What We Are Investigating?

Our firm is launching a comprehensive investigation into 247SmartFx over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that 247SmartFx - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

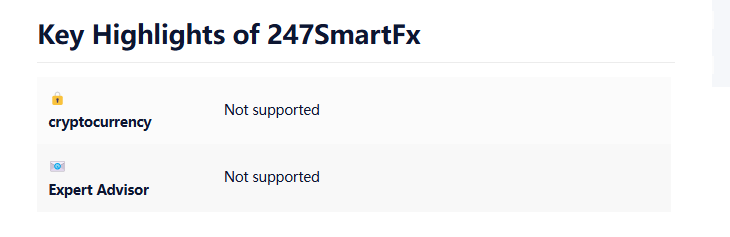

247SmartFx, an online trading platform, has faced a series of serious allegations and red flags that have cast a shadow over its reputation and credibility. These issues range from regulatory concerns to customer complaints, raising questions about the company’s legitimacy and business practices. Below is a summary of the major allegations and adverse news, along with an analysis of why 247SmartFx might seek to suppress this information, even resorting to unethical or illegal means.

Major Allegations and Red Flags

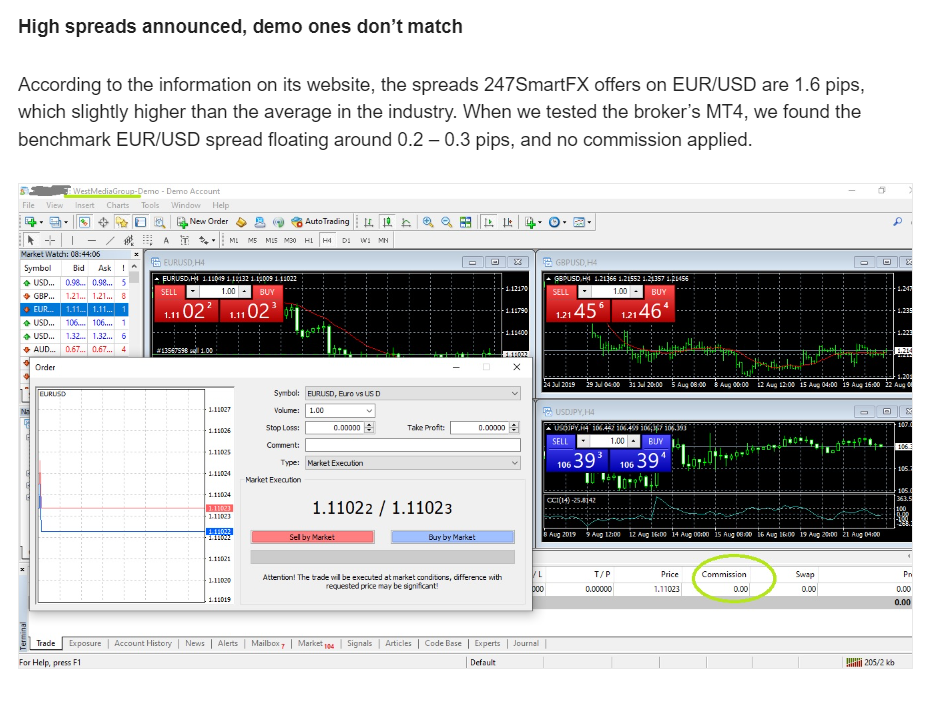

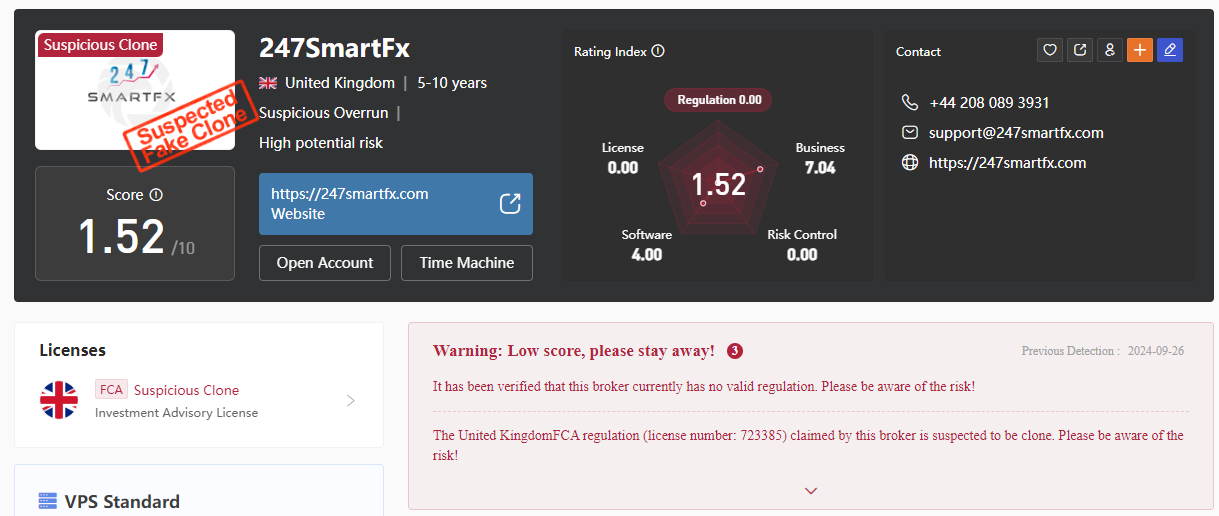

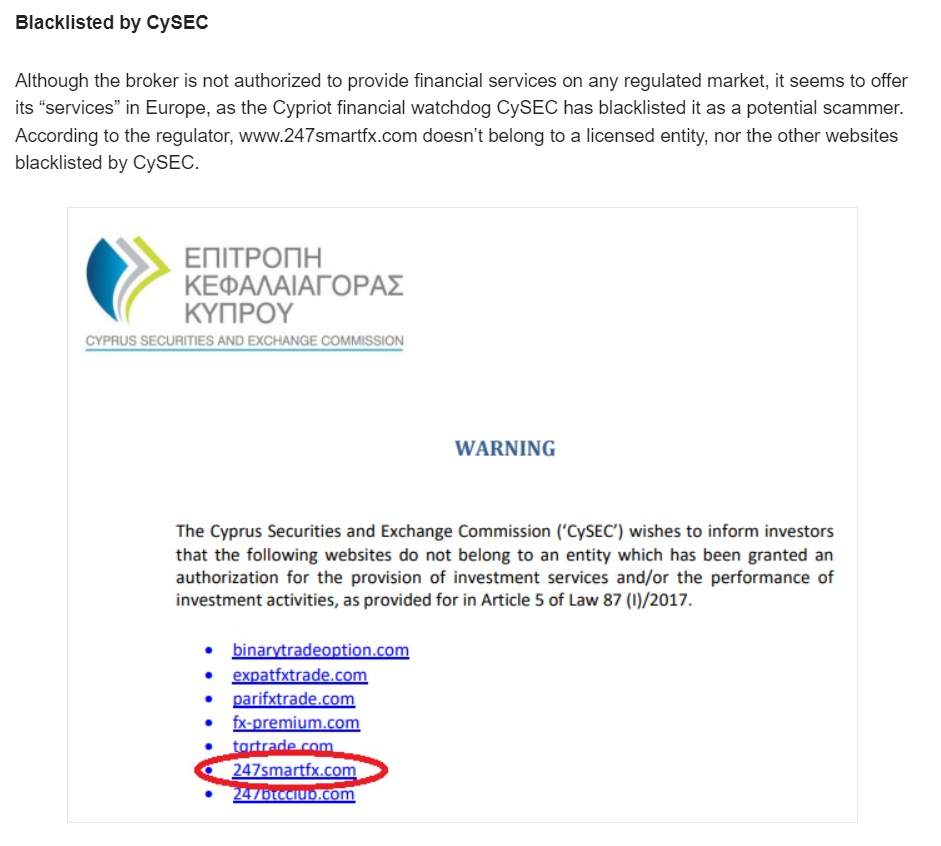

Lack of Regulatory Compliance

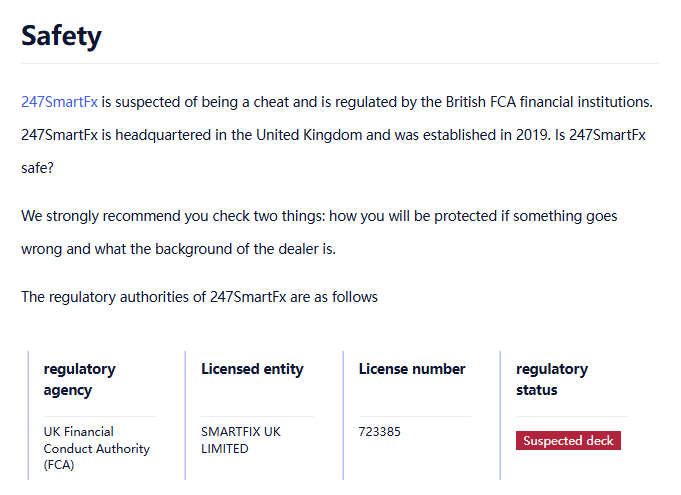

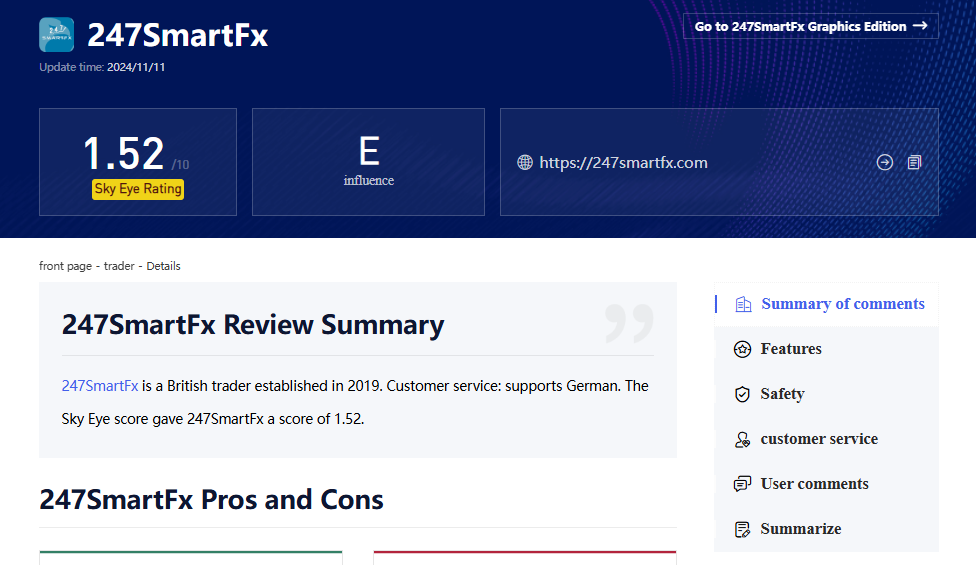

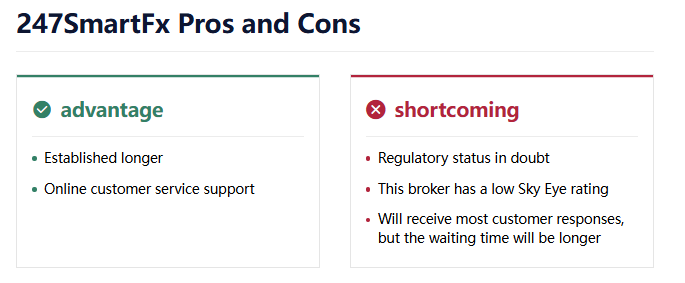

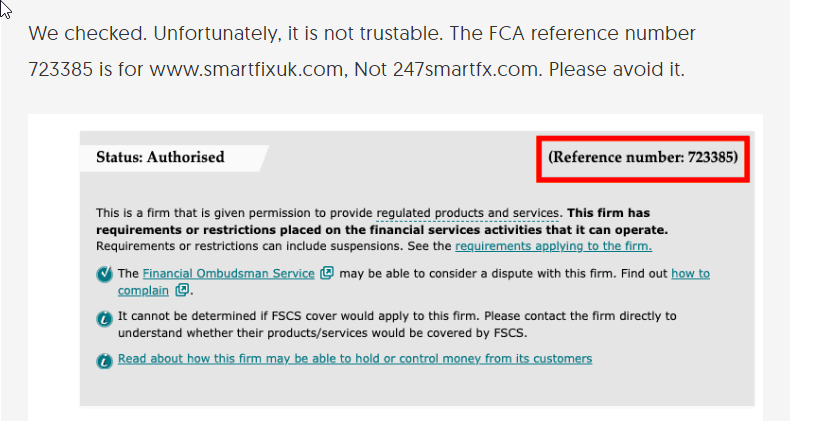

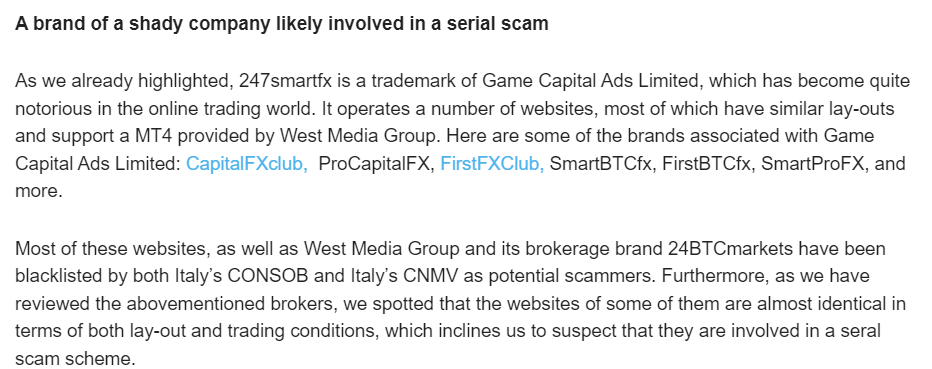

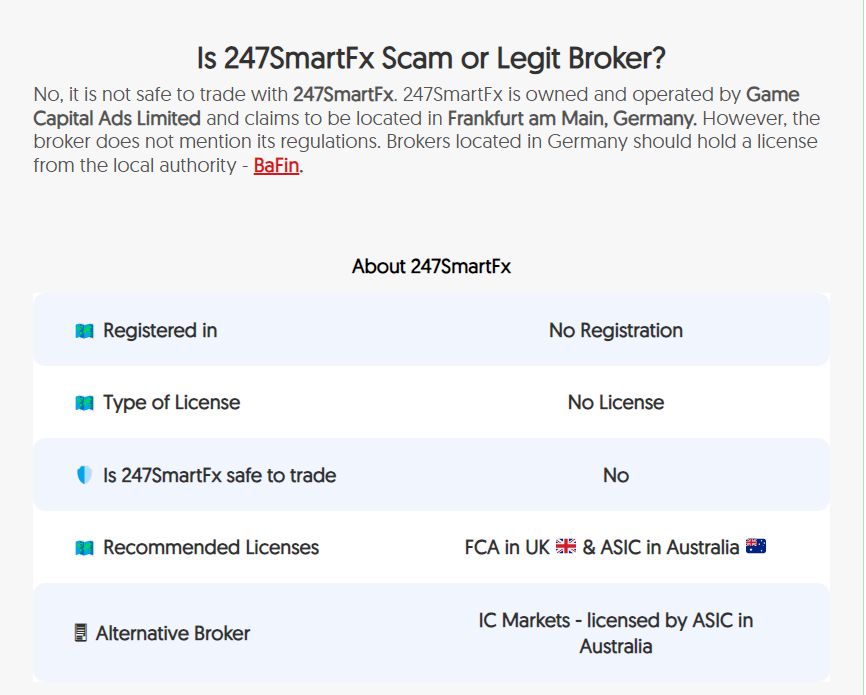

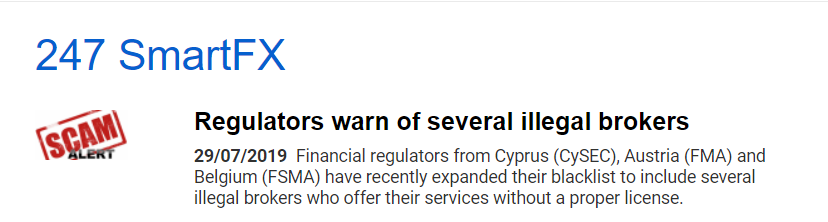

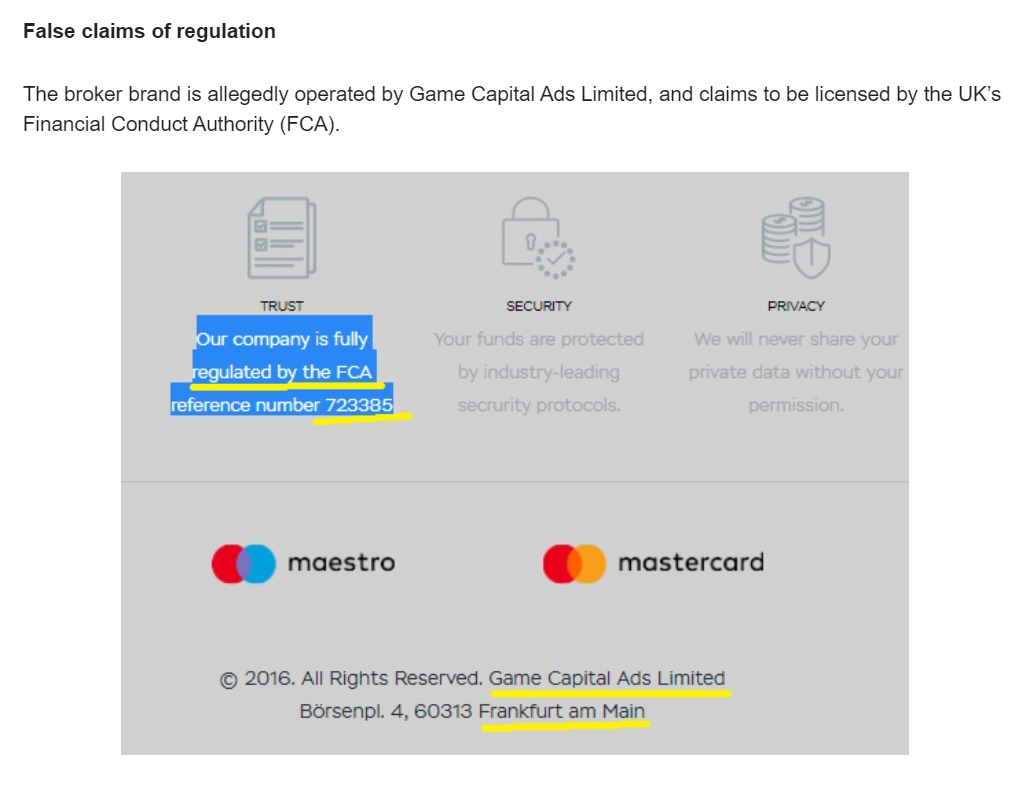

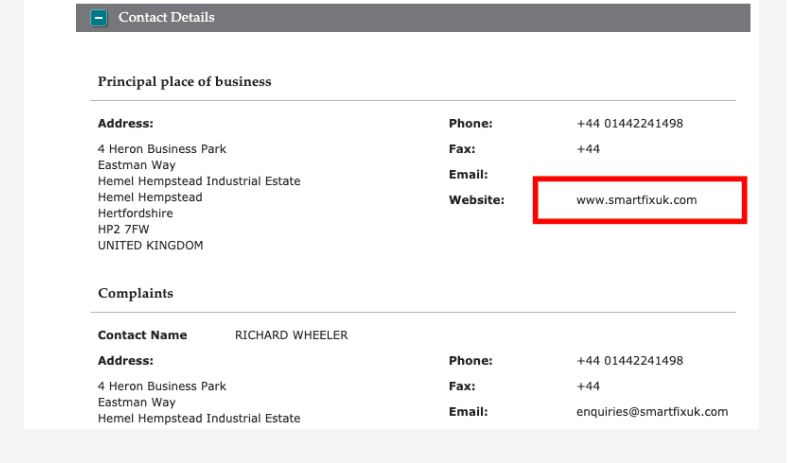

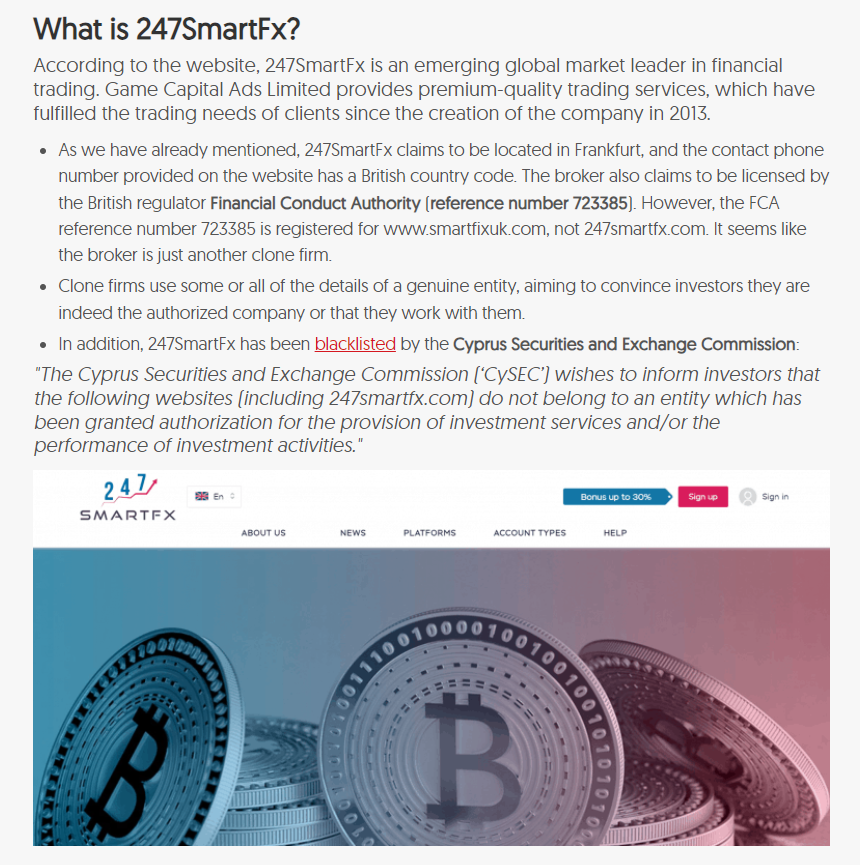

One of the most significant red flags is the absence of credible regulatory oversight. 247SmartFx has been accused of operating without proper licenses from reputable financial authorities such as the U.S. Securities and Exchange Commission (SEC), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC). Unregulated platforms are often associated with higher risks of fraud and malpractice.

Customer Complaints of Scams

Numerous online reviews and complaints allege that 247SmartFx engages in fraudulent activities, including withholding withdrawals, manipulating trading platforms, and pressuring clients into making additional deposits. Some customers have claimed that their accounts were abruptly closed after attempting to withdraw funds, a common tactic in scam operations.

Misleading Marketing Practices

The company has been accused of using aggressive and misleading marketing tactics to lure inexperienced traders. Promises of guaranteed high returns and risk-free trading are often cited as deceptive, as no legitimate trading platform can guarantee profits in volatile markets.

Anonymous Ownership and Lack of Transparency

The ownership and management of 247SmartFx remain shrouded in mystery. The company does not provide clear information about its leadership team or physical headquarters, which is a significant red flag for potential investors. This lack of transparency fuels suspicions about the platform’s legitimacy.

Adverse Media Coverage

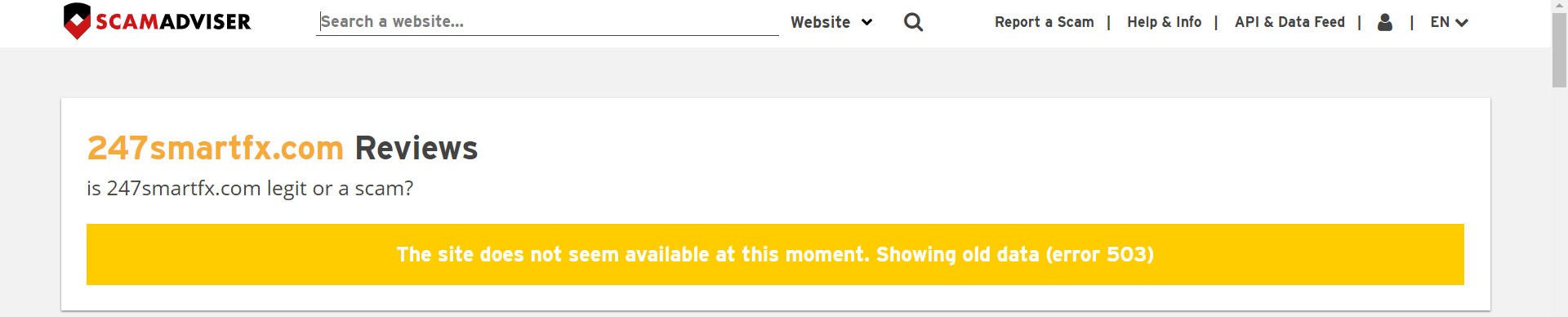

Several investigative reports and consumer watchdog websites have flagged 247SmartFx as a potential scam. These reports often highlight the platform’s unregulated status, customer complaints, and questionable practices, further damaging its reputation.

Reputational Harm and Motivation for Suppression

The allegations and adverse news surrounding 247SmartFx pose a severe threat to its reputation and business operations. For a company that relies heavily on attracting new clients, negative publicity can lead to a loss of trust, reduced customer acquisition, and ultimately, financial losses. Here’s why 247SmartFx might want to suppress this information:

Loss of Credibility

The lack of regulatory compliance and transparency undermines the platform’s credibility. Potential clients are likely to avoid a platform that is flagged as unregulated or fraudulent, especially in the highly competitive online trading industry.

Impact on Revenue

Customer complaints about withheld withdrawals and scam allegations can deter new investors and prompt existing clients to withdraw their funds. This directly impacts the company’s revenue stream and profitability.

Legal and Regulatory Risks

Persistent negative media coverage and consumer complaints could attract the attention of regulatory authorities, leading to investigations, fines, or even shutdowns. Suppressing such information could help the company avoid legal repercussions.

Reputation Management

In the digital age, online reputation is critical. Negative reviews, scam allegations, and adverse news can dominate search engine results, making it difficult for 247SmartFx to attract new clients. Removing or suppressing this information could help the company maintain a facade of legitimacy.

The Cybercrime Angle

Given the high stakes, 247SmartFx might be tempted to resort to unethical or illegal means to suppress damaging information. This could include hacking into websites to remove negative reviews, launching distributed denial-of-service (DDoS) attacks against critics, or employing fake accounts to manipulate online discussions. Such actions, while illegal, could provide a temporary reprieve from the negative publicity, allowing the company to continue its operations without immediate scrutiny.

However, engaging in cybercrime would only compound the company’s legal and ethical issues, potentially leading to more severe consequences in the long run. The risks of exposure, prosecution, and further reputational damage make this a dangerous and unsustainable strategy.

Conclusion

The allegations and red flags against 247SmartFx paint a troubling picture of a platform that may prioritize profit over ethical business practices. While the company might seek to suppress this information to protect its reputation and revenue, doing so through illegal means would only exacerbate its problems. For potential investors, the best course of action is to exercise caution, conduct thorough due diligence, and avoid platforms with such a tarnished track record.

- https://lumendatabase.org/notices/44342506

- Sep 05, 2024

- OptiPulse Technologies Ltd.

- https://www.worldforexaward.com/ms/directory-of-forex-brokers/report/247smartfx

- https://www.wikifx.com/zh/word/2281496635.html

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.6

Based on 15 ratings

by: Benjamin Walker

They’re fighting bad press with fake reviews and intimidation tactics, not improvements. If 247SmartFx spent less time covering tracks and more on legitimate business, they might actually be worth something but they won’t.

by: Emily Perez

Platforms like 247SmartFx rely on fake marketing and buried criticism to lure in victims. From sketchy claims to mysterious owners, the whole setup screams fraud. No license, no oversight, no recourse. Only risk and regret.

by: James Mitchell

247SmartFx’s entire operation reeks of deception unlicensed, anonymous, and packed with complaints. Once you try to withdraw your money, the smiling sales pitch vanishes. You’re left with silence, delays, or outright denial. That’s not trading it’s theft.

by: Isabella Harris

Spent weeks trying to withdraw. Still nothing. Zero transparency.

by: Andrew Jackson

Can’t believe I fell for this. Lesson learned the hard way 💸

by: Sophia White

They promise 24/7 service but go silent the moment you deposit.

by: Niko Fischer

The absence of verifiable regulatory credentials for 247SmartFx raises significant concerns about its legitimacy and adherence to financial standards.

by: Emma Novak

Invested a good sum, but the platform started acting up. Can't access my account anymore.

by: Erik García

Tried to withdraw my funds, but they kept making excuses. Now, they don't even respond. Total scam!

by: Grace Young

247SmartFx is a complete fraud! They manipulate trades, refuse payouts, and now they’re hiding negative reviews? Stay far away

by: Daniel White

I deposited $5,000, made a few profitable trades, but when I tried to withdraw, they suddenly 'needed verification' again and again. Eventually, they just locked me out. Lesson learned, never trust unregulated brokers

by: Lucas Young

I’ve seen better crypto platforms with transparent policies and lower fees. 247SmartFX doesn’t stand out in any positive way. Stay away...

Cons

by: Amelia Lewis

I lost money trading with 247SmartFX because of their unpredictable spreads and sudden price changes.

by: Sophia Garcia

They make me fall so badly for them and my money was taken away From me.

by: Liam Williams

Don't trust "247smartfx" at all!! I invested about $87000. I sent the crypto funds, then I waited and waited and never got a response.

Cons

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations