What We Are Investigating?

Our firm is launching a comprehensive investigation into Andy Altahawi over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Andy Altahawi - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Andy Altahawi may not be a household name, but in financial circles, his reputation precedes him—for all the wrong reasons. Once a lawyer and financial consultant, Altahawi found himself at the center of a multi-million-dollar securities fraud case involving Longfin Corp., a fintech company that became infamous for its meteoric rise and catastrophic fall. But rather than owning up to his alleged misdeeds, Altahawi has seemingly chosen a different strategy: rewriting his narrative by burying the evidence of his financial shenanigans.

In this report, I’ll expose the red flags surrounding Altahawi, the adverse media coverage he so desperately wants to silence, and the tactics he may be using to erase or suppress incriminating information. If you’re an investor considering any involvement with entities or individuals linked to Altahawi, consider this your flashing red warning light.

The Longfin Debacle: How It All Unraveled

To understand why Andy Altahawi is on a reputational clean-up mission, you need to know about Longfin Corp., the ill-fated company that dragged him into the SEC’s crosshairs. Longfin was a supposed fintech disruptor that launched in 2017 with grand promises of revolutionizing blockchain-powered financial services. In December of that year, the company announced its acquisition of Ziddu.com, a cryptocurrency platform, and its stock price skyrocketed by an unfathomable 2,600% in just days.

Sounds suspicious? It was. The SEC later determined that this price surge was part of a fraudulent scheme orchestrated by Longfin insiders, including Andy Altahawi. The accusations were damning: Altahawi and his associates were found to have illegally sold restricted shares during the company’s artificial stock surge, raking in over $27 million in profits. The U.S. federal court froze their assets, backing the SEC’s claim that the scheme violated securities laws.

And yet, while Longfin’s CEO, Venkat Meenavalli, became the face of the scandal, Altahawi managed to slink into the background—possibly hoping that if he stayed quiet long enough, the world would forget about his role. Unfortunately for him, the internet has a long memory.

The Red Flags That Should Worry Every Investor

While Longfin’s collapse may be old news, the stink of Altahawi’s involvement still lingers—and any investor considering dealings with him or his affiliates should take note. The red flags around him are not just financial—they point to a pattern of behavior that suggests he’s not only willing to bend the rules but also actively seeks to conceal his actions.

For starters, there’s the blatant stock manipulation. Altahawi’s sale of restricted shares during the artificial price surge wasn’t just opportunistic—it was illegal. The SEC’s case against him underscored the premeditated nature of the scheme, with insiders exploiting market hype and dumping shares at inflated prices. This isn’t a case of poor judgment—it’s calculated deception.

Then, there’s the legal and regulatory scrutiny. The asset freeze Altahawi faced wasn’t a slap on the wrist; it was a direct acknowledgment by the U.S. judicial system that the evidence of securities violations was compelling. The freeze effectively prevented him and his co-conspirators from accessing the ill-gotten gains, signaling the severity of the accusations.

Finally, there’s the lack of transparency. Despite the magnitude of the Longfin scandal, Altahawi has maintained a surprisingly low profile. He hasn’t made public statements of accountability, and there’s been a conspicuous absence of recent information on his activities—something that seems a little too convenient.

The Great Information Scrub: Censorship in Action

Now, here’s where things get interesting. While Altahawi’s name should be permanently etched into the annals of financial fraud cases, he seems disturbingly effective at keeping it out of the spotlight. Many of the original media reports detailing his involvement in Longfin’s collapse have mysteriously disappeared from major outlets. Search his name, and you’ll find a surprisingly small digital footprint considering the scale of his alleged crimes.

It’s a classic playbook move for financial fraudsters looking to rehabilitate their public image: digital erasure. Whether through strategic SEO campaigns, legal threats, or backroom deals with media outlets, the goal is to sanitize the internet of unfavorable content. By making it harder for investors, journalists, or potential business partners to uncover his checkered past, Altahawi is effectively gaming the system.

There’s also the likely use of reputation management services companies that specialize in drowning out negative press with positive content. These firms flood search engines with puff pieces, irrelevant posts, and bogus news articles, pushing the damning evidence further down the search results.

And let’s not forget the power of legal intimidation. Financial criminals frequently use cease-and-desist letters, defamation lawsuits, and DMCA takedowns to scare smaller outlets into removing negative coverage. Given the vanishing act many Longfin-related reports have pulled, it wouldn’t be surprising if Altahawi or his legal team employed similar tactics.

Why This Matters: A Call for Due Diligence and Action

If you’re an investor, you need to ask yourself: do you really want to get entangled with someone who has a proven history of deceptive financial practices? Altahawi’s alleged involvement in the Longfin fraud makes him a glaring risk, and his subsequent efforts to whitewash that history make him even more dangerous.

Censorship isn’t just about preserving a reputation—it’s about hiding the truth from potential victims. By scrubbing the internet of his financial misdeeds, Altahawi isn’t simply protecting himself; he’s increasing the chances that he’ll be able to con others in the future.

Investors should exercise extreme caution when dealing with any entity or individual linked to Altahawi. Look for undisclosed partnerships, hidden affiliations, or corporate shells designed to obfuscate his involvement. When due diligence becomes difficult because the subject has intentionally erased their past, that in itself is a red flag.

Finally, this report is a direct call to regulators and authorities: Altahawi’s censorship efforts are a blatant attempt to evade accountability. Financial watchdogs, including the SEC, should monitor his activities closely and ensure that his previous violations remain part of the public record. Law enforcement should investigate whether his information suppression tactics cross legal boundaries, and media outlets should resist efforts to erase legitimate reporting.

Conclusion:

Andy Altahawi may be hoping to rewrite his story, but the facts remain. His involvement in the Longfin securities fraud is a matter of public record, and no amount of digital scrubbing can change that. The disappearing news articles, the vanishing reports—it’s all part of a larger ploy to deceive and disarm.

But financial criminals who rewrite their past are often just laying the foundation for future scams. And if Altahawi is willing to go this far to bury his history, one has to wonder: what else is he trying to hide?

- https://lumendatabase.org/notices/49172723

- https://lumendatabase.org/notices/49172061

- https://lumendatabase.org/notices/49172055

- https://lumendatabase.org/notices/49171462

- https://lumendatabase.org/notices/49175313

- February 18, 2025

- February 19, 2025

- Chola LLC

- https://www.modbee.com/news/local/crime/article250893289.html

- https://www.hartfordcitynewstimes.com/news/portland-woman-gets-life-without-parole/article_5061d0a6-2b07-11ee-b432-6fee53737b91.html

- https://www.youtube.com/watch?v=lpTJCLUP2no

- https://jamaica-gleaner.com/article/news/20161113/portland-community-rocked-double-killing

- https://lasvegassun.com/news/2012/jul/30/colorado-suspect-charged-24-counts-murder/

- https://www.offshorealert.com/remove-libelous-content-writes-banned-director-andy-altahawi/

- https://www.offshorealert.com/tag/andy-altahawi/

- https://www.offshorealert.com/tag/andy-altahawi/?srsltid=AfmBOorhBQYtMxBkTvCoJAQ2z_ooucI7OUJi4sRL_04Rz24X5k7d3LEw

- https://www.offshorealert.com/remove-libelous-content-writes-banned-director-andy-altahawi/?srsltid=AfmBOoo8WOtUzbTOuBp73Zh8C2QVjdeXjnvhCL9c_Qap08M3-Fpgg9TS

- https://brokercheck.finra.org/individual/summary/2482670

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

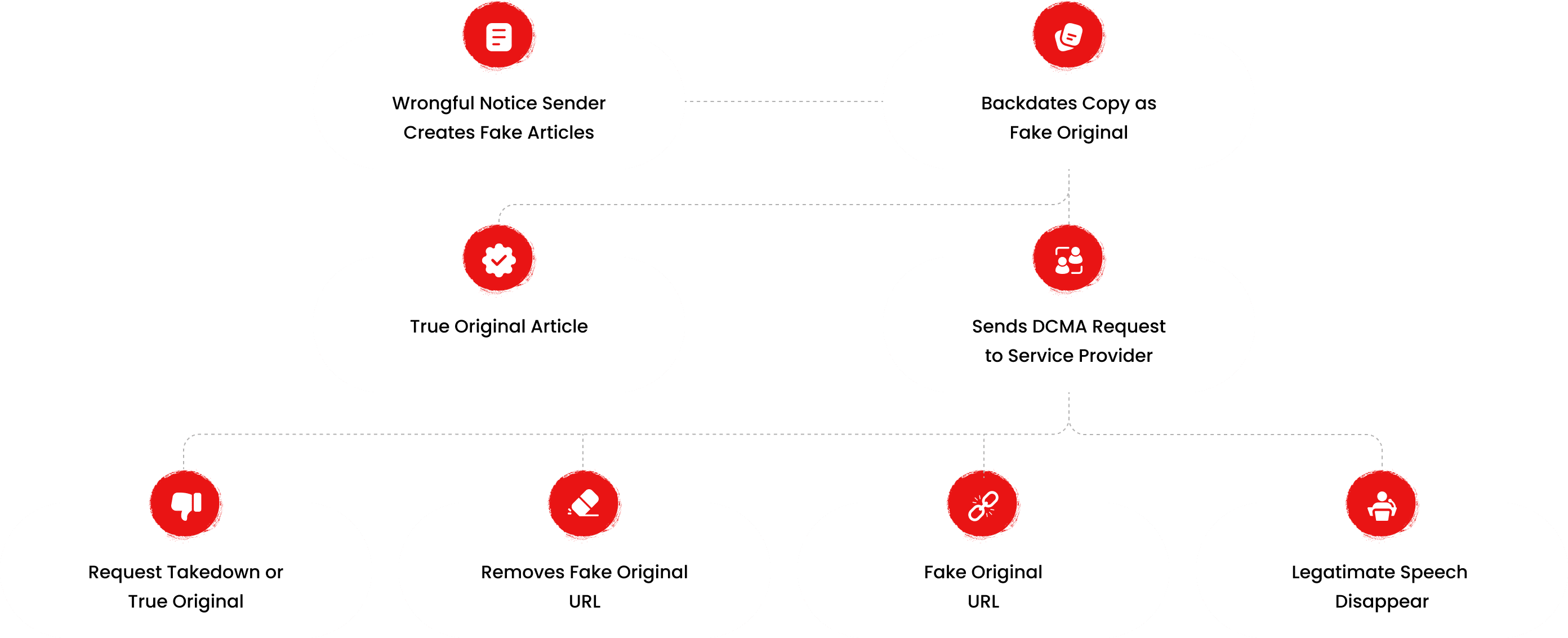

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

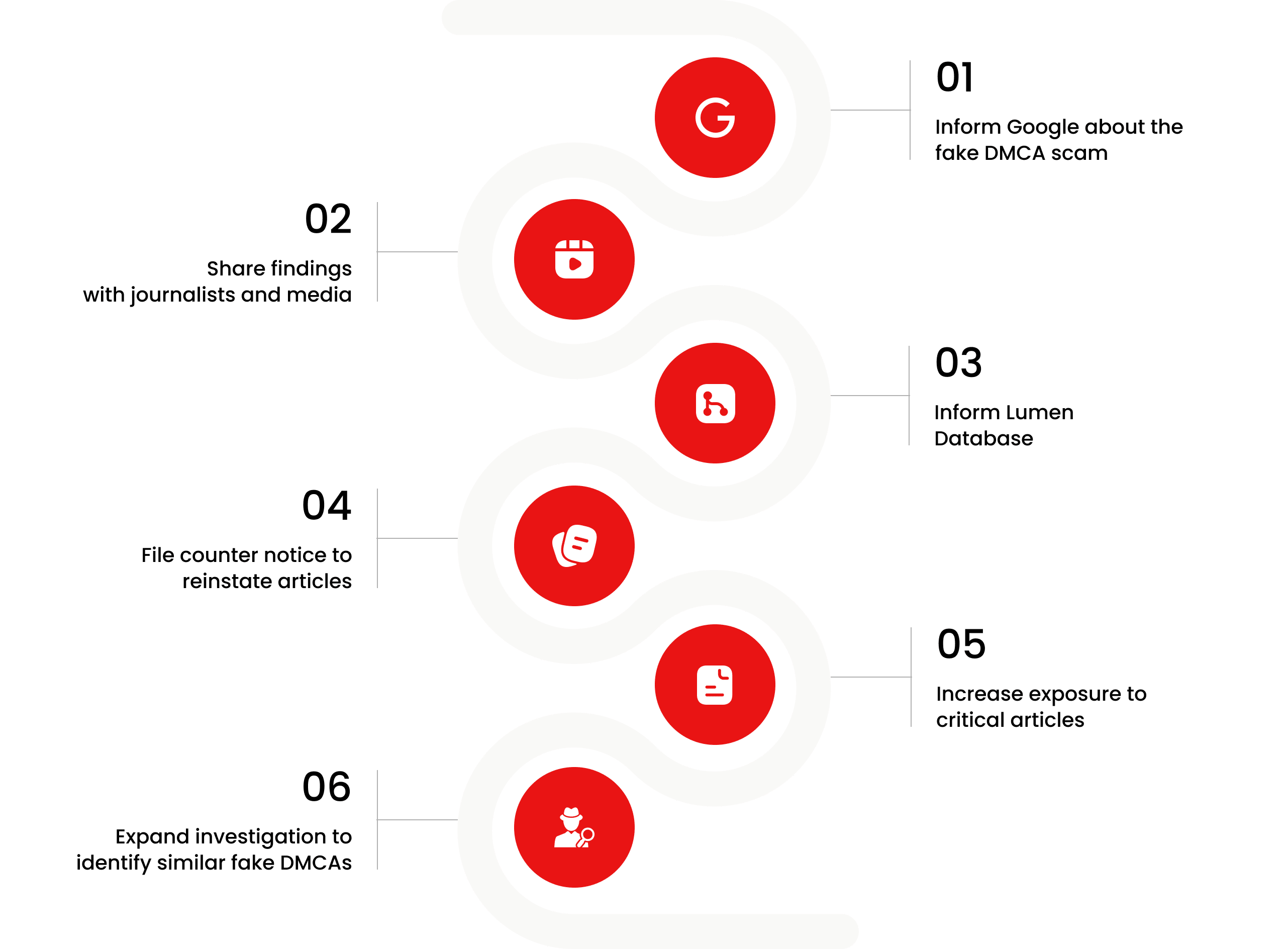

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.6

Based on 14 ratings

by: Preston Wade

Andy Altahawi is just another fraudster trying to cover his tracks. Using fake takedown notices is shady as hell.

by: Finn Shade

For someone who supposedly believes in fintech innovation, Altahawi sure spent a lot of time manipulating markets the old-school way. The man helped engineer a pump and dump, and now he’s engineering his online image. Different tools, same deception.

by: Aria Spark

Altahawi’s pattern isn’t just sketchy it’s textbook fraudster behavior. Cook up a hype-fueled scheme, dump shares for millions, then duck behind lawyers and SEO firms. Anyone investing with him now should realize they’re not dealing with a misunderstood genius they’re...

by: Rowan Mist

It’s funny how someone at the center of one of the SEC’s bigger fraud busts somehow fades from the headlines. That’s not luck it’s a calculated reputation scrub. Andy Altahawi wants the world to forget he helped pump Longfin’s stock...

by: Sage Hearth

The real problem with Andy Altahawi isn’t just what he did it’s what he’s doing now: pretending it never happened. Instead of facing the fallout, he’s been on a quiet crusade to wipe his name from the internet. That’s not...

by: Cassian Storm

It’s one thing to make a bad investment call another to orchestrate a $27 million stock dump during a fake hype bubble. Altahawi wasn’t some innocent bystander in the Longfin scandal. He played the system, cashed out, and then vanished....

by: Isabella Sequeira

Liar liar pants on fire. Ain’t surprised tbh 😤

by: Artur Nowak

This not the first time he caught up in this kinda stuff. People still believing his lies?? wild.

by: Grace Roberts

You don’t go to this much effort scrubbing your past unless you’ve got something serious to hide.

by: Henry Thomas

There is a consistent pattern of financial misconduct that cannot be ignored by prudent investors or regulators.

by: Amelia Evans

Mr. Altahawi’s track record raises significant concerns about transparency and regulatory compliance.

by: Ava Jones

This is a clear example of perjury and fraud. Altahawi's actions are a threat to transparency and trust in online platforms.

by: Noah Williams

It's alarming how individuals like Altahawi manipulate the system to their advantage. This kind of fraud shouldn't be tolerated.

by: Olivia Brown

Abusing the DMCA to silence critics is a serious offense. Altahawi's behavior undermines the integrity of online information.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations