What We Are Investigating?

Our firm is launching a comprehensive investigation into financely-group over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that financely-group - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

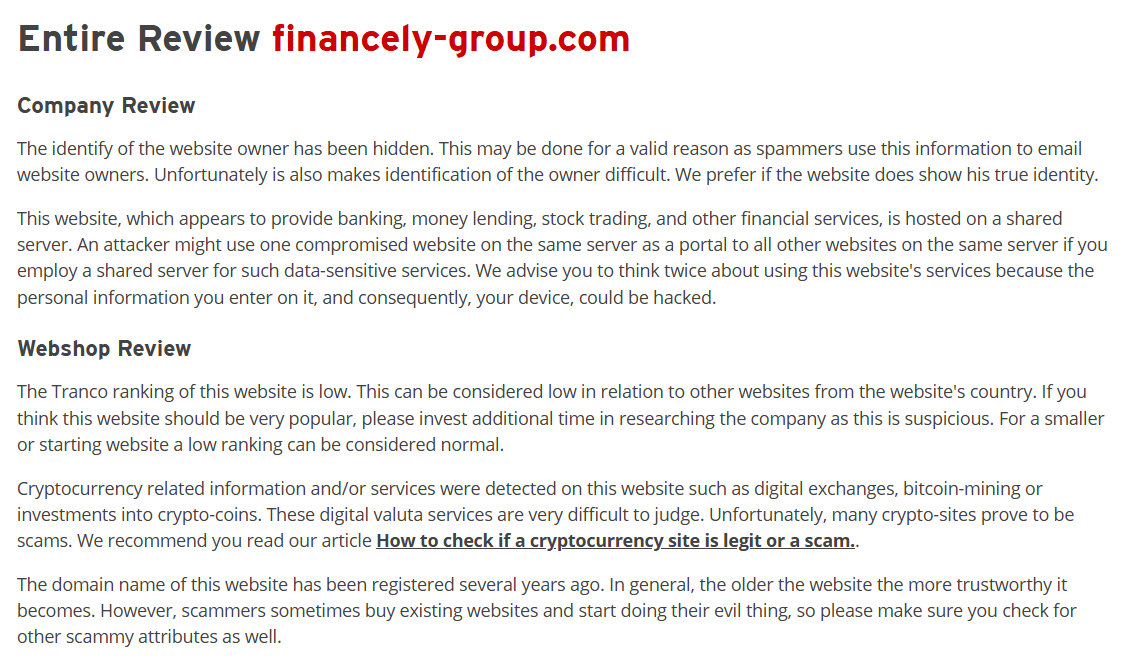

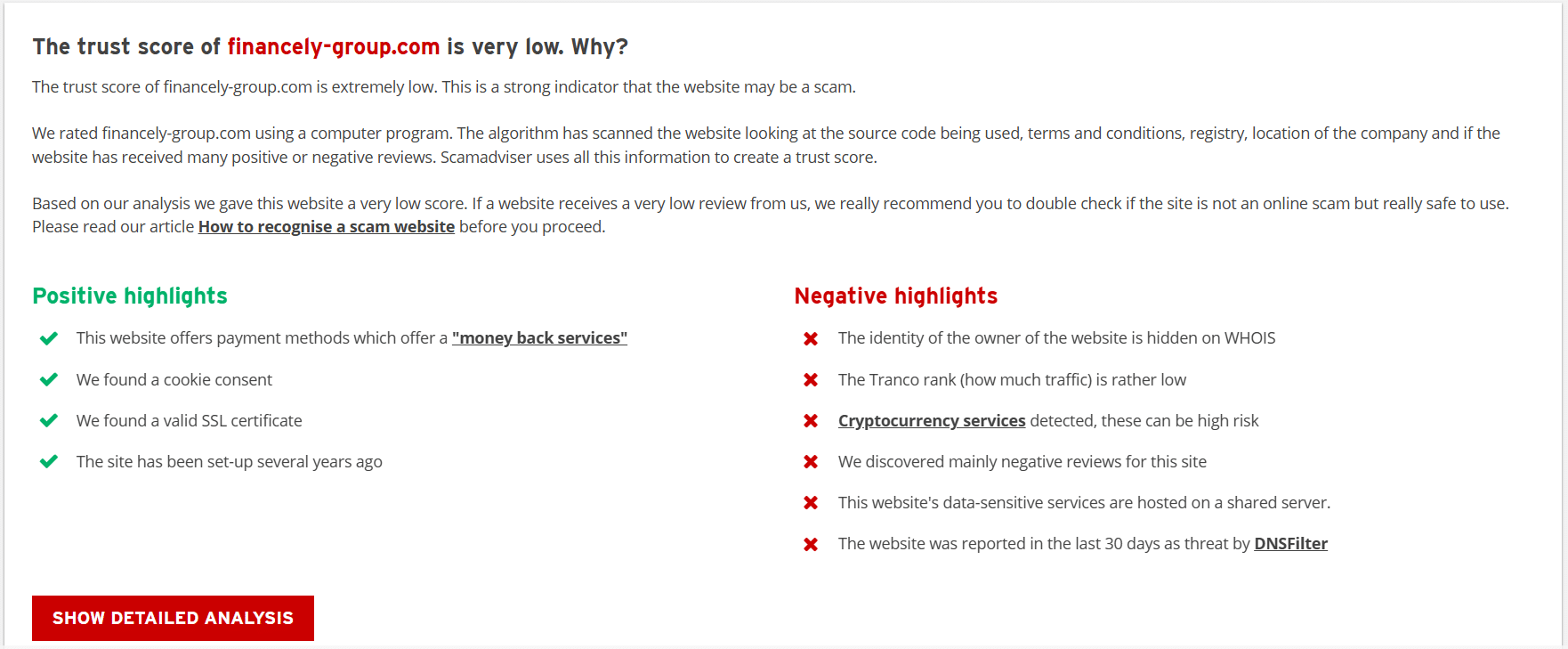

Financely Group, a structured finance advisory firm, has recently come under scrutiny due to a series of allegations and negative reviews. While the company has issued a rebuttal addressing these concerns, it’s essential to examine the available information to provide a comprehensive overview.

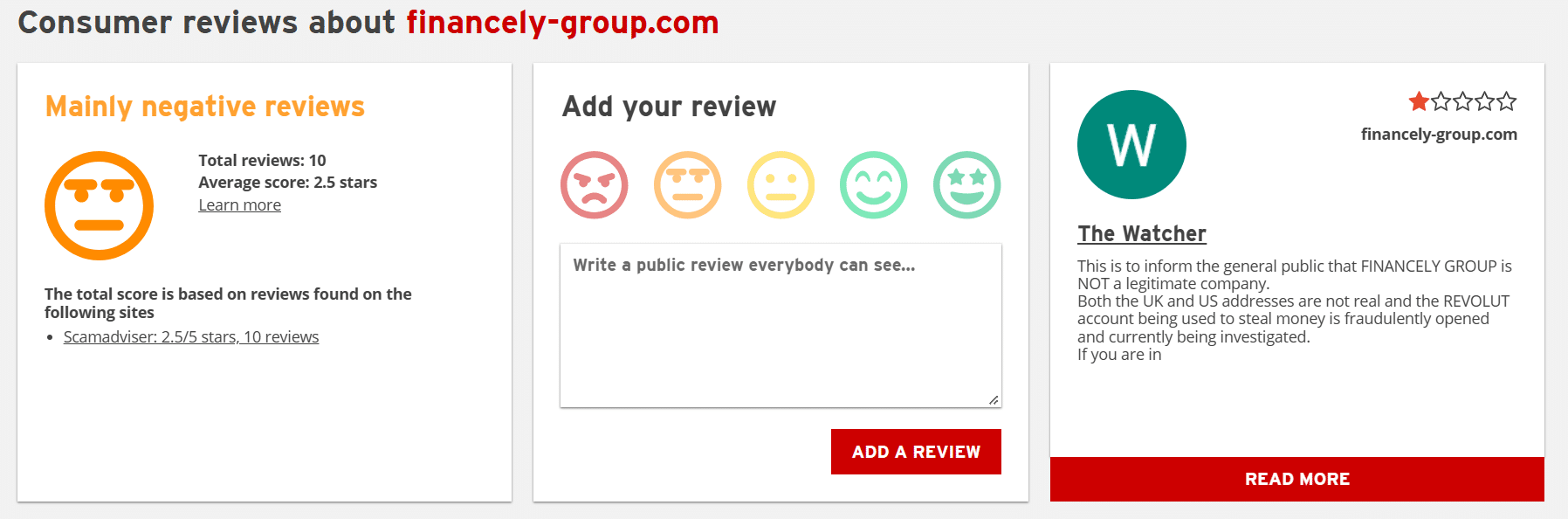

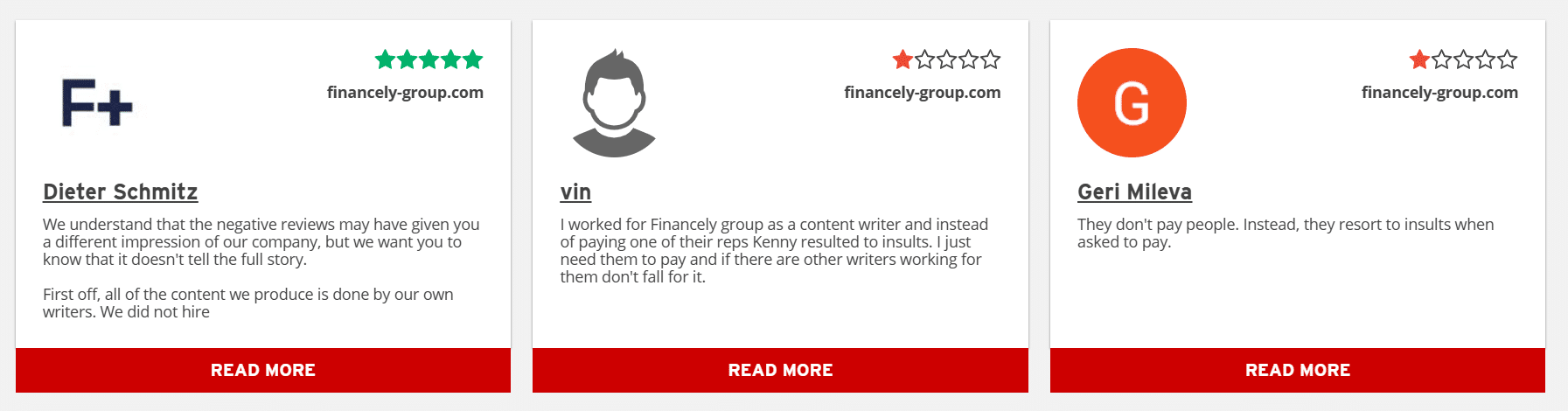

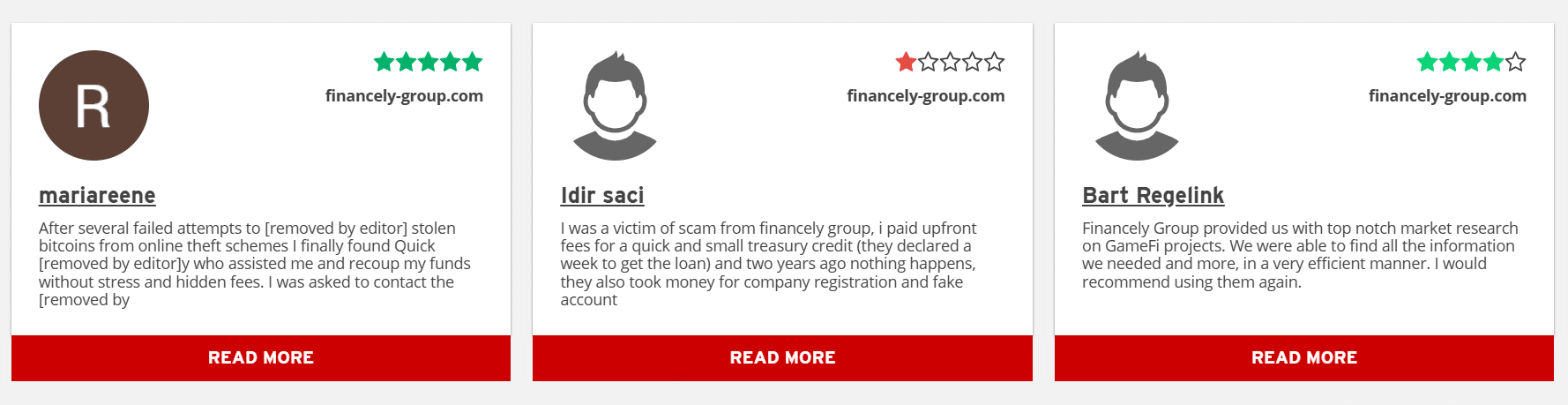

Allegations and Negative Reviews

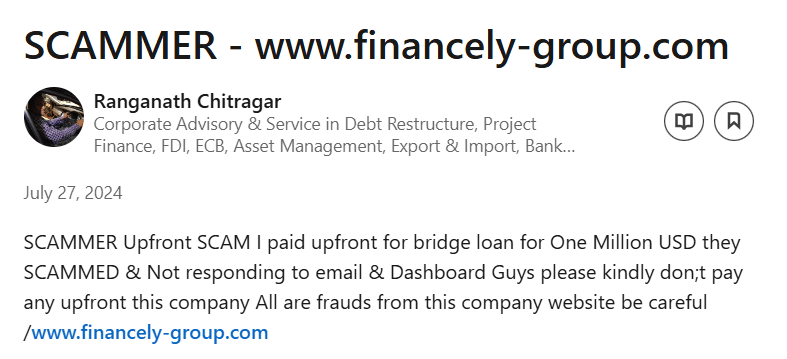

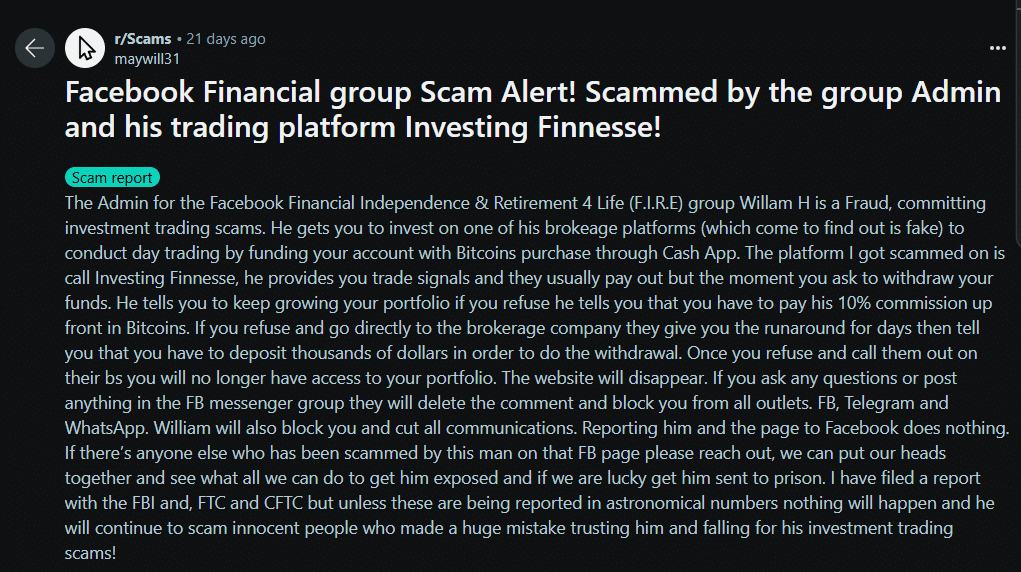

Several online reviews have raised concerns about Financely Group’s operations. Some individuals have claimed that the company’s UK and US addresses are not real and that they use fraudulent accounts to conduct business. One reviewer stated, “Financely group is a complete scam, with all the bells and whistles. They stole over $60,000 from me. A well-oiled scam company with no way to pursue. FBI have been advised about them and are working with Interpol to bring them to justice.”

Another reviewer mentioned being swindled into investing through an online relationship, only to find themselves unable to withdraw funds. These reviews suggest a pattern of alleged fraudulent activities associated with the company.

Company’s Response

In response to these allegations, Financely Group published a statement on their website. They assert that the accusations are baseless and often spread by disgruntled individuals or competitors. The company clarifies that they are not a bank or direct lender but a structured finance advisory firm. They emphasize their role in connecting viable transactions with capital sources and ensuring compliance and risk mitigation.

Financely Group also addresses refund requests, stating that their retainer and origination fees are compensation for work performed and not an insurance policy against deals failing due to a client’s incomplete disclosures or unrealistic expectations. They highlight their focus on high-quality transactions and their commitment to working with clients who have legitimate, well-documented transactions.

The Smoke and Mirrors of Global Presence

Let’s start with the supposed “global footprint” of Financely Group. The company claims to operate out of prime financial districts in the UK and the US—impressive, right? Well, not quite. Independent checks of these addresses reveal the classic signs of virtual office rentals or, worse, complete fabrications.

It’s like renting a P.O. box and calling yourself a multinational. This is particularly alarming for a firm that supposedly facilitates complex structured finance deals worth millions. If you’re handling billions in financing (as they subtly suggest), wouldn’t you at least have a receptionist?

This illusion of legitimacy is a hallmark red flag of entities engaged in questionable practices: make it look legit to instill confidence, while the operations remain paper-thin.

Web Presence: All Polish, No Substance

A quick glance at the Financely Group website reveals a professionally designed interface with a boatload of buzzwords: “institutional-grade finance,” “bespoke funding structures,” “proprietary platform.” It’s a smorgasbord of financial jargon that reads more like a pitch to venture capitalists on LinkedIn than a real service offering.

But here’s the catch—there’s very little substantive detail. The team is nameless, the success stories unverified, and the partnerships vague at best. Legitimate financial intermediaries typically feature clear leadership bios, regulatory disclosures, and at least one press release from a reputable outlet.

Financely Group, on the other hand, seems to have spent more time on WordPress themes than on transparency.

The Mysterious Disappearance of Negative Feedback

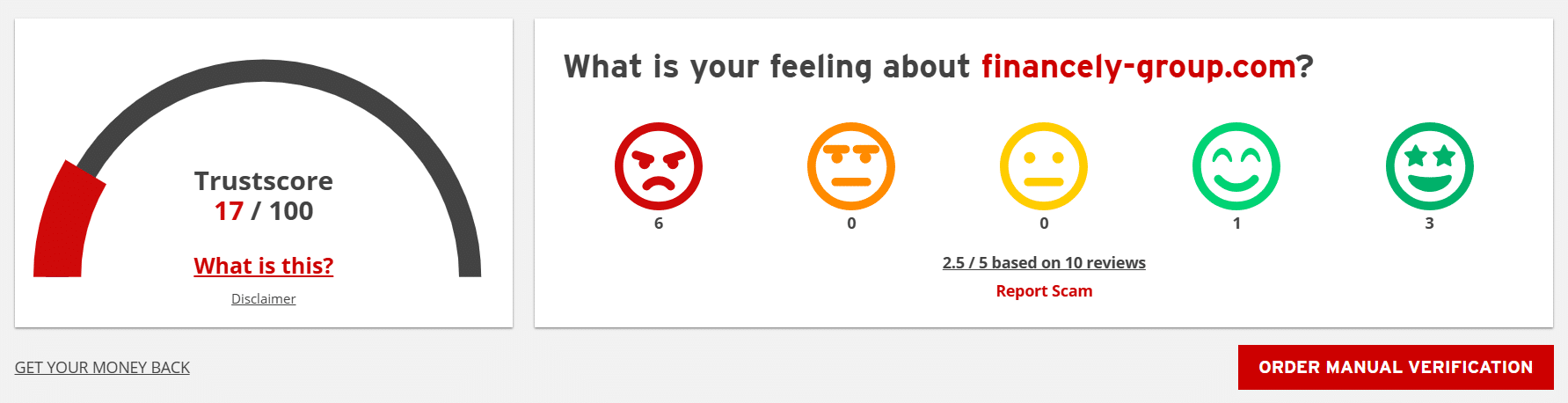

Here’s where things start to get really interesting—and suspicious. Try to find detailed, critical reviews or discussions about Financely Group beyond a few isolated accusations. Go ahead. You’ll find some scattered on TrustPilot, Reddit, and consumer protection forums. But oddly enough, many more seem to have… vanished.

Multiple reviewers have reported takedown requests of their critical reviews. One whistleblower even claimed that their negative post on a scam-awareness forum mysteriously disappeared after receiving a notice that it “violated terms.” Sounds familiar? It should. This is a known tactic used by shady companies trying to scrub the internet clean of anything remotely unflattering.

Censorship in this context isn’t just an ego defense; it’s a control tactic. And it begs the question—why would a legitimate business care this much about controlling their online narrative?

Client Retainers: A One-Way Street?

A frequent point of contention in adverse media is Financely Group’s use of non-refundable retainers. According to complaints, clients are asked to pay upfront fees for “project preparation” or “deal packaging”—but then, mysteriously, no actual financing materializes.

When clients ask for refunds, they’re met with stiff legalese and silence. Financely Group has defended this by claiming they’re being compensated for time and effort, not guaranteed outcomes. While this is technically fair, it’s also convenient. You get paid no matter what—and your client is left wondering if anything was ever going to happen.

Now, if this were a rare occurrence, it could be chalked up to misunderstandings. But multiple clients claiming a similar pattern? That sounds like a business model designed to extract money under the illusion of service.

The ‘Institutional Capital Sources’ That No One Can Verify

Financely Group loves name-dropping institutional capital. Their pitch decks are laced with phrases like “global liquidity partners,” “Tier 1 funders,” and “international banking relationships.” But when pressed for details, things go suspiciously quiet.

No named banks. No documented deals. No linked case studies or press coverage. Just vague allusions to “relationships” with untraceable financial entities.

If you’ve ever worked in finance, you know this is not how real structured finance operates. Lenders and institutions are not secret entities hiding in the shadows. Transparency is the bedrock of trust in any financial transaction. The absence of it here is not just suspicious—it’s damning.

A Call for Regulatory Oversight

Here’s the uncomfortable truth: despite its slick branding and complex financial jargon, Financely Group shows many of the warning signs associated with financial schemes that prioritize extracting fees over delivering services.

It’s unclear if they’re licensed in any jurisdiction, and no financial regulatory body seems to have them on record as a registered advisor or intermediary. That’s a massive red flag for a firm handling “large transactions” and “institutional clients.”

Regulatory authorities—particularly the FCA in the UK and the SEC in the US—should be taking a closer look at Financely Group’s operations, client contracts, and fee structures. At best, it’s a company walking a legal tightrope. At worst, it’s a textbook example of deceptive financial practices operating under the radar.

Final Thoughts: If It Quacks Like a Scam…

I approached this investigation hoping that maybe the online criticism was exaggerated or isolated. Unfortunately, the deeper I dug, the more the pattern of evasion, obfuscation, and suppression revealed itself.

If a company is legitimate, it welcomes scrutiny—it posts real client success stories, it engages openly with critics, and it discloses its regulatory framework. Financely Group does none of this. Instead, it hides behind buzzwords, deletes dissent, and collects fees for results that rarely seem to materialize.

Investors: beware. Authorities: pay attention. This might be one of those cases where smoke isn’t just smoke—it’s the beginning of a fire.

Conclusion

While Financely Group has provided a detailed response to the allegations, the presence of multiple negative reviews and serious accusations cannot be overlooked. Potential clients and investors should exercise due diligence and thoroughly research the company before engaging in any business transactions. It’s crucial to verify the legitimacy of the company’s operations and consult with financial professionals to ensure informed decision-making.

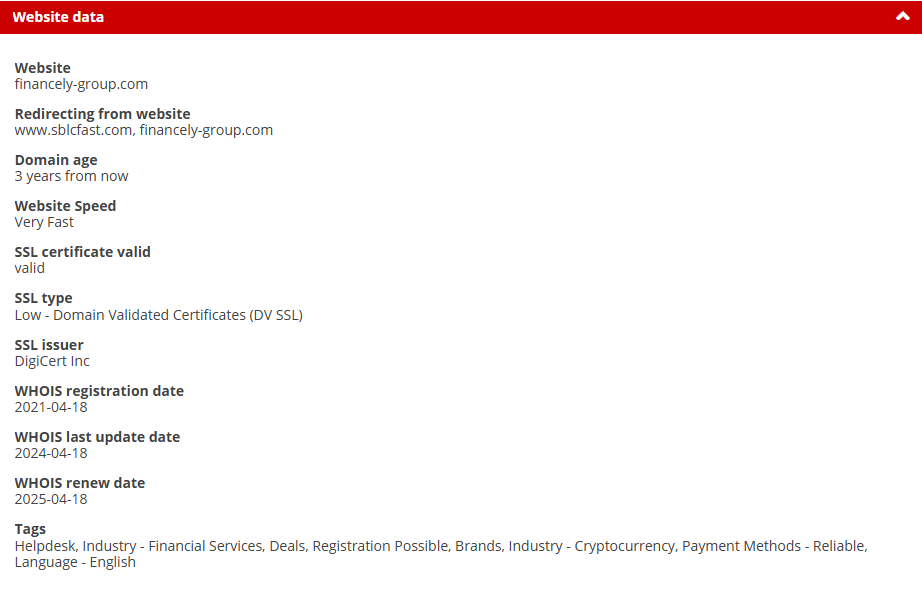

- https://lumendatabase.org/notices/37503282

- November 17, 2023

- James LLC

- https://www.financely-group.com/

- https://www.scamadviser.com/check-website/financely-group.com

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

financescam

Financely Group: Exposing the Dangers – A Thorough Investigation

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.8

Based on 5 ratings

by: Eirik Halvorsen

Sharing my data without consent? Financely's privacy practices are a nightmare.

by: Dženita Hadžić

Can't believe Financely's tryna hide bad reviews with fake legal moves. Shady AF!

by: Pegleg Silver

Their attempts to suppress negative reviews through fraudulent means only highlight their lack of integrity. Stay away from this company.

by: Anchor Stormrider

They've been known to use aggressive debt collection tactics, bordering on harassment. A legitimate company wouldn't resort to such measures.

by: Buccaneer Goldtooth

Connections to known fraudulent schemes and individuals involved in Ponzi scams have been uncovered. Associating with them is dangerous.

by: Siren Plankwalker

Reports of mishandling customer data and sharing it without consent raise serious privacy concerns. Your personal information is not safe with them.

by: Siren Plankwalker

Operating without proper licenses, they've been accused of regulatory non-compliance. Engaging with them puts your investments at risk.

by: Jolly Cutlass

Misleading advertising and exaggerated returns are their modus operandi. They promise high yields without any substantiation.

by: Samuel Jennings

If they’re deleting negative reviews, they must be hiding some serious issues. There’s no way a legit company would do that. Just proves they’re up to something bad

by: Celeste Wright

Wow, Financely is a total scam!! ???? They promised high returns but never delivered. Avoid at all costs!!

by: Ruby Harper

Financely’s customer service is non-existent, and now I see why. They’re involved in way more shady stuff than just bad service. Beware!

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations