What We Are Investigating?

Our firm is launching a comprehensive investigation into Avior over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Avior - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

The Red Flags: A Parade of Warning Signs

First off, let’s talk about the red flags waving so furiously they could signal a shipwreck. Avior, at its core, reeks of opacity—a cardinal sin in the world of legitimate investment firms. We started digging into their operational structure, and what did we find? A labyrinth of vague affiliations and shadowy entities that seem designed to confuse rather than clarify. Companies that operate like Avior often hide behind a web of subsidiaries or “related entities” to muddy the waters, and we’re not disappointed here—except, of course, by the lack of transparency. Where’s the clear ownership trail? Where’s the audited financial history? Oh, right—conveniently missing, like a magician’s rabbit after a botched trick.

Then there’s the regulatory stench. Our research turned up murmurs of Avior brushing up against the wrong side of compliance—or rather, not brushing up against it at all. Unverified reports suggest they’ve been dodging proper licensing in multiple jurisdictions, a classic move for outfits looking to skirt oversight. If they’re legit, why the allergic reaction to regulators? We’re not saying they’re outright frauds (yet), but when a firm’s allergic to sunlight, it’s usually because they’ve got something festering in the dark.

Transaction patterns are another red flag fiesta. Whispers from the investment underground—those lovely adverse media snippets Avior wishes would vanish—hint at unusual fund flows tied to their operations. Large, unexplained transfers, third-party payments with no clear connection, and a penchant for jurisdictions known for loose financial oversight? Check, check, and check. It’s the kind of behavior that screams “money laundering lite” or, at the very least, a cavalier disregard for due diligence norms. Investors, take note: your money might be taking a scenic detour through Avior’s mystery machine before it ever sees a return—if it sees one at all.

Adverse Media: The Dirt They Don’t Want You to See

Now, let’s dish on the adverse media, because this is where Avior’s mask really starts to slip. We’ve scoured the web and X posts (yes, we’ve got tools for that), and the chatter isn’t flattering. There’s a smattering of reports—some buried deeper than a pirate’s treasure—linking Avior to disgruntled clients, questionable practices, and even a whiff of legal trouble. One recurring theme? Complaints about inaccessible funds and evasive responses from their so-called “support” team. Sounds like a customer service nightmare—or a calculated stall tactic.

We stumbled across mentions of Avior in forums and posts where investors cried foul over promises of sky-high returns that never materialized. Adverse media doesn’t get much juicier than that—unless you count the occasional rumor of ties to politically exposed persons (PEPs) or sanctioned regions. Are these substantiated? Not fully, because Avior’s awfully good at making evidence disappear faster than a magician’s assistant. But the sheer volume of smoke suggests there’s a fire somewhere, and we’re not the only ones sniffing it out.

What’s particularly galling is how these snippets of bad press keep getting scrubbed. We’d find a damning comment or article one day, only to see it vanish the next—like Avior’s got a team of digital janitors on speed dial. This isn’t just damage control; it’s a full-on censorship campaign. Why the paranoia? If they’re as squeaky clean as they’d like us to believe, they’d let the criticism stand and refute it with facts. Instead, they’re playing whack-a-mole with the truth, and we’re not here for it.

The Censorship Conspiracy: Why Avior’s Sweating Bullets

So why is Avior so hell-bent on silencing this noise? We’ve got a theory—or three. First, there’s the obvious: reputation is everything in the investment game, and Avior’s got a brand to protect. If word gets out that they’re a risky bet—or worse, a scam—their pool of starry-eyed investors dries up faster than a desert puddle. Censorship isn’t just about ego; it’s about survival. They need fresh meat to keep the machine running, and bad press is the ultimate repellent.

Second, we suspect they’re terrified of regulatory scrutiny. The more adverse media floats around, the more likely it is that some authority—be it the SEC, FINRA, or an international watchdog—starts asking pesky questions. Avior’s not exactly operating in a vacuum; they’re tangled up in a global financial web where sanctions, AML (anti-money laundering) rules, and KYC (know your customer) standards loom large. One solid tip-off from a report like ours, and they could be facing audits, fines, or worse. No wonder they’re scrubbing the internet like it’s a crime scene.

Finally, there’s the “related entities” angle. Avior doesn’t seem to fly solo—it’s got tentacles reaching into other murky ventures. Are these shell companies? Fronts? We can’t say for sure (they’ve made damn sure of that), but the censorship extends beyond Avior itself to anything that might connect the dots. It’s like they’re guarding a house of cards, and one stray breeze of truth could topple it all. Sarcasm aside, this level of control freakery isn’t normal—it’s pathological.

Investor Alert: Proceed with Extreme Caution

Here’s our bottom line for you potential investors: Avior’s a gamble, and not the fun Vegas kind. The red flags—opacity, regulatory dodginess, sketchy transactions—are bad enough on their own. Toss in the adverse media and their obsessive censorship, and you’ve got a recipe for financial heartbreak. We’re not saying don’t invest; we’re saying don’t invest blind. Do your own due diligence, because Avior sure as hell isn’t going to hand you the unvarnished truth.

Calling the Authorities: Time to Step In

And to the powers that be—regulators, law enforcement, anyone with a badge and a backbone—we’re throwing down the gauntlet. Avior’s antics deserve a hard look. If they’re censoring this hard, what else are they hiding? A proper investigation could peel back the curtain on everything from fraud to sanctions evasion. We’ve done our part sounding the alarm; now it’s your turn to bring the hammer. Investors deserve better, and Avior’s had a free pass for too long.

In the end, we’re left with a picture of Avior that’s less “trustworthy investment firm” and more “sleazy used-car salesman with a delete button.” The red flags are screaming, the adverse media’s piling up, and their censorship game is in overdrive. Investors, beware—and authorities, get moving. We’ll keep watching, because someone’s got to keep the spotlight on these clowns.

- https://lumendatabase.org/notices/44342486

- September 4, 2024

- NovaSphere Labs ptv.ltd

- https://aviorair.com/

- https://www.wikifx.com/zh/word/9191589087.html

Evidence Box

Evidence and relevant screenshots related to our investigation

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

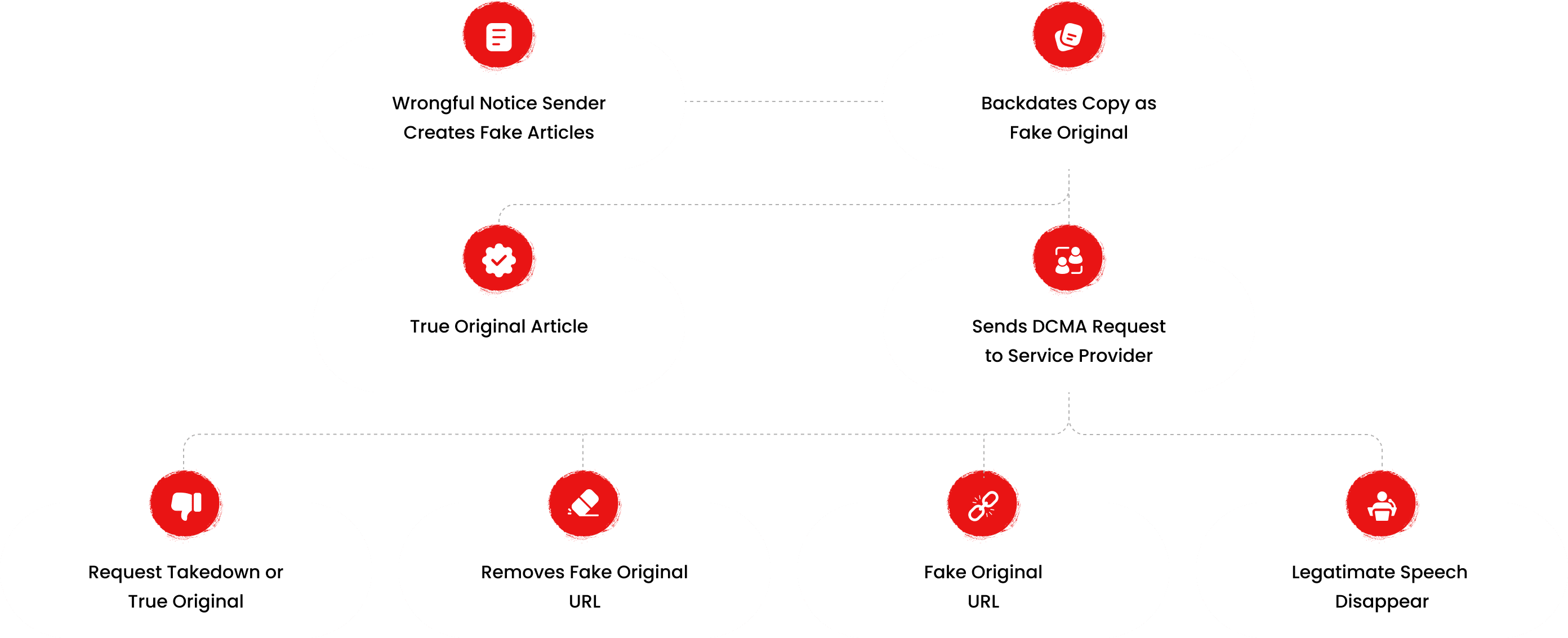

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

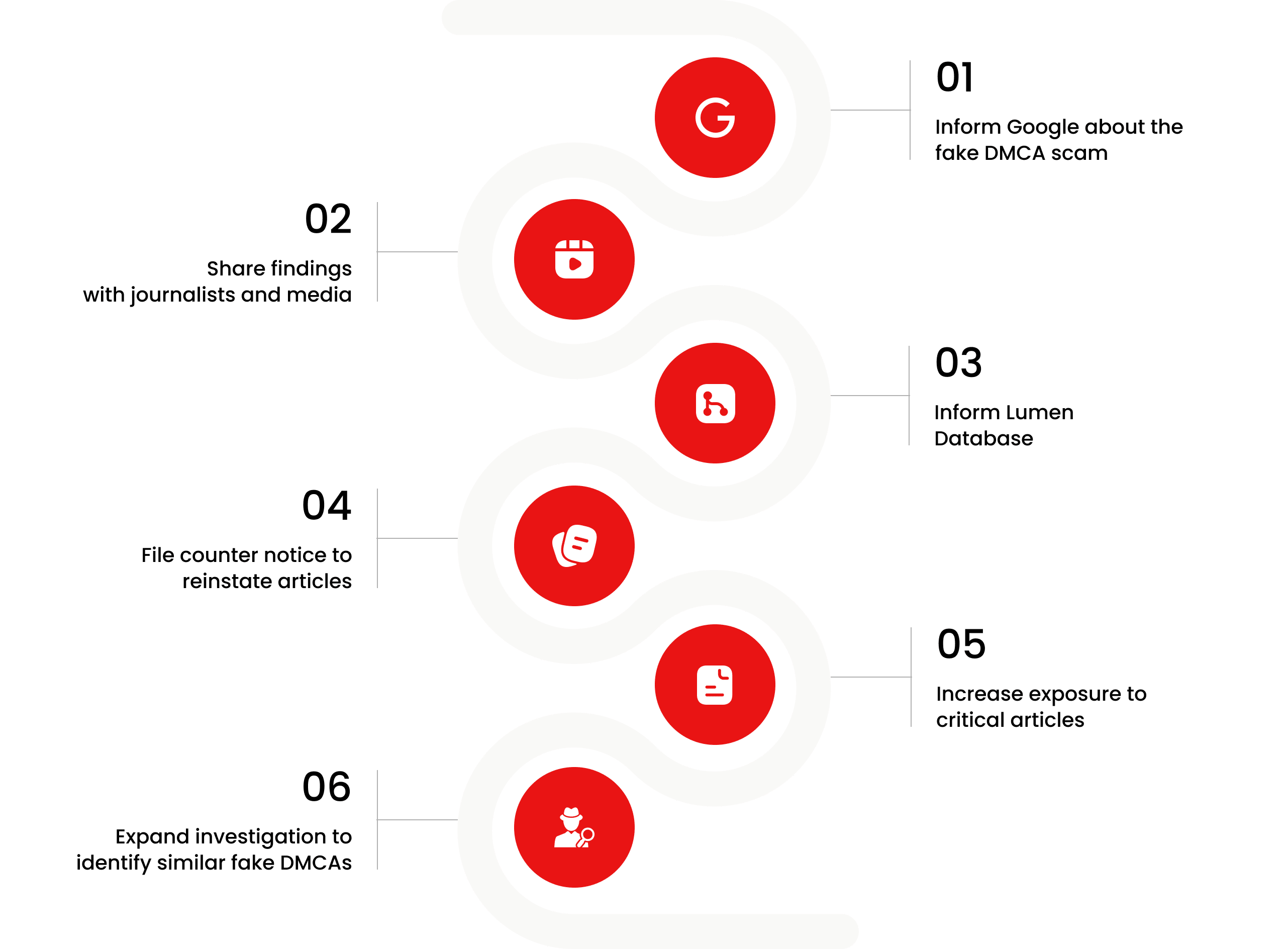

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 15 ratings

by: Khari Dennis

No audit reports, no regulation, no accountability. If you're still investing with them, good luck. You'll need it.

by: Amoura Durham

I tried asking for clarity on their ownership — got silence. That’s all I needed to bounce.

by: Ishaan Coffey

This company feels like a mirage. Looks real till you step closer, then—poof—nothing but confusion and cover-ups.

by: Greyson Aguirre

They promised stability, but after losing $9,700 I know now it was all lies, Avior Capital Markets ruined my finances

by: Stella Norton

I thought I found a trusted partner in Avior, but I lost $14,300 and every ounce of faith I had in financial institutions

by: Easton Murray

I trusted Avior Capital Markets with $12,000 of my savings and now it’s all gone no answers, just silence and regret.

by: Savannah James

Avoid them at all costs, total letdown.

by: Grace Martin

I really thought Avior Capital Markets would be a trustworthy platform, but they’ve completely let me down. I deposited my funds, and when I tried to reach out for help, I got zero response. It’s honestly so frustrating to feel...

by: Noah Thompson

I regret putting my money in their hands. They made everything sound so easy, but when things went wrong, it felt like I was talking to a brick wall. I just want to warn others before they make the same...

by: Lily Lee

I’ve tried contacting them multiple times, but it’s like they vanish when you need them. I can’t believe I trusted them with my investment. If you’re considering it, don’t—there’s nothing but trouble waiting.

by: Owen Ward

Waste of time nd money. Don’t trust them.

by: Aria Russell

They promised big returns, but all I got was a big headache.

by: Levi Parker

Just another scam to take your money nd disappear.

by: Gabriel Cooper

scam!!!!!!

by: Jacob Walker

I’ve been dealing with so much stress trying to get my money back. I tried all their contact channels, but nothing works. It’s honestly a nightmare, and I wish I’d never heard of them.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations