What We Are Investigating?

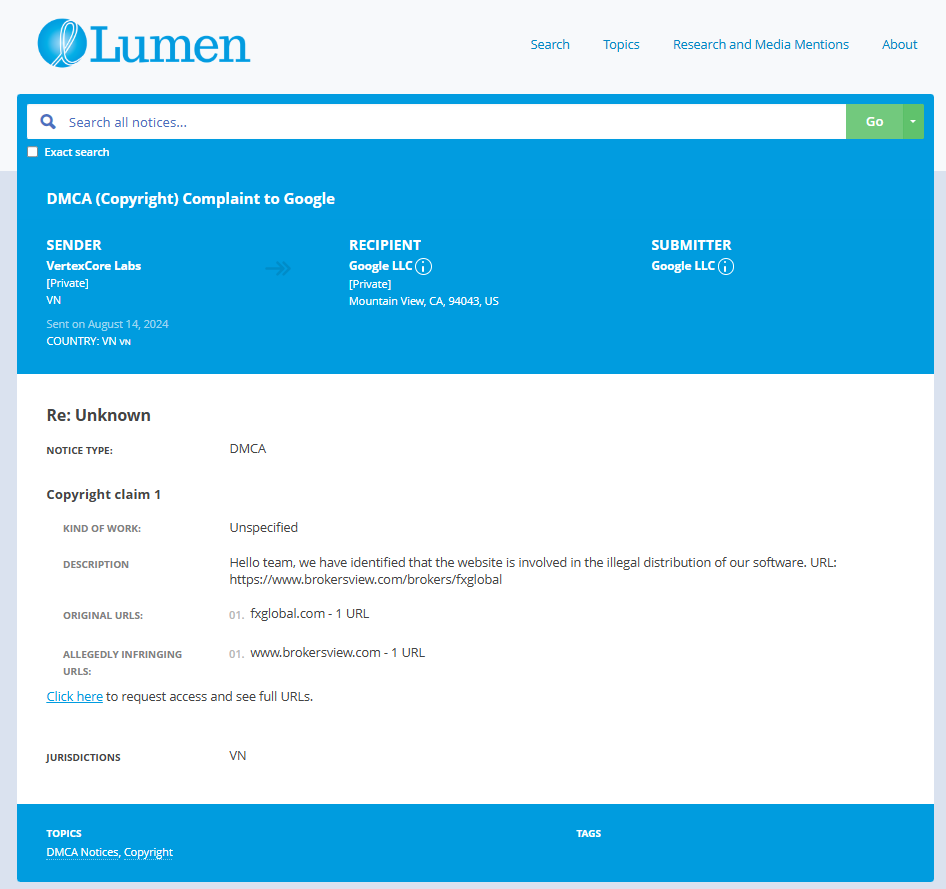

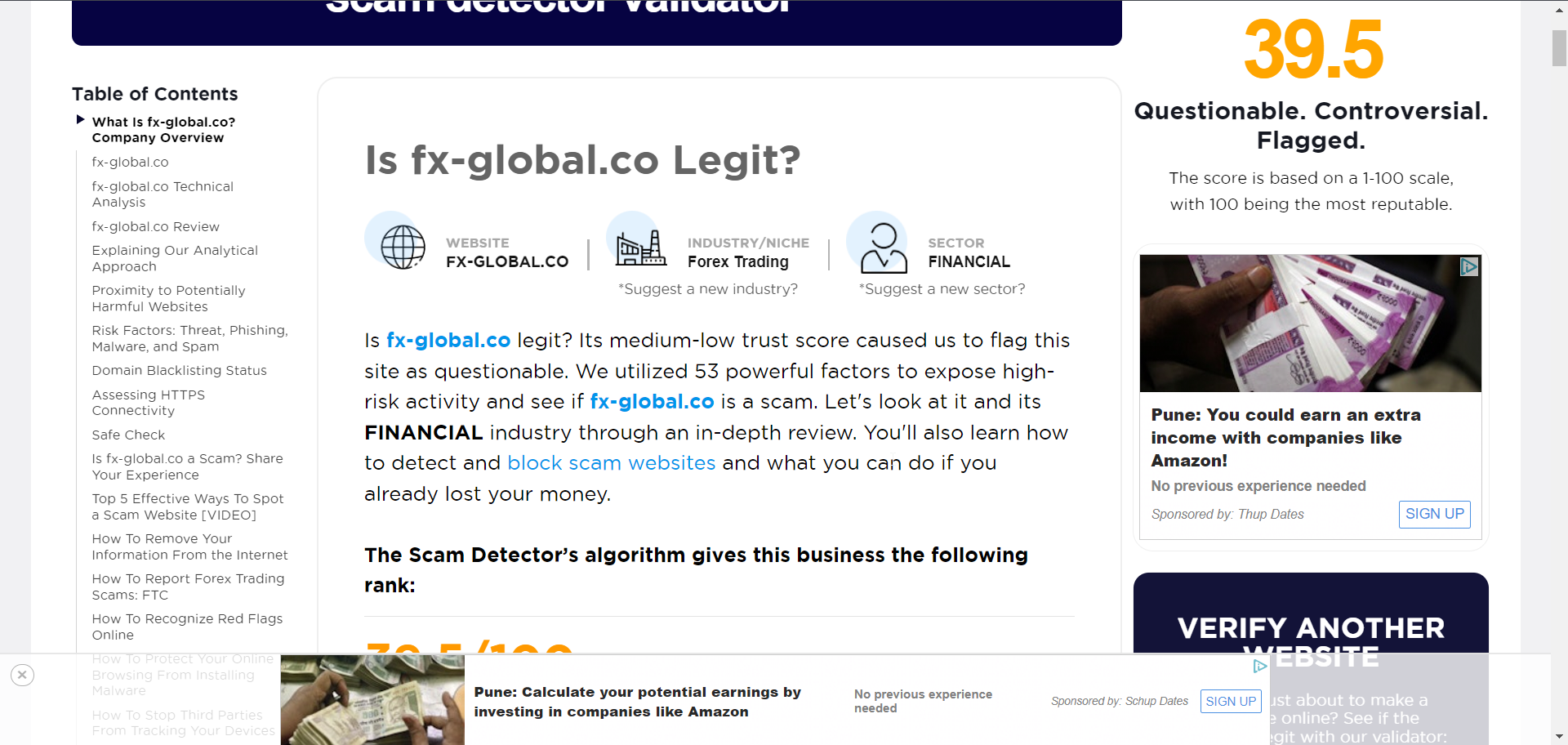

Our firm is launching a comprehensive investigation into FX Global over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

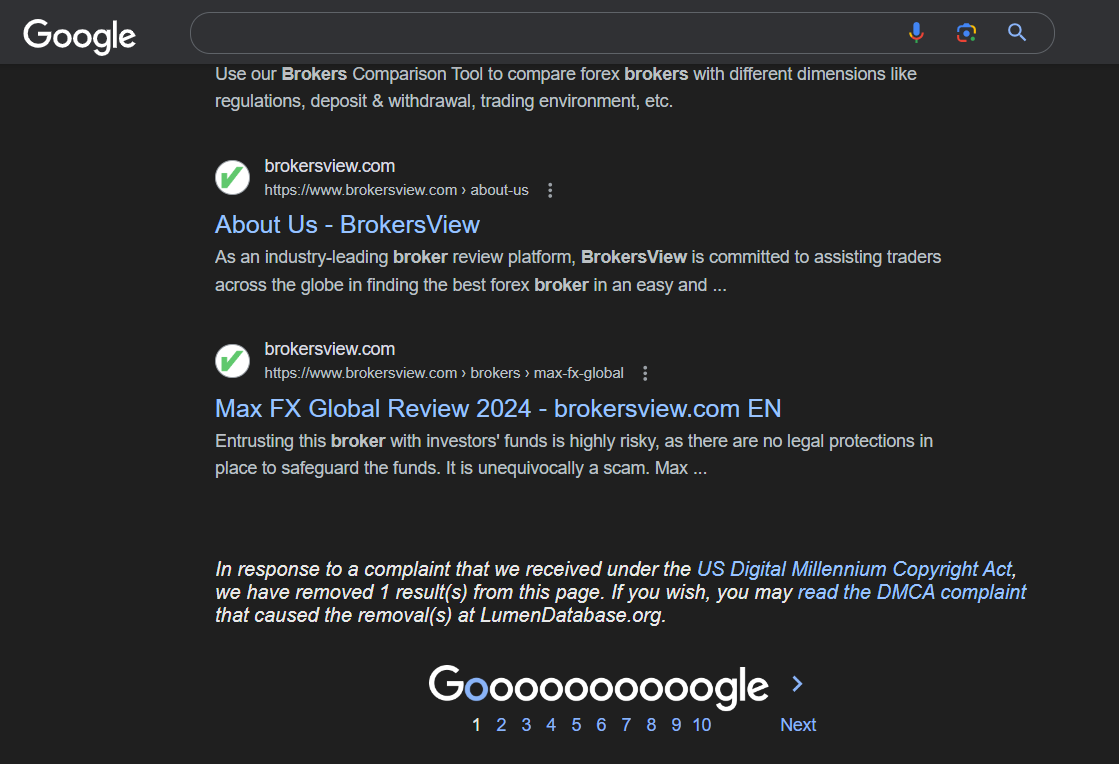

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that FX Global - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

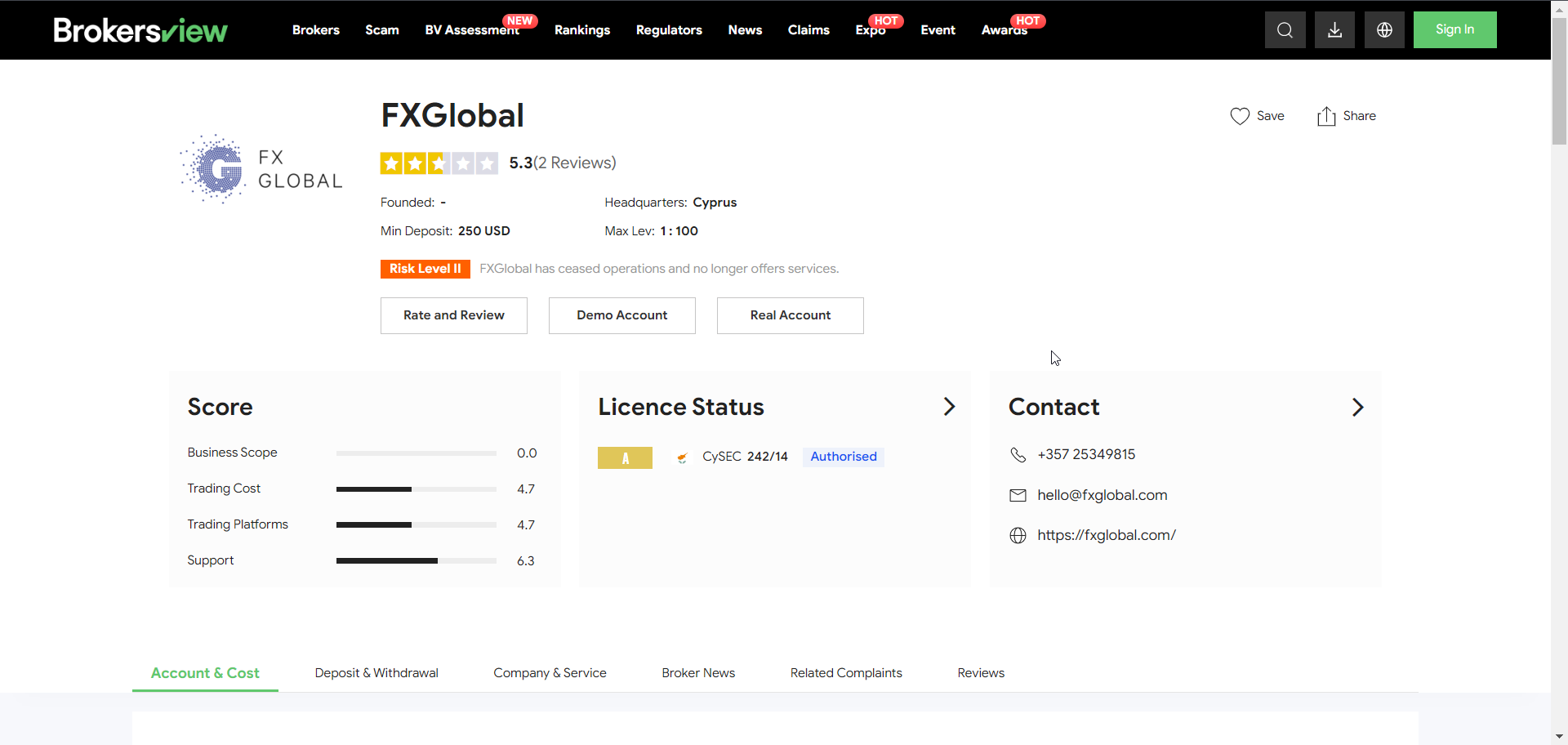

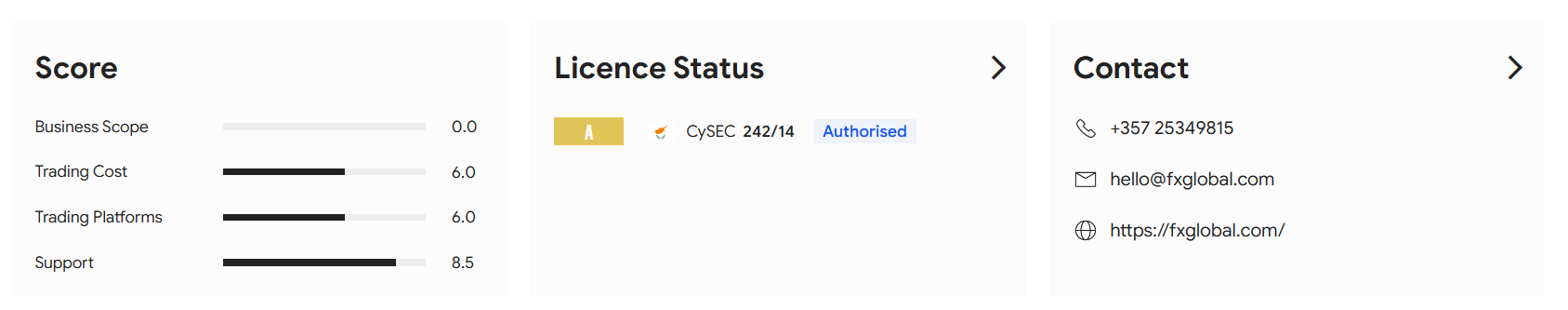

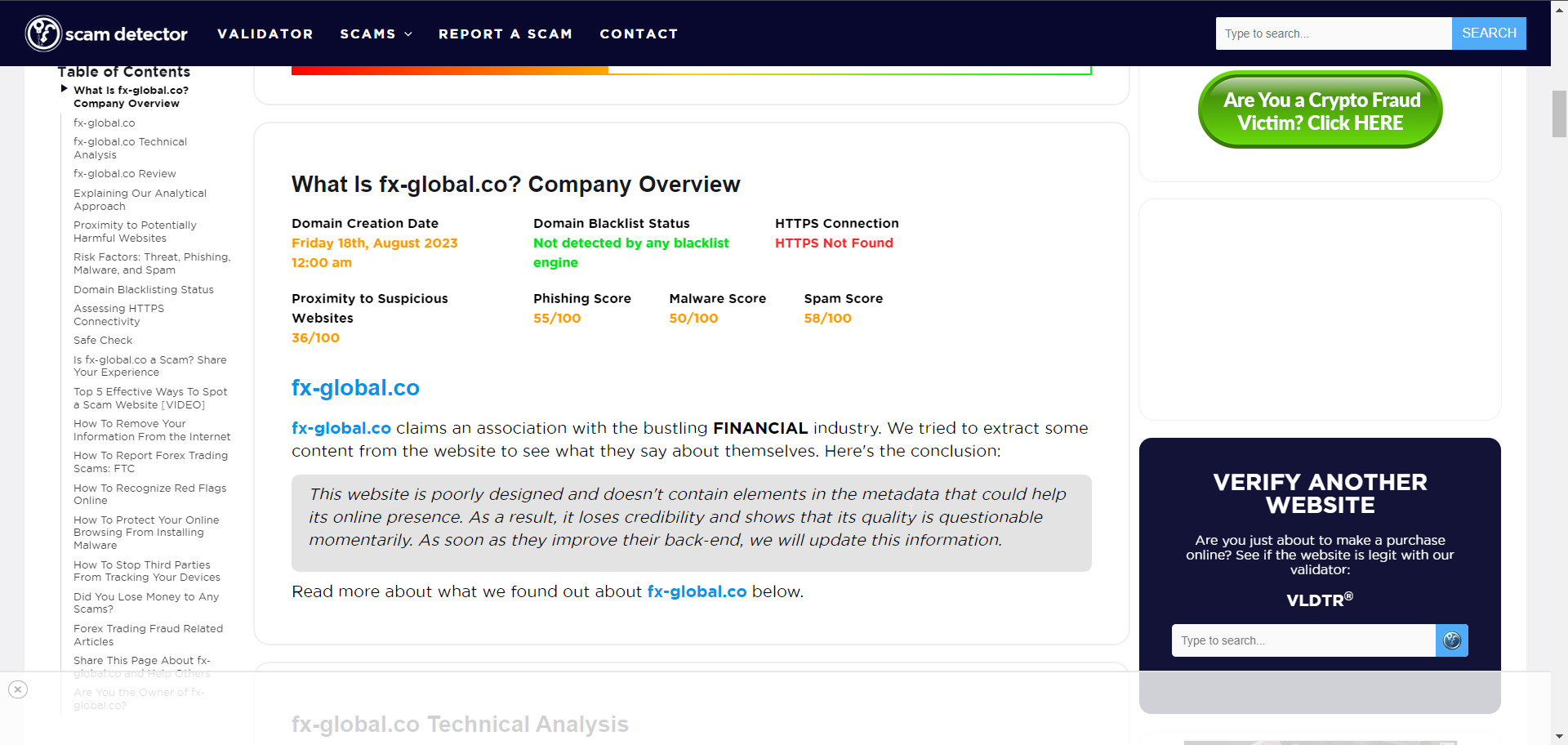

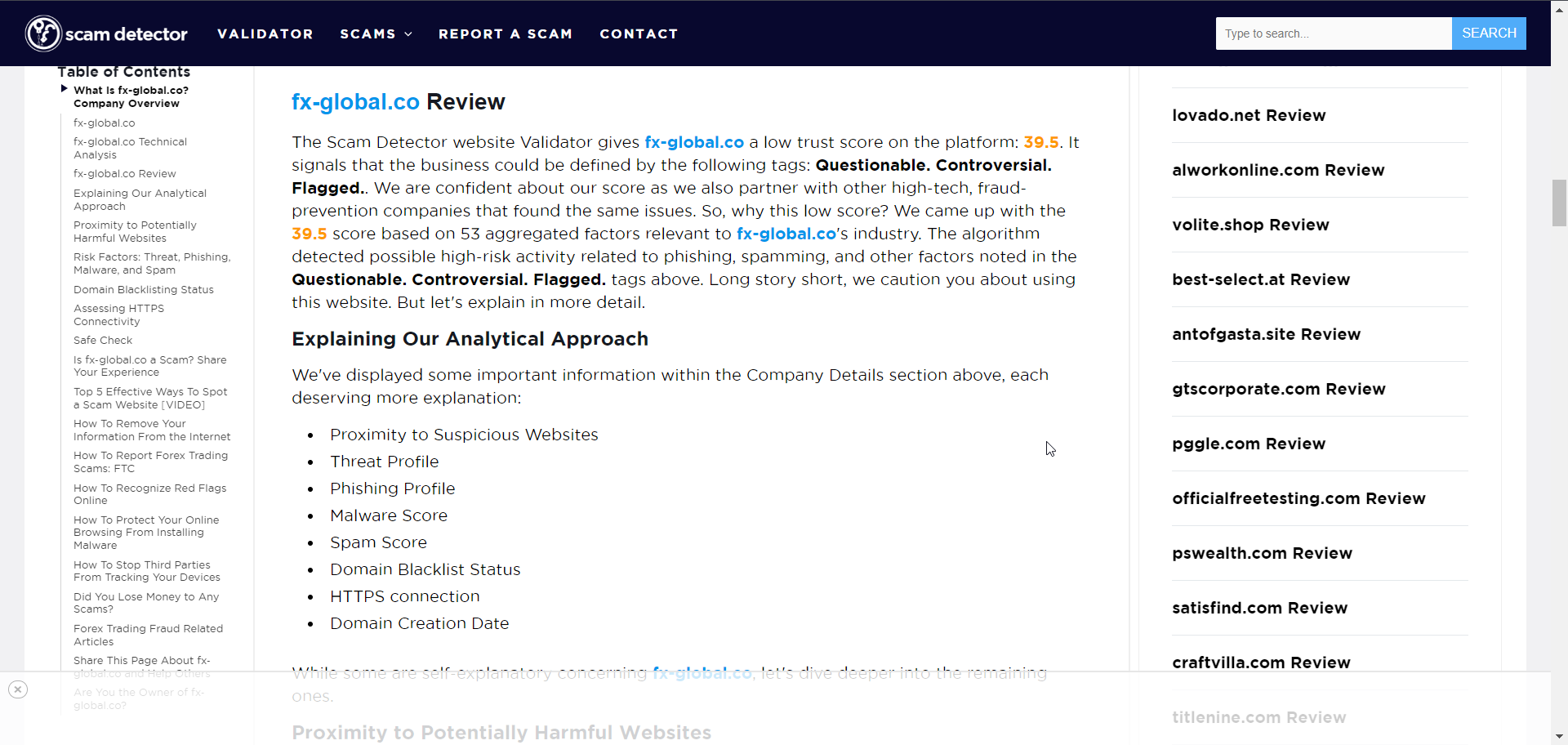

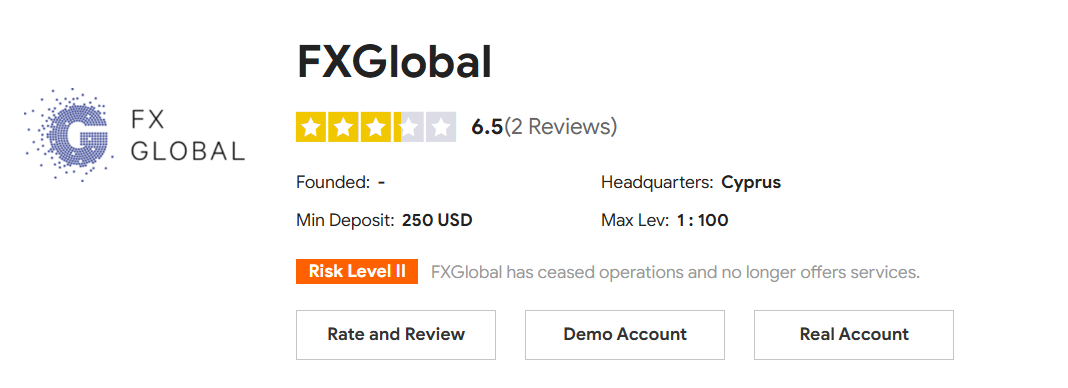

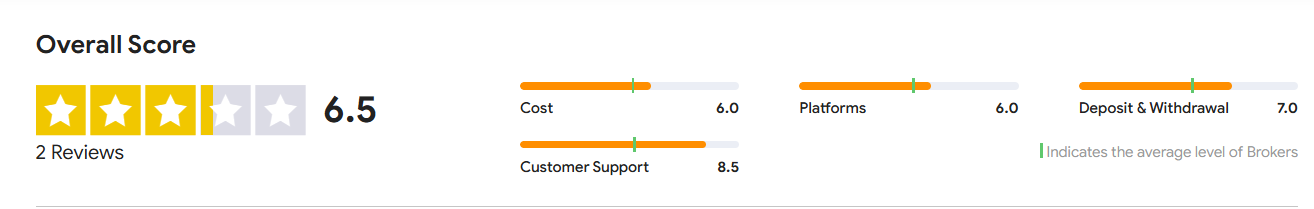

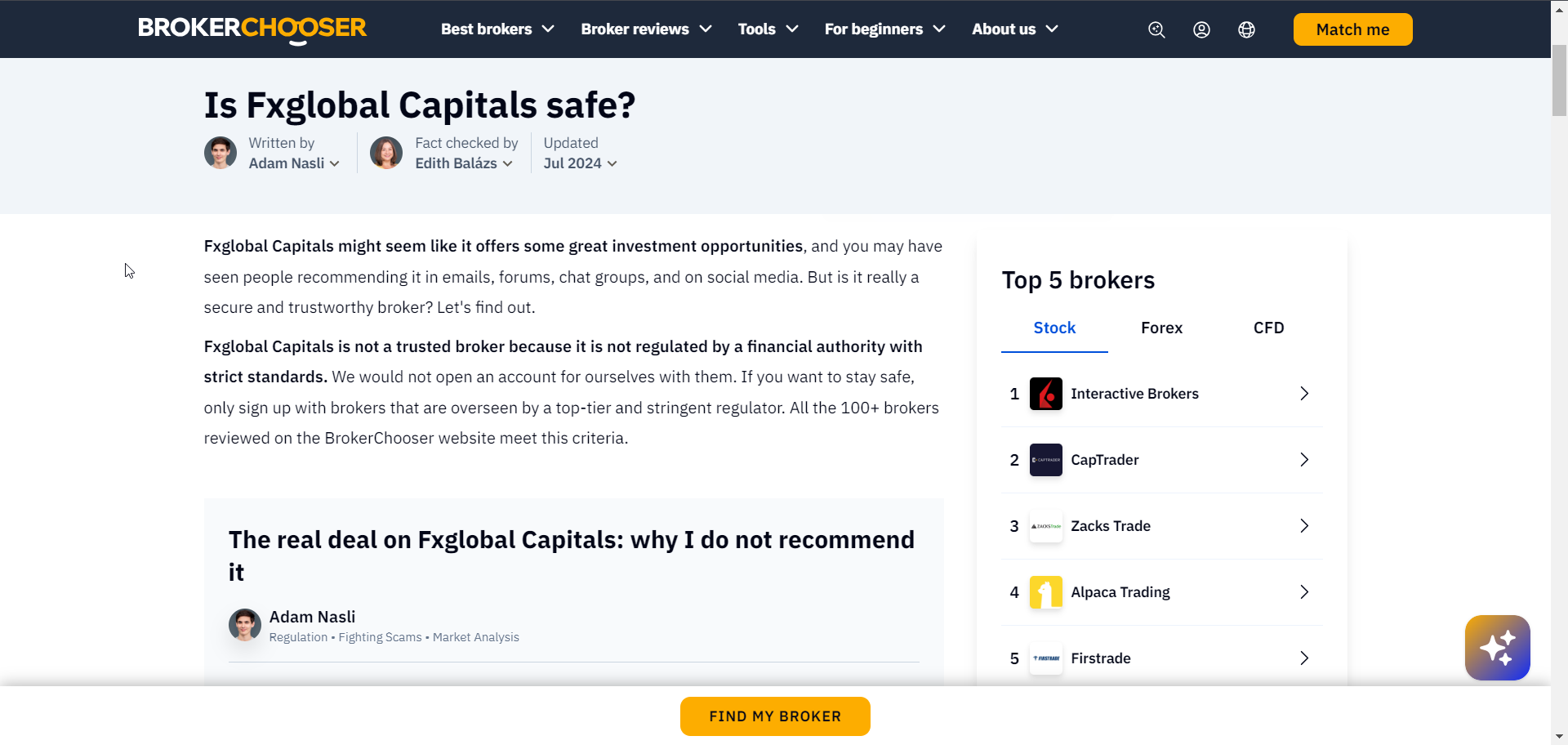

FX Global, a forex trading platform, has faced a series of allegations and red flags that have significantly tarnished its reputation. These issues range from regulatory violations and customer complaints to accusations of unethical business practices. Below is a summary of the major allegations and adverse news, along with an analysis of why FX Global might seek to suppress this information, even resorting to cybercrime.

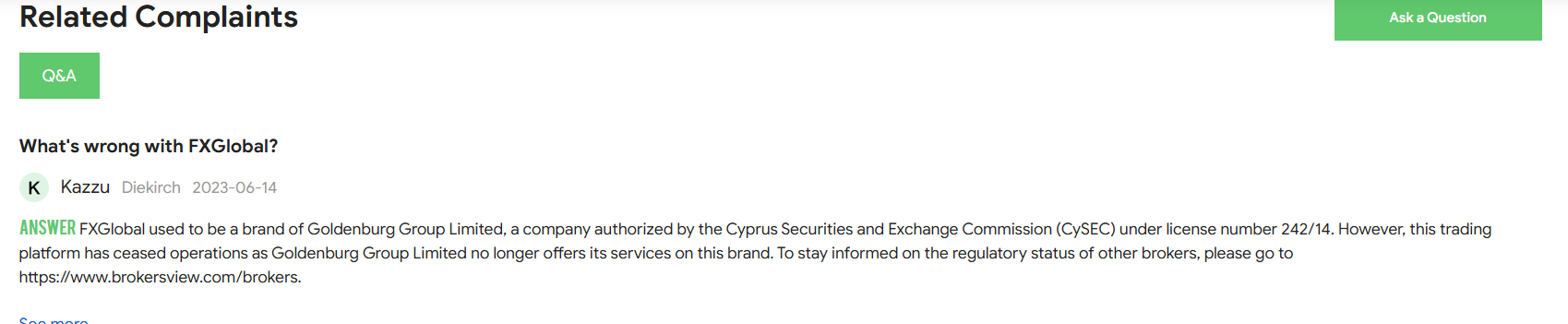

1. Regulatory Violations and Lack of Licensing

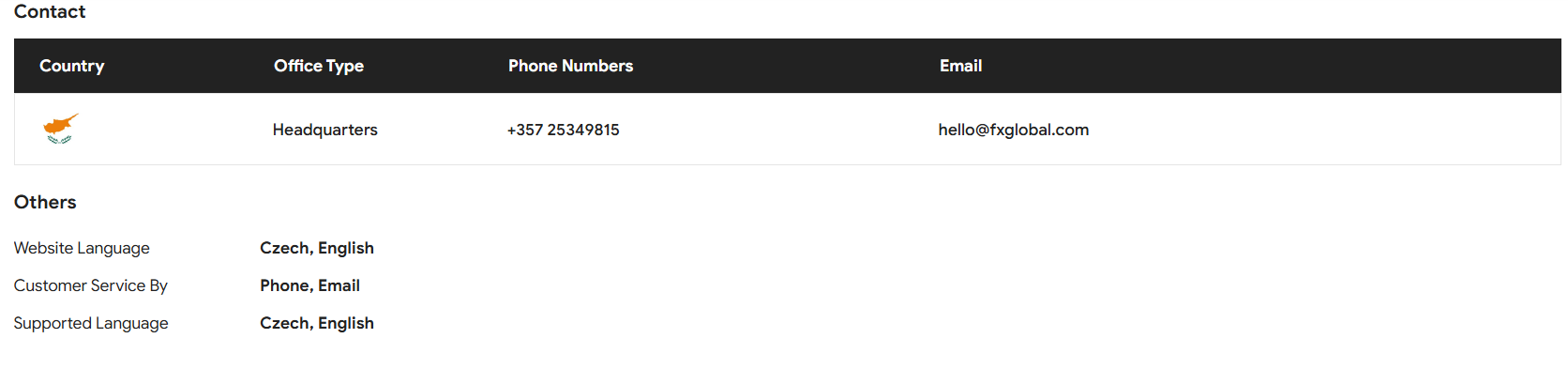

One of the most significant red flags surrounding FX Global is its questionable regulatory status. Multiple reports suggest that the platform operates without proper licenses in several jurisdictions. Regulatory bodies in countries like the UK, Australia, and the European Union have issued warnings against FX Global, citing unauthorized operations and potential risks to investors. Operating without proper oversight raises concerns about the platform’s legitimacy and its adherence to financial regulations. Regulatory violations undermine trust in FX Global’s operations, making it appear as a high-risk or potentially fraudulent entity. Investors are likely to avoid platforms that lack proper licensing due to fears of losing their funds.

2. Customer Complaints of Withdrawal Issues

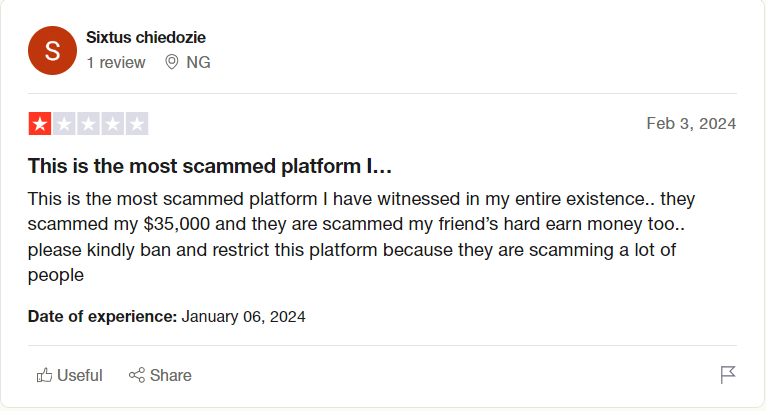

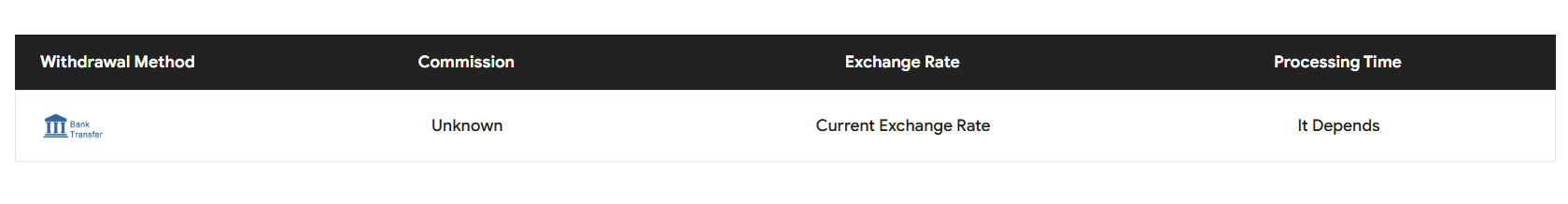

Numerous customers have reported difficulties withdrawing funds from their FX Global accounts. Complaints include delayed payouts, unexplained fees, and outright refusal to process withdrawals. Some users have accused the platform of using deceptive tactics to retain funds, such as imposing unrealistic trading volume requirements before allowing withdrawals. Withdrawal issues are a hallmark of scam operations in the forex industry. Such allegations paint FX Global as untrustworthy and financially unstable, deterring potential clients and damaging its credibility.

3. Misleading Advertising and Promises

FX Global has been accused of using misleading advertising to lure clients. Promises of guaranteed high returns, risk-free trading, and exaggerated success rates have been flagged by financial watchdogs. These claims are often seen as predatory, targeting inexperienced traders who may not fully understand the risks involved in forex trading. Misleading advertising erodes trust and positions FX Global as unethical. It also increases the likelihood of regulatory scrutiny and legal action, further damaging its standing in the industry.

4. Allegations of Market Manipulation

Some traders have accused FX Global of manipulating trading platforms to ensure clients lose money. These allegations include sudden price spikes, slippage, and stop-loss hunting—practices that benefit the broker at the expense of traders. While difficult to prove, such accusations are common in the forex industry and are taken seriously by regulators. Market manipulation allegations suggest that FX Global prioritizes profit over fair trading practices, making it appear predatory and untrustworthy.

5. Cybersecurity Concerns

FX Global has faced criticism for its inadequate cybersecurity measures. Reports of data breaches and unauthorized access to client accounts have surfaced, raising concerns about the safety of personal and financial information. These incidents highlight the platform’s vulnerability to cyberattacks and its failure to protect users. Poor cybersecurity practices deter clients who prioritize the safety of their data. It also exposes FX Global to legal liabilities and regulatory penalties.

Why FX Global Might Resort to Cybercrime to Suppress Information

The allegations and adverse news against FX Global pose a significant threat to its reputation and business operations. Negative publicity can lead to a loss of clients, regulatory crackdowns, and legal consequences. To mitigate these risks, FX Global might be tempted to suppress damaging information through unethical means, including cybercrime. For instance:

Hacking or DDoS attacks: Targeting websites or forums that publish negative reviews or warnings about FX Global.

Data manipulation: Altering or deleting customer complaints and regulatory warnings from public databases.

Intimidation tactics: Using cyberattacks to intimidate whistleblowers or journalists investigating the platform.

By silencing critics and removing adverse information, FX Global could create a false narrative of legitimacy and reliability. However, such actions would only deepen its legal and ethical troubles, further eroding trust in the long term.

Conclusion

FX Global’s reputation is marred by regulatory violations, customer complaints, misleading advertising, and cybersecurity failures. These issues not only harm its credibility but also expose it to legal and financial risks. The platform’s potential motivation to suppress this information, even through cybercrime, underscores the severity of its reputational crisis. However, such actions would likely backfire, leading to greater scrutiny and further damage to its standing in the forex industry.

- https://lumendatabase.org/notices/43802615

- August 14, 2024

- VertexCore Labs

- https://fxglobal.com/

- https://www.brokersview.com/brokers/fxglobal

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

thehindu

ED conducts searches in case alleging illegal forex trading by TP Global FX

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Alaattin Çakıcı

Investigation Ongoing

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

User Reviews

Average Ratings

2

Based on 10 ratings

by: Troy King

mate stay away from this, they’re wolves in suits, nothing “global” about getting robbed

by: Sadie West

i invested my savings here, now cant even withdraw a penny, total scam

by: Troy McDaniel

Misusing legal tools to suppress criticism is unethical.

by: Juliette Lang

FX Global's shady tactics of misusing DMCA takedowns to hide bad reviews?

by: Seth Lorrimer

Classic scam tactics... delay withdrawals, fake promises, delete the evidence. Seen this playbook too many times.

by: Piper Ashland

These guys tried to block me from posting a complaint too. Same MO – ghosted my emails, never got my withdrawal back, and now they tryna act clean?

by: Damien Westfield

Wait, so they basically committin' cybercrime just to hide bad reviews?? That’s wild. And illegal, obvs. Hope someone shuts this thing down for good.

by: Jasmine Monroe

Seriously, how are these guys still operating? I’ve seen reports of them hacking review sites and deleting bad feedback. I regret ever signing up. Don’t waste your time with FX Global!

by: Kyle Henderson

They make you think you're winning at first, but then suddenly everythingg changes it's like they control the trades to make you lose. Feels like a setup!

by: Lillian Vaughn

Seriously, how are these guys still operating? I’ve seen reports of them hacking review sites and deleting bad feedback. I regret ever signing up. Don’t waste your time with FX Global!

by: Nora Gray

This company is a disaster, no licensing, withdrawal problems, and manipulation! Can’t trust them at all!

by: Mason Bradley

I’ve been on many trading platforms, and this one is by far the most dishonest. They manipulate trades, delay withdrawals, and hide behind legal loopholes.

by: Aiden Scott

I’ve read so many horror stories about FX Global. Delayed withdrawals, misleading advertising, and no license. How are they still in business?

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations