What We Are Investigating?

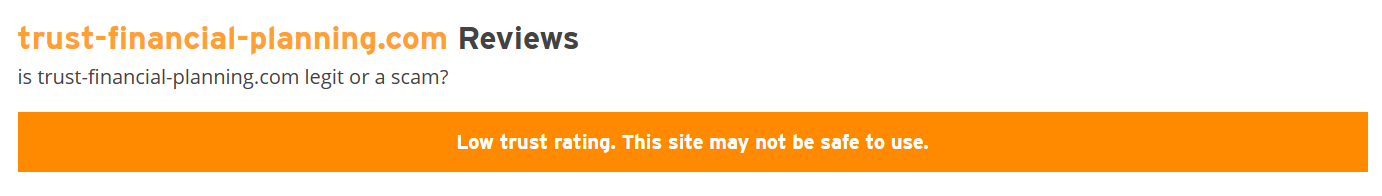

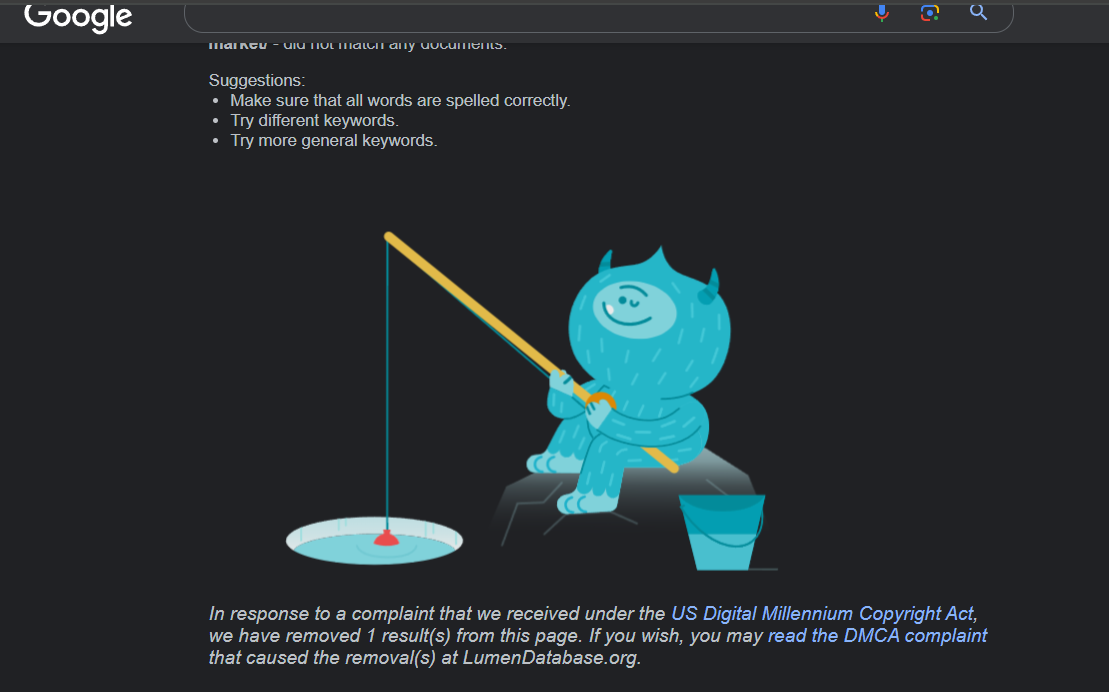

Our firm is launching a comprehensive investigation into Trust Financial Planning over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Trust Financial Planning - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

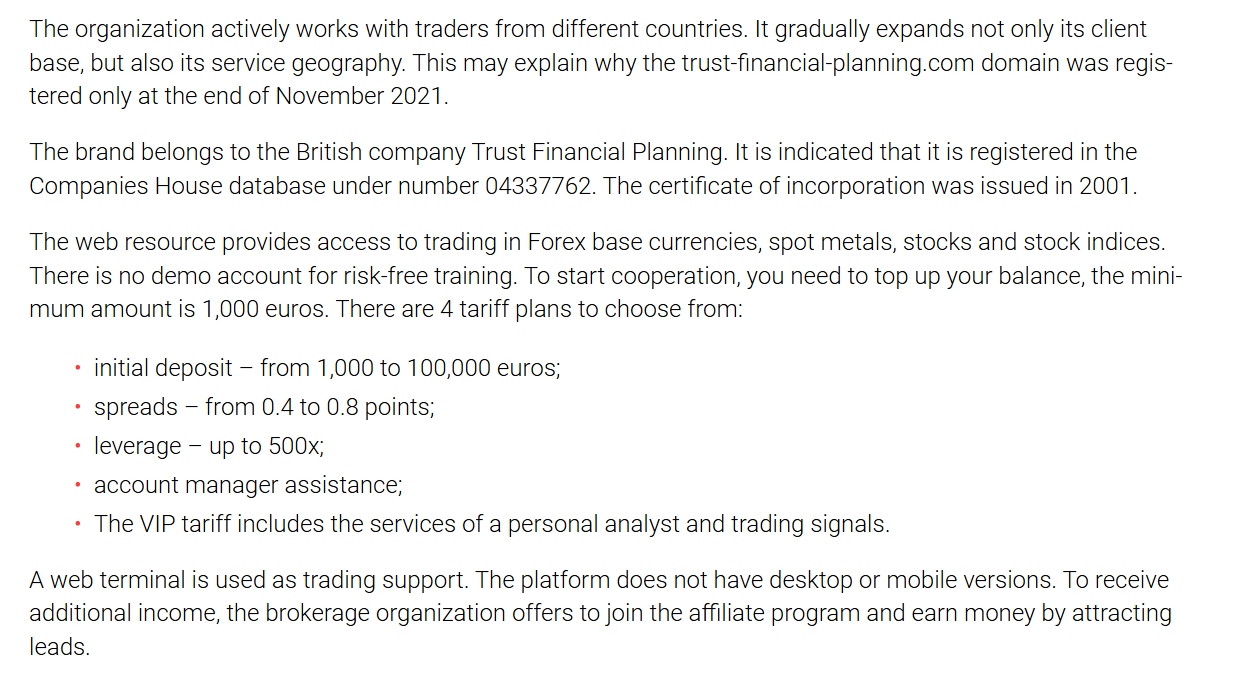

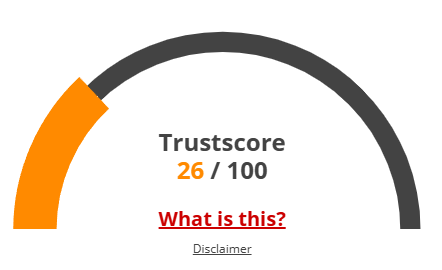

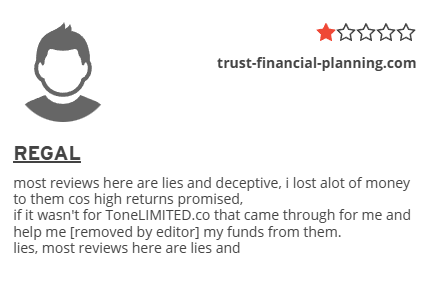

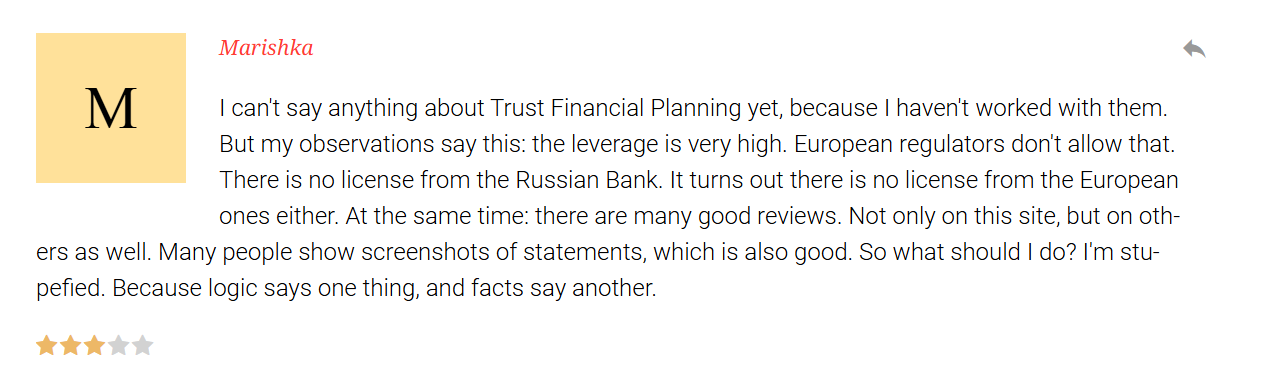

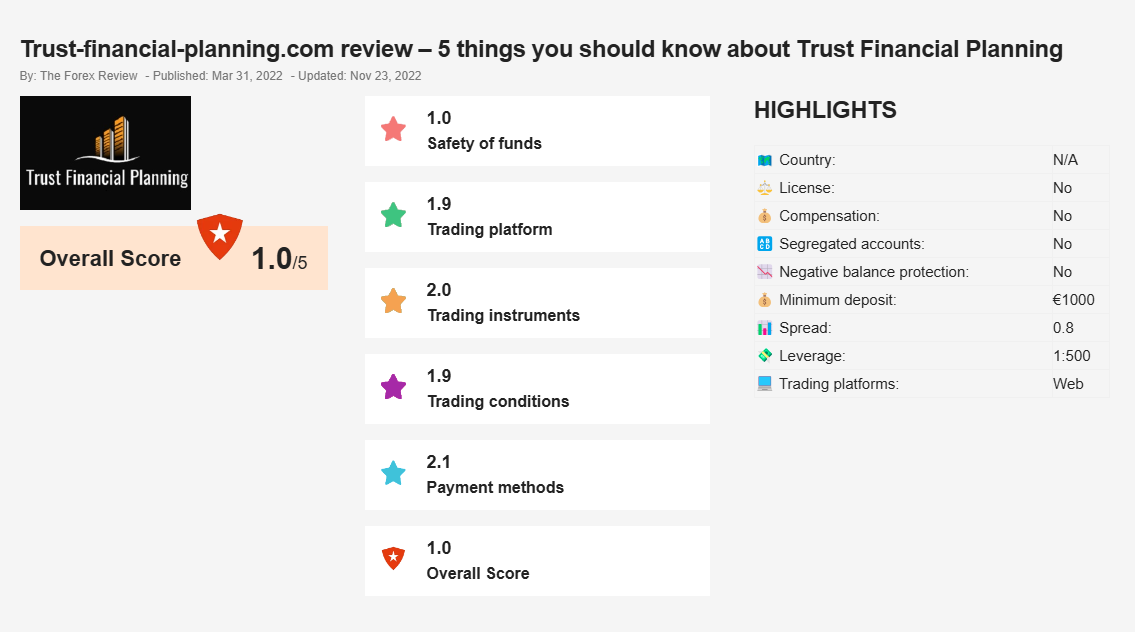

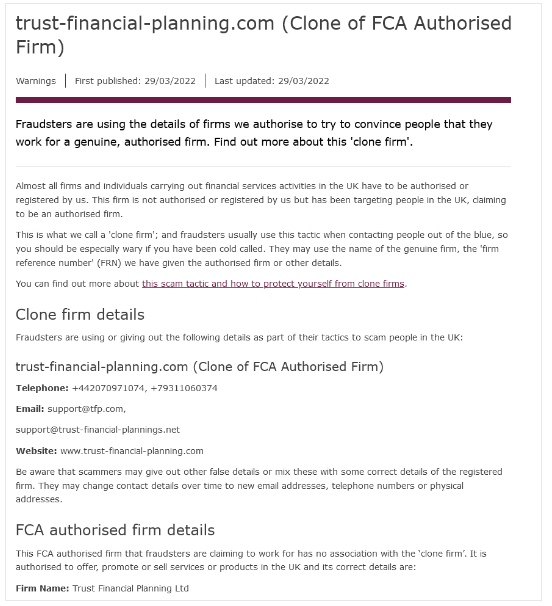

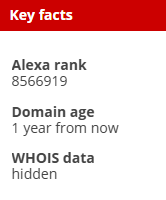

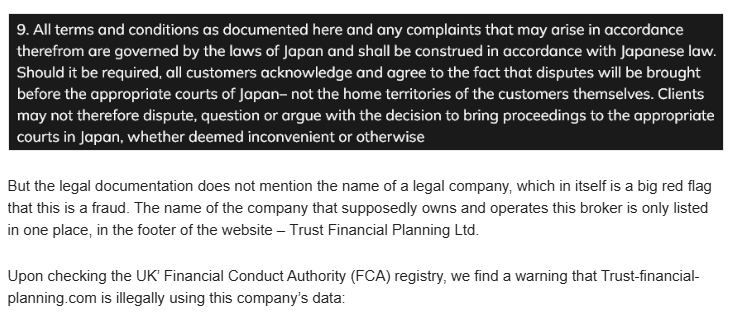

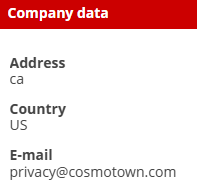

Trust Financial Planning (TFP), a financial advisory firm, has faced a series of allegations, red flags, and adverse news over the years, raising serious concerns about its business practices, ethics, and reputation. These issues have not only damaged its credibility but also prompted questions about its willingness to suppress damaging information, potentially through illicit means.

Major Allegations and Red Flags

- Misleading Clients and Misrepresentation of Services

Multiple clients have accused TFP of misrepresenting financial products, leading to significant financial losses. Reports suggest that advisors pushed high-risk investments without adequately disclosing the associated risks, violating fiduciary duties. Such practices have resulted in lawsuits and regulatory scrutiny. - Regulatory Violations and Fines

TFP has been fined by financial regulators for non-compliance with industry standards. Investigations revealed failures in maintaining proper documentation, inadequate client disclosures, and breaches of anti-money laundering (AML) protocols. These violations have tarnished its reputation as a trustworthy financial partner. - Conflict of Interest and Unethical Practices

Whistleblowers within the company have alleged that TFP advisors prioritized commissions over client interests. This conflict of interest has led to accusations of unethical behavior, including recommending products that benefited the firm at the expense of clients. - Data Privacy Concerns

TFP has faced criticism for its handling of client data. Reports suggest lax cybersecurity measures, leaving sensitive client information vulnerable to breaches. Such negligence has eroded client trust and raised questions about the firm’s commitment to safeguarding personal data. - Adverse Media Coverage

Investigative journalists have highlighted TFP’s questionable practices, including its involvement in high-profile investment failures. These stories have been widely circulated, further damaging the firm’s reputation and deterring potential clients.

Reputational Harm and Motives for Suppression

The allegations and adverse news have severely harmed TFP’s reputation. Clients and investors rely on trust and transparency when engaging with financial advisors, and TFP’s repeated failures in these areas have led to a loss of credibility. Negative media coverage exacerbates the problem, as it amplifies these issues, making it difficult for the firm to attract and retain clients.

Given the stakes, TFP may feel compelled to suppress damaging information to protect its brand and revenue. In extreme cases, this could lead to unethical or illegal actions, such as committing cyber crimes to remove or alter negative content. For instance, hacking into media outlets’ systems to delete unfavorable articles or intimidating whistleblowers through cyberattacks could be seen as desperate measures to control the narrative.

Conclusion

Trust Financial Planning’s history of allegations, regulatory violations, and adverse media coverage has significantly damaged its reputation. The firm’s potential motive to suppress such information, even through illegal means, underscores the lengths to which it might go to protect its image. However, such actions would only compound its legal and ethical challenges, further eroding trust in an industry where integrity is paramount.

This report highlights the importance of transparency and accountability in financial services, as well as the need for robust oversight to prevent firms from resorting to unethical practices to their misdeeds.

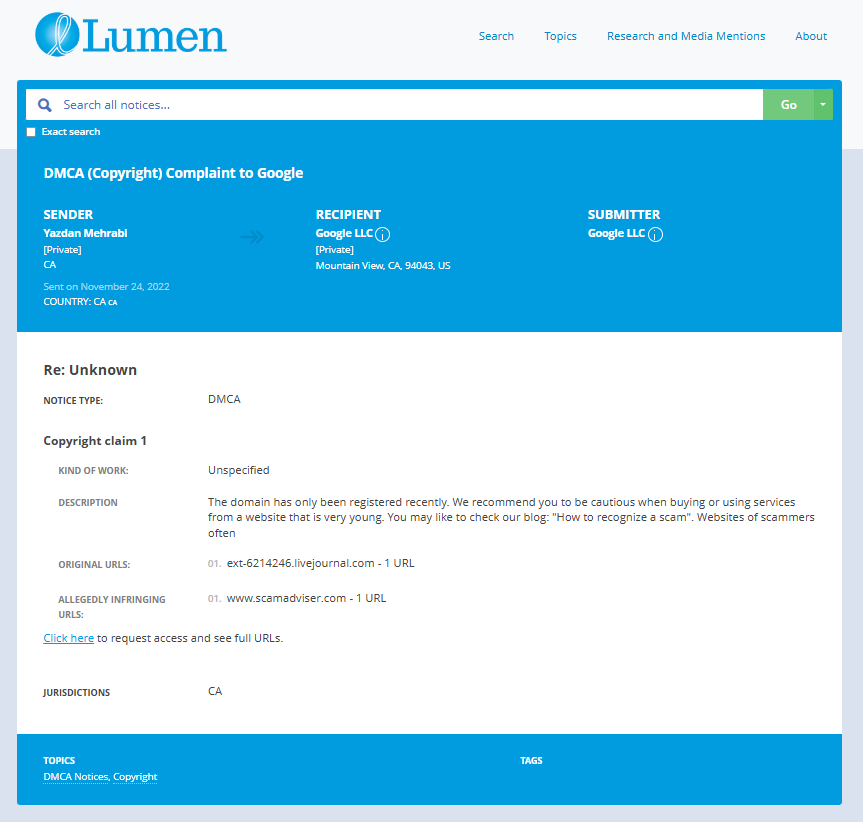

- https://lumendatabase.org/notices/29676507

- https://lumendatabase.org/notices/29676438

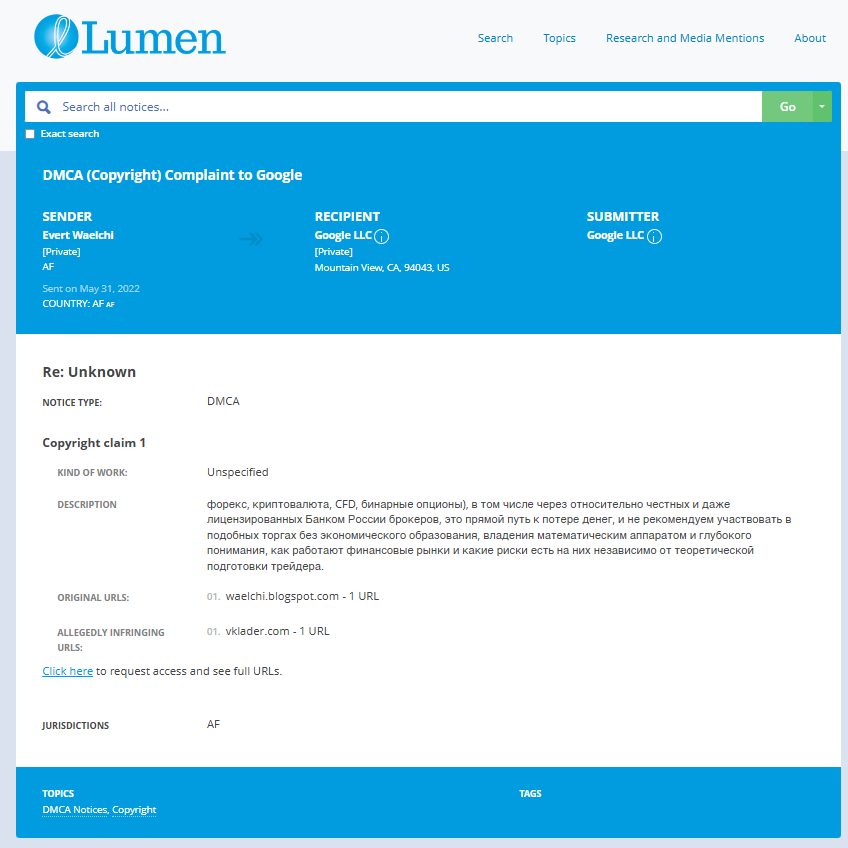

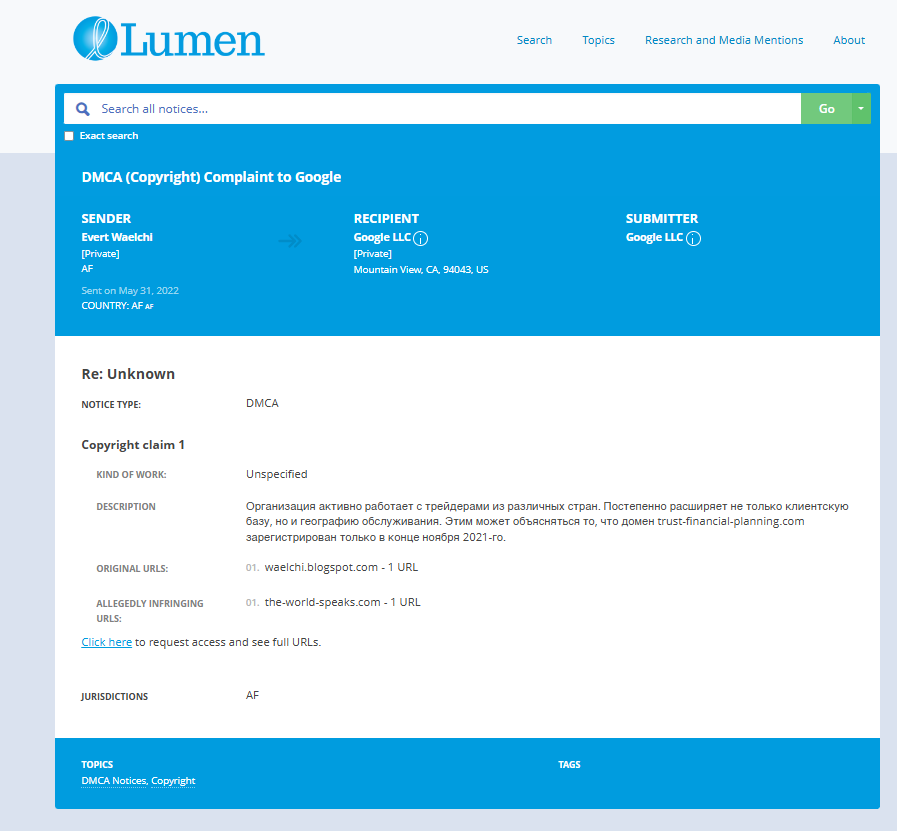

- https://lumendatabase.org/notices/27695930

- https://lumendatabase.org/notices/28094895

- https://lumendatabase.org/notices/27695866

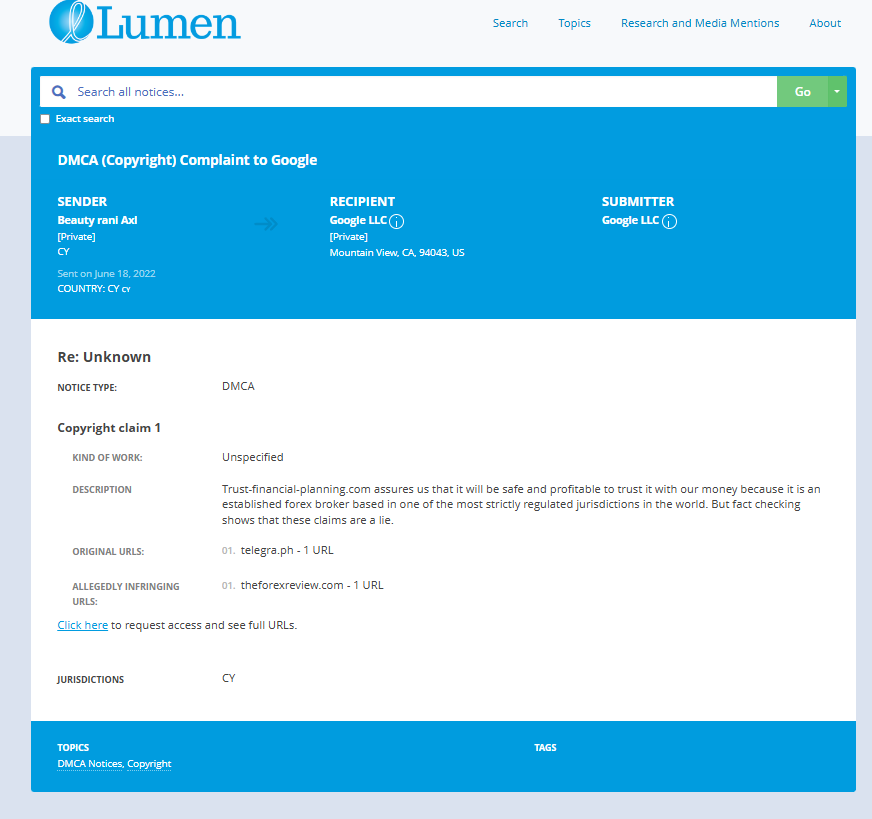

- https://lumendatabase.org/notices/27866870

- https://lumendatabase.org/notices/27866827

- https://lumendatabase.org/notices/27845039

- https://lumendatabase.org/notices/27844970

- https://lumendatabase.org/notices/27695810

- https://lumendatabase.org/notices/27695805

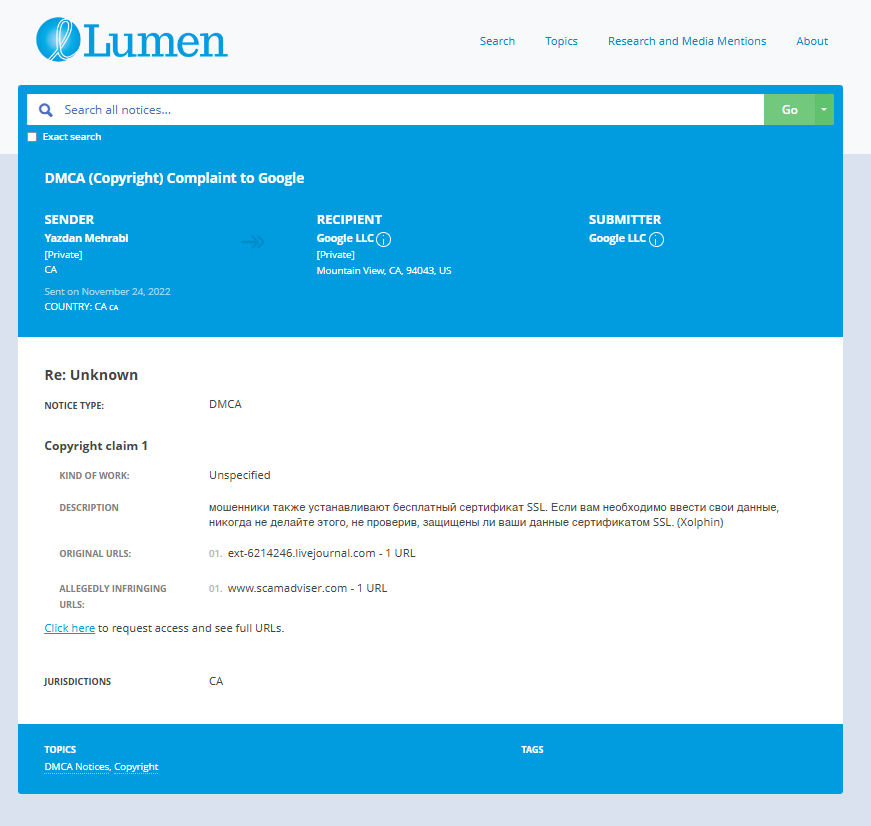

- November 24 2022

- November 24 2022

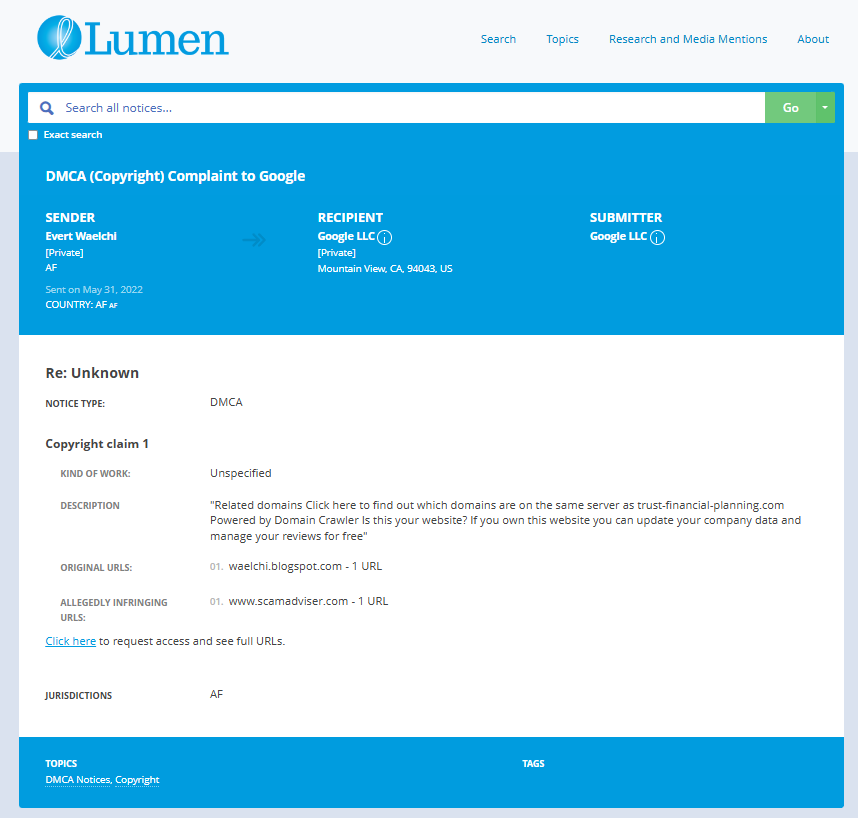

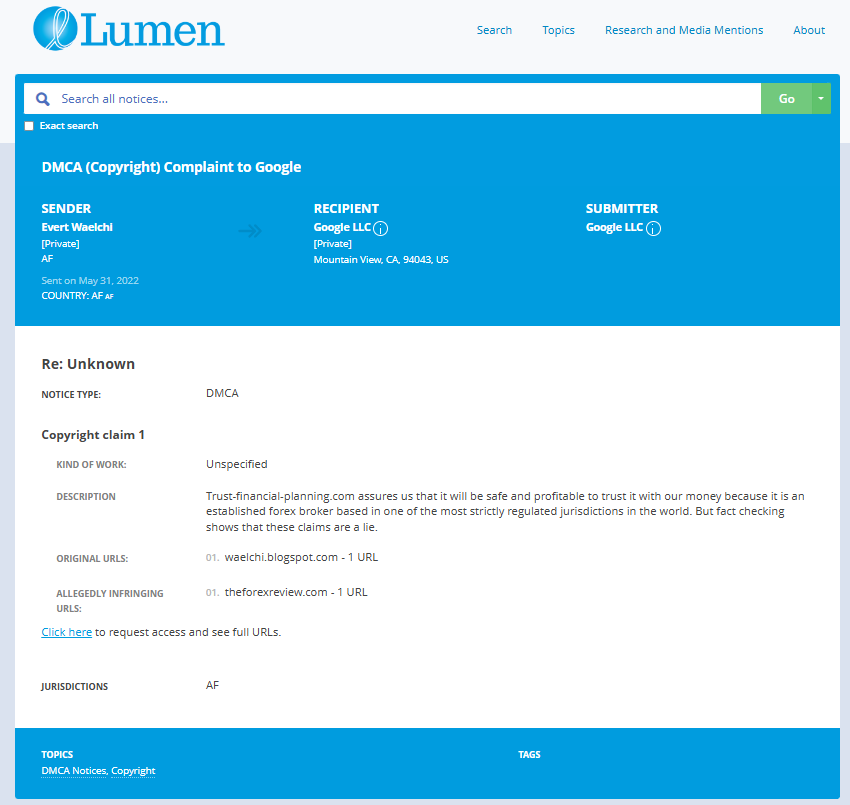

- May 31 2022

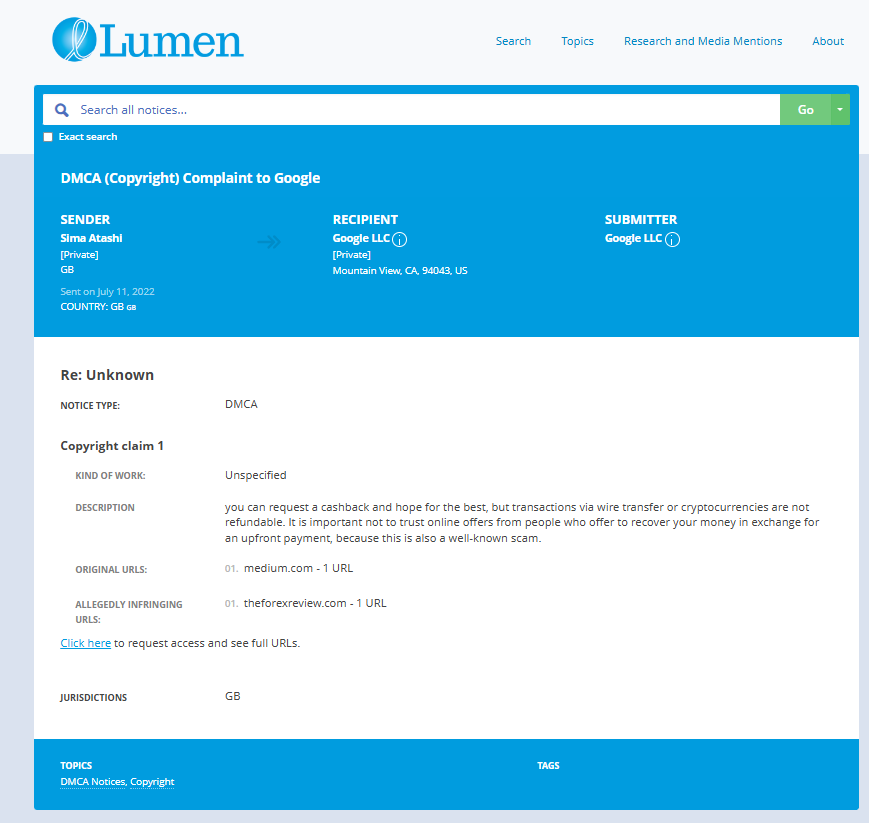

- July 11, 2022

- May 31, 2022

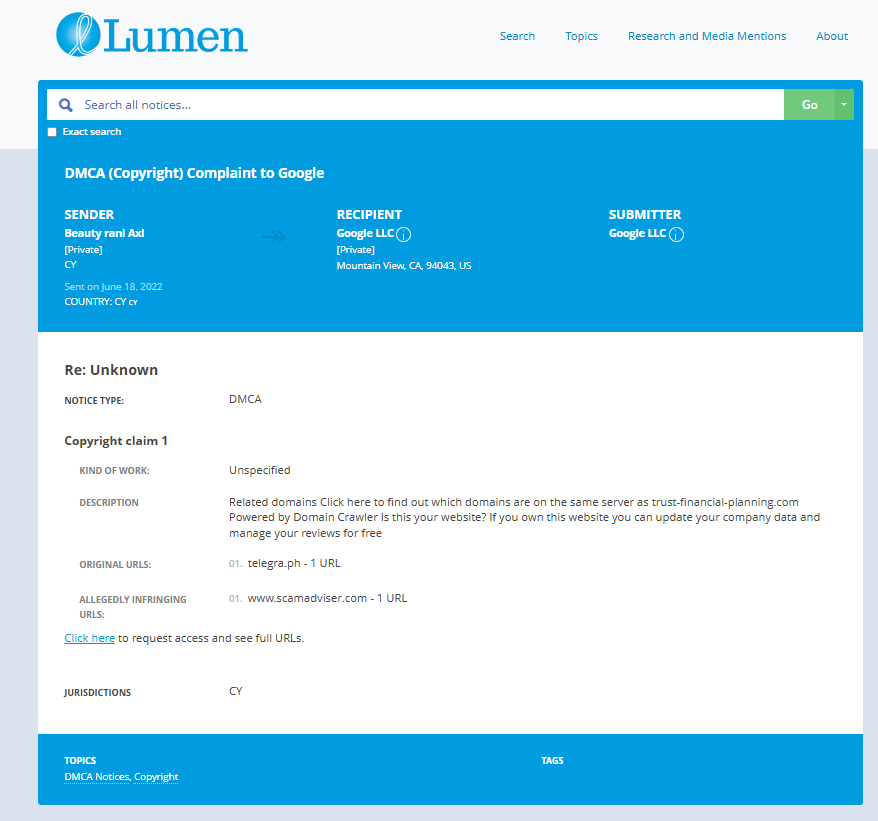

- June 18, 2022

- June 18, 2022

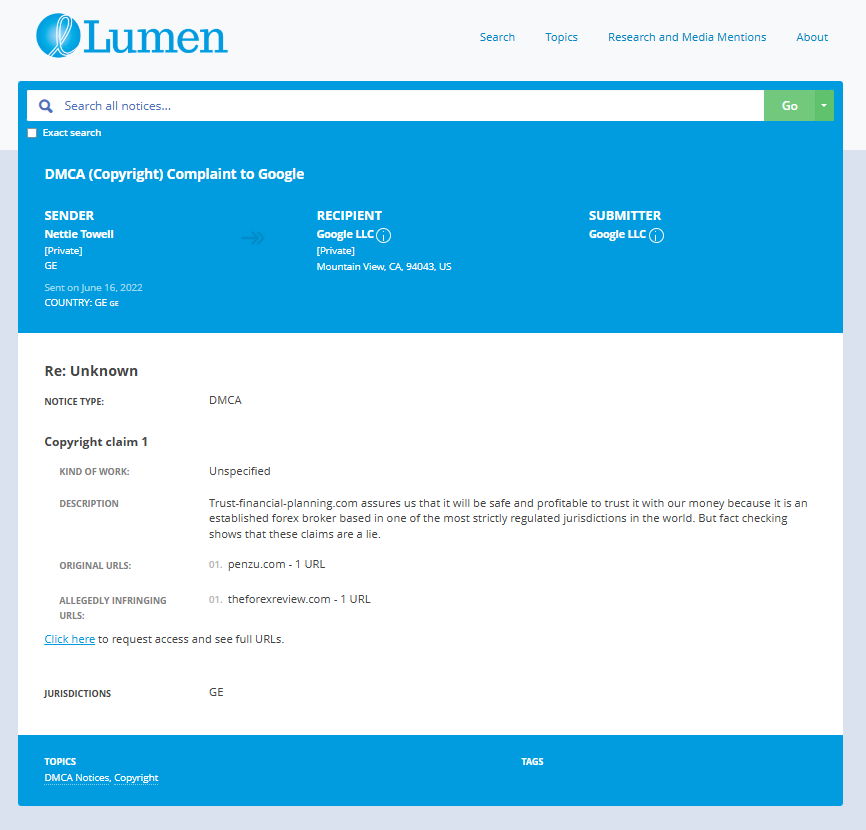

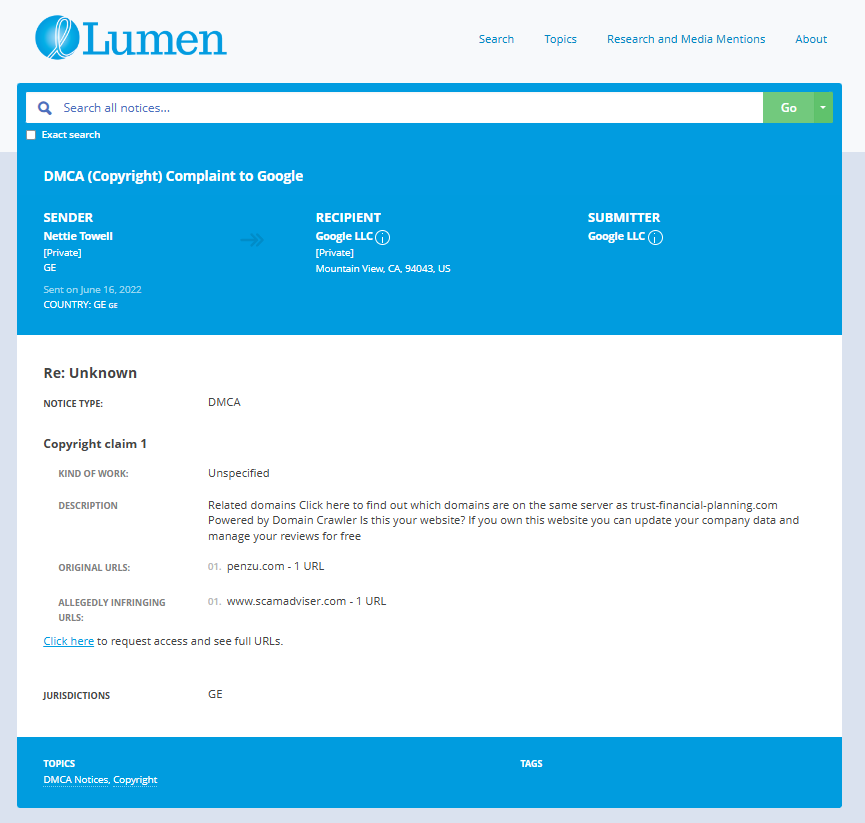

- June 16, 2022

- June 16, 2022

- May 31, 2022

- May 31, 2022

- Yazdan Mehrabi

- Yazdan Mehrabi

- Evert Waelchi

- Sima Atashi

- Evert Waelchi

- Beauty rani Axl

- Beauty rani Axl

- Nettie Towell

- Nettie Towell

- Evert Waelchi

- Evert Waelchi

- https://ext-6214246.livejournal.com/4024.html

- https://waelchi.blogspot.com/2022/05/trust-financial-planning.html

- https://medium.com/@simaatashi218/trust-financial-planning-com-review-5-things-you-should-know-about-%D1%82rust-financial-planning-b5b4c694d5be

- https://telegra.ph/Trust-financial-planningcom-review–5-things-you-should-know-about-Trust-Financial-Planning-06-18

- https://telegra.ph/Why-does-trust-financial-planningcom-have-a-very-low-trust-score-06-18-2https://penzu.com/p/b663ec52

- https://penzu.com/p/ba5b092chttps://waelchi.blogspot.com/2022/05/trust-financial-planningcom-review-5.html

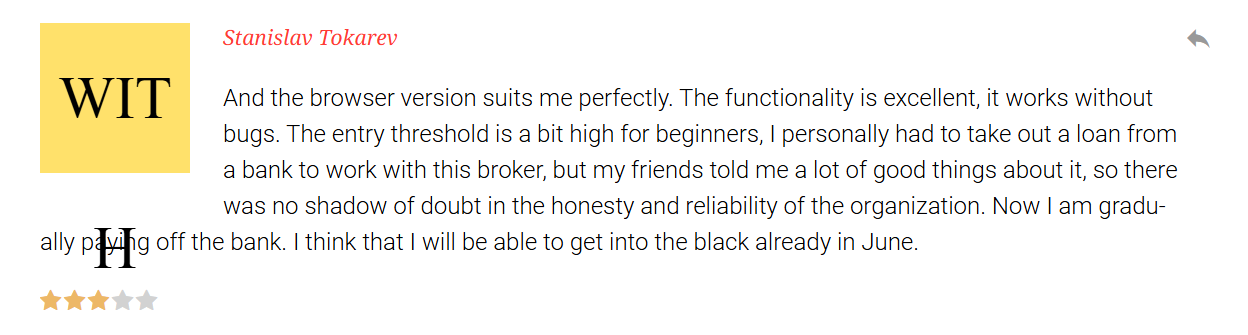

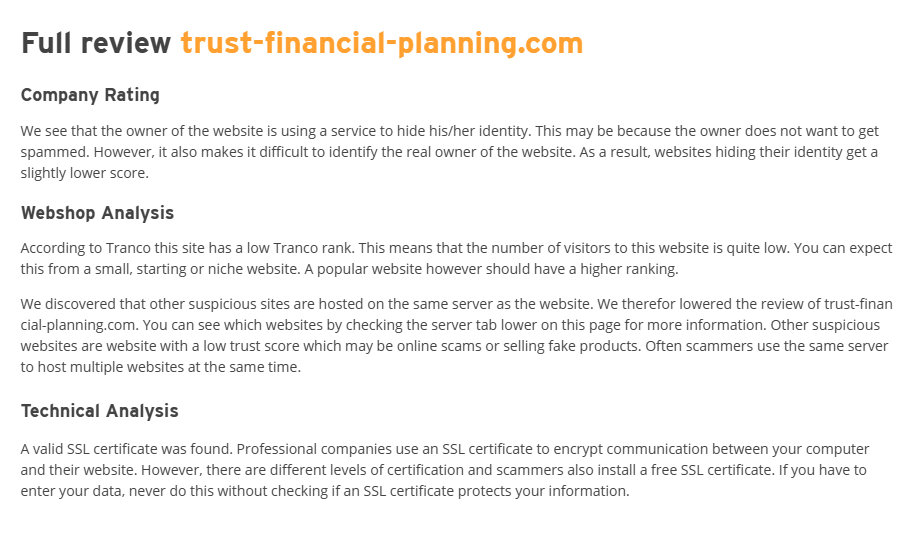

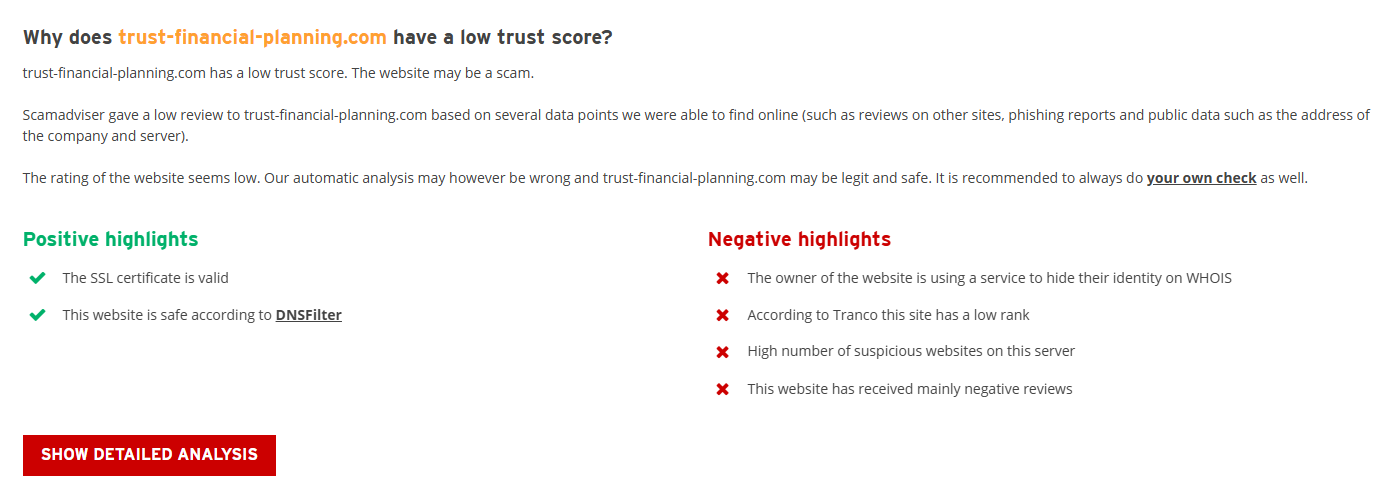

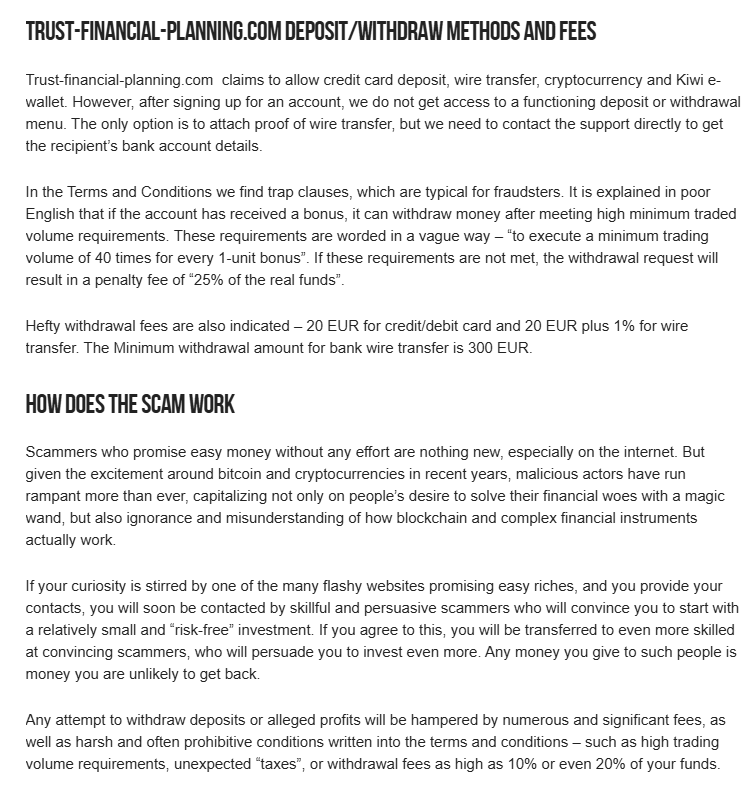

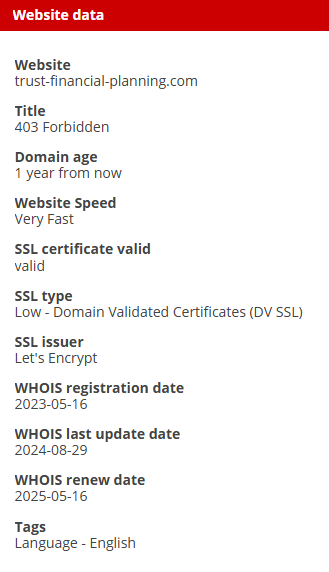

- https://www.scamadviser.com/check-website/trust-financial-planning.com

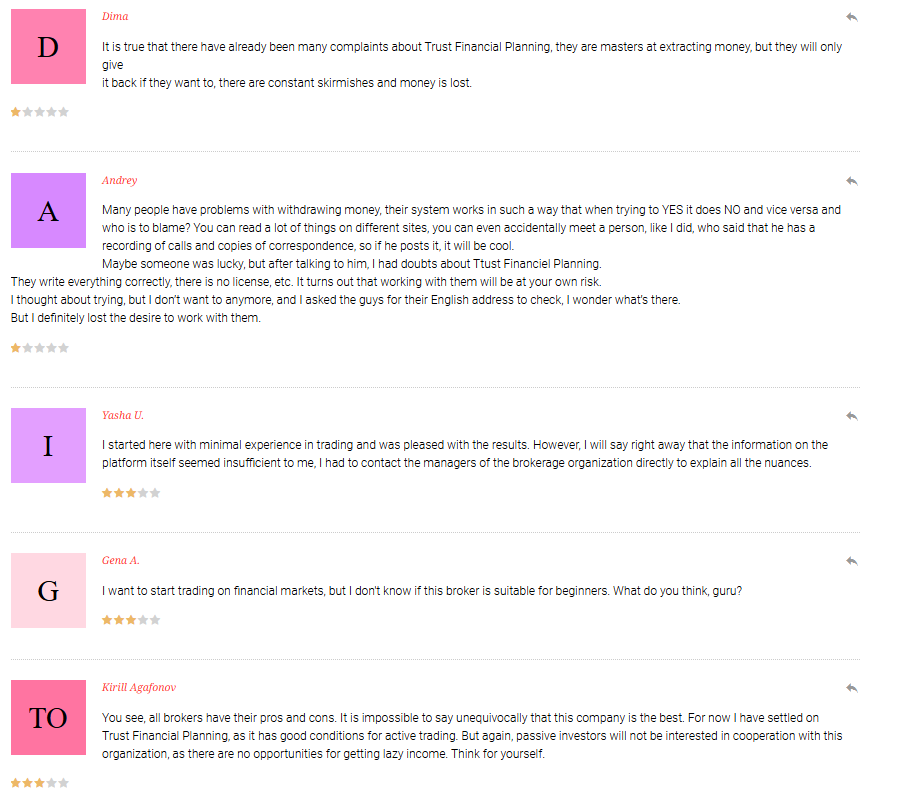

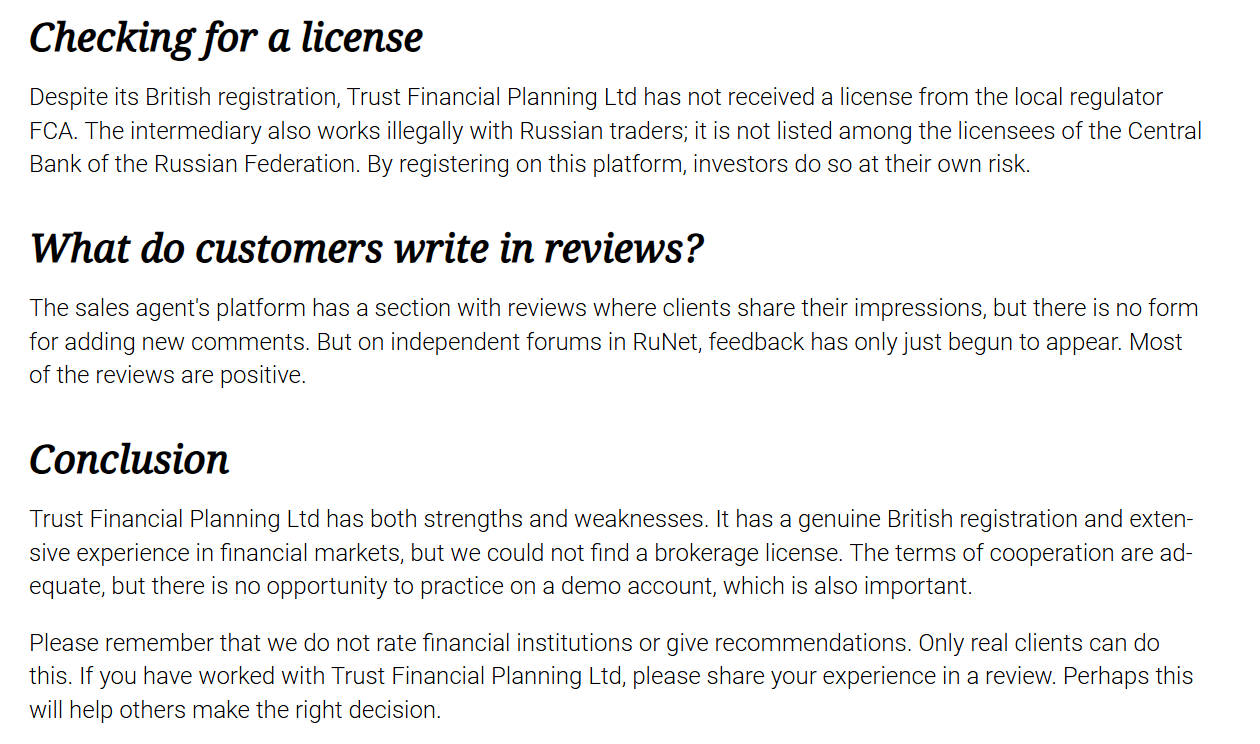

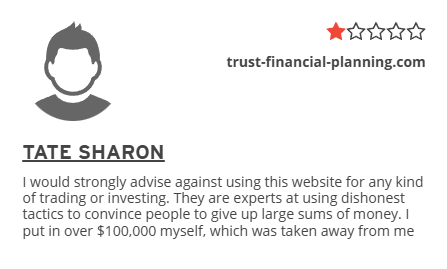

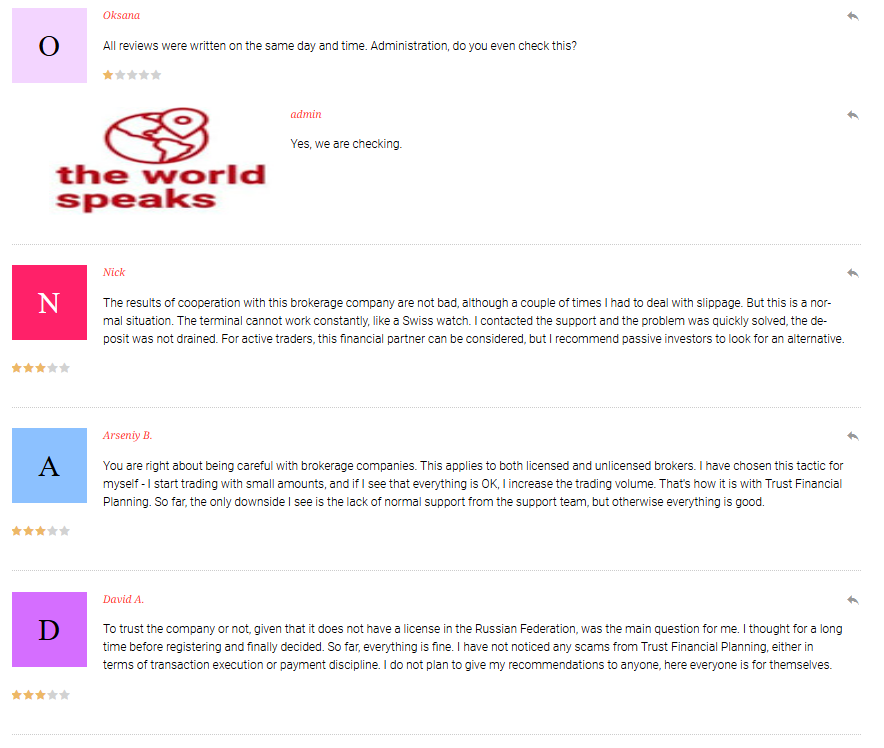

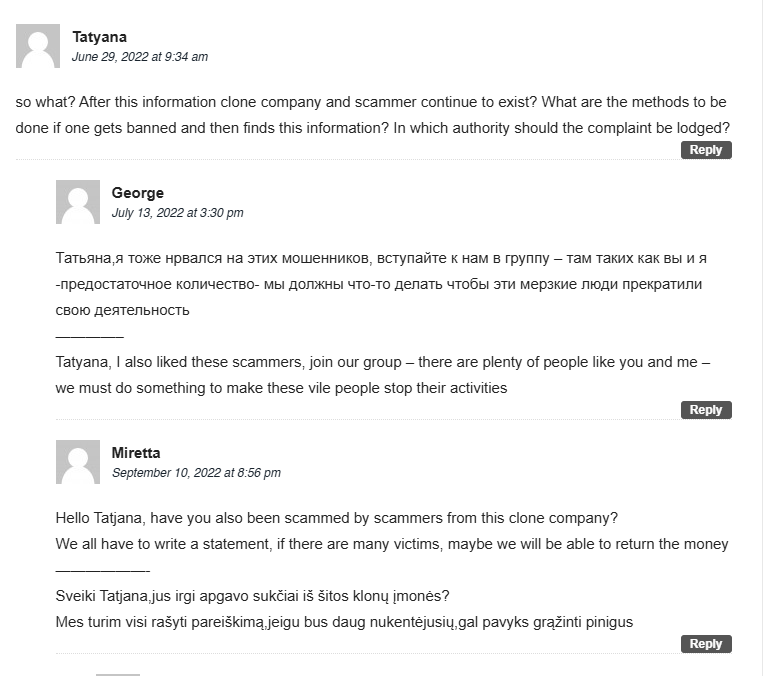

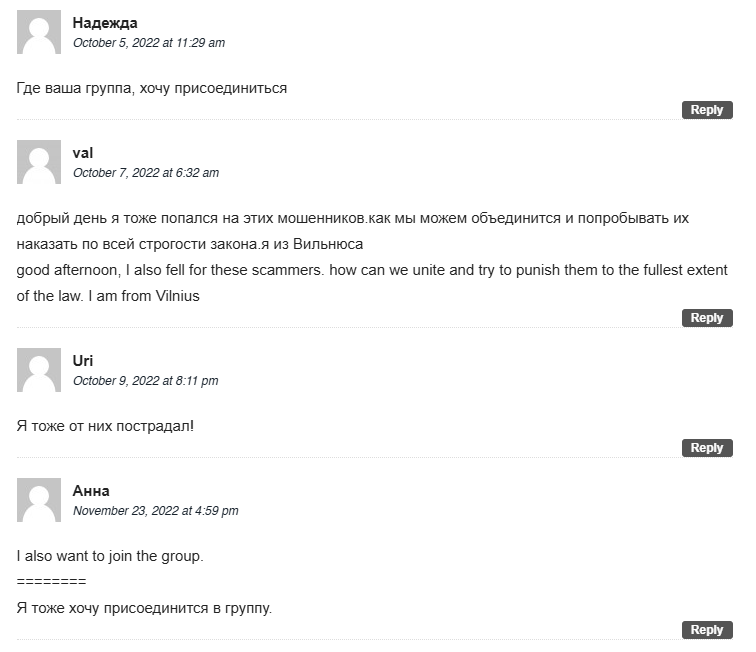

- https://the-world-speaks.com/brokery/otzyvy-o-trust-financial-planning-proverennyj-posrednik-ili-vtorosortnaja-kuhnja/

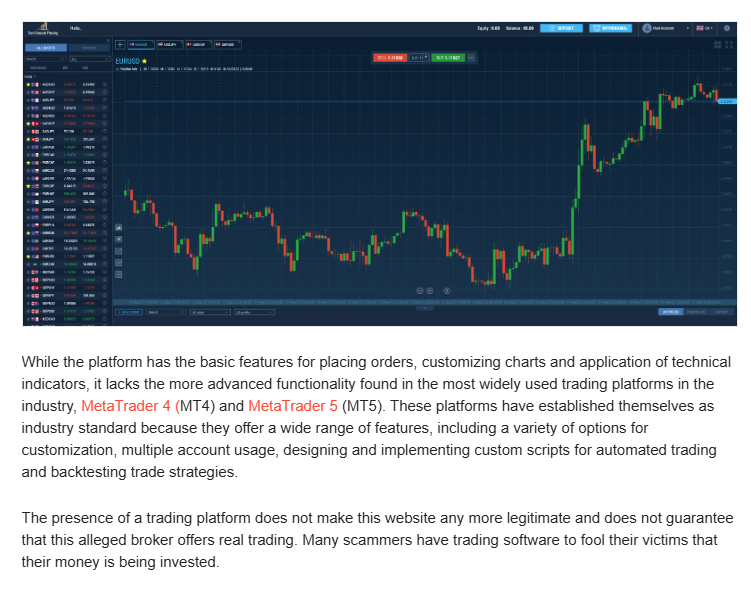

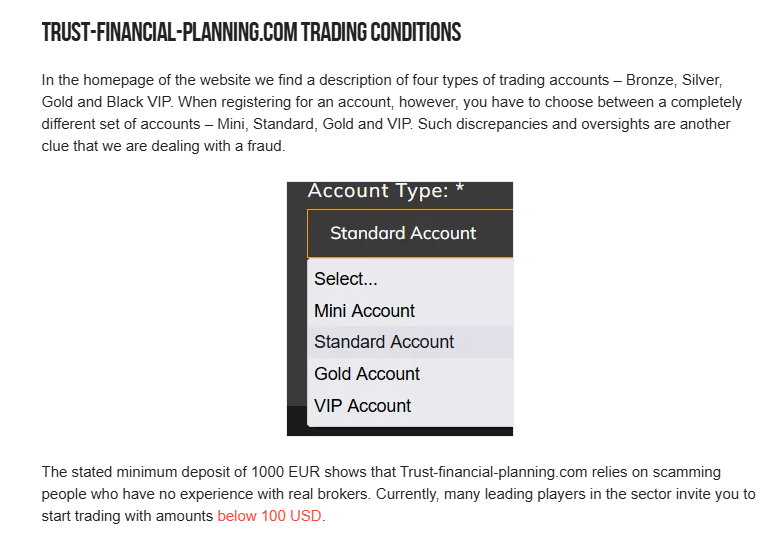

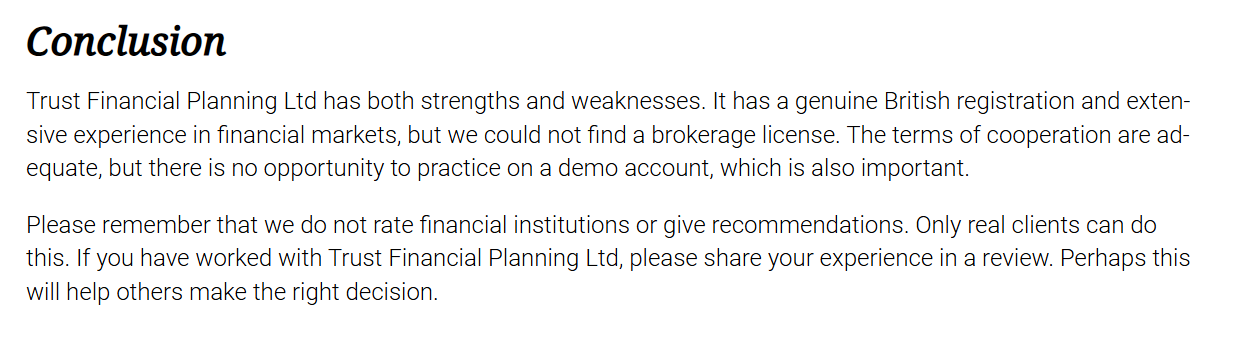

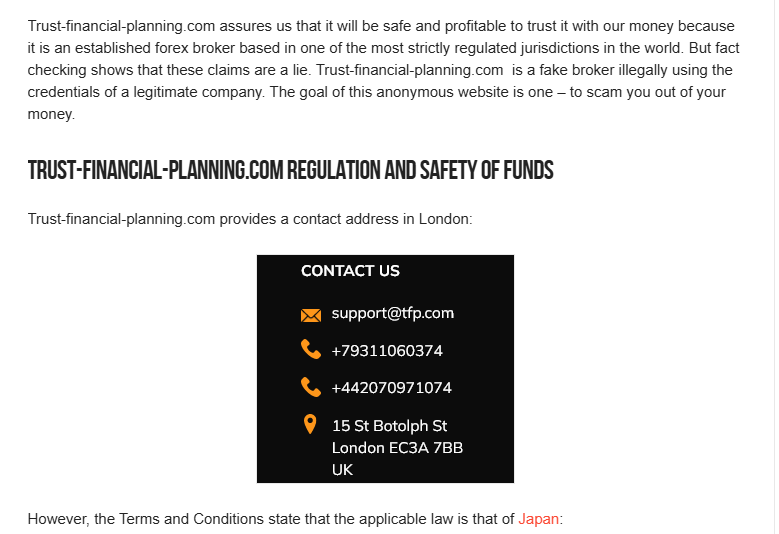

- https://theforexreview.com/2022/03/31/trust-financial-planning-com-review/

- https://vklader.com/trust-financial-planning-finsterling-btpgroup-nyx-broker-vnp-market/

Evidence Box

Evidence and relevant screenshots related to our investigation

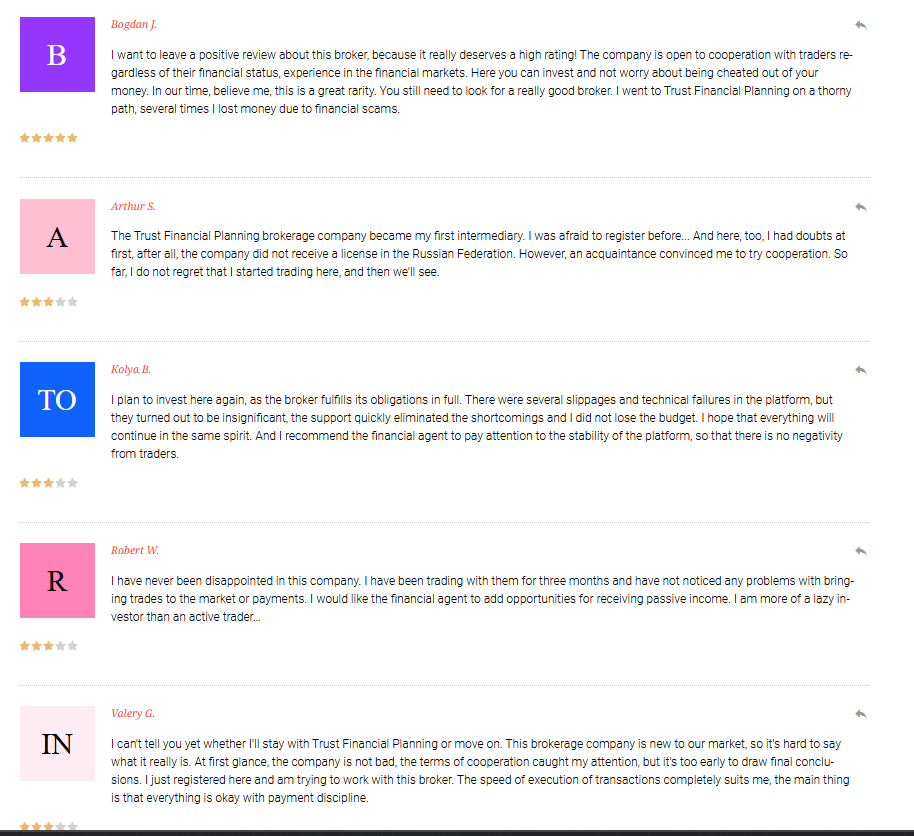

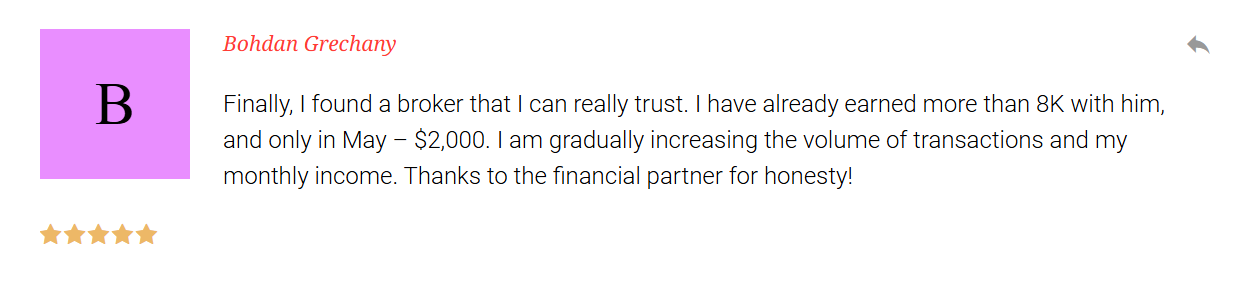

Targeted Content and Red Flags

the-world-speaks

Reviews of Trust Financial Planning: a proven broker or a second-rate "kitchen"

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Carl Koenemann

Investigation Ongoing

Vitaly Abasov

Investigation Ongoing

Samir Tabar

Investigation Ongoing

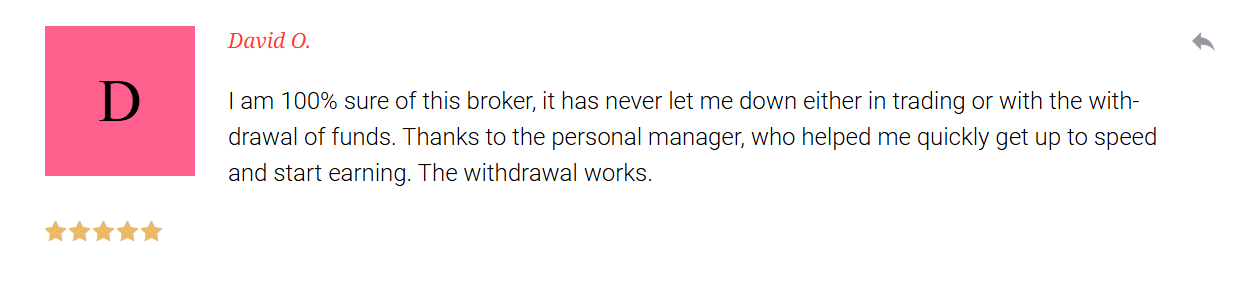

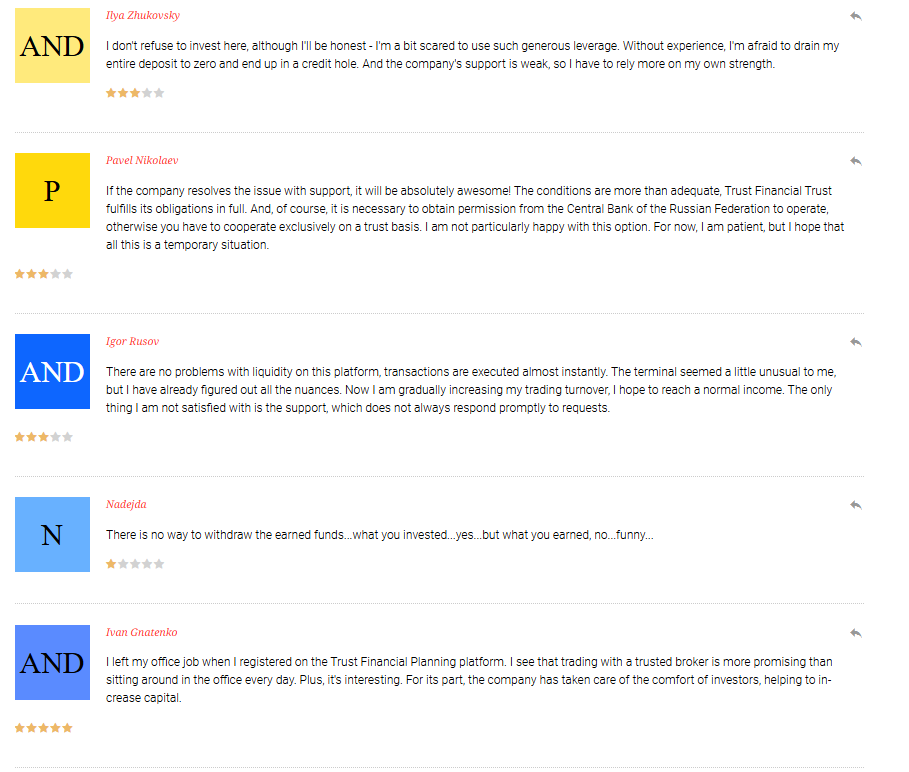

User Reviews

Average Ratings

1.9

Based on 3 ratings

by: Audrey Kelly

Trust Financial? More like Distrust Financial lmao. Nothing they did felt transparent. Just buzzwords and bad advice.

by: Joseph Bailey

I lost thousands through one of their 'advisors' who talked me into a 'safe' fund that tanked in months. Should’ve trusted my gut.

by: Hannah Rogers

If they’re misusing copyright laws just to shut people up, what ELSE are they hiding?

by: Brandon Neal

When you’re caught violating anti-money laundering protocols and client trust, maybe don’t name your firm “Trust.” The irony is just painful at this point. Financial partners should provide peace of mind, not lawsuits, scandals, and hacked media. This isn’t a...

by: Julia Bowman

Trust Financial Planning has become a case study in how not to run a financial advisory firm. From shady investment pushes to regulatory smackdowns, they’ve left a trail of mismanagement and mistrust. Clients deserve better than being treated like commission...

by: Sophia Diaz

Total scam! They stole my money and won’t even let me get in touch with anyone. Do not trust them!

by: Elijah Campbell

I was promised great returns but only faced deceit. Trust Financial Planning convinced me to invest large amounts, but they took everything. Don’t fall for their tricks!

by: Harper Young

Trust Financial Planning is a scam stay far away if you don’t want to lose your money.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations