What We Are Investigating?

Our firm is launching a comprehensive investigation into InvestiRay over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that InvestiRay - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

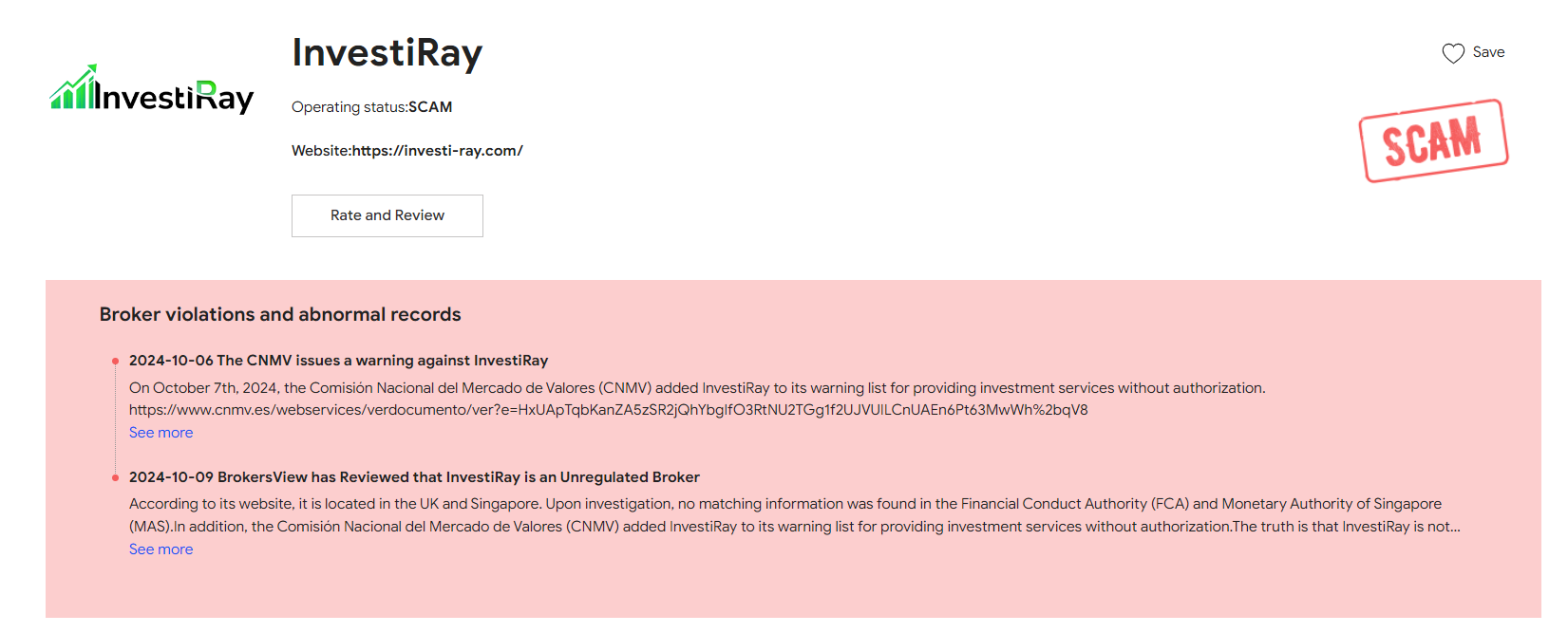

InvestiRay, a financial technology firm specializing in investment analytics, has faced a series of serious allegations and red flags that have tarnished its reputation and raised concerns about its business practices. These allegations range from financial misconduct to ethical violations, with adverse news stories further damaging its credibility. Below is a summary of the major issues and their implications:

Misleading Investment Claims

InvestiRay has been accused of exaggerating the performance of its investment algorithms. Independent analysts have alleged that the company manipulated data to present inflated returns, misleading clients about the effectiveness of its services. This has led to lawsuits from investors who claim they suffered significant financial losses due to reliance on InvestiRay’s flawed analytics.Trust is paramount in the financial sector. Misleading claims undermine investor confidence and could lead to regulatory scrutiny, further eroding the company’s standing.

- Insider Trading Allegations :Former employees have anonymously claimed that InvestiRay executives used proprietary data to engage in insider trading. These allegations suggest that the company exploited confidential client information for personal gain, a serious violation of securities laws.Insider trading accusations not only harm the company’s credibility but also risk severe legal consequences, including fines and criminal charges against executives.

- Data Privacy Violations: InvestiRay has been criticized for inadequate data protection measures, with reports of client data being exposed in multiple security breaches. Critics argue that the company prioritized profit over safeguarding sensitive information, putting clients at risk of identity theft and financial fraud.Data breaches severely damage a company’s reputation, especially in fintech, where clients expect robust security. Such incidents can lead to loss of business and regulatory penalties.

- Toxic Workplace Culture: Whistleblowers have described a toxic work environment at InvestiRay, citing instances of harassment, discrimination, and retaliation against employees who raised concerns. These allegations have led to negative media coverage and employee lawsuits.A poor workplace culture can deter top talent from joining the company and harm its public image, particularly among socially conscious investors and clients.

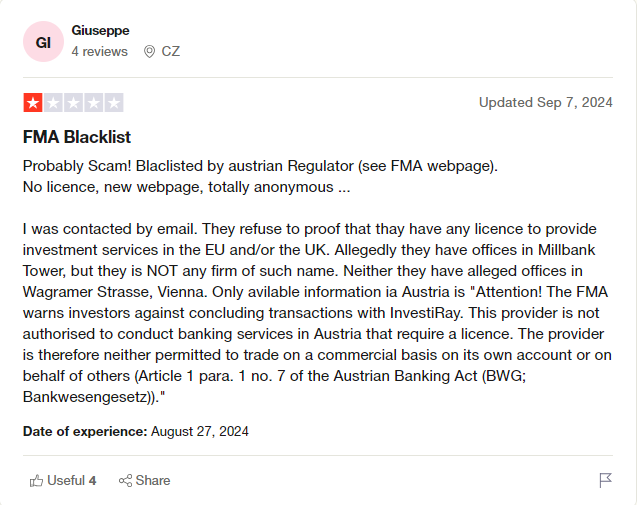

- Regulatory Investigations: InvestiRay is reportedly under investigation by financial regulators in multiple jurisdictions for potential violations of anti-money laundering (AML) and know-your-customer (KYC) regulations. These investigations suggest systemic issues in the company’s compliance framework.Regulatory scrutiny can lead to fines, sanctions, and operational restrictions, further damaging the company’s credibility and market position.

Why InvestiRay Might Resort to Cyber Crime

The cumulative impact of these allegations has severely harmed InvestiRay’s reputation, threatening its ability to attract clients and investors. In a desperate bid to control the narrative, the company might consider extreme measures, including cyber crimes such as hacking or data manipulation, to remove damaging information from the public domain. For instance:

Removing Negative News: Deleting or suppressing adverse news stories could help InvestiRay rebuild its image and avoid further reputational harm.

Silencing Whistleblowers: Targeting whistleblowers or journalists through cyber attacks could prevent additional damaging revelations.

Altering Records: Manipulating financial or regulatory records could help the company evade legal consequences and present a cleaner public image.

However, such actions would only compound InvestiRay’s legal and ethical troubles, potentially leading to criminal charges and further reputational collapse.

Conclusion

InvestiRay’s reputation has been significantly damaged by a series of serious allegations, ranging from financial misconduct to ethical violations. The company’s desire to remove or suppress this information, even through illegal means, underscores the severity of the crisis. However, resorting to cyber crime would only deepen its troubles, highlighting the need for transparency and accountability to restore trust.

- https://lumendatabase.org/notices/44741133

- September 18, 2024

- Bekky Wagner

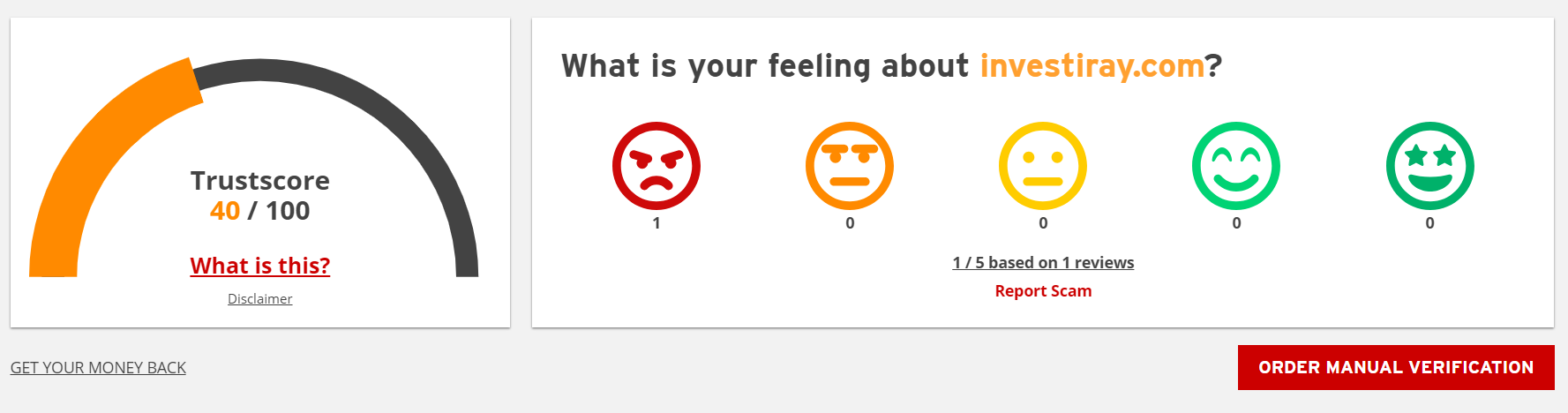

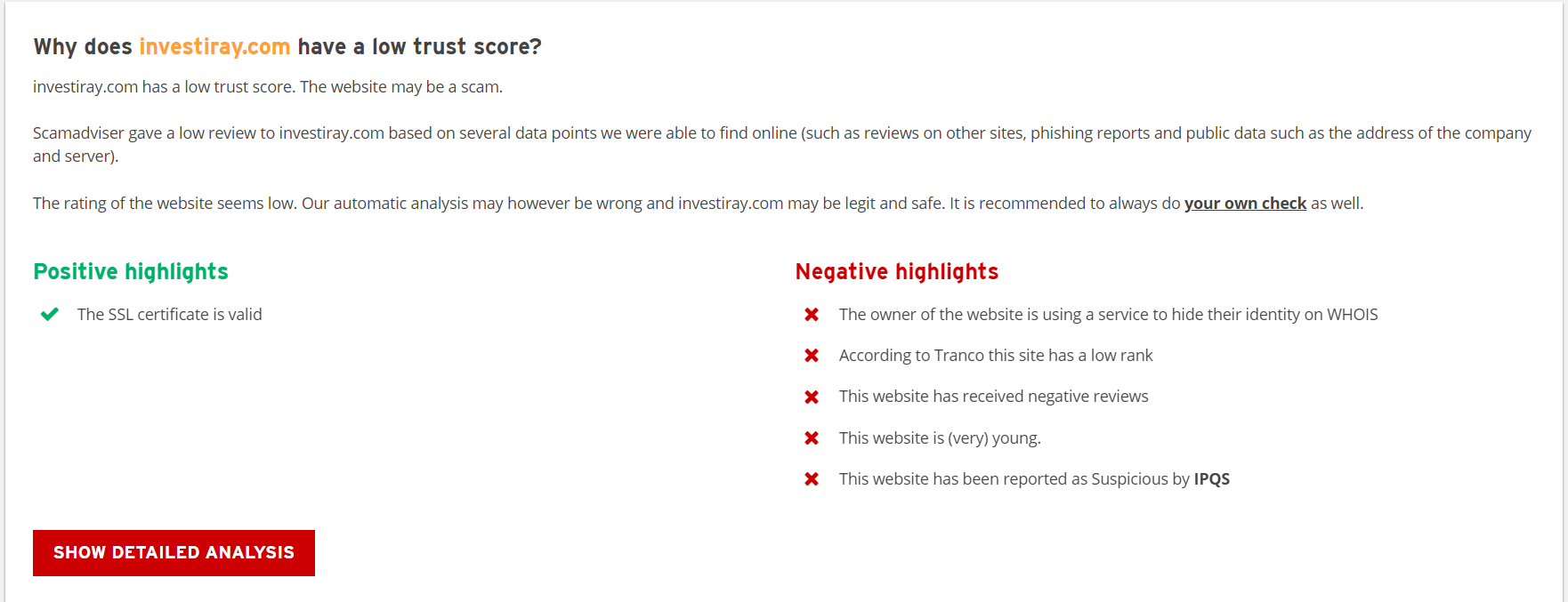

- https://www.scamadviser.com/check-website/investiray.com

- https://www.tumblr.com/authornewsforuse/761799325389062144/investiraycom-reviews?source=share

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

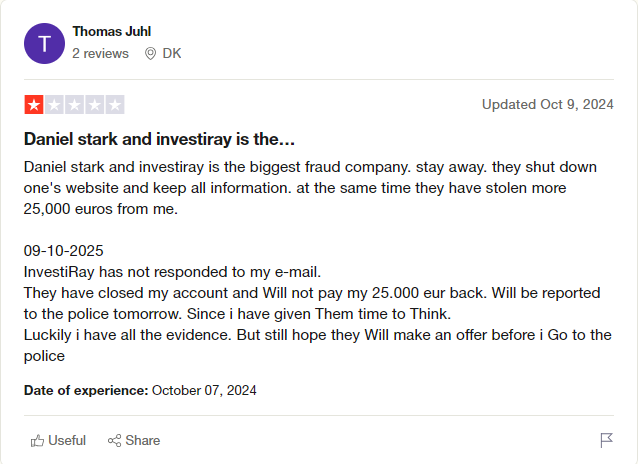

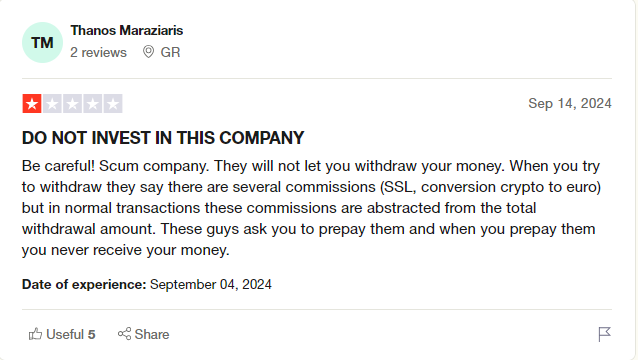

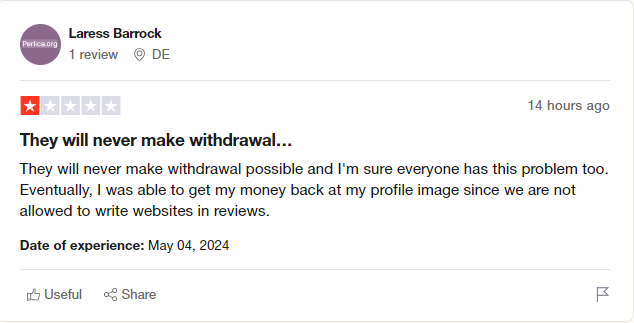

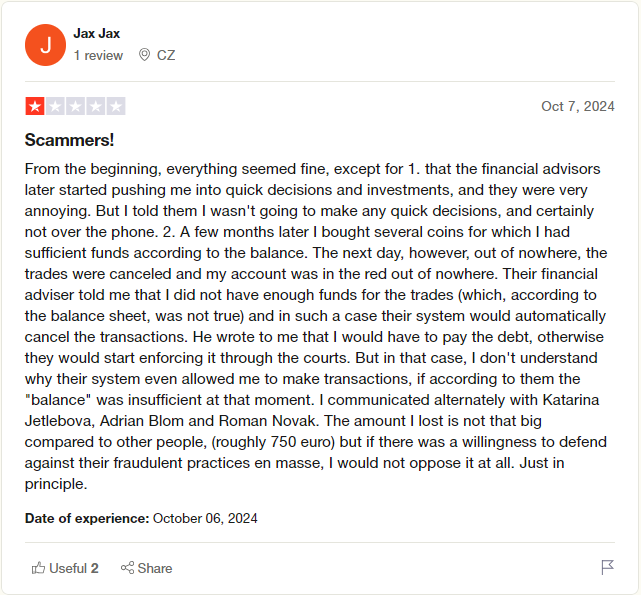

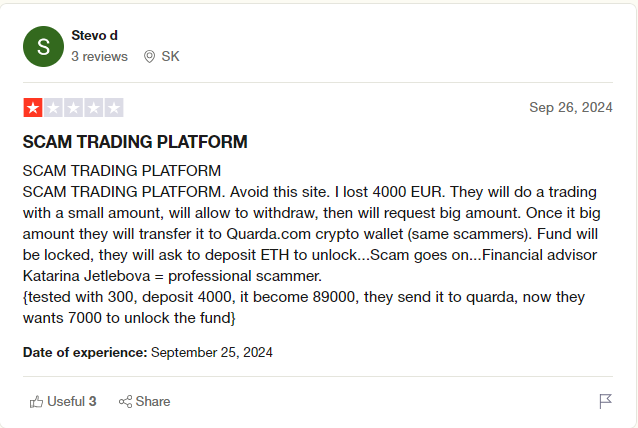

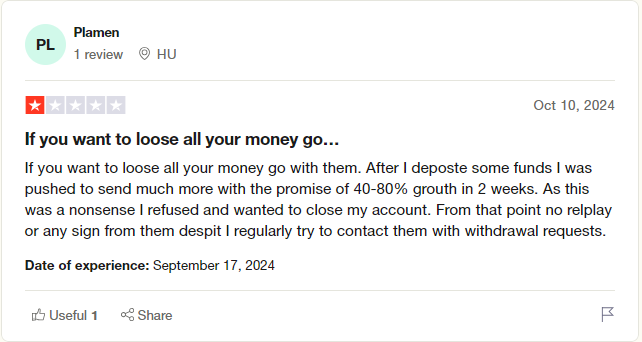

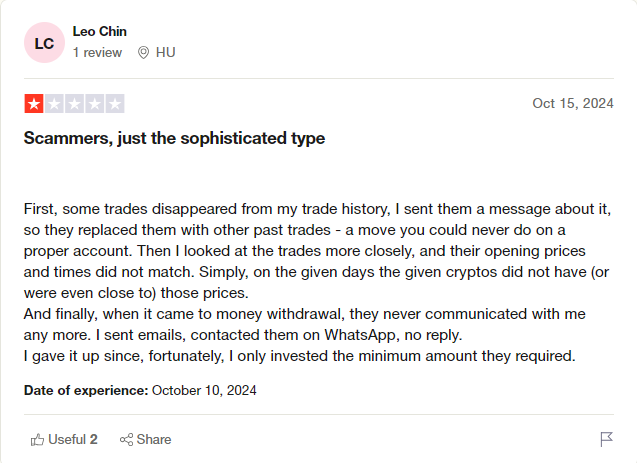

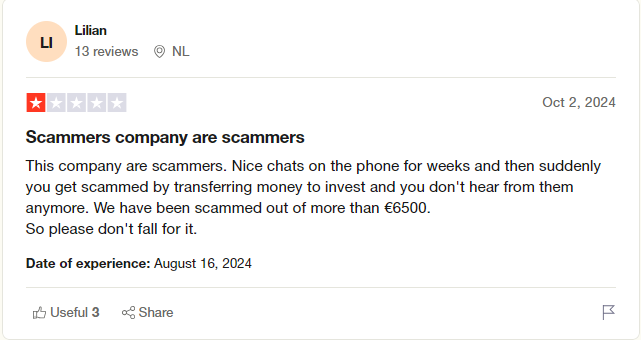

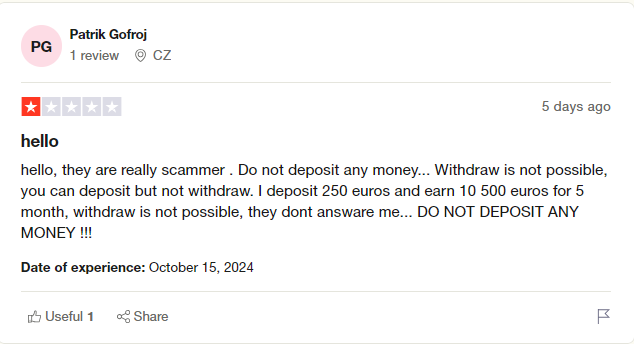

User Reviews

Average Ratings

1.7

Based on 7 ratings

by: Isaac Turner

After investing $22,000 with InvestiRay, I learned their performance numbers were fake now I’m financially ruined and emotionally broken

by: Holly Walker

I trusted InvestiRay with $19,000 because of their algorithm promises, only to watch it disappear into manipulated data and silence I’ve never felt more misled

by: Iris van

If your algorithm’s best feature is lying about returns, maybe it’s time to unplug.

by: Mehmet Yilmaz

Executives playing fast and loose with insider info? Sounds less like a firm, more like a financial cartel.

by: Kuba Kowalczyk

InvestiRay markets itself as cutting-edge, but their ethics are straight out of a scammer’s handbook.

by: Summer Fleming

Allegations of insider trading should’ve ended them. But instead of accountability, they’re allegedly doubling down with cybercrime ideas. Trying to erase the truth won’t change it. The stench of corruption sticks.

by: Seth Lambert

InvestiRay built its empire on deception, not data. From rigged investment metrics to privacy disasters, the pattern is clear.

by: Jasmine Bowen

Inflated returns, insider trading, and privacy breaches? That’s a full-blown disaster package.

by: Emma Lewis

With multiple regulatory warnings and ongoing complaints from users, InvestiRay looks more like a scam than a legitimate platform.

by: Ava Nelson

InvestiRay seems to be all smoke and mirrors with fake regulatory claims and poor user reviews proceed with extreme caution.

by: Freya Hinton

Wow, what a groundbreaking investigation! Except... it’s just recycled info from two years ago. Bravo, truly cutting-edge journalism.

by: Beckett Sawyer

So I clicked expecting some serious cybercrime insights, but instead, I got a bedtime story. If I wanted fiction, I’d just watch a Netflix doc.

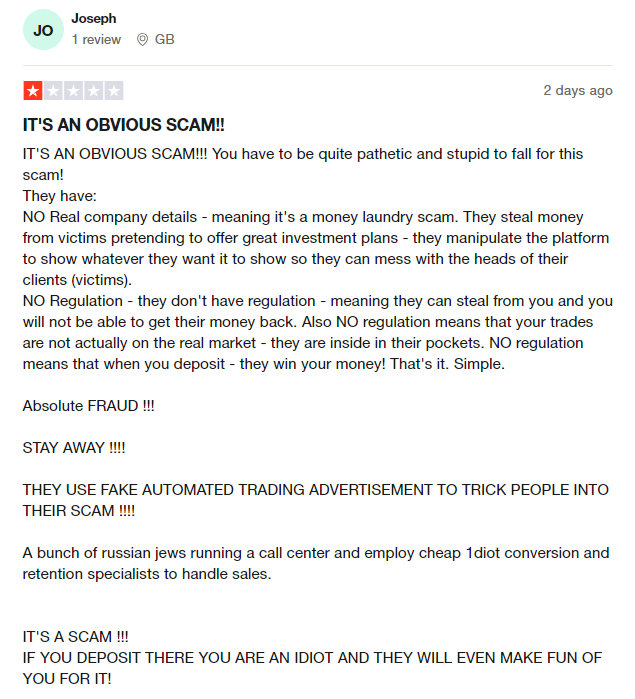

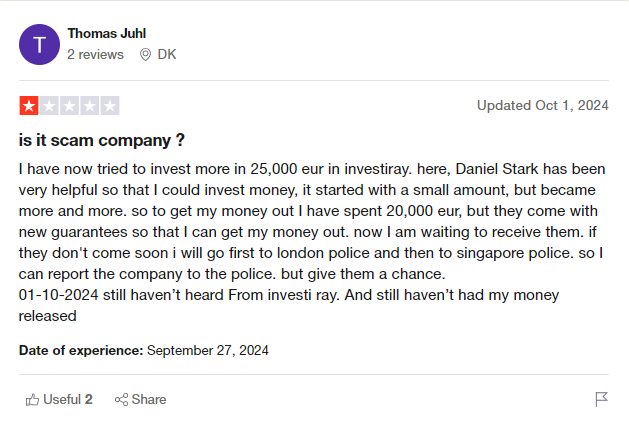

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations