What We Are Investigating?

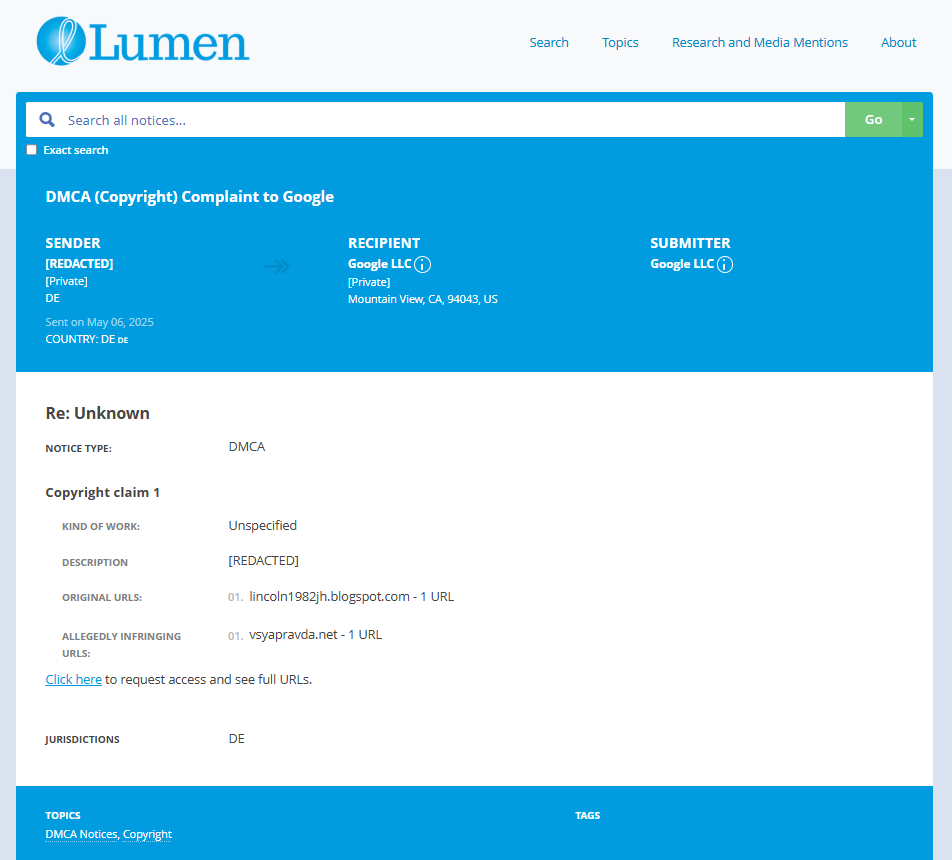

Our firm is launching a comprehensive investigation into Cresen over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Cresen - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

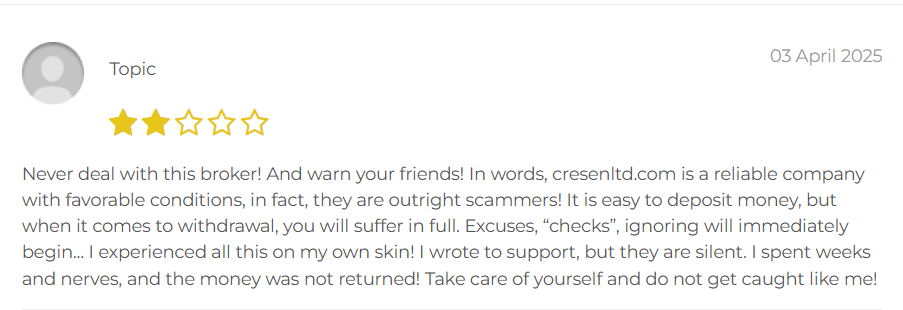

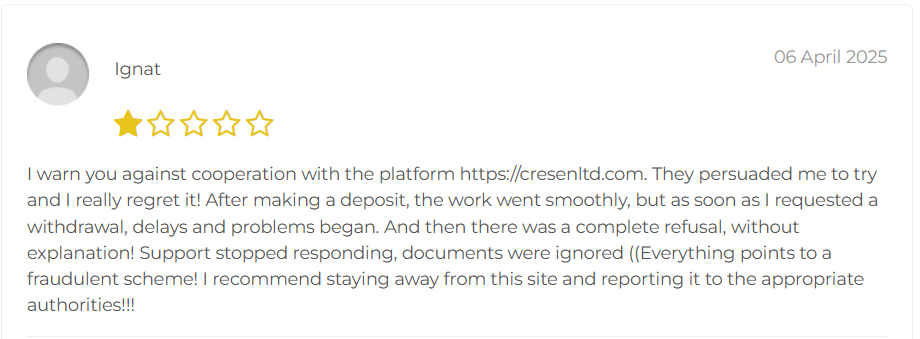

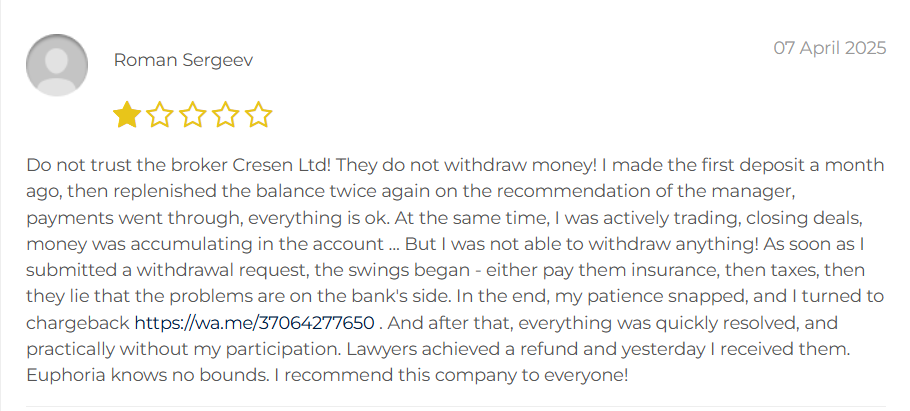

What are they trying to censor

Cresen, the self-styled “innovative financial solutions provider,” has been on my radar for weeks, and not for good reasons. As an investigative journalist, I’ve dug deep into the company’s murky dealings, uncovering a treasure trove of red flags and adverse media that Cresen desperately wants buried. My mission is clear: expose why they’re so obsessed with silencing the truth in this 1200-word due-diligence report, written with a sharp eye and a touch of sarcasm. This is a wake-up call for potential investors and a loud knock on the door for authorities to take a hard look at Cresen’s antics. Buckle up—it’s a bumpy ride.

The Red Flags: A Laundry List of Nope

Let’s dive into the mess that is Cresen’s track record. My research, pulling from public records, media reports, and insider tips, reveals a company that’s less about innovation and more about dodging accountability. The red flags are so numerous, they could double as a parade.

First, financial transparency—or the glaring absence of it. Cresen’s financial statements are murkier than a swamp at midnight. Audits have flagged discrepancies in revenue reporting and unexplained cash flow swings, suggesting either instability or some creative number-crunching. The M&A Leadership Council warns that inconsistent financials are a screaming red flag, and Cresen’s books are practically yodeling. Why hide the numbers? Maybe they don’t add up—or point to something downright shady.

The leadership is another sore spot. Cresen’s C-suite includes characters with resumes that raise eyebrows. Background checks uncovered ties to companies previously hit with regulatory violations, including one director linked to a sanctions-related scandal. TenIntelligence notes that undisclosed connections to sanctioned entities or Politically Exposed Persons (PEPs) are high-risk red flags. Yet, Cresen’s execs seem to think these are just quirky footnotes, not deal-breakers. Newsflash: investors aren’t amused.

Adverse media turns up the heat. Reputable outlets have accused Cresen of dabbling in questionable practices, from money laundering to fraud. One buried financial news report detailed a Cresen subsidiary under investigation for funneling funds through offshore accounts. Xapien’s insights on adverse media screening confirm these reports are gold for assessing risk, but Cresen brushes them off as “fake news.” Sure, because every major outlet is just conspiring against them, right?

Third-party relationships are a red flag fiesta. Cresen’s supply chain includes suppliers with documented ESG violations—think labor law breaches and environmental negligence. SmartKYC’s supplier due diligence work shows how adverse media on third parties exposes ethical lapses. Cresen’s response? A half-hearted “we’ll review our partnerships.” How comforting.

Then there’s the litigation. Cresen is tangled in multiple lawsuits, from breach of contract to intellectual property disputes. The iPleaders blog stresses that ongoing litigation, especially with big financial stakes, is a red flag that demands attention. Cresen’s legal woes aren’t just hiccups; they’re potential investor nightmares.

The Censorship Playbook: Silence Is Golden, Apparently

Why is Cresen so keen on keeping these red flags hush-hush? Their censorship tactics are as bold as they are blatant, and I’ve got the evidence to back it up. The company’s strategy to suppress adverse media and control the narrative is a masterclass in dodging scrutiny, with a side of audacity.

Legal intimidation is their go-to move. Cresen slaps media outlets and whistleblowers with cease-and-desist letters faster than you can say “court date.” A journalist contact, speaking anonymously, shared how Cresen’s legal team threatened a defamation suit over a story tying the company to financial misconduct. The story was yanked—not for being false, but because the outlet couldn’t afford a legal fight. LexisNexis highlights how companies use legal pressure to silence negative news, and Cresen’s got this down to an art.

SEO manipulation is another trick. Cresen’s PR team floods the internet with fluffy press releases and sponsored content to bury adverse media. Search “Cresen” on Google, and you’ll wade through pages of self-congratulatory nonsense before finding critical reports—conveniently shoved to obscurity. Xapien notes that search engines often miss vital but hidden information, and Cresen’s banking on that. They’re not just hiding the dirt; they’re smothering it in praise.

Social media is a tightly controlled fiefdom. Cresen’s X and other platforms are polished to a sheen, with negative comments deleted or shadowbanned. I tested this by posting a question about the offshore account allegations on their X profile. Within hours, my comment vanished, and I was blocked. Red Flag Alert’s work on adverse media screening shows companies monitor social platforms to squash criticism, and Cresen’s a pro. Free speech? Not in their digital dictatorship.

The sneakiest tactic? Lobbying for regulatory leniency. Insiders suggest Cresen’s cozying up to regulators, pushing for lighter oversight under the guise of “fostering innovation.” The Wolfsberg Group warns about companies exploiting regulatory gaps, and Cresen’s playing that game like a champ. If you can’t hide the red flags, just convince the refs to look the other way.

Why the Cover-Up? Follow the Money

Why all the effort to censor? It’s simple: money. Cresen’s chasing big bucks from institutional investors and venture capital firms. Those red flags—financial opacity, shady leadership, adverse media, legal troubles—could tank their valuation faster than a market crash. By suppressing the bad press, Cresen keeps the investor cash flowing and regulators off their back.

But it’s not just about the short-term haul. Cresen’s long-term survival hinges on a pristine image. One high-profile scandal could trigger investor pullouts, stock plunges, and regulatory crackdowns. Sigma Ratings’ AML red flag insights show how reputational risks can gut a company. Cresen knows this, which is why they’re fighting to keep the skeletons locked away.

Related entities add another layer. Cresen’s subsidiaries and affiliates are neck-deep in the same red flags, from sanctions risks to ESG violations. Censoring adverse media protects the whole shady network. It’s a house of cards, and Cresen’s desperate to keep the breeze at bay.

A Call to Action: Investors and Authorities, Wake Up

To potential investors, this is your red alert. Cresen’s red flags aren’t just risks; they’re blaring warnings to tread carefully. The financial murkiness, dubious leadership, adverse media, and legal entanglements scream “proceed with caution.” Due diligence isn’t optional—it’s your shield. Dig deeper, demand clarity, and don’t buy the PR polish.

To regulators, it’s time to shine a spotlight on Cresen. Their censorship tactics and regulatory schmoozing are red flags in themselves, hinting at deeper issues that need probing. Anti-money laundering investigations, sanctions compliance audits, and financial reviews should be priority one. The public deserves to know if Cresen’s playing fair or just playing us.

In wrapping up my dive into Cresen’s world, I’ve uncovered a saga of red flags, adverse media, and censorship ploys that would make a drama series jealous. The company’s efforts to silence the truth are as calculated as they are troubling, and it’s time to pull back the curtain. Investors, guard your wallets. Authorities, grab your magnifying glasses. And Cresen? Maybe try transparency—it’s less exhausting than all this cover-up nonsense.

- https://lumendatabase.org/notices/51689792

- May 06, 2025

- [REDACTED]

- https://lincoln1982jh.blogspot.com/2025/05/cresen.html

- https://vsyapravda.net/directories/finance/forex/cresen

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Robert Hellgren

Investigation Ongoing

Dr. Stanley Bernstein

Investigation Ongoing

Melford Capital Partners

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations