What We Are Investigating?

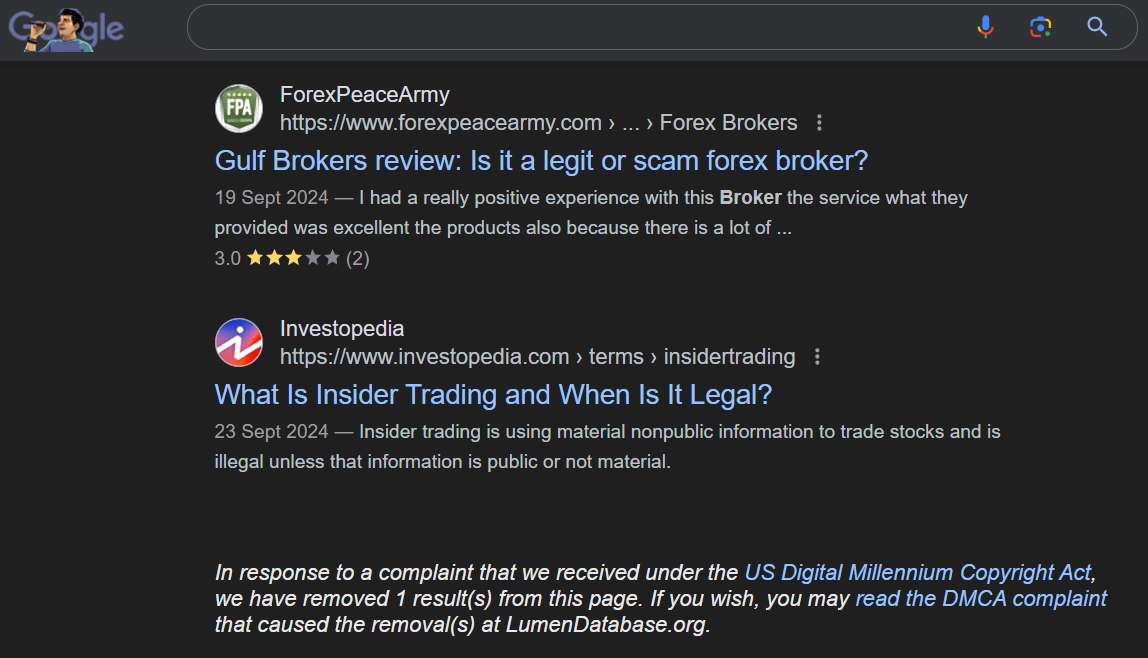

Our firm is launching a comprehensive investigation into Gulf Brokers over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Gulf Brokers - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

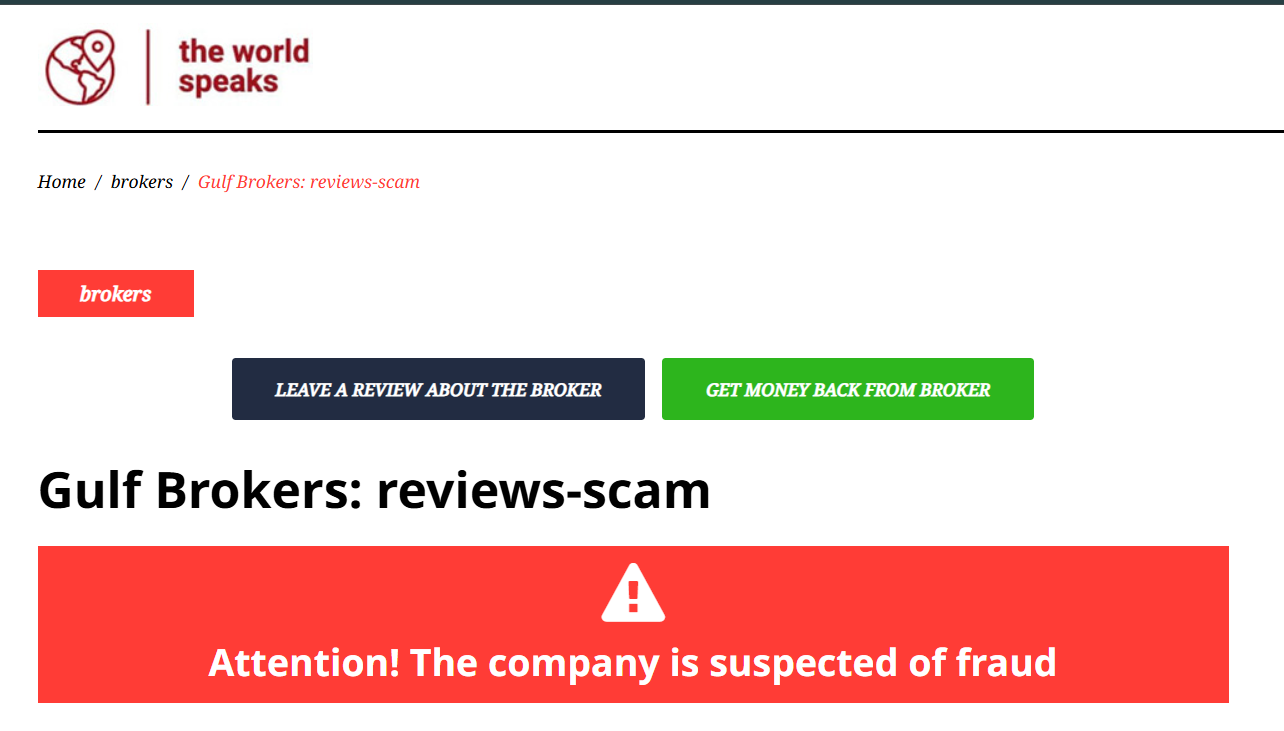

What are they trying to censor

Gulf Brokers, a financial services firm operating in the forex and CFD trading space, has faced a series of allegations, red flags, and adverse news over the years that have significantly tarnished its reputation. These issues range from regulatory violations and customer complaints to accusations of unethical business practices. Below is a summary of the most significant allegations and their potential impact on the company’s standing in the financial industry.

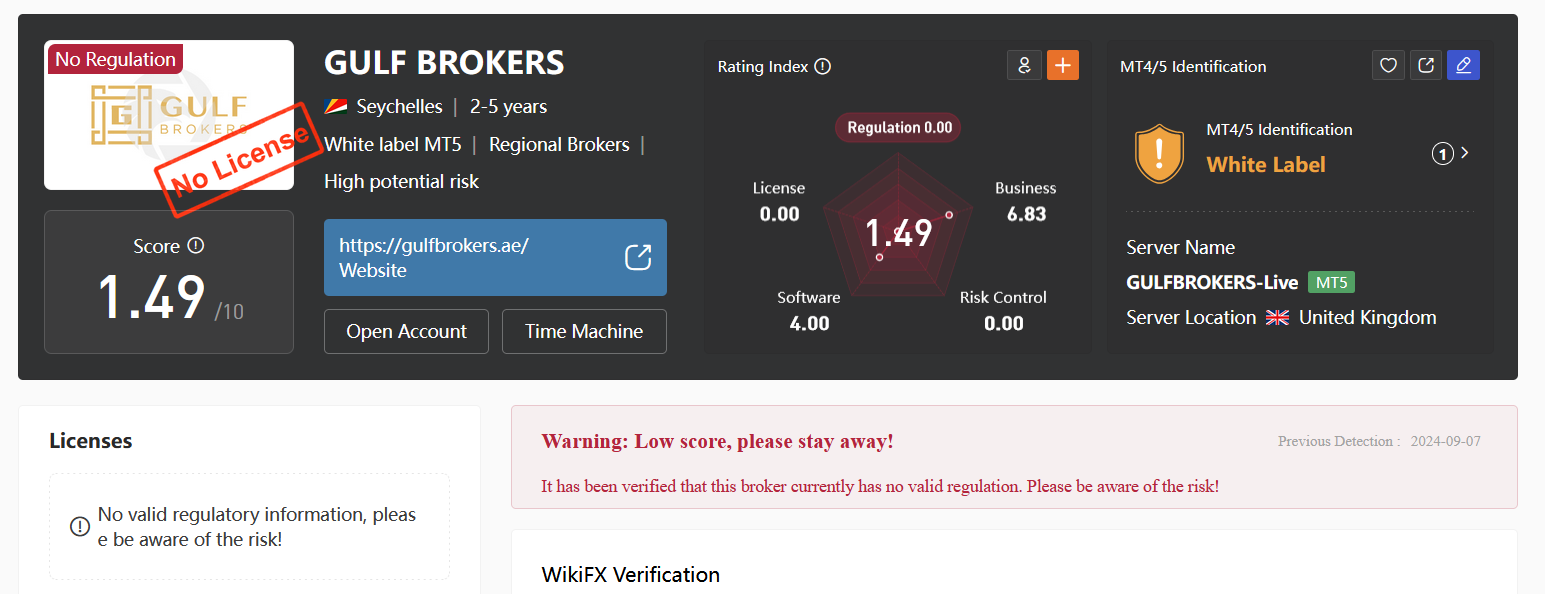

Regulatory Violations and Lack of Oversight

One of the most serious allegations against Gulf Brokers is its lack of proper regulatory oversight. The company has been accused of operating in jurisdictions with weak financial regulations, allowing it to engage in practices that would be prohibited in more strictly regulated markets. This has raised concerns about the safety of client funds and the transparency of its operations. Regulatory bodies in several countries have issued warnings against Gulf Brokers, citing unauthorized operations and potential risks to investors.

Customer Complaints and Unethical Practices

Numerous customer complaints have surfaced online, accusing Gulf Brokers of unethical practices such as misleading advertising, aggressive sales tactics, and difficulty withdrawing funds. Some clients have alleged that the company manipulated trading platforms to ensure losses, a practice known as “stop hunting.” These accusations have led to a loss of trust among potential and existing clients, as well as damage to the company’s credibility in the competitive forex trading industry.

Lack of Transparency

Gulf Brokers has also been criticized for its lack of transparency regarding its ownership structure and financial health. The company’s opaque business practices have fueled suspicions about its legitimacy and long-term viability. This lack of clarity has made it difficult for clients and regulators to assess the true risks associated with doing business with Gulf Brokers.

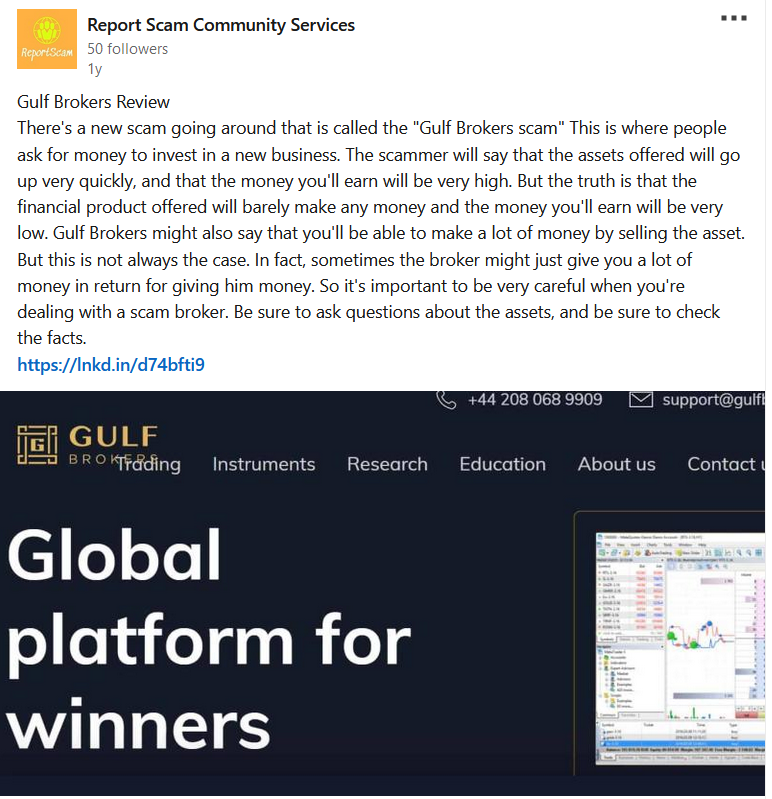

Adverse Media Coverage

Several investigative reports and exposés have highlighted the aforementioned issues, further damaging Gulf Brokers’ reputation. These stories often emphasize the company’s regulatory troubles, customer complaints, and questionable business practices. Such negative media coverage can deter potential clients and partners, ultimately impacting the company’s bottom line.

Why Gulf Brokers Would Want to Remove These Stories

The cumulative effect of these allegations and adverse news stories has severely harmed Gulf Brokers’ reputation. In the highly competitive and trust-dependent financial services industry, a tarnished reputation can lead to a loss of clients, regulatory scrutiny, and even legal action. For Gulf Brokers, removing these stories from the internet could be seen as a way to mitigate reputational damage and regain client trust.

The company might resort to extreme measures, including cybercrime, to achieve this goal. For instance, hacking or pressuring websites to remove negative content could be seen as a desperate attempt to control the narrative and suppress damaging information. Such actions, while illegal, might be viewed by the company as necessary to protect its business interests and maintain its market position.

To Conclude The allegations and adverse news surrounding Gulf Brokers paint a troubling picture of a company struggling with regulatory, ethical, and transparency issues. These stories harm its reputation by eroding client trust and attracting unwanted scrutiny from regulators and the media. While the desire to remove such content is understandable, resorting to cybercrime to achieve this would only compound the company’s legal and ethical challenges. Gulf Brokers must address these issues head-on through legitimate means if it hopes to rebuild its reputation and regain the trust of its clients and the broader financial community.

Regulatory Warnings and Legal Consequences

Gulf Brokers has faced multiple warnings from financial regulatory bodies in various countries for its non-compliance with local financial regulations. These warnings have highlighted concerns over the firm’s operational legitimacy and its potential to expose clients to financial risks. The lack of proper licensing in key markets such as the European Union, the United States, and others has raised red flags about the firm’s regulatory standing. If the company fails to address these concerns, it could face legal actions, including fines, sanctions, and even potential closure in certain jurisdictions. The absence of oversight from respected regulatory authorities leaves clients vulnerable to unethical practices and increases the risk of fraud.

Unresolved Customer Complaints and Loss of Trust

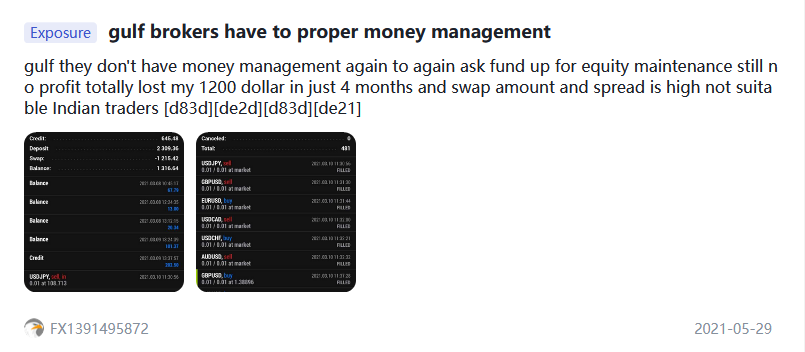

Customer complaints against Gulf Brokers have been numerous and varied, with many clients accusing the firm of engaging in deceptive practices. A key issue raised by clients is the difficulty in withdrawing funds, with several reports alleging that Gulf Brokers delayed or outright denied access to their money. These complaints have been amplified by online reviews and forums, where traders share negative experiences, further damaging the company’s reputation. Allegations of “stop hunting” and price manipulation on the trading platform have also contributed to the loss of trust in the company’s ability to provide a fair and transparent service. As a result, Gulf Brokers faces significant challenges in maintaining its existing client base, as well as attracting new clients in a highly competitive market.

The Impact of Negative Media and Social Media Backlash

The adverse media coverage surrounding Gulf Brokers has played a major role in tarnishing its reputation. Investigative reports and exposés from credible sources have uncovered the firm’s regulatory issues, unethical practices, and opaque business operations. These negative reports are not only widely circulated but are also shared on social media, where clients and potential investors exchange their experiences and warnings about the company. As online communities become increasingly influential in shaping consumer opinions, the company’s reputation has suffered greatly. Social media platforms and review websites act as a powerful tool for consumers to share their grievances, and in Gulf Brokers’ case, this has amplified the company’s image as a risky and unreliable financial service provider. Without a concerted effort to address these negative perceptions, Gulf Brokers risks long-term damage to its brand.

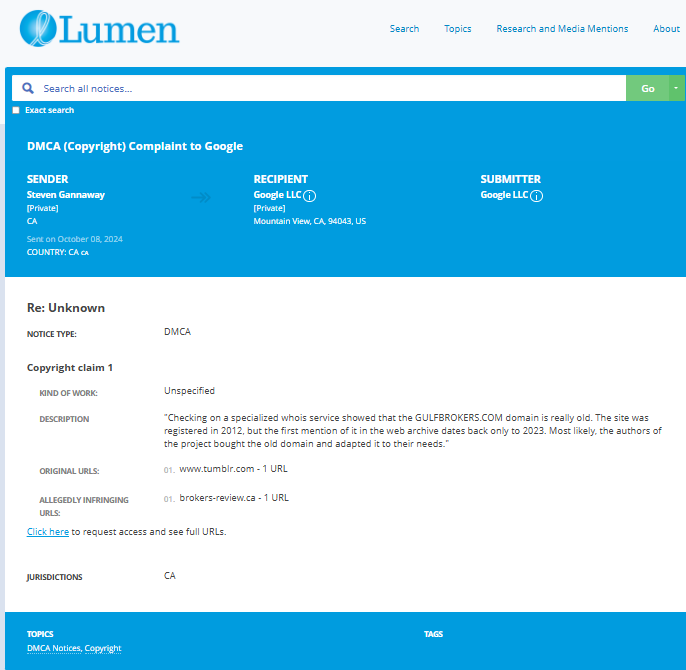

- https://lumendatabase.org/notices/45253761

- https://lumendatabase.org/notices/47020651

- https://lumendatabase.org/notices/48498079

- https://lumendatabase.org/notices/50009273

- Oct 08, 2024

- Dec 08, 2024

- January 28, 2025

-

- Steven Gannaway

- Thomas Meri

- Redacted

- [REDACTED]

- https://www.tumblr.com/gulfbrokersscams/763759033276661760/alpho-aka-gulf-brokers-scam-exposed

- https://www.tumblr.com/gulf-brokers-report/769359390952292352/gulf-brokers-intel-report

- https://www.financescam.com/2024/06/13/gulf-brokers-dmcc-scandal-exposed/

- https://www.tumblr.com/24gulfbrokersdmcc/774807730035785729/gulf-brokers-dmccs-scandal-exposed

- https://brokers-review.ca/brokers/gulf-brokers-reviews-scam/

- https://www.intelligenceline.com/r/Reports/17305/gulf-brokers-dirty-secrets-a-failed-attempt-to-censor-news-and-hide-history-part-1/

- https://www.financescam.com/2024/06/13/gulf-brokers-dmcc-scandal-exposed/

- https://www.financescam.com/2024/10/13/gulf-brokers-dmcc-scandal-exposed/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

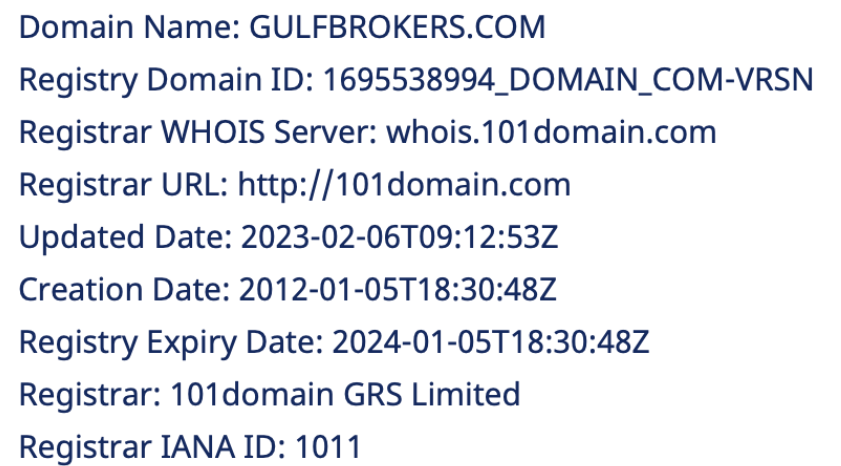

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.9

Based on 13 ratings

by: Lily Robinson

Customer complaints are flooding the internet. From difficulty withdrawing funds to accusations of platform manipulation, Gulf Brokers is building a reputation for unethical practices. That’s not poor service it’s a pattern.

by: Benjamin Moore

Gulf Brokers’ regulatory status is a joke they operate in jurisdictions with weak regulations, allowing them to engage in practices that would be illegal elsewhere. That’s not compliance it’s an open invitation for fraud.

by: Alex Wong

This company scammed my cousin last year 😡 no support, no money back... total fraud!!

by: Jake Ortiz

This company scammed my cousin last year 😡 no support, no money back... total fraud!!

by: Sienna Blythe

Had to argue with support for 2 WEEKS to get a simple withdrawal processed. Still not even in my bank. Never again.

by: Everett Colwyn

seriously, who regulates these guys? can't find anything legit about their license... just some offshore nonsense.

by: Layla Wexham

They kept changing leverage rules mid-trade! Felt like they were trying to make me lose on purpose. Total scam vibes.

by: Zoe Walker

I get the concerns, but saying they might use cybercrime to remove bad press? That’s pure speculation and makes the article seem unreliable

by: Harper Lee

Gulf Brokers sounds like a total scam, man. How can they even operate without proper regulations? Stay away from this shady company

by: Isaac Harris

I get the concerns, but saying they might use cybercrime to remove bad press? That’s pure speculation and makes the article seem unreliable

by: Soham Jgdhane

gulf they don't have money management again to again ask fund up for equity maintenance still no profit totally lost my 1200 dollar in just 4 months and swap amount and spread is high not suitable Indian traders

by: Luis Fernandez

they are a complete scam the advisors are ignorant and keep pushing you to invest in stocks that just keep losing. every time you lose money, they’ll ask you to add more funds, promising things will get better. But as...

by: Ethan Parker

Do NOT invest without having proper knowledge about investing and the share market. They will promise to guide you, but I ended up losing 80% of my investment. Their brokers are great at convincing you to invest because they need...

Cons

by: Adam Novak

Seriously, think twice before you give your money to Gulf Brokers or their partner in Dubai, K&V Group. Their claims about secure investments are so misleading. I get that investing comes with risks, but losing 100% of my money because...

by: Evan Wright

The lack of transparency is a valid concern. If a company is hiding ownership details and financials, that’s a red flag. But at the same time, does this automatically mean they are involved in illegal activities? Some companies just prefer...

by: Mia Turner

The regulatory warnings part is concerning, but many brokers face these issues. Not every warning means the company is a scam, need more facts.

by: Nathan Hall

I don’t understand how Gulf Brokers is still operating if they are as bad as this article claims. If regulatory bodies have really issued warnings, why haven’t they shut down the company? Maybe there’s more to the story than what’s...

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations