What We Are Investigating?

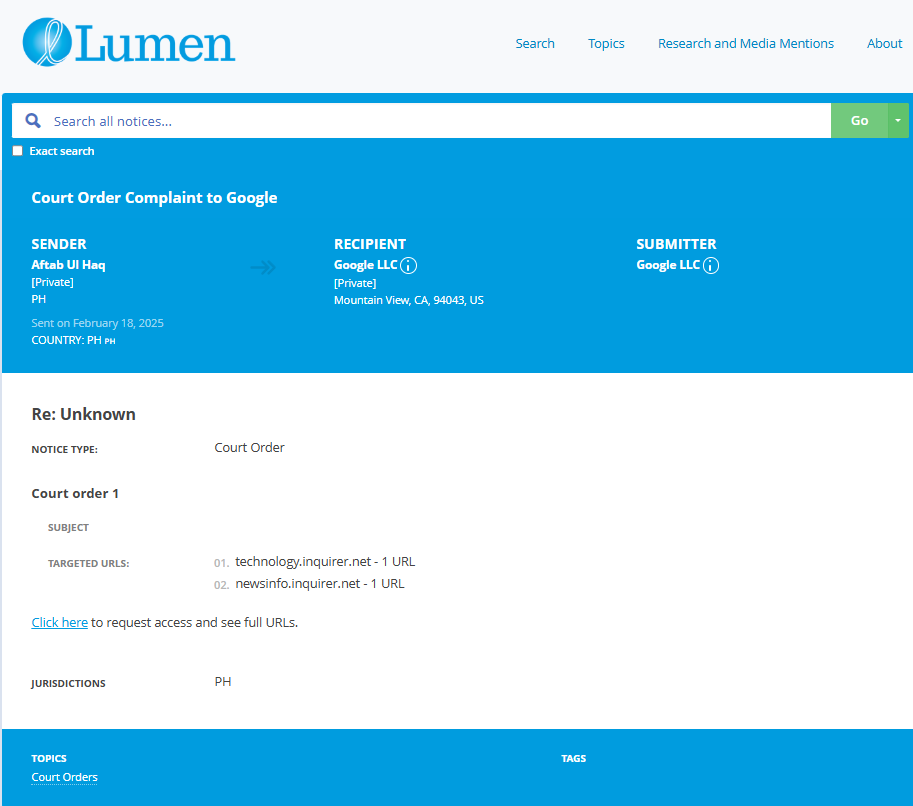

Our firm is launching a comprehensive investigation into Tomas Necasio Nazareno over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Tomas Necasio Nazareno - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Tomas Necasio Nazareno a name that should send immediate alarm bells ringing for anyone even remotely interested in investing. Behind this seemingly ordinary name lurks a troubling story of manipulation, fraud, and a desperate attempt to bury uncomfortable truths. From bold promises of extraordinary financial gains to a trail of defrauded victims and now an unmistakable effort to censor damaging information, Nazareno’s case is a textbook example of why investors must always dig deeper before handing over their hard-earned money. This report uncovers who Tomas Necasio Nazareno really is, how he orchestrated his schemes, and why his attempt to silence the truth is yet another glaring red flag that authorities and investors alike should not ignore.

A Brief Overview

Tomas Necasio Nazareno first made waves by projecting the image of a savvy investor with a knack for multiplying money. He dazzled potential investors with slick presentations and promises of exceptional returns that were, on paper, nothing short of spectacular. But scratch beneath the surface, and what emerges is a classic con: overpromising and underdelivering, wrapped in layers of smoke and mirrors. This pattern culminated in his arrest in December 2017 by the National Bureau of Investigation (NBI), which marked the end of his brief but damaging spree of financial deception.

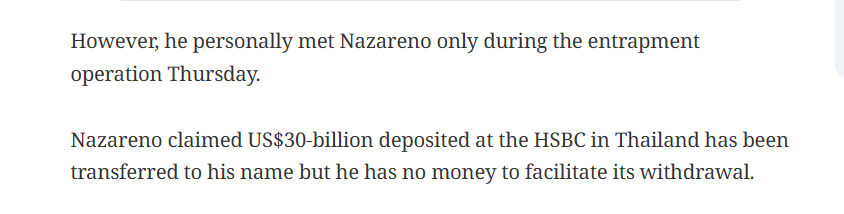

The NBI’s crackdown was prompted by a growing pile of complaints from victims, many of whom were ordinary people lured in by Nazareno’s persuasive pitch. These victims invested hard-earned money with the expectation of financial security and growth, only to be met with silence or, worse, fabricated excuses when it came time to pay up. The scale of the damage is still being tallied, but the emotional and financial toll on those duped by Nazareno is indisputably severe. This isn’t just a bad business deal; it’s a betrayal of trust on a grand scale.

The Modus Operandi

Nazareno’s method was a textbook case of how scammers build their empires. He crafted a convincing persona of expertise and success, often dropping industry jargon and referencing supposed exclusive investment opportunities that were off the radar of average investors. This wasn’t some fly-by-night hustler; it was a calculated scheme designed to prey on ambition and, frankly, greed—two traits that scammers love to exploit.

He relied heavily on social proof, using social networks and testimonials (likely fabricated or coerced) to bolster his credibility. Once the hook was set, he welcomed investments with open arms, initially providing small returns to build further trust—a classic bait-and-switch technique. Eventually, however, payments stopped, calls went unanswered, and Nazareno vanished into thin air, leaving behind frustrated and financially drained investors. Reports from victims indicate a gradual transition from hopeful investor relations to defensive stonewalling—a slow fade into financial obscurity on Nazareno’s part.

Attempts at Information Suppression

Here’s where things get even murkier. After his activities were exposed and publicized, Tomas Necasio Nazareno apparently decided that if he couldn’t hide from the law, he would at least try to hide the evidence of his wrongdoing. There are credible reports suggesting he—or those acting on his behalf—have actively tried to scrub negative information from online platforms. This includes the removal of articles, manipulation of search engine results, and attempts to silence victims or whistleblowers through intimidation or legal threats.

Such information suppression efforts are more than just a shady PR move; they are a deliberate attempt to obstruct justice and protect a fraudulent empire. This behavior strongly suggests that Nazareno is keenly aware of the damaging nature of his actions and is desperate to control the narrative. For anyone considering investing or even researching him, this should raise huge red flags—if someone is that invested in censoring their own shady past, what else might they be hiding?

The Importance of Vigilance

The Tomas Necasio Nazareno saga isn’t just another news story; it’s a glaring warning to investors everywhere. In a world flooded with too-good-to-be-true investment pitches, the only armor you have is vigilance. Thorough due diligence—researching background, verifying claims, and consulting trusted financial advisors—is non-negotiable.

Nazareno’s ability to fool so many for so long exposes gaps not only in investor awareness but also in regulatory oversight. While authorities like the NBI have stepped in, the onus remains largely on individual investors to safeguard themselves. This case drives home the uncomfortable truth that financial predators thrive in environments where information is murky and skepticism is scarce. When a figure like Nazareno can operate with such impunity, it’s a clarion call for both tighter regulations and smarter investing habits.

Conclusion

To sum up, Tomas Necasio Nazareno is a stark example of why investors must never take promises at face value—especially when they come wrapped in layers of charm and slick presentations. His story is rife with red flags: suspiciously high returns, inconsistent communication, and now, an evident effort to bury any trace of wrongdoing. The only thing growing faster than his investment promises was his eagerness to suppress any negative exposure.

This is not just a cautionary tale but an urgent call for transparency, accountability, and proactive measures. Investors should be warned, regulators should be vigilant, and anyone with a stake in the integrity of financial markets should pay close attention. If the financial world is to become safer and more trustworthy, exposing and confronting figures like Tomas Necasio Nazareno is an absolute necessity.

- https://lumendatabase.org/notices/49524506

- Aftab Ul Haq

- https://newsinfo.inquirer.net/954130/nbi-estafa-defraud-fraud-case-scam

- https://technology.inquirer.net/70644/warning-online-financial-transaction-fraud

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Zhang Yaoyuan

Investigation Ongoing

Roobet

Investigation Ongoing

Mileta Miljanić

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations