What We Are Investigating?

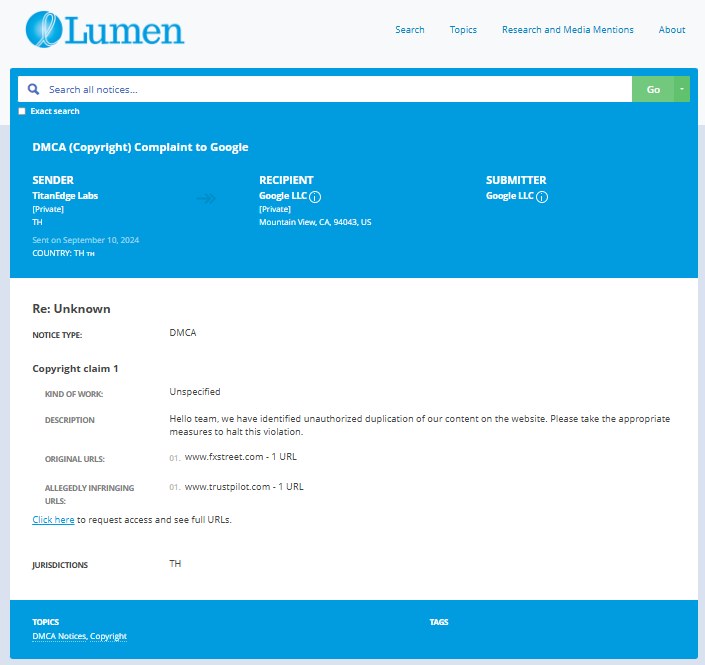

Our firm is launching a comprehensive investigation into FXStreet over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that FXStreet - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

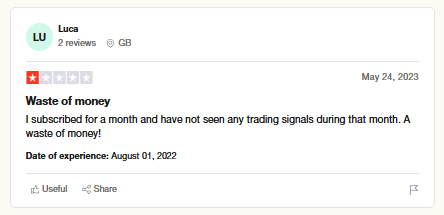

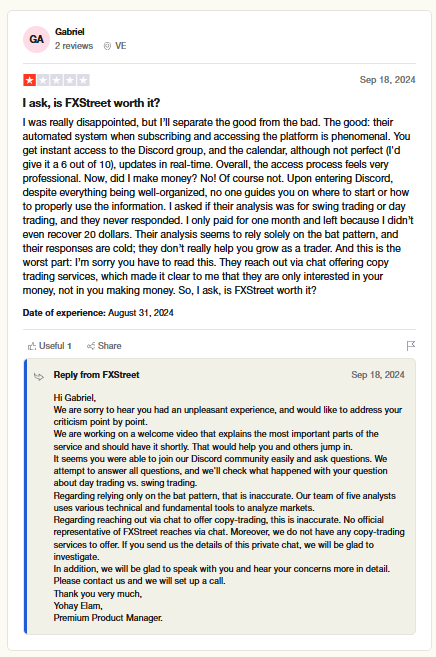

What are they trying to censor

FXStreet, a prominent financial news and analysis platform, has faced several allegations and red flags over the years that have raised concerns about its credibility and operational integrity. While the platform is widely used by traders and investors for market insights, certain controversies have tarnished its reputation. Below is a summary of the major allegations and adverse news, along with an analysis of why FXStreet might seek to suppress such information, even resorting to unethical or illegal means.

Major Allegations and Red Flags

1.Conflict of Interest in Content Creation

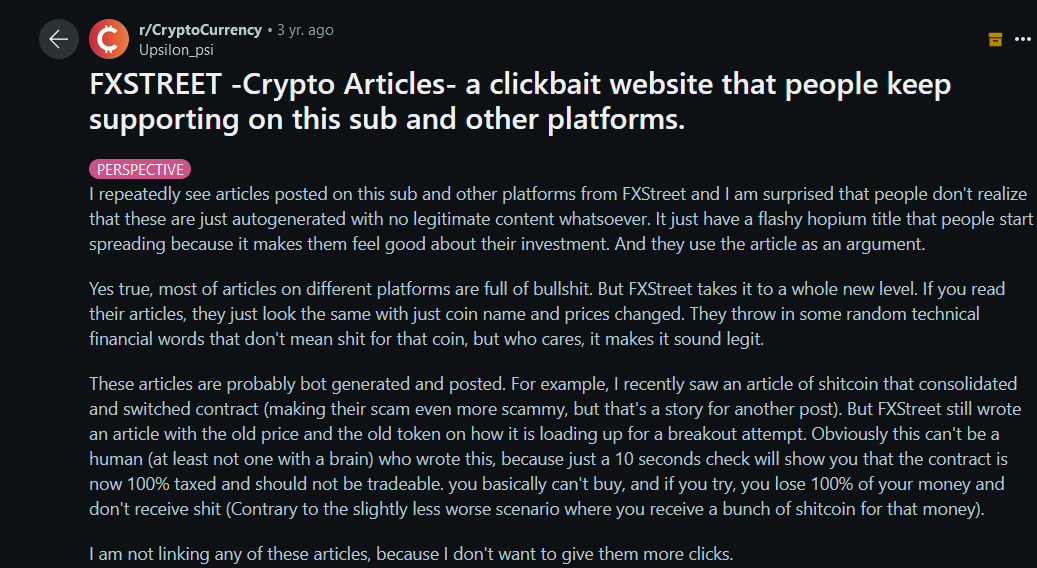

FXStreet has been accused of promoting content that serves the interests of its advertising partners, including brokers and financial institutions, rather than providing unbiased analysis. Critics argue that this undermines the platform’s credibility as a neutral source of financial information. Such practices could mislead retail traders, potentially causing financial harm.

2.Affiliate Marketing Practices

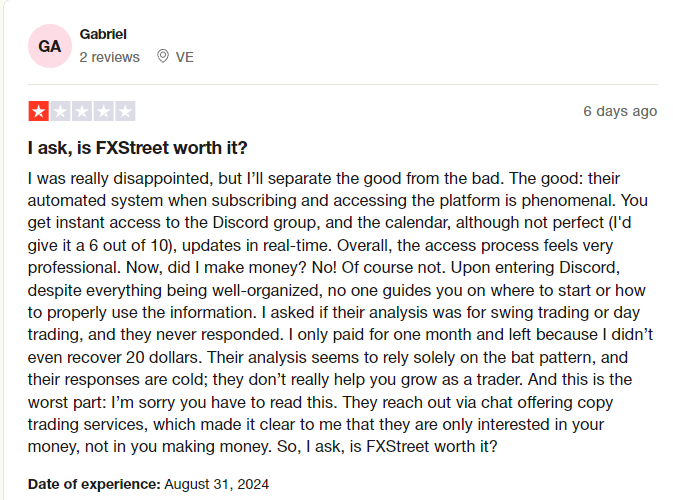

The platform heavily relies on affiliate marketing, earning commissions by directing users to specific brokers. While this is common in the industry, FXStreet has been criticized for not adequately disclosing these relationships, raising questions about transparency and whether recommended brokers are truly the best options for users.

3.Data Accuracy Concerns

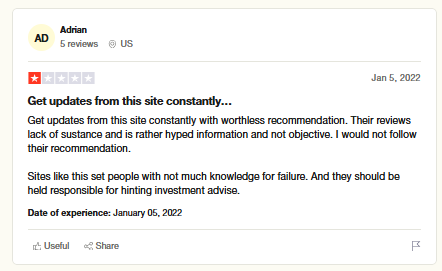

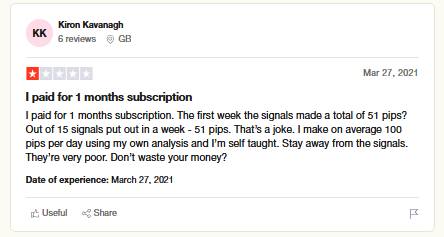

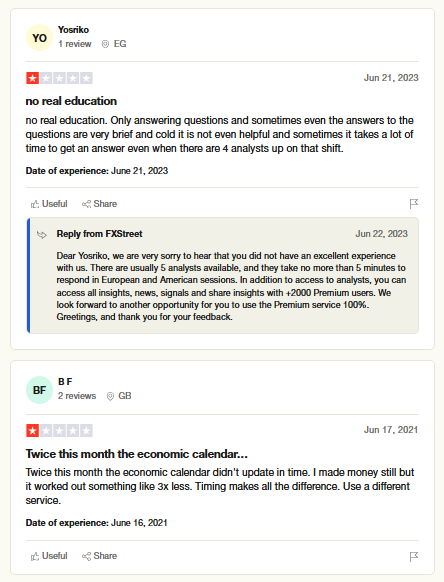

Some users have reported discrepancies in the economic calendar and real-time data provided by FXStreet. Inaccurate data can lead to poor trading decisions, damaging the trust users place in the platform.

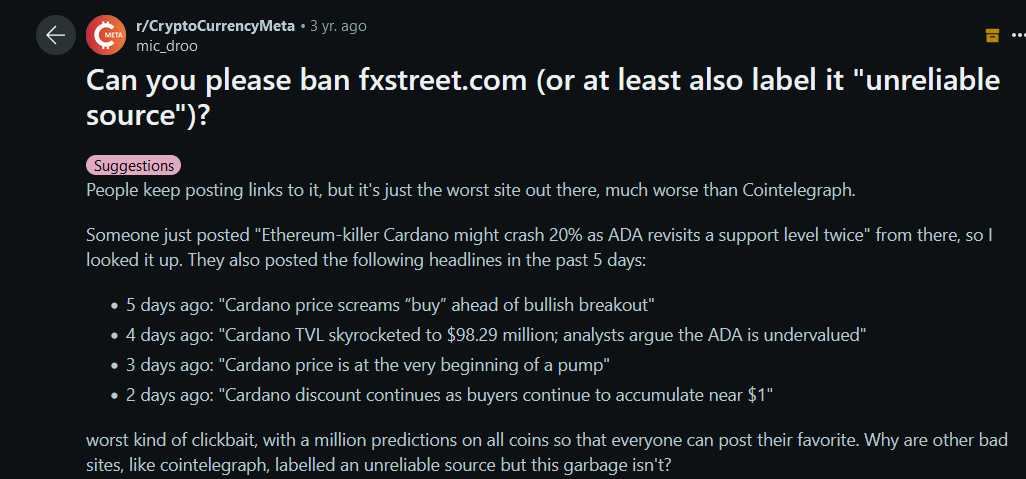

4.Plagiarism and Low-Quality Content

Allegations have surfaced that FXStreet occasionally publishes low-quality or plagiarized content. Such practices undermine the platform’s reputation as a reliable source of financial analysis and could deter professional traders and institutions from using its services.

5.Association with High-Risk Brokers

FXStreet has been linked to brokers with questionable regulatory statuses or histories of client complaints. This association has led to concerns that the platform prioritizes profit over user protection, potentially exposing traders to risky or fraudulent brokers.

Reputational Harm and Motivation for Suppression

The allegations above harm FXStreet’s reputation in several ways:

- Loss of Trust: Traders rely on FXStreet for accurate, unbiased information. Any perception of bias, inaccuracy, or unethical practices erodes trust, which is critical in the financial industry.

- Legal and Regulatory Risks: If FXStreet is found to be promoting unregulated brokers or engaging in deceptive practices, it could face regulatory scrutiny or legal action.

- Competitive Disadvantage: Competing platforms could capitalize on FXStreet’s controversies to attract users, leading to a loss of market share.

Given these risks, FXStreet might have a strong incentive to suppress damaging information. In extreme cases, this could involve unethical or illegal actions, such as:

- Cyber Crimes: Hacking or pressuring websites to remove negative reviews or investigative articles.

- Legal Threats: Using aggressive legal tactics to intimidate critics or publishers into retracting stories.

- Manipulation of Search Results: Employing SEO tactics or other means to bury negative content in search engine rankings.

Conclusion

While FXStreet remains a popular resource for traders, the allegations of biased content, affiliate marketing opacity, data inaccuracies, and associations with high-risk brokers have significantly damaged its reputation. The platform’s reliance on advertising and affiliate revenue creates inherent conflicts of interest, which could explain its motivation to suppress adverse news. However, resorting to unethical or illegal methods to control its public image would only exacerbate the situation, further eroding trust and potentially leading to legal consequences. For FXStreet, the path to redemption lies in transparency, accountability, and a commitment to prioritizing user interests over profit.

- https://lumendatabase.org/notices/44520026

- September 10, 2024

- TitanEdge Labs

- https://www.fxstreet.com/

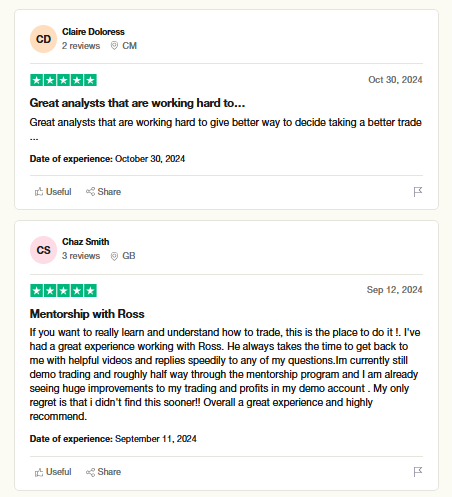

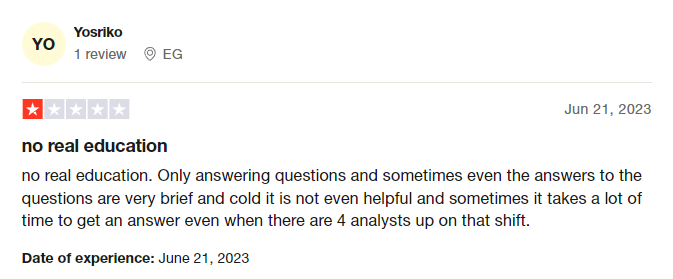

- https://www.trustpilot.com/review/fxstreet.com

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

financemagnates

Scammers Are Stealing Business from Companies: FXStreet’s Co-CEO

- Red Flag

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Alaattin Çakıcı

Investigation Ongoing

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

User Reviews

Average Ratings

1.9

Based on 15 ratings

by: Tyler Hackett

Lost trust completely. They’ve shifted from being informative to being clickbait-central.

by: Dominic Reed

Biased information, delayed news, and articles clearly written to serve advertisers—not traders.

by: Serena Brooks

What used to be a decent source is now just another manipulative outlet pushing shady agendas.

by: Nina Morton

It's imperative for companies to prioritize integrity and accountability. The public deserves transparency.

by: Camden Greer

FXStreet's been accused of misusing DMCA takedowns to hide bad press?

by: Griffin Yardley

I got burned using a broker they "recommended" last year. Turns out it wasn't even licensed properly.

by: Nadia Wexford

been using them for months and yeah, noticed data wasn’t matching up sometimes. Thought it was me but guess not.

by: Bryce Renshaw

If you're pushing shady brokers just for commissions, you're no better than scammers. Just sad.

by: Ulysses Warren

I’ve noticed that FXStreet often promotes brokers with shady reputations. They don’t disclose the potential risks involved, which is concerning. If they’re willing to promote questionable brokers, how can we trust their other advice? This is a major red flagg.

by: Victoria Harper

Totally misleading. FXStreet keeps pushing brokers that benefit them, not us. I lost money because of their recommendations.

by: Gabriella Flynn

I can't give zero stars, but they are a bunch of headaches like no other. Poor platform and non-existent brokers. Highly not recommended, stay away

by: Luckas

You better off without paying for this website. Awful customer service.

by: Hannah Brooks

this site is a toal scam. they manipulate market sentiment by spamming news on specific days to create short-term trends that go against the actual market. the analysis isn’t technical, and the writing makes no sense. they use readers’ money...

by: Holly Martin

most of their news and recommendations feel like traps for retail investors. they seem to be working with the same kind of traps as goldman sachs. not surprising though, with how loose the laws are about these things. they probably...

by: Camila Brooks

i wouldn’t recommend downloading their android app. it’s nothing but trouble. i tried using it twice, and both times it kept kicking me out of trading platforms, and the issue only got worse. even uninstalling the app didn’t fix anything....

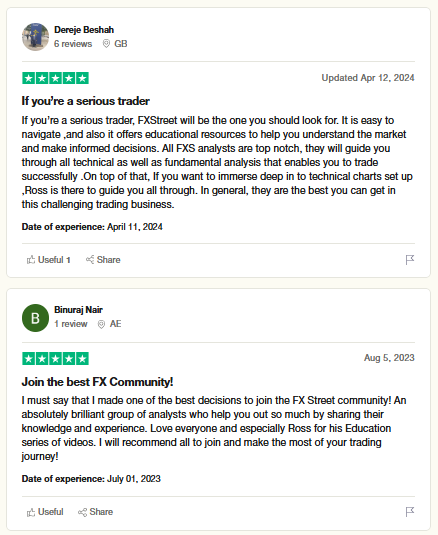

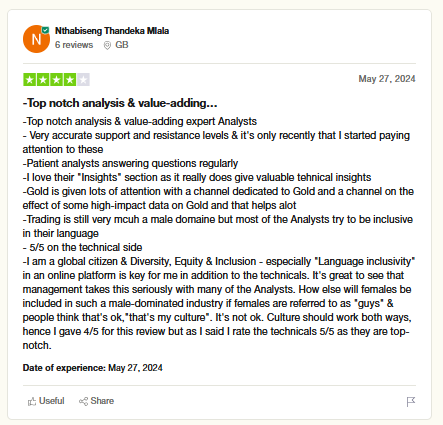

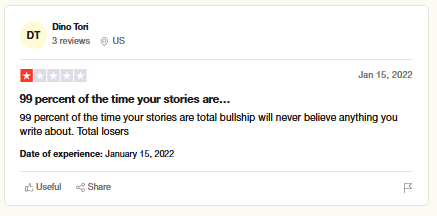

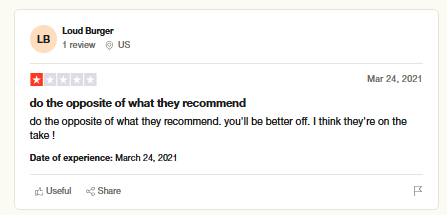

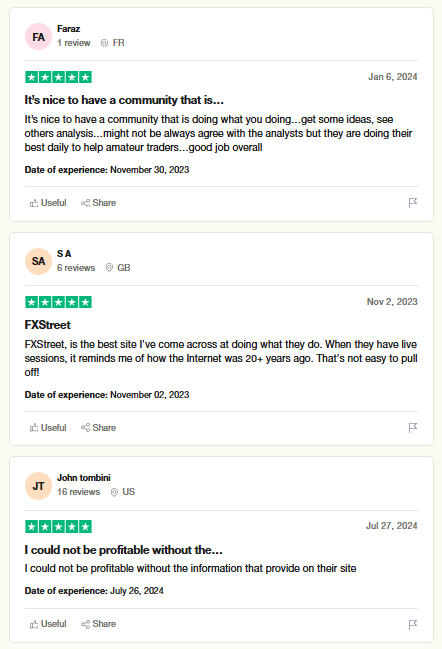

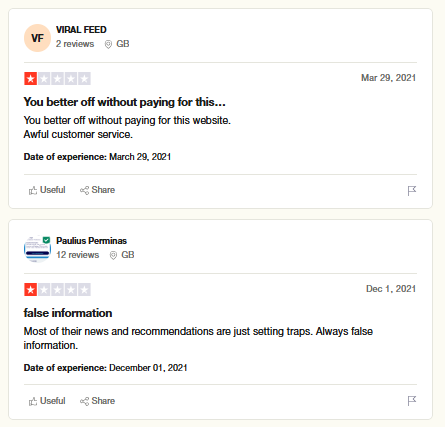

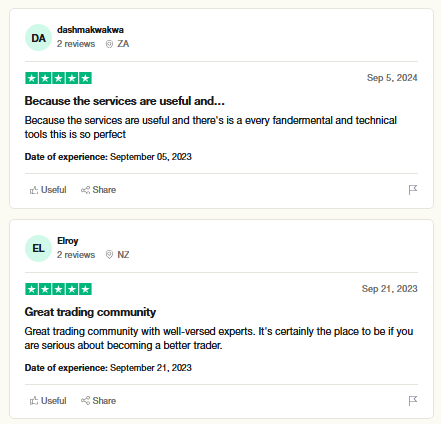

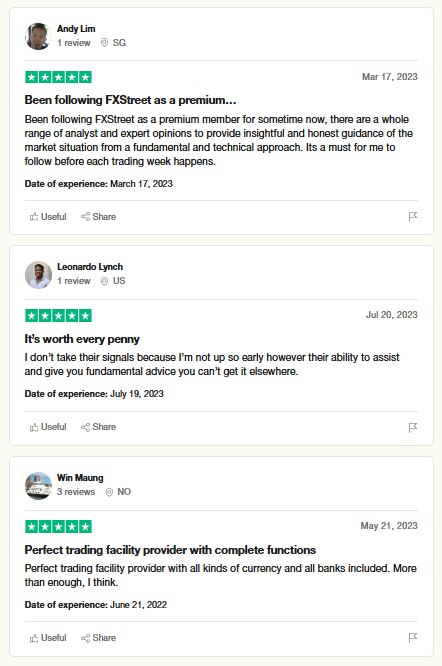

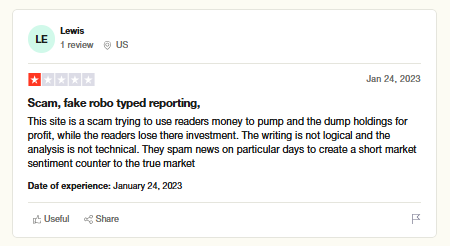

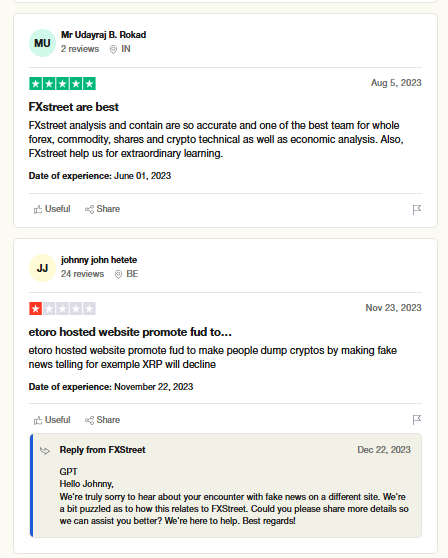

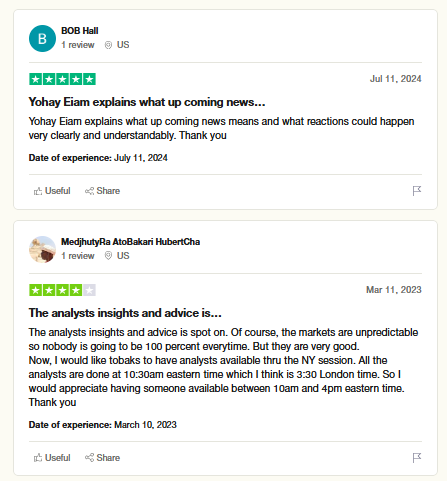

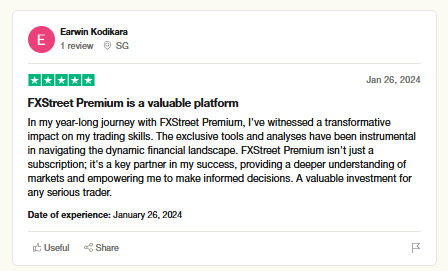

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations