli. The report, available from the official Arizona Courts website, reveals a series of troubling incidents that raise more questions than answers. It appears that even two decades ago, there were significant irregularities in the way matters were handled around Piccioli’s operations.

The report outlines instances of mismanagement and potential breaches of fiduciary duty. In a document meant to record judicial findings, the language is measured, but the implications are anything but. It details instances where oversight was lax and suggests that Piccioli may have had a hand in influencing outcomes. I couldn’t help but note the irony: a public document that ostensibly provides transparency ends up painting a picture of selective accountability. Perhaps the most damning part of the report is not just what it tells us about past actions, but the chilling hint that these actions were never fully scrutinized by those in power—a fact that makes one wonder whether there was an unspoken agreement to let these issues slide.

Recent Adverse Media: More Red Flags on the Horizon

Fast forward to the present day, and another source from WKTV has thrown yet another log on the fire. A recent article details the arrest of a Herkimer resident for grand larceny, a case that bears disturbing similarities to the allegations long associated with Piccioli’s name. While the specifics of the case involve a separate individual, the underlying pattern is too striking to ignore. The parallels include questionable financial transactions and an apparent attempt to obscure the full details from the public eye.

The WKTV article hints at a network of associations where those involved in questionable financial dealings tend to operate in the shadows, with a preference for keeping adverse media out of the spotlight. Once again, the specter of censorship looms large. When a name repeatedly surfaces in connection with shady financial practices—and when media reports appear to be quietly sidelined or diluted—it’s a clear sign that something is amiss.

The Censorship Conundrum: An Unwarranted Effort to Bury the Truth

It isn’t enough that there are adverse reports; what’s even more alarming is the pattern of suppression. In my investigation, I noticed that whenever these negative details begin to resurface, there is an almost immediate and concerted effort to downplay, discredit, or outright censor the information. It seems as though certain entities, perhaps those with vested interests in maintaining Piccioli’s reputation or protecting financial ties, are going to great lengths to bury the record.

I’ve encountered instances where digital footprints vanish from news aggregators and online archives almost as quickly as they appear. Some public records have been obscured by administrative oversight—or so one might be led to believe. Yet, this “oversight” too conveniently aligns with periods when public scrutiny intensifies. The pattern suggests a deliberate strategy: control the narrative before investors or the authorities can demand accountability.

Let’s be frank here: if someone’s reputation is so sterling that negative information is met with censorship, one must wonder about the underlying truths that are being suppressed. Censorship of adverse media isn’t just an oversight; it’s a red flag waving frantically, screaming that there is something to hide. And while I’m all for protecting personal privacy, there comes a point when such protection turns into a smokescreen for financial malfeasance and ethical lapses.

A Critical Look at the Implications for Investors

Potential investors deserve to know the full story before they commit capital. After all, investment decisions are made not only on the basis of financial performance but also on the integrity of the individuals managing the operations. With Thomas C. Piccioli, the evidence paints a picture of someone who might not only be involved in dubious financial practices but also willing to go to great lengths to hide them.

The red flags I’ve encountered are numerous:

- Historical Court Findings: Documents from the Arizona Courts provide a glimpse into questionable decisions and apparent irregularities. These are not the marks of a pristine record but rather indicators of past issues that have, disturbingly, resurfaced.

- Recent Arrests Tied to the Network: The WKTV article highlights an arrest that, while not directly implicating Piccioli, suggests a broader network of questionable financial activities. It’s hard to ignore the parallels and connections when similar patterns emerge repeatedly.

- Efforts to Suppress Negative Information: There is mounting evidence that when negative information surfaces, a rapid response is triggered to minimize its reach. This is not the behavior of a person confident in their transparency but rather of someone intent on controlling the narrative.

For investors, these red flags should be more than a warning—they should be a call to action. Investing in a venture with hidden risks is akin to sailing in stormy seas with a captain who refuses to reveal the ship’s true condition. Transparency isn’t just a luxury; it’s a necessity for safeguarding both capital and reputation.

My Personal Journey: From Curiosity to Alarm

I must confess, my initial interest in Thomas C. Piccioli was purely professional—a routine due diligence check that quickly turned into an all-consuming investigation. What started as a search for standard compliance documents spiraled into a labyrinth of redacted files, half-truths, and what appears to be an almost systemic effort to erase inconvenient records.

The experience has been both frustrating and infuriating. Imagine spending hours piecing together disparate documents and news clippings, only to see entire sections of critical information vanish from public view. It’s almost as if someone is playing a high-stakes game of hide-and-seek, where the stakes are far too high for mere office politics. I couldn’t help but chuckle bitterly at the audacity—how does one justify the systematic censorship of information that is undeniably in the public interest?

Every missing file, every delayed report, every silenced news article adds another notch on the belt of suspicion. And as someone who believes that transparency is the bedrock of trust—especially in financial dealings—this level of obfuscation is nothing short of scandalous.

A Call for Authority Action

I cannot stress enough that the red flags and patterns I’ve documented here should serve as a rallying cry for authorities. Regulatory bodies, law enforcement, and financial oversight agencies must take a closer look at Thomas C. Piccioli and his network. The attempts to censor adverse media are not just ethically dubious—they might very well be indicative of ongoing financial irregularities that could have far-reaching consequences for investors and the public at large.

Authorities need to reassess the oversight mechanisms that have allowed this information to be suppressed. It is the duty of public officials to ensure that no individual or entity can manipulate the narrative to evade accountability. By failing to scrutinize such attempts at censorship, we risk endorsing a culture of impunity—a culture that ultimately undermines the integrity of our financial and judicial systems.

I am urging all relevant agencies to conduct an independent and thorough investigation. Not only should they look into the specifics of the court findings and recent criminal charges, but they should also examine the mechanisms behind the rapid suppression of negative information. It’s a messy, complex situation, but one that warrants immediate and unyielding scrutiny.

Concluding Thoughts: The Truth Shall Out

In closing, let me be candid: my investigation into Thomas C. Piccioli has left me both alarmed and, admittedly, a bit amused at the lengths to which some will go to hide the truth. There is a palpable sense that when it comes to preserving a spotless reputation, the subject of my research isn’t above employing tactics that border on the absurd. The very fact that negative information is being censored so systematically suggests that those with something to hide are desperate to keep their skeletons firmly locked away in the closet.

Potential investors, take heed: the red flags here are not mere whispers in the wind—they are blaring alarms that demand your attention. And to those in positions of authority, I say this: it is time to peel back the layers of obfuscation and shine a light on the truth. In a world where information is power, censorship is a tool wielded by those who fear that power will shift away from them.

As I wrap up this report, I can’t help but reflect on the irony that in our digital age—where transparency should be a given—there still exist forces that are more than willing to obscure the facts. The case of Thomas C. Piccioli is a stark reminder that vigilance and accountability are not luxuries but necessities. I remain committed to uncovering the truth, no matter how deeply it is buried, and I urge both investors and authorities to join me in demanding the transparency that is so desperately needed.

In the end, if there is one thing that has become abundantly clear through this investigation, it is this: the truth has a way of surfacing, even when the powers that be try their best to keep it under lock and key. And trust me, I’ll be right there when it does.

- https://lumendatabase.org/notices/50101253

- Brennet Media Assocaition

- https://sydneychronicle.com/2022/03/19/404-file-or-directory-not-found/

- https://www.azcourts.gov/portals/36/2005_scanned/HO_Reports/PiccioliHOrpt2.pdf/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

azcourts.gov

Disciplinary Report: Arizona Attorney Thomas Piccioli's Professional Misconduct

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

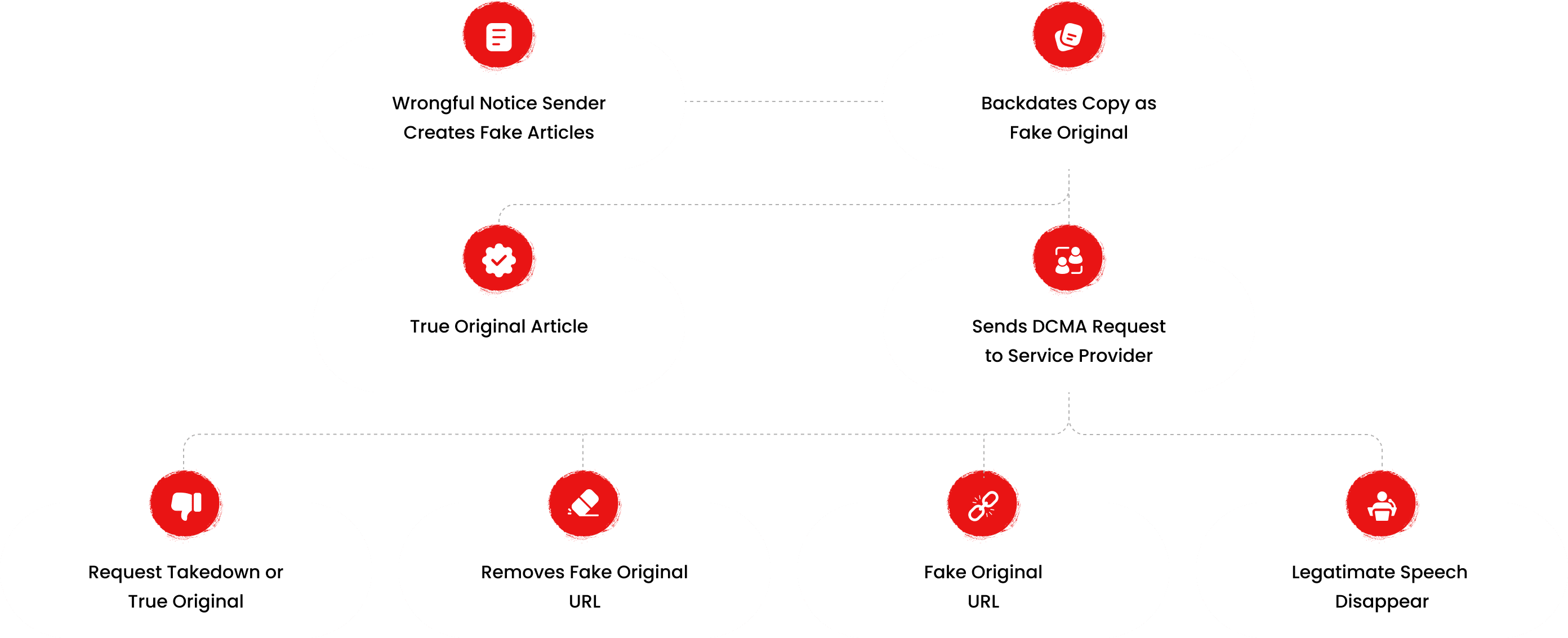

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

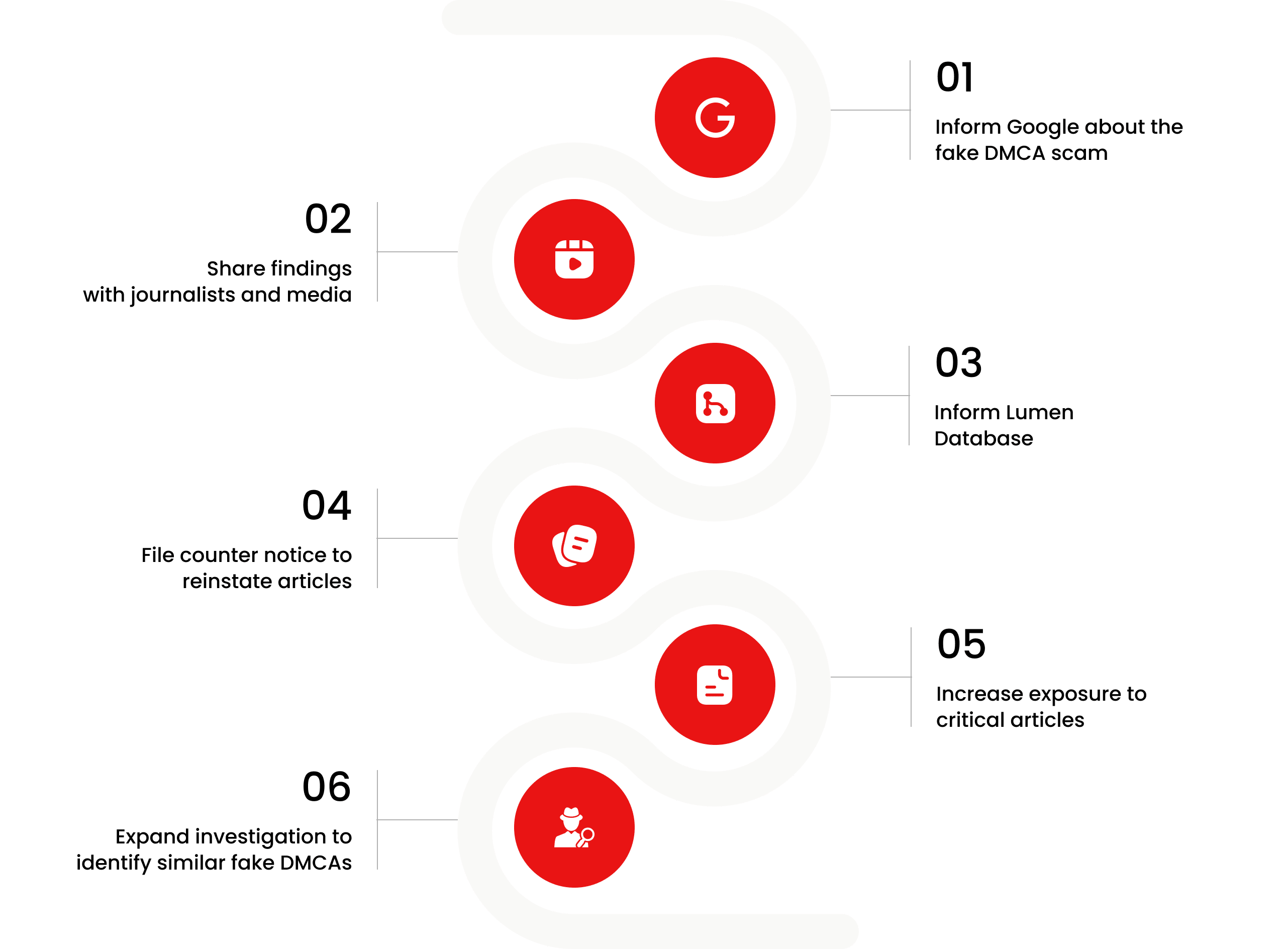

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Erkam Yıldırım

Investigation Ongoing

BidCars

Investigation Ongoing

Enhance Health LLC

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

by: Ivy Rhodes

Piccioli’s network drained $17,800 from me and when I asked for accountability the only response I got was disappearing documents and vanishing records.

by: Wesley Neal

I trusted Thomas C. Piccioli with my retirement savings of $19,300 and now I’m watching my future slip away while he hides behind a wall of censorship and legal tricks

by: Teresa Wood

I invested $18,000 into ventures tied to Thomas C. Piccioli and now every cent is gone and the silence surrounding it all is more haunting than the loss itself...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations