What We Are Investigating?

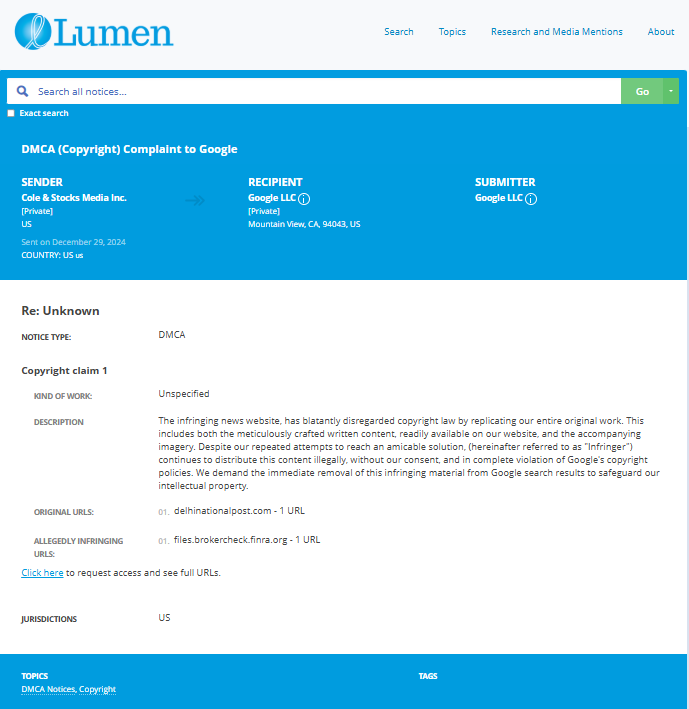

Our firm is launching a comprehensive investigation into Alpine Securities USVI, LLC over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Alpine Securities USVI, LLC - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Alpine Securities USVI, LLC. has been flying under the radar, but not for reasons that should reassure investors. With a direct link to its scandal-ridden predecessor, Alpine Securities Corporation, this firm appears to be a rebranded continuation of the same problematic business practices that led to expulsion from the financial industry. Even more troubling are the apparent efforts to suppress information about its past, raising serious concerns about its transparency and trustworthiness. This report will delve into the red flags surrounding Alpine Securities USVI, LLC., its deep-rooted issues, and its attempts to control the narrative through censorship.

Alpine Securities USVI, LLC. : A Masterclass in Financial Red Flags and Censorship Attempts

In the world of finance, where transparency and integrity are paramount, few entities have managed to set off as many alarm bells as Alpine Securities USVI, LLC. While they may attempt to operate under the radar, their connections, actions, and alleged efforts to suppress negative information make them a textbook example of why due diligence is crucial.

The Alpine Securities Web of Controversy

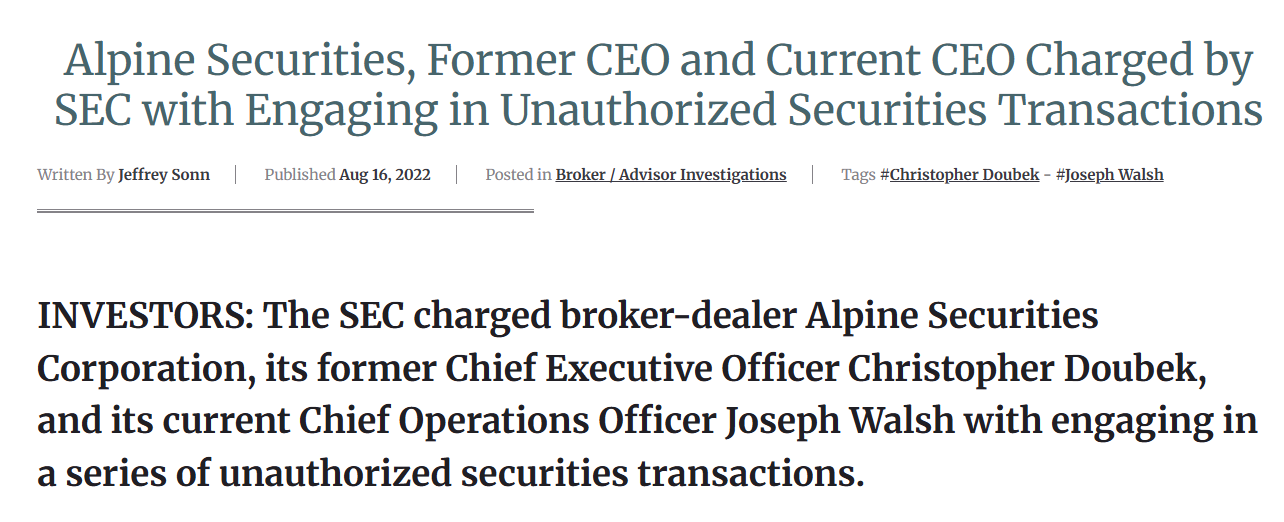

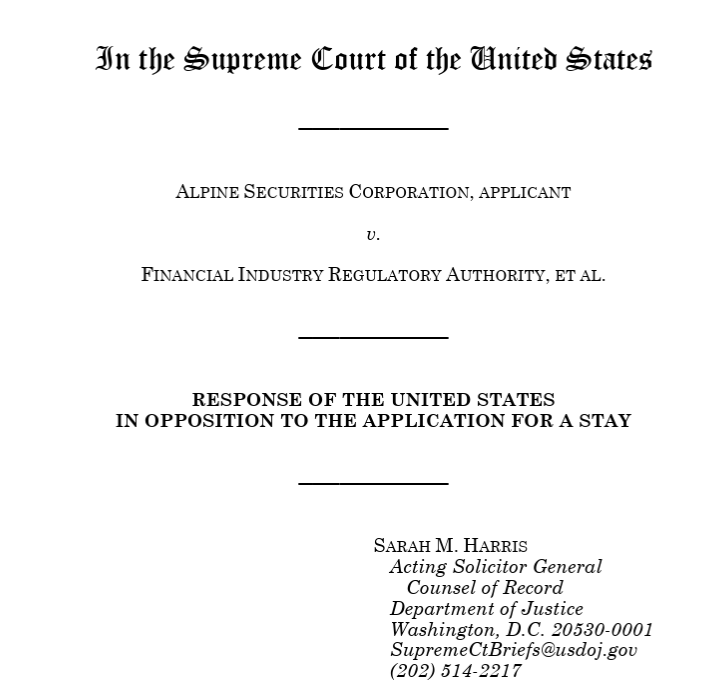

To truly understand the risk factors associated with Alpine Securities USVI, LLC., one must look at its close relative: Alpine Securities Corporation. Based in Salt Lake City, this brokerage firm was expelled from the Financial Industry Regulatory Authority (FINRA) in March 2022 for a laundry list of violations that read like a financial crime thriller.

Among the most egregious of their infractions were:

- Misuse of customer funds and securities

- Unauthorized trading

- Imposing exorbitant and undisclosed fees

- Illegally withdrawing capital

Regulators found that Alpine Securities Corporation was engaged in systematic misconduct, essentially fleecing investors through hidden fees and unauthorized transactions. One particularly notorious tactic involved imposing an absurd $5,000 monthly fee on customers who hadn’t closed their accounts—a move designed to strong-arm clients into forfeiting their investments. To make matters worse, when customers tried to exit, Alpine allegedly appropriated smaller-value securities for mere pennies on the dollar, leading to significant financial losses.

These are not the actions of a firm looking out for investors; they are the telltale signs of a predatory institution seeking to extract every last cent from its clients before regulators catch on.

Alpine Securities USVI, LLC.: A New Name, Same Old Playbook?

After the well-publicized downfall of Alpine Securities Corporation, one would think that any affiliated entities would work overtime to distance themselves from controversy. Instead, Alpine Securities USVI, LLC. appears to be operating under a veil of secrecy, likely hoping to avoid the same fate as its FINRA-expelled counterpart.

One could argue that moving operations to the U.S. Virgin Islands was a strategic decision—not necessarily to seek better business opportunities, but rather to leverage the regulatory environment to their advantage. The USVI’s financial oversight is less aggressive than FINRA, making it a potentially appealing jurisdiction for firms looking to escape stringent U.S. regulations while still operating in a U.S. territory.

The Art of Censorship: Alpine’s Suspect Media Suppression Tactics

In today’s digital world, reputational damage can be just as devastating as financial penalties. It appears Alpine Securities USVI, LLC. is well aware of this, as multiple sources suggest that the firm has actively tried to suppress negative coverage about its connections and past misconduct.

Some key indicators of this attempt to control the narrative include:

- Legal threats against whistleblowers and journalists: When unfavorable reports surface, some firms resort to legal intimidation rather than transparency. If Alpine has nothing to hide, why the aggression toward those reporting on its history?

- Search engine manipulation: Companies engaged in questionable activities often invest in reputation management services to bury negative press under a flood of self-published content or misleading SEO tactics.

- Silence from the company itself: Firms with nothing to hide usually address concerns head-on. The conspicuous lack of direct responses from Alpine Securities USVI, LLC. regarding its connection to the disgraced Alpine Securities Corporation suggests they would rather let the controversy fade than engage in damage control.

Why Investors and Regulators Should Be Concerned

While Alpine Securities USVI, LLC. might not have racked up the same number of fines or penalties as its now-expelled predecessor, its association with a firm that was effectively run out of the brokerage industry should give any investor serious pause. Given the history, can one really trust that this entity operates any differently?

Regulators should also be watching closely. The brokerage world is no stranger to firms reinventing themselves under new names or jurisdictions to avoid past regulatory actions. Without stricter oversight, it’s only a matter of time before history repeats itself.

Conclusion: A Dangerous Bet

At the end of the day, investing in a firm with Alpine’s history is like playing financial Russian roulette. The risks are enormous, and the track record speaks for itself. For investors, the smartest move is simple: stay far away. For regulators, it’s time to shine a spotlight on Alpine Securities USVI, LLC. before it becomes the next headline for all the wrong reasons.

- https://lumendatabase.org/notices/47574489

- December 29, 2024

- Cole & Stocks Media Inc.

- https://delhinationalpost.com/2024/03/29/this-xml-file-does-not-appear-to-have-any-style-information-associated-with-it-the-document-tree-is-shown-below/

- https://files.brokercheck.finra.org/firm/firm_149217.pdf/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

securitiesarbitrations.com

FINRA Charges Alpine Securities With Theft Of Customer Funds

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

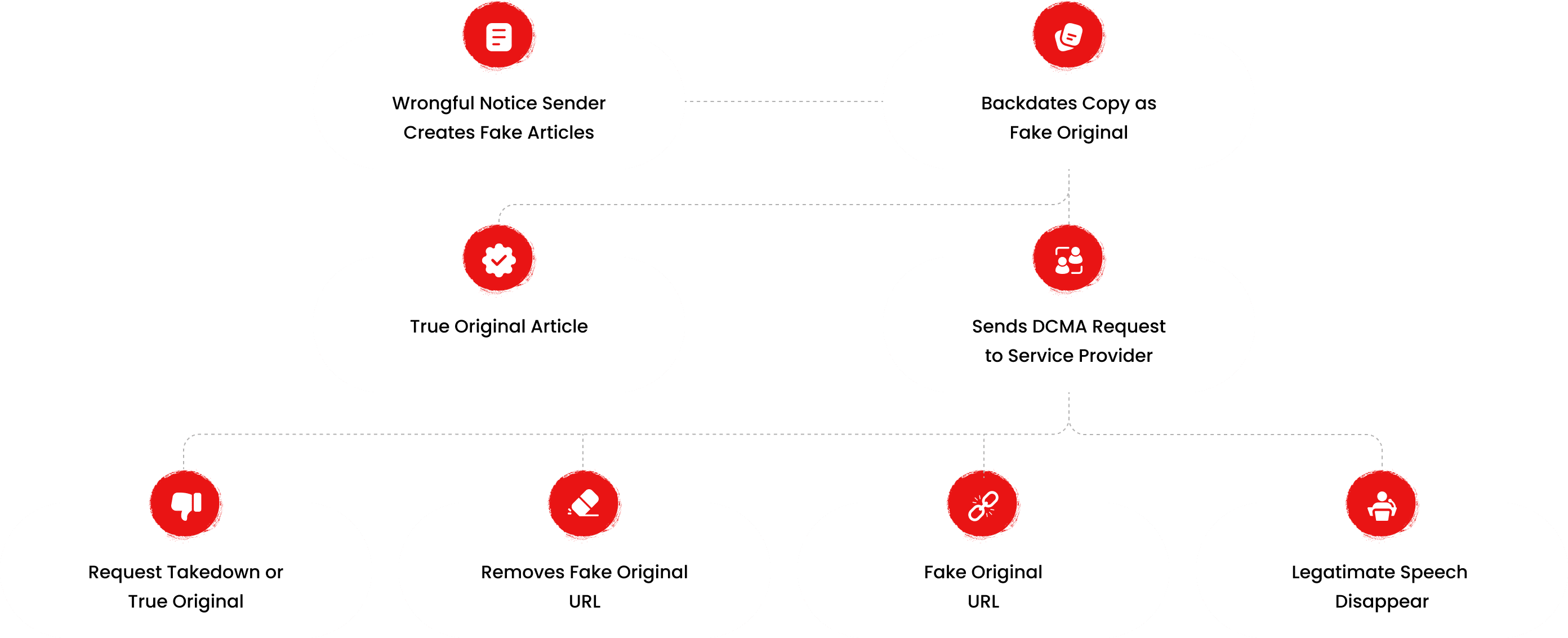

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

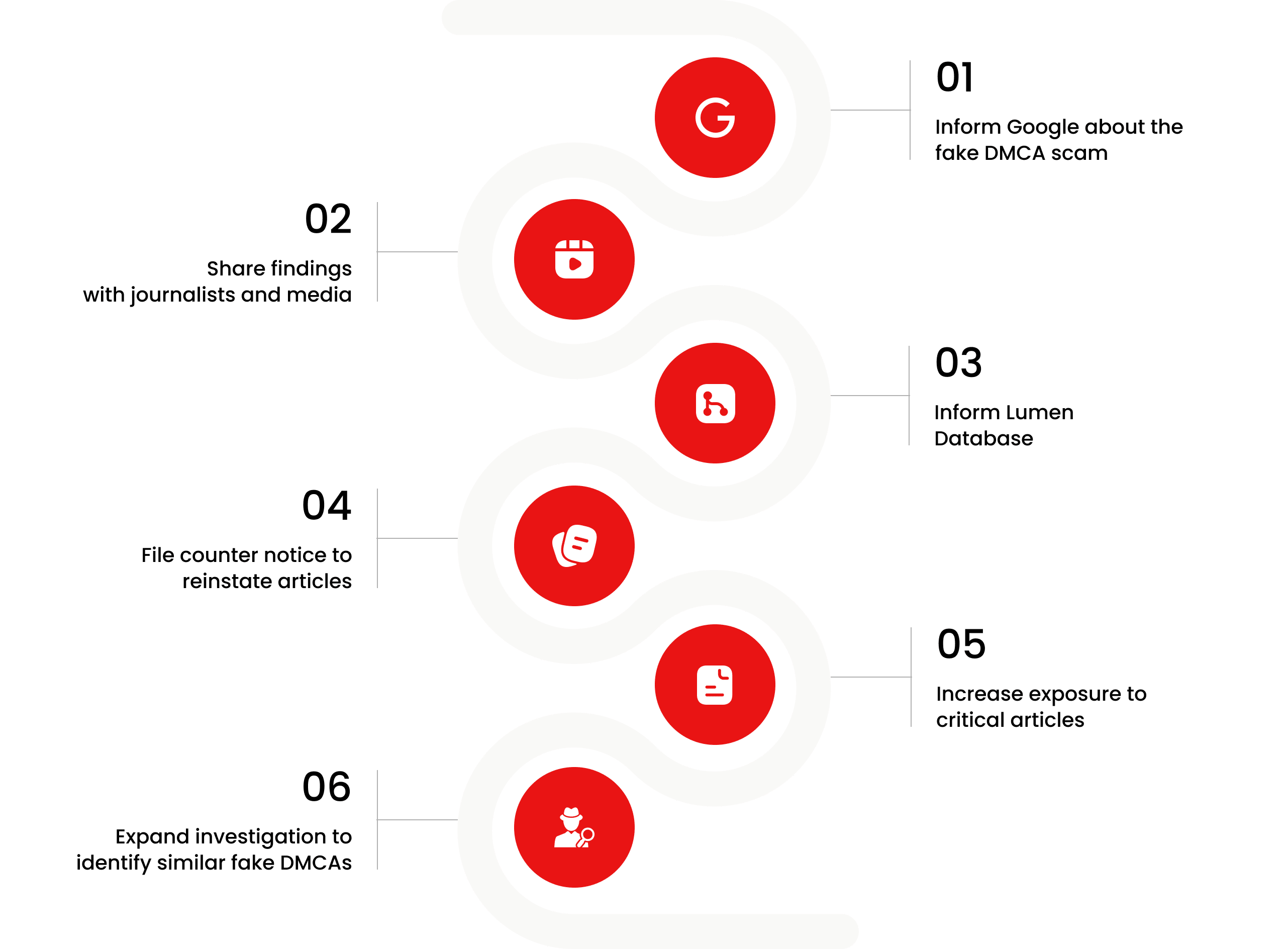

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 5 ratings

by: Jack Holt

I lost thousands cause of these crooks. no warning, no help, just silence. Whole thing’s shady and no one seems to care. Regulators sleeping or what?

by: Isla Frost

this is straight up fraud, how this ppl even allowed to run firms?

by: Lila Monroe

Moving operations to the U.S. Virgin Islands looks like a strategic play to evade stricter regulations, and investors should be wary of firms trying to escape oversight. With ties to a previously expelled firm, Alpine Securities USVI raises more questions...

by: Jasper Kane

When a company has a history of fleecing its customers with hidden fees and unauthorized transactions, you don’t just brush it off because they changed their name. Alpine Securities USVI is built on a foundation of dishonesty, and their shady...

by: Ivy Hayes

If there’s one thing Alpine Securities USVI excels at, it’s censorship. From silencing journalists to manipulating search engine results, they seem more focused on protecting their reputation than providing transparent services. Investors should take note: companies this secretive are a...

by: Finn Glover

It’s hard to ignore the fact that Alpine Securities USVI is just a reincarnation of a scandal-ridden firm that was kicked out of the financial industry. They may have moved to the U.S. Virgin Islands to avoid regulatory oversight, but...

by: Elise Ford

Alpine Securities USVI, LLC. might have changed its name, but its shady practices are still alive and well. With a history of deceit, from unauthorized trading to exorbitant hidden fees, this firm is anything but trustworthy. Their attempts to bury...

by: Natalie Pearson

After losing $14,000 to Alpine Securities USVI, I’m convinced they’re running the same scams as their predecessor stay far away, these guys are nothing but trouble

by: Henry Chambers

After losing $12,500 with Alpine Securities USVI, I’ve realized it was just a rebranded version of a company that’s been kicked out for fraud they’ll take your money and run...

by: Caitlin Watson

I invested $15,000 with Alpine Securities USVI, and now I'm left with nothing after they played every trick in the book to prevent me from withdrawing this feels like a scam😥

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations