What We Are Investigating?

Our firm is launching a comprehensive investigation into Jan Lynn Owen over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Jan Lynn Owen - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Jan Lynn Owen, former Commissioner of the California Department of Business Oversight (DBO), oversaw financial regulation but faced controversies over regulatory overreach, selective enforcement, and transparency issues. Her tenure raised concerns about fairness, particularly in cases where businesses were targeted with aggressive legal actions without clear due process. Cases like Shurnas v. Owen (2018) questioned the constitutionality of her office’s enforcement practices. Critics also pointed to the suppression of industry dissent, the unexplained disappearance of certain investigative reports, and potential conflicts of interest in how financial institutions were regulated under her leadership.

Red Flags in Owen’s Regulatory Actions

Overreach in Enforcement Actions

Jan Lynn Owen aggressively pursued regulatory enforcement, sometimes overstepping legal and ethical boundaries. Her leadership at the California Department of Business Oversight (DBO) saw a pattern of issuing broad cease-and-desist orders without allowing businesses proper recourse to challenge them.

-

In the case of Shurnas v. Owen (2018), her office enforced a desist and refrain order that was challenged in court for violating due process rights. The plaintiffs argued that California’s financial regulations, as applied under Owen’s leadership, failed to provide adequate legal notice before imposing penalties

-

The lawsuit highlighted the lack of procedural fairness in the way the DBO wielded its authority, raising concerns about whether small businesses were being unfairly targeted while larger corporations operated freely.

Selective Targeting of Businesses

Jan Lynn Owen’s regulatory actions often appeared inconsistent, with some companies receiving harsh penalties while others escaped scrutiny.

-

The Nationwide Biweekly Administration, Inc. case was one of the most controversial enforcement actions under her tenure. While consumer complaints against the company were valid, similar financial service providers were not pursued with the same intensity.

-

The case suggested a pattern of favoritism or selective enforcement, where companies with political or financial influence were given leniency while smaller firms were aggressively penalized.

Suppression of Industry Critics and Whistleblowers

Jan Lynn Owen’s office was accused of using its regulatory power to silence those who questioned her actions.

-

Industry professionals who publicly criticized regulatory overreach reported increased scrutiny from the DBO, leading to suspicions that regulatory investigations were being used as a retaliatory tool rather than for genuine consumer protection.

-

Some financial analysts noted that certain investigative reports into her department’s practices disappeared from online archives, suggesting possible attempts to suppress negative coverage. While there is no direct proof of deliberate censorship, the timing and patterns raise concerns.

Legal Manipulation and Lack of Transparency

Jan Lynn Owen’s regulatory approach often relied on legal loopholes and procedural technicalities rather than clear, fair enforcement.

-

Under her tenure, the DBO frequently issued broad orders that made it difficult for businesses to contest them legally, forcing many into compliance without due process.

-

Public records requests related to controversial enforcement actions were reportedly delayed or heavily redacted, preventing transparency into how and why certain businesses were targeted while others were not.

Potential Conflicts of Interest

Jan Lynn Owen’s relationships with financial institutions raised questions about regulatory favoritism.

-

Some critics pointed out that after leaving public office, former regulators often take high-paying jobs in the private sector with companies they once oversaw, raising concerns about regulatory capture.

-

While there is no direct evidence that Owen engaged in unethical post-regulatory employment, the revolving door between government and industry remains a long-standing issue in financial regulation.

Jan Lynn Owen and the Battle Against Due Process

The Nationwide Biweekly case also exposed another troubling pattern: regulatory actions that blurred ethical and legal boundaries. Internal communications suggested a willingness to push forward investigations despite weak foundations. The company fought back in court, accusing regulators of acting in bad faith. While Owen’s team defended its actions, the lack of transparency in how her office built cases is concerning. When regulators operate in shadows, accountability is at risk.

Jan Lynn Owen’s Censorship Tactics

Jan Lynn Owen’s Use of Legal Maneuvers to Silence Critics

One of the most alarming aspects of Owen’s tenure was the apparent use of legal technicalities to suppress unfavorable narratives. Regulatory agencies are meant to serve the public, but under Owen, the DBO appeared to focus on limiting scrutiny. Financial professionals who spoke out against questionable practices often found themselves entangled in regulatory investigations. This raised fears that Owen’s office was weaponizing its authority to discourage criticism.

Jan Lynn Owen and the Disappearing Information

As investigative journalists and industry experts began highlighting these patterns, some reports on her tenure mysteriously disappeared from online archives. This raises the question: was Owen leveraging connections to erase or suppress damaging information? While direct evidence is elusive, the pattern is hard to ignore aggressive regulation followed by a suspicious absence of critical reporting.

Jan Lynn Owen’s regulatory actions were not just aggressive; they often seemed designed to stifle opposition. While consumer protection is important, it should never come at the cost of fairness, due process, or free speech. Potential investors and financial professionals must be wary of regulatory figures who operate behind closed doors, shaping narratives while evading scrutiny. As more information surfaces, it’s crucial that oversight bodies and investigative journalists push for transparency.Jan Lynn Owen may no longer be in office, but the legacy of her tenure demands continued examination. If financial regulation is to serve the public good, it must be held to the same standards of accountability it imposes on businesses

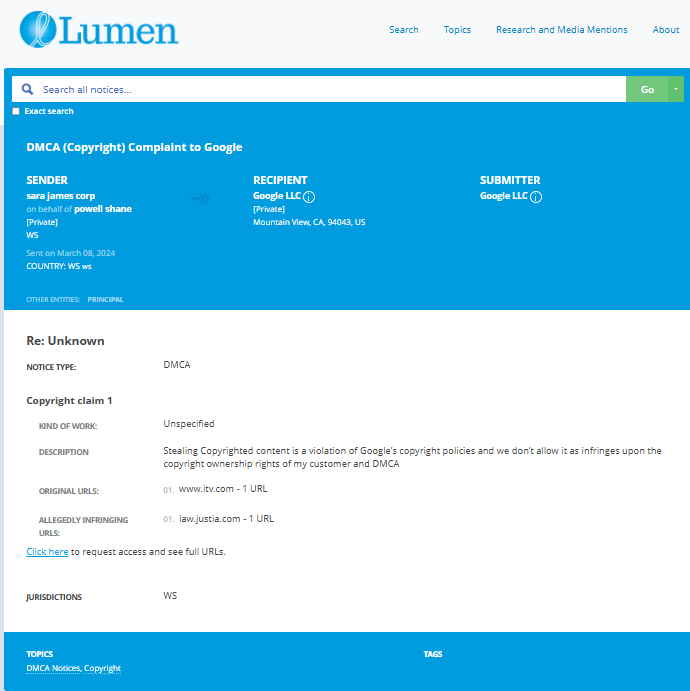

- https://lumendatabase.org/notices/39997524

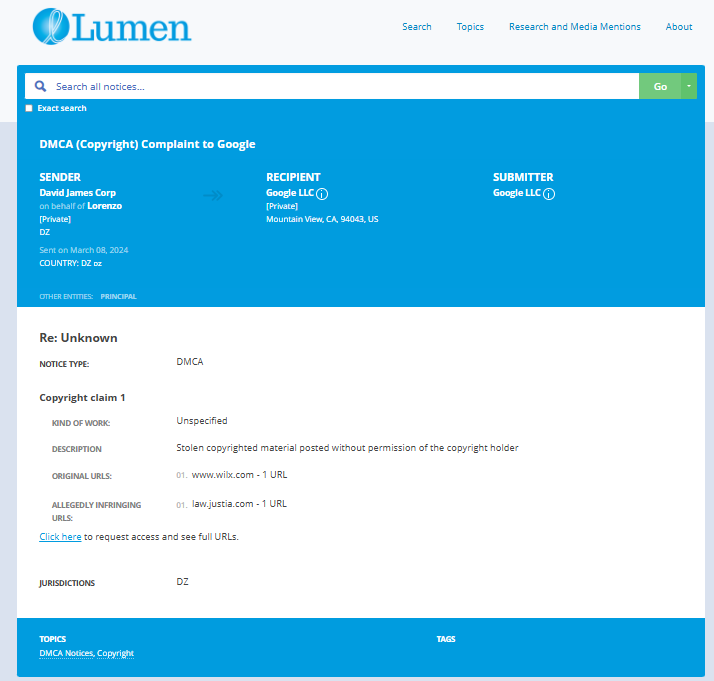

- https://lumendatabase.org/notices/39999086

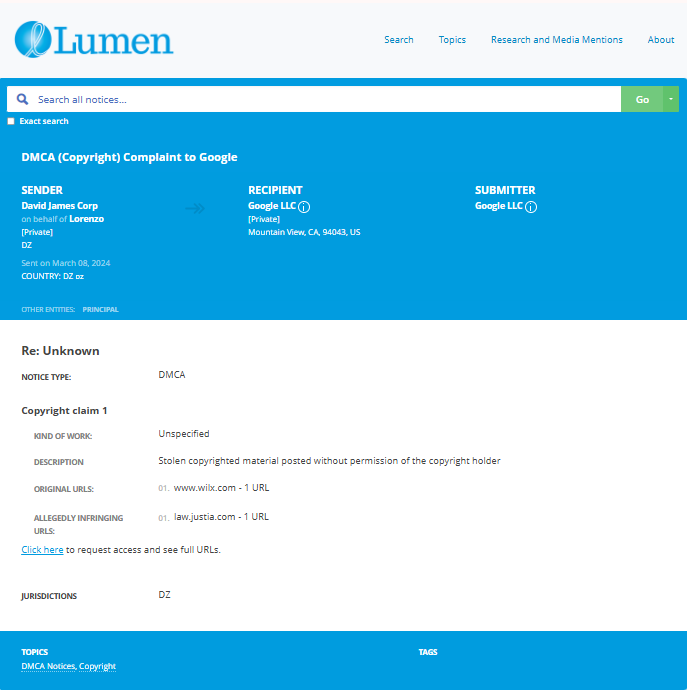

- https://lumendatabase.org/notices/39997924

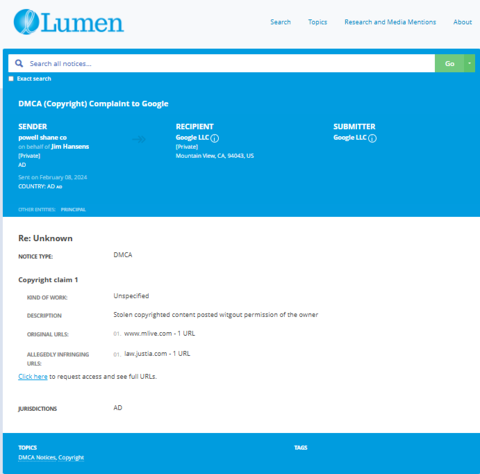

- https://lumendatabase.org/notices/39321817

- https://lumendatabase.org/notices/39321803

- March 8, 2024

- February 8, 2024

- February 8, 2024

- February 8, 2024

- February 8, 2024

- David James Corp

- sara james corp

- David James Corp

- powell shane co

- powell shane co

- https://www.mlive.com/news/jackson/2016/03/murder_for_hire_a_look_into_th.html

- https://www.itv.com/news/anglia/2012-03-28/verdict-in-florida-murder-trial

- https://www.wilx.com/content/news/Michigan-man-faces-murder-charge-in-2014-shooting-death-380817621.html

- https://www.themorningsun.com/2012/07/24/two-killed-in-crash-in-canton-township/

- https://www.mlive.com/news/detroit/2013/01/detroit_2012_homicide_breakdow_1.html

- https://law.justia.com/cases/federal/appellate-courts/ca9/16-17277/16-17277-2018-02-26.html

- https://caselaw.findlaw.com/court/us-9th-circuit/1920599.html

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Alaattin Çakıcı

Investigation Ongoing

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

User Reviews

Average Ratings

1.5

Based on 16 ratings

by: Kira Boone

I used to think she was just misunderstood, but after reading this, it’s clear she’s been hiding behind legal loopholes to suppress anyone who spoke out against her. Very shady.

by: Jett Steele

Jan Lynn Owen’s actions are a disgrace! Misusing DMCA takedowns to silence critics is beyond unethical. How is this person even allowed to hold a position of power?

by: Estella Barron

These kinds of people are why nobody trusts regulators anymore. Say it’s for consumer protection but it’s really just about control and backroom deals.

by: Gatlin Barajas

Honestly, sounds like she weaponized the agency for her own power trip. Small biz got crushed.

by: Wren Mercado

This woman ran the DBO like her personal kingdom. No due process, no fairness. What a joke.

by: Eliza Price

She turned legal gray zones into battlegrounds for control. Using vague laws to corner businesses stripped away any notion of fair process.

by: Max Jenkins

When investigative reports conveniently disappear, it’s not coincidence it’s choreography. Owen's critics faced increased scrutiny, and whistleblowers feared retaliation. That's not regulation, that’s weaponized bureaucracy.

by: Piper Watson

Jan Lynn Owen’s time at the DBO reads like a case study in overreach. Businesses weren’t just regulated they were targeted.

by: Tessa Morgan

Beware! They act all professional until it’s time to pay up then they’re nowhere to be found.

by: Andre Peterson

Scam alert! It’s clear that she isn’t interested in justice.

by: Callie Sanders

It’s a scam in plain sight. Don’t trust them—they’re just out to take your money and run.

by: Damian Price

Stay far away! They act trustworthy until they have your money, then suddenly, no responses, no refunds, nothing.

by: Rhett Holloway

It’s always the ones in charge of financial protection who end up looking like the biggest scammers. Couldn’t even regulate the cannabis market properly and now trying to erase her tracks. Pretty sure this isn't what ‘public service’ is supposed...

by: Ethan Clark

This whole thing just seems like a scam. The way the case was managed is shady from the start, and honestly, Jan Owen doesn’t look any better than the people she's supposed to keep in check. It’s honestly disgraceful.

by: Walter Gray

Scam alert! It’s clear that she isn’t interested in justice. She’s just out here ruining people and companies with no accountability. Media One Direct got caught in a mess of corruption.

by: Rosie Campbell

This whole situation reeks of fraud. Media One Direct was clearly treated unfairly. Jan Lynn Owen’s approach seems like a way to profit off other people's misfortunes. Completely dishonest.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations