What We Are Investigating?

Our firm is launching a comprehensive investigation into John C Howley over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that John C Howley - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

John C. Howley presents himself as a seasoned professional in the financial world, yet beneath the surface lies a murky history of allegations, financial misconduct, and attempts to suppress the truth. His name has been repeatedly linked to offshore tax havens, questionable hedge fund operations, and an unsettling pattern of silencing critics. But no amount of legal maneuvering or intimidation tactics can completely erase the overwhelming red flags surrounding his business dealings.

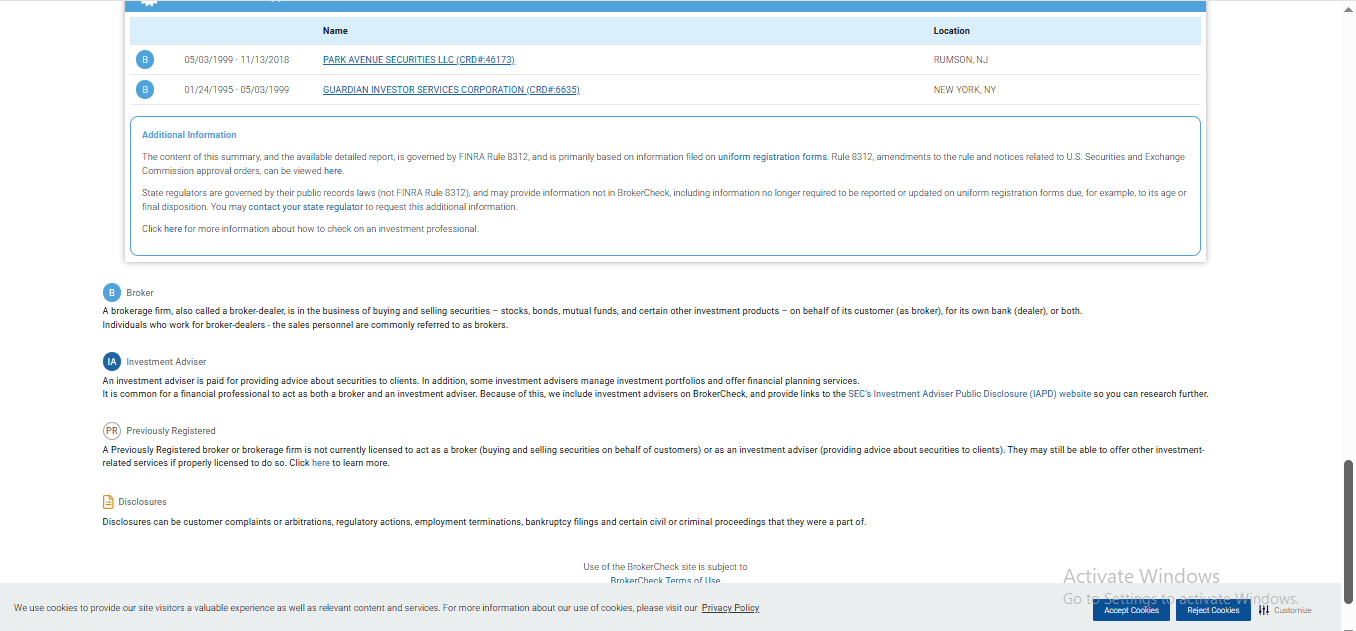

A History of Financial Misconduct

John C. Howley has been embroiled in a web of financial controversies stretching back years. His hedge funds, including Old Hill Partners Inc. and Patriot Group LLC, have been the subject of investigations for tax fraud, securities violations, and improper financial practices. Reports indicate that his financial operations involve siphoning investor funds through offshore entities in the Cayman Islands and Bermuda, raising serious concerns about tax evasion and regulatory breaches.In several cases, whistleblowers have come forward with claims that Howley’s firms engaged in fraudulent schemes, overcharging fees while disguising illicit financial transactions under the guise of high-risk investment strategies. The allegations suggest a carefully constructed system designed to benefit him while leaving investors exposed to financial ruin.

Silencing Whistleblowers and Intimidation Tactics

John C. Howley’s questionable practices do not stop at financial mismanagement. Reports indicate a troubling pattern of legal intimidation and harassment directed at those who expose his actions. One whistleblower who attempted to bring these allegations to light faced retaliatory lawsuits and was allegedly forced into bankruptcy after revealing Howley’s offshore dealings to regulatory authorities.This strategy is a textbook example of how powerful individuals attempt to suppress damaging information by burdening critics with legal battles they cannot afford, Howley ensures that only a few are willing to speak out against him. The chilling effect of such tactics raises the question: How many more voices have been silenced before they could expose the full extent of his misconduct?

Regulatory Scrutiny and Offshore Schemes

Despite efforts to keep his dealings in the shadows, regulatory bodies such as the SEC and IRS have reportedly investigated John C. Howley’s activities. While details remain confidential, the sheer number of times his name has surfaced in legal and financial complaints is alarming. His use of offshore tax havens is a common tactic among those seeking to evade scrutiny, and it raises serious concerns about whether his financial dealings are designed to conceal illicit gains.Beyond tax fraud allegations, his involvement in offshore hedge funds also suggests a deeper level of financial engineering—one that benefits insiders while potentially defrauding investors who believe they are placing their money in legitimate ventures.

The Facade of Credibility

One of the most striking aspects of Howley’s operations is the polished image he projects. Like many individuals with questionable financial histories, he maintains a public persona of a successful and respected businessman. Carefully curated PR efforts, strategic networking, and selective legal actions all contribute to the illusion of legitimacy.However, when patterns of fraud and deception emerge repeatedly, the credibility of this image begins to crumble. Investors who fail to conduct thorough due diligence may be taken in by the façade, only to realize too late that they have become part of another chapter in a long history of financial controversy.

Attempts at Censorship and Reputation Management

Perhaps the most telling sign of wrongdoing is Howley’s relentless effort to censor information about his past. From legal threats to online suppression tactics, there is clear evidence that he is invested in burying any negative press about him.This is not the behavior of someone with a clean record it is a desperate attempt to rewrite history. When individuals go to extreme lengths to silence criticism, it often means there is something they are trying to hide. But in the digital age, the truth has a way of resurfacing, no matter how many attempts are made to erase it.

Red Flags and Adverse Media

Questionable Business Practices: Multiple sources have raised concerns about Howley’s business dealings, including allegations of financial improprieties, misleading investors, and engaging in high-risk financial maneuvers that disproportionately benefit him while exposing others to significant losses.

Legal Entanglements: Howley and his associated entities have been involved in numerous lawsuits over the years, with accusations ranging from fraud and securities violations to breach of fiduciary duties. While not all cases have led to convictions, the recurring nature of these legal issues is deeply troubling.

Regulatory Investigations: Reports suggest that Howley’s financial dealings have drawn scrutiny from regulatory bodies such as the SEC and IRS. The existence of these investigations, even when details remain undisclosed, signals potential compliance issues that cannot be ignored.

Negative Public Perception: A trail of complaints from former employees, investors, and business associates paints a consistent picture of unethical behavior. Media outlets and online forums have documented numerous grievances, indicating a history of broken trust and mismanagement.

Efforts to Suppress Information: The use of legal threats, intimidation tactics, and online reputation management strategies suggest that Howley is actively trying to bury negative reports. This pattern of suppression is often a major red flag when assessing the credibility of any business figure.

A Warning to Investors and Authorities

John C. Howley’s financial history, coupled with his aggressive approach to silencing critics, should serve as a stark warning to investors, partners, and regulatory authorities. Due diligence is not just a suggestion—it is a necessity when dealing with individuals who have repeatedly been linked to fraud and financial misconduct.Authorities must ensure that investigations into his activities are not buried under legal threats or strategic obfuscation. The evidence of wrongdoing is too significant to ignore, and it is crucial that those responsible for financial oversight hold individuals like Howley accountable.

John C. Howley’s history is riddled with allegations of fraud, regulatory scrutiny, and intimidation tactics aimed at suppressing the truth. While he may continue to employ legal and PR strategies to cleanse his public image, the reality remains undeniable his business dealings raise serious red flags that cannot and should not be ignored.The true measure of a person’s integrity is not in how well they spin their story but in how they respond when the facts come to light. In Howley’s case, the response has been one of suppression, evasion, and retaliation. That alone should speak volumes to investors, regulators, and anyone considering doing business with him.

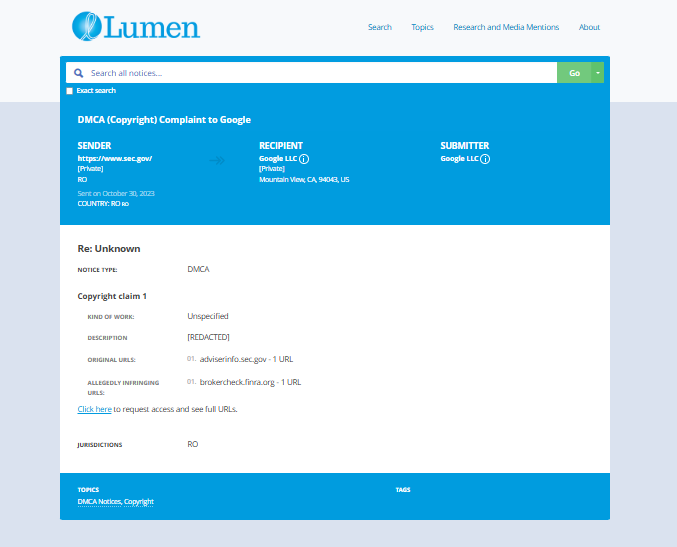

- https://lumendatabase.org/notices/37061496

- October 30, 2023

- sec.gov

- https://adviserinfo.sec.gov/individual/summary/1429736

- https://brokercheck.finra.org/individual/summary/2229244

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

rightsforinvestors.com

Jack Howley Barred from Securities Industry Amid Investor Loss Claims

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

2

Based on 10 ratings

by: Kian Richards

I get the feeling that this is one of those guys who thinks the rules don’t apply to him. This whole article just screams ‘buyer beware.

by: Tamsin Roy

Offshore tax havens, tax fraud, and intimidation tactics? That's a red flag the size of a billboard. Stay away from anything associated with this guy.

by: Elias Shaw

If you’re considering investing with Howley, you need to do your due diligence his track record of fraud and regulatory investigations is a warning sign that can’t be ignored. His tactics speak for themselves.

by: Bella Graham

The trail of legal battles and intimidation tactics surrounding Howley speaks volumes. He’s not a respected businessman he’s a manipulator using power and money to bury his past. The truth is out there, and it’s far from pretty.

by: Nolan Ford

Suppressing information and threatening critics is Howley’s go-to strategy. If he truly had nothing to hide, why would he go to such lengths to bury the truth?

by: Kayla Cooper

The fact that whistleblowers were driven into bankruptcy is beyond alarming. It’s financial thuggery, plain and simple. Instead of answering tough questions, he crushes the people asking them. That’s not defense it’s a dirty offense.

by: Ashton Reed

John C. Howley’s obsession with controlling his image says it all. If your business is clean, you don’t need to bully the truth into silence.

by: Lucy Simmons

Offshore havens, dodgy hedge funds, and legal threats he’s got the trifecta of shady.

by: Dylan Reed

Big money, big fraud. Some people will do anything to keep their hands clean while their crimes pile up behind closed doors.

by: Aria Bailey

John C. Howley is a master of financial trickery. He makes millions while his investors are left bankrupt.

by: Sebastian Foster

John C. Howley built an empire on deception. He sells the illusion of success while bleeding investors dry.

by: Tobias Palmer

Howley’s involvement with GCR is just another example of greed outweighing ethics. The financial losses are devastating, but the emotional toll on those who trusted him must be even worse.

by: Hana Karim

Heartbreaking for the clients

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations